Market Overview:

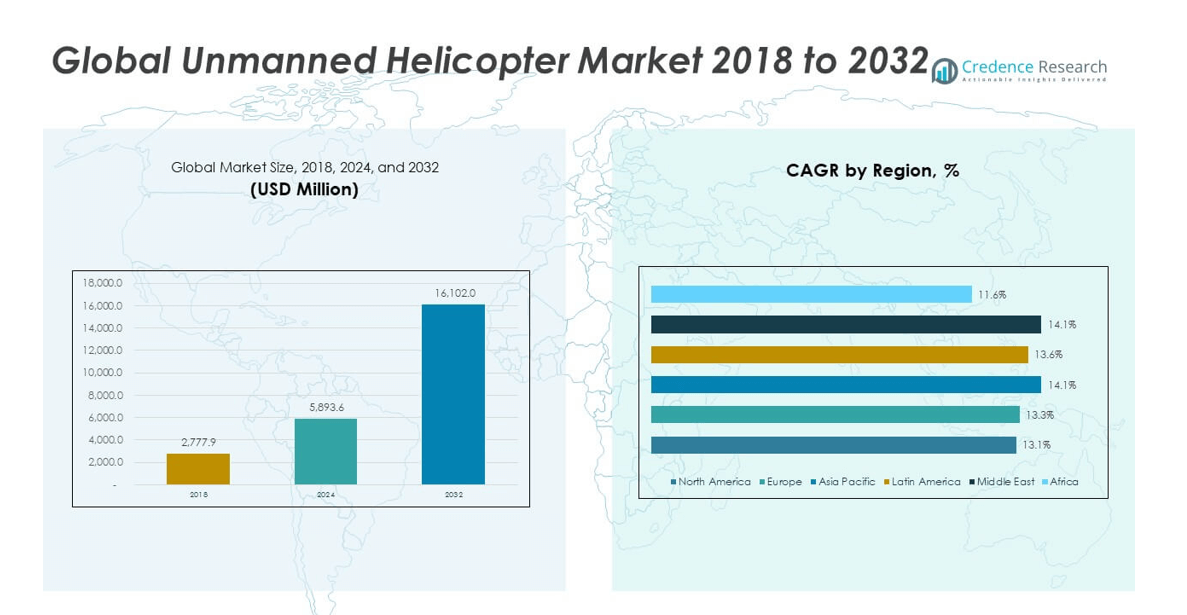

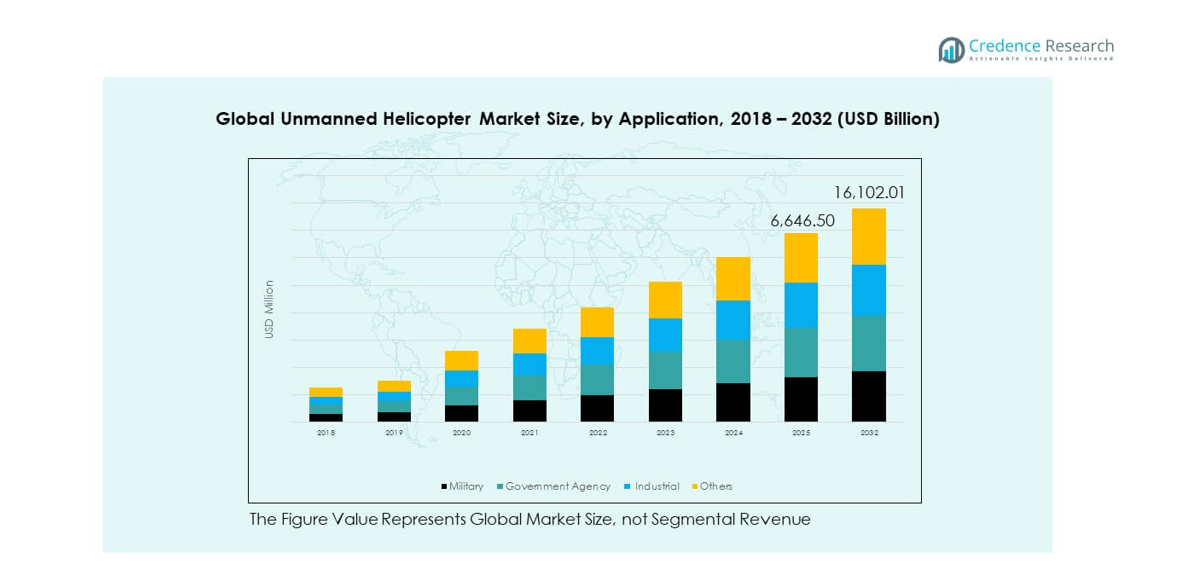

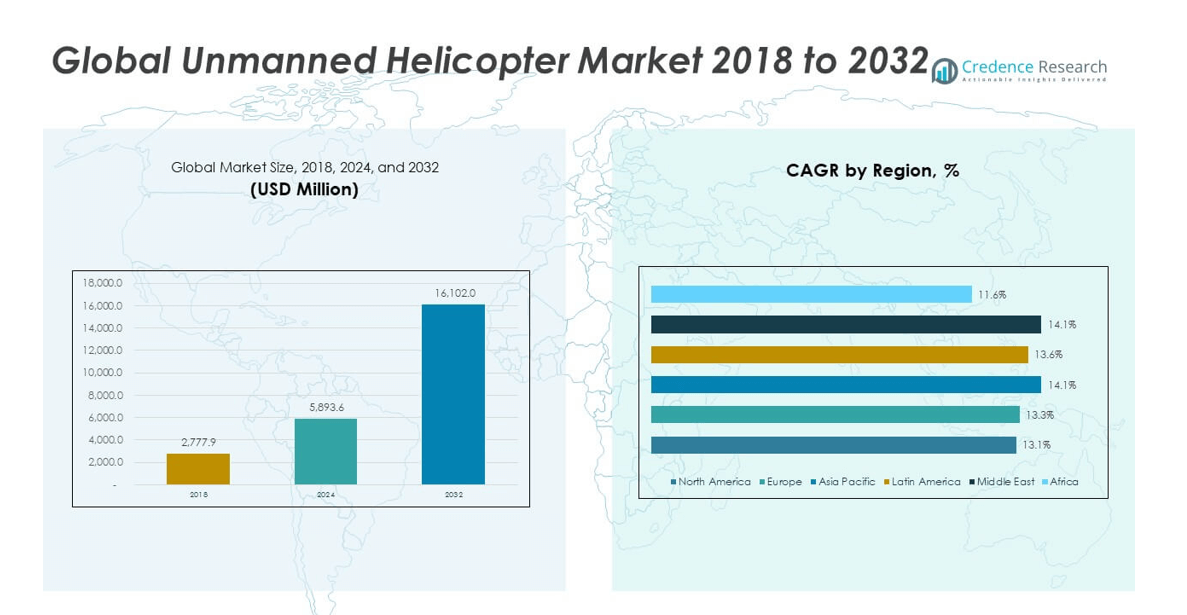

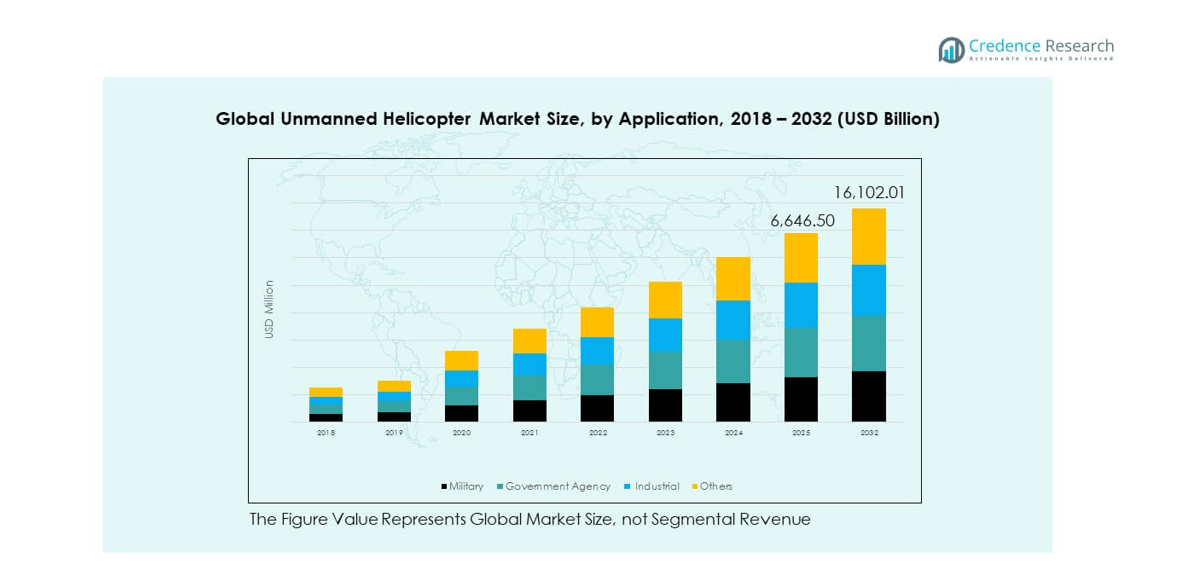

The Global Unmanned Helicopter Market size was valued at USD 2,777.9 million in 2018 to USD 5,893.6 million in 2024 and is anticipated to reach USD 16,102.0 million by 2032, at a CAGR of 13.47% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Unmanned Helicopter Market Size 2024 |

USD 5,893.6 million |

| Unmanned Helicopter Market, CAGR |

13.47% |

| Unmanned Helicopter Market Size 2032 |

USD 16,102.0 million |

The market is expanding due to increasing demand for aerial surveillance, disaster management, and logistics support applications. Defense sectors are adopting unmanned helicopters for reconnaissance, search and rescue, and border security operations. Their ability to operate in high-risk environments and carry advanced sensors makes them vital for modern military missions. Commercial sectors are using them for mapping, inspection, and cargo delivery. Continuous improvements in flight endurance, automation, and payload capabilities further strengthen market adoption.

North America dominates the Global Unmanned Helicopter Market due to high defense spending, ongoing military modernization, and the presence of key manufacturers. Europe shows steady growth supported by cross-border security projects and technological innovations. Asia Pacific is emerging rapidly, led by increased investments in defense modernization programs in China, India, and Japan. The Middle East is expanding its use for surveillance and oil infrastructure monitoring, while Latin America explores adoption for border and agricultural monitoring applications.

