Market Overview

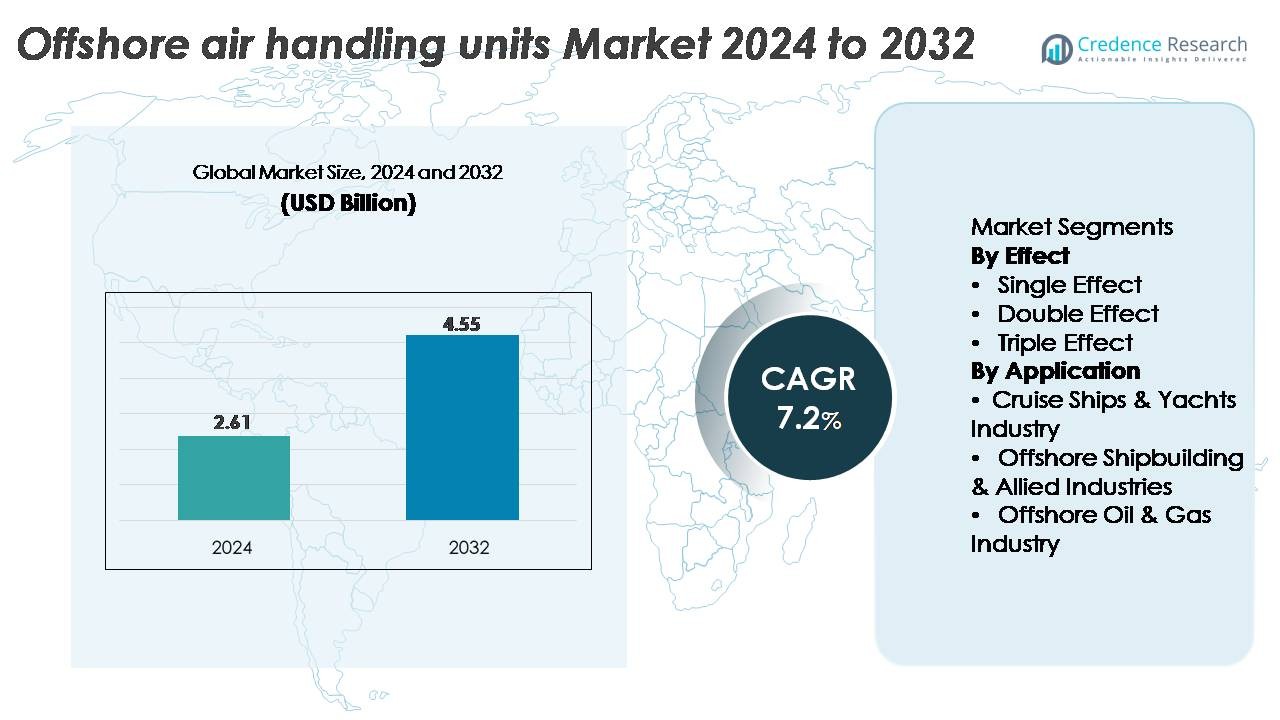

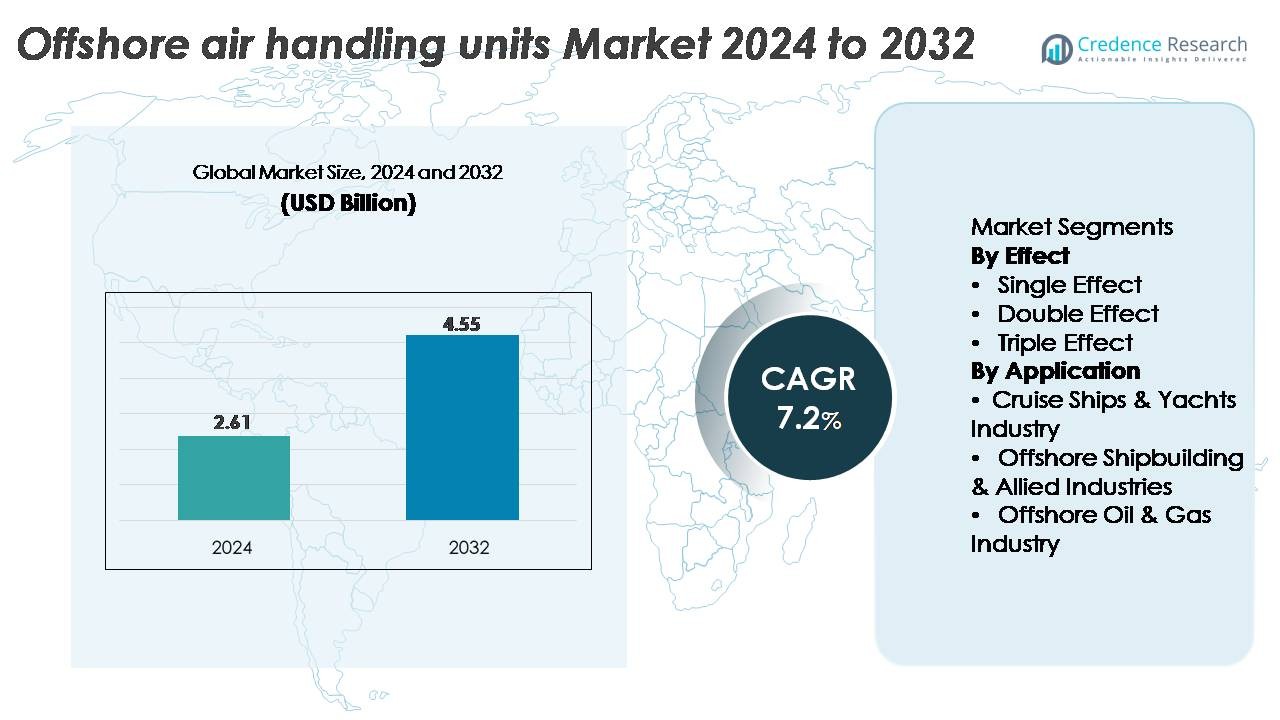

The global offshore air handling units (AHU) market was valued at USD 2.61 billion in 2024 and is projected to reach USD 4.55 billion by 2032, reflecting a CAGR of 7.2% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Offshore Air Handling Units (AHU) Market Size 2024 |

USD 2.61 Billion |

| Offshore Air Handling Units (AHU) Market, CAGR |

7.2% |

| Offshore Air Handling Units (AHU) Market Size 2032 |

USD 4.55 Billion |

The offshore air handling units market is shaped by strong competition among established HVAC and marine-environment engineering leaders such as Carrier Corporation, Thermax Inc., Hitachi Appliances Inc., Yazaki Energy Systems Inc., Trane Inc., EAW Energieanlagenbau GmbH, Robur Corporation, Johnson Controls, Century Corporation, and Broad Air Conditioning Co. Ltd. These companies focus on corrosion-resistant designs, ATEX/IECEx-certified components, and advanced energy-efficient systems tailored for offshore rigs, FPSOs, and marine vessels. Asia–Pacific leads the global market with approximately 29% share, driven by large-scale shipbuilding capacity, strong offshore exploration activity, and rapid offshore wind expansion, positioning it as the primary hub for both demand and manufacturing strength in offshore AHUs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The offshore air handling units market reached USD 2.61 billion in 2024 and is projected to hit USD 4.55 billion by 2032, registering a 7.2% CAGR over the forecast period.

- Market growth is driven by rising offshore oil and gas expansion, increasing HVAC modernization on rigs and vessels, and stricter safety standards requiring corrosion-resistant, explosion-proof AHUs for continuous marine operations.

- Key trends include adoption of energy-efficient EC-motor systems, sensor-integrated AHUs for predictive maintenance, and modular marine-grade designs tailored for FPSOs, offshore substations, and specialized vessels.

- Competition remains strong among Carrier Corporation, Trane Inc., Johnson Controls, Hitachi Appliances Inc., Thermax Inc., Yazaki Energy Systems Inc., and others focusing on compliance-driven engineering and long-life offshore ventilation solutions.

- Asia–Pacific leads with 29% regional share, followed by North America at 32% and Europe at 27%, while the Single Effect segment dominates the product landscape with the largest adoption due to simpler operation and lower lifecycle costs.

Market Segmentation Analysis:

By Effect

Single-effect offshore air handling units represent the dominant segment with the largest market share, driven by their lower energy consumption, simpler operational design, and strong suitability for compact machinery spaces on offshore vessels and platforms. Their reliability in harsh marine environments and reduced maintenance requirements make them preferred for most standard HVAC loads aboard rigs and ships. Double-effect systems gain traction where enhanced thermal performance is required, while triple-effect units remain niche, primarily used in high-capacity offshore processing modules demanding superior heat recovery efficiency.

· For instance, Johnson Controls’ YORK® Solution AHUs offer airflow capacities ranging from about 1,700 to 170,000 cubic meters per hour, depending on module size, and use direct-drive EC fan arrays designed for marine-duty performance. These units also feature corrosion-resistant housings and offshore-rated components suitable for oil platforms and FPSOs.

By Application

The offshore oil and gas industry holds the highest market share, supported by continuous demand for robust AHUs capable of handling corrosive atmospheres, explosive-zone compliance, and round-the-clock ventilation requirements on fixed and floating installations. High air-quality standards for drilling decks, accommodation modules, and compressor areas accelerate adoption of advanced, marine-grade systems. Cruise ships and luxury yachts contribute steady growth through premium HVAC requirements, while offshore shipbuilding and allied sectors drive demand for customizable AHUs integrated into newbuild platforms and vessel retrofits, supporting long-term fleet modernization.

- For instance, FläktGroup engineers marine-duty AHUs that can be equipped with ATEX-certified Zone 1 or Zone 2 motors, controls, and electrical parts for hazardous offshore spaces. These offshore units support drilling platforms and FPSOs that require explosion-protected ventilation systems and corrosion-resistant construction for safe operation.

Key Growth Drivers:

Rising Offshore Infrastructure Expansion and HVAC Modernization

Rapid growth in offshore oil and gas exploration, FPSO deployments, and offshore wind installations continues to strengthen demand for marine-grade air handling units. As operators modernize ventilation infrastructure to comply with stringent air-quality, safety, and energy-efficiency mandates, AHUs with corrosion-resistant housings, explosion-proof components, and enhanced filtration become essential. The expansion of offshore accommodation modules, compressor platforms, and subsea support vessels further drives HVAC upgrades to maintain stable temperature, humidity, and pressurization. Additionally, retrofitting activities accelerate as aging offshore assets require upgraded AHUs capable of delivering reliable airflow and reduced energy losses. This infrastructure expansion, combined with higher operational standards, remains a foundational driver for market growth.

· For instance, Johnson Controls offers marine-duty AHUs built with corrosion-resistant 316L stainless-steel frames and high-efficiency EC fan motors with power ratings that can reach 15 kW in large units. These offshore AHUs are engineered for long-term performance in salt-spray and high-humidity environments common on oil platforms and FPSOs.

Increasing Focus on Occupational Safety and Regulatory Compliance

Offshore installations operate in environments with hazardous gases, high salinity, and mechanical vibrations, making advanced AHUs critical for worker safety and equipment protection. Compliance with IMO, ABS, and DNV ventilation standards pushes operators to deploy high-performance units with tightly controlled air handling, HEPA/activated carbon filtration, and ATEX-certified components. Improved indoor air quality reduces the likelihood of respiratory issues, contamination, and equipment overheating, contributing to stable operational efficiency. The enforcement of stricter safety regulations across drilling rigs, floating platforms, and offshore support vessels is driving a shift toward highly engineered AHUs that guarantee continuous airflow and contamination control, making regulatory alignment a major growth catalyst.

Technological Advancements and Shift Toward Energy-Efficient AHUs

Emerging HVAC technologies such as EC motors, variable air volume systems, integrated heat recovery wheels, and predictive monitoring sensors are reshaping AHU performance in offshore environments. Energy-efficient configurations reduce fuel consumption on diesel-powered rigs and ships, directly supporting operators’ decarbonization goals. Smart control systems enable real-time optimization of airflow, humidity, and filtration performance, reducing maintenance cycles and improving system reliability. Anti-corrosive composites, marine-grade coatings, and modular AHU architectures also enhance durability and ease of transportation in offshore conditions. As offshore operators prioritize lifecycle cost reduction, energy-efficient and digitally optimized AHUs gain significant adoption momentum.

- For instance, Novenco’s ZerAx® EC fan technology delivers efficiencies up to 92% with noise levels as low as 63 dB(A), and the system is deployed in offshore HVAC units designed for continuous operation on oil platforms and FPSOs.

Key Trends and Opportunities:

Growing Adoption of Smart, Sensor-Integrated, and Predictive AHU Systems

A major trend shaping the market is the transition toward digitally intelligent AHUs equipped with IoT sensors, condition monitoring systems, and cloud-based performance dashboards. These systems provide real-time insights on airflow rates, pressure drops, filter health, and vibration patterns, enabling predictive maintenance that minimizes downtime on offshore rigs. Smart AHUs also support remote diagnostics an advantage for installations located far from onshore service hubs. The integration of automated control systems further optimizes airflow distribution and energy usage under variable offshore weather conditions. As operators emphasize operational continuity and reduced service costs, sensor-based AHUs create strong opportunities for technological differentiation and premium product offerings.

· For instance, Heinen & Hopman integrates continuous condition-monitoring systems into its offshore AHUs that track vibration levels, motor temperature, and filter status in real time, with data streamed to the VIMEX Monitoring platform for remote diagnostics on rigs and FPSOs.

