Market Overview

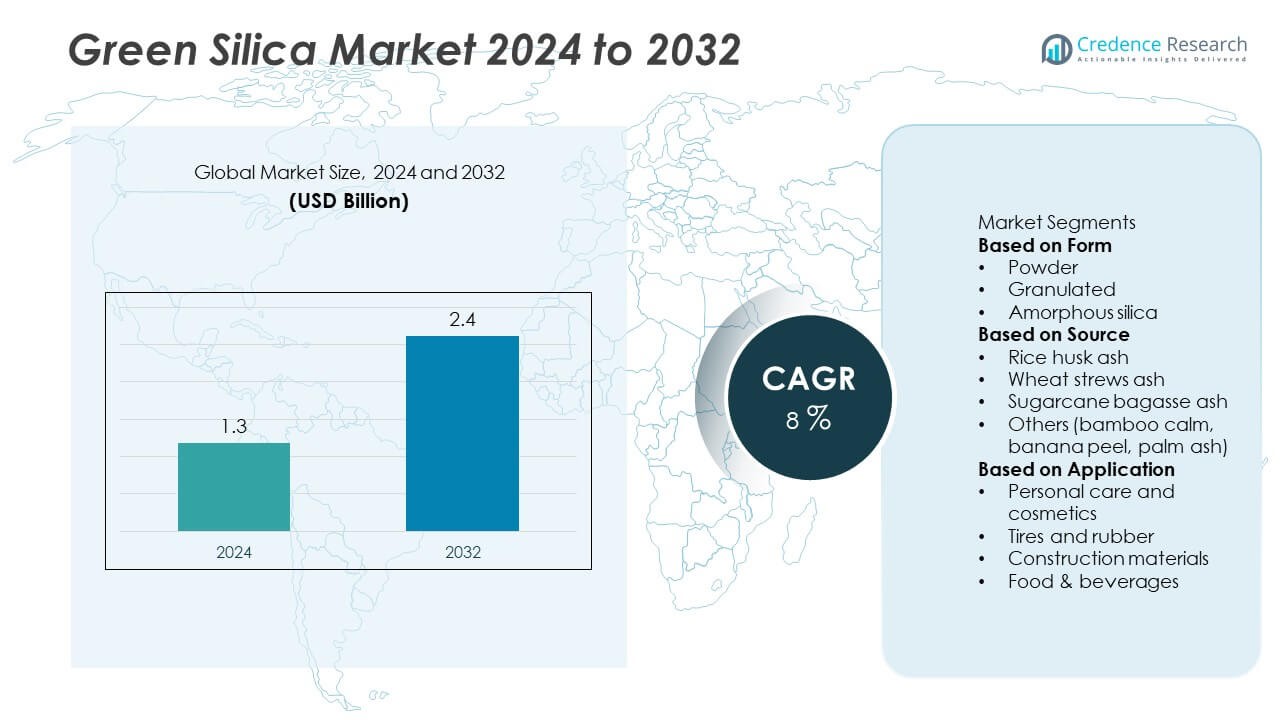

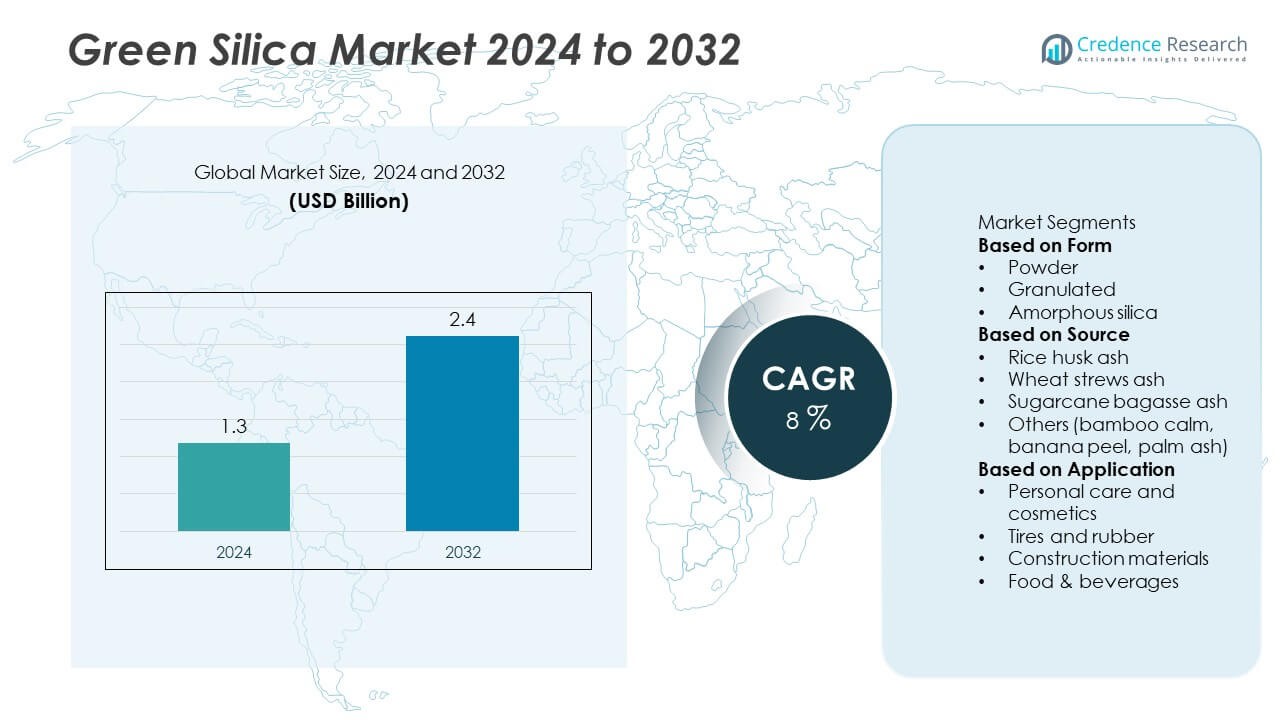

The Green Silica Market reached USD 1.3 billion in 2024 and is expected to grow to USD 2.4 billion by 2032, registering a strong 8% CAGR during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Green Silica Market Size 2024 |

USD 1.3 Billion |

| Green Silica Market, CAGR |

8% |

| Green Silica Market Size 2032 |

USD 2.4 Billion |

Top players in the Green Silica market include Green Vision Silica, Refratechnik, Brisil, Solvay, Palamatic PROCESS, Katyayani Organic, Evonik, Green Silica, Dow Corporate, and Biosilico. These companies strengthen their position through advanced biomass-based extraction technologies, high-purity product lines, and strong partnerships in automotive, cosmetics, and construction sectors. Asia Pacific leads the market with a 34% share, driven by abundant agricultural waste resources and expanding tire production. North America follows with a 32% share, supported by strong demand for sustainable materials and advanced R&D capabilities. Europe holds a 28% share, backed by strict environmental regulations and high adoption of bio-based industrial ingredients.

Market Insights

Market Insights

- The Green Silica market reached USD 1.3 billion in 2024 and is projected to hit USD 2.4 billion by 2032 at an 8% CAGR, reflecting strong demand for sustainable, bio-based materials.

- Demand grows as the tires and rubber segment dominates with a 46% share, driven by the need for energy-efficient, low-rolling-resistance tires adopting green silica for better reinforcement and reduced emissions.

- Market trends highlight rising adoption of bio-based materials, advanced biomass-extraction technologies, and growing use in personal care, coatings, and green construction applications.

- Competitive activity intensifies as companies invest in high-purity product development and circular-economy processing while facing restraints from high production costs and biomass supply variability.

- Asia Pacific leads with a 34% share, followed by North America at 32% and Europe at 28%, supported by strong manufacturing bases, sustainability policies, and expanding applications across automotive, personal care, and construction sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Form

Powder form led the Green Silica market with a 52% share in 2024, supported by strong adoption in personal care, coatings, and rubber reinforcement. The fine particle structure improves dispersion, stability, and absorption, making it suitable for cosmetics, adhesives, and specialty chemicals. Granulated silica followed due to rising use in construction additives and filtration media. Amorphous silica gained traction for high-purity applications but remained a smaller segment. The dominance of powder form comes from its compatibility with diverse industrial processes and its ability to meet performance and sustainability requirements across multiple sectors.

- For instance, Evonik commissioned a new plant for its innovative AEROSIL® Easy-to-Disperse (E2D) silicas at its Rheinfelden site in June 2024, an upgrade designed to improve processing efficiency, sustainability, and performance in paints and coatings.

By Source

Rice husk ash dominated the segment with a 58% share in 2024, driven by its high silica content, consistent quality, and strong availability in major agricultural regions. The material supports circular economy practices by converting biomass waste into high-value green silica. Wheat straw ash ranked second as industries adopt low-carbon alternatives for rubber, plastics, and fillers. Sugarcane bagasse ash also expanded due to its suitability for reinforced composites. Other sources, including bamboo and palm ash, contributed niche demand. Rice husk ash leads because it offers stable yield, low production cost, and reliable purity.

- For instance, Brisil’s green silica unit in Gujarat processes approximately 18,250 tons of rice husk ash annually (50 tons daily) and extracts silica with a range of technical specifications, which can be customized to meet client requirements.

By Application

Tires and rubber held the largest share of 46% in 2024, supported by strong demand for sustainable reinforcement materials in fuel-efficient and low-rolling-resistance tires. Green silica enhances tensile strength, abrasion resistance, and energy efficiency, making it a preferred choice for automotive OEMs. Personal care and cosmetics followed as brands adopted bio-based silica for exfoliants, oil absorbers, and clean-label formulations. Construction materials gained steady demand from green concrete and lightweight composites. Food and beverage applications grew gradually through use in anticaking and clarifying agents. Tires and rubber remain dominant due to performance and sustainability advantages.

Key Growth Drivers

Rising Demand for Sustainable and Bio-Based Materials

Demand for eco-friendly materials drives strong growth as industries shift toward low-carbon inputs. Green silica produced from agricultural waste supports emission reduction and circular economy goals. Manufacturers in automotive, personal care, and construction adopt bio-based silica to replace conventional synthetic variants. Regulatory pressure to reduce carbon footprints strengthens this transition. Growing consumer preference for clean-label and sustainable products accelerates adoption across multiple end-use industries.

- For instance, Solvay advanced its bio-silica program by integrating a proprietary process that uses bio-based sodium silicate derived from rice husk ash to produce high-purity renewable silica.

Increasing Use in High-Performance Tire Manufacturing

The tire industry fuels major demand as manufacturers adopt green silica to improve rolling resistance, durability, and fuel efficiency. Green silica enhances grip and wear performance while supporting sustainability goals. Automotive OEMs increasingly require eco-friendly reinforcement materials to meet global emission standards. Expansion of electric vehicles further boosts use because green silica improves energy efficiency and battery range. Tire producers also benefit from stable sourcing of agricultural waste-derived silica.

- For instance, Pirelli has integrated bio-based silica derived from rice processing waste (rice husk ash) into its high-performance tire lines to improve wet grip and rolling resistance.

Expanding Applications in Personal Care and Cosmetics

Personal care brands drive strong adoption as green silica replaces microplastics in exfoliators, powders, and oil-absorbing formulations. The material offers safe, biodegradable performance and supports clean-label positioning. Regulatory restrictions on microbeads accelerate demand for plant-based alternatives. Green silica’s high absorption, smooth texture, and skin-friendly profile strengthen its use in premium cosmetic products. Innovation in bio-derived functional ingredients continues to widen opportunities in skincare and hygiene applications.

Key Trends & Opportunities

Shift Toward Circular Economy and Waste Valorization

A major trend involves transforming agricultural residues into high-value green silica. Industries adopt circular processing to reduce waste and minimize environmental impact. Rice husk ash, wheat straw ash, and bagasse ash emerge as reliable feedstocks, creating opportunities for large-scale biomass utilization. Governments support waste-to-resource technologies through sustainability policies. This trend strengthens supply stability, lowers production costs, and supports rapid expansion in developing markets with strong agricultural output.

- For instance, the general process of creating silica from rice husk ash is a known industrial application, and facilities can achieve high purity levels (up to 99.7%) and generate energy as a by product.

Advancements in Green Silica Extraction and Purification

Technological improvements create opportunities to deliver higher-purity, nano-structured, and application-specific silica. Advanced thermal treatment, controlled combustion, and chemical purification enhance consistency and performance. These innovations help green silica meet strict quality requirements for tires, electronics, cosmetics, and advanced composites. Improved efficiency also reduces energy use and processing cost, strengthening competitiveness against traditional silica. Companies adopting these technologies gain access to high-value industrial applications.

- For instance, Cabot Corporation operates multiple fumed silica manufacturing facilities globally, including in Barry, Wales, and Wuhai, China, to meet growing demand in applications such as silicones, paints/coatings, and adhesives/sealants.

Key Challenges

Limited Standardization and Quality Variability

Green silica faces quality variation due to differences in biomass sources, combustion methods, and processing conditions. Inconsistent purity and particle structure create challenges for industries requiring strict performance standards, such as tires and electronics. Lack of global standardization slows large-scale adoption. Manufacturers must invest in advanced purification and quality control systems to achieve stable output. This challenge increases operational cost and limits competitiveness in high-precision applications.

High Production Costs Compared to Conventional Silica

Production of green silica involves energy-intensive processing, controlled combustion, and chemical treatment, which raise costs compared to traditional silica. Limited large-scale facilities also restrict economies of scale. In some regions, sourcing consistent biomass ash adds logistical challenges. These cost barriers affect adoption in price-sensitive industries such as construction and packaging. Manufacturers must advance process efficiency and secure stable feedstock chains to close the cost gap with conventional silica.

Regional Analysis

North America

North America held a 32% share of the Green Silica market in 2024, supported by strong demand from tire manufacturing, personal care, and high-performance industrial applications. The region benefits from advanced R&D capabilities and growing adoption of bio-based materials driven by sustainability regulations. Automotive manufacturers increasingly use green silica to improve tire efficiency and reduce emissions. Rising consumer preference for natural cosmetic ingredients further strengthens market penetration. Investments in waste-to-resource technologies also support production growth. The United States leads consumption due to a well-established industrial base and rising focus on circular economy practices.

Europe

Europe accounted for a 28% share in 2024, driven by strict environmental regulations and strong adoption of sustainable materials across automotive, cosmetics, and construction industries. The region’s focus on decarbonization encourages manufacturers to replace conventional silica with low-carbon, biomass-derived alternatives. Germany, France, and the Netherlands remain major consumers due to advanced tire production and strong natural cosmetics demand. Green building initiatives also support use in eco-friendly concrete and coatings. Growing emphasis on circular economy policies enhances market growth, supported by well-developed recycling and agricultural waste utilization systems.

Asia Pacific

Asia Pacific led the Green Silica market with a 34% share in 2024, supported by expanding manufacturing capacity, abundant agricultural waste sources, and rapid industrialization. China dominates production due to large rice husk availability and strong tire manufacturing activity. India and Southeast Asia drive additional growth as industries adopt sustainable materials in automotive, construction, and personal care. Rising government focus on waste valorization boosts green silica output. Growing consumption of fuel-efficient tires and natural cosmetic products reinforces the region’s leadership. Strong cost advantages and a large industrial base position Asia Pacific as the fastest-growing regional market.

