Market Overview

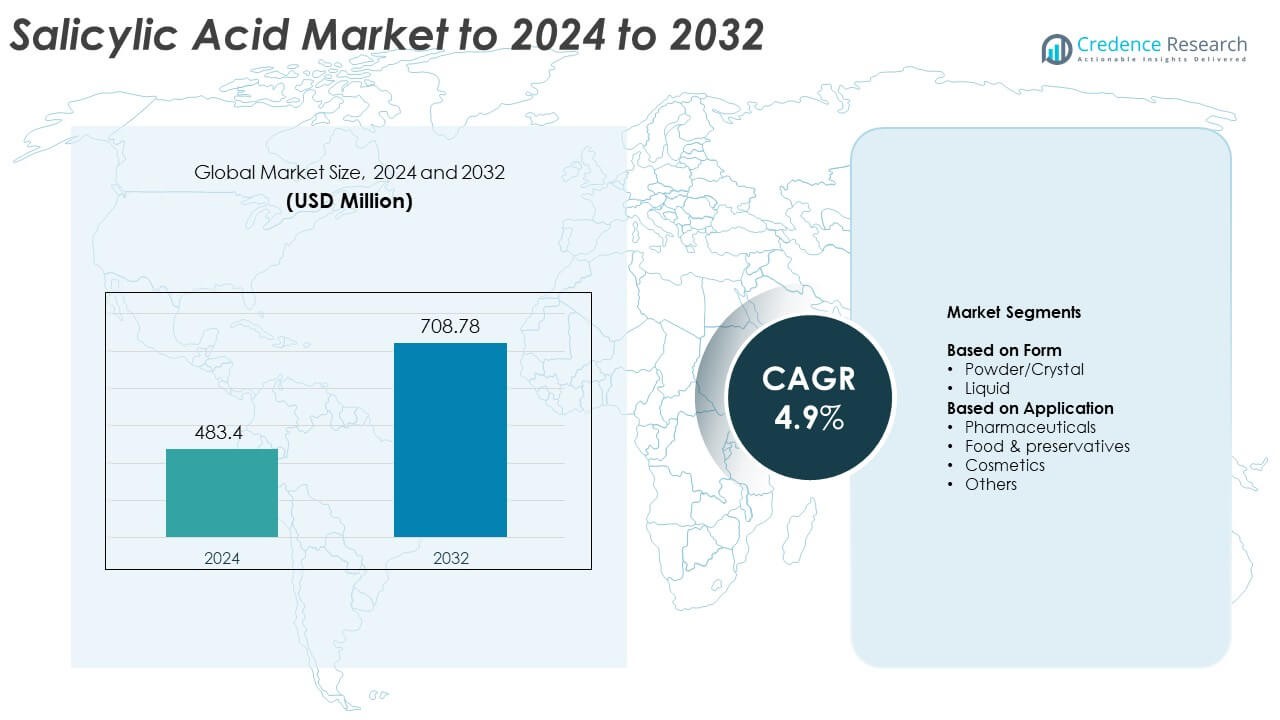

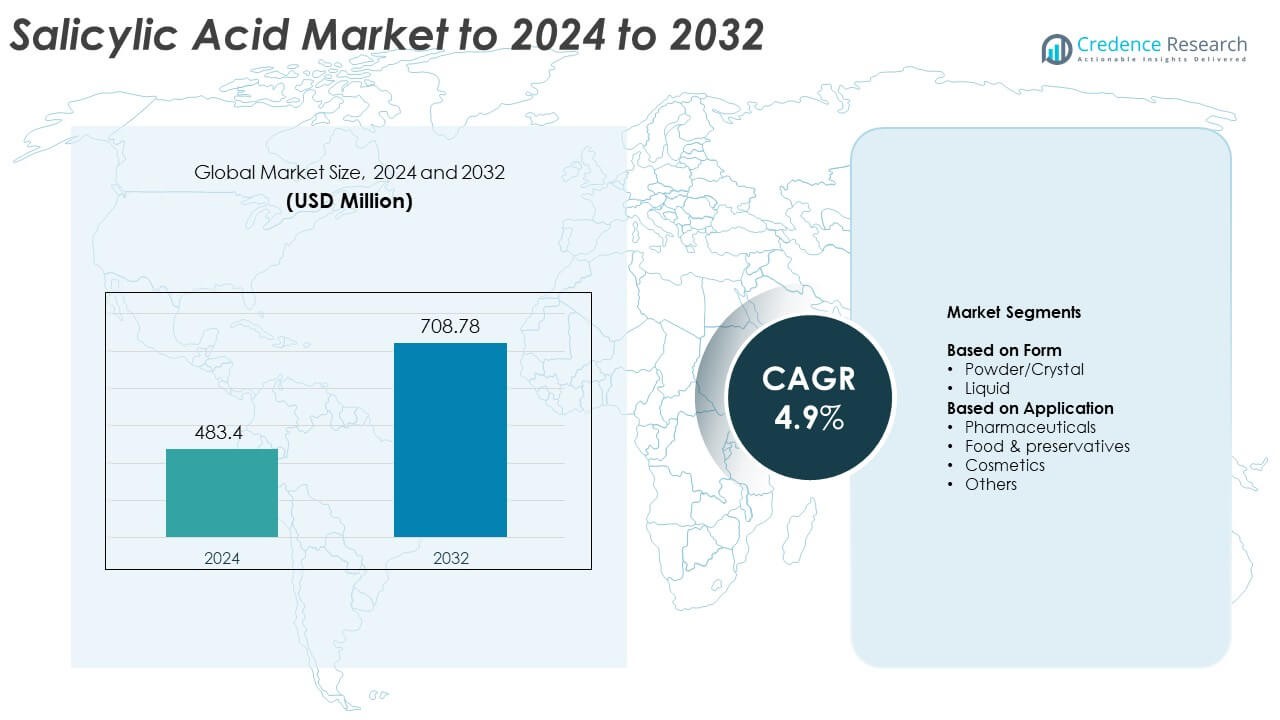

Salicylic Acid Market size was valued at USD 483.4 million in 2024 and is anticipated to reach USD 708.78 million by 2032, at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Salicylic Acid Market Size 2024 |

USD 483.4 Million |

| Salicylic Acid Market, CAGR |

4.9% |

| Salicylic Acid Market Size 2032 |

USD 708.78 Million |

The salicylic acid market includes key players such as Thermo Fisher Scientific Inc, Flychem, Hebei Jingye Medical Technology Co., Dove, Re’equil, Novocap SA, Alta Laboratories Ltd, Siddharth Carbochem Products Ltd, and Zhenjiang Gaopeng Pharmaceutical Co., Ltd. These companies strengthened their positions by improving purity grades, expanding production capacity, and supporting rising demand from pharmaceuticals, cosmetics, and food-preservative applications. Producers focused on stable supply and regulatory compliance, which helped maintain strong partnerships with global buyers. Asia Pacific emerged as the leading region in 2024 with a 34% market share, supported by large-scale manufacturing bases and growing consumption in dermatology and personal-care products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The salicylic acid market reached USD 483.4 million in 2024 and is projected to reach USD 708.78 million by 2032, growing at a CAGR of 4.9%.

- Rising demand for acne-care formulas and pharmaceutical-grade topical treatments drives steady consumption across major end-use industries.

- Skincare trends favor exfoliating, clean-label, and multifunctional products, increasing use of high-purity salicylic acid in cosmetics.

- Market competition intensifies as producers enhance purity levels and expand capacity, while powder or crystal form leads the form segment with about 62% share.

