Market Overview

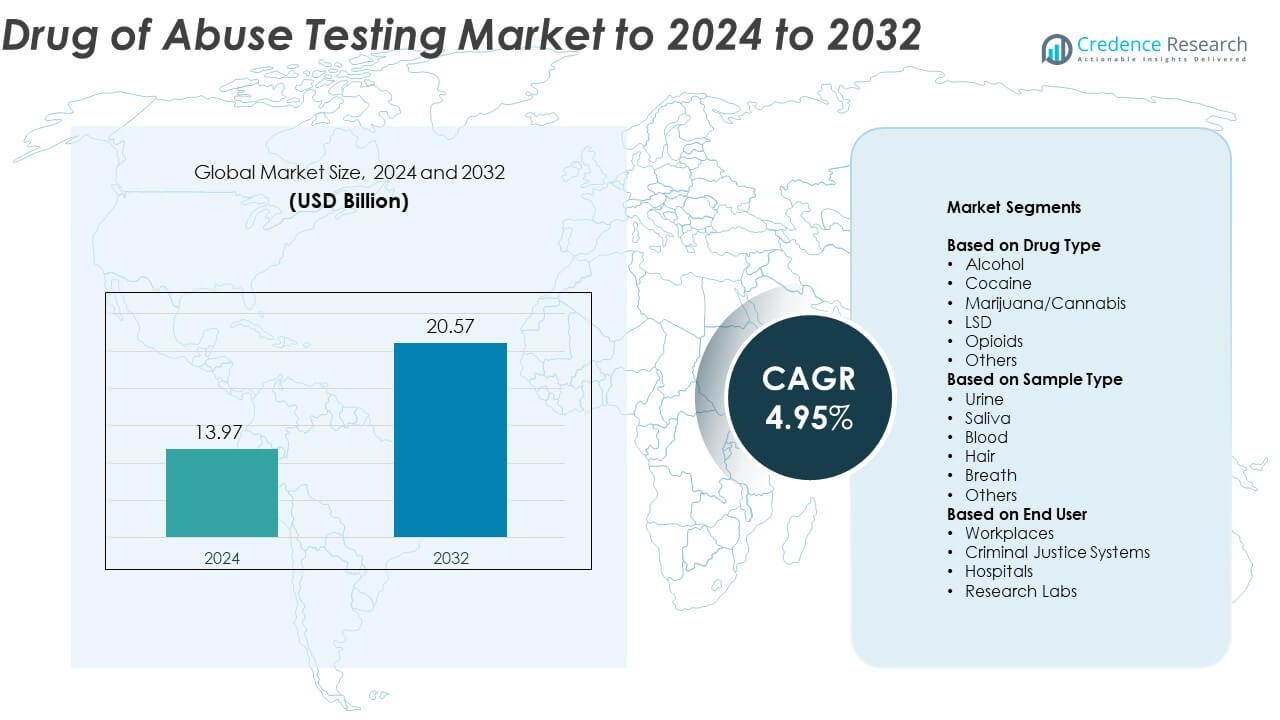

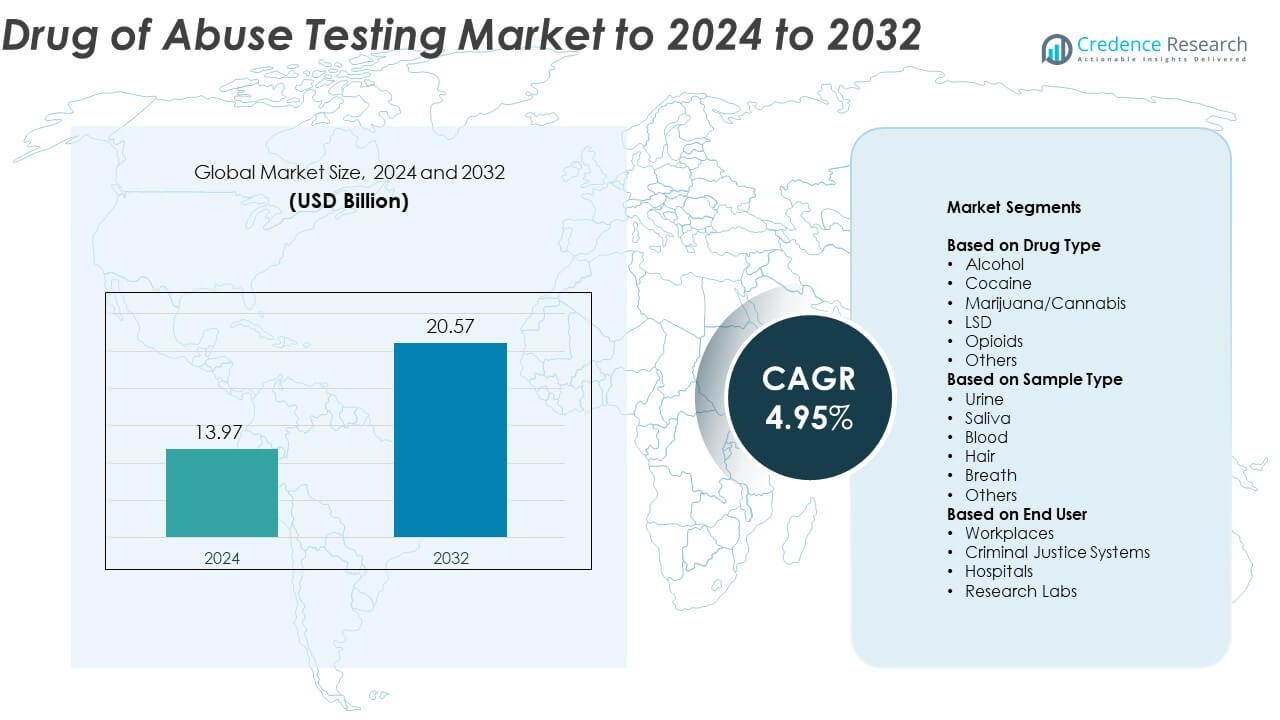

Drug of Abuse Testing Market size was valued at USD 13.97 Billion in 2024 and is anticipated to reach USD 20.57 Billion by 2032, at a CAGR of 4.95% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drug of Abuse Testing Market Size 2024 |

USD 13.97 Billion |

| Drug of Abuse Testing Market, CAGR |

4.95% |

| Drug of Abuse Testing Market Size 2032 |

USD 20.57 Billion |

The drug of abuse testing market is led by major players including Quest Diagnostics, Inc., Abbott Laboratories, LGC Group, Cordant Health Solutions, Precision Diagnostics, Mayo Clinic Laboratories, DrugScan, Legacy Medical Services, LabCorp, and Danaher Corporation. These companies focus on advanced testing technologies, automation, and data integration to improve screening accuracy and efficiency. North America holds the leading position with 37.2% market share in 2024, supported by strong regulatory frameworks, established laboratory infrastructure, and widespread adoption of workplace testing programs. Europe follows with 28.6% share, while Asia Pacific emerges as a rapidly growing region driven by expanding diagnostic capabilities and government initiatives promoting substance abuse control.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The drug of abuse testing market was valued at USD 13.97 Billion in 2024 and is projected to reach USD 20.57 Billion by 2032, expanding at a CAGR of 4.95%.

• Growing prevalence of substance abuse and increasing workplace testing programs are major drivers supporting consistent market growth across developed and emerging economies.

• Technological advancements such as point-of-care testing devices and multi-panel rapid kits are shaping industry trends, enabling faster and more accurate detection.

• The market is moderately competitive, with key players focusing on innovation, digital data integration, and service expansion to strengthen their global presence.

