Market Overview

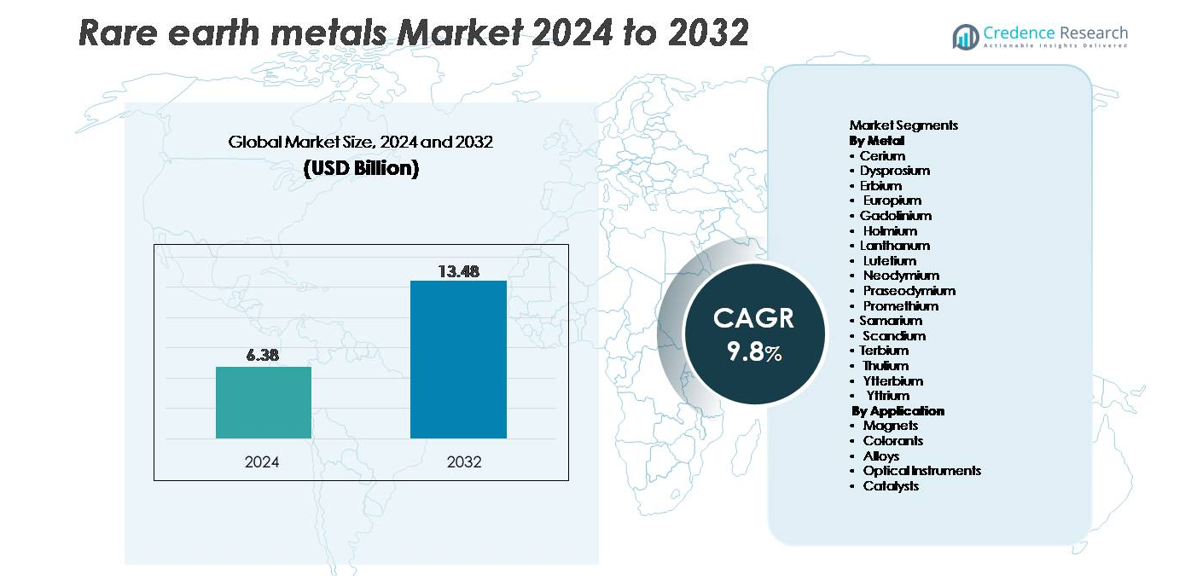

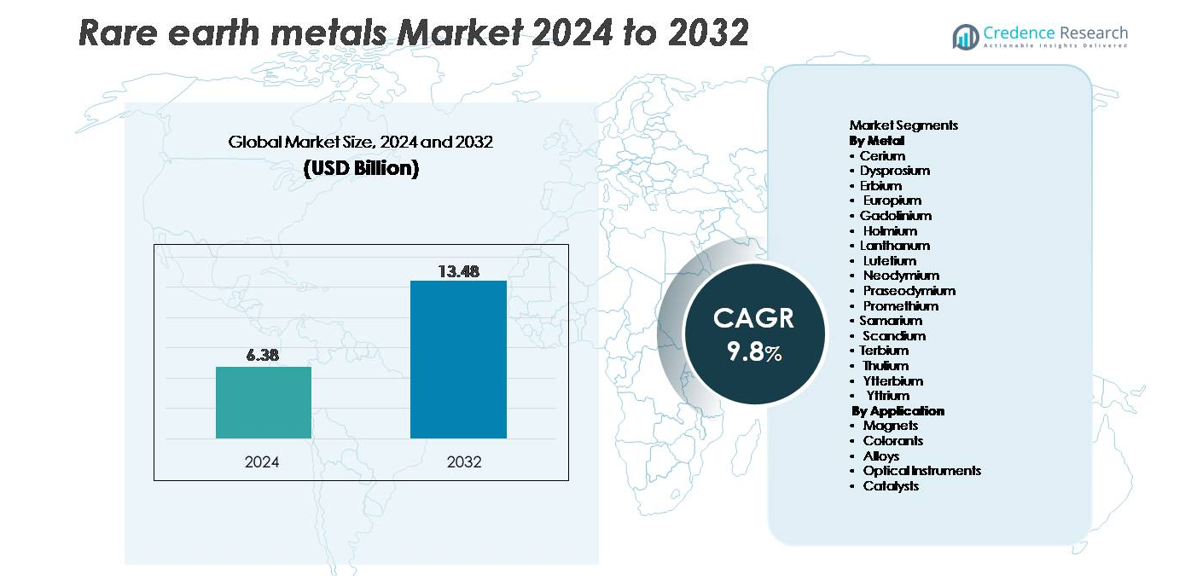

The global rare earth metals market was valued at USD 6.38 billion in 2024 and is projected to reach USD 13.48 billion by 2032, expanding at a CAGR of 9.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rare Earth Metals Market Size 2024 |