Market Insights:

- The Global Unmanned Helicopter Market was valued at USD 2,777.9 million in 2018, reached USD 5,893.6 million in 2024, and is projected to reach USD 16,102.0 million by 2032, growing at a CAGR of 13.47%.

- North America leads with 33% share due to robust defense budgets, advanced R&D infrastructure, and early UAV adoption, followed by Europe at 26% supported by strong aerospace capabilities and regulatory alignment.

- Asia Pacific holds 25% share and records the fastest growth, driven by expanding defense modernization, industrial automation, and increasing UAV applications in surveillance and logistics.

- The military segment dominates the market with around 42% share, attributed to its widespread use in reconnaissance, intelligence gathering, and tactical operations across global defense forces.

- The industrial and government agency segments collectively account for nearly 45% of total revenue, driven by adoption in inspection, disaster management, and public safety operations worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Adoption in Defense and Security Operations

The Global Unmanned Helicopter Market is gaining momentum due to its expanding defense and homeland security applications. Armed forces deploy unmanned helicopters for intelligence, surveillance, and reconnaissance in hostile or inaccessible areas. Their ability to carry advanced sensors, thermal cameras, and communication systems increases mission efficiency. Governments are investing heavily in autonomous aviation to reduce human risk and enhance response time. The growing use of unmanned platforms for logistics support, border monitoring, and maritime patrols further accelerates demand. It benefits from modernization programs emphasizing unmanned aerial capabilities. High endurance and vertical take-off and landing features make them indispensable for tactical missions. Continuous innovation ensures better reliability and operational flexibility for defense forces.

- For instance, Elbit Systems’ Hermes 900 UAS is actively used by more than 20 countries, has completed contracts such as a $120 million deal in September 2025, and delivers up to 36 hours endurance for persistent ISR missions.

Expanding Commercial and Industrial Applications

The commercial segment is a major growth driver in the Global Unmanned Helicopter Market. It supports industries such as construction, energy, agriculture, and logistics by offering real-time monitoring and aerial transport. The technology improves asset inspection efficiency for pipelines, power lines, and wind turbines. Companies use it to reduce operational downtime and improve worker safety. Unmanned helicopters are also becoming vital for emergency deliveries in remote locations. The e-commerce sector explores their integration into last-mile delivery services. Their strong payload capacity and precise maneuverability make them more suitable than traditional drones. Demand is rising across agriculture for crop monitoring and pesticide spraying. It benefits from supportive government initiatives promoting industrial automation.

- For instance, Airbus and Shield AI successfully accomplished the first fully autonomous helicopter flight for aerial logistics in August 2025 using the MQ-72C system, demonstrating real-world applications of unmanned helicopter technology designed for high-payload delivery.

Technological Advancements and Autonomous System Integration

Rapid innovation in automation and control systems is transforming the Global Unmanned Helicopter Market. AI, machine learning, and advanced navigation software are improving flight precision and autonomous decision-making. Integration of real-time data analytics supports predictive maintenance and situational awareness. Manufacturers are enhancing system reliability with collision avoidance and obstacle detection technologies. Hybrid propulsion systems and lightweight materials extend flight duration and reduce energy consumption. The adoption of 5G and satellite communication improves connectivity in remote missions. These features make unmanned helicopters adaptable for civil, defense, and environmental use. Continuous R&D investment is fostering smarter, safer, and more efficient aerial platforms.

Increasing Demand for Disaster Response and Humanitarian Missions

Unmanned helicopters are proving essential in emergency response and humanitarian operations. The Global Unmanned Helicopter Market benefits from their ability to reach disaster zones quickly with minimal risk. They support aerial surveillance, damage assessment, and supply delivery in floods, earthquakes, and wildfires. Their deployment enhances coordination between rescue teams and improves disaster management outcomes. Governments and NGOs use them for medical delivery and communication restoration in inaccessible regions. The capability to hover and operate under adverse conditions makes them superior to fixed-wing UAVs. Growing climate-related disasters are pushing higher adoption rates. Continuous performance optimization ensures timely assistance and safety during crises.

Market Trends:

Rising Focus on Hybrid Propulsion and Sustainable Flight Systems

The Global Unmanned Helicopter Market is witnessing a major shift toward hybrid and electric propulsion systems. Manufacturers are focusing on reducing carbon emissions and improving energy efficiency. Lightweight composites and advanced aerodynamics are enhancing endurance and payload capacity. The trend aligns with global sustainability goals in aviation. Hybrid models allow longer flight hours and lower operational costs compared to fuel-only systems. Growing demand for eco-friendly aerial vehicles is encouraging innovation in battery and hydrogen fuel cells. It supports urban operations where emission standards are stringent. This technological evolution positions unmanned helicopters as a clean and efficient aerial alternative.

- For instance, Airbus’ HTeaming trials in May 2025 utilized the H135 helicopter operated by the Spanish Navy with unmanned Flexrotor UAS, showcasing integrated hybrid missions for enhanced energy management and efficient crewed-uncrewed operations.

Integration of Artificial Intelligence and Autonomous Navigation

AI-based flight control and decision-making systems are becoming a defining trend. The Global Unmanned Helicopter Market is evolving through integration of deep learning and sensor fusion technologies. These tools enable real-time obstacle detection, autonomous route planning, and terrain adaptation. Enhanced onboard computing allows dynamic mission execution without human intervention. AI-driven vision systems improve navigation in low-visibility environments. Integration of swarm technology enables coordinated multi-vehicle missions. The rise of intelligent automation improves operational safety and precision. Increasing collaboration between tech firms and aerospace companies drives rapid innovation in this area.

- For instance, DARPA’s LongShot program, launched in 2021, aims to develop an air-launched UAV capable of carrying air-to-air weapons to extend the operational reach of manned aircraft in joint missions. While Northrop Grumman participated in the initial design phase, General Atomics was selected in 2023 to continue developing and testing the LongShot prototype. Northrop Grumman’s separate Beacon program, which began flight trials in 2025, integrates proprietary AI-based flight controls on a modified testbed aircraft for dynamic multi-vehicle air combat experimentation.

Growing Use in Cargo Delivery and Urban Air Mobility

The logistics and mobility sector is adopting unmanned helicopters for time-critical deliveries. The Global Unmanned Helicopter Market benefits from growing interest in urban air mobility systems. Governments and private firms are testing UAVs for medical supplies, spare parts, and perishable goods transport. Unmanned helicopters provide higher lift capacity than multicopters, improving efficiency for mid-range cargo. Their VTOL feature supports operations in dense urban environments. Infrastructure for UAV corridors and landing hubs is expanding across developed nations. Partnerships between logistics and aerospace companies accelerate pilot programs and regulatory approval. This growing focus on aerial logistics marks a key transition toward smart city integration.

Increased Collaboration Between Defense and Commercial Sectors

Public-private partnerships are shaping innovation and production in the Global Unmanned Helicopter Market. Defense manufacturers are licensing their technology for civilian adaptation. Collaboration drives cost efficiency, dual-use applications, and faster certification cycles. Joint R&D programs foster advancements in flight endurance, automation, and communication security. Many countries are promoting shared use of unmanned systems for border security and disaster management. Civil aviation regulators are adapting rules to support integration into controlled airspace. These collaborations enable sustainable scaling of unmanned systems. It creates a bridge between defense-grade reliability and commercial affordability.

Market Challenges Analysis:

High Operational Costs and Limited Regulatory Framework

The Global Unmanned Helicopter Market faces challenges related to high procurement and maintenance costs. Complex propulsion systems and sensor integration increase production expenses. Smaller firms struggle with affordability, slowing market penetration. Lack of standardized regulations for beyond-visual-line-of-sight operations limits scalability. Many regions lack defined airspace management systems for UAVs, hindering commercial deployment. Certification and compliance costs remain high due to strict safety norms. It must overcome barriers to achieve widespread adoption across industries. Governments are working toward harmonized rules, but progress varies regionally, delaying consistent growth.

Cybersecurity Risks and Technical Limitations

Data security is a growing concern in the Global Unmanned Helicopter Market. Communication networks and GPS-based controls are vulnerable to interference and hacking. Unsecured data links expose missions to unauthorized access or manipulation. Power management and battery limitations also restrict flight endurance in electric models. Harsh weather conditions and complex terrain challenge sensor accuracy and flight stability. Technical failures can lead to mission loss and regulatory penalties. It must strengthen cybersecurity infrastructure and redundancy measures. Continuous innovation is essential to enhance reliability and operational safety across diverse applications.

Market Opportunities:

Emerging Applications in Infrastructure, Healthcare, and Agriculture

New applications are expanding growth prospects in the Global Unmanned Helicopter Market. Infrastructure inspection, precision agriculture, and medical supply delivery are key focus areas. Governments are investing in UAV programs to support emergency response and development projects. The healthcare industry explores unmanned helicopters for organ and vaccine transport. Agricultural sectors use them for crop surveillance and soil assessment. These applications enhance efficiency and cost savings across industries. It benefits from supportive funding and rapid adoption of automation in developing regions.

Expansion Across Emerging Markets and Smart City Projects

Emerging economies present major opportunities for the Global Unmanned Helicopter Market. Asia Pacific, Latin America, and the Middle East are increasing defense and smart infrastructure investments. Integration into smart city mobility systems and traffic management is growing. Expanding air mobility corridors and UAV infrastructure foster new deployment models. The trend toward autonomous logistics and urban delivery networks supports future growth. Rising partnerships between international manufacturers and local governments create strong market potential. It is well-positioned to benefit from rapid technological adoption and expanding global UAV policies.

Market Segmentation Analysis:

By Application Segment

The Global Unmanned Helicopter Market is divided into military, government agency, industrial, and others based on application. The military segment holds the dominant share due to widespread adoption for surveillance, reconnaissance, and tactical missions. Governments prioritize unmanned helicopters for border control, disaster response, and environmental monitoring, enhancing national security and public safety. The industrial segment shows steady growth, driven by applications in logistics, power line inspection, and infrastructure monitoring. The others category includes research, agriculture, and environmental observation, supported by growing interest in autonomous operations and remote data collection. It continues to expand with technological integration across diverse operational sectors.

- For instance, Lockheed Martin’s Sikorsky division converted the S-70 Black Hawk into a fully autonomous U-HAWK, officially unveiled in October 2025, which demonstrated unmanned cargo and resupply missions with rapid conversion from crewed to autonomous control.

By End User Segment

Based on end user, the Global Unmanned Helicopter Market includes defense agencies, law enforcement, and emergency services. Defense agencies represent the largest user base, employing UAVs for intelligence gathering, communication relay, and precision targeting in complex terrains. Law enforcement agencies utilize these helicopters for crowd surveillance, crime tracking, and traffic management to enhance situational awareness. Emergency services are adopting UAVs for search and rescue, fire monitoring, and medical supply delivery in disaster-affected areas. It benefits from continuous advancements in payload capacity, automation, and endurance, enabling improved efficiency across mission-critical operations.

- For instance, Northrop Grumman’s MQ-8C Fire Scout accumulated over 1,500 developmental flight hours before it achieved initial operational capability (IOC) in mid-2019. The U.S. Navy ended its operational employment of the MQ-8C by the end of fiscal year 2024 and plans to fully retire the fleet by late 2026. The predecessor, the MQ-8B, accumulated over 17,000 operational flight hours during its service before being retired in 2022.

Segmentation:

Application Segments:

- Military

- Government Agency

- Industrial

- Others

End User Segments:

- Defense Agencies

- Law Enforcement

- Emergency Services

Regional Segments:

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Regional Analysis:

North America

The North America Unmanned Helicopter Market size was valued at USD 947.81 million in 2018 to USD 1,977.05 million in 2024 and is anticipated to reach USD 5,278.24 million by 2032, at a CAGR of 13.1% during the forecast period. North America holds around 33% market share in the Global Unmanned Helicopter Market. The region leads due to advanced defense programs, significant R&D investments, and early adoption of autonomous aerial systems. The U.S. Department of Defense and Homeland Security deploy UAV helicopters for border security, reconnaissance, and logistics. Strong aerospace infrastructure and technological expertise support continuous innovation. Canada contributes with growing interest in surveillance and remote monitoring applications. Integration of artificial intelligence and hybrid propulsion systems enhances mission performance. Strategic collaborations between manufacturers and government agencies strengthen market penetration and competitiveness across the region.

Europe

The Europe Unmanned Helicopter Market size was valued at USD 742.53 million in 2018 to USD 1,559.45 million in 2024 and is anticipated to reach USD 4,202.62 million by 2032, at a CAGR of 13.3% during the forecast period. Europe accounts for about 26% market share of the Global Unmanned Helicopter Market. The region benefits from cross-border security initiatives, border surveillance programs, and strong aerospace manufacturing capabilities. Countries such as the UK, France, Germany, and Italy are leading adopters of UAV technology for military and civilian applications. The European Union supports UAV integration through safety and operational regulations. Increasing adoption in infrastructure monitoring, emergency response, and law enforcement drives market expansion. Investments in hybrid-electric technologies enhance energy efficiency and sustainability. Continuous focus on modernization of defense and civil aviation systems supports regional growth.

Asia Pacific

The Asia Pacific Unmanned Helicopter Market size was valued at USD 645.02 million in 2018 to USD 1,413.45 million in 2024 and is anticipated to reach USD 4,025.50 million by 2032, at a CAGR of 14.1% during the forecast period. Asia Pacific holds nearly 25% market share of the Global Unmanned Helicopter Market. The region shows rapid growth driven by defense modernization, industrial expansion, and increasing UAV adoption in surveillance and logistics. China, Japan, India, and South Korea are key markets investing in unmanned aerial platforms. Strong domestic manufacturing and government-funded defense programs support technological advancement. Expanding infrastructure and maritime surveillance requirements drive procurement. Civil applications such as agriculture, disaster management, and cargo transport further strengthen adoption. It benefits from favorable policies promoting UAV innovation and production.

Latin America

The Latin America Unmanned Helicopter Market size was valued at USD 283.34 million in 2018 to USD 604.68 million in 2024 and is anticipated to reach USD 1,664.95 million by 2032, at a CAGR of 13.6% during the forecast period. Latin America represents around 9% market share of the Global Unmanned Helicopter Market. The region’s growth is supported by defense modernization and law enforcement applications. Brazil and Mexico lead adoption for surveillance, border patrol, and counter-narcotics missions. Governments are investing in UAV programs to enhance emergency and security responses. The commercial sector is gradually adopting unmanned helicopters for agricultural mapping and infrastructure inspection. Local manufacturing initiatives are improving accessibility and reducing import dependence. Technological collaborations with global OEMs are enhancing operational capabilities and training infrastructure.