• North America leads with 37.2% share, followed by Europe at 28.6% and Asia Pacific at 22.4%, while the marijuana or cannabis segment dominates the market among drug types with 32.6% share due to high consumption and legalization trends.

Market Segmentation Analysis:

By Drug Type

The marijuana or cannabis segment dominates the drug of abuse testing market with nearly 32.6% share in 2024. Its dominance is driven by the increasing prevalence of cannabis use among young adults and its legalization in several countries, which has prompted the need for effective monitoring and workplace testing. Advances in analytical methods such as liquid chromatography-mass spectrometry have improved detection accuracy for THC metabolites. Rising adoption of multi-panel testing kits and government-led awareness campaigns on substance misuse further support the expansion of cannabis testing programs worldwide.

- For instance, Shimadzu Corporation’s LCMS-8050 platform is widely used in certified forensic laboratories for cannabis analysis, including the detection of THC metabolites, with published application notes demonstrating the capability to detect these metabolites in urine samples at a Limit of Quantification (LOQ) of 5 ng/mL.

By Sample Type

The urine segment leads the market with approximately 41.8% share in 2024. Urine-based testing remains the most widely used method due to its cost efficiency, non-invasive collection, and extended detection window for multiple drug classes. Laboratories and employers prefer urine assays for their reliability and regulatory acceptance in screening programs. The growing use of instant urine test kits in clinical and workplace settings enhances result turnaround times. Increasing R&D investments in advanced immunoassay formats continue to strengthen this segment’s position in the global market.

- For instance, Quest’s 2024 DTI analyzed over 2.8 million federally mandated urine tests.

