| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Underground Mining Trucks Market Size 2024 |

USD 9,680.2 million |

| Underground Mining Trucks Market, CAGR |

4.17% |

| Underground Mining Trucks Market Size 2032 |

USD 13,447.4 million |

Market Overview:

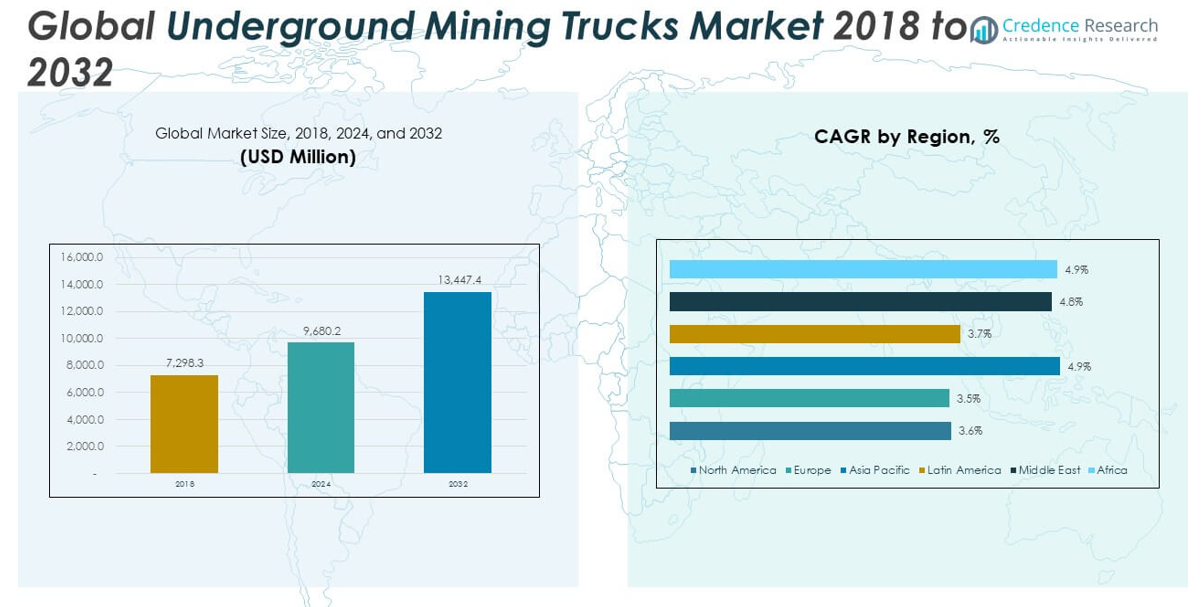

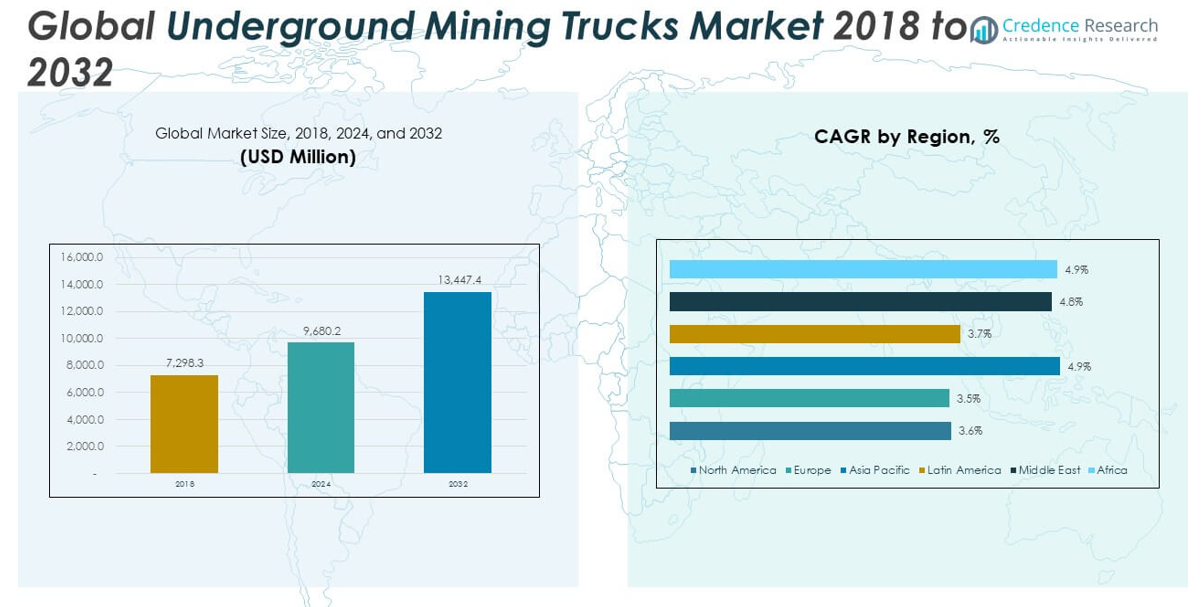

The Underground Mining Trucks Market size was valued at USD 7,298.3 million in 2018 to USD 9,680.2 million in 2024 and is anticipated to reach USD 13,447.4 million by 2032, at a CAGR of 4.17% during the forecast period.

The underground mining trucks market is primarily driven by technological advancements, regulatory compliance, and environmental concerns. Automation and electrification have become key enablers in improving operational efficiency and reducing operational costs in mining operations. Autonomous haulage systems (AHS) and battery-electric vehicles (BEVs) are gaining traction, particularly due to their ability to reduce emissions and increase productivity. Safety regulations also play a crucial role in driving market growth, as mining companies adopt advanced safety features, such as collision avoidance systems, to enhance worker safety in hazardous underground environments. Additionally, the demand for sustainable and environmentally friendly mining solutions is pushing companies to invest in electric and hybrid mining trucks, aiming to reduce carbon footprints and meet regulatory standards.

The underground mining trucks market shows diverse growth trends across regions. Asia Pacific holds the largest share due to extensive mining operations in countries like China, India, and Australia, where the demand for efficient and sustainable mining solutions is high. North America follows closely, with significant growth driven by technological innovation and the need for mining