Market Overview

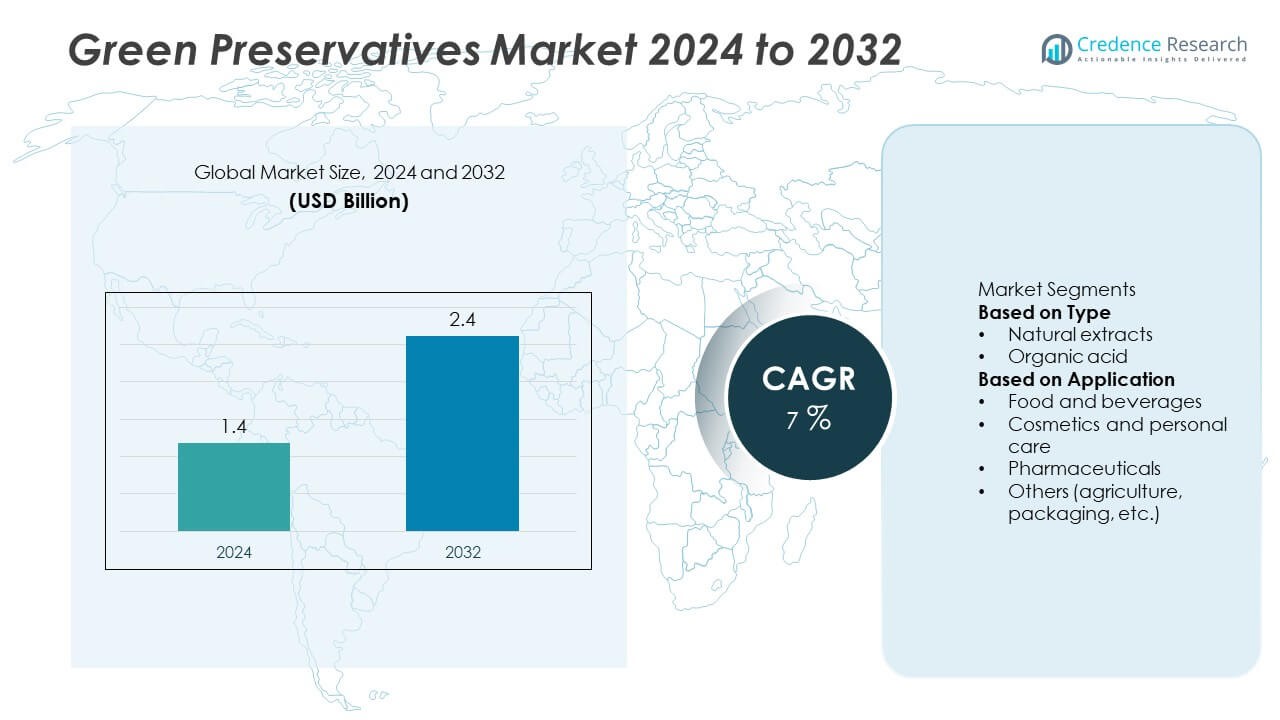

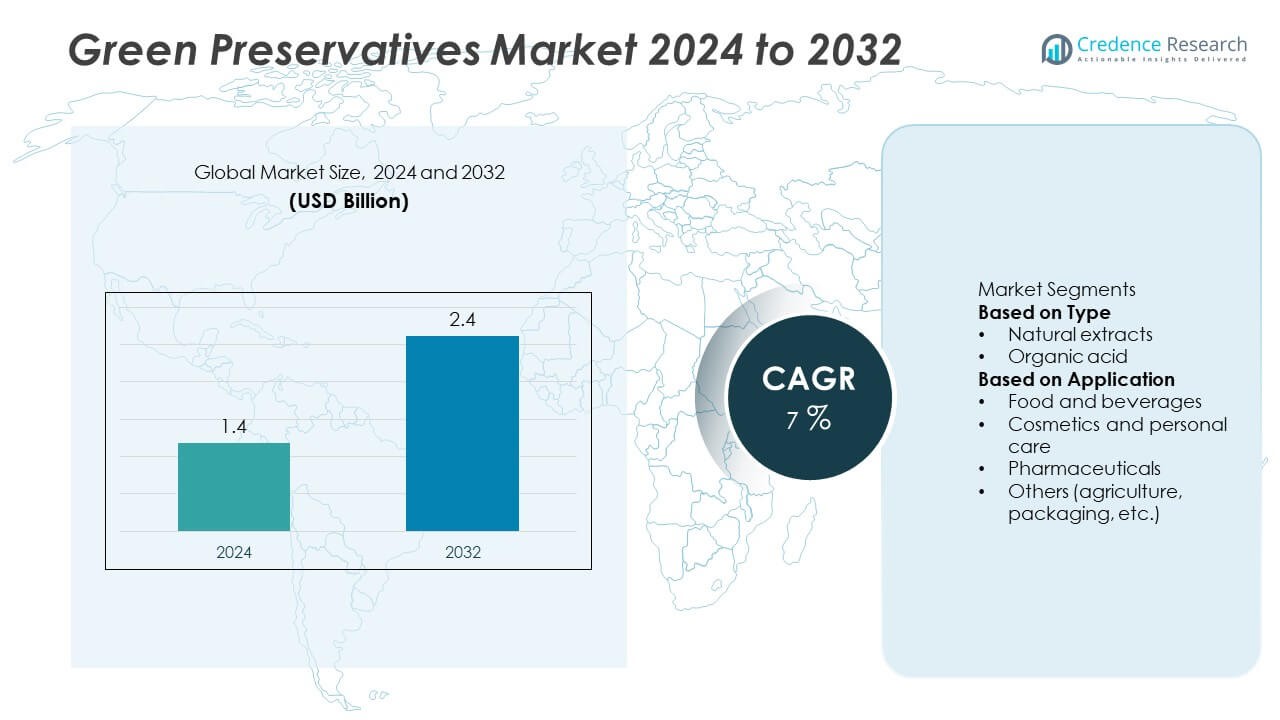

The Green Preservatives Market was valued at USD 1.4 billion in 2024 and is projected to reach USD 2.4 billion by 2032, registering a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Green Preservatives Market Size 2024 |

USD 1.4 Billion |

| Green Preservatives Market, CAGR |

7% |

| Green Preservatives Market Size 2032 |

USD 2.4 Billion |

Top players in the Green Preservatives market include Wang Pharmaceuticals and Chemicals, Firmenich, Kemin Industries, Lanxess, DSM, Symrise, BASF SE, Givaudan, Kerry, and Kalsec, each strengthening their position through innovation and expanded natural ingredient portfolios. These companies invest in plant-based antimicrobial technologies, sustainable sourcing, and advanced extraction methods to meet growing clean-label demand. Regionally, North America leads the market with a 36% share, supported by strong regulatory standards and high consumer preference for natural formulations. Europe follows with a 32% share, driven by strict ingredient regulations and strong adoption of eco-friendly preservation solutions across food, cosmetics, and personal care industries.

Market Insights

- The Green Preservatives market reached USD 1.4 billion in 2024 and will grow at a 7% CAGR through 2032, supported by rising adoption across food, cosmetics, and pharmaceuticals.

- Demand grows as clean-label and natural products gain traction, with natural extracts holding a 48% segment share due to strong consumer acceptance and broad antimicrobial performance.

- Trends include advancements in plant-based and bio-derived preservatives, along with rising use in sustainable packaging and premium organic formulations across global industries.

- Competition strengthens as key players expand natural ingredient portfolios and invest in sustainable sourcing, advanced extraction, and high-performance antimicrobial technologies.

