Market Overview

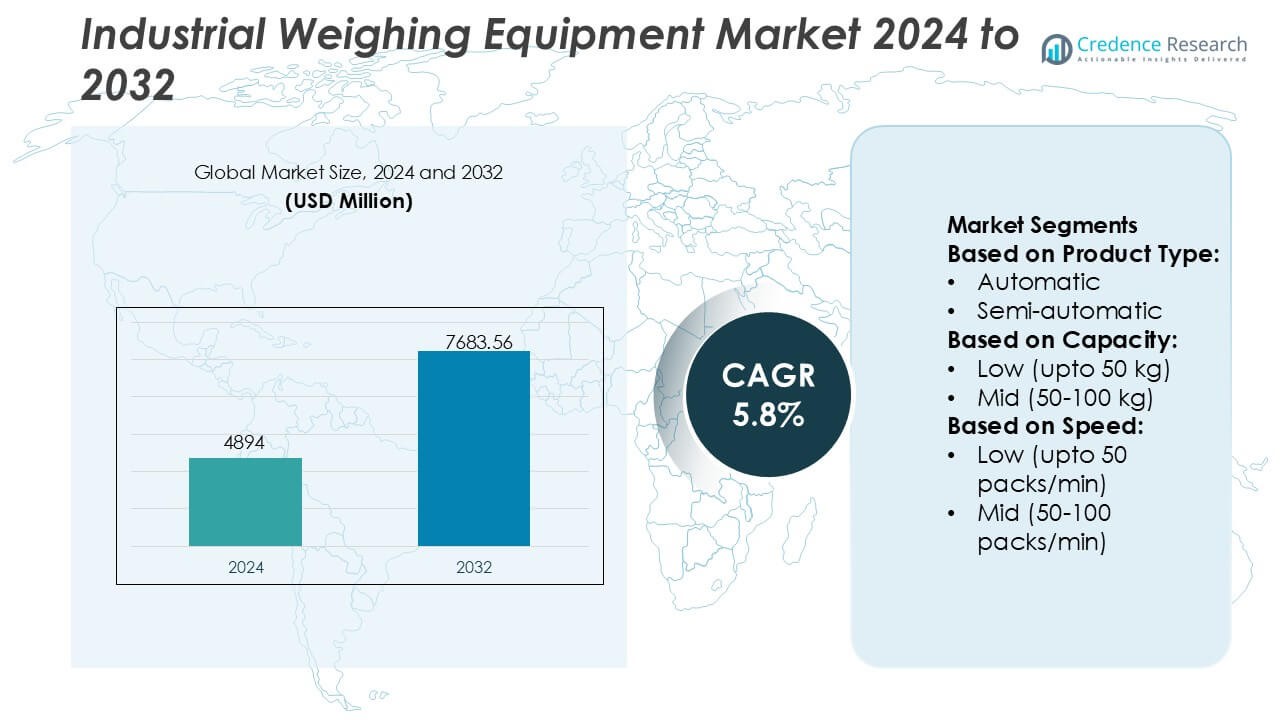

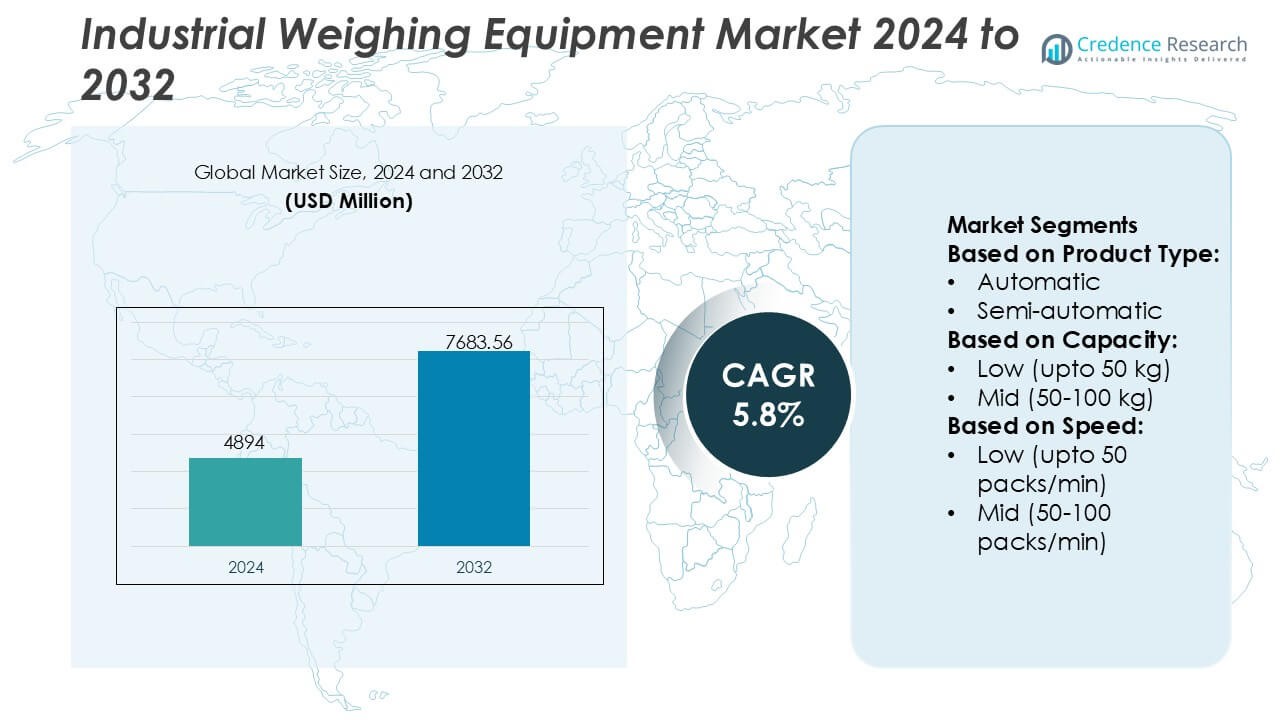

Industrial Weighing Equipment Market size was valued USD 4894 million in 2024 and is anticipated to reach USD 7683.56 million by 2032, at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Weighing Equipment Market Size 2024 |

USD 4894 Million |

| Industrial Weighing Equipment Market, CAGR |

5.8% |

| Industrial Weighing Equipment Market Size 2032 |

USD 7683.56 Million |

The Industrial Weighing Equipment Market is shaped by a mix of global manufacturers that advance precision load-cell technologies, automated checkweighing systems, and IoT-enabled measurement platforms to support high-performance industrial operations. These companies strengthen competitiveness through product innovation, expanded service portfolios, and integration of weighing systems with modern digital control architectures. The market also benefits from rising adoption across food processing, logistics, chemicals, and manufacturing industries, where accuracy and speed remain critical. Asia-Pacific leads the global market with an exact 34% share, supported by rapid industrial expansion, strong manufacturing output, and increasing investment in automated production and logistics infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market reached USD 4894 million in 2024 and is projected to attain USD 7683.56 million by 2032 at a 5.8% CAGR, reflecting steady demand for high-precision and automated weighing solutions.

- Adoption accelerates as industries prioritize advanced load-cell technologies, high-speed checkweighers, and IoT-enabled systems that improve accuracy, productivity, and operational transparency.

- The competitive landscape strengthens through product innovation, digital integration capabilities, and service-focused strategies as companies expand automated and smart weighing portfolios.

- Market restraints include high installation costs, integration complexity, and rapid wear of equipment in harsh industrial environments, requiring frequent calibration and maintenance.

- Asia-Pacific leads with 34% share, driven by large-scale manufacturing and logistics expansion, while high-speed weighing systems hold the dominant segment position with strong adoption across food, packaging, and e-commerce operations.

Market Segmentation Analysis:

By Product Type

Automatic weighing systems hold the dominant position with an exact 62% market share, driven by rising adoption across food processing, pharmaceuticals, logistics, and bulk material handling environments. Their ability to deliver continuous measurement, minimize human error, and integrate with PLC-based control architectures strengthens preference over semi-automatic alternatives. Growing investments in Industry 4.0, real-time quality control, and high-throughput packaging lines further accelerate deployment. Semi-automatic units continue to serve small-scale operations but face slower growth due to limited scalability and higher labor dependence compared to fully automated platforms.

- For instance, Fairbanks Scales Inc. integrated its FB2550 instrument platform with its digital Intalogix load-cell technology that uses a 32-bit processing core, which provides enhanced diagnostics and helps in reducing calibration drift for applications like high-throughput truck and rail scales.

By Capacity

High-capacity equipment (above 100 kg) leads the market with an exact 47% share, supported by broad usage in manufacturing, mining, chemicals, warehousing, and industrial bulk processing. Demand increases as enterprises handle heavier loads and prioritize robust platforms capable of maintaining accuracy under high mechanical stress. The shift toward automated palletization, forklift-integrated sensors, and heavy-duty conveyor systems reinforces adoption. Mid-capacity systems maintain relevance in food, textile, and assembly operations, while low-capacity equipment finds uptake in laboratories and small-batch production environments.

- For instance, Sartorius’ Combics® 3 industrial weighing platform offers a wide range of models supporting maximum load capacities up to 3,000 kg and delivering high-precision measurements with readability/repeatability of 0.1 g for lower-capacity bench models.

By Speed

High-speed systems (above 100 packs/min) dominate with an exact 58% market share, driven by the need for rapid throughput in packaged foods, beverages, nutraceuticals, and e-commerce fulfillment. Their advanced load cells, faster signal processing, and compatibility with automated inspection units enable consistent performance at elevated line speeds. Manufacturers benefit from reduced bottlenecks, improved productivity, and tighter compliance with weight accuracy standards. Mid-speed and low-speed machines continue to support smaller facilities, yet they trail in adoption as industries optimize operations for higher production efficiency and minimal downtime.

Key Growth Drivers

- Expansion of Automation Across Manufacturing and Processing Industries

Automation adoption accelerates demand for advanced industrial weighing systems as manufacturers pursue higher accuracy, reduced manual intervention, and improved productivity. Automated weighing platforms integrate seamlessly with PLCs, MES, and SCADA systems, enabling continuous monitoring and real-time quality control. Industries such as food processing, chemicals, and logistics increasingly deploy intelligent load cells, digital indicators, and automated batching units. This expansion strengthens investment in precision weighing technologies that support faster operations, traceability, and compliance with evolving global standards.

- For instance, ZM615 features an Ethernet port configurable with up to twenty different protocols, including standard industrial options like EtherNet/IP, PROFINET, and Modbus TCP.

- Rising Emphasis on Quality Assurance and Regulatory Compliance

Stringent regulations governing product consistency, weight accuracy, and labeling integrity fuel uptake of industrial weighing solutions across regulated sectors. Companies rely on advanced scales, checkweighers, and moisture-balancing systems to maintain compliance with food safety frameworks, pharmaceutical requirements, and industrial metrology standards. The push for audit-ready production environments elevates the role of high-precision weight verification and data logging. As manufacturers prioritize quality certifications and minimize deviations, precision weighing equipment becomes essential for maintaining operational credibility and reducing batch-level discrepancies.

- For instance, Shimadzu’s UniBloc® load cell technology, deployed across its analytical and precision balance series, integrates a monolithic aluminum load cell with temperature compensation circuits that stabilize measurement drift to within ±2 ppm/°C, while offering models that deliver readability and repeatability down to 0.1 mg under controlled conditions.

- Growth of Logistics, Warehousing, and E-Commerce Operations

Expanding distribution networks and surging e-commerce volumes create sustained demand for fast and reliable weighing systems. Facilities adopt pallet scales, dynamic checkweighers, and conveyor-integrated sensors to streamline inbound and outbound operations. Accurate weight capture supports freight billing, load optimization, inventory control, and automated sorting. As warehouses transition toward smart fulfillment models, real-time weighing data enhances efficiency in storage allocation and shipment processing. This reinforces demand for rugged, networked, and high-throughput weighing solutions optimized for logistics workflows.

Key Trends & Opportunities

- Increase in Digital and IoT-Enabled Weighing Platforms

Digital transformation encourages manufacturers to shift from analog to IoT-enabled weighing systems with enhanced connectivity and predictive intelligence. These solutions offer remote monitoring, automated calibration alerts, and integration with enterprise software, creating opportunities for vendors to deliver value-added digital services. Cloud-linked scales and smart load cells support traceability, anomaly detection, and data-driven decision-making. As industrial users prioritize operational transparency and reduced downtime, adoption of connected weighing ecosystems continues to expand across global markets.

- For instance, Doran Scales’ 2200CW Series checkweigher integrates an onboard industrial processor that facilitates fast manual checkweighing operations, supports weight resolutions as low as 0.1 g for precision models, and supports real-time data exchange through standard RS-232 and optional Ethernet TCP/IP interfaces for direct connectivity with MES and plant control systems.

- Rising Demand for High-Speed and High-Capacity Systems

Industries with rapid throughput requirements such as packaged foods, bulk materials, and courier operations drive interest in high-speed and high-capacity weighing equipment. Manufacturers focus on systems capable of maintaining precision at elevated speeds and under heavy load conditions. This shift creates opportunities for innovations in load cell durability, signal processing algorithms, and conveyor-mounted weighing solutions. Vendors that offer advanced industrial-grade platforms capable of supporting automated packaging, pallet handling, and continuous batching stand to capture a larger share of emerging demand.

- For instance, BONSO’s BSL Series shear beam load cells, manufactured from 17-4 PH stainless steel, support rated capacities ranging from 500 kg to 50,000 kg, comply with OIML R60 C3 classification (3,000 verification intervals), and deliver combined error performance within ±0.02% of rated output.

- Opportunity for Sustainable and Energy-Efficient Equipment Development

Growing emphasis on sustainability encourages companies to adopt weighing solutions with lower energy consumption, longer component lifespan, and reduced recalibration frequency. Equipment designers explore lightweight structural materials, optimized sensors, and energy-efficient electronics. Additionally, end-users seek systems that minimize product waste during weighing, batching, and filling operations. Vendors capable of delivering sustainability-focused features such as reduced maintenance requirements and recyclable components gain opportunities in markets prioritizing eco-efficient production practices.

Key Challenges

- High Initial Investment and Integration Complexity

Industrial weighing equipment, particularly automated and high-capacity systems, requires considerable upfront investment. Integrating advanced weighing platforms with existing production or warehouse systems can also involve significant customization, technical expertise, and downtime. Smaller enterprises face cost barriers related to installation, training, and long-term service contracts. These financial and operational complexities slow adoption in cost-sensitive industries and hinder rapid modernization efforts, creating disparities between large-scale facilities and small to mid-sized manufacturers.

- Maintenance Requirements and Accuracy Degradation in Harsh Environments

Heavy-duty industrial environments expose weighing systems to dust, moisture, vibration, and temperature fluctuations that can degrade accuracy over time. Regular calibration, sensor replacement, and maintenance are essential to preserve performance, creating operational challenges for users with continuous production schedules. Industries such as mining, chemicals, and food processing encounter accelerated wear on load cells and weighing platforms. These environmental impacts increase long-term ownership costs and compel manufacturers to invest in rugged designs that withstand demanding field conditions.

Regional Analysis

North America

North America holds an exact 28% market share, supported by strong automation maturity across food processing, pharmaceuticals, chemicals, and logistics. The region benefits from advanced industrial infrastructure, early adoption of digital weighing technologies, and stringent regulatory frameworks governing weight accuracy and labeling compliance. High investment in automated packaging lines, warehouse optimization, and IIoT-enabled measurement systems drives steady demand. Growth in e-commerce fulfillment centers accelerates the need for high-speed checkweighers, pallet scales, and conveyor-integrated systems. The presence of leading equipment manufacturers and technology integrators further strengthens the region’s competitive positioning.

Europe

Europe maintains a significant 25% market share, driven by its well-established manufacturing base, strong emphasis on metrology standards, and widespread regulatory enforcement for quality assurance. The region’s food, chemicals, and precision engineering industries rely heavily on high-accuracy weighing solutions to support traceability and standardized production workflows. Growing focus on energy-efficient equipment and automated material handling enhances market traction. Adoption of digital load cells, automated batching systems, and smart calibration tools increases as factories align with Industry 4.0 initiatives. Continuous investments in modernization, combined with environmental compliance frameworks, reinforce sustained demand across European industries.

Asia-Pacific

Asia-Pacific leads the global market with an exact 34% share, supported by large-scale manufacturing expansion, growing industrialization, and rapid deployment of automated production lines. High-capacity and high-speed weighing systems gain strong adoption across automotive, electronics, food processing, and bulk material sectors. Rising investments in logistics, warehousing, and e-commerce infrastructure further elevate demand for dynamic weighing platforms. Countries such as China, India, Japan, and South Korea accelerate integration of digital and IoT-enabled equipment to strengthen productivity and regulatory compliance. Competitive pricing, strong local manufacturing capabilities, and large end-user industries reinforce the region’s dominant position.

Latin America

Latin America accounts for 7% market share, driven by gradual adoption of weighing technologies across food processing, mining, agriculture, and industrial packaging. Increasing investment in logistics infrastructure and export-oriented industries supports demand for high-capacity scales and conveyor-mounted checkweighing systems. Regulatory improvements in product quality and traceability encourage companies to upgrade from manual to semi-automatic and automated weighing platforms. Economic volatility and budget constraints slow modernization in smaller facilities, yet regional manufacturers continue to adopt precision systems to enhance productivity and reduce operational inefficiencies.

Middle East & Africa

The Middle East & Africa region holds an exact 6% share, supported by expanding industrial activity in oil and gas, construction materials, mining, and food processing. Large-scale bulk handling operations create demand for heavy-duty weighbridges, high-capacity scales, and rugged load cells capable of withstanding harsh environmental conditions. Growing investments in logistics hubs, particularly in GCC countries, increase adoption of automated pallet and conveyor weighing solutions. Despite slower technology penetration in parts of Africa, improving industrial infrastructure and regulatory alignment with global standards contribute to steady, long-term market opportunities.

Market Segmentations:

By Product Type:

By Capacity:

- Low (upto 50 kg)

- Mid (50-100 kg)

By Speed:

- Low (upto 50 packs/min)

- Mid (50-100 packs/min)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Industrial Weighing Equipment Market features a strong mix of global and regional manufacturers, including Fairbanks Scales Inc., Sartorius Group, Avery Weigh-Tronix, LLC, Shimadzu Corporation, Doran Scales, Inc., BONSO Electronics International Inc., Kern & Sohn GmbH, Mettler-Toledo International, Inc., A&D Company, Ltd., and Essae-Teraoka Pvt. Ltd. the Industrial Weighing Equipment Market is defined by continuous innovation, strong technological differentiation, and expanding integration with digital manufacturing ecosystems. Companies focus on enhancing weighing precision, improving load-cell durability, and developing equipment capable of supporting high-speed production environments. Advancements in IoT connectivity, automated calibration, and data-driven diagnostics shape competitive strategies as end users demand real-time visibility and reduced operational downtime. Vendors strengthen their market positions through broader service portfolios, application-specific product lines, and strategic investments in automation-ready solutions. Increasing emphasis on regulatory compliance, traceability, and energy-efficient equipment further drives competition across global and regional markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fairbanks Scales Inc.

- Sartorius Group

- Avery Weigh-Tronix, LLC

- Shimadzu Corporation

- Doran Scales, Inc.

- BONSO Electronics International Inc.

- Kern & Sohn GmbH

- Mettler-Toledo International, Inc.

- A&D Company, Ltd.

- Essae-Teraoka Pvt. Ltd.

Recent Developments

- In May 2025, Jungheinrich and EP Equipment formed a strategic alliance launching the slogan “Shaping the future of material handling together” to drive industry electrification, expand Jungheinrich’s mid-tech offerings with the new AntOn by Jungheinrich brand (electric forklifts/warehouse trucks), and leverage shared strengths in lithium-ion tech for better customer solutions, boosting competitiveness for both.

- In April 2025, Komatsu announced an update to its Smart Construction 3D Machine Guidance system that enables full bucket rotation and generates a real-time digital twin of the job site. This was part of a larger showcase of new generation and electric machines.

- In April 2025, JCB announced it would double its new San Antonio, Texas factory, a significant expansion from initial plans, to better serve the U.S. market, reduce supply chain risks, and mitigate impacts from new tariffs, aiming to boost local production and deliver machines faster to North American customers.

- In March 2025, Gather AI indeed launched its AI-powered Material Handling Equipment (MHE) Vision system turning forklifts and other MHE into data collectors to provide real-time inventory visibility, automate tracking, and offer actionable insights for better warehouse efficiency, without needing new infrastructure, boosting throughput and reducing errors.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Capacity, Speed and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly adopt IoT-enabled weighing systems that deliver real-time monitoring and predictive maintenance.

- Automated weighing platforms will gain wider use as industries accelerate digital transformation initiatives.

- High-speed and high-capacity systems will see strong demand in food processing, logistics, and bulk material sectors.

- Integration of weighing data with MES, ERP, and cloud platforms will become standard across modern facilities.

- Manufacturers will focus on energy-efficient designs and sustainable materials to meet environmental expectations.

- Advanced load-cell technologies will improve accuracy, durability, and performance in harsh industrial conditions.

- Rising regulatory pressure will drive greater adoption of precision equipment for quality assurance.

- Smart packaging and automated fulfillment centers will expand demand for dynamic checkweighing solutions.

- Modular and easily scalable systems will gain preference among mid-sized manufacturers.

- Global players will strengthen service networks to support calibration, compliance, and lifecycle management needs.