USD 6.38 billion |

| Rare Earth Metals Market, CAGR |

9.8% |

| Rare Earth Metals Market Size 2032 |

USD 13.48 billion |

The rare earth metals market is shaped by a mix of globally integrated producers and emerging mining specialists. Leading players such as Lynas Corporation Ltd., China Minmetals Rare Earth Co., Baotou Jinmeng Rare Earth Co., Iluka Resources Limited, Arafura Resources Ltd., Northern Minerals Limited, Alkane Resources Ltd., Greenland Minerals and Energy Ltd., Indian Rare Earths Limited, and Canada Rare Earth Corporation drive industry development through expanded mining capacity, refining technology, and magnet-materials processing. Asia-Pacific dominates the market with over 70% share, owing to China’s extensive refining infrastructure and downstream magnet manufacturing base. North America and Europe accelerate strategic projects to reduce import dependence, while Australia strengthens its position as a key non-China supplier.

Market Insights

- The global rare earth metals market was valued at USD 6.38 billion in 2024 and is projected to reach USD 13.48 billion by 2032, registering a CAGR of 9.8% during the forecast period.

- Demand continues to rise due to strong consumption in NdFeB magnets, which hold the largest segment share, driven by EV motors, wind turbines, and industrial automation. Expanding use in catalysts, aerospace alloys, and photonic materials further strengthens overall market growth.

- Key trends include rapid adoption of recycling and urban mining, advanced separation technologies, and rising investments in non-China refining hubs to improve supply-chain resilience.

- Competition intensifies as players such as Lynas, China Minmetals, Baotou Jinmeng, Iluka, Arafura, and Northern Minerals expand mining capacity and downstream processing; however, environmental regulations, high capital costs, and supply concentration remain major restraints.

- Asia-Pacific accounts for over 70% of global share, followed by North America at 14% and Europe at 12%, reflecting strong downstream magnet manufacturing and growing regional diversification efforts.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Metal

Neodymium remains the dominant metal segment, capturing the largest share due to its critical role in manufacturing high-performance NdFeB permanent magnets used in EV traction motors, industrial automation systems, and direct-drive wind turbines. The rising deployment of electric powertrains and high-efficiency generators strengthens demand for neodymium and its co-dependencies with praseodymium and dysprosium, which enhance thermal stability. Lanthanum and cerium maintain steady consumption in catalysts and polishing powders, while scandium gains traction in aerospace-grade alloys. Heavy rare earths such as terbium and ytterbium expand gradually, driven by advanced imaging, photonics, and magnetic-cooling research.

- For instance, Hitachi Metals’ NdFeB magnet lines utilize neodymium-blended alloys achieving coercivity levels above 1,200 kA/m, while Airbus has tested scandium-aluminum alloys containing up to 0.4% scandium to improve tensile strength by more than 50% in aerospace components.

By Application

Magnets represent the leading application segment, accounting for the highest market share as NdFeB and SmCo magnets remain indispensable for EV motors, robotics, wind turbine generators, and high-density electronics. Their superior magnetic strength, lightweight structure, and high coercivity drive consistent adoption in next-generation mobility and renewable energy systems. Catalysts follow as a major segment, supported by lanthanum- and cerium-based formulations used in petroleum refining and emissions control. Alloys show rising demand from aerospace and additive manufacturing, while optical instruments and colorants maintain niche but growing usage across lasers, phosphors, and display technologies.

- For instance, Tesla’s permanent-magnet motors rely on NdFeB magnets delivering energy products above 52 MGOe, while GE Vernova’s 12-MW Haliade-X offshore turbine uses magnet assemblies containing more than 600 kg of rare-earth magnet materials per nacelle.

KEY GROWTH DRIVERS:

Expanding Demand from Electric Vehicles and High-Performance Magnets

The accelerating adoption of electric vehicles (EVs), hybrid powertrains, and high-efficiency industrial motors remains the strongest growth driver for the rare earth metals market. Neodymium, praseodymium, dysprosium, and terbium are essential for producing NdFeB permanent magnets, which deliver superior magnetic strength and durability required for traction motors, robotics, and automation systems. As global EV sales surpass tens of millions of units annually, OEMs increase long-term procurement of magnet-grade rare earths to stabilize supply. Wind energy installations further amplify demand, particularly direct-drive turbines that heavily rely on neodymium-enriched magnets for improved torque density and reduced maintenance. Consumer electronics, including smartphones, wearables, and data-center cooling technologies, also require high-precision magnets, driving continuous consumption across multiple sectors. Government mandates supporting electrification, renewable energy expansion, and energy-efficient systems reinforce structural demand growth. Together, these trends solidify high-performance magnet materials as the primary catalyst for long-term rare earth metal consumption.

