Market Overview:

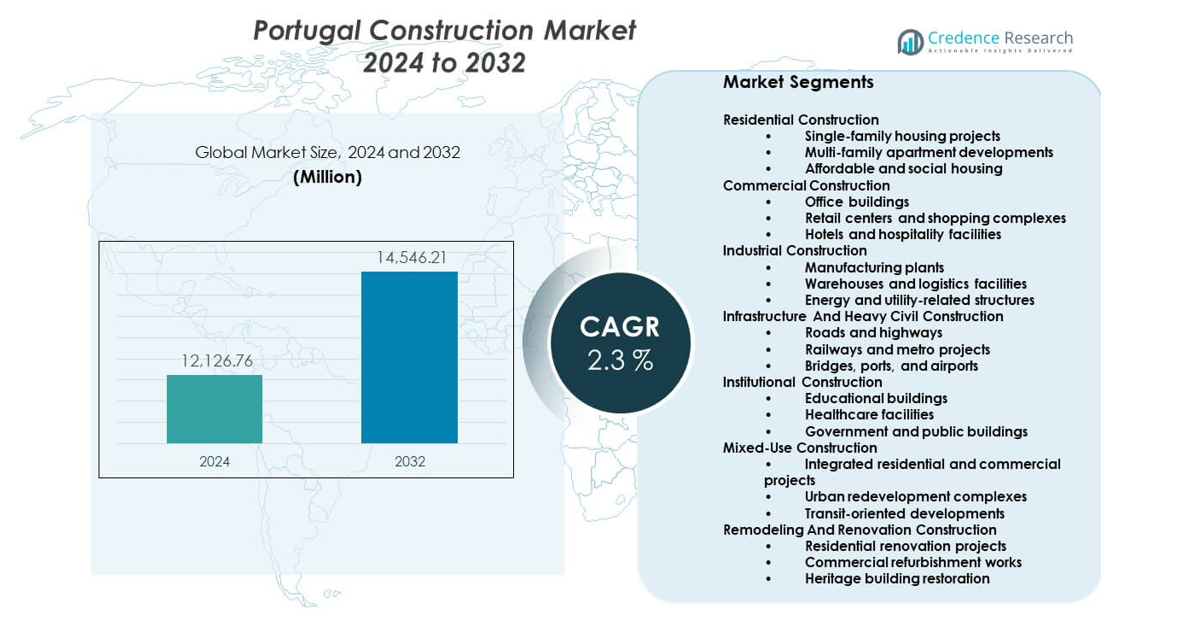

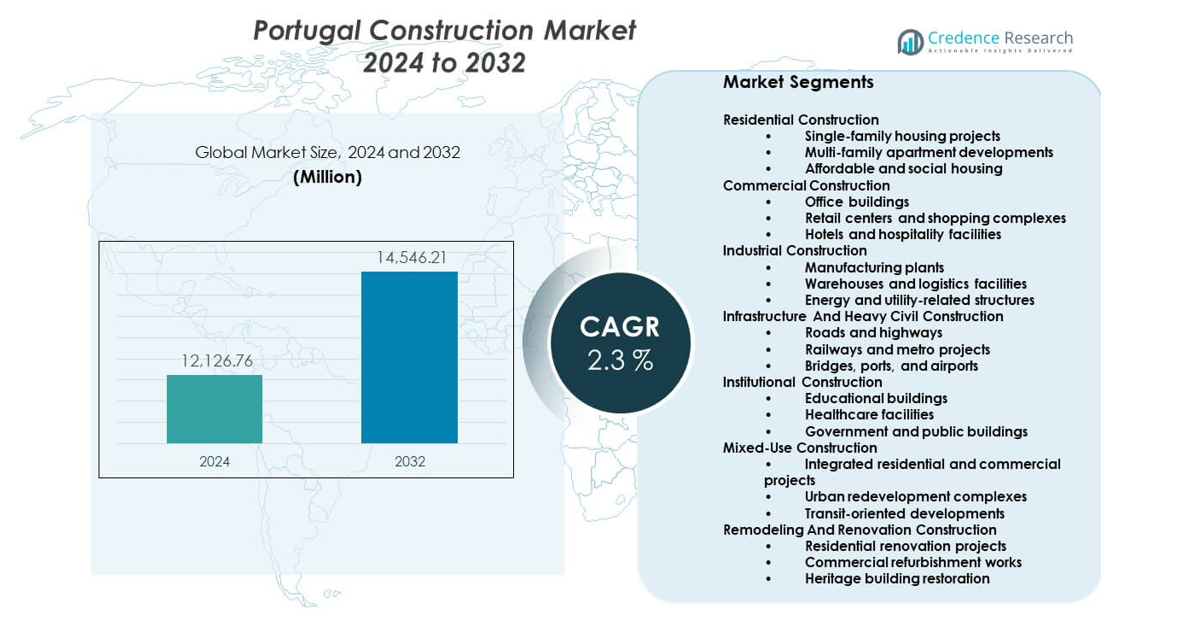

The Portugal Construction Market is projected to grow from USD 12,126.76 million in 2024 to USD 14,546.21 million by 2032, with a CAGR of 2.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Portugal Construction Market Size 2024 |

USD 12,126.76 million |

| Portugal Construction Market, CAGR |

2.3% |

| Portugal Construction Market Size 2032 |

USD 14,546.21 million |

Market drivers include housing demand, infrastructure upgrades, and sustainability goals. Urban population growth supports new residential developments. Government programs encourage energy-efficient buildings and seismic retrofitting. Infrastructure projects focus on roads, rail, and ports to improve logistics. Tourism recovery supports hotels, resorts, and public facilities. Foreign investment supports commercial and logistics construction. Digital tools improve project planning and cost control. Skilled labor shortages raise productivity focus. These factors support stable construction activity across segments.

Regional activity concentrates around major economic hubs. Lisbon leads due to urban redevelopment and housing demand. Porto follows with commercial growth and transport upgrades. Coastal regions benefit from tourism-driven construction. The Algarve shows steady demand for hospitality and residential projects. Interior regions remain emerging markets with infrastructure-led growth. Cross-border trade supports logistics assets near Spain. Regional funding programs help balance development gaps. These patterns shape construction demand across Portugal.

Market Insights:

- The Portugal Construction Market stood at USD 12,126.76 million in 2024 and will reach USD 14,546.21 million by 2032, with a 2.3% CAGR, supported by steady public and private investment.

- Lisbon Metropolitan Area leads with 38% share due to dense urban demand, followed by Norte at 27% from industrial and logistics growth, and Centro at 20% from infrastructure and institutional projects.