By End User

Workplaces represent the largest end-user segment, accounting for around 36.2% share in 2024. The dominance is attributed to strict organizational policies, occupational safety requirements, and the rise in pre-employment drug screening across industries such as transportation, construction, and healthcare. Employers implement regular and random testing to reduce accidents, absenteeism, and productivity loss caused by substance abuse. Expanding regulatory mandates and integration of on-site rapid testing technologies are reinforcing adoption in corporate and industrial environments, making workplace drug testing a key growth driver in the overall market.

Key Growth Drivers

Rising Substance Abuse Prevalence

The growing global prevalence of drug misuse is a major growth driver for the drug of abuse testing market. Increasing cases of opioid, cannabis, and synthetic drug consumption have prompted stricter enforcement of screening programs across workplaces, healthcare facilities, and transportation sectors. Governments are mandating regular testing to ensure safety and compliance, while healthcare providers are expanding diagnostic coverage. This surge in substance abuse detection initiatives directly boosts demand for rapid, accurate, and multi-panel testing solutions worldwide.

- For instance, Millennium Health assessed 1.4 million fentanyl-positive urine tests in 2024 analyses.

Expanding Workplace Screening Programs

The rising emphasis on employee safety and productivity is driving demand for workplace drug testing programs. Employers across industries such as aviation, logistics, and construction increasingly use pre-employment and random drug tests to minimize risks associated with substance use. Regulatory frameworks in the United States, Europe, and parts of Asia have further supported this expansion. Integration of cost-effective, on-site testing kits enables faster results and higher adoption among both small and large organizations.

- For instance, First Advantage analyzed 100 million+ screening checks in 2022 for employers.

Advancements in Testing Technologies

Continuous innovation in testing technologies has improved accuracy, sensitivity, and convenience in detecting multiple drugs simultaneously. The adoption of chromatographic and immunoassay techniques, along with portable testing devices, has transformed screening capabilities across laboratories and field settings. Automation and digital data management further enhance workflow efficiency and result integrity. These advancements support faster turnaround times and strengthen the reliability of results, positioning technology upgrades as a core driver of market expansion.

Key Trends & Opportunities

Growing Adoption of Point-of-Care Testing

Point-of-care testing devices are increasingly gaining traction due to their portability, rapid results, and ease of use. These tools are particularly beneficial for law enforcement, emergency departments, and on-site workplace testing. Miniaturized analyzers and disposable testing kits enable real-time decision-making while maintaining regulatory compliance. The trend toward decentralized diagnostics presents major opportunities for manufacturers offering compact, multi-drug detection systems.

- For instance, Abbott’s SoToxa detects up to six drug classes in about 5 minutes.

Increased Focus on Prescription Drug Monitoring

The rising misuse of prescription medications, particularly opioids and sedatives, has created new opportunities for advanced testing solutions. Healthcare providers and regulatory bodies are implementing prescription drug monitoring programs to identify misuse patterns and prevent addiction. This trend encourages the development of high-sensitivity assays and integrated data platforms that track patient compliance. Expanding clinical applications of drug testing beyond illicit substances will further accelerate market growth.

- For instance, Bamboo Health supports ~7 billion PDMP queries yearly across 44 jurisdictions.

Key Challenges

Regulatory and Ethical Concerns

Stringent regulatory frameworks and ethical concerns surrounding privacy pose significant challenges for the drug of abuse testing industry. Variations in drug testing laws across regions create complexity for global companies. Additionally, concerns about individual rights, false positives, and data confidentiality hinder wider adoption. Addressing these regulatory inconsistencies while ensuring accurate and ethical testing practices remains critical for sustained market growth.

High Cost and Limited Accessibility

The high cost of advanced analytical instruments and testing reagents limits accessibility in low-income regions. Many small organizations and public institutions lack resources to adopt high-end laboratory-based testing. Furthermore, maintenance and calibration costs add to operational burdens. Expanding affordable, easy-to-use testing solutions and improving infrastructure in emerging economies are essential to overcome these challenges and achieve broader market penetration.

Regional Analysis

North America

North America dominates the drug of abuse testing market with nearly 37.2% share in 2024. The region’s leadership stems from strict government regulations, widespread workplace testing policies, and rising substance abuse rates. The United States contributes significantly through robust adoption of urine and saliva-based testing across corporate and transportation sectors. Continuous technological innovation, coupled with established laboratory infrastructure, supports market growth. Increasing awareness of drug-related health risks and strong enforcement measures by federal agencies such as SAMHSA and DOT further reinforce North America’s position as the leading regional market.

