Market Overview

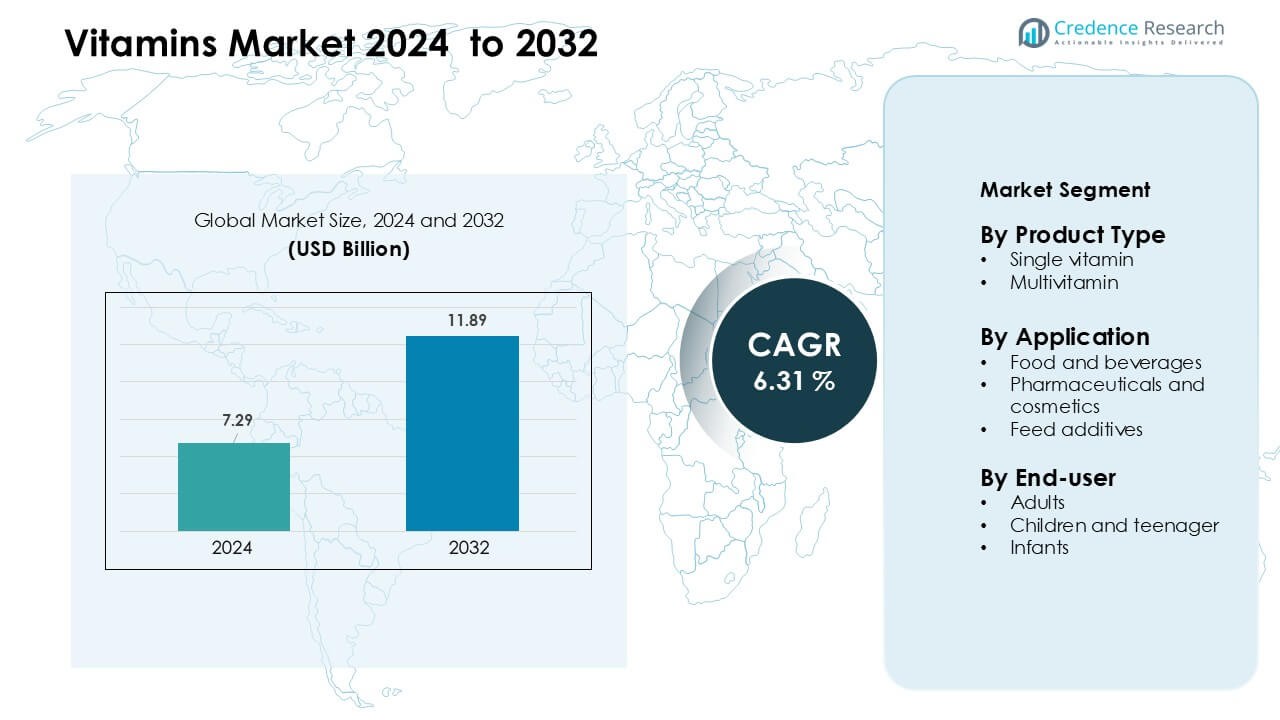

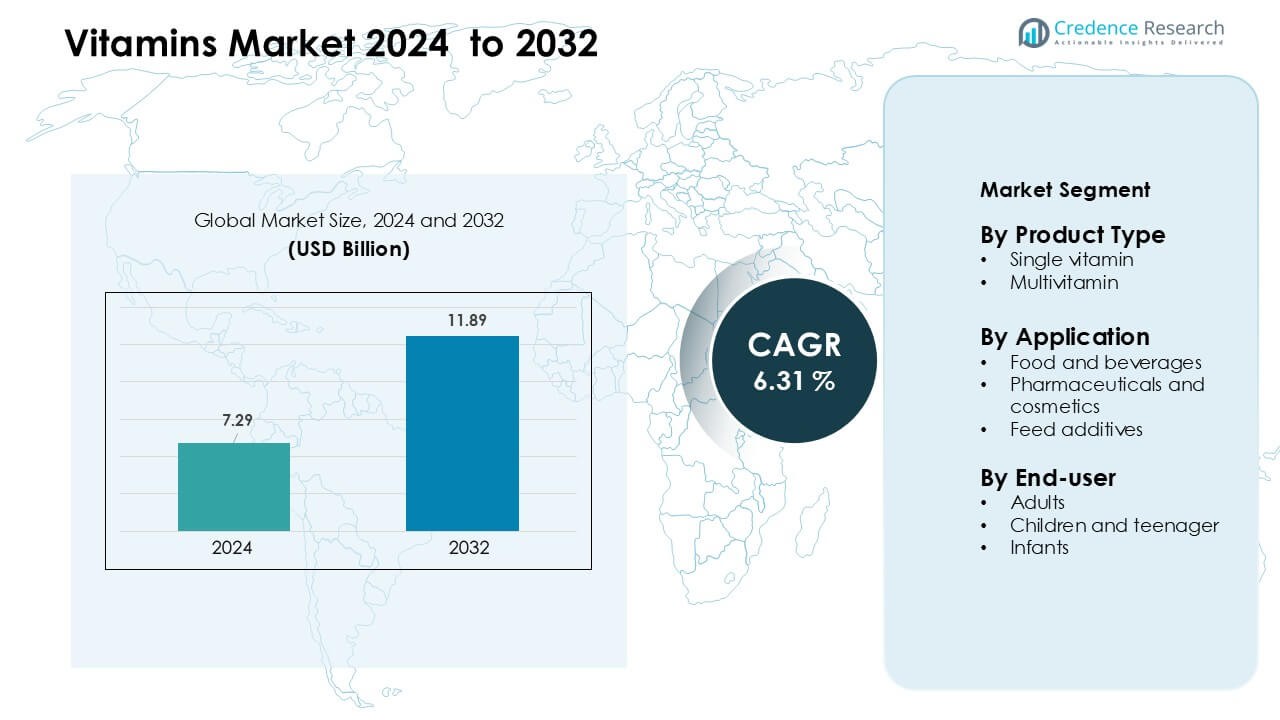

Vitamins market was valued at USD 7.29 billion in 2024 and is anticipated to reach USD 11.89 billion by 2032, growing at a CAGR of 6.31 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vitamins Market Size 2024 |

USD 7.29 Billion |

| Vitamins Market, CAGR |

6.31 % |

| Vitamins Market Size 2032 |

USD 11.89 Billion |

The vitamins market is shaped by major players such as DSM-Firmenich AG, Chr Hansen AS, Cargill Inc., Adisseo France SAS, Alltech Inc., BASF SE, Archer Daniels Midland Co., Ajinomoto Co. Inc., Associated British Foods Plc, and Abbott Laboratories. These companies strengthen their positions through advanced ingredient technologies, wide product portfolios, and strong partnerships with food, beverage, pharmaceutical, and nutraceutical manufacturers. They also invest in clean-label formulations and personalized nutrition to meet evolving consumer needs. North America remained the leading region in 2024, holding about 34% share, supported by high preventive-health adoption and strong retail distribution.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The vitamins market reached USD 7.29 billion in 2024 and is projected to expand at a 6.31% CAGR through 2032.

- Rising preventive-health adoption and widespread vitamin D and B12 deficiencies drive strong demand, with single-vitamin products leading the market at about 58% share.

- Clean-label, plant-based ingredients and fortified food launches shape key trends as consumers prefer natural, transparent, and convenient nutrition formats.

- Competition remains intense as major players focus on high-purity formulations, broader retail penetration, and personalized nutrition to differentiate in a saturated market.

- North America held the largest regional share at 34%, followed by Asia Pacific at 30%, supported by strong supplement usage and expanding fortified food consumption across both regions.

Market Segmentation Analysis:

By Product Type

Single vitamins dominated the vitamins market in 2024 with about 58% share, driven by rising demand for targeted nutrient correction and physician-recommended supplementation. Consumers used single-nutrient formats such as vitamin D, B12, and C to manage deficiencies linked with lifestyle disorders and limited sun exposure. Clear dosage control and strong clinical backing supported adoption across pharmacies and online channels. Multivitamins grew steadily as daily wellness habits improved, but single vitamins stayed ahead due to higher prescription use, precise health benefits, and strong uptake in adults with specific nutritional gaps.

