Market Overview

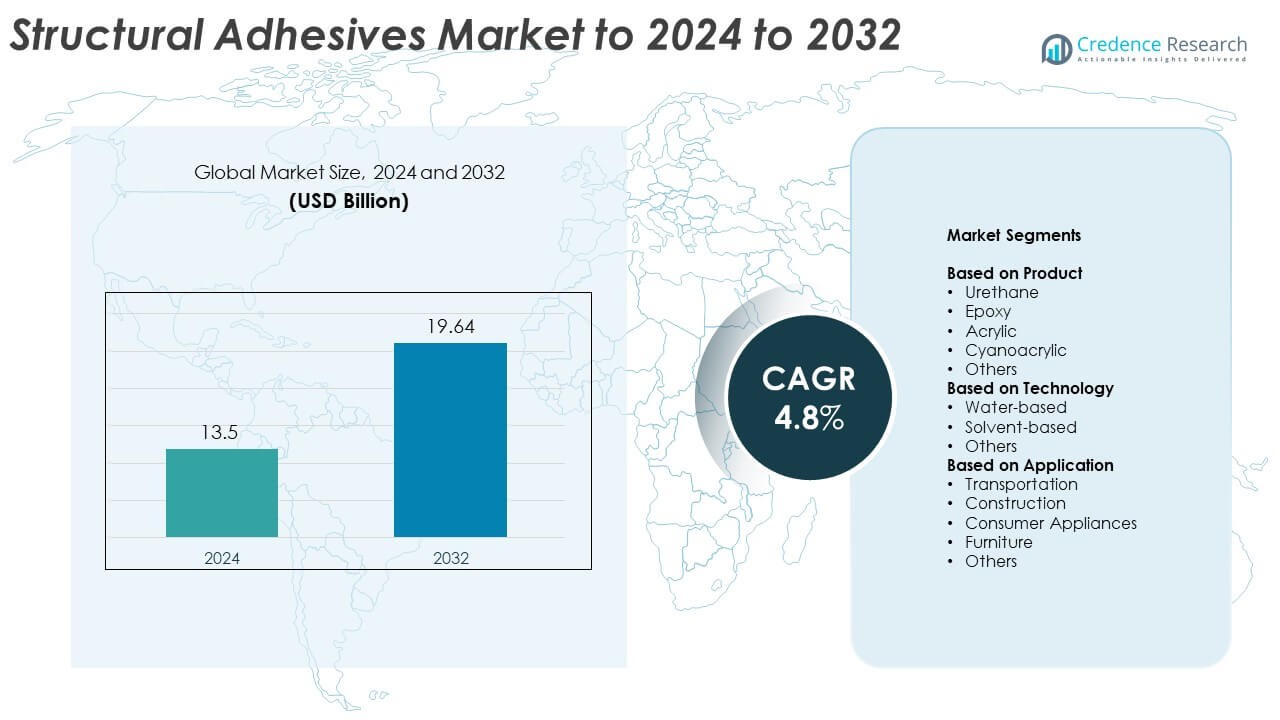

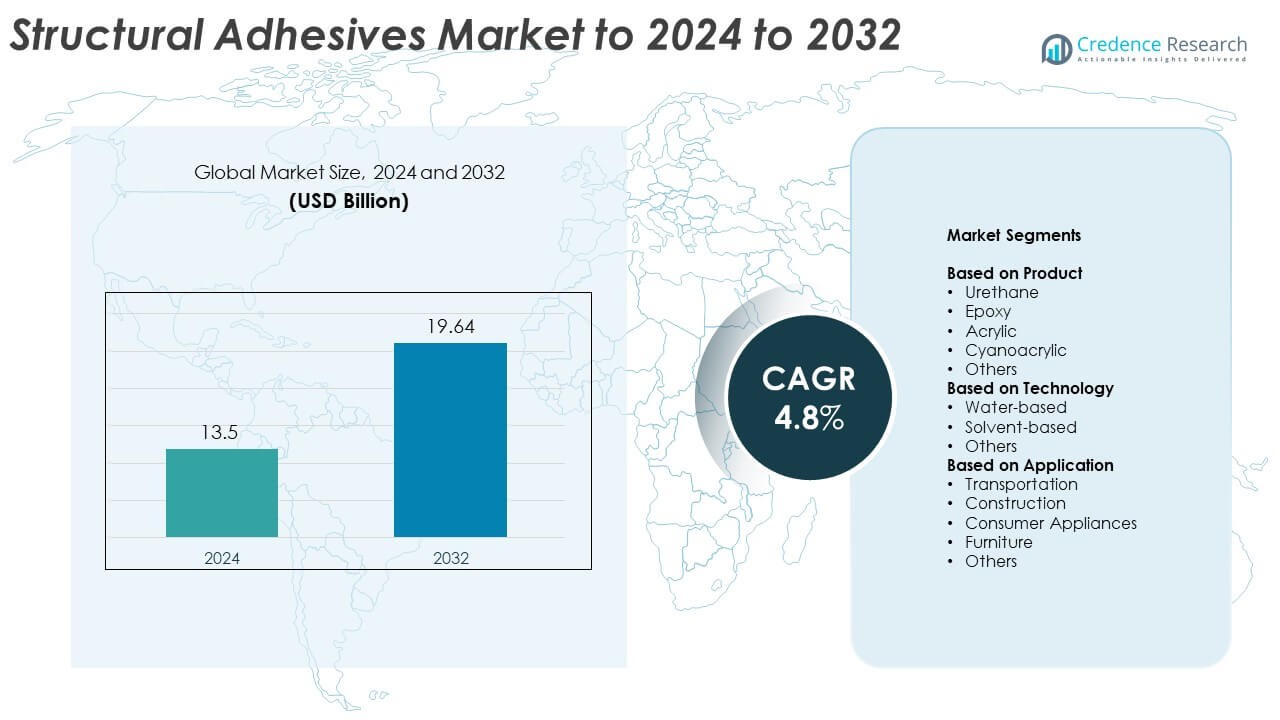

Structural Adhesives Market size was valued at USD 13.5 Billion in 2024 and is anticipated to reach USD 19.64 Billion by 2032, at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Structural Adhesives Market Size 2024 |

USD 13.5 Billion |

| Structural Adhesives Market, CAGR |

4.8% |

| Structural Adhesives Market Size 2032 |

USD 19.64 Billion |

The structural adhesives market includes major players such as Arkema S.A., Scott Bader Co., HB Fuller Company, 3M, Ashland Global Specialty Chemicals Inc., Franklin International, Inc., Lord Corporation, Dow, Henkel AG & Co. KGaA, and Avery Dennison Corporation. These companies strengthen the market through innovation in high-performance bonding, sustainable formulations, and advanced curing technologies. North America leads the global market with about 32% share due to strong automotive, aerospace, and construction demand. Europe follows with nearly 28% share, supported by stringent environmental standards and advanced engineering industries, while Asia Pacific shows rapid expansion driven by manufacturing growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The structural adhesives market reached USD 13.5 Billion in 2024 and is projected to hit USD 19.64 Billion by 2032, expanding at a CAGR of 4.8% during the forecast period.

- Rising demand for lightweight materials in automotive, aerospace, and transportation drives strong adoption, with the urethane segment leading the product category at about 36% share in 2024.

- Water-based technology continues to gain traction as a key trend due to tightening environmental regulations and rising preference for low-VOC, sustainable adhesive solutions across industries.

- The market remains moderately consolidated, with leading companies focusing on hybrid chemistries, faster curing systems, and automation-ready formulations to enhance performance in high-volume manufacturing.

- North America leads with around 32% share, followed by Europe at nearly 28%, while Asia Pacific accounts for about 30% and shows the fastest growth due to expanding automotive, electronics, and construction activities.

Market Segmentation Analysis:

By Product