Europe

Europe holds around 28.6% share of the global drug of abuse testing market in 2024. The region benefits from strong public health initiatives, expanding drug monitoring programs, and regulatory emphasis on workplace safety. Countries such as Germany, the United Kingdom, and France are at the forefront due to increasing drug use among young adults and professionals. Widespread implementation of oral fluid and hair testing technologies enhances adoption. Ongoing investment in laboratory automation and data management systems, along with rising demand for point-of-care testing, continues to strengthen Europe’s market presence.

Asia Pacific

Asia Pacific accounts for approximately 22.4% share of the drug of abuse testing market in 2024. The region is witnessing rapid expansion driven by growing awareness of drug misuse, especially in emerging economies such as China, India, and Japan. Governments are implementing national-level drug surveillance programs and increasing investment in diagnostic infrastructure. The expansion of workplace drug screening and public health initiatives further contributes to growth. Rising affordability of test kits and international collaborations with research institutions are expected to enhance adoption across both urban and rural areas.

Latin America

Latin America captures about 7.1% share of the drug of abuse testing market in 2024. The region’s growth is supported by rising drug trafficking, increasing substance misuse, and expanding law enforcement initiatives. Brazil and Mexico lead due to strengthened government policies and investments in forensic testing. Growing adoption of workplace and roadside testing programs enhances demand for portable detection devices. However, limited healthcare infrastructure and inconsistent regulatory enforcement remain challenges. Ongoing efforts to modernize laboratory facilities and promote public awareness are gradually improving testing penetration in the region.

Middle East & Africa

The Middle East and Africa region represents nearly 4.7% share of the global drug of abuse testing market in 2024. Growth is driven by rising government campaigns addressing addiction and expanding screening in transportation and healthcare sectors. Gulf countries such as Saudi Arabia and the UAE are investing in advanced diagnostic facilities to combat substance misuse. In Africa, increasing drug abuse awareness and collaborations with international organizations are helping build testing capacity. However, limited funding and lack of standardized regulations constrain widespread adoption, though gradual progress is evident in urban centers.

Market Segmentations:

By Drug Type

- Alcohol

- Cocaine

- Marijuana/Cannabis

- LSD

- Opioids

- Others

By Sample Type

- Urine

- Saliva

- Blood

- Hair

- Breath

- Others

By End User

- Workplaces

- Criminal Justice Systems

- Hospitals

- Research Labs

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the drug of abuse testing market includes key players such as Quest Diagnostics, Inc., Abbott Laboratories, LGC Group, Cordant Health Solutions, Precision Diagnostics, Mayo Clinic Laboratories, DrugScan, Legacy Medical Services, LabCorp, and Danaher Corporation. The market is characterized by continuous innovation in testing technologies, expansion of product portfolios, and strategic partnerships to enhance service capabilities. Companies are focusing on developing multi-panel, rapid testing solutions that provide faster and more accurate results for workplace, clinical, and forensic applications. Investments in automation, digital reporting systems, and portable testing devices are shaping future competitiveness. Moreover, collaborations with regulatory agencies and healthcare institutions are supporting compliance with global testing standards. The increasing demand for remote and point-of-care testing, coupled with the integration of cloud-based data management, is further intensifying competition among leading manufacturers and service providers across the global landscape.

Key Player Analysis

- Quest Diagnostics, Inc.

- Abbott Laboratories

- LGC Group

- Cordant Health Solutions

- Precision Diagnostics

- Mayo Clinic Laboratories

- DrugScan

- Legacy Medical Services

- LabCorp

- Danaher Corporation

Recent Developments

- In 2025, Danaher announced a strategic partnership with AstraZeneca focused on the development and commercialization of novel diagnostic tools, aiming to advance precision medicine, including drug testing areas.

- In 2025, LabCorp Published its “Evolving Drug Trends” clinical toxicology report noting shifts such as rising medetomidine detections in fentanyl-positive samples.

- In 2023, Quest Diagnostics introduced a Drug Monitoring panel targeting Novel Psychoactive Substances (NPS), utilizing liquid chromatography with tandem mass spectrometry (LC-MS/MS) to identify major classes of NPS.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Drug Type, Sample Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising awareness of substance misuse will continue to drive global testing demand.

- Integration of AI and automation will enhance testing accuracy and efficiency.

- Point-of-care testing devices will gain popularity for rapid, on-site screening.

- Expansion of workplace testing programs will strengthen market penetration.

- Advances in chromatography and immunoassay technologies will improve detection sensitivity.

- Government-led initiatives will boost adoption across healthcare and transportation sectors.

- Growing focus on prescription drug monitoring will open new market opportunities.

- Emerging economies will experience faster adoption due to improved healthcare infrastructure.

- Ethical and regulatory standardization will support consistent global testing practices.

- Continuous innovation in portable analyzers will make testing more accessible and cost-effective.