Market Overview

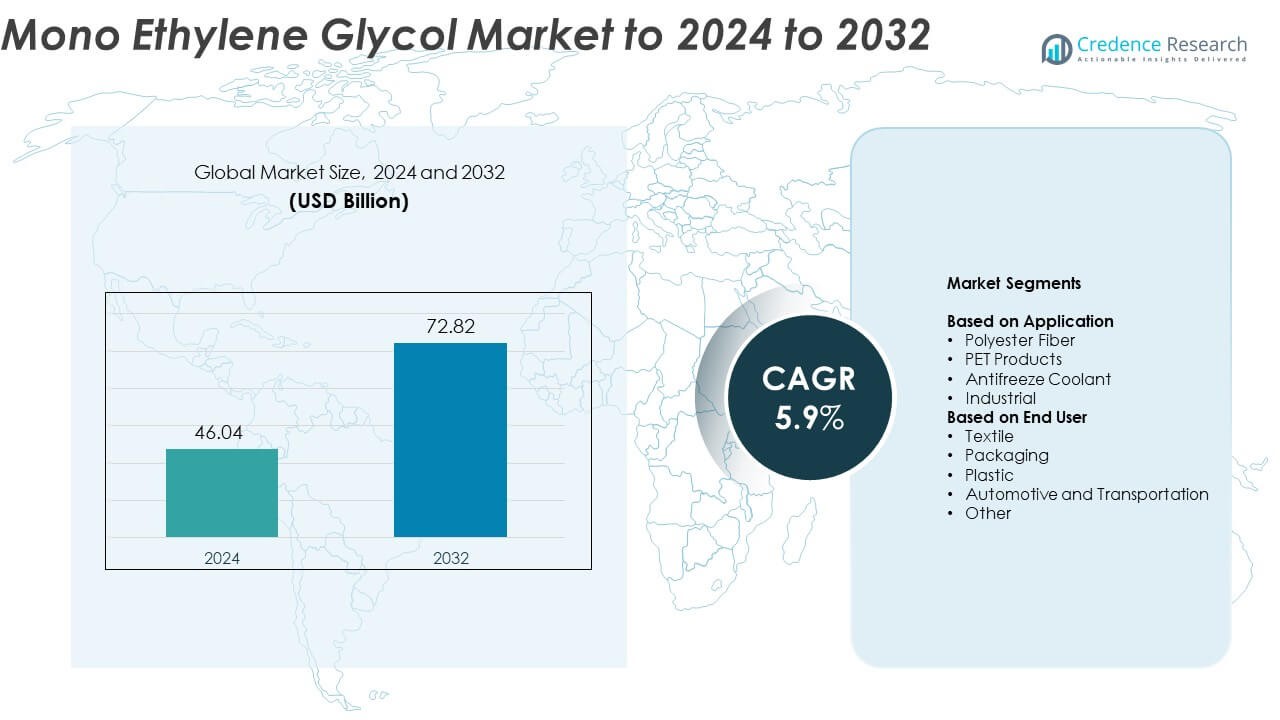

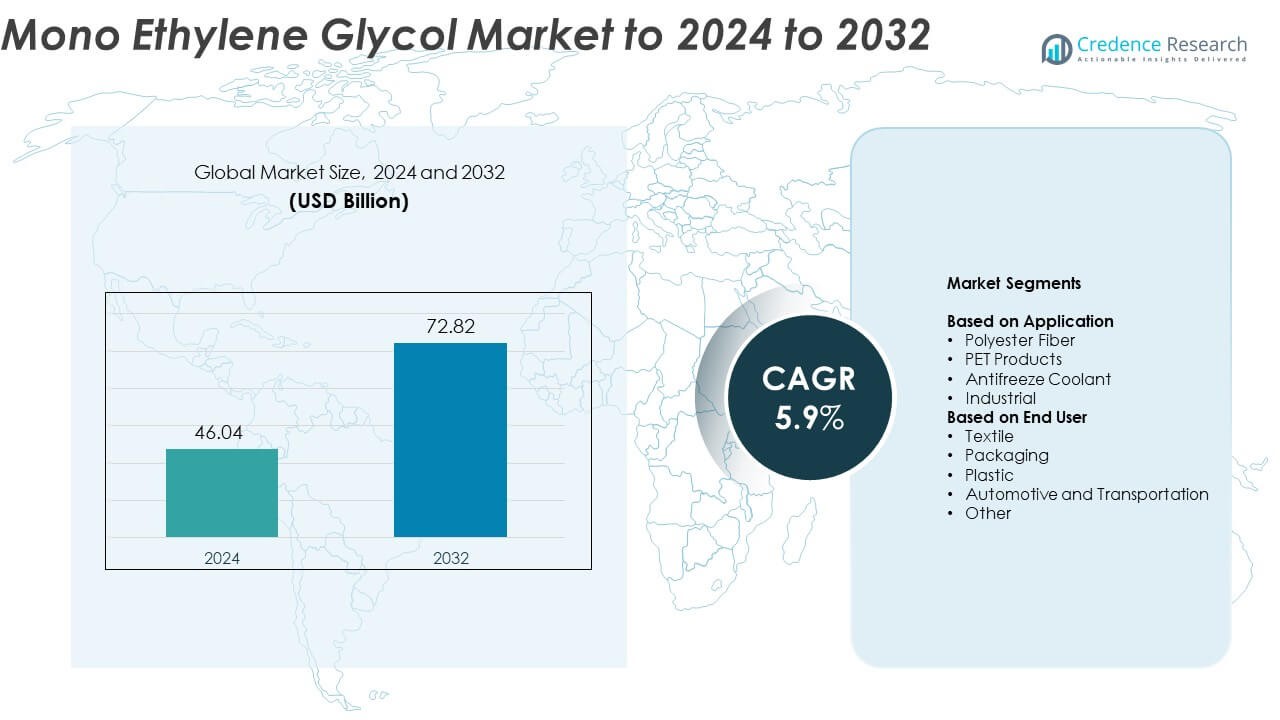

Mono Ethylene Glycol market size was valued at USD 46.04 Billion in 2024 and is anticipated to reach USD 72.82 Billion by 2032, at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Monoethylene Glycol (MEG) Market Size 2024 |

USD 46.04 Billion |

| Monoethylene Glycol (MEG) Market, CAGR |

5.9% |

| Monoethylene Glycol (MEG) Market Size 2032 |

USD 72.82 Billion |

The mono ethylene glycol market is led by major players such as Exxon Mobil Corporation, Dow, Royal Dutch Shell PLC, Mitsubishi Chemical Corporation, China Petroleum & Chemical Corporation, LyondellBasell Industries Holdings BV, NAN YA PLASTICS CORPORATION, Petro Rabigh, ME, India Glycols Limited, and UPM. These companies dominate through integrated petrochemical operations, technological innovation, and global supply networks. Asia-Pacific remains the leading region, accounting for about 41.6% share in 2024, driven by its strong textile, packaging, and automotive sectors. North America follows with around 27.8% share, supported by advanced chemical production infrastructure and sustained PET demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The mono ethylene glycol market was valued at USD 46.04 Billion in 2024 and is projected to reach USD 72.82 Billion by 2032, growing at a CAGR of 5.9%.

• Increasing demand for polyester fiber in textiles and PET packaging applications remains the key growth driver, supported by industrial expansion in emerging economies.

• The market is witnessing trends toward bio-based MEG production and advanced catalytic technologies aimed at improving efficiency and sustainability.

• Competitive dynamics are shaped by global producers focusing on capacity expansion, vertical integration, and adoption of greener manufacturing processes.