- North America leads with a 36% share, followed by Europe at 32% and Asia Pacific at 22%, while food and beverages remain the top application segment with a 41% share due to strict safety standards and growing preference for natural preservation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Natural extracts dominated the Green Preservatives market with a 48% share in 2024, supported by rising demand for clean-label, plant-based preservatives across food, cosmetics, and pharmaceuticals. These extracts offer broad antimicrobial action and strong consumer acceptance, which drives wider adoption in premium formulations. Organic acids accounted for the remaining 52% share, driven by strong usage in food and beverage applications where they provide reliable pH control and extended shelf life. Growth in natural products and regulatory pressure on synthetic additives continue to support both sub-segments.

- For instance, Kemin Industries provides a line of rosemary extracts (such as FORTIUM® R) designed to be effective against color and flavor degradation in various food applications, including snack products, fats, and oils.

By Application

Food and beverages held the leading position with a 41% share in 2024, driven by increasing preference for natural ingredients and strict regulations on artificial preservatives. Companies use green preservatives to meet safety standards and extend product stability without synthetic additives. Cosmetics and personal care represented a 33% share, supported by rising demand for organic skincare and haircare products. Pharmaceuticals held a 17% share, while the remaining 9% came from agriculture, packaging, and other niche uses that benefit from non-toxic, eco-friendly preservation solutions.

- For instance, Acerola extract is a natural source of Vitamin C and other phytonutrients like phenolics and carotenoids, which are known to have high antioxidant capacity. Studies have demonstrated that acerola extracts can inhibit free radicals and provide a protective effect against DNA damage caused by oxidative stress.

KEY GROWTH DRIVERS

Rising Demand for Clean-Label and Natural Products

Growing consumer preference for clean-label goods drives strong adoption of green preservatives. Brands across food, cosmetics, and pharmaceuticals prefer natural systems that align with wellness and transparency goals. Regulatory pressure on synthetic additives strengthens this shift as companies reformulate portfolios to meet safety norms. Natural extracts, essential oils, and plant-based antimicrobials gain traction due to strong acceptance and functional performance. This broad movement supports steady expansion across global markets.

- For instance, Givaudan develops active cosmetic ingredients, leveraging biotechnology and green fractionation techniques to create sustainable and effective solutions from botanical sources.

Regulatory Support for Non-Toxic Preservation Systems

Global regulatory bodies promote safer, eco-friendly preservatives, encouraging companies to replace synthetic chemicals with natural alternatives. Stricter rules on parabens, formaldehyde donors, and similar agents accelerate innovation in compliant natural solutions. Manufacturers invest in R&D to develop effective antimicrobial blends suited for sensitive products. This regulatory momentum increases adoption and encourages faster integration of green preservatives across industries focused on safety and sustainability.

- For instance, a natural antimicrobial system may demonstrate specific efficacy against various bacteria and fungi in a laboratory setting. The performance metrics, such as log reduction rates, optimal dosage levels, viscosity limits, and effective pH ranges, are highly dependent on the exact chemical composition of the system and the formulation it is used within.

Expansion of Premium and Organic Product Categories

Premium categories such as organic cosmetics, plant-based foods, and nutritional supplements rely heavily on green preservatives. These segments demand natural protection systems that avoid chemicals while offering strong shelf stability. Brands adopt botanical extracts, fermented ingredients, and organic acids to meet clean-label expectations. Rising incomes and stronger willingness to pay for natural products boost this trend. Growth in these premium categories creates higher-value opportunities for advanced preservation solutions.

KEY TRENDS & OPPORTUNITIES

Advancements in Plant-Based and Bio-Derived Preservatives

Innovation in bio-derived preservatives creates major opportunities for manufacturers seeking safe and high-performing solutions. Companies explore antimicrobial compounds from herbs, algae, fruits, and fermented sources to enhance efficiency and broaden application uses. These advances improve formulation stability while reducing reliance on synthetic additives. With rising confidence in plant-based ingredients, brands use natural systems to differentiate and strengthen their premium positions in clean-label categories.

- For instance, Kerry Group expanded its plant-based preservation portfolio by integrating a natural ferment produced through a controlled culture process that delivers 2.5 log reduction in spoilage organisms within 24 hours. The company validated this performance across 60 pilot formulations, demonstrating higher stability and longer shelf life for bakery and beverage applications.

Adoption in Sustainable Packaging and Eco-Friendly Product Lines

The shift toward sustainable packaging and low-impact production increases demand for green preservatives. Natural preservatives align with biodegradable packaging and organic product lines by reducing chemical exposure. Food and cosmetic brands adopt these solutions to reinforce sustainability commitments and meet environmentally focused consumer expectations. This alignment between product content and packaging creates strong commercial opportunities, especially for companies offering integrated natural preservation systems.

- For instance, Corbion offers various natural, label-friendly preservation solutions, such as those in the Verdad® portfolio, that are proven to suppress the growth of pathogens and spoilage bacteria in food products.

Growth of E-Commerce and Direct-to-Consumer Channels

The expansion of e-commerce drives demand for stable, long-lasting natural products that withstand transport and storage. Direct-to-consumer brands rely on green preservatives to maintain freshness without compromising clean-label claims. This need encourages adoption of multifunctional natural antimicrobials that offer extended protection. As online sales rise across beauty, wellness, and specialty foods, companies invest in advanced preservation systems to ensure consistent performance during shipment and fulfillment.

KEY CHALLENGES

Limited Stability Compared to Synthetic Preservatives

Green preservatives often deliver lower antimicrobial strength and shorter shelf protection than synthetic alternatives. This creates challenges in high-risk applications requiring long-term stability. Formulators use synergistic blends, enhanced extraction methods, or antioxidants to improve performance, but these steps raise cost and development time. Frequent reformulation reduces appeal for manufacturers seeking predictable outcomes. This stability limitation remains a key barrier to mass-market penetration.

High Production Costs and Supply Chain Variability

Natural preservatives involve complex extraction and sustainable sourcing, leading to higher production costs. Raw material supply depends on agricultural cycles and climate conditions, creating inconsistent availability. These factors increase price volatility and reduce competitiveness against synthetic preservatives. Smaller producers face added barriers due to limited access to certified natural inputs. Addressing cost efficiency and supply reliability is essential for scaling adoption in broader industries.

Regional Analysis

North America

North America held a 36% share of the Green Preservatives market in 2024, driven by strong demand for natural ingredients across food, cosmetics, and nutraceutical sectors. Consumers show high acceptance of clean-label goods, pushing manufacturers to reduce synthetic additives. Regulatory bodies enforce strict guidelines on chemical preservatives, encouraging wider adoption of plant-based and bio-derived alternatives. The region benefits from strong R&D capabilities and rapid product innovation. Growing interest in organic foods and premium natural skincare further strengthens the demand for advanced, safe, and sustainable preservation systems across the region.

Europe

Europe captured a 32% share in 2024, supported by stringent regulatory standards restricting the use of synthetic preservatives. The region leads in clean-label adoption as consumers prioritize safety, transparency, and sustainability. Food and cosmetic manufacturers rely heavily on natural extracts, organic acids, and bio-derived antimicrobials to meet compliance requirements. Strong growth in organic personal care, functional foods, and eco-friendly packaging also drives usage of green preservatives. Government-backed sustainability programs encourage innovation in natural preservation technologies, reinforcing Europe’s position as a key market for environmentally aligned product formulations.

Asia Pacific

Asia Pacific accounted for a 22% share in 2024, driven by rapid expansion of food processing, personal care manufacturing, and natural product consumption. Rising urbanization increases demand for safe, clean-label packaged foods and cosmetics. Manufacturers adopt green preservatives to meet regulatory improvements and appeal to health-conscious consumers. Growing interest in traditional herbal ingredients supports local innovation in plant-derived antimicrobial systems. The region’s strong production capabilities and expanding retail landscape create strategic opportunities for natural preservation solutions across mass-market and premium categories.

Latin America

Latin America held an 8% share of the market in 2024, supported by rising awareness of natural ingredients and growth in processed foods and personal care products. Countries such as Brazil and Mexico see increasing adoption of clean-label formulations driven by young, health-focused consumers. Manufacturers integrate plant-based and fermentation-derived preservatives to reduce chemical content and comply with evolving standards. Local sourcing of botanical ingredients also supports cost efficiency and product authenticity. As sustainability efforts expand across industries, demand for eco-friendly preservation systems continues to strengthen in the region.

Middle East & Africa

The Middle East & Africa region recorded a 6% share in 2024, driven by gradual shifts toward natural and safer ingredients in food, cosmetics, and pharmaceuticals. Rising disposable incomes and growth in premium personal care help create demand for clean-label formulations. Import-dependent markets rely on global suppliers offering plant-based and bio-derived preservatives that meet international standards. Increased government focus on product safety and quality accelerates adoption. As awareness of sustainable and chemical-free products expands, green preservatives gain traction in both mainstream and specialized applications across the region.

Market Segmentations:

By Type

- Natural extracts

- Organic acid

By Application

- Food and beverages

- Cosmetics and personal care

- Pharmaceuticals

- Others (agriculture, packaging, etc.)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Green Preservatives market includes major participants such as Wang Pharmaceuticals and Chemicals, Firmenich, Kemin Industries, Lanxess, DSM, Symrise, BASF SE, Givaudan, Kerry, and Kalsec. These companies compete through innovation, strong R&D capabilities, and expanded natural ingredient portfolios. Many players focus on plant-based extracts, fermentation-derived antimicrobials, and multifunctional preservation systems to meet clean-label and regulatory demands. Strategic investments in sustainable sourcing, advanced extraction technologies, and formulation support strengthen their market positions. Several companies also expand partnerships with food, cosmetics, and pharmaceutical manufacturers to enhance supply reliability. With rising interest in natural and eco-friendly products, competitive intensity increases as firms pursue new bio-derived molecules and higher-performance green preservation solutions.

Key Player Analysis

- Wang Pharmaceuticals and Chemicals

- Firmenich

- Kemin Industries

- Lanxess

- DSM

- Symrise

- BASF SE

- Givaudan

- Kerry

- Kalsec

Recent Developments

- In April 2025, BASF SE introduced aroma ingredient L-Menthol FCC rPCF with a reduced product carbon footprint (10-15 % lower than conventional product) as part of its sustainable ingredients strategy.

- In March 2025, Kemin Industries launched PROSIDIUM™, a novel feed-pathogen control solution using peroxy acids to improve food security in animal feed supply chains.

- In October 2023, BASF launched new sustainable solutions, including the biodegradable polymer Sokalan Ecopure C, aimed at enhancing automatic dishwashing detergents. This innovation supports various formats while ensuring effective stain removal.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for natural and clean-label formulations will continue to rise across food, cosmetics, and pharmaceuticals.

- Manufacturers will increase investment in plant-based and bio-derived antimicrobial technologies.

- Regulatory pressure on synthetic preservatives will accelerate the shift toward safer, eco-friendly alternatives.

- Innovation in fermentation-based preservation systems will gain strong industry traction.

- Wider adoption of multifunctional natural preservatives will support product stability and longer shelf life.

- Sustainable packaging trends will create stronger alignment with green preservation solutions.

- Premium and organic product categories will drive higher usage of botanical and herbal preservatives.

- Companies will expand partnerships to improve sourcing transparency and supply chain resilience.

- Emerging markets in Asia Pacific and Latin America will show faster adoption as clean-label awareness grows.

- Digitalization and e-commerce expansion will increase demand for stable, natural formulations suitable for long transport and storage.