Latin America

Latin America represented a 4% share in 2024, influenced by moderate adoption across automotive, agriculture, and construction sectors. Brazil and Mexico lead consumption driven by growing interest in sustainable tire materials and green concrete applications. The region’s large agricultural output provides strong potential for rice husk and bagasse-based silica production, though commercial processing remains limited. Rising investment in natural personal care products supports incremental demand. Expanding infrastructure development creates new opportunities for green silica in eco-construction materials. Despite slower industrial adoption, sustainability awareness is steadily driving future growth prospects.

Middle East & Africa

The Middle East & Africa region held a 2% share in 2024, supported by emerging demand for sustainable construction materials and natural cosmetic ingredients. Gulf countries adopt green silica in high-performance coatings and concrete admixtures for large-scale infrastructure projects. African markets show potential due to abundant biomass waste suitable for silica extraction, though processing capacity remains limited. Rising interest in eco-friendly beauty products and energy-efficient building materials supports gradual market expansion. Government initiatives promoting circular economy practices and diversification of industrial sectors create future growth opportunities for green silica suppliers.

Market Segmentations:

By Form

- Powder

- Granulated

- Amorphous silica

By Source

- Rice husk ash

- Wheat strews ash

- Sugarcane bagasse ash

- Others (bamboo calm, banana peel, palm ash)

By Application

- Personal care and cosmetics

- Tires and rubber

- Construction materials

- Food & beverages

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Green Silica market includes key players such as Green Vision Silica, Refratechnik, Brisil, Solvay, Palamatic PROCESS, Katyayani Organic, Evonik, Green Silica, Dow Corporate, and Biosilico. These companies compete by expanding production capabilities, enhancing purity levels, and improving processing technologies to supply high-performance green silica derived from agricultural waste. Leading manufacturers invest in advanced extraction and calcination systems to deliver consistent quality suitable for tires, personal care, coatings, and construction applications. Partnerships with automotive and cosmetics industries strengthen long-term demand as sustainability requirements rise globally. Companies also focus on circular economy models by sourcing biomass waste such as rice husk and bagasse to reduce environmental impact and production costs. New entrants emphasize localized sourcing and cost-efficient technologies, intensifying competition. Continuous product innovation and expansion into emerging markets help established brands maintain a strong competitive edge in the evolving green silica industry.

Key Player Analysis

- Green Vision Silica

- Refratechnik

- Brisil

- Solvay

- Palamatic PROCESS

- Katyayani Organic

- Evonik

- Green Silica

- Dow Corporate

- Biosilico

Recent Developments

- In September 2025, Solvay advanced its global circular silica strategy by announcing that the conversion of its Qingdao (China) and Gunsan (South Korea) production plants to use ISCC+ certified waste sand as a circular raw material would be operational from 2026 onwards

- In January 2025, Solvay signed an MoU with Hankook Tire to develop circular silica derived from bio- and waste-sourced raw materials for tires.

- In January 2025, Evonik formed a new business line “Smart Effects” by merging its Silica and Silanes units, focusing on sustainability, circular economy and innovation in green markets (e.g., green tires, electronics).

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Form, Source, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for green silica will rise as tire manufacturers prioritize low-emission and energy-efficient materials.

- Adoption in personal care will grow as brands replace microplastics with biodegradable silica alternatives.

- Use in green construction materials will expand as builders shift to low-carbon concrete and coatings.

- Producers will invest in advanced extraction technologies to improve purity and reduce processing costs.

- Circular-economy initiatives will drive higher sourcing of agricultural waste for silica production.

- Electric vehicle growth will increase demand for high-performance silica in advanced rubber compounds.

- Emerging markets will show strong consumption due to rising industrialization and sustainability policies.

- Competition will intensify as new entrants focus on cost-efficient biomass processing solutions.

- Supply chain optimization will gain priority to manage variability in biomass quality and availability.

- Collaboration between manufacturers and automotive, cosmetic, and construction industries will support tailored product development.

Market Insights

Market Insights