• Asia-Pacific dominates with 41.6% market share, followed by North America at 27.8% and Europe at 22.5%, while the polyester fiber segment holds the largest share at 53.7%, driven by growing demand from the textile industry.

Market Segmentation Analysis:

By Application

The polyester fiber segment dominates the mono ethylene glycol market, accounting for around 53.7% share in 2024. Its leadership is driven by the extensive use of MEG as a key raw material in polyester fiber manufacturing, which is widely applied in textiles, apparel, and home furnishings. The strong growth of the apparel industry and increasing demand for synthetic fibers across Asia-Pacific further strengthen this segment. Rising consumption of polyester fiber in industrial and technical textiles, coupled with expanding production capacities in China and India, continues to propel the demand for mono ethylene glycol.

- For instance, Reliance Industries has polyester fiber and yarn capacity of 2.5 million tons per year

By End User

The textile segment leads the mono ethylene glycol market with approximately 39.2% share in 2024. This dominance is fueled by the extensive application of MEG in producing polyester-based yarns and fabrics used across clothing, upholstery, and industrial materials. The surge in fast fashion trends, coupled with growing exports of synthetic textiles from emerging economies, drives significant consumption. Increasing investments in textile manufacturing and the shift toward durable, cost-effective polyester blends further reinforce the segment’s growth trajectory in the global mono ethylene glycol market.

- For instance, Hengli reports polymerization capacity of 6 million tons and fabric output over 4 billion meters annually.