- Asia Pacific holds the highest regional share at 34%, followed by North America at 32% and Europe at 29%, supported by strong pharmaceutical and cosmetic production.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Form

Powder or crystal form dominated the salicylic acid market in 2024 with about 62% share. Manufacturers preferred this form because it offers high stability, easy blending, and better suitability for pharmaceutical and cosmetic formulations. Strong adoption came from acne-care products, wart-removal treatments, and topical anti-inflammatory medicines that require precise concentration levels. Liquid form expanded at a steady pace due to rising use in chemical processing and food-preservative blends, but powder or crystal form stayed ahead as healthcare brands increased production of dermatology-focused products across global facilities.

- For instance, Shandong Xinhua Pharmaceutical I&E Co., Ltd., a major producer of pain relievers, has a current production capacity of 10,000 metric tons annually for Aspirin (Acetyl Salicylic Acid), a derivative of salicylic acid, and exports 5,000 metric tons of this product globally.

By Application

Pharmaceuticals led the application segment in 2024 with nearly 46% share. Demand grew as drug makers used salicylic acid for acne therapies, keratolytic creams, analgesic intermediates, and anti-inflammatory preparations. The segment benefited from rising dermatology consultations and wider access to prescription and OTC skin-treatment products. Cosmetics followed closely due to growth in exfoliating serums and deep-cleansing formulations, while food and preservatives and other industrial uses advanced steadily. Pharmaceuticals remained dominant because regulated drug formulations require consistent purity and high-grade salicylic acid for targeted therapeutic action.

- For instance, Almirall’s Actikerall cutaneous solution contains 100 mg of salicylic acid in each gram of formulation, used topically for hyperkeratotic actinic keratosis in regulated prescription therapy.

Key Growth Drivers

Rising demand for dermatology and skincare products

Growing demand for acne-care and exfoliation products increased global use of salicylic acid in 2024. Dermatology brands relied on the compound for its keratolytic action, which supports skin renewal and reduces breakouts. Expanding consumer focus on facial cleansing, deep-pore treatment, and anti-blemish solutions strengthened market growth across retail and online channels. Wider access to OTC treatment options and rising awareness about preventive skincare further pushed demand from cosmetic and pharmaceutical manufacturers.

- For instance, Neutrogena Oil-Free Acne Wash is labeled with 2% salicylic acid, a standard and effective concentration for treating acne.

Expansion of pharmaceutical applications

Pharmaceutical companies used salicylic acid as a key intermediate in producing analgesics, anti-inflammatory drugs, and topical therapeutic creams. Rising cases of skin disorders and musculoskeletal pain increased consumption across developed and emerging markets. The compound’s versatility supported multiple formulations, which encouraged drug makers to scale procurement. Strong investment in dermatology research and wider availability of prescription therapies helped sustain ongoing demand in regulated markets.

- For instance, Bayer’s regular-strength Aspirin tablets each contain 325 mg of acetylsalicylic acid, and the product is supplied globally in multiple strengths for analgesic and cardiovascular indications.

Growing adoption in food preservation and industrial processes

Food processors used salicylic acid in controlled applications to extend product shelf life and maintain stability. Industrial users adopted the compound for dye manufacturing, rubber processing, and chemical synthesis. Growing packaged-food consumption and rising production volumes in chemical plants supported market uptake from non-pharma sectors. Consistent regulatory focus on product quality encouraged companies to use high-purity grades, which added momentum to the segment.

Key Trends and Opportunities

Growth in clean-label and multifunctional cosmetic formulations

Cosmetic companies shifted toward clean-label and multifunctional skincare solutions, increasing use of salicylic acid in gentle exfoliators, toners, and serums. Demand rose for formulations that combined salicylic acid with plant extracts and hydrating agents to deliver balanced skin treatment. Brands capitalized on consumer interest in non-irritating, science-backed ingredients, creating new product lines across premium and mass segments. This trend opened opportunities for high-purity and sustainably sourced salicylic acid.

- For instance, COSRX BHA Blackhead Power Liquid is formulated with 4% betaine salicylate in a 100 ml bottle, pairing a salicylic-acid derivative with willow bark extract to deliver gentle exfoliation for acne-prone skin.

Rising manufacturing capacity in Asia Pacific

Producers expanded salicylic acid output in India, China, and Southeast Asia to meet strong domestic and export demand. Competitive production costs and improving chemical-grade quality standards allowed regional companies to attract global buyers. Growing pharmaceutical and cosmetic manufacturing clusters created a wide opportunity for suppliers to offer customized purity levels. This shift strengthened Asia Pacific’s role as a key sourcing hub for multiple end-use industries.

- For instamce, Aarti Drugs Ltd. in India started production at its Tarapur facility at the beginning of FY25. Initial salicylic acid output was around 100 tonnes per month due to start-up issues.

Key Challenges

Stringent regulatory requirements across end-use industries

Pharmaceutical, cosmetic, and food industries follow strict regulations on concentration levels, purity grades, and approved applications of salicylic acid. Compliance with these standards increases operational cost and slows product development cycles. Companies face periodic changes in safety guidelines, which require reformulation or re-validation of existing products. These compliance barriers limit rapid market expansion and demand consistent investment in quality-control systems.

Availability of alternative active ingredients

The market faces pressure from alternative ingredients such as glycolic acid, benzoyl peroxide, lactic acid, and natural exfoliants. These substitutes often appeal to consumers seeking milder or more natural formulations. Competing compounds reduce dependence on salicylic acid in several skincare and pharmaceutical applications. This competition forces manufacturers to innovate and maintain product differentiation, especially in regions where consumer preferences shift toward botanical or low-acid solutions.

Regional Analysis

North America

North America held about 32% share of the salicylic acid market in 2024. Strong demand came from pharmaceutical manufacturers producing topical treatments and pain-relief formulations. Skincare brands increased the use of salicylic acid in exfoliating cleansers and acne-care products, supported by high consumer awareness. The region also saw wider adoption in food-grade preservatives and industrial applications. Steady investment in dermatology research and strong retail presence across the U.S. and Canada helped maintain regional dominance during the review period.

