Market Overview

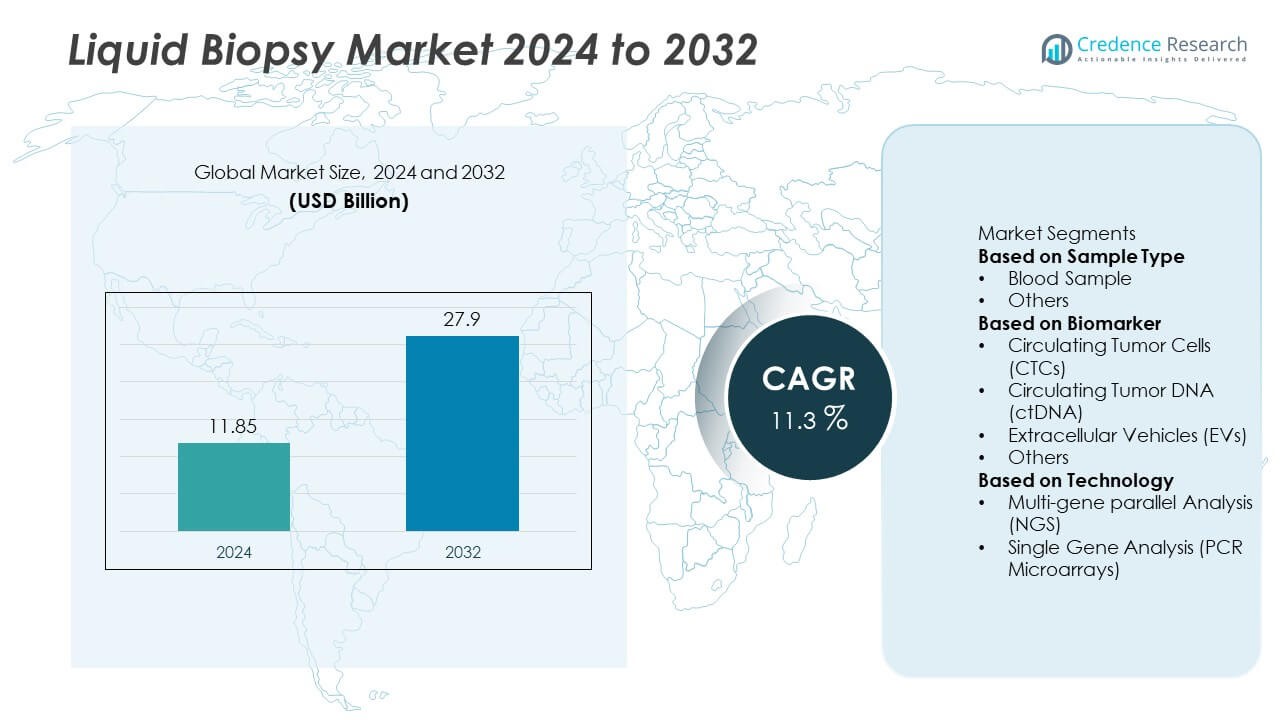

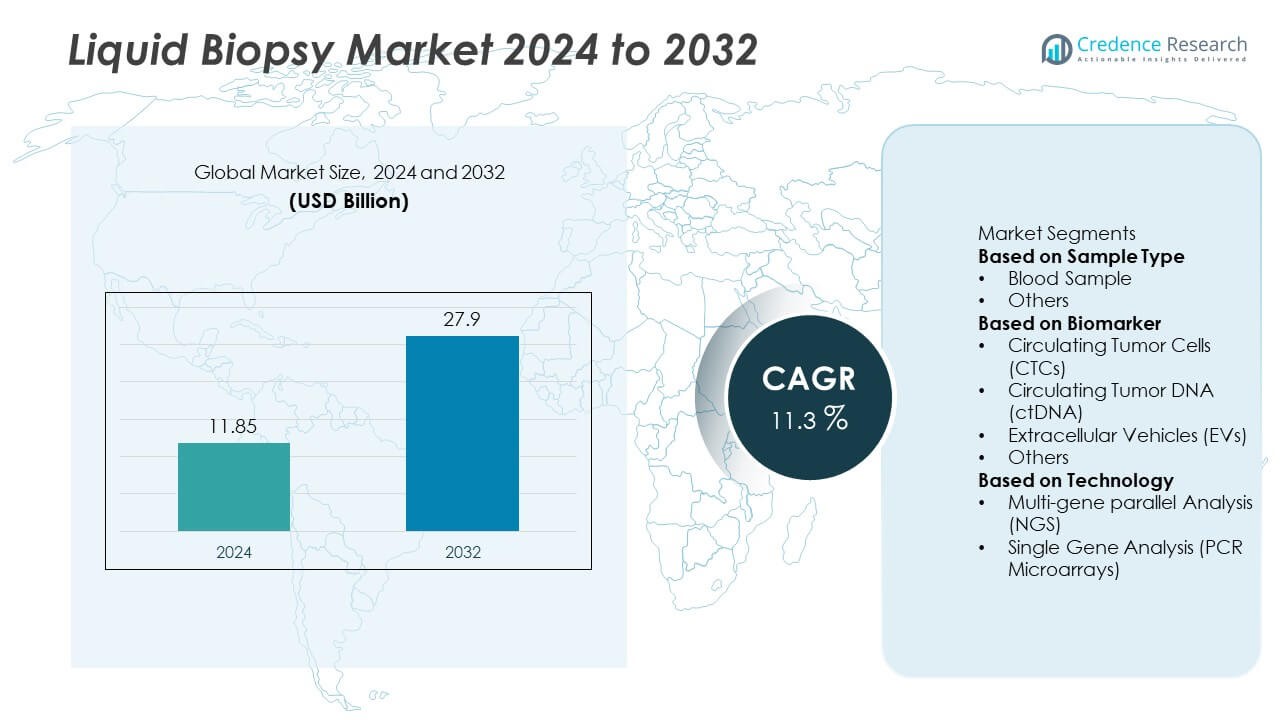

Liquid Biopsy market size reached USD 11.85 billion in 2024 and is projected to rise to USD 27.9 billion by 2032, supported by an 11.3% CAGR during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Liquid Biopsy Market Size 2024 |

USD 11.85 Billion |

| Liquid Biopsy Market, CAGR |

11.3% |

| Liquid Biopsy Market Size 2032 |

USD 27.9 Billion |

The Liquid Biopsy market is shaped by leading players such as Guardant Health, Foundation Medicine, Roche Diagnostics, Thermo Fisher Scientific, Qiagen, Illumina, NeoGenomics Laboratories, MDxHealth, Bio-Rad Laboratories, and Biocept. These companies expand their positions through advanced ctDNA platforms, high-sensitivity NGS solutions, and companion diagnostic development for targeted therapies. Their focus on MRD testing, multi-analyte assays, and automated workflows strengthens clinical adoption across oncology care. North America leads the global market with a 41% share, supported by strong precision-medicine programs and large-scale cancer screening initiatives. Europe follows with expanding adoption driven by molecular diagnostic integration and national early detection frameworks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Liquid Biopsy market reached USD 11.85 billion in 2024 and is set to grow to USD 27.9 billion by 2032 at an 11.3% CAGR, supported by rising adoption in early detection and treatment monitoring.

- Growth is driven by high demand for non-invasive testing, strong adoption of blood-based sampling with a 72% share, and wider use of ctDNA analysis, which leads the biomarker segment with a 58% share.

- Key trends include rapid expansion of multi-gene NGS platforms that dominate the technology segment with a 64% share, and rising use of multi-omic workflows for improved mutation detection.

- Competitive focus strengthens as leading players expand MRD assays, automate workflows, and pursue regulatory approvals to increase clinical use while navigating high test costs and limited reimbursement.

- Regionally, North America leads with a 41% share, followed by Europe at 28% and Asia Pacific at 22%, supported by strong diagnostic infrastructure and precision-medicine programs.

Market Segmentation Analysis:

By Sample Type

Blood samples lead this segment with a 72% share, driven by wide clinical use and strong test accuracy. Blood draws support fast processing, simple handling, and high patient acceptance in routine oncology care. Labs prefer blood because it delivers reliable tumor signals with minimal variability. Other sample types, including urine and saliva, grow due to non-invasive screening efforts in early detection programs. Growth in alternative samples comes from rising demand for home-based tests and improved biomarker capture tools. Broader adoption of multi-sample workflows also supports advanced monitoring across diverse tumor settings.

- For instance, Guardant Health uses its Guardant360 platform to detect genomic alterations from a single 10-mL blood tube, enabling broad mutation coverage for advanced cancer cases.

By Biomarker

Circulating tumor DNA dominates the biomarker segment with a 58% share, supported by high sensitivity and strong compatibility with advanced sequencing tools. ctDNA enables early detection, minimal residual disease tracking, and continuous therapy monitoring. Its strong performance drives rapid adoption in personalized treatment plans across major cancer centers. Circulating tumor cells show steady demand due to value in metastatic profiling. Extracellular vesicles gain traction as platforms improve purity and analytical efficiency. Broader biomarker use rises with multi-omic approaches that help clinicians capture richer tumor signals.

- For instance, Foundation Medicine uses its FoundationOne Liquid CDx assay to analyze more than 300 genes through hybrid-capture sequencing with a minimum input of 2-ng DNA.

By Technology

Multi-gene parallel analysis (NGS) holds the leading position with a 64% share, driven by its ability to scan many mutations in a single run. NGS supports high-precision profiling, rapid disease monitoring, and detailed therapy guidance. Oncology labs favor the method because it delivers deep molecular insight at improving turnaround times. Single-gene analysis tools, including PCR microarrays, remain relevant due to low cost and ease of use. Growth in PCR methods continues in community hospitals and small labs. Rising demand for complex mutation panels strengthens NGS adoption across global testing networks.

Key Growth Drivers

Rising Adoption in Early Cancer Detection

Early detection needs push strong demand for liquid biopsy in global oncology programs. Healthcare providers use these tests to track tumor signals before symptoms appear, helping improve treatment outcomes. Screening programs expand as hospitals seek non-invasive tools that support frequent monitoring with minimal patient burden. Adoption rises in lung, breast, colorectal, and prostate cancers where mutation tracking plays a key role. Growing clinical acceptance, along with higher test accuracy, drives broader integration into diagnostic pathways. Governments also support early detection frameworks, strengthening market growth across high-risk populations.

- For instance, Illumina supports early detection through its TruSight Oncology 500 ctDNA assay, which analyzes 523 genes using a recommended input of 20 ng of cfDNA for the v2 assay.

Expansion of Personalized and Targeted Therapies

Growth accelerates as clinicians rely on liquid biopsy to guide targeted therapy selection and adjust treatment plans in real time. These tests help identify actionable mutations and resistance markers without invasive tissue sampling. Cancer centers benefit from rapid turnaround that supports timely therapeutic decisions. Personalized care models encourage routine use of molecular profiling during treatment cycles. Pharma companies incorporate liquid biopsy in drug development for companion diagnostics. Broader precision oncology programs strengthen demand for continuous biomarker analysis, supporting strong market expansion.

- For instance, NeoGenomics Laboratories offers an analytical service, the FLT3 Mutation Analysis test, which uses highly sensitive methods like fragment analysis and PCR to detect ITD mutations, reporting results quantitatively as an allelic ratio.

Increased Use in Minimal Residual Disease (MRD) Monitoring

MRD monitoring becomes a major driver as hospitals seek precise ways to detect recurrence risks. Liquid biopsy offers high sensitivity in tracking residual cancer cells after surgery or chemotherapy. Clinicians adopt MRD tools to predict relapse earlier than imaging-based methods. Regular blood-based monitoring helps adjust therapy plans and improve survival outcomes. Adoption grows in breast, lung, colorectal, and hematologic cancers. Demand rises as payers and providers recognize the cost savings from early intervention. Expanding MRD-focused testing pipelines further strengthens market growth.