- Algarve is the fastest-growing region with a 15% share, driven by tourism-led hospitality projects and coastal residential development.

- Infrastructure and heavy civil construction holds about 34% share, led by roads, railways, ports, and long-term public funding pipelines.

- Residential construction accounts for nearly 28% share, supported by urban housing demand, renovation activity, and affordable housing programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Sustained Public Infrastructure Spending And Urban Redevelopment Focus

Government investment supports transport, utilities, and public facilities nationwide. Urban renewal programs target aging districts and city centers. These projects improve mobility and service access. Public housing upgrades strengthen social infrastructure. Municipal spending ensures steady contractor demand. Policy stability supports long-term planning confidence. The Portugal Construction Market benefits from predictable infrastructure pipelines. It supports balanced growth across civil works and buildings.

- For instance, Infraestruturas de Portugal completed modernization of the Northern Line rail corridor covering over 100 km, increasing line capacity and reducing travel times through upgraded signaling and track systems.

Residential Housing Demand Driven By Urbanization And Demographic Shifts

Urban population growth increases housing demand. Affordable housing programs support large residential projects. Renovation activity rises due to old building stock. Energy upgrades improve safety and efficiency. Developers focus on mixed-use housing formats. Mortgage access supports buyer confidence. Population concentration sustains urban construction volumes. It maintains consistent residential project flow.

- For instance, Casais Group delivered more than 1,200 residential units in Lisbon and Porto between 2021 and 2024, including high-efficiency buildings certified under Class A energy standards.