companies to modernize their fleets. The U.S. mining sector, in particular, focuses heavily on upgrading equipment to improve safety and operational efficiency. Europe, with its strong focus on environmental regulations and sustainability, is witnessing a steady shift towards the adoption of electric mining trucks. Meanwhile, Latin America is increasingly investing in low-emission and dual-fuel mining trucks, especially in Brazil, where the mining sector is transitioning towards cleaner technologies. In the Middle East and Africa, the market is emerging, with growing investments in mining infrastructure driving demand for underground mining trucks.

Market Insights:

- The Underground Mining Trucks Market was valued at USD 7,298.3 million in 2018 and is projected to reach USD 13,447.4 million by 2032, growing at a CAGR of 4.17% during the forecast period.

- Technological advancements, including autonomous haulage systems (AHS) and battery-electric vehicles (BEVs), are driving significant growth by improving operational efficiency and reducing environmental impact.

- Regulatory compliance, especially with safety standards such as OSHA and ISO, is pushing mining companies to adopt advanced equipment that meets stringent safety requirements.

- Environmental sustainability pressures are encouraging the mining industry to invest in eco-friendly solutions, like electric mining trucks, to reduce emissions and meet growing regulatory demands.

- Rising demand for efficient material transport solutions in the mining sector is fueling the market, with underground mining trucks providing high payload capacity and reliability for challenging conditions.

- The market faces challenges from high initial investment costs, with electric, hybrid, and autonomous trucks requiring significant capital investment, especially for smaller mining operations.