Key Growth Drivers

Rising Demand for Polyester-Based Textiles

The growing global demand for polyester fibers in clothing, home furnishings, and industrial fabrics is a primary driver for the mono ethylene glycol market. MEG serves as a crucial feedstock in polyester fiber and PET resin production, making it indispensable to the textile industry. Rapid urbanization, expanding middle-class populations, and increasing fashion consumption in emerging economies such as China and India are amplifying this demand. The shift toward cost-effective synthetic fibers over natural materials continues to sustain long-term growth.

- For instance, Toray Advanced Materials Korea Inc. increased its annual production capacity for TORELINA™ polyphenylene sulfide (PPS) resin by 5,000 metric tons at its Gunsan plant, with operations starting from November 2024 (slightly ahead of the originally planned December 2024 completion date).

Expansion of PET Packaging Applications

The widespread use of PET products across food, beverage, and personal care packaging sectors significantly boosts MEG consumption. Growing awareness of lightweight and recyclable packaging materials enhances the adoption of PET bottles and containers. With rising global beverage consumption and the expansion of e-commerce, PET demand is increasing steadily. Technological advancements in PET recycling and sustainable packaging solutions further reinforce the long-term potential for MEG in the packaging industry.

- For instance, Indorama recycled over 26 billion PET bottles in 2024, contributing to a total of more than 150 billion bottles recycled from 2011 to August 2025.

Industrial and Automotive Growth

Expanding automotive and industrial activities worldwide have accelerated the demand for MEG-based antifreeze coolants and lubricants. MEG’s excellent thermal properties and ability to prevent freezing make it vital for engine performance and equipment maintenance. Increasing vehicle ownership and infrastructure development in developing countries support higher MEG usage. Additionally, industrial applications, including resins, solvents, and chemical intermediates, contribute to consistent market expansion across various sectors.

Key Trends & Opportunities

Shift Toward Bio-Based Mono Ethylene Glycol

The growing emphasis on sustainability and carbon footprint reduction is driving investment in bio-based MEG production. Companies are adopting renewable feedstocks such as bioethanol or sugarcane to produce eco-friendly alternatives to conventional petrochemical-derived MEG. This shift aligns with global environmental goals and consumer preference for green materials. As regulatory pressure intensifies on fossil-based products, bio-MEG offers significant opportunities for innovation and competitive differentiation.

- For instance, Avantium’s plant-based MEG demo unit in Delfzijl has about 10 tons per-year capacity.

Technological Advancements in Production Processes

Continuous improvement in MEG production efficiency through catalytic oxidation and advanced separation techniques is shaping market dynamics. New process designs reduce energy consumption, minimize by-products, and enhance yield quality. Integrated manufacturing setups combining MEG with other glycols or PET operations offer cost optimization and sustainability benefits. Such technological advancements strengthen supply reliability and support manufacturers in maintaining competitiveness under fluctuating raw material costs.

- For instance, Shell’s OMEGA process technology is used in several plants and enables operators to produce up to 1.95 tons of mono-ethylene glycol (MEG) per ton of ethylene consumed, which is more efficient than conventional processes that produce between 1.53 and 1.70 tons of MEG per ton of ethylene.

Key Challenges

Volatility in Crude Oil Prices

Fluctuations in crude oil and ethylene prices directly impact MEG production costs, creating market uncertainty. As MEG is derived from ethylene obtained from petroleum feedstocks, any shift in oil markets influences its profit margins. Geopolitical tensions, supply disruptions, and changing refinery output levels add to the volatility. These cost fluctuations challenge producers to maintain stable pricing structures and secure long-term supply contracts with end users.

Environmental and Regulatory Pressures

The mono ethylene glycol industry faces growing environmental scrutiny due to its petrochemical origin and potential ecological risks during production and disposal. Stricter emission norms and sustainability mandates compel manufacturers to adopt greener technologies and cleaner production methods. Compliance with environmental regulations increases capital expenditure and operational complexity. The transition toward sustainable manufacturing practices remains challenging, particularly for smaller producers with limited technological resources.

Regional Analysis

North America

North America holds around 27.8% share of the mono ethylene glycol market in 2024, driven by strong demand from the packaging, automotive, and textile sectors. The United States leads the region due to its extensive PET production and established chemical manufacturing infrastructure. Growth in sustainable packaging and expanding use of antifreeze coolants in the automotive industry further support market expansion. Rising investments in bio-based MEG production and recycling facilities enhance regional competitiveness. The presence of major producers and advanced refining capabilities ensures a stable supply chain across key industrial applications.