Tourism Recovery Supporting Commercial And Hospitality Construction Activity

Tourism growth supports hotels, resorts, and leisure assets. Hospitality operators invest in capacity upgrades. Mixed-use projects meet retail and leisure needs. Coastal regions attract strong private investment. Public amenities near tourist areas expand. Seasonal demand shapes phased project delivery. The Portugal Construction Market gains from tourism-linked demand. It supports long-term commercial development.

Environmental Policies And Energy Efficiency Compliance Requirements

Green building rules shape construction standards. Energy mandates support retrofit activity. Public incentives encourage low-carbon materials. Developers adopt sustainable design practices. Renewable systems integrate into new projects. Compliance improves asset durability and value. Environmental goals influence project approvals. It strengthens demand for compliant construction solutions.

Market Trends:

Growing Use Of Modular Construction And Prefabricated Building Systems

Builders adopt modular methods to reduce timelines. Prefabrication improves site quality control. Labor shortages support off-site production. Cost certainty improves budget planning. Residential projects adopt modular formats faster. Hospitality assets favor rapid installation. The Portugal Construction Market shows steady modular uptake. It improves efficiency in dense urban areas.

Digitalization Of Construction Planning And Project Management Practices

Construction firms adopt digital design tools. BIM improves coordination among stakeholders. Cost tracking systems support financial control. Digital scheduling reduces delay risks. Data use improves resource allocation. Cloud tools gain adoption among small firms. The Portugal Construction Market advances digital maturity. It supports transparent project execution.

- For instance, Mota-Engil applies BIM Level 2 workflows across major infrastructure projects, coordinating over 15 disciplines per project and reducing rework through fully federated digital models.

Preference For Compact Mixed-Use Urban Developments

Developers favor integrated residential and commercial assets. Land scarcity drives vertical construction formats. Walkable designs align with city planning goals. Retail integrates with housing and offices. Transit access guides site selection. Compact layouts improve land efficiency. The Portugal Construction Market reflects urban lifestyle shifts. It supports higher-density developments.

Rising Emphasis On Renovation And Adaptive Reuse Projects

Renovation demand exceeds new builds in cities. Historic assets require structural upgrades. Energy retrofits gain priority in approvals. Adaptive reuse supports commercial redevelopment. Regulations favor preservation-led projects. Urban character shapes design scope. The Portugal Construction Market adapts to renewal demand. It balances heritage and modernization needs.

Market Challenges Analysis:

Skilled Labor Shortages And Workforce Capacity Constraints

Skilled labor supply remains limited across regions. An aging workforce affects site productivity. Training gaps impact build quality. Labor costs rise steadily. Smaller contractors face hiring pressure. Project schedules face workforce risks. The Portugal Construction Market experiences capacity strain. It increases reliance on subcontracting models.

Material Cost Volatility And Complex Regulatory Processes

Construction material prices fluctuate frequently. Supply chain disruption raises procurement risk. Permit approvals delay project starts. Local regulations vary across municipalities. Compliance adds administrative workload. Financing delays affect private developments. The Portugal Construction Market faces execution uncertainty. It requires stronger cost and risk management.

Market Opportunities:

Expansion Of Green Retrofit And Energy Upgrade Construction Projects

Building owners seek energy efficiency improvements. Retrofit demand grows across residential assets. Public incentives support upgrade programs. Contractors gain recurring project opportunities. Energy compliance improves asset competitiveness. Technology improves retrofit execution quality. The Portugal Construction Market benefits from sustainability focus. It supports long-term renovation growth.

Infrastructure Modernization And Regional Development Initiatives

Transport upgrades create new construction demand. Port and logistics projects support trade growth. Interior regions gain infrastructure-led development. Public funding improves regional connectivity. Contractors expand beyond urban centers. Local economies attract private projects. The Portugal Construction Market gains regional depth. It supports balanced national construction activity.

Market Segmentation Analysis:

Residential Construction

Residential construction covers single-family housing, multi-family apartments, and affordable housing projects. Urban demand supports apartment developments in major cities. Social housing programs sustain public and private participation. Renovation and energy upgrades improve housing quality. This segment shows stable demand across income groups.