- For instance, dsm-firmenich N.V., a leading nutraceutical company, reported €10,627 million in net sales in 2023, significantly impacted by its vitamin business highlighting the scale at which a major supplier contributes to single-vitamin offerings.

By Application

Pharmaceuticals and cosmetics held the leading position in 2024 with nearly 46% share, supported by strong use in immunity boosters, dermatology products, and therapeutic supplements. Demand increased as brands used vitamins A, C, and E in skin repair, anti-aging, and immune-health formulations. Food and beverages expanded with fortified drinks and functional snacks, while feed additives grew due to rising livestock nutrition focus. The pharmaceutical and cosmetic segment remained dominant because regulated formulations, higher efficacy needs, and clinical validation boosted product acceptance across global markets.

- For instance, dsm-firmenich (formerly DSM) reported €2,270 million in net sales in its Health, Nutrition & Care (HNC) segment in 2023, reflecting how its vitamin-based formulations significantly feed into pharmaceutical and cosmetic applications.

By End-user

Adults accounted for the largest share in 2024 at around 62%, driven by high adoption of preventive health supplements and rising cases of vitamin D and B12 deficiencies. Busy lifestyles, rising workplace stress, and growing fitness awareness encouraged routine vitamin intake among adults. Children and teenagers showed steady growth through fortified gummies and flavored liquids, while infants relied on prescribed drops for bone and immune development. The adult segment continued to dominate due to larger purchasing power, wider deficiency occurrence, and increasing reliance on daily nutritional supplementation.

Key Growth Drivers

Growing Focus on Preventive Health and Immunity

Rising awareness about preventive care continues to push global demand for vitamins, especially products that support immunity and metabolic balance. More adults adopt daily vitamin routines to manage stress, fatigue, bone strength, and lifestyle-related deficiencies. Governments and health agencies also promote essential nutrient intake to reduce long-term disease burden, which increases vitamin adoption across both clinical and retail channels. The shift toward self-care after recent global health crises further boosts interest in vitamins such as D, C, and B-complex. Online platforms make these supplements more accessible, encouraging first-time users and strengthening repeat purchases. Preventive care remains a major growth pillar for the vitamins market because consumers want simple and affordable ways to support long-term health.

- For instance, Pharmavite’s Nature Made brand a widely trusted supplement maker produces more than 150 different types of vitamins and dietary supplements, enabling a broad preventive-health portfolio that includes immune-support and B-complex products.

Expansion of Fortified and Functional Food Consumption

Food and beverage manufacturers increasingly add essential vitamins to dairy, snacks, cereals, and beverages to meet growing demand for convenient nutrition. Fortified foods offer an easy method to bridge nutrient gaps without requiring separate supplement routines. Rising urban lifestyles and busy work schedules make functional foods a preferred choice, especially among young adults and working professionals. Companies launch new vitamin-infused drinks, gummies, and ready-to-eat items to attract health-conscious buyers. Regulatory support for food fortification in several countries also encourages broader adoption. This expansion drives strong market gains because fortified products combine daily nutrition with taste and convenience, reaching a wider consumer base.

- For instance, Nestlé was 124 billion servings of fortified foods in 2021 and approximately 128 billion in 2023.

Rising Deficiency Levels and Targeted Supplementation

Increasing cases of vitamin D, B12, and iron deficiencies across regions fuel consistent demand for targeted supplementation. Sedentary routines, limited sun exposure, and changing food habits contribute to widespread nutrient gaps in adults and teenagers. Healthcare professionals prescribe single-vitamin formulations more frequently to correct specific deficiencies, which boosts demand for high-purity and clinically validated supplements. Diagnostic testing becomes more common, helping consumers choose precise supplements rather than broad multivitamins. The trend toward personalized nutrition also encourages tailored vitamin products for different age groups, health conditions, and activity levels. Targeted supplementation continues to expand because consumers prefer accurate solutions rather than general wellness products.

Key Trends & Opportunities

Growing Shift Toward Clean-Label and Natural Ingredients

Consumers increasingly prefer vitamins made from natural, plant-based, and non-synthetic sources. Clean-label expectations push companies to avoid artificial colors, unnecessary additives, and chemically processed ingredients. Brands develop organic, vegan, and allergen-free vitamin lines to appeal to health-focused buyers and environmentally conscious users. This shift expands the market as companies reformulate products to align with transparent ingredient standards. Strong consumer trust in natural formulations supports premium pricing and long-term brand loyalty.

- For instance, DSM Nutrition offers over 70 plant-based ingredients, including natural vitamin D3 derived from lichen and vitamin C from acerola cherry, supporting clean-label premix formulations.

Digital Distribution and Personalization Opportunities

E-commerce platforms, subscription models, and digital health apps create strong opportunities for market expansion. Online channels allow consumers to compare products, check clinical information, and access customized vitamin plans. Subscription-based vitamin packs and virtual dietitian tools gain traction among millennials and young professionals. Digital distribution also helps smaller brands reach global buyers without heavy retail investments, strengthening market competition.

Key Challenges

Regulatory Variations and Compliance Burden

The vitamins market faces regulatory differences across countries, affecting formulation, labeling, health claims, and ingredient approvals. Companies must meet strict quality guidelines to avoid compliance risks, which raises operational costs. Inconsistent global standards complicate cross-border sales and slow product launches. Smaller manufacturers struggle to align with documentation and testing requirements, limiting market entry. Regulatory pressure remains a major challenge as oversight strengthens worldwide.

Rising Competition and Product Saturation

The market has many brands offering similar formulations, which increases competition and reduces differentiation. Price-sensitive buyers often choose low-cost alternatives, tightening margins for premium brands. Heavy promotional activity across online channels makes consumer choices more fragmented. Companies must innovate with personalized blends, new delivery formats, and stronger clinical evidence to stand out. Saturation and intense rivalry continue to challenge stable growth for both new and established players.

Regional Analysis

North America

North America held the largest share in the vitamins market in 2024 at around 34%, supported by strong consumer focus on preventive care and high adoption of fortified foods. Adults rely on vitamin D, B12, and multivitamin supplements to address lifestyle-related deficiencies. High healthcare spending, strong retail penetration, and wide availability of clean-label and personalized vitamin products strengthen regional demand. E-commerce platforms also boost sales through convenient subscription models. Growing awareness of immunity and bone health keeps North America a leading contributor to overall market growth.

Europe

Europe accounted for nearly 28% share in 2024, driven by rising interest in natural, plant-based, and clean-label vitamin formulations. Consumers increasingly prefer organic and vegan-certified supplements due to strong nutritional awareness and regulatory support for high-quality standards. The region also benefits from widespread demand for fortified cereals, beverages, and infant nutrition products. Growing elderly populations accelerate intake of vitamins supporting bone strength, immunity, and cognitive health. Europe maintains stable growth as pharmacies, online platforms, and specialty wellness stores offer diverse and premium vitamin assortments.

Asia Pacific

Asia Pacific held about 30% share in 2024, emerging as the fastest-growing region due to large populations, increasing disposable income, and rising deficiency levels. Urban consumers adopt vitamins to support immunity, energy, and general wellness, while expanding middle-class households drive demand for fortified foods and children’s supplements. Governments promote nutrition programs and fortification standards, which increases awareness across India, China, and Southeast Asia. Strong e-commerce ecosystems further boost access to branded and personalized vitamin packs. Asia Pacific continues to advance due to rapid lifestyle changes and higher focus on preventive health.

Latin America

Latin America captured nearly 5% share in 2024, with growth supported by rising awareness of nutrient deficiencies and expanding retail distribution. Consumers increasingly adopt affordable multivitamin and vitamin C products to support daily wellness. Economic fluctuations encourage demand for low-cost and value-focused supplements across pharmacies and supermarkets. Fortified foods gain attention as governments address gaps in childhood nutrition. Although growth remains moderate, improving digital access and broader product availability continue to strengthen regional participation in the vitamins market.

Middle East & Africa

The Middle East & Africa region held about 3% share in 2024, driven by growing awareness of immunity, maternal health, and child nutrition. Urban centers show rising demand for multivitamins, vitamin D, and fortified foods due to lifestyle shifts and widespread deficiency patterns. Pharmacies remain the primary sales channel, supported by expanding healthcare infrastructure. However, limited affordability in several countries slows broader adoption. Growing digital retail, government-led nutrition programs, and rising interest in preventive health contribute to steady long-term growth in the region.

Market Segmentations:

By Product Type

- Single vitamin

- Multivitamin

By Application

- Food and beverages

- Pharmaceuticals and cosmetics

- Feed additives

By End-user

- Adults

- Children and teenager

- Infants

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the vitamins market features a mix of global nutrition companies, ingredient suppliers, and diversified health product manufacturers that compete through product quality, scientific validation, and strong distribution networks. Leading players such as DSM-Firmenich AG, Chr Hansen AS, Cargill Inc., Adisseo France SAS, Alltech Inc., BASF SE, Archer Daniels Midland Co., Ajinomoto Co. Inc., Associated British Foods Plc, and Abbott Laboratories strengthen their market positions through advanced formulation capabilities, large-scale production, and consistent investments in R&D. Companies focus on clean-label, plant-based, and high-purity vitamin ingredients to meet shifting consumer expectations. Many brands expand digital channels and personalized nutrition platforms to increase customer engagement and subscription-based sales. Strategic partnerships with food, beverage, pharmaceutical, and animal nutrition manufacturers support broader market penetration. Sustainability goals and traceability initiatives further differentiate leading suppliers as buyers increasingly evaluate sourcing practices and environmental impact when selecting vitamin products.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DSM-Firmenich AG

- Chr Hansen AS

- Cargill Inc.

- Adisseo France SAS

- Alltech Inc.

- BASF SE

- Archer Daniels Midland Co.

- Ajinomoto Co. Inc.

- Associated British Foods Plc

- Abbott Laboratories

Recent Developments

- In November 2025, Cargill Inc.: Expanded the production capacity of its Micronutrition & Health Solutions business (Animal Nutrition & Health segment) at its Engerwitzdorf, Austria facility increasing capacity ~50 % to meet demand for micronutrition solutions including vitamins.

- In November 2025, Abbott Laboratories launched an updated Ensure Diabetes Care formulation in India (mid-November 2025) a science-backed, vitamin-and-mineral-containing adult nutrition product positioned for people with diabetes — and reported sustained nutrition segment momentum in its Q3 2025 results (nutrition sales growth led by Ensure/Glucerna lines). These moves reflect clear product innovation and commercial focus in fortified adult nutrition (vitamin-containing) portfolios.

- In November 2025, Associated British Foods plc (ABF / ABF Ingredients): In its Nov 2025 results and related filings ABF highlighted continued investment and re-shaping of its Ingredients (ABF Ingredients) portfolio including recent M&A and reorganisations inside ABFI that expand its health & nutrition capabilities (e.g., acquisitions and integrations across specialty ingredients, polyphenols and active-nutrient businesses) to better serve dietary-supplement and fortified-ingredient markets. The FY2025 announcement also details specific Ingredients acquisitions and capital spend to grow capability and capacity.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for personalized vitamin plans will grow as consumers seek targeted nutrition.

- Adoption of plant-based and natural vitamin sources will increase across all age groups.

- Fortified foods and beverages will expand as manufacturers add essential nutrients to daily products.

- Online sales and subscription models will rise as digital health platforms gain users.

- Preventive-health habits will strengthen long-term vitamin consumption among adults.

- Advances in clinical research will support more evidence-based vitamin formulations.

- Gummies, liquids, and fast-absorption formats will grow due to higher convenience needs.

- Emerging markets in Asia and Latin America will show faster adoption of multivitamins.

- Sustainability and transparent sourcing will become key factors in brand selection.

- Partnerships between nutrition companies and healthcare providers will expand guided supplementation.