Europe

Europe accounted for nearly 29% share in 2024, driven by strong cosmetic and personal-care product consumption. Major skincare companies expanded clean-label formulations, boosting demand for high-purity salicylic acid. Pharmaceutical usage remained consistent across Germany, France, and the U.K. due to high dermatology treatment rates. The region also adopted salicylic acid in controlled food-preservative applications and niche chemical processes. Strict quality regulations encouraged manufacturers to focus on premium and compliant grades, sustaining stable long-term growth.

Asia Pacific

Asia Pacific held the largest share after North America and Europe, reaching about 34% in 2024. The region grew rapidly due to strong production capacity in China and India and rising use in pharmaceuticals and cosmetics. Expanding skincare markets in South Korea, Japan, and Southeast Asia pushed demand for exfoliating and acne-care formulas. Local chemical manufacturers increased output to support global supply chains. Lower production costs and high export volumes positioned Asia Pacific as a major growth hub.

Latin America

Latin America captured around 3% share in 2024, supported by growing demand for acne-treatment products and rising consumer spending on beauty and personal care. Pharmaceutical distributors in Brazil and Mexico increased purchases due to higher availability of affordable OTC dermatology products. Food-preservative applications expanded gradually with growth in packaged foods. However, limited local manufacturing and reliance on imports slowed broader market expansion. Regional demand continued to rise as urban consumers adopted global skincare routines.

Middle East and Africa

Middle East and Africa held nearly 2% share in 2024. Consumption grew in pharmaceuticals for topical and anti-inflammatory treatments, particularly in Gulf countries with strong healthcare infrastructure. Cosmetic brands expanded their presence in urban markets, raising demand for exfoliating products. Industrial applications and preservative uses developed slowly due to limited chemical manufacturing. Despite low overall share, rising retail penetration and increasing awareness of skincare benefits supported gradual market progression across the region.

Market Segmentations:

By Form

By Application

- Pharmaceuticals

- Food & preservatives

- Cosmetics

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The salicylic acid market features companies such as Thermo Fisher Scientific Inc, Flychem, Hebei Jingye Medical Technology Co., Dove, Re’equil, Novocap SA, Alta Laboratories Ltd, Siddharth Carbochem Products Ltd, and Zhenjiang Gaopeng Pharmaceutical Co., Ltd. Competition remained strong as producers focused on purity, safety, and consistent supply for pharmaceutical and cosmetic applications. Manufacturers expanded production lines to support rising demand from acne-care, exfoliation, and topical treatment products. Global suppliers improved quality standards to meet strict regulations across major markets. Many companies upgraded technology to increase yield and reduce energy use during processing. Brands with flexible-grade offerings gained an advantage because buyers required tailored purity for diverse uses. Market players also worked on sustainable sourcing strategies to align with clean-label trends in cosmetics. Firms strengthened distribution across Asia Pacific, North America, and Europe to reduce delivery gaps and support contract manufacturing demand. Strategic partnerships, capacity scaling, and stable logistics networks supported competitive positioning.

Key Player Analysis

- Thermo Fisher Scientific Inc

- Flychem

- Hebei Jingye Medical Technology Co.

- Dove

- Re’equil

- Novocap SA

- Alta Laboratories Ltd

- Siddharth Carbochem Products Ltd.

- Zhenjiang Gaopeng Pharmaceutical Co., Ltd.

Recent Developments

- In 2024 Flychem, introduced KOSAVA™, a new high-purity encapsulated salicylic acid product using ProbiCap™ encapsulation technology for personal care and pharmaceutical formulations.

- In 2024, Re’equil announced the launch of its Skin Clarifying Serum with Encapsulated Salicylic Acid and Granactive ACNE.

- In 2024, Dove introduced its range of serum body washes, which included Acne Clear, which contained a 1% clearing salicylic acid acne treatment that can help clear and prevent acne.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-purity salicylic acid will rise as dermatology products expand globally.

- Pharmaceutical companies will increase usage in topical and anti-inflammatory formulations.

- Clean-label skincare trends will boost adoption in exfoliating and acne-treatment products.

- Asia Pacific will strengthen its position as a major production and export hub.

- Cosmetic brands will launch multifunctional formulas that integrate salicylic acid with mild actives.

- Food-preservative applications will grow with rising packaged and processed food consumption.

- Industrial uses in dyes, rubber, and chemical synthesis will continue to diversify.

- Manufacturers will invest in sustainable and energy-efficient production processes.

- Regulatory compliance will push companies toward improved quality-control systems.

- Expanding e-commerce channels will support wider distribution of salicylic acid-based consumer products.

Market Segmentation Analysis:

Market Segmentation Analysis: