Market Overview

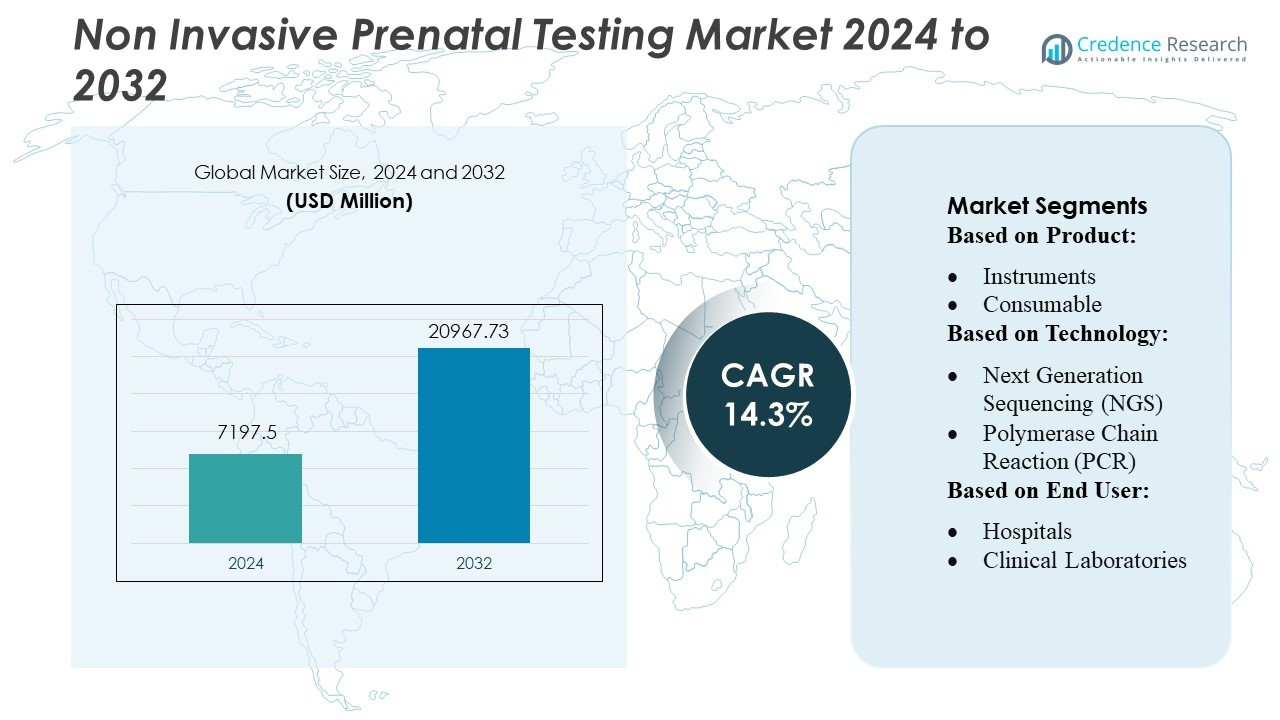

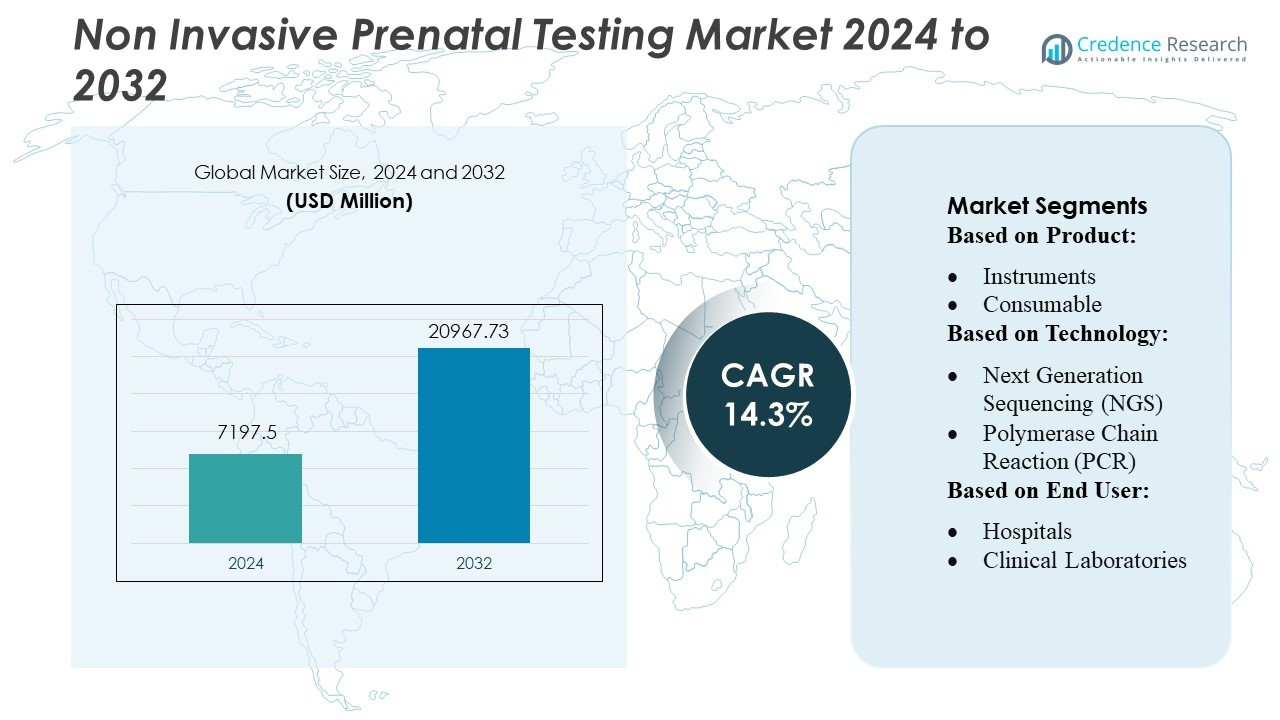

Non Invasive Prenatal Testing Market size was valued USD 7197.5 million in 2024 and is anticipated to reach USD 20967.73 million by 2032, at a CAGR of 14.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Non Invasive Prenatal Testing Market Size 2024 |

USD 7197.5 Million |

| Non Invasive Prenatal Testing Market, CAGR |

14.3% |

| Non Invasive Prenatal Testing Market Size 2032 |

USD 20967.73 Million |

The Non-Invasive Prenatal Testing (NIPT) market features strong participation from global genomics and diagnostic leaders that continue to advance sequencing accuracy, expand test panels, and enhance laboratory automation. These companies compete through technology innovation, strategic collaborations with hospitals and clinical laboratories, and continuous improvements in bioinformatics platforms that strengthen clinical reliability. North America remains the leading region, accounting for approximately 40–42% of the global market, supported by robust prenatal screening adoption, established reimbursement frameworks, and the presence of high-capacity sequencing laboratories. Ongoing integration of NIPT into routine prenatal care further reinforces the region’s dominance and accelerates overall market growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Non-Invasive Prenatal Testing market was valued at USD 7,197.5 million in 2024 and is projected to reach USD 20,967.73 million by 2032, growing at a CAGR of 14.3% during the forecast period.

- Rising adoption of NGS-based tests, which hold about 55–60% share, and consumables and reagents accounting for nearly 65–70% share, continues to drive strong demand due to recurring use and high analytical accuracy.

