Market Overview

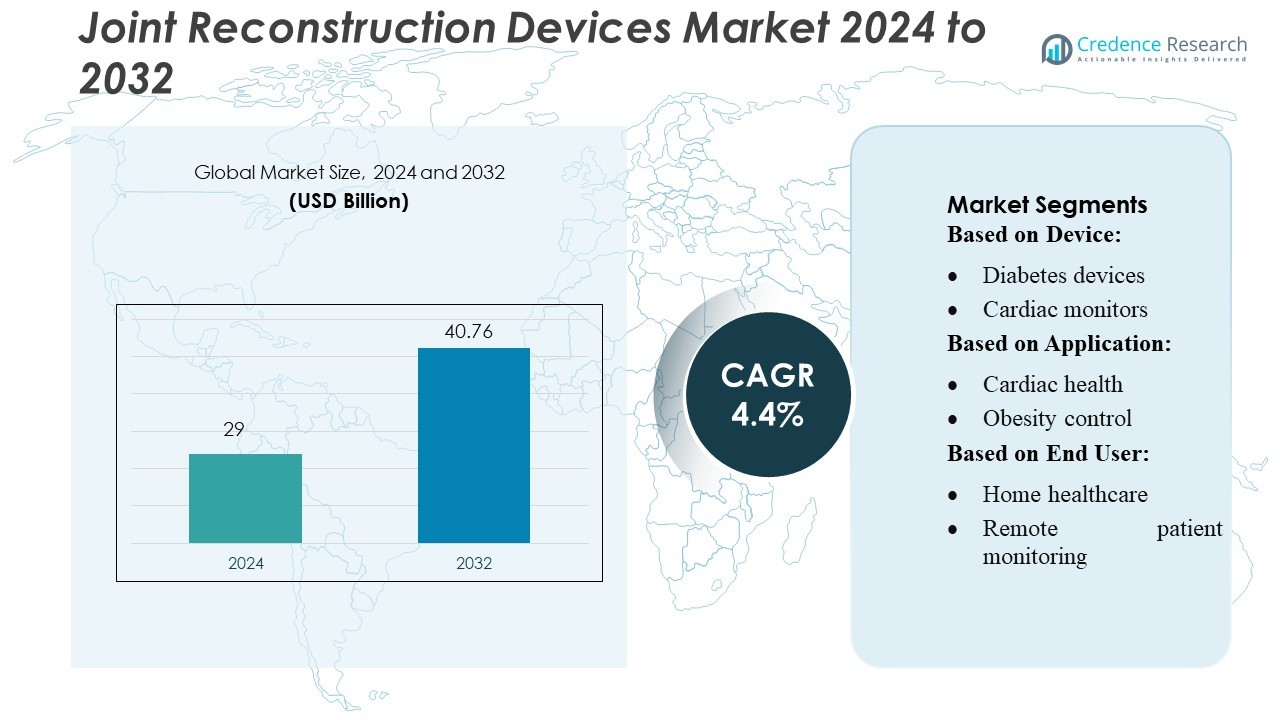

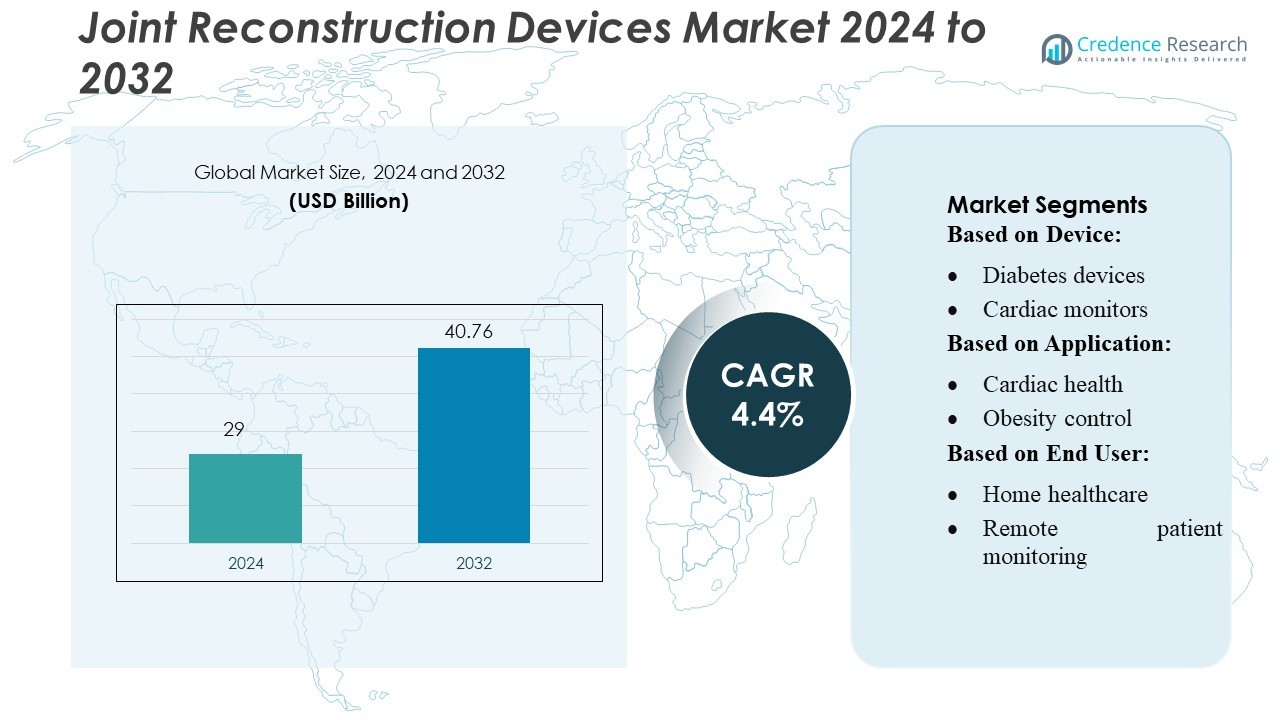

Joint Reconstruction Devices Market size was valued USD 29 billion in 2024 and is anticipated to reach USD 40.76 billion by 2032, at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Joint Reconstruction Devices Market Size 2024 |

USD 29 Billion |

| Joint Reconstruction Devices Market, CAGR |

4.4% |

| Joint Reconstruction Devices Market Size 2032 |

USD 40.76 Billion |

The Joint Reconstruction Devices Market is shaped by strong competition among leading players such as Stryker, Zimmer Biomet, DePuy Synthes, Smith+Nephew, Medtronic, CONMED Corporation, NuVasive, DJO, Aesculap (B. Braun), and Wright Medical. These companies strengthen their market positions through innovations in implant materials, robotic-assisted systems, and patient-specific design technologies. North America remains the dominant regional market, accounting for 38–40% of global share, supported by advanced healthcare infrastructure, high surgical volumes, and rapid adoption of digital and minimally invasive orthopedic solutions. The region’s consistent investment in technology and surgeon training sustains its leading position.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Joint Reconstruction Devices Market was valued at USD 29 billion in 2024 and is projected to reach USD 40.76 billion by 2032, registering a 4% CAGR, supported by rising procedure volumes and expanding adoption of advanced surgical technologies.

- Market growth is driven by increasing prevalence of osteoarthritis, rising geriatric population, and rapid adoption of robotic-assisted and minimally invasive joint reconstruction systems that enhance precision and reduce recovery time.

