Market Overview

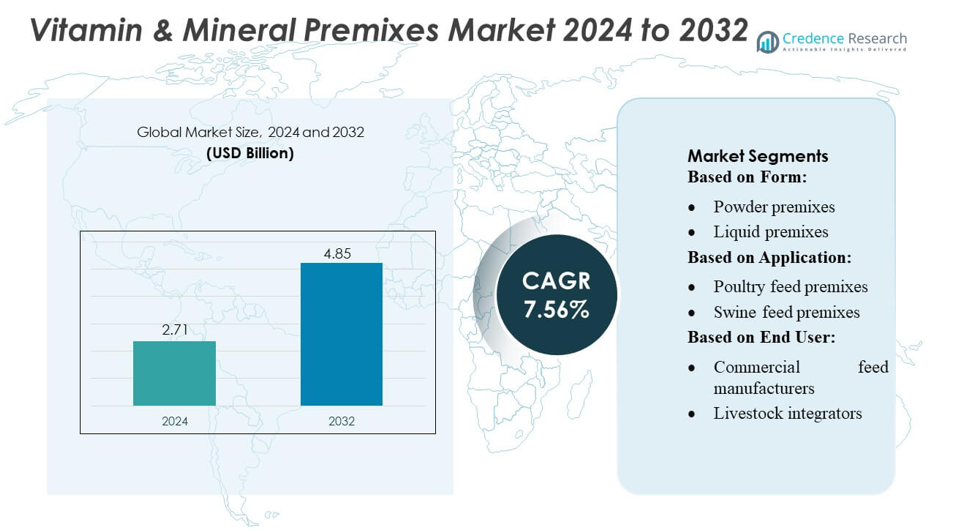

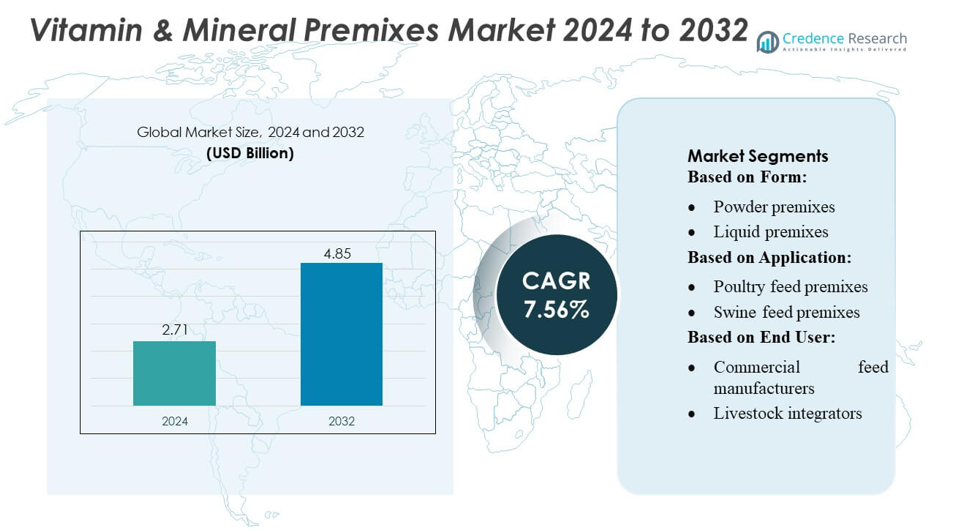

Vitamin & Mineral Premixes Market size was valued USD 2.71 billion in 2024 and is anticipated to reach USD 4.85 billion by 2032, at a CAGR of 7.56% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vitamin & Mineral Premixes Market Size 2024 |

USD 2.71 billion |

| Vitamin & Mineral Premixes Market, CAGR |

7.56% |

| Vitamin & Mineral Premixes Market Size 2032 |

USD 4.85 billion |

The Vitamin & Mineral Premixes Market is shaped by several major companies that focus on product innovation, customized formulations, and strong global distribution to meet rising demand across food, beverage, supplement, and animal nutrition sectors. These players continue to enhance nutrient stability, expand clean-label offerings, and strengthen partnerships with manufacturers to support fortified product development. Asia-Pacific stands as the leading regional market, holding about 37% of global share, supported by rapid urbanization, growing health awareness, and increased consumption of fortified and functional foods across major economies in the region.

Market Insights

- The Vitamin & Mineral Premixes Market was valued at USD 2.71 billion in 2024 and is projected to reach USD 4.85 billion by 2032, registering a 56% CAGR during the forecast period.

- Rising demand for fortified foods, dietary supplements, and functional beverages continues to drive market expansion as consumers prioritize preventive health and daily nutrition.

- Clean-label formulations, natural ingredient sourcing, and advanced nutrient stabilization technologies are strengthening product innovation and shaping evolving market trends.

- Competition intensifies as companies invest in customized premixes, global manufacturing capabilities, and partnerships to enhance application-specific formulations across human and animal nutrition; however, raw material price volatility and regulatory complexity act as key restraints.

- Asia-Pacific leads with about 37% regional share, while the food and beverage segment remains the largest application category, supported by expanding fortified product lines and increasing health-conscious consumer demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Form

Powder premixes dominate the Vitamin & Mineral Premixes Market, accounting for the largest share due to their superior stability, ease of blending, and cost-effective bulk handling. Manufacturers prefer powder formats because they ensure uniform nutrient dispersion in compound feed and exhibit longer shelf life compared with liquid or pelletized variants. Demand intensifies across poultry and ruminant feeds as producers prioritize consistent micronutrient delivery and simplified transport logistics. Liquid, granular, and pelletized premixes are growing in niche applications, but powders remain the preferred choice where operational efficiency and formulation flexibility are critical.

- For instance, Barentz — through its own business group — operates in over 70 countries and serves more than 25,000 customers worldwide, enabling it to supply powder‑based premixes at global scale with consistency.

By Application

Poultry feed premixes hold the leading market share, driven by rapid expansion in broiler and layer production and the sector’s high dependency on nutrient-dense feed formulations. Producers adopt vitamin and mineral blends to enhance feed conversion ratios, improve eggshell quality, and reduce disease incidence. Rising consumption of poultry meat and eggs in emerging markets further strengthens this segment. Swine and ruminant applications follow, supported by intensifying commercial farming, while aquaculture and pet food premixes gain steady traction as producers shift toward fortified, species-specific nutrition programs.

- For instance, Corbion has expanded its algae‑based ingredient lineup to include AlgaPrime™ DHA, a high‑quality source of omega‑3 DHA for animal nutrition (including aquaculture, pet food, and other feed applications).

By End User

Commercial feed manufacturers represent the dominant end-user segment, benefiting from large-scale production capabilities and continuous investment in fortified feed formulations. Their extensive distribution networks and adherence to stringent feed quality standards drive consistent uptake of premixes. Livestock integrators also contribute significantly as vertically integrated operations prioritize controlled nutrition for productivity gains. On-farm mixers and specialty feed producers show rising adoption due to the growing trend of customized micronutrient blends, while pet food manufacturers expand usage to meet demand for premium, fortified diets in the companion animal sector.

Key Growth Drivers

Rising Demand for Fortified Food and Beverages

Growing consumer awareness of nutrient deficiencies and lifestyle-related disorders strongly drives the adoption of fortified foods enriched with vitamin and mineral premixes. Food and beverage manufacturers increasingly incorporate premixes to meet regulatory fortification mandates and enhance product health claims. The expansion of ready-to-eat, functional beverages, and convenience nutrition products has widened the application base. Additionally, preventive healthcare trends encourage consumers to prefer daily nutrition through dietary sources, boosting demand for customized vitamin and mineral blends across global markets.

- For instance, NAGASE’s food‑ingredients business claims to distribute over 2,000 distinct food ingredients (including vitamins, amino acids, nutrient premixes, saccharides, sweeteners, acidulants, flavor materials) to beverage, confectionery, dairy, bakery, and nutritional‑supplement manufacturers worldwide.

Expansion of the Nutraceuticals and Dietary Supplements Industry

Rapid growth in nutraceuticals and dietary supplements significantly boosts the vitamin and mineral premixes market. Consumers are shifting toward personalized nutrition, protein powders, and immunity-boosting supplements that rely heavily on standardized and precise premix formulations. Regulatory frameworks supporting clean-label and clinically validated ingredients further accelerate adoption. Supplement manufacturers increasingly prefer premixes due to benefits such as formulation consistency, simplified production, and enhanced micronutrient stability. This demand is particularly strong in emerging economies experiencing rising disposable incomes and escalating health consciousness.

- For instance, DSM‑Firmenich was named among the world’s “Top 100 Global Innovators” by LexisNexis, holding over 16,000 patents across 2,600 patent families.

Increased Adoption in Animal Nutrition and Feed Fortification

The animal feed industry demonstrates growing demand for vitamin and mineral premixes to improve livestock health, productivity, and disease resistance. Premixes help maintain optimal nutrient balance critical for poultry, swine, and ruminant growth cycles. Rising global protein consumption heightens the need for efficient feed fortification programs. Governments and industry regulators are emphasizing controlled nutrient supplementation to enhance feed quality and reduce production inefficiencies. As producers adopt precision nutrition practices, demand intensifies for customized premixes tailored to species-specific metabolic requirements.

Key Trends & Opportunities

Shift Toward Clean-Label, Organic, and Plant-Based Premixes

Consumers now prioritize ingredient transparency, sustainability, and natural formulations, prompting manufacturers to develop clean-label vitamin and mineral premixes. Organic, allergen-free, and plant-derived micronutrient sources present attractive opportunities. Brands that offer premixes free from synthetic additives, artificial stabilizers, and genetically modified elements gain competitive advantage. This trend aligns closely with the rising adoption of holistic wellness and natural nutrition solutions. Companies investing in eco-friendly processing technologies and traceable supply chains are positioned to capture expanding premium-segment demand.

- For instance, ADM had enrolled over 28,000 growers by 2023, covering more than 2.8 million acres globally under regenerative agriculture practices — demonstrating the company’s capacity to supply plant‑derived ingredients from sustainable, traceable sources.

Growing Demand for Customized and Application-Specific Premixes

Manufacturers across food, beverage, supplements, and animal feed sectors increasingly prefer tailored premixes designed for specific physiological needs or product formats. Customized blends enhance nutrient functionality, improve bioavailability, and support targeted claims such as immunity, bone health, energy, or cognitive enhancement. Innovations in encapsulation and stabilization technologies further enable product differentiation. As companies seek formulation efficiency and consistency, premix suppliers offering end-to-end customization, rapid prototyping, and regulatory-compliant formulations gain significant market opportunity.

- For instance, Danone’s Evian brand introduced evian+, a 330 ml sparkling RTD can that boosts magnesium content to 50 mg per can and zinc to 1.1 mg, targeting cognitive function.

Technological Advancements in Microencapsulation and Nutrient Delivery

Advances in microencapsulation, spray-drying, and controlled-release systems are transforming premix stability and performance. These technologies improve nutrient protection from heat, moisture, and oxidation during processing, extending shelf life and enhancing bioavailability. They also enable seamless incorporation into challenging matrices such as bakery, dairy, and functional beverages. As brands pursue innovative delivery formats—including gummies, powdered drinks, and fortified snacks—technology-driven premixes offer competitive advantages. This trend opens opportunities for high-value functional nutrition solutions.

Key Challenges

Fluctuating Raw Material Prices and Supply Chain Constraints

Volatility in prices of key vitamins, minerals, and specialty ingredients poses challenges for premix manufacturers. Dependence on geographically concentrated suppliers—especially for vitamins A, E, and D—exposes companies to supply disruptions, geopolitical tensions, and logistics bottlenecks. Maintaining consistent quality standards amid raw material variability increases production complexity and costs. These issues can deter smaller manufacturers from scaling operations and pressure margins across the value chain, particularly during periods of global ingredient shortages.

Stringent Regulatory Frameworks and Complex Compliance Requirements

The vitamin and mineral premixes market operates under strict food safety, labeling, and fortification standards that vary by region, adding compliance complexity. Manufacturers must adhere to rigorous testing protocols, permissible nutrient limits, and documentation requirements. Frequent regulatory updates, especially related to health claims and ingredient safety, create operational challenges. Companies investing insufficiently in quality assurance face risks of product recalls or compliance penalties. Ensuring regulatory alignment across multiple application sectors increases costs and prolongs product development cycles.

Regional Analysis

North America

North America holds an estimated 32–34% market share, driven by strong demand for fortified foods, dietary supplements, and functional beverages. The region benefits from advanced food processing capabilities, a mature nutraceuticals industry, and high consumer awareness of micronutrient deficiencies. U.S. manufacturers increasingly adopt customized premixes to support clean-label, plant-based, and immunity-focused product lines. Regulatory frameworks from the FDA and Health Canada reinforce quality and transparency, strengthening consumer trust. Growth is further supported by expanding applications in infant nutrition, sports nutrition, and adult wellness categories, which collectively boost regional penetration and value-added innovation.

Europe

Europe accounts for approximately 28–30% of global market share, supported by robust regulatory standards, strong adoption of fortified foods, and rising interest in preventive healthcare. Demand is driven by increasing consumption of functional dairy products, bakery fortification, and premium nutrition supplements. The region’s aging population accelerates demand for premixes tailored to bone health, immunity, and cognitive support. Manufacturers emphasize clean-label formulations aligned with EU health claim regulations, encouraging greater use of natural, organic, and plant-derived micronutrients. Western Europe leads consumption, while Central and Eastern Europe show accelerating adoption due to expanding processed food industries.

Asia-Pacific

Asia-Pacific remains the fastest-growing region, holding roughly 22–24% of the market, driven by population growth, rising incomes, and rapid urbanization. Consumers increasingly adopt fortified foods, infant formula, and dietary supplements to address widespread micronutrient deficiencies. China and India dominate consumption as food and beverage manufacturers scale fortified product lines for health-conscious and convenience-seeking consumers. Government-led nutritional programs and expanding livestock production further boost premix demand across human and animal nutrition. International players are also expanding regional manufacturing capacity to meet volume demand and support cost-effective, application-specific premix solutions.

Latin America

Latin America represents an estimated 7–8% market share, supported by growing demand for fortified staple foods and beverages, particularly in Brazil and Mexico. Regional consumers increasingly prioritize affordable nutrition solutions, encouraging manufacturers to integrate vitamin and mineral premixes into dairy, bakery, and cereal-based products. Public health initiatives addressing iron and vitamin A deficiencies also stimulate demand. Growth opportunities arise in animal feed fortification as livestock and poultry industries expand. Despite economic fluctuations, rising urbanization and increasing availability of fortified packaged foods continue to sustain steady market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Middle East & Africa

The Middle East & Africa region holds approximately 6–7% share, with growth driven by rising awareness of malnutrition, expanding middle-class spending, and increased availability of fortified packaged foods. Gulf countries exhibit strong demand for premium supplements and functional beverages, while African markets focus more on staple food fortification supported by government and NGO-led nutrition programs. The region’s growing livestock sector also contributes to expanding use of vitamin and mineral premixes in feed formulations. Despite infrastructure and regulatory challenges, increasing investments in food processing and health-focused products support long-term market potential.

Market Segmentations:

By Form:

- Powder premixes

- Liquid premixes

By Application:

- Poultry feed premixes

- Swine feed premixes

By End User:

- Commercial feed manufacturers

- Livestock integrators

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Vitamin & Mineral Premixes Market include Barentz, Corbion, Nutreco, NAGASE & CO., LTD., AMINO GmbH, Glanbia PLC, FENCHEM, dsm-firmenich, Archer Daniels Midland Company (ADM), and SternVitamin GmbH & Co. KG. The Vitamin & Mineral Premixes Market features a moderately consolidated competitive environment, driven by companies focusing on formulation innovation, high-quality nutrient sourcing, and advanced delivery technologies. Market participants emphasize customized premixes tailored for applications in food, beverages, dietary supplements, and animal nutrition. Investments in microencapsulation, clean-label ingredient development, and bioavailability enhancement remain central to differentiation. Many manufacturers are expanding regional production capabilities to strengthen supply chain resilience and reduce lead times. Competitive strategies increasingly revolve around technical expertise, regulatory compliance support, and collaborative product development with end-use industries, enabling firms to capture emerging opportunities in health-focused and fortified product segments.

Key Player Analysis

- Barentz

- Corbion

- Nutreco

- NAGASE & CO., LTD.

- AMINO GmbH

- Glanbia PLC

- FENCHEM

- dsm-firmenich

- Archer Daniels Midland Company (ADM)

- SternVitamin GmbH & Co. KG

Recent Developments

- In December 2024, BASF SE expanded its ammonium chloride production by 50% at its Ludwigshafen site, improving product quality and supply reliability. The expansion is part of a strategy to meet growing demand with a more efficient process, which also ensures the product meets the strict regulatory standards for food and animal feed applications.

- In September 2024, India’s oil and gas company, ONGC Videsh Ltd (OVL), Oil India Ltd (OIL), and Khanij Bidesh India (Kabil) collaborated with United Arab Emirates (UAE)’s International Resources Holding RSC Ltd (IRH) under an MoU.

- In July 2024, Barentz International, a global specialty ingredients solution provider, acquired Anshul Life Sciences Group in India to strengthen its presence in India and establish a leading life science distribution platform.

- In May 2024, Dawn’s Total Cake Solutions concept has been developed for bakers across all fluffy texture, barely sweet and with a hint of yogurt flavor and can be used for various baked goods like muffins and loaf cakes.

Report Coverage

The research report offers an in-depth analysis based on Form, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as consumers increasingly prioritize preventive health and nutrient-rich diets.

- Demand will rise for personalized nutrition solutions tailored to age, lifestyle, and health conditions.

- Manufacturers will accelerate adoption of clean-label, organic, and plant-derived micronutrient sources.

- Technological advancements in microencapsulation will enhance nutrient stability and bioavailability.

- Fortified foods and functional beverages will continue gaining traction across both developed and emerging markets.

- Companies will strengthen regional manufacturing to improve supply chain resilience and reduce dependency on global suppliers.

- Regulatory bodies will tighten guidelines, driving greater transparency and traceability in ingredient sourcing.

- Growth in animal nutrition will support increased use of precision premixes to optimize livestock performance.

- Collaborations between ingredient suppliers and end-use manufacturers will intensify to create tailored formulations.

- Digitalization and smart formulation tools will enhance product development efficiency and quality control.