- Increasing technological innovation, expanding panel depth, and strategic collaborations among global diagnostic leaders intensify competitive activity and accelerate advancements in automation and bioinformatics.

- Limited reimbursement coverage in several regions and the high cost of genome-wide testing remain key restraints, slowing penetration in cost-sensitive markets.

- North America leads the market with a 40–42% share, supported by strong prenatal screening adoption, while clinical laboratories globally maintain dominance with a 60–65% end-user share as high-throughput facilities continue to scale NIPT services.

Market Segmentation Analysis:

By Product

Consumables and reagents dominate the Non-Invasive Prenatal Testing (NIPT) market, accounting for an estimated 65–70% share, driven by their recurring use in sample preparation, DNA extraction, and library construction workflows. Demand accelerates as laboratories adopt high-throughput NIPT platforms requiring consistent reagent replenishment to maintain testing accuracy. Instruments hold a smaller share due to one-time capital purchases, but growth continues as hospitals upgrade to automated systems that enhance throughput and reduce hands-on time. The consumables segment remains dominant due to rising test volumes, expanding prenatal screening programs, and technological refinements that improve assay sensitivity.

- For instance, MedGenome Labs has processed over 60,000 NIPT samples since 2017, validating its proprietary Claria NIPT (based on Illumina’s VeriSeq) with 100 % concordance in sex-chromosome aneuploidy detection across 51 high-risk cases.

By Technology

Next-Generation Sequencing (NGS) leads the technology landscape with an approximate 55–60% market share, supported by its high analytical sensitivity for detecting chromosomal aneuploidies and microdeletions with low false-positive rates. Growing adoption of whole-genome and targeted sequencing workflows reinforces this dominance as laboratories prioritize depth, precision, and scalability. PCR and microarray technologies remain relevant for specific targeted applications but hold smaller shares due to limited multiplexing capabilities. Rolling circle amplification is niche, used mainly in cost-sensitive settings. Overall, NGS remains the primary growth driver due to falling sequencing costs and expanding clinical validation.

- For instance, Qiagen launched its QIAseq Targeted DNA Pro Panels that cut library-preparation time to 6 hours and integrate unique molecular indices for ultra-sensitive variant detection, validated across more than 4 million NGS samples.

By End-User

Clinical laboratories command the largest share of the NIPT market, contributing roughly 60–65%, fueled by their specialized testing expertise, advanced instrumentation, and ability to process high sample volumes with lower per-test costs. Centralized labs also benefit from strong partnerships with obstetric clinics, enabling faster turnaround times and broader geographic coverage. Hospitals hold a smaller but steadily growing share as they integrate in-house NIPT capabilities to improve care coordination and retain revenue streams. The clinical laboratory segment remains dominant due to economies of scale, high-throughput workflows, and expanding accreditation for NIPT services.

Key Growth Drivers

- Rising Maternal Age & Increasing Pregnancy Risks

The global rise in maternal age significantly drives demand for Non-Invasive Prenatal Testing (NIPT), as pregnancies in women over 35 carry a higher risk of chromosomal abnormalities such as trisomy 21 and 18. This demographic shift increases the need for accurate, early-stage screening options that avoid the procedure-related risks of invasive methods. As healthcare systems strengthen prenatal care programs, the adoption of NIPT accelerates, supported by its strong clinical reliability, reduced anxiety for expectant mothers, and expanding physician awareness of its diagnostic advantages.

- For instance, Myriad Women’s Health (Counsyl) recently demonstrated that its Prequel Prenatal Screen with AMPLIFY returns reliable fetal-fraction levels as early as 8 weeks’ gestation, matching the quality of standard screening at 10 weeks.

- Advancements in Genomic Technologies

Continuous improvements in genomic sequencing technologies—particularly next-generation sequencing (NGS)—serve as a key driver of market expansion. Enhanced sequencing accuracy, reduced costs, and higher throughput allow laboratories to process larger sample volumes with improved detection sensitivity. These advancements enable broader screening panels covering microdeletions and rare aneuploidies, supporting clinical confidence and expanding applications beyond traditional high-risk pregnancies. As genomic platforms become more automated and cost-effective, NIPT becomes increasingly accessible to diverse healthcare settings, accelerating market penetration globally.

- For instance, MedGenome Labs has processed over 60,000 NIPT samples since 2017, validating its proprietary Claria NIPT (based on Illumina’s VeriSeq) with 100% concordance in sex-chromosome aneuploidy detection across 51 high-risk cases.

- Growing Integration of NIPT into National Prenatal Programs

Governments and healthcare authorities are increasingly incorporating NIPT into routine prenatal screening guidelines, boosting adoption rates. Public reimbursement initiatives in several countries reduce patient out-of-pocket costs, enabling wider access across socioeconomic groups. The integration into standardized prenatal pathways strengthens clinical acceptance and encourages early testing. Growing support from professional societies and evidence-based validation studies further reinforce NIPT’s role as a frontline screening method. This policy-driven expansion significantly widens the eligible testing population, establishing NIPT as a foundational component of modern prenatal care.

Key Trends & Opportunities

- Expansion of Genome-Wide and Microdeletion Screening Panels

A major trend shaping the market is the shift toward expanded NIPT panels that analyze genome-wide chromosomal variations and microdeletions. These advanced tests offer deeper clinical insights, enabling early detection of a broader range of genetic disorders. As sequencing technologies improve, laboratories can deliver more comprehensive reports without significantly increasing costs. This creates a substantial opportunity for companies to differentiate their offerings with high-value, clinically actionable data. The expansion of panel depth also supports personalized prenatal care, providing clinicians with richer diagnostic information for patient counseling.

- For instance, Laboratory Corporation of America (LabCorp) offers its MaterniT GENOME test, which analyzes all 23 chromosome pairs and reports gains or losses of chromosome material ≥ 7 Mb as well as seven clinically significant microdeletion regions.

- Growing Adoption of NIPT in Low- and Middle-Income Countries

The market is witnessing rising adoption in emerging economies due to expanding private healthcare infrastructure, improving awareness, and declining costs of sequencing technologies. International collaborations and mobile diagnostic services improve test accessibility in underserved regions. This creates large untapped opportunities, especially where conventional prenatal screening capabilities are limited. As regulatory frameworks evolve and pricing strategies adapt to regional affordability, NIPT adoption in these markets is expected to accelerate, making them critical growth engines for global players seeking geographic expansion.

- For instance, Illumina (Verinata) launched its CE-IVD VeriSeq™ NIPT Solution v2 in Thailand through a partnership with NGG Thailand, validating over 2,300 plasma samples for whole-genome screening; the test achieved 98.8% pass rate on the first assay run.

- Integration of AI and Digital Platforms for Data Interpretation

Artificial intelligence and advanced bioinformatics tools are increasingly used to enhance NIPT data interpretation accuracy and reduce turnaround times. Digital platforms streamline workflow automation, improve quality control, and support remote reporting, making testing more efficient for high-throughput labs. AI-enabled analytics also facilitate personalized risk assessment, broadening clinical utility. This trend provides opportunities for companies to develop proprietary algorithms and value-added services that strengthen competitive differentiation. As digital integration deepens, it paves the way for scalable, cloud-based NIPT ecosystems supporting global clinical networks.

Key Challenges

- High Cost of Testing and Limited Reimbursement Coverage

Despite technological progress, NIPT remains relatively expensive, limiting adoption in regions with constrained healthcare budgets. Inconsistent reimbursement policies across countries further restrict accessibility, particularly for average-risk pregnancies. These financial barriers hinder widespread integration of NIPT into routine prenatal screening workflows. Pricing pressure also challenges laboratories in maintaining profitability while offering competitive test panels. Addressing this challenge requires collaborative approaches involving policymakers, insurers, and diagnostic companies to develop sustainable pricing and reimbursement models that support broader patient access.

- Ethical, Legal, and Data Privacy Concerns

Ethical debates surrounding expanded fetal genetic screening—particularly genome-wide analyses—pose a significant challenge to market growth. Concerns about potential misuse of genetic information, psychological impacts on parents, and societal implications of broad prenatal testing create regulatory scrutiny. Data privacy issues related to sequencing and cloud-based storage further complicate adoption, especially in regions with strict data protection laws. Ensuring transparent consent processes, secure data handling, and responsible clinical communication is essential for maintaining public trust and regulatory compliance while supporting the ethical expansion of NIPT applications.

Regional Analysis

North America

North America holds the largest share of the Non-Invasive Prenatal Testing (NIPT) market, accounting for approximately 40–42%, supported by advanced genomic infrastructure, high diagnostic awareness, and widespread availability of NGS-based screening. Strong reimbursement frameworks in the U.S. further accelerate adoption, particularly among average-risk pregnancies. The region benefits from the presence of major market players, extensive clinical validation studies, and a high proportion of pregnancies in women over 35. Continued expansion of prenatal care programs and the integration of genome-wide NIPT panels reinforce North America’s leadership in test volumes and technological innovations.

Europe

Europe represents around 28–30% of the global NIPT market, driven by growing acceptance of prenatal genetic screening and supportive national healthcare policies. Countries such as the U.K., Germany, and the Netherlands have integrated NIPT into public prenatal screening frameworks, enabling broader accessibility. Rising maternal age and strong clinical emphasis on early detection of chromosomal abnormalities fuel demand across the region. Advancements in laboratory automation and expansion of accredited testing centers enhance test reliability. Despite regulatory variations across countries, Europe continues to experience steady growth supported by robust healthcare infrastructure and increased patient awareness.

Asia-Pacific

Asia-Pacific accounts for roughly 20–22% of the NIPT market and represents the fastest-growing region due to expanding healthcare coverage, declining sequencing costs, and rising rates of high-risk pregnancies. China leads regional adoption, followed by Japan, South Korea, and India, where private diagnostic networks continue to scale high-throughput NIPT services. Increasing urbanization and growing awareness of prenatal screening options drive testing volumes, especially in densely populated markets. Government efforts to strengthen maternal health programs and rapid laboratory modernization further accelerate uptake. Asia-Pacific is expected to significantly expand its global share over the next decade.

Latin America

Latin America captures an estimated 5–6% share of the global NIPT market, with growth fueled by rising private healthcare spending and increasing adoption of advanced prenatal diagnostics in Brazil, Mexico, and Argentina. Awareness of chromosomal screening benefits is improving, particularly among urban populations seeking safer alternatives to invasive procedures. Limited reimbursement and uneven access to genomic technologies remain barriers, but expanding partnerships between international diagnostic companies and regional laboratories support market penetration. Gradual improvements in lab infrastructure and maternal health programs are expected to strengthen demand in the coming years.

Middle East & Africa

The Middle East & Africa region holds a developing share of approximately 3–4% of the NIPT market, driven by rising prevalence of genetic disorders, increasing maternal age, and growing investments in women’s healthcare. Wealthier Gulf countries, including the UAE and Saudi Arabia, lead adoption through advanced clinical facilities and growing use of NGS-based technologies. However, limited laboratory capabilities and affordability constraints slow broader penetration across Africa. International collaborations and increased availability of outsourced testing services help expand access. As awareness of non-invasive screening improves, the region is expected to experience gradual, steady growth.

Market Segmentations:

By Product:

By Technology:

- Next Generation Sequencing (NGS)

- Polymerase Chain Reaction (PCR)

By End User:

- Hospitals

- Clinical Laboratories

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Non-Invasive Prenatal Testing (NIPT) market features a strong mix of global genomics leaders and specialized diagnostic innovators, including MedGenome Labs Ltd., Qiagen, Myriad Women’s Health, Inc. (Counsyl, Inc.), Eurofins LifeCodexx GmbH, Laboratory Corp. of America Holdings, Illumina, Inc. (Verinata Health, Inc.), Genesis Genetics (CooperSurgical, Inc.), F. Hoffmann-La Roche Ltd. (Ariosa Diagnostics), Centogene N.V., and Natera, Inc. The Non-Invasive Prenatal Testing (NIPT) market is defined by rapid technological advancements, expanding test menus, and increasing investments in bioinformatics capabilities. Companies compete primarily on sequencing accuracy, panel breadth, turnaround time, and cost efficiency, driving continuous innovation in genome-wide and microdeletion screening. Strategic collaborations with hospitals, clinical laboratories, and national prenatal screening programs play a central role in strengthening market presence and improving test accessibility. Market participants also focus on automation, AI-enabled data interpretation, and workflow integration to enhance scalability and reduce operational burdens. Additionally, regulatory approvals and regional reimbursement expansions continue to shape competitive positioning, enabling firms to differentiate their offerings and accelerate global adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- MedGenome Labs Ltd.

- Qiagen

- Myriad Women’s Health, Inc. (Counsyl, Inc.)

- Eurofins LifeCodexx GmbH

- Laboratory Corp. of America Holdings

- Illumina, Inc. (Verinata Health, Inc.)

- Genesis Genetics (CooperSurgical, Inc.)

- Hoffmann-La Roche Ltd. (Ariosa Diagnostics)

- Centogene N.V.

- Natera, Inc.

Recent Developments

- In October 2025, Accenture launched its Physical AI Orchestrator, a cloud-based solution that allows manufacturers to manage software-defined facilities using digital twins and AI agents.

- In May 2025, Roche announced collaboration with Broad Clinical Labs to accelerate adoption of SBX sequencing technology for critically ill newborns, focusing on whole-genome sequencing integration into routine clinical practice.

- In August 2023, Tricentis patented the faster optical character recognition technology to automate AI testing. The single-pass OCR methodology and system were developed as the technology for Vision AI, the AI-based test automation capability of Tricentis Tosca, the company’s intelligent test automation product.

Report Coverage

The research report offers an in-depth analysis based on Product, Technology, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding as NIPT becomes a routine component of early prenatal screening across both high-risk and average-risk pregnancies.

- Advancements in sequencing technologies will enhance test accuracy and enable broader detection of genetic abnormalities.

- Adoption will rise in emerging markets as healthcare infrastructure strengthens and awareness of prenatal screening improves.

- Integration of AI and advanced bioinformatics will streamline data interpretation and reduce turnaround times.

- Expanded genome-wide panels will gain traction as clinicians seek more comprehensive fetal genetic insights.

- Growing reimbursement support across regions will improve accessibility and increase testing volumes.

- Partnerships between diagnostic companies and clinical laboratories will accelerate geographic expansion and service scalability.

- Portable and decentralized testing solutions will emerge, supporting broader use in low-resource settings.

- Ethical guidelines and regulatory frameworks will continue evolving to ensure responsible use of advanced prenatal screening.

- Increased competition will drive innovation in automation, cost efficiency, and patient-centric reporting tools.