- For instance, Teixeira Duarte Engenharia has completed various construction and rehabilitation projects in the Lisbon metropolitan area, such as the rehabilitation of the 1,654 m² Corte Real building for tourist apartments and significant infrastructure reinforcement work on the Lisbon riverfront. The company actively participates in research and development initiatives regarding sustainable solutions and energy efficiency in construction, aligning with Portuguese energy regulations and industry best practices.

Commercial Construction

Commercial construction includes offices, retail centers, and hospitality assets. Office projects focus on flexible and energy-efficient spaces. Retail development aligns with mixed-use formats. Hotels and resorts benefit from tourism demand. The segment supports steady private investment.

- For instance, VINCI Energies’ local network in Portugal, including business units like Sotécnica and Longo Plano, applies high-efficiency solutions in its projects, such as recovering water from the heating and air-conditioning systems at Faro airport for reuse in cleaning operations, thereby reducing the extraction of water resources. The broader VINCI Construction group is involved in various large-scale building projects globally, including hotel complexes and urban developments, and consistently aims for high energy efficiency and sustainability across its operations.

Industrial Construction

Industrial construction serves manufacturing plants, logistics warehouses, and utility structures. Growth in logistics supports warehouse expansion. Industrial upgrades improve automation and efficiency. Energy-related facilities support national supply needs. This segment links closely with trade and exports.

Infrastructure And Heavy Civil Construction

Infrastructure covers roads, railways, bridges, ports, and airports. Public funding supports transport modernization. Rail and metro projects improve urban mobility. Port upgrades support trade flows. The segment provides long-term project visibility.

Institutional Construction

Institutional projects include schools, hospitals, and public buildings. Government spending supports healthcare and education assets. Modern designs improve safety and capacity. This segment ensures steady public sector demand.

Mixed-Use Construction

Mixed-use projects integrate housing, offices, and retail. Urban redevelopment favors compact designs. Transit-oriented projects improve land use. This segment aligns with city planning goals.

Remodeling And Renovation Construction

Renovation includes residential upgrades, commercial refurbishments, and heritage restoration. Aging buildings drive retrofit demand. Preservation rules support careful restoration. This segment grows faster in urban areas.

Specialized And Environmental Construction

Specialized work covers structural repairs, MEP systems, and fit-outs. Environmental construction includes water treatment, waste facilities, and renewable support. Sustainability goals support this segment. The Portugal Construction Market gains resilience through diversified segment demand.

Segmentation:

Residential Construction

- Single-family housing projects

- Multi-family apartment developments

- Affordable and social housing

Commercial Construction

- Office buildings

- Retail centers and shopping complexes

- Hotels and hospitality facilities

Industrial Construction

- Manufacturing plants

- Warehouses and logistics facilities

- Energy and utility-related structures

Infrastructure And Heavy Civil Construction

- Roads and highways

- Railways and metro projects

- Bridges, ports, and airports

Institutional Construction

- Educational buildings

- Healthcare facilities

- Government and public buildings

Mixed-Use Construction

- Integrated residential and commercial projects

- Urban redevelopment complexes

- Transit-oriented developments

Remodeling And Renovation Construction

- Residential renovation projects

- Commercial refurbishment works

- Heritage building restoration

Specialized Construction

- Structural repair services

- Mechanical and electrical works

- Fit-out and finishing services

Environmental Construction

- Water treatment facilities

- Waste management infrastructure

- Renewable energy support structures

Regional Analysis:

Lisbon Metropolitan Area

The Lisbon Metropolitan Area holds the largest share of the Portugal Construction Market, accounting for about 38% of total activity. Strong housing demand supports residential and mixed-use projects. Office development benefits from business services and foreign investment. Transport upgrades improve urban mobility and logistics access. Public buildings and social infrastructure receive steady funding. Tourism supports hotel and refurbishment projects. It remains the primary construction hub due to economic concentration.

Norte (North) Region

The Norte region represents nearly 27% of the market share. Porto drives commercial, residential, and infrastructure development. Industrial construction supports manufacturing and export-oriented activities. Logistics facilities expand near ports and highways. Urban renewal projects improve older districts. Public transport and road projects strengthen regional connectivity. It shows balanced growth across public and private segments.

Centro And Algarve Regions

The Centro region accounts for around 20% of construction activity. Infrastructure projects and institutional buildings support regional development. Industrial parks and logistics assets gain gradual investment. The Algarve holds close to 15% market share, driven by tourism-led construction. Hospitality, leisure, and residential projects dominate local demand. Public infrastructure upgrades support seasonal population growth. It reflects region-specific construction patterns within the Portugal Construction Market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Portugal Construction Market features strong competition among domestic and international contractors. Leading players compete through diversified project portfolios, technical expertise, and long-term public contracts. Large firms focus on infrastructure, energy, and transport projects, while mid-sized companies strengthen positions in residential and commercial construction. Strategic partnerships help firms manage complex projects and risk exposure. Cost control, execution speed, and regulatory compliance remain key differentiators. Digital tools support planning accuracy and transparency. It shows moderate consolidation, with established players holding advantage in large-scale and public-sector works.

Recent Developments:

- In December 2025, Grupo Casais announced the acquisition of Terratest’s productive unit in Spain, a landmark transaction enhancing the group’s capacity across the Iberian Peninsula. The acquisition includes an industrial park, advanced machinery, two factories, and a highly skilled team of 300 employees concentrated in Madrid, Cartagena, and Seville. This strategic move strengthens Casais’ capabilities in specialized construction and geotechnics, with integration plans for Terratest with Casais’ existing subsidiary Ancorpor to establish an Iberian Geotechnics Hub. The transaction demonstrates Casais’ strategy of specialization and internationalization, with plans for significant investment in modernizing the Seville factory and upgrading equipment using advanced SAP systems and digital tools. Earlier in March 2025, Casais Entirez, a partnership between Grupo Casais and Nahaz Investment Group, was featured as a strategic collaboration bringing Casais’ 60 years of sustainable construction expertise to Saudi Arabia’s market. This joint venture aims to introduce cutting-edge building technologies to Saudi Arabia and support the country’s Vision 2030 objectives.

- In August 2025, Visabeira Indústria announced a mandatory public takeover bid for all shares of Martifer not already controlled by itself, the I’M group (owned by brothers Carlos and Jorge Martins), and Mota-Engil, which together held 87.4% of the capital. The takeover bid was launched at €2.057 per share, following an earlier shareholders’ agreement that defined the terms of control. The offer resulted from a tripartite agreement between the three companies with modifications to the original terms of their shareholders’ agreement. Martifer closed 2024 with a net profit of €23 million, representing a 16.8% increase compared to €19.7 million in 2023, marking the company’s best result since 2009. The company’s strong performance was bolstered by major contracts signed in December 2023, including a €300 million agreement with the Portuguese State to construct six Ocean Patrol Vessels, and €103 million contract with Japanese shipowner Ryobi Holdings for luxury cruise ship construction.

- In July 2025, the consortium named LusoLav was officially awarded the concession contract for the first phase of the Porto–Lisbon High Speed Railway project. The consortium established a specific company, Avan Norte – Gestão da Ferrovia de Alta Velocidade, which signed the 30-year concession contract with Infraestruturas de Portugal on July 29, 2025.

Report Coverage:

The research report offers an in-depth analysis based on residential construction, commercial construction, industrial construction, infrastructure and heavy civil construction, institutional construction, mixed-use construction, remodeling and renovation construction, specialized construction, and environmental construction. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Infrastructure modernization will remain a key growth pillar.

- Residential demand will stay steady in urban centers.

- Renovation projects will outpace new builds in cities.

- Sustainability rules will shape material and design choices.

- Digital tools will improve project efficiency and control.

- Mixed-use developments will gain wider acceptance.

- Tourism recovery will support hospitality construction.

- Regional development will expand beyond major metros.

- Skilled labor shortages will drive productivity focus.

- Public-private collaboration will support long-term stability.