Key Trends & Opportunities

Growth of Multi-Omic and Multi-Analyte Testing

Advanced testing platforms combine ctDNA, CTCs, RNA, and epigenetic markers to deliver richer tumor insights. Multi-omic workflows enhance diagnostic confidence and support complex therapy planning. Labs adopt integrated analysis tools that improve sensitivity for early-stage cancers. Companies develop high-throughput platforms that allow broad mutation coverage in a single test. This shift supports precision oncology and creates new product development opportunities. Multi-analyte workflows also expand applications beyond oncology, including prenatal screening and transplant monitoring. The trend drives strong innovation and long-term market potential.

- For instance, Thermo Fisher Scientific uses its Ion Torrent Genexus System to process DNA, RNA, and fusion markers in one run with a hands-on time of under 20 minutes.

Expansion of At-Home and Decentralized Testing Models

Decentralized testing grows as patients and clinics prefer flexible, non-invasive sample collection. At-home blood and saliva kits gain traction due to rising demand for easy monitoring during treatment cycles. Tele-oncology models increase adoption by connecting remote patients with cancer specialists. Diagnostic firms explore partnerships with digital health platforms to streamline logistics and reporting. Decentralized workflows help reduce hospital load and improve patient compliance. This trend creates strong opportunities for companies developing portable kits and automated processing systems that support wide population reach.

- For instance, Exact Sciences offers its home-collection, stool-based kit, known as Cologuard®, which was used in a pivotal study involving more than 10,000 participants for colorectal cancer risk assessment.

Key Challenges

Limited Standardization Across Testing Platforms

Variation in detection methods, biomarker thresholds, and reporting formats creates barriers in clinical adoption. Hospitals face challenges comparing test results across vendors, slowing routine integration into care pathways. Differences in sample preparation and sequencing depth can influence data accuracy. Regulatory bodies push for harmonized standards, but implementation remains slow. These inconsistencies reduce clinician confidence, especially in early-stage detection. Achieving consistent quality across global labs remains a major hurdle that affects reimbursement, widespread usage, and long-term market reliability.

High Cost and Reimbursement Barriers

The market faces challenges due to high test costs and inconsistent reimbursement policies across regions. Patients and providers hesitate to adopt liquid biopsy when coverage gaps increase financial burden. Complex regulatory requirements delay reimbursement approvals, especially for emerging applications like MRD monitoring. Smaller hospitals struggle to invest in advanced sequencing equipment and trained staff. Cost pressures limit adoption in low- and middle-income regions. Broader payer acceptance is needed to support routine use in large patient populations and ensure sustainable market growth.

Regional Analysis

North America

North America leads the Liquid Biopsy market with a 41% share, driven by strong adoption across oncology centers and high investment in precision medicine. Cancer screening programs support widespread use of ctDNA and NGS-based tests in early detection and treatment monitoring. Hospitals prefer liquid biopsy for its speed and non-invasive nature, which improves patient compliance and clinical decision-making. The region benefits from advanced laboratory networks, supportive reimbursement in select indications, and continuous product launches. Ongoing MRD-focused trials and integration into personalized therapy pathways further strengthen regional growth.

Europe

Europe holds a 28% share supported by expanding molecular diagnostics infrastructure and rising regulatory focus on early cancer detection. National screening initiatives accelerate adoption of liquid biopsy for lung, breast, and colorectal cancers. Hospitals integrate NGS and PCR platforms into routine workflows as clinical validation grows. Strong collaboration between research institutes and diagnostic developers drives innovation in multi-omic testing. Favorable government funding in Western Europe increases test accessibility. Growing emphasis on decentralized and home-based sample collection further boosts market expansion across major countries.

Asia Pacific

Asia Pacific accounts for a 22% share, driven by rising cancer incidence and expanding access to molecular diagnostics. Major countries invest in advanced sequencing labs to support early detection and treatment monitoring. Healthcare providers adopt liquid biopsy due to its lower procedure burden in large patient populations. China, Japan, and South Korea lead adoption through strong research pipelines and government-backed precision oncology programs. Increasing private-sector investment enhances affordability and availability of high-sensitivity tests. Rapid digital health integration strengthens patient engagement and supports wider use across urban and semi-urban centers.