- Maintenance and infrastructure requirements for electric and hybrid trucks, including charging stations and service centers, pose a barrier to widespread adoption, increasing operational complexity and costs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Technological Advancements in Mining Equipment

The Underground Mining Trucks Market is benefiting from significant technological advancements in mining equipment. The integration of automation, such as autonomous haulage systems (AHS), has revolutionized operations by enhancing efficiency and reducing the need for human labor in hazardous environments. These systems can navigate challenging terrains and transport materials without direct human intervention, minimizing risks and improving productivity. Furthermore, the introduction of battery-electric vehicles (BEVs) is driving the market’s growth by offering eco-friendly alternatives to traditional diesel-powered trucks. These innovations are not only increasing the operational capacity of mining trucks but are also addressing environmental concerns by reducing carbon emissions in underground mining operations.

Regulatory Compliance and Safety Requirements

Safety regulations and compliance requirements are pivotal drivers for the Underground Mining Trucks Market. Stringent safety standards, such as those outlined by OSHA and ISO, are compelling mining companies to adopt advanced machinery that ensures safer working conditions. Modern underground mining trucks are equipped with collision avoidance systems, real-time monitoring capabilities, and enhanced ergonomic features to mitigate risks associated with deep mining operations. Compliance with these safety regulations has made it necessary for mining companies to invest in updated and safer equipment. By implementing these regulations, companies not only ensure employee well-being but also reduce the likelihood of operational delays caused by accidents or safety violations.

- For instance, the Mine Safety and Health Administration (MSHA) in the U.S. requires formal approval for diesel engines used underground, including emission testing under the ISO 8178 C1 cycle.

Environmental Sustainability Pressures

Environmental concerns are another critical factor influencing the growth of the Underground Mining Trucks Market. Growing awareness about the environmental impact of mining operations is pushing companies to adopt more sustainable and environmentally friendly equipment. The shift toward battery-electric trucks, which produce fewer emissions than their diesel counterparts, aligns with the mining industry’s broader efforts to reduce its carbon footprint. Mining operations are under increasing pressure from regulatory bodies to adopt green technologies, and electric mining trucks offer a solution that helps meet these environmental goals. This transition to sustainable solutions is also aligned with global efforts to reduce pollution and promote clean energy.

- For example, companies like Caterpillar and Newmont are explicitly targeting zero-carbon-emitting mining systems. BluVein’s dynamic charging system enables BEVs to operate continuously, eliminating diesel particulates and reducing the carbon footprint of underground operations.

Demand for Efficient Material Transport Solutions

The increasing demand for efficient material transport solutions in the mining sector is driving the growth of the Underground Mining Trucks Market. As the global demand for minerals, metals, and other resources rises, mining companies are looking for ways to improve productivity and reduce costs. The ability to quickly and safely transport large quantities of material from underground operations to surface facilities is vital. Underground mining trucks provide a solution by offering high payload capacities and reliability, ensuring that materials are transported efficiently in the most challenging mining conditions. These trucks play a crucial role in helping companies maintain high productivity levels and meet the growing demand for mined resources.

Market Trends:

Increasing Adoption of Electric and Hybrid Mining Trucks

One of the key trends in the Underground Mining Trucks Market is the growing adoption of electric and hybrid mining trucks. The transition from traditional diesel-powered trucks to electric and hybrid models reflects the mining industry’s commitment to reducing carbon emissions and improving sustainability. Battery-electric trucks are particularly popular due to their ability to operate in confined underground spaces without emitting harmful pollutants. These trucks provide mining companies with a viable solution to meet stringent environmental regulations while improving operational efficiency. The push towards greener mining operations continues to gain momentum, and the adoption of electric mining trucks is expected to accelerate over the coming years.

- A leading example of electrification is the Epiroc Minetruck MT42 Battery, which was deployed at Boliden’s Kristineberg mine in Sweden. According to Epiroc’s official documentation, the MT42 Battery offers a 42-tonne payload and enables zero-emission operation in underground environments.