- For instance, Toyota’s latest e-Axle motors use advanced neodymium-reducedNdFeB magnets that achieve typical energy products in the 30-40 MGOe range for commercial automotive use, while Vestas’ 15-MW offshore turbine platforms incorporate hundreds of kilograms (potentially over 800 kg in some designs) of rare-earth magnet material per unit to sustain high-torque, low-maintenance operation.”

Rising Use of Rare Earths in Catalysts, Alloys, and Advanced Material Systems

Rare earth metals experience significant demand growth in refining catalysts, aerospace alloys, optical systems, and defense technologies, forming a diversified driver base beyond magnets. Cerium and lanthanum remain indispensable for fluid catalytic cracking (FCC) in petroleum refining, supporting cleaner fuel production and emissions control regulations worldwide. Meanwhile, scandium-aluminum alloys enable exceptional strength-to-weight performance for aerospace structures, additive manufacturing, and next-generation mobility platforms. Europium, terbium, and yttrium maintain relevance in phosphors for high-efficiency displays, lasers, and sensor systems used in medical imaging, defense optics, and industrial metrology. As materials science advances, emerging applications such as magnetic refrigeration, solid-state batteries, and quantum communication technologies further expand the addressable market for select rare earth elements. These factors collectively strengthen demand for diversified rare earth-based materials aligned with high-precision, lightweight, and energy-efficient engineering requirements across multiple industries.

- For instance, Rio Tinto’s scandium-aluminum alloy pilot line produces alloy billets containing 0.4–0.6% scandium, increasing yield strength by over 150 MPa, while UOP’s FCC catalyst formulations incorporate cerium oxide levels up to 3 wt% to enhance catalytic activity.

Strategic Government Policies Supporting Supply Chain Security and Regional Mining

Global governments increasingly prioritize rare earth metals as strategic resources due to their indispensable role in defense systems, renewable energy, and advanced electronics. This recognition drives national policies supporting diversified mining, refining, and magnet manufacturing outside traditional supply-dominant regions. The United States, European Union, Japan, Australia, and India have launched incentive programs, tax credits, and public-private partnerships to establish reliable supply chains and reduce import dependence. Investments target new mining operations, separation plants, recycling systems, and end-use manufacturing hubs such as magnet facilities and battery precursor plants. These initiatives help stabilize market availability while fostering technological independence for critical sectors. Defense agencies also integrate rare earth stockpiling strategies to secure uninterrupted supply for missile guidance, radar components, and high-precision sensors. As geopolitical pressures intensify, government-backed supply chain resilience becomes a powerful structural growth driver for the global rare earth metals market.

KEY TRENDS & OPPORTUNITIES:

Expansion of Recycling, Urban Mining, and Circular Magnet Recovery Systems

A major opportunity emerges from large-scale recycling of rare earths from end-of-life electronics, wind turbines, motors, and industrial equipment. Traditional mining faces limitations such as environmental impact, complex ore processing, and long commissioning timelines, making recycled rare earths an increasingly attractive alternative. Advanced hydrometallurgical and solvent-extraction technologies enable selective recovery of neodymium, dysprosium, and terbium from NdFeB magnets with improving purity and efficiency. Urban mining programs across Europe, North America, and East Asia expand collection frameworks for small electronic devices, helping capture significant quantities of magnet materials previously discarded. Companies are also commercializing closed-loop magnet-to-magnet recycling systems that reduce energy intensity and bypass early-stage ore processing steps. As sustainability regulations tighten and manufacturers seek low-carbon raw materials, recycling becomes a major long-term growth opportunity and a stabilizing factor for rare earth supply.

- For instance, Hitachi’s rare-earth recycling pilot program in the early 2010s demonstrated technology capable of processing approximately 100 HDD units per hourwith machinery, achieving high neodymium recovery rates from the extracted magnets.

Technological Innovations in Magnet Manufacturing, Separation Chemistry, and Alloy Engineering

Advances in magnet fabrication, separation chemistry, and material engineering create substantial opportunities for specialized rare earth applications. Grain-boundary diffusion technologies reduce dysprosium usage while improving magnet performance at high operating temperatures, enabling cost-effective scaling for EVs and industrial motors. Breakthroughs in solvent extraction, membrane filtration, and ion-exchange systems enhance the efficiency and environmental footprint of refining processes, addressing historical constraints around waste management and chemical intensity. In alloys, scandium integration in aluminum matrices accelerates aerospace adoption thanks to improved tensile strength, weldability, and fatigue resistance. Innovations in photonic materials, luminescent films, and laser crystals open new demand for erbium, ytterbium, europium, and terbium across optical sensing, fiber amplifiers, and precision instrumentation. These technological advancements drive premium-grade rare earth consumption and unlock high-value engineering applications.

