Market Overview

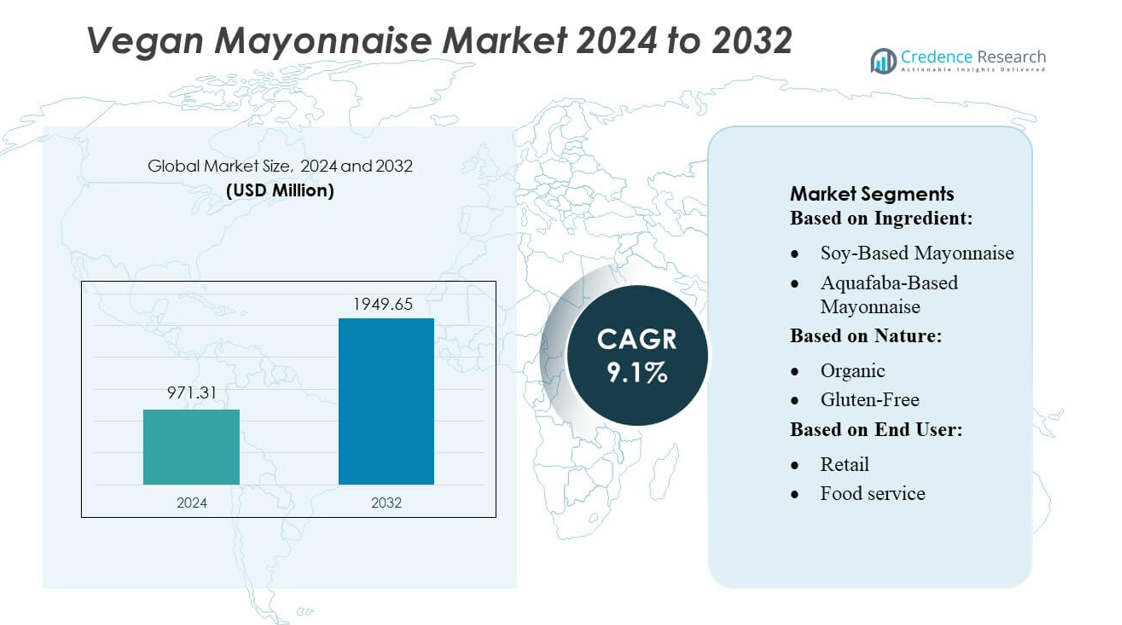

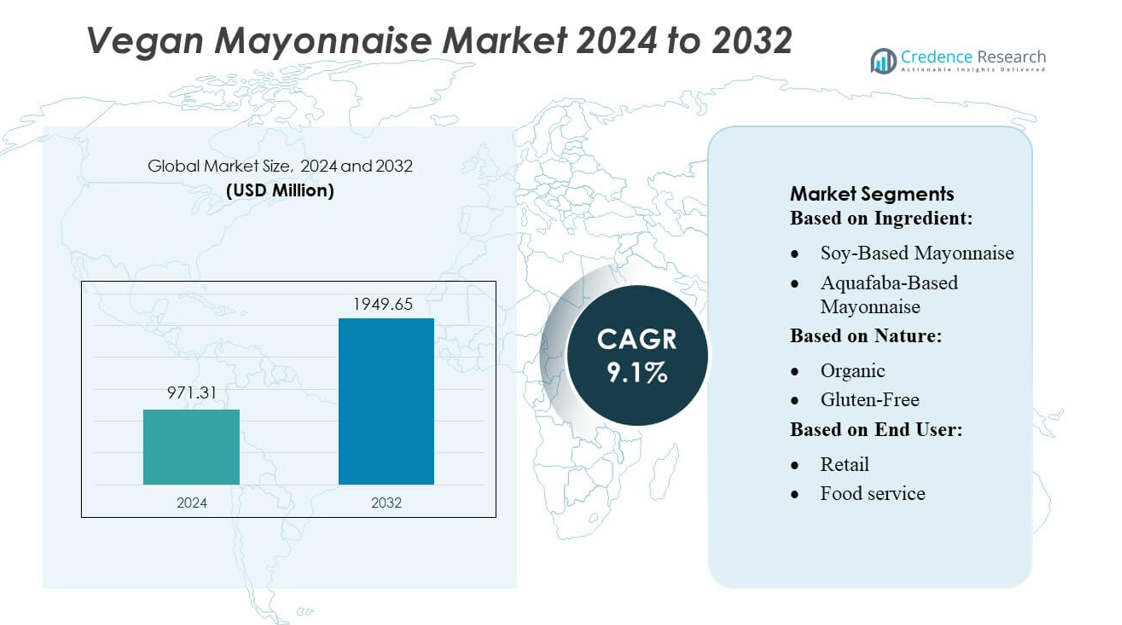

Vegan Mayonnaise Market size was valued USD 971.31 million in 2024 and is anticipated to reach USD 1949.65 million by 2032, at a CAGR of 9.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vegan Mayonnaise Market Size 2024 |

USD 971.31 million |

| Vegan Mayonnaise Market, CAGR |

9.1% |

| Vegan Mayonnaise Market Size 2032 |

USD 1949.65 million |

The vegan mayonnaise market is highly competitive, with leading players such as Eden Foods Inc., VBites Foods Limited, Tofutti Brands Inc., Danone S.A, Beyond Meat, Plamil Foods Ltd, Amy’s Kitchen, VITASOY International Holdings Limited, SunOpta, and Daiya Foods Inc. driving innovation through diverse plant-based formulations, including soy, aquafaba, and avocado-based variants. These companies focus on expanding distribution, enhancing product taste and texture, and offering clean-label, organic, and allergen-free options to meet evolving consumer demand. North America emerges as the leading region, accounting for approximately 35% of the global market, supported by high awareness of plant-based diets, strong retail and e-commerce networks, and rapid adoption in foodservice channels. Continuous product development, strategic partnerships, and sustainable packaging initiatives are expected to strengthen competitive positioning and maintain the region’s dominance in the vegan mayonnaise market.