Automation and Smart Mining Technologies

Automation is another significant trend influencing the Underground Mining Trucks Market. Mining companies are increasingly integrating autonomous haulage systems (AHS) into their operations to improve efficiency, safety, and cost-effectiveness. Autonomous trucks can navigate complex underground terrains without human intervention, which reduces the risk of accidents and enhances operational productivity. Furthermore, these systems can communicate with other automated equipment to create a fully integrated, smart mining environment. This trend toward automation is expected to expand as mining companies strive for greater efficiency and reduced labor costs while ensuring a safer working environment for their employees.

- For instance, Komatsu’s FrontRunner Autonomous Haulage System (AHS)has set a benchmark in automation, with company reports confirming that over 700 Komatsu AHS trucks have autonomously hauled more than 7.2 billion tonnes of material globally as of early 2025.

Focus on Safety and Regulatory Compliance

The focus on safety and regulatory compliance continues to shape the Underground Mining Trucks Market. Mining companies are adopting advanced safety technologies, such as collision avoidance systems, driver assistance technologies, and real-time monitoring systems, to ensure the protection of workers in hazardous underground environments. These safety systems are becoming a standard feature in modern mining trucks to meet increasingly stringent regulations. Regulatory bodies are pushing for more robust safety measures in mining operations, and companies are responding by incorporating the latest safety innovations. This trend is driving the demand for more advanced underground mining trucks that meet both safety and compliance requirements.

Integration of Digitalization and Data Analytics

The integration of digitalization and data analytics is becoming a prominent trend in the Underground Mining Trucks Market. Mining companies are leveraging advanced data analytics tools to improve fleet management, monitor truck performance, and optimize maintenance schedules. Real-time data collection from mining trucks allows for predictive maintenance, reducing downtime and ensuring trucks are operating at peak efficiency. This trend toward data-driven decision-making is enhancing the overall productivity of underground mining operations and contributing to the long-term sustainability of mining fleets. The use of digital technologies is expected to become more widespread as mining companies look to improve efficiency and reduce operational costs.

Market Challenges Analysis:

High Initial Investment Costs

One of the primary challenges facing the Underground Mining Trucks Market is the high initial investment required for advanced mining trucks. The adoption of electric, hybrid, and autonomous trucks involves significant upfront costs compared to traditional diesel-powered trucks. These trucks are equipped with advanced technologies, such as battery systems and automation, which increase their price. For many mining companies, especially small- to medium-sized operations, the cost of purchasing and implementing these sophisticated systems can be a major barrier. Although the long-term operational savings from improved fuel efficiency and reduced labor costs may justify the investment, the high initial capital expenditure remains a key challenge in the market.

Maintenance and Infrastructure Requirements

Another challenge hindering the growth of the Underground Mining Trucks Market is the maintenance and infrastructure demands associated with advanced mining trucks. Electric and hybrid trucks require specialized charging infrastructure and maintenance facilities, which can be costly and require time to implement. Mining companies need to ensure that their infrastructure can support the operation of these advanced trucks, including adequate charging stations and service centers for routine maintenance and repairs. The complexity of maintaining autonomous and electric systems, such as batteries and automation software, can also lead to increased operational costs and potential downtime if not properly managed. These factors may discourage some companies from transitioning to newer, more advanced underground mining trucks.

Market Opportunities:

Expansion of Electric and Autonomous Truck Adoption

The Underground Mining Trucks Market presents significant opportunities through the increasing adoption of electric and autonomous trucks. As the mining industry focuses on sustainability and safety, there is a growing demand for eco-friendly and automated solutions. Electric trucks offer the benefit of lower emissions and reduced operational costs, aligning with stricter environmental regulations. Autonomous trucks are also gaining traction, offering improved efficiency, safety, and productivity. The demand for these advanced trucks is expected to rise as companies look to modernize their fleets while adhering to environmental and safety standards.

Technological Advancements and Digitalization Integration

There are substantial opportunities for growth in the integration of digitalization and advanced technologies in the Underground Mining Trucks Market. The use of data analytics, real-time monitoring, and predictive maintenance can enhance the performance and lifespan of mining trucks. As mining companies continue to adopt more digital solutions, they can improve fleet management, reduce operational downtime, and optimize the maintenance schedules of their trucks. The ongoing evolution of digital technologies provides an avenue for companies to enhance operational efficiency, driving further growth in the market.

Market Segmentation Analysis:

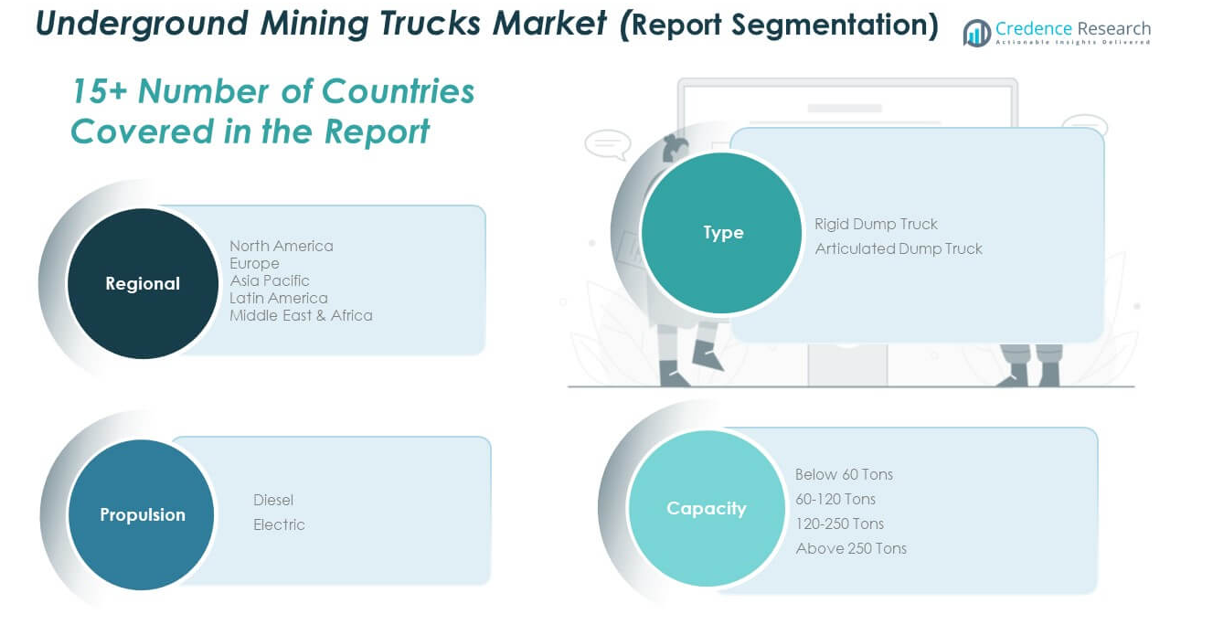

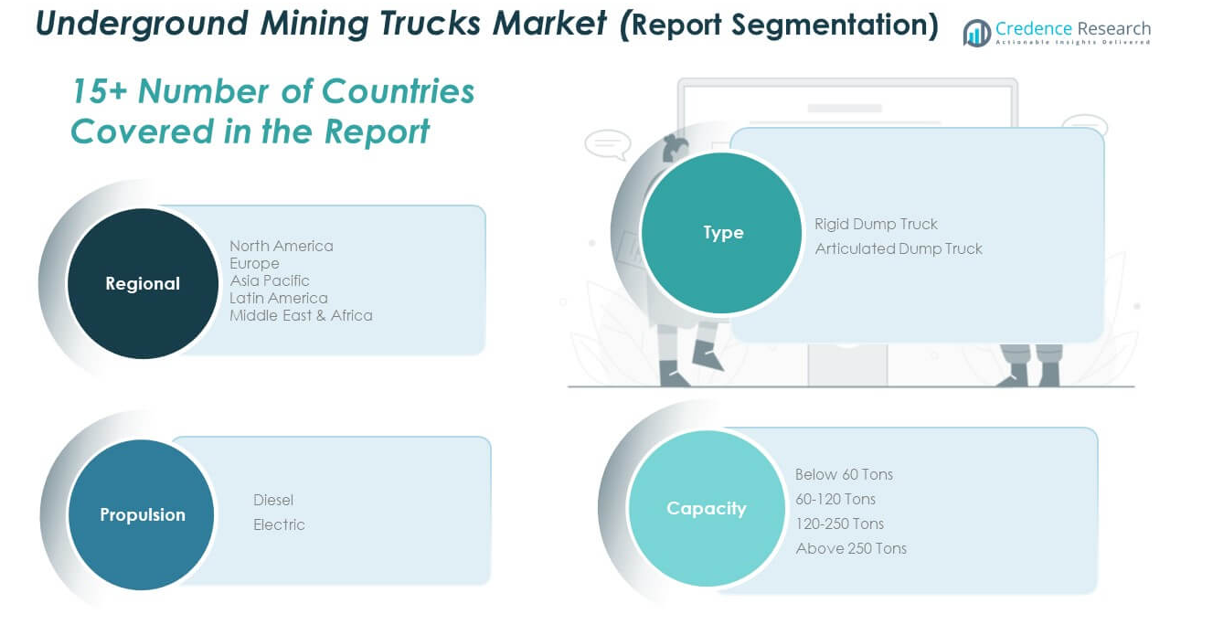

The Underground Mining Trucks Market is segmented by type, propulsion, and capacity, with each segment playing a significant role in its growth.

By type, the market is divided into rigid dump trucks and articulated dump trucks. Rigid dump trucks are known for their ability to carry heavier loads over longer distances, making them suitable for large-scale mining operations. Articulated dump trucks, on the other hand, offer greater maneuverability in tight underground spaces, making them ideal for more complex mining environments.

- For rigid dump trucks, the Caterpillar 797F is a flagship example, offering a payload capacity of 400 tons. This model is widely deployed in large-scale mining operations where the ability to carry heavier loads over long distances is essential.

By propulsion, the market is divided into diesel and electric-powered trucks. Diesel-powered trucks continue to dominate due to their high power output and long operational hours in harsh mining conditions. However, electric trucks are gaining traction due to their lower emissions, better fuel efficiency, and alignment with environmental regulations. The adoption of electric trucks is expected to rise as mining companies prioritize sustainability.

- The Epiroc Minetruck MT42 Battery is a prominent example of the market’s shift toward sustainability. This electric-powered truck is utilized in underground mining for its zero-emission operation and enhanced energy efficiency, as highlighted in Epiroc’s official sustainability report.

By capacity segment includes trucks below 60 tons, 60-120 tons, 120-250 tons, and above 250 tons. Trucks with capacities between 60-120 tons are expected to see significant growth due to their balance of power and maneuverability, suitable for medium-scale operations. Larger capacity trucks, particularly those above 250 tons, are essential for large mining operations that require high payload capabilities. Trucks with smaller capacities are preferred for operations that involve tight spaces and lower payload demands. These segments collectively influence the overall dynamics of the Underground Mining Trucks Market.

Segmentation:

By Type

- Rigid Dump Truck

- Articulated Dump Truck

By Propulsion

By Capacity

- Below 60 Tons

- 60-120 Tons

- 120-250 Tons

- Above 250 Tons

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Underground Mining Trucks Market size was valued at USD 1,662.56 million in 2018, is projected to reach USD 2,131.31 million by 2024, and is anticipated to reach USD 2,823.96 million by 2032, at a CAGR of 3.6% during the forecast period. The region holds a prominent market share in the underground mining trucks industry, driven by strong demand from the mining sectors in the United States and Canada. The North American market benefits from the adoption of advanced technologies, including electric and autonomous mining trucks, which are gaining traction due to the region’s commitment to sustainability and safety regulations. The integration of automation in mining operations to enhance productivity and reduce labor costs further contributes to the market’s growth. As mining companies strive to modernize their fleets, North America continues to lead in technological advancements, particularly in equipment automation.

Europe

The Europe Underground Mining Trucks Market size was valued at USD 1,808.53 million in 2018, is projected to reach USD 2,315.79 million by 2024, and is anticipated to reach USD 3,063.32 million by 2032, at a CAGR of 3.5% during the forecast period. Europe holds a significant share of the global market, primarily driven by the region’s stringent safety and environmental regulations. The adoption of eco-friendly electric mining trucks is rising as part of Europe’s commitment to sustainability and reducing carbon emissions. The European market also benefits from increasing demand for advanced mining technologies, such as automation and digitalization, to improve operational efficiency. The mining industry in countries like Germany, Russia, and Sweden is focused on enhancing the productivity of underground mining operations, contributing to the steady growth of the market in this region.

Asia Pacific

The Asia Pacific Underground Mining Trucks Market size was valued at USD 2,270.51 million in 2018, is projected to reach USD 3,152.16 million by 2024, and is anticipated to reach USD 4,639.36 million by 2032, at a CAGR of 4.9% during the forecast period. The Asia Pacific region holds the largest market share, driven by large-scale mining operations in countries like China, India, and Australia. The region’s growing focus on enhancing mining efficiency and safety is driving the adoption of advanced mining trucks, particularly electric and autonomous models. Additionally, the increasing demand for minerals, metals, and coal from various industries is fueling the need for more robust and efficient underground mining equipment. The significant investments in mining infrastructure across Asia Pacific further contribute to the market’s growth.

Latin America

The Latin America Underground Mining Trucks Market size was valued at USD 762.68 million in 2018, is projected to reach USD 983.79 million by 2024, and is anticipated to reach USD 1,315.16 million by 2032, at a CAGR of 3.7% during the forecast period. Latin America is witnessing steady growth in the underground mining trucks market, with Brazil and Chile being the key contributors. The region’s mining industry is increasingly adopting modern mining technologies to enhance productivity and minimize operational costs. The push toward sustainability, along with stricter environmental regulations, is driving the adoption of electric mining trucks. Additionally, mining companies in Latin America are modernizing their fleets to improve safety and efficiency, creating substantial growth opportunities for the market in this region.

Middle East

The Middle East Underground Mining Trucks Market size was valued at USD 518.91 million in 2018, is projected to reach USD 716.06 million by 2024, and is anticipated to reach USD 1,046.21 million by 2032, at a CAGR of 4.8% during the forecast period. The market in the Middle East is growing rapidly, supported by increasing investments in mining infrastructure, particularly in countries like Saudi Arabia and the UAE. The region’s focus on sustainable mining practices is driving the adoption of environmentally friendly mining equipment, including electric and hybrid trucks. The push for automation to improve mining productivity and reduce labor costs is another key driver of market growth. As mining operations expand in the Middle East, the demand for advanced underground mining trucks is expected to rise steadily.