Urethane leads the product segment with about 36% share in 2024 due to strong bonding flexibility, high impact resistance, and broad compatibility with metals, plastics, and composites. The urethane category grows as manufacturers in automotive and construction prefer durable adhesives that withstand vibration and thermal stress. Epoxy follows due to superior structural strength, while acrylic and cyanoacrylic gain steady use in fast-curing applications. Other product types serve niche needs where chemical resistance and specific material bonding are required.

- For instance, Arkema’s Bostik plant in Columbus, Ohio, has a total annual production capacity of up to 100 million pounds of specialty adhesives, which are used to produce products for food packaging (laminating flexible films) and wood bonding (engineered wood products, flooring, windows, and doors) customers.

By Technology

Water-based structural adhesives dominate this segment with nearly 42% share in 2024 because industries are shifting to low-VOC, environmentally safer formulations. Growth accelerates as regulators promote eco-friendly bonding solutions across transportation, furniture, and construction. Solvent-based adhesives remain relevant in heavy-duty and high-temperature applications, but adoption slows due to stricter emission rules. Other technologies, including reactive systems and hybrid chemistries, expand as manufacturers seek stronger adhesion with reduced curing time.

- For instance, Henkel’s Adhesive Technologies Innovation Center in Düsseldorf spans about 47,000 square meters. The site hosts more than 650 experts developing new water-based and low-emission adhesive systems.

By Application

Transportation holds the dominant position with about 38% share in 2024 due to rising use of lightweight materials in automotive, aerospace, rail, and marine sectors. Structural adhesives replace welding and mechanical fasteners as OEMs seek higher fatigue resistance and better design flexibility. Construction follows with increasing demand for high-strength bonding in panels, facades, and infrastructure components. Consumer appliances, furniture, and other applications grow steadily as manufacturers aim for quieter operation, improved aesthetics, and reduced assembly time.

Key Growth Drivers

Rising Demand for Lightweight Materials

The shift toward lightweight components in automotive, aerospace, and transportation sectors drives strong adoption of structural adhesives. Manufacturers replace mechanical fasteners to reduce vehicle weight, enhance fuel efficiency, and improve crash performance. Adhesives support bonding of composites, aluminum, and engineered plastics, enabling advanced design flexibility. This transition accelerates as OEMs align with global emission targets and efficiency mandates. The trend strengthens multi-material assembly needs, making lightweight construction the leading growth driver in the structural adhesives market.

- For instance, the BMW i3 features a LifeDrive architecture, where the CFRP (carbon-fiber–reinforced plastic) “Life module” (the passenger cell) sits on an aluminum “Drive module” (chassis, battery, and powertrain). The passenger compartment structure is comprised of around 150 CFRP parts.

Expansion in Construction and Infrastructure Projects

Global infrastructure investment boosts demand for high-strength bonding solutions across residential, commercial, and industrial projects. Structural adhesives support durable connections in facades, panels, flooring, and modular structures. Rising urbanization and large-scale smart city development further accelerate usage. Builders prefer adhesive bonding over welding due to faster installation, reduced labor cost, and enhanced design freedom. This consistent need for reliable and long-lasting adhesion makes construction activity a major driver in the structural adhesives market.

- For instance, as of the end of 2023, the Mapei Group operated in 57 countries, with 96 subsidiaries and 93 production plants Mapei 2023 Consolidated Financial Statements.

Growth of Consumer Appliances and Electronics Manufacturing

Rapid expansion of appliance and electronics production strengthens adhesive consumption, particularly in compact and lightweight device assembly. Adhesives support vibration damping, thermal stability, and aesthetic surface bonding, which improve product durability and design quality. Manufacturers rely on advanced formulations to bond plastics, glass, and metal components without visible joints. Increasing consumer demand for efficient and stylish home appliances keeps structural adhesives essential in assembly lines, making this segment a significant growth driver.

Key Trends and Opportunities

Adoption of Sustainable and Low-VOC Formulations

A major trend shaping the market is the rapid move toward eco-friendly, low-VOC, and water-based adhesive technologies. Manufacturers innovate to meet strict environmental regulations and rising customer preference for safer materials. Investments in bio-based and hybrid chemistries offer new opportunities for durable yet sustainable bonding. This shift encourages adoption in automotive, furniture, and construction applications, where sustainability standards continue to tighten. The transition to greener solutions creates long-term growth potential for high-performance adhesive formulations.

- For instance, Avery Dennison’s 2023 CDP Climate filing describes science-based targets for its adhesive businesses. Targets cut Scope 1 and 2 emissions from 2015 levels and pursue net-zero by 2050.

Expansion of Automation and Advanced Manufacturing

Increasing automation across automotive, electronics, and appliance sectors creates strong opportunities for structural adhesives tailored for robotic application. Consistent dispensing, fast curing, and high strength make adhesives ideal for automated assembly lines. Companies seek formulations compatible with precision manufacturing to improve cycle time and reliability. This trend grows as industries adopt Industry 4.0 technologies. The shift enables greater production efficiency and expands adhesive use in next-generation manufacturing environments.

- For instance, FANUC announced in 2023 that its cumulative industrial robot shipments reached 1 million units.

Key Challenges

Fluctuating Raw Material Prices

Volatility in petrochemical-based raw materials affects structural adhesive production costs and profit margins. Manufacturers face supply instability for key ingredients such as polyols, isocyanates, and epoxy resins. Global disruptions, geopolitical tensions, and energy price swings intensify this challenge. Price fluctuations make long-term planning difficult for adhesive producers and end-users. Companies often seek alternative formulations or diversify sourcing to reduce dependency, but cost pressure remains a major constraint in the structural adhesives market.

Performance Limitations in Extreme Conditions

Structural adhesives face challenges when exposed to extreme temperatures, high humidity, or harsh chemicals, which may weaken bond strength. Applications in aerospace, automotive under-the-hood systems, and heavy industrial environments demand exceptional durability. Some adhesive types still struggle to meet these rigorous standards, leading manufacturers to rely on mechanical fastening or hybrid bonding in critical zones. Continued R&D is required to overcome these performance gaps and expand adoption in high-stress applications.

Regional Analysis

North America

North America holds about 32% share of the structural adhesives market in 2024 due to strong demand from automotive, construction, aerospace, and appliance manufacturing. The United States dominates regional consumption as OEMs adopt advanced bonding solutions for lightweight vehicles and high-performance industrial products. Growth continues with rising investments in infrastructure renovation and energy-efficient building materials. Canada adds steady demand through construction upgrades and machinery production. Expanding use of composites and the shift toward low-VOC formulations further enhance adoption across major industries.

Europe

Europe accounts for nearly 28% share, supported by strong automotive production, thriving aerospace operations, and advanced engineering industries. Germany, France, Italy, and the United Kingdom remain key contributors as manufacturers shift to lightweight materials and adopt high-strength bonding technologies. Stringent environmental regulations accelerate demand for water-based and low-VOC adhesives across construction and transportation segments. The region’s renewable energy expansion, including wind turbine components, further boosts usage. Ongoing industrial modernization and sustainability goals keep Europe a major market.

Asia Pacific

Asia Pacific leads growth momentum with around 30% share in 2024, driven by rapid industrialization and large-scale manufacturing across China, India, Japan, and South Korea. The region benefits from expanding automotive production, electronics assembly, and infrastructure development. China remains the largest consumer as factories adopt structural adhesives to improve efficiency and reduce assembly costs. Rising disposable income and growing appliance demand also support uptake. Government initiatives promoting energy-efficient buildings and electric vehicle production strengthen regional expansion.

Latin America

Latin America holds close to 6% share, driven by steady growth in construction, automotive assembly, and consumer goods production. Brazil and Mexico remain the primary markets as manufacturers adopt adhesives in vehicle components, household appliances, and industrial equipment. Increasing investments in infrastructure, residential housing, and commercial facilities support regional consumption. Adoption grows as industries shift from mechanical fasteners to high-strength adhesive bonding for cost efficiency and improved product durability. Economic recovery and manufacturing expansion help maintain stable demand.

Middle East and Africa

Middle East and Africa capture about 4% share in 2024, supported by rising construction projects, infrastructure expansion, and growing automotive and industrial activities. The United Arab Emirates and Saudi Arabia lead adoption with large-scale commercial developments and rising demand for durable bonding solutions in building materials. South Africa contributes through automotive assembly and consumer appliance production. Although the market is smaller compared with other regions, increasing industrial diversification and investment in manufacturing strengthen long-term opportunities.

Market Segmentations:

By Product

- Urethane

- Epoxy

- Acrylic

- Cyanoacrylic

- Others

By Technology

- Water-based

- Solvent-based

- Others

By Application

- Transportation

- Construction

- Consumer Appliances

- Furniture

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the structural adhesives market features key players such as Arkema S.A., Scott Bader Co., HB Fuller Company, 3M, Ashland Global Specialty Chemicals Inc., Franklin International, Inc., Lord Corporation, Dow, Henkel AG & Co. KGaA, and Avery Dennison Corporation. The market remains moderately consolidated, with companies focusing on product innovation, sustainable formulations, and advanced bonding technologies to meet evolving industrial needs. Many manufacturers invest in low-VOC and water-based solutions as environmental regulations tighten worldwide. Strategic partnerships with automotive, aerospace, construction, and appliance manufacturers support long-term growth. Firms also expand their portfolios through R&D in hybrid chemistries that improve curing efficiency and bond strength. Capacity expansion in high-demand regions and investments in automated adhesive dispensing systems further enhance competitiveness. As industries shift toward lightweight materials and multi-substrate bonding, companies strengthen their technical support and application expertise to maintain market position.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Arkema S.A.

- Scott Bader Co.

- HB Fuller Company

- 3M

- Ashland Global Specialty Chemicals Inc.

- Franklin International, Inc.

- Lord Corporation

- Dow

- Henkel AG & Co. KGaA

- Avery Dennison Corporation

Recent Developments

- In 2025, Dow announced the launch of an advanced structural epoxy adhesive designed for high-temperature and high-load applications

- In 2023, Bostik, a worldwide adhesive expert, introduced its new Thermal Conductive Adhesives (TCA) range at the India Battery Show. Bostik and Polytec PT collaborated to create a new TCA series that addresses the thermal management challenges of the latest Cell-to-Pack (CTP) battery designs.

- In 2023, Scott Bader launched two advanced sandable structural adhesives, Crestabond M1-60HV/2 and M1-90HV/2, designed to meet demanding bonding needs in various assembly operations

Report Coverage

The research report offers an in-depth analysis based on Product, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as industries shift toward lightweight materials in automotive and aerospace.

- Water-based and low-VOC adhesives will gain faster adoption due to stricter regulations.

- Demand from electric vehicle manufacturing will rise with increased use of multi-material structures.

- Automation in assembly lines will boost the need for adhesives compatible with robotic application.

- Construction activity will expand usage in facades, panels, and modular building systems.

- Advancements in hybrid chemistries will improve strength, flexibility, and curing performance.

- Appliance and electronics production will drive higher consumption for compact device assembly.

- Improved bonding solutions for extreme temperatures will open new industrial applications.

- Sustainability goals will encourage adoption of bio-based adhesive formulations.

- Global manufacturing expansion will create strong demand across emerging economies.