Rising Opportunity in Offshore Wind and Next-Generation Vessels

The global expansion of offshore wind farms, installation vessels, and service operation vessels (SOVs) is creating new opportunities for HVAC suppliers. Unlike oil and gas installations, renewable offshore assets require high-performance AHUs with strict humidity control, vibration resistance, and compact footprints for turbine nacelles, electrical substations, and crew vessels. The rapid increase in offshore wind capacity additions encourages demand for custom-engineered AHUs that can operate reliably in cold, high-moisture marine environments. Additionally, next-generation support vessels built with hybrid propulsion and advanced energy-saving layouts require equally efficient AHUs, opening doors for lightweight, modular, and energy-optimized HVAC solutions.

· For instance, Carrier Marine & Offshore equips its offshore HVAC systems with the SmartVu™ control platform, which logs airflow, pressure, and coil temperature data in real time and supports remote diagnostics over BACnet/IP, enabling predictive maintenance on offshore rigs and FPSOs.

Growing Demand for Corrosion-Resistant and Modular AHU Designs

The market is witnessing a shift toward materials and designs engineered specifically for extreme marine climates. AHUs with stainless steel 316L housings, marine-grade epoxy coatings, and composite components offer enhanced life expectancy under salt-laden offshore conditions. Modular AHU configurations, allowing easier installation in confined platform spaces, are increasingly preferred for both newbuild and retrofit projects. This trend opens opportunities for OEMs offering customizable configurations, fast-assembly modules, and compact units tailored for FPSOs, jack-ups, and SOVs. As asset operators focus on reduced downtime and easier serviceability, modular and corrosion-resistant AHUs gain a competitive edge.

Key Challenges:

Harsh Offshore Environment Increasing Wear, Maintenance, and Lifecycle Costs

Operating in offshore environments exposes AHUs to saltwater spray, humidity fluctuations, corrosive gases, and continuous vibration, which significantly accelerates component degradation. These conditions often lead to frequent maintenance cycles, unplanned shutdowns, and higher lifecycle expenses. Installation and servicing are also challenging due to limited access, requiring specialized technicians and high-cost logistics such as helicopter transport or vessel deployment. Ensuring continuous ventilation and contamination control becomes difficult as filters clog faster in offshore settings. Overcoming durability and maintenance challenges requires advanced materials, robust engineering, and consistent upkeep, making operational costs a persistent concern for operators.

High Capital Costs and Complexity of Custom Engineering

Offshore AHUs must meet stringent safety, certification, and performance standards, resulting in higher initial costs compared to onshore units. Custom engineering such as explosion-proof motors, marine-grade casings, ATEX/IECEx compliance, and high-efficiency filtration adds to production complexity and procurement expense. Smaller operators often face budget constraints when adopting advanced systems with integrated sensors and automated controls. Manufacturing lead times are also longer due to the need for specialized components and testing. These cost and customization challenges inhibit rapid adoption, particularly in markets with price-sensitive project developers or fluctuating offshore investment cycles.

Regional Analysis

North America

North America holds around 32% of the offshore air handling units market, driven by its extensive offshore oil and gas infrastructure in the Gulf of Mexico and continuous investments in FPSO conversions and platform modernization. Stringent HVAC performance standards set by ABS and OSHA reinforce demand for durable, explosion-proof AHUs designed for corrosive marine environments. Rising refurbishment activity on aging offshore assets further accelerates AHU replacement cycles. The growth of offshore wind projects along the East Coast also supports incremental demand for compact, energy-efficient AHUs used in substations and SOVs.

Europe

Europe accounts for roughly 27% of the market, supported by advanced offshore engineering capabilities in the North Sea, Norway, and the UK. Strong regulations related to air quality, safety compliance, and carbon reduction encourage adoption of energy-efficient and EC-motor-driven AHUs. Europe’s accelerating offshore wind expansion, particularly in Germany, Denmark, and the Netherlands, drives recurring demand for HVAC solutions for turbine nacelles, converter stations, and service operation vessels. Additionally, the region’s robust shipbuilding and retrofit ecosystem contributes to steady AHU installations in offshore support vessels, Arctic-class ships, and specialized marine constructions.

Asia–Pacific

Asia–Pacific holds an estimated 29% share, emerging as one of the fastest-growing regions due to rising offshore exploration in Malaysia, Indonesia, India, and China. Expanding shipbuilding clusters in South Korea, China, and Singapore strengthen demand for modular, corrosion-resistant AHUs for rigs, FPSOs, and offshore construction vessels. Government-backed investments in deepwater projects and new offshore wind developments in Taiwan, Japan, and South Korea further boost demand for high-capacity units. The region’s competitive manufacturing ecosystem also supports cost-effective AHU production, making APAC a preferred sourcing hub for global offshore HVAC procurement.

Middle East & Africa

The Middle East & Africa captures about 8% of the global market, primarily driven by offshore oil and gas activity in Saudi Arabia, the UAE, and West Africa. Offshore platforms in the Persian Gulf require AHUs engineered for extreme temperature variations, high salinity, and continuous high-load ventilation. Large-scale offshore expansion projects and national energy investments continue to support sustained procurement of marine-grade HVAC systems. In Africa, offshore developments in Nigeria and Angola contribute to moderate but stable AHU adoption, particularly for FPSO modules, accommodation blocks, and drilling support vessels.

Latin America

Latin America represents approximately 4% of the market, supported mainly by Brazil’s deepwater and ultra-deepwater activities in the pre-salt basin. Expansion of FPSO fleets and continuous offshore field development by major operators sustains demand for robust AHUs with high filtration efficiency and corrosion-resistant designs. Mexico’s offshore exploration activities contribute additional demand for specialized ventilation units across platforms and supply vessels. Although investment cycles in the region fluctuate, ongoing offshore asset development and retrofit programs maintain a consistent requirement for reliable, marine-certified AHUs across key offshore fields.

Market Segmentations:

By Effect

- Single Effect

- Double Effect

- Triple Effect

By Application

- Cruise Ships & Yachts Industry

- Offshore Shipbuilding & Allied Industries

- Offshore Oil & Gas Industry

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The competitive landscape of the offshore air handling units market is characterized by a mix of global HVAC manufacturers, marine engineering specialists, and OEMs focused on offshore-certified ventilation systems. Leading companies prioritize corrosion-resistant materials, ATEX/IECEx compliance, heat recovery integration, and digitally controlled airflow technologies to strengthen differentiation. Competitors increasingly invest in modular AHU architectures that support easier installation within confined offshore spaces and accommodate both newbuild and retrofit requirements. Strategic partnerships with shipyards, EPC contractors, and offshore operators enhance project visibility and strengthen long-term service contracts. Additionally, manufacturers are expanding their portfolios with sensor-enabled, predictive maintenance–ready AHUs to reduce lifecycle costs for offshore clients. As offshore oil and gas, wind energy, and marine transport sectors grow, competition intensifies around customized engineering, energy-efficient performance, and adherence to global marine standards, driving continuous innovation across the industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Carrier Corporation

- Johnson Controls

- Trane, Inc.

- Hitachi Appliances, Inc. (moderate relevance)

- Heinen & Hopman

- Novenco Marine & Offshore

- FläktGroup (Fläkt Woods)

Recent Developments

- In September 2025,Trane, Inc.The company underscored its commitment to thermal management and building electrification via a major retrofit project at a large office building in New York City, showcasing its ability to operate HVAC systems under retrofit conditions a capability potentially translatable to offshore/refit contexts.

- In March 2025, Trane advanced its modular, self-contained HVAC units as part of its expanded thermal-management system offerings, targeting high-performance cooling and ventilation applications.

- In January 2024, Carrier Corporation expanded its “Made-in-India” HVAC product portfolio to include air handling units (AHUs) and fan coil units (FCUs,” reinforcing its manufacturing footprint and enhancing availability of AHUs for global projects.

Report Coverage

The research report offers an in-depth analysis based on Effect, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for offshore air handling units will rise as operators expand deepwater projects and upgrade HVAC systems on aging platforms and vessels.

- Energy-efficient AHUs with EC motors and heat-recovery features will gain wider adoption to support decarbonization targets.

- Digitalized AHUs with IoT sensors and predictive maintenance capabilities will become standard across new offshore installations.

- Corrosion-resistant materials and marine-grade coatings will see greater use to extend equipment lifespan in harsh offshore environments.

- Modular and compact AHU designs will grow in popularity to simplify installation in confined marine spaces.

- Offshore wind expansion will create new demand for specialized AHUs for substations, turbine nacelles, and SOV fleets.

- Hybrid propulsion vessels and next-generation support ships will drive uptake of high-efficiency, space-optimized AHUs.

- Certification-compliant AHUs meeting ATEX, IECEx, and marine standards will remain a priority across operators.

- Retrofit projects will accelerate as offshore operators modernize older HVAC infrastructure.

- Collaboration between AHU manufacturers, shipyards, and EPC contractors will intensify to deliver tailored offshore ventilation solutions.