Middle East

The Middle East Unmanned Helicopter Market size was valued at USD 120.56 million in 2018 to USD 264.12 million in 2024 and is anticipated to reach USD 751.96 million by 2032, at a CAGR of 14.1% during the forecast period. The Middle East contributes nearly 5% market share to the Global Unmanned Helicopter Market. The region witnesses rising demand from defense, oil and gas, and border security sectors. Countries such as Israel, UAE, and Saudi Arabia are investing in UAV fleets for tactical reconnaissance and facility surveillance. Regional instability and large-scale infrastructure projects increase reliance on aerial monitoring. Unmanned helicopters are also being deployed for coastal patrol and disaster management. Partnerships with Western and Asian manufacturers enhance regional production and system integration. It continues to evolve with growing emphasis on autonomous systems for national security.

Africa

The Africa Unmanned Helicopter Market size was valued at USD 38.61 million in 2018 to USD 74.85 million in 2024 and is anticipated to reach USD 178.73 million by 2032, at a CAGR of 11.6% during the forecast period. Africa holds approximately 2% market share of the Global Unmanned Helicopter Market. The region is in the early stage of adoption, driven by surveillance, agriculture, and humanitarian applications. South Africa leads with established drone regulations and industrial deployment. Increasing demand for border control, wildlife monitoring, and disaster response enhances market potential. Infrastructure and budget limitations constrain large-scale adoption. Partnerships with international defense firms are fostering technology transfer. It is expected to gain steady momentum with improvements in local manufacturing capacity and UAV regulatory frameworks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Elbit Systems

- CybAero

- Northrop Grumman

- MD Helicopters

- AVIC Helicopter Company

- Airbus Helicopters

- Leonardo

- Schiebel Group

- Lockheed Martin

- Yamaha Motor Company

- Other Key Players

Competitive Analysis:

The Global Unmanned Helicopter Market is highly competitive, driven by technological advancement and expanding defense modernization programs. Key players focus on innovation in autonomous control, payload integration, and hybrid propulsion systems to strengthen product portfolios. It includes established aerospace manufacturers and specialized UAV developers competing for government and commercial contracts. Strategic collaborations, mergers, and long-term supply agreements enhance market positioning. The competition is shaped by continuous R&D investment, cost efficiency, and regulatory compliance. Companies are diversifying offerings to cater to both tactical and industrial applications, ensuring wider market reach.

Recent Developments:

- In October 2025, Elbit Systems announced a significant contract worth approximately $120 million to supply its Hermes 900 Unmanned Aerial System for long-range maritime surveillance to an international customer. The Hermes 900 MALE UAS is recognized for its advanced capabilities in area dominance and persistent intelligence, surveillance, and reconnaissance missions, strengthening Elbit Systems’ presence in the global unmanned helicopter market. For instance, the company has continued its expansion with recent deliveries and product showcasing events, including launches at international exhibitions in September and October 2025.

- In October 2025, Lockheed Martin, through its Sikorsky division, officially unveiled the S-70 UAS—nicknamed the “U-HAWK,” a fully autonomous version of the Black Hawk helicopter. This transformation was completed in less than a year, and the U-HAWK was developed to perform unmanned missions across multiple domains, demonstrated during the Association of the U.S. Army’s conference. For instance, the program leverages Sikorsky’s Matrix autonomy system and represents a milestone in unmanned helicopter innovation.

- In September 2025, Northrop Grumman was contracted by the US Navy, alongside partners such as Anduril, Boeing, and General Atomics, to develop conceptual designs for a carrier-based collaborative combat aircraft (CCA). This initiative aims to create uncrewed aircraft, including autonomous helicopter platforms, to support higher-risk missions and extend operational reach for carrier air wings. For instance, Northrop Grumman is utilizing its extensive expertise in naval aviation and autonomy for this effort.

Report Coverage:

The research report offers an in-depth analysis based on application and end-user segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing integration of AI and autonomous navigation systems will redefine aerial surveillance capabilities.

- Hybrid propulsion systems will gain traction to enhance flight endurance and reduce emissions.

- Defense modernization programs will continue driving large-scale procurement of unmanned helicopters.

- Commercial adoption will expand in logistics, inspection, and infrastructure monitoring sectors.

- Regulatory standardization will improve airspace integration and operational safety worldwide.

- Collaboration between OEMs and defense ministries will support long-term technology advancement.

- Demand for maritime and border surveillance platforms will increase across emerging economies.

- Innovations in lightweight materials will reduce operational costs and improve payload efficiency.

- Smart city projects will integrate unmanned helicopters for security and traffic management.

- Research in hydrogen fuel cell and 5G communication systems will strengthen performance potential.