Market Insights

- The vegan mayonnaise market size was valued at USD 971.31 million in 2024 and is anticipated to reach USD 1949.65 million by 2032, growing at a CAGR of 9.1% during the forecast period.

- Market growth is driven by rising vegan and flexitarian populations, increasing demand for clean-label, organic, and allergen-free products, and expanding adoption in retail and foodservice channels.

- Trends indicate innovation in plant-based ingredients such as soy, aquafaba, and avocado, along with flavored and fortified variants, sustainable packaging, and expansion into e-commerce platforms.

- The market is highly competitive, with leading players focusing on product diversification, taste and texture improvement, strategic partnerships, and global distribution expansion to strengthen positioning.

- North America dominates the regional market with approximately 35% share, followed by Europe and Asia-Pacific, while soy-based and organic variants lead segmentally, reflecting consumer preference for plant-based and health-focused alternatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Ingredient

The vegan mayonnaise market segmented by ingredient shows soy-based mayonnaise as the dominant sub-segment, capturing approximately 40% of the market share. Its popularity stems from the high protein content, neutral flavor profile, and widespread consumer familiarity. Aquafaba-based mayonnaise is gaining traction due to its allergen-free and cholesterol-free characteristics, while avocado-based options appeal to health-conscious consumers seeking natural fats and antioxidants. Drivers for growth across all ingredient types include rising veganism, increasing awareness of plant-based nutrition, and innovations in texture and flavor that closely mimic traditional mayonnaise, enhancing consumer adoption.

- For instance,’Edensoy’ line their unsweetened soymilk delivers 12 grams of protein per 8-ounce (240ml) serving, illustrating the high protein potential of soy-based formulations.

By Nature

Within the nature-based sub-segment, organic vegan mayonnaise leads the market with a share of nearly 35%, driven by increasing demand for clean-label and preservative-free products. Gluten-free variants cater to consumers with dietary restrictions, while low-fat and flavored varieties attract health-conscious and culinary-exploring customers. Key market drivers include growing health awareness, expansion of premium retail channels, and a shift towards sustainable and chemical-free food products. The push for transparency in labeling and the ability to meet diverse dietary requirements continues to boost adoption across these categories.

- For instance, VBites Foods Limited, prior to entering administration in December 2023, maintained a fully plant-based manufacturing portfolio with “more than 50 different foods” produced at its Corby facility—all free from cholesterol, artificial colors/preservatives, lactose, hydrogenated fats, and GMOs.

By End-User

In the end-user segmentation, the retail channel dominates with around 50% market share due to strong presence in supermarkets, e-commerce platforms, and specialty stores. The food service segment, including quick-service restaurants and cafes, is expanding, driven by menu diversification and increasing vegan demand. Industrial usage remains smaller but grows steadily as food manufacturers incorporate vegan mayonnaise into ready-to-eat products. Drivers for growth include increasing consumer preference for convenient, plant-based products, rising vegan and flexitarian populations, and the expansion of retail networks providing wider product accessibility and visibility.

Key Growth Drivers

Rising Vegan and Flexitarian Diets

The surge in veganism and flexitarian lifestyles significantly drives the vegan mayonnaise market. Consumers increasingly seek plant-based alternatives to traditional condiments to align with ethical, environmental, and health considerations. This shift encourages manufacturers to innovate and expand product portfolios. Retailers and foodservice operators respond by offering diverse vegan options, enhancing market penetration. The growing preference for plant-based diets, particularly among millennials and Gen Z, continues to fuel demand for vegan mayonnaise as a versatile, protein-rich, and cholesterol-free condiment.

- For instance, Danone expanded a major plant‑based production facility near Barcelona with an investment of €12 million, adding 12 new jobs and converting the plant towards oat‑ and coconut‑based dairy‑free alternatives.

Health and Wellness Awareness

Health-conscious consumers are increasingly choosing vegan mayonnaise due to its lower saturated fat, absence of cholesterol, and plant-derived ingredients. The demand for clean-label, organic, and allergen-free products further supports market growth. Rising incidences of lifestyle-related diseases, such as heart disease and obesity, drive consumers toward nutrient-rich and low-calorie alternatives. Manufacturers are responding with innovations like aquafaba and avocado-based formulations, enhancing nutritional profiles without compromising taste. This health-focused trend strengthens consumer trust and expands the market across retail and foodservice segments.

- For instance, Beyond Meat, which recently introduced its fourth‑generation “Beyond IV” platform that delivers 21 g of protein per serving while lowering saturated fat to just 2 g per serving.

Expansion of Retail and E-Commerce Channels

The availability of vegan mayonnaise across modern retail, specialty stores, and e-commerce platforms accelerates market growth. Online channels provide convenience, variety, and direct access to niche consumers seeking plant-based options. Retail expansion into urban and semi-urban areas also increases visibility and adoption. Promotions, sampling, and subscription-based sales models in digital marketