Market Overview:

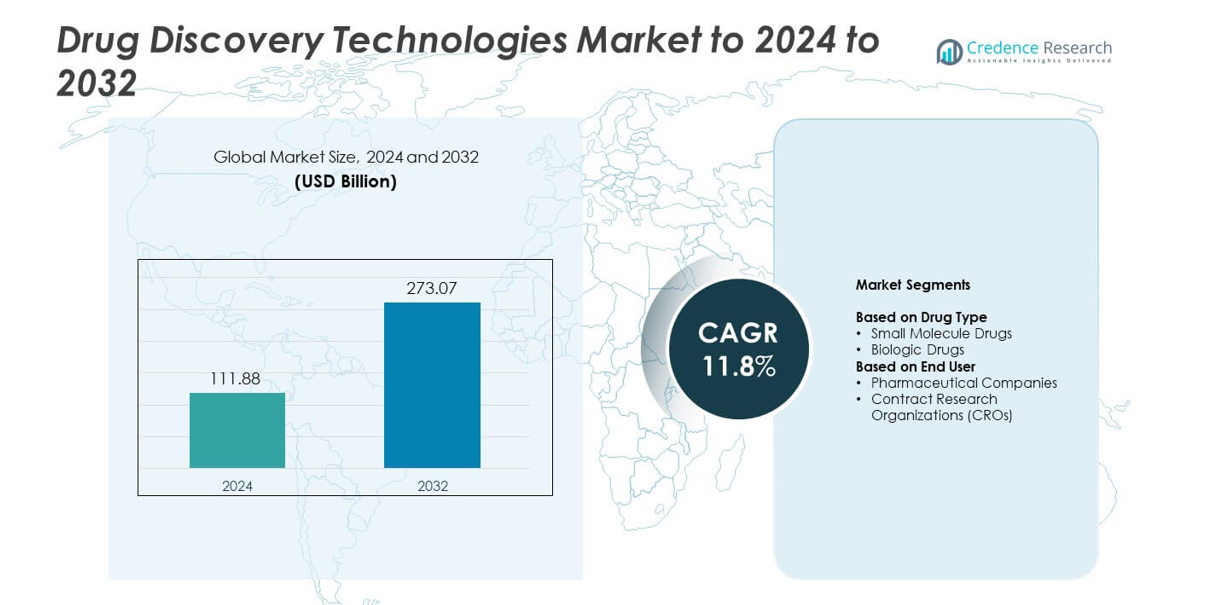

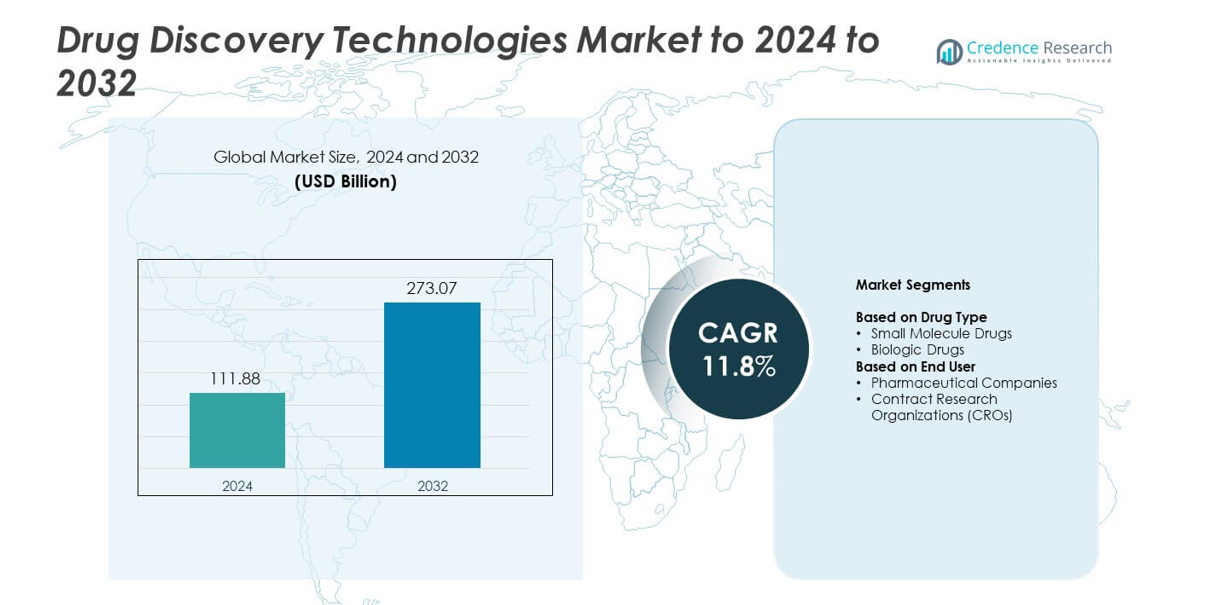

Drug Discovery Technologies Market size was valued at USD 111.88 billion in 2024 and is anticipated to reach USD 273.07 billion by 2032, at a CAGR of 11.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drug Discovery Technologies Market Size 2024 |

USD 111.88 billion |

| Drug Discovery Technologies Market, CAGR |

11.8% |

| Drug Discovery Technologies Market Size 2032 |

USD 273.07 billion |

The drug discovery technologies market is driven by major players including Eli Lilly and Company, Abbott Laboratories Inc., Bayer AG, Merck & Co. Inc., AstraZeneca PLC, Agilent Technologies Inc., F. Hoffmann La Roche Ltd, GlaxoSmithKline PLC, Pfizer Inc., and Shimadzu Corp. These companies strengthen global R&D through AI-enabled discovery tools, automated screening systems, and multi-omics integration. North America led the market in 2024 with about 41% share due to advanced biotech clusters, strong funding, and rapid adoption of digital drug discovery platforms. Europe followed with nearly 28% share, supported by robust pharmaceutical pipelines and expanding biologics research.

Market Insights

- The drug discovery technologies market reached USD 111.88 billion in 2024 and is projected to hit USD 273.07 billion by 2032, growing at a CAGR of 11.8%.

- Demand increased due to the rise of precision therapies and strong adoption of AI-driven discovery tools across pharmaceutical companies.

- Trends shifted toward biologics, RNA-based drugs, multi-omics integration, and cloud-enabled collaborative R&D models that improved data sharing.

- Competition intensified as leading companies expanded automated screening, digital labs, and advanced analytics, while small molecule drugs held about 62% share as the dominant segment.

- North America led with nearly 41% share, followed by Europe at 28% and Asia Pacific at about 22%, supported by strong biotech ecosystems and rising investments in early-stage discovery.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Drug Type

Small molecule drugs dominated the drug type segment in 2024 with about 62% share, driven by strong demand for targeted therapies, oncology drugs, and chronic disease treatments. These compounds remained preferred because they offer easier synthesis, predictable absorption, and lower development cost compared to biologics. Advancements in high-throughput screening, AI-based molecule design, and structure-guided discovery further strengthened the position of small molecules. Biologic drugs continued to grow at a fast pace due to rising interest in monoclonal antibodies and gene-based treatments, but higher manufacturing complexity kept their share lower than small molecules.

- For instance, Novartis discovered the small-molecule branaplam after running a high-throughput phenotypic screen of approximately 1.4 million compounds to find small molecules that increased SMN protein levels for spinal muscular atrophy.

By End User

Pharmaceutical companies led the end-user segment in 2024 with nearly 71% share, supported by large R&D budgets, in-house discovery programs, and rapid adoption of advanced screening platforms. These companies invested heavily in AI-enabled analytics, automated lab systems, and precision-based drug pipelines to speed up candidate identification. Growing focus on personalized medicine, rare disease research, and faster lead optimization strengthened their dominance. Contract Research Organizations (CROs) expanded their role due to outsourcing trends, but their market share stayed lower as pharma companies maintained control over high-value discovery stages.

- For instance, Roche reported a pharmaceuticals pipeline with 71 new molecular entities and a total of 122 projects in development, showing how a single pharma company can run discovery and development programs at large scale inside its own organization.

Key Growth Drivers

Rising Demand for Targeted and Precision Therapies

Demand for targeted and precision therapies increased as healthcare systems focused on personalized treatment. Drug developers adopted advanced discovery platforms to identify disease-specific pathways with higher accuracy. Strong growth in oncology, autoimmune disorders, and rare disease pipelines pushed companies to invest in high-throughput screening and AI-enabled drug design. Precision approaches reduced failure rates and improved clinical outcomes, encouraging wider use of modern drug discovery technologies. These shifts positioned targeted therapies as a major engine for long-term market expansion.

- For instance, the 2024 Access to Medicine Index report indicated that Eli Lilly had a total of 25 R&D projects in scope for its analysis

Advancements in AI, Automation, and Machine Learning

AI, machine learning, and automation transformed early-stage discovery by accelerating molecule identification and reducing research time. Automated screening platforms processed large chemical libraries faster, while predictive algorithms improved hit-to-lead accuracy. Pharmaceutical companies integrated cloud-based analytics and digital twins to enhance decision-making across discovery phases. These tools reduced operational cost and improved success rates, driving strong adoption across global R&D pipelines. The rapid integration of digital technologies continues to act as a core driver for market growth.

- For instance, Recursion built an in-house chemical library of about 1.2 million compounds and used its AI platform (MatchMaker technology) to predict protein targets for roughly 36 billion small molecules in the Enamine REAL Space library around August 2023

Growing Pipeline Expansion by Pharmaceutical Companies

Pharmaceutical companies expanded their R&D pipelines to address rising demand for innovative treatments across chronic and infectious diseases. Increased investment in biologics, gene therapies, and small molecule innovations boosted the uptake of advanced discovery tools. Companies strengthened in-house capabilities through robotics, automated chemistry, and bio-informatics platforms. This expansion supported faster lead optimization and diversified discovery efforts. Growing competition among global pharma players encouraged sustained spending on cutting-edge technologies, making pipeline expansion a primary growth catalyst.

Key Trends and Opportunities

Rapid Adoption of Cloud-Based and Collaborative R&D Models

Cloud-based platforms enabled real-time collaboration among global research teams, supporting integrated workflows for screening, modeling, and data sharing. These systems enhanced scalability, reduced infrastructure cost, and improved access to advanced analytics. Partnerships among pharmaceutical companies, CROs, and technology providers expanded due to the need for flexible and distributed R&D environments. This trend created strong opportunities for cloud-driven discovery solutions as organizations digitalized research operations.

- For instance, Moderna used its AWS-based digital platform to increase mRNA constructs for research from about 40 per month to more than 1,000 per month, allowing scientists to run around 1,000 design experiments in parallel through cloud-supported workflows.

Growth of Biologics and Next-Generation Modalities

Interest in biologics, gene therapies, RNA-based drugs, and antibody-drug conjugates opened new opportunities for discovery platforms designed for complex molecules. Researchers adopted advanced cell-based assays, structural biology tools, and multi-omics technologies to support these emerging modalities. Demand grew quickly due to rising approval rates of biologic therapies and increased focus on immune-based treatments. This shift broadened the technology landscape, creating strong prospects for high-value discovery tools.

- For instance, Takeda announced at its 2019 R&D Day that it targeted the delivery of 12 new molecular entities with the potential for 14 launches within the subsequent five fiscal years (through FY2024)

Key Challenges

High R&D Cost and Long Development Cycle

Drug discovery remained costly due to extensive screening, validation, and preclinical requirements. Companies faced rising expenses related to automation technologies, advanced assays, and regulatory compliance. Long development timelines slowed commercialization and increased financial risk, especially for smaller firms. These factors created pressure on innovators, making cost management and process efficiency critical challenges in the market.

Complexity in Biologic and Multi-Target Drug Development

Biologic drugs and multi-target therapies posed significant scientific and technical challenges. These therapies required advanced modeling, accurate structural data, and sophisticated assay systems. Limited reproducibility, data integration issues, and complex manufacturing needs increased risk during early discovery. Companies struggled to manage variability in biological responses, making development more difficult than traditional small molecule discovery.

Regional Analysis

North America

North America held the leading position in 2024 with about 41% share, supported by strong pharmaceutical R&D spending, advanced drug discovery infrastructure, and rapid adoption of AI-enabled platforms. The United States drove most activity due to large biotech clusters, strong venture funding, and continuous expansion of precision-medicine programs. Regulatory support for innovative therapies and strong collaboration among pharma companies, CROs, and academic labs further strengthened growth across the region. Canada added steady demand through investments in biologics and genomics-focused discovery projects, helping maintain North America’s clear lead in the global market.

Europe

Europe accounted for nearly 28% share in 2024, driven by strong biotechnology networks, rising investment in early-stage research, and growing emphasis on personalized medicine. Germany, the United Kingdom, and France remained key contributors with robust pharmaceutical pipelines and active adoption of automation and AI tools. The region benefited from supportive regulatory frameworks and collaborative research programs funded through the EU. Expansion in biologics, cell therapy research, and multi-omics capabilities further increased technology uptake across discovery labs, allowing Europe to remain a major hub for innovation.

Asia Pacific

Asia Pacific captured around 22% share in 2024 and emerged as the fastest-growing region due to expanding pharmaceutical manufacturing, rising healthcare investment, and strong government support for biotechnology development. China, India, Japan, and South Korea accelerated adoption of high-throughput screening, computational discovery platforms, and biologics research capabilities. Growing outsourcing demand from global pharma companies boosted CRO activities across the region. Increasing talent availability, rising clinical trial activity, and rapid digital transformation positioned Asia Pacific as a key region for long-term expansion in drug discovery technologies.

Latin America

Latin America held approximately 6% share in 2024, supported by growing interest in pharmaceutical research and gradual modernization of laboratory infrastructure. Brazil and Mexico led adoption due to rising investment in biologics, infectious disease research, and early drug screening technologies. Regional CROs expanded capabilities as multinational companies increased outsourcing for cost-efficient discovery support. Despite slower technological integration than major markets, ongoing improvements in research funding and collaborations with global biotech firms helped strengthen the region’s presence in the market.

Middle East and Africa

The Middle East and Africa accounted for about 3% share in 2024, driven by improving medical research infrastructure and rising government funding for biotechnology. Countries such as the United Arab Emirates, Saudi Arabia, and South Africa expanded lab capabilities to support early drug research, particularly in infectious and chronic disease areas. Partnerships with global pharma companies and academic institutions supported technology transfer and skill development. Although adoption remained early-stage, growing interest in genomics and digital health research created emerging opportunities for drug discovery technologies in the region.

Market Segmentations:

By Drug Type

- Small Molecule Drugs

- Biologic Drugs

By End User

- Pharmaceutical Companies

- Contract Research Organizations (CROs)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the drug discovery technologies market is shaped by leading companies such as Eli Lilly and Company, Abbott Laboratories Inc., Bayer AG, Merck & Co. Inc., AstraZeneca PLC, Agilent Technologies Inc., F. Hoffmann La Roche Ltd, GlaxoSmithKline PLC, Pfizer Inc., and Shimadzu Corp. The market features strong competition driven by continuous R&D investment, rapid adoption of AI-enabled discovery platforms, and the need for faster lead optimization. Companies focus on expanding automated screening capacity, enhancing imaging technologies, and integrating data analytics to improve accuracy in target identification. Strategic partnerships with biotechnology firms, CROs, and academic institutions strengthen access to advanced tools and global research networks. Many players prioritize biologics, gene therapy research, and multi-omics integration to stay competitive in high-growth therapeutic areas. Rising emphasis on cloud-based workflows, digital labs, and automation continues to reshape competitive strategies, encouraging innovation and long-term investment in cutting-edge discovery infrastructure.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Merck entered a partnership with Promega Corporation to develop high-throughput drug screening and discovery technologies integrating organoid expertise and reporter assay technologies to advance complex disease therapeutic identification.

- In 2025, Agilent Technologies Inc. has actively developed automated target enrichment protocols for genomic sequencing, introduced collaborations such as with Lunit to create AI-based companion diagnostic solutions, and launched new products like the Avida DNA Cancer Panels that enable ultra-sensitive and rapid cancer genomic profiling.

- In 2023, Pfizer completed the acquisition of Seagen for a total enterprise value of approximately $43 billion to enhance its position in oncology and acquire pioneering Antibody-Drug Conjugate (ADC) technology.

Report Coverage

The research report offers an in-depth analysis based on Drug Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- AI and machine learning will streamline hit identification and speed up early discovery.

- Automation will reduce manual lab work and support higher screening accuracy.

- Cloud-based platforms will expand global collaboration in research programs.

- Growth in biologics and RNA-based drugs will drive demand for advanced discovery tools.

- Multi-omics integration will enhance pathway mapping and precision-target selection.

- CRO partnerships will rise as pharma companies increase outsourcing for discovery.

- Digital twins and simulation models will improve molecule prediction and optimization.

- Investments in rare disease and oncology pipelines will boost technology adoption.

- Regulatory support for innovative therapies will encourage wider use of AI-driven platforms.

- Emerging markets will expand discovery capabilities through rising biotech funding.