Africa

The Africa Underground Mining Trucks Market size was valued at USD 275.15 million in 2018, is projected to reach USD 381.12 million by 2024, and is anticipated to reach USD 559.41 million by 2032, at a CAGR of 4.9% during the forecast period. The African market is expanding due to the growing mining operations in South Africa, Ghana, and other countries rich in natural resources. The region is increasingly adopting advanced mining technologies, including electric and autonomous trucks, to enhance efficiency and comply with environmental regulations. The demand for mining trucks in Africa is fueled by the need for safer and more efficient transportation of mined materials in challenging underground conditions. The ongoing development of mining infrastructure in Africa presents significant opportunities for market growth in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BelAZ

- CRRC Group

- Terex Corporation

- Volvo Construction Equipment

- Atlas Copco

- Dux Machinery Corporation

- Bell Equipment

- Sany Heavy Industry

- Caterpillar

- Zoomlion

- Other Key Players

Competitive Analysis:

The Underground Mining Trucks Market is highly competitive, with several key players vying for market share. Companies like Caterpillar, Komatsu, Sandvik, and Volvo dominate the market due to their extensive product portfolios, technological innovations, and strong global presence. These manufacturers focus on offering advanced mining trucks equipped with automation and electric propulsion systems to cater to the growing demand for sustainable and efficient solutions. Players are increasingly investing in research and development to enhance their products’ capabilities, including improved payload capacity, fuel efficiency, and safety features. Strategic partnerships and acquisitions are common in this market, enabling companies to expand their technological expertise and enhance their product offerings. The competitive landscape is also shaped by regional players who focus on meeting local market demands with tailored solutions. To maintain a competitive edge, companies are focusing on technological advancements, safety enhancements, and improving operational cost efficiency.

Recent Developments:

- In January 2025, Epiroc and ABB advanced their partnership by signing a Memorandum of Understanding to collaborate on underground trolley solutions for mining. Their joint teams are conducting a comprehensive feasibility assessment to develop ruggedized, high-power, and automated trolley systems specifically for harsh underground mine environments.

- In January 2025, Volvo CE launched a new lineup of articulated haulers (A25-A60), featuring a new electronic system and in-house transmission for up to 15% better fuel efficiency. The range includes the all-new A50 model, broadening Volvo’s offerings for demanding hauling tasks.

- In July 2024, Komatsu Limited, a leading Japanese manufacturer of mining and construction equipment, completed the acquisition of GHH Group GmbH, a Germany-based company specializing in underground mining trucks, including articulated dump trucks for underground mining and tunneling.

Market Concentration & Characteristics:

The Underground Mining Trucks Market is moderately concentrated, with a few major players dominating the competitive landscape. Companies such as Caterpillar, Komatsu, and Sandvik hold substantial market share due to their established brand presence, broad product portfolios, and technological advancements. The market is characterized by a strong focus on innovation, particularly in electric and autonomous mining trucks, which are becoming essential in modern mining operations. Key players are investing heavily in research and development to enhance the efficiency, safety, and sustainability of their trucks. While global leaders control a significant portion of the market, regional players are emerging to meet local demand, offering more customized solutions. The market is driven by continuous product advancements, regulatory pressures for sustainability, and the increasing need for efficient and safer mining equipment. The competition remains robust, with companies focusing on technological differentiation and cost-effective solutions.

Report Coverage:

The research report offers an in-depth analysis based on type, propulsion, and capacity. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Underground Mining Trucks Market is expected to grow at a steady pace, driven by increasing demand for efficient material transport solutions in mining operations.

- Electric and autonomous trucks will become more prevalent as mining companies prioritize sustainability and safety.

- Technological advancements in battery systems and automation will enhance truck performance and reduce operational costs.

- The market will see rising demand for eco-friendly solutions as regulations on emissions and environmental impact tighten.

- Growing mining operations in emerging economies will contribute to market expansion, especially in Asia Pacific and Latin America.

- Strategic partnerships and collaborations between truck manufacturers and technology providers will foster innovation.

- Increasing focus on predictive maintenance and fleet management solutions will optimize truck uptime and reduce maintenance costs.

- The shift towards digitalization and data analytics will help improve operational efficiency and decision-making in mining operations.

- Investment in infrastructure to support electric and hybrid trucks will accelerate growth in key regions.

- Regional players will continue to innovate to meet the specific needs of local markets while competing with global leaders.