- Key trends include the growing use of patient-specific and 3D-printed implants, integration of smart sensor-enabled devices, and rising demand for outpatient joint procedures across ambulatory surgical centers.

- The competitive landscape remains intense as major players innovate through upgraded biomaterials, digital navigation platforms, and AI-guided surgical planning while strengthening global distribution and surgeon-training networks.

- North America leads the market with 38–40% share, while the knee reconstruction segment dominates with over 45% share, though high device costs and varying reimbursement policies restrain adoption in emerging regions.

Market Segmentation Analysis:

By Device

Activity/fitness monitors dominate the device segment with an estimated 30–35% market share, driven by strong consumer adoption, continuous sensor upgrades, and expanding integration of motion-tracking and biometric analytics. Their dominance stems from consistent use in rehabilitation tracking, early mobility monitoring, and post-procedure recovery assessment. Cardiac, diabetes, neurological, and respiratory monitors follow, supported by growing chronic disease prevalence and real-time data needs. Body-temperature and in-ear devices expand steadily as manufacturers integrate multimodal sensors for seamless monitoring in both clinical and home-care environments.

- For instance, CONMED’s patient-monitoring portfolio includes more than 10 different types of ECG electrodes and pulse-oximetry sensors, such as its adult reusable finger-clip sensor (catalog ref. 2010) listed in its product catalog.

By Application

Cardiac health represents the leading application area, capturing around 28–32% of market share due to the high incidence of cardiovascular disorders and the clinical priority for continuous rhythm and hemodynamic monitoring. Demand accelerates as hospitals and home-care providers use connected diagnostics to reduce readmissions and support early alerts. Obesity control and diabetes care segments grow robustly as metabolic disorders rise globally, while fitness monitoring and sleep tracking gain traction from consumer health-optimization trends and device-driven behavioral analytics.

- For instance, Zimmer Biomet’s Persona IQ smart knee implant embeds a 3D accelerometer and gyroscope within its stem, capturing ~1,201 qualified steps, ~0.74 million meters of stride length, cadence of 85 steps/min, and a walking speed of ~0.54 m/s, all of which transmit securely to the ZBEdge Cloud.

By End User

Home healthcare remains the dominant end-user segment with approximately 40% market share, driven by the shift toward decentralized care, cost-effective rehabilitation, and the need for continuous post-treatment monitoring outside clinical facilities. Device manufacturers support this transition by offering user-friendly, wireless, and app-integrated systems. Remote patient monitoring expands rapidly as clinicians adopt real-time dashboards and predictive alerts. Fitness and sports users contribute to growth through heightened interest in performance analytics, recovery tracking, and injury-prevention insights.

Key Growth Drivers

- Rising Prevalence of Osteoarthritis and Musculoskeletal Disorders

The increasing global burden of osteoarthritis, rheumatoid arthritis, and age-related joint degeneration strongly drives demand for joint reconstruction devices. An aging population, longer life expectancy, and higher obesity rates further contribute to rising case volumes, prompting healthcare systems to prioritize early surgical intervention. As mobility complications surge, hospitals adopt advanced implants designed for durability and biomechanical precision. This steady growth in patient pools supports sustained procedure volumes, particularly for knee and hip replacements, strengthening the market’s long-term expansion trajectory.

- For instance, Wright Medical Group N.V.—now part of Stryker—documented clinically validated performance metrics for its INFINITY™ Total Ankle System, including a reported talar component subsidence rate under 1 mm at two-year follow-up and alignment accuracy within ±2° of the targeted tibial axis, as published in its pre-acquisition clinical summaries.

- Advancements in Implant Materials and Surgical Techniques

Innovations such as highly cross-linked polyethylene, porous titanium coatings, and patient-specific 3D-printed implants significantly enhance device longevity and stability, driving surgeon adoption. The expansion of minimally invasive and robotic-assisted joint replacement procedures improves surgical accuracy, reduces postoperative complications, and accelerates patient recovery times. These technological improvements increase success rates and expand candidacy to younger, more active individuals. As hospitals upgrade operating suites with navigation and robotics platforms, demand for technologically advanced joint reconstruction devices continues to rise rapidly.

- For instance, NuVasive’s Advanced Materials Science (AMS) portfolio features its Modulus® titanium implant, whose proprietary lattice architecture delivers a bone-like modulus and fully porous endplate that achieves peak integration strength by 12 weeks in preclinical models.

- Increasing Preference for Outpatient and Ambulatory Joint Procedures

A major growth driver is the shift toward outpatient and ambulatory surgical centers (ASCs), enabled by enhanced implant design, faster recovery pathways, and improved anesthesia protocols. Patients benefit from lower costs, shorter stays, and rapid mobility restoration, encouraging higher procedure volumes. Payers and health systems also support this transition due to its cost-efficiency and reduced resource burden. As more primary joint replacements move into ASCs, manufacturers innovate device systems optimized for shorter surgical times, simplified instrumentation, and streamlined workflows that suit same-day surgeries.

Key Trends & Opportunities

1. Expansion of Robotic-Assisted and AI-Guided Joint Surgery

Robotic-assisted systems and AI-enabled surgical planning are becoming major market catalysts, offering superior component positioning, alignment accuracy, and personalized implant selection. Surgeons increasingly rely on intraoperative analytics and real-time mapping to minimize revision risks and improve functional outcomes. This trend opens opportunities for device manufacturers to integrate software ecosystems, preoperative modeling platforms, and smart instrumentation. Companies investing in robotic-compatible implants and data-driven surgical tools are positioned to capture high-value segments as hospitals modernize operating infrastructure.

- For instance, Stryker’s Mako SmartRobotics™ platform—backed by more than 2 million procedures globally across 45 countries—leverages 3D CT-based planning, AccuStop™ haptic feedback, and real-time analytics.

2. Growth of Customized and Patient-Specific Implant Solutions

Demand for personalized orthopedic solutions is rising as surgeons aim to optimize fit, biomechanics, and long-term device performance. Patient-specific implants, 3D-printed components, and anatomically contoured systems reduce intraoperative adjustments and enhance post-surgical satisfaction. This trend creates opportunities for device manufacturers to expand digital modeling capabilities and collaborative planning workflows. The technology particularly benefits patients with anatomical deformities or complex revisions, encouraging hospitals to adopt advanced imaging and customization platforms. As regulatory pathways streamline, personalized implant adoption is expected to accelerate.

- For instance, Smith+Nephew’s VISIONAIRE™ Patient Matched Technology generates a 3D knee model based on an MRI and X-ray; it then produces 3D-printed cutting guides tailored to a patient’s anatomy.

3. Increasing Adoption of Smart and Sensor-Enabled Implants

Smart implants equipped with embedded sensors are emerging as a promising innovation, enabling real-time monitoring of load, strain, temperature, and activity levels post-surgery. These capabilities support early detection of complications, enhance rehabilitation, and offer data-driven insights to surgeons. This trend aligns with the rising digital health ecosystem and remote monitoring models. Manufacturers integrating wireless communication, analytics dashboards, and cloud connectivity into implants gain a competitive advantage. As value-based care expands globally, smart implants present a significant opportunity for improved outcomes and reduced revision rates.

Key Challenges

1. High Cost of Advanced Devices and Surgical Systems

The high capital costs associated with premium implants, robotic platforms, and digital navigation systems remain a major challenge for hospitals, particularly in developing regions. Limited reimbursement coverage for technologically advanced procedures restricts patient accessibility. Smaller facilities often struggle to justify investments due to lower surgical volumes. Additionally, inflation in raw materials and supply chain constraints continue to elevate manufacturing costs. These financial barriers can slow adoption of next-generation devices and widen the technology gap between high-income and emerging healthcare markets.

2. Stringent Regulatory Requirements and Compliance Constraints

Joint reconstruction devices undergo rigorous regulatory scrutiny due to their classification as high-risk, long-term implants. Compliance with evolving standards for biocompatibility, clinical evidence, and post-market surveillance increases development timelines and costs for manufacturers. Regional variations in approval pathways complicate global product launches and require extensive documentation and testing. Companies also face heightened obligations for tracking implant performance and reporting adverse events. These complexities can delay market entry, slow innovation cycles, and increase operational burdens, particularly for small and mid-sized device developers.

Regional Analysis

North America

North America leads the joint reconstruction devices market with an estimated 38–40% share, supported by high procedure volumes, strong reimbursement structures, and widespread adoption of robotic-assisted and minimally invasive orthopedic surgeries. The U.S. dominates the regional landscape due to its advanced healthcare infrastructure, early uptake of premium implants, and expanding ambulatory surgical center ecosystem. Continuous technological innovation and strong presence of global device manufacturers further strengthen market penetration. Additionally, a growing elderly population with high osteoarthritis prevalence sustains steady demand for knee, hip, and shoulder reconstruction procedures across hospitals and outpatient settings.

Europe

Europe accounts for 28–30% of the market, driven by established orthopedic care systems, rising demand for revision surgeries, and the growing shift toward personalized and 3D-printed implants. Germany, the U.K., and France remain key contributors due to widespread adoption of navigation-assisted joint replacement procedures and strong integration of digital surgical planning tools. Favorable government healthcare spending and surgeon preference for advanced biomaterials support market stability. Additionally, the region benefits from strong regulatory oversight that enhances product quality, enabling high acceptance of next-generation implants and contributing to consistent growth across both public and private healthcare facilities.

Asia-Pacific

Asia-Pacific represents one of the fastest-growing regions, holding 20–22% of the market, supported by a large patient pool, increased healthcare investments, and expanding access to orthopedic surgical services. China and India experience rapid growth as hospitals modernize operating rooms and adopt advanced joint replacement technologies. Rising disposable income, medical tourism expansion, and greater awareness of joint preservation procedures accelerate uptake of premium implants. Additionally, the region’s aging population significantly boosts demand for hip and knee reconstruction. Increased collaborations between global manufacturers and regional healthcare providers further enhance market penetration and technology transfer.

Latin America

Latin America captures 6–7% of the market, driven by growing orthopedic procedure rates and improving healthcare infrastructure in Brazil, Mexico, and Argentina. The region benefits from increasing availability of cost-effective implant options and gradual adoption of minimally invasive joint reconstruction techniques. Rising incidences of trauma-related injuries and osteoarthritis among the aging population further support market expansion. However, economic disparities and varying reimbursement structures limit uptake of advanced robotic and navigation-assisted systems. Despite these challenges, partnerships with global device manufacturers and investment in orthopedic training programs contribute to steady, long-term growth.

Middle East & Africa

The Middle East & Africa region holds an estimated 3–4% market share, with growth concentrated in the Gulf Cooperation Council (GCC) countries where healthcare modernization and orthopedic specialization are advancing rapidly. Increased prevalence of obesity-related joint disorders and trauma cases drives procedure volumes, particularly for knee and hip reconstruction. Medical tourism hubs such as the UAE and Saudi Arabia attract patients seeking advanced implants and minimally invasive surgeries. However, limited access to high-end surgical technologies across Africa constrains broader market expansion. Rising investments in hospital infrastructure and surgeon training programs support gradual, sustained growth.

Market Segmentations:

By Device:

- Diabetes devices

- Cardiac monitors

By Application:

- Cardiac health

- Obesity control

By End User:

- Home healthcare

- Remote patient monitoring

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Joint Reconstruction Devices Market features leading companies such as CONMED Corporation, Zimmer Biomet, Wright Medical Group N.V., NuVasive, Inc., Stryker, Smith+Nephew, DJO, LLC, Aesculap, Inc. (B. Braun company), DePuy Synthes, and Medtronic. The Joint Reconstruction Devices Market is characterized by strong innovation, expanding technological capabilities, and increasing emphasis on outcome-driven surgical solutions. Companies compete by advancing implant materials, enhancing durability, and integrating digital tools such as robotic-assisted systems, navigation platforms, and AI-guided planning software. The market also shows a clear shift toward patient-specific implants, 3D-printed components, and minimally invasive instrumentation that reduces operative time and recovery periods. Additionally, manufacturers invest heavily in R&D, strategic partnerships, and surgeon training programs to strengthen market presence. Growing demand for outpatient orthopedic procedures further accelerates competition as firms develop streamlined, cost-efficient device systems tailored for ambulatory surgical centers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- CONMED Corporation

- Zimmer Biomet

- Wright Medical Group N.V.

- NuVasive, Inc.

- Stryker

- Smith+Nephew

- DJO, LLC

- Aesculap, Inc. (B. Braun company)

- DePuy Synthes

- Medtronic

Recent Developments

- In June 2024, DePuy Synthes, the orthopedics company of Johnson & Johnson, received 510(k) clearance from the FDA for the clinical use of the VELYS™ Robotic-Assisted Solution in Unicompartmental Knee Arthroplasty (UKA).

- In February 2024, Smith+Nephew, a global medical technology company, launched its AETOS Shoulder System for full commercial availability in the U.S. Additionally, it has received 510(k) clearance for its integration with 3D Planning Software for total shoulder arthroplasty.

- In February 2024, AddUp, a global OEM specializing in metal additive manufacturing, and Anatomic Implants announced their collaboration to submit a 510(k) joint type for the world’s inaugural 3D-printed toe joint replacement.

- In February 2024, THINK Surgical, Inc., revealed a new partnership with Waldemar Link of Germany, known for its groundbreaking joint replacement solutions. Under this partnership, THINK Surgical will integrate the LinkSymphoKnee System into THINK Surgical’s ID-HUB.

Report Coverage

The research report offers an in-depth analysis based on Device, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly adopt robotic-assisted and navigation-enabled systems to improve surgical accuracy and reduce revision rates.

- Demand for personalized and 3D-printed implants will rise as providers prioritize anatomical fit and long-term functional outcomes.

- Smart implants with embedded sensors will gain traction, enabling real-time post-surgical monitoring and data-driven rehabilitation.

- Minimally invasive and muscle-sparing joint reconstruction techniques will expand due to faster recovery and lower complication risks.

- Ambulatory surgical centers will perform a growing share of joint procedures as outpatient models continue to strengthen.

- Advancements in biomaterials will enhance implant durability, wear resistance, and compatibility with active patient lifestyles.

- AI-driven preoperative planning and predictive analytics will become integral to surgical workflows.

- Emerging markets will witness rapid growth as healthcare infrastructure and orthopedic specialization strengthen.

- Manufacturers will expand value-based care partnerships focused on improving outcomes and lowering long-term treatment costs.

- Competitive differentiation will increasingly rely on integrated digital ecosystems that connect implants, surgical tools, and remote monitoring platforms.