Europe

Europe accounts for nearly 22.5% share of the mono ethylene glycol market in 2024, supported by rising demand for PET-based packaging and polyester fibers. The region benefits from strict environmental regulations that encourage sustainable MEG production and recycling initiatives. Countries such as Germany, France, and the United Kingdom are leading adopters of energy-efficient and low-emission manufacturing technologies. The growing electric vehicle industry increases the use of MEG-based coolants, while the textile and industrial sectors remain key consumers. Circular economy initiatives are fostering innovation in bio-derived MEG alternatives across Europe.

Asia-Pacific

Asia-Pacific dominates the mono ethylene glycol market, accounting for about 41.6% share in 2024. China and India are major production and consumption hubs due to their vast textile, packaging, and automotive industries. Rapid urbanization, industrial expansion, and the growing preference for polyester fibers drive substantial demand across the region. Expanding PET bottle manufacturing and increasing investments in sustainable production facilities strengthen Asia-Pacific’s leadership. Government initiatives supporting industrial growth and large-scale chemical capacity expansions continue to position the region as a global MEG production powerhouse.

Latin America

Latin America captures around 4.6% share of the global mono ethylene glycol market in 2024. Brazil and Mexico serve as major growth centers due to rising demand for PET packaging and automotive coolants. Increasing industrialization and urban population are fueling consumption in the textile and packaging sectors. Expanding regional trade and supportive government policies encourage foreign investments in chemical manufacturing. Although the market remains smaller than Asia-Pacific and North America, infrastructure development and emerging bio-MEG projects offer long-term growth potential for Latin American producers.

Middle East & Africa

The Middle East & Africa region holds approximately 3.5% share of the mono ethylene glycol market in 2024, driven by abundant petrochemical feedstock availability. Saudi Arabia, Qatar, and the United Arab Emirates are major producers, leveraging large-scale ethylene and glycol plants to serve global markets. The region’s strategic exports to Asia and Europe enhance its market position. Growing infrastructure and automotive development in African nations are also contributing to steady consumption growth. Continued investments in refining and downstream integration strengthen the region’s competitive edge in MEG production.

Market Segmentations:

By Application

- Polyester Fiber

- PET Products

- Antifreeze Coolant

- Industrial

By End User

- Textile

- Packaging

- Plastic

- Automotive and Transportation

- Other

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The mono ethylene glycol market features prominent players such as Exxon Mobil Corporation (US), Dow (US), Royal Dutch Shell PLC, Mitsubishi Chemical Corporation, China Petroleum & Chemical Corporation, LyondellBasell Industries Holdings BV, NAN YA PLASTICS CORPORATION, Petro Rabigh (Saudi Arabia), ME (UAE), India Glycols Limited (India), and UPM. The competitive landscape is characterized by integrated production capacities, strategic joint ventures, and continuous process optimization to enhance cost efficiency. Companies are increasingly investing in sustainable manufacturing technologies and exploring bio-based MEG production to meet tightening environmental regulations. Expansion of PET and polyester fiber industries across Asia-Pacific drives capacity additions and long-term supply contracts. Market participants focus on technological advancements, improved feedstock utilization, and global supply chain optimization to maintain competitiveness. Strategic partnerships with packaging and textile manufacturers, along with innovations in recycling and green chemistry, continue to shape market positioning and strengthen sustainability-driven growth across key regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Shell Chemicals expanded its Monoethylene Glycol (MEG) production capacity in Asia to meet rising demand from industrialization and the growth of products like PET for packaging.

- In 2025, LyondellBasell commissioned a new MEG production line in Texas, USA. This facility expansion aims to enhance domestic supply for polyester and antifreeze applications, targeting growing demand from the textile and automotive sectors.

- In 2025, UPM continued to develop and introduce bio-based MEG materials from sustainable sources.

Report Coverage

The research report offers an in-depth analysis based on Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising demand for polyester fibers will continue to drive MEG consumption globally.

- Growing adoption of PET packaging in food and beverage industries will sustain market expansion.

- Increasing investments in bio-based MEG production will enhance sustainability and reduce dependency on fossil feedstocks.

- Rapid industrialization and automotive growth in Asia-Pacific will strengthen regional dominance.

- Technological advancements in catalytic and energy-efficient processes will improve production efficiency.

- Expanding textile manufacturing in emerging economies will create new opportunities for MEG suppliers.

- Strong focus on recycling and circular economy models will influence market strategies.

- Integration of MEG production with refinery and petrochemical complexes will improve cost competitiveness.

- Environmental and regulatory compliance will drive innovation in greener manufacturing practices.

- Strategic mergers and capacity expansions among global producers will shape long-term market dynamics.