Latin America

Latin America holds a 5% share, with growth led by rising demand for non-invasive diagnostics in major urban hospitals. Adoption increases as cancer cases rise and clinicians seek alternatives to invasive tissue biopsies. Key countries such as Brazil and Mexico expand molecular testing capacity through public and private partnerships. Limited reimbursement and cost challenges slow widespread use, but pilot programs in oncology centers support early adoption. Improving access to NGS platforms and growing telemedicine networks create opportunities for broader market penetration across the region.

Middle East & Africa

Middle East & Africa represent a 4% share, supported by growing investment in advanced cancer diagnostics and precision medicine. High-income countries in the Gulf region expand liquid biopsy capabilities through modern oncology centers and partnerships with global diagnostic firms. Adoption grows in breast, lung, and colorectal cancers where early detection is a priority. Limited laboratory infrastructure in parts of Africa slows adoption, but awareness programs and international collaborations improve access. Rising government focus on early screening and digital reporting creates opportunities for long-term market development.

Market Segmentations:

By Sample Type

By Biomarker

- Circulating Tumor Cells (CTCs)

- Circulating Tumor DNA (ctDNA)

- Extracellular Vehicles (EVs)

- Others

By Technology

- Multi-gene parallel Analysis (NGS)

- Single Gene Analysis (PCR Microarrays)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Liquid Biopsy market features key players such as Guardant Health, Foundation Medicine, Bio-Rad Laboratories, Qiagen, Thermo Fisher Scientific, Roche Diagnostics, Illumina, NeoGenomics Laboratories, MDxHealth, and Biocept. These companies strengthen their positions through continuous advancements in ctDNA analysis, multi-gene sequencing platforms, and high-sensitivity detection tools. Leading firms invest in expanding companion diagnostic partnerships to support personalized therapy selection. Product portfolios grow through improved NGS workflows, automated sample processing, and MRD-focused assays designed for early recurrence prediction. Many players pursue regulatory approvals in major markets to increase clinical adoption. Strategic mergers, collaborations with oncology centers, and expansion into decentralized testing models support wider accessibility. Companies also focus on cost-efficient assays to enhance adoption across emerging regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Guardant Health

- Foundation Medicine

- Bio-Rad Laboratories

- Qiagen

- Thermo Fisher Scientific

- Roche Diagnostics

- Illumina

- NeoGenomics Laboratories

- MDxHealth

- Biocept

Recent Developments

- In November 2025, Thermo Fisher Scientific announced that its Oncomine Dx Target Test received FDA approval as a companion diagnostic to identify patients eligible for a new therapy.

- In November 2024, Foundation Medicine received U.S. FDA approval for its FoundationOne® Liquid CDx test as a companion diagnostic for Tepmetko® (tepotinib) to identify MET exon 14 skipping alterations in metastatic non-small cell lung cancer.

- In July 2024, Foundation Medicine’s FoundationOne® Liquid CDx was approved by the FDA as a companion diagnostic for AKEEGA® (niraparib + abiraterone acetate) in BRCA-positive metastatic castration-resistant prostate cancer.

Report Coverage

The research report offers an in-depth analysis based on Sample Type, Biomarker, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Liquid biopsy adoption will expand as early cancer detection programs gain stronger clinical acceptance.

- MRD monitoring will become a routine part of treatment planning across major cancer types.

- Multi-omic and multi-analyte testing will improve diagnostic accuracy and guide targeted therapies.

- AI-driven analytics will enhance mutation interpretation and support faster clinical decisions.

- Decentralized and at-home sample collection models will increase patient access and compliance.

- NGS platform advancements will reduce turnaround times and strengthen multi-gene analysis use.

- Pharma collaborations will grow as liquid biopsy becomes central to companion diagnostic development.

- Cost-efficient assay designs will support wider adoption in emerging and resource-limited markets.

- Regulatory approvals for new assay types will accelerate integration into global oncology workflows.

- Broader reimbursement coverage will support long-term market expansion and higher test utilization.