- For instance, Shin-Etsu Chemical’s diffusion-treated NdFeB magnets cut dysprosium consumption by nearly 50% while sustaining operational temperatures above 200°C, and Neo Performance Materials’ solvent-extraction circuits process over 14,000 tonnes of rare-earth feedstock annually.

Growth of Defense, Space, and Quantum Technologies Driving Strategic Material Demand

Defense, aerospace, and quantum technology ecosystems continue to generate high-value opportunities for rare earth metals due to their exceptional magnetic, optical, and thermal characteristics. Permanent magnets support missile actuators, aircraft control systems, radar platforms, and guidance components requiring extreme reliability. Rare earth-doped crystals such as ytterbium, erbium, and holmium enable high-power lasers, night-vision optics, and advanced sensor arrays. In the space sector, lightweight rare earth alloys strengthen satellite structures and propulsion components designed for extreme-temperature environments. Emerging quantum communication and computing technologies rely on rare earth-ion dopants for ultra-stable optical transitions and secure information processing. As defense modernization and space exploration intensify globally, demand for high-purity rare earth materials in mission-critical applications grows steadily, presenting substantial long-term market opportunities.

KEY CHALLENGES:

Supply Concentration, Geopolitical Risks, and Limited Refining Capacity

The rare earth metals market faces a major challenge stemming from extreme supply concentration in mining, separation, and processing stages. A single region dominates global refining capacity, creating vulnerabilities for importing countries and industries reliant on magnet-grade oxides and metals. Geopolitical tensions, trade restrictions, or export policy changes can disrupt downstream manufacturing, particularly in EV motors, wind turbine components, and defense technologies. Developing alternative refining hubs requires significant capital expenditure, complex environmental approvals, and long lead times, limiting short-term diversification. These constraints create price volatility, supply insecurity, and long-term risk for industries dependent on stable rare earth availability.

Environmental, Regulatory, and Waste-Management Constraints in Mining and Processing

Rare earth extraction and separation remain environmentally intensive, involving radioactive by-products, high chemical consumption, and complex waste-management requirements. Stricter environmental regulations across multiple regions increase compliance costs, delay project timelines, and limit the feasibility of new mining operations. Communities and regulators demand improved sustainability practices, including wastewater treatment, emissions control, tailings management, and land-restoration commitments. Although modern technologies reduce environmental impact, large-scale implementation remains challenging. These issues constrain the pace of capacity expansion for mining and refining, restricting global supply flexibility. As demand accelerates, environmental constraints pose a significant barrier to achieving balanced rare earth supply chains.

Regional Analysis

Asia-Pacific (APAC)

Asia-Pacific dominates the rare earth metals market, accounting for over 70% of global share, driven by China’s overwhelming leadership in mining, separation, and magnet manufacturing. China controls the majority of global refining capacity and maintains strong domestic demand from its EV, wind energy, consumer electronics, and industrial sectors. Japan and South Korea contribute significantly through high-value magnet production and advanced materials engineering. Growing investments in India and Australia further strengthen the regional supply base. Government policies supporting supply independence, expanded mining licenses, and downstream processing projects keep APAC firmly positioned as the global hub for rare earth production and consumption.

North America

North America holds approximately 14% of the global market, supported by strategic government initiatives to rebuild domestic mining and separation capabilities. The United States leads regional growth with investments in neodymium–praseodymium processing, magnet manufacturing, and defense-grade material supply. Policy frameworks such as the Defense Production Act and clean-energy incentives accelerate demand across EV motors, wind turbines, and high-performance electronics. Collaboration between mining companies, magnet producers, and technology developers strengthens regional supply-chain resilience. Increasing adoption of advanced aerospace alloys and rare earth–dependent defense systems further boosts consumption, positioning North America as a rapidly expanding demand center despite limited refining capacity.

Europe

Europe represents roughly 12% of global market share, supported by strong demand from renewable energy, electric mobility, and industrial automation sectors. Countries such as Germany, France, and the UK drive consumption through expanding EV production and offshore wind installations requiring high-strength NdFeB magnets. The EU’s Critical Raw Materials Act encourages diversified sourcing, recycling infrastructure, and localized magnet production to reduce import dependency. Advanced research in photonics, catalysts, and aerospace alloys strengthens specialty rare earth usage across high-tech industries. Despite limited upstream capacity, Europe’s emphasis on sustainability, circularity, and strategic autonomy fuels steady growth in rare earth consumption.

Latin America

Latin America accounts for 4% of the global market, with demand primarily driven by industrial processing, automotive components, and emerging renewable energy investments. Brazil and Argentina lead regional activity, leveraging growing EV adoption, refinery catalyst demand, and the expansion of local electronics assembly. Geological surveys in Brazil and Chile increasingly highlight promising rare earth deposits, attracting international exploration interest. However, limited refining capacity, regulatory delays, and infrastructure constraints restrict domestic processing scale. As regional governments promote mineral development and clean-energy transitions, Latin America is gradually strengthening its role within global rare earth value chains.

Middle East & Africa (MEA)

MEA holds an estimated 4% market share, supported by rising exploration activities and strategic interest in rare earth resources. African nations—including South Africa, Madagascar, and Tanzania—possess substantial untapped deposits, drawing investment for upstream development. Demand across the Middle East increases steadily due to diversification strategies in aerospace, clean-energy technologies, and high-efficiency industrial systems. However, the region faces challenges in establishing large-scale refining capacity and downstream manufacturing. Government-backed initiatives and partnerships with global mining firms continue to improve project feasibility. MEA’s long-term growth potential remains strong as countries aim to integrate more deeply into the rare earth supply chain.

Market Segmentations:

By Metal

- Cerium

- Dysprosium

- Erbium

- Europium

- Gadolinium

- Holmium

- Lanthanum

- Lutetium

- Neodymium

- Praseodymium

- Promethium

- Samarium

- Scandium

- Terbium

- Thulium

- Ytterbium

- Yttrium

By Application

- Magnets

- Colorants

- Alloys

- Optical Instruments

- Catalysts

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the rare earth metals market is characterized by strong dominance of vertically integrated producers, expanding global mining initiatives, and rising investments in downstream magnet manufacturing. China remains the center of competition through leading companies that control mining, separation, oxide refining, and NdFeB magnet production, allowing cost efficiency and secure supply. International players in Australia, the United States, and Canada continue advancing new mining and processing projects to diversify global sources. Companies increasingly focus on high-purity oxides, recycled magnet materials, and specialty alloys to capture value in EV motors, wind turbines, and defense technologies. Strategic partnerships between miners, magnet manufacturers, and automotive OEMs strengthen supply-chain resilience, while governments accelerate funding and regulatory support for domestic processing hubs. As technology evolves, competition intensifies around high-performance magnets, advanced separation chemistry, and environmentally responsible refining practices, positioning innovation and supply security as the core competitive differentiators in the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Lynas Corporation Ltd.

- Baotou Jinmeng Rare Earth Co.

- Iluka Resources Limited

- Northern Minerals Limited

- Arafura Resources Ltd

- China Minmetals Rare Earth Co., Ltd

- Greenland Minerals and Energy Ltd

- Alkane Resources Ltd

- Indian Rare Earths Limited

- Canada Rare Earth Corporation

Recent Developments:

- In October 2025, Lynas announced a A$180 million investment to build a dedicated heavy rare-earth separation facility in Malaysia to process ~5,000 tpa of heavy-rare-earth feedstock, aiming to reduce reliance on Chinese refining infrastructure.

- In October 2025, Northern Minerals raised A$60.5 million to advance its Browns Range heavy rare-earth project.

- In August 2025, Arafura had previously completed a capital raise (~A$70.2 million in the first tranche) to support its flagship Nolans Rare Earths Project, a critical step toward final investment decision.

Report Coverage:

The research report offers an in-depth analysis based on Metal, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Global demand for NdFeB magnets will continue rising as EV adoption, robotics, and wind energy installations accelerate worldwide.

- Governments will expand strategic policies to build domestic mining, refining, and magnet manufacturing capabilities.

- Recycling and urban mining will become a major secondary supply source, reducing dependency on primary extraction.

- New refining technologies will improve efficiency, lower environmental impact, and enhance high-purity oxide production.

- Aerospace, defense, and space technologies will increase consumption of heavy rare earths for precision optics and high-performance alloys.

- Supply-chain diversification outside China will intensify through new projects in Australia, the United States, Canada, and Africa.

- Magnet-to-magnet recycling systems will scale up, enabling circular production for EV motors and industrial equipment.

- Quantum technologies and advanced photonics will expand specialty demand for elements such as erbium, ytterbium, and europium.

- Long-term contracts between OEMs and miners will become common to secure material availability.

- Sustainability, traceability, and low-carbon processing will emerge as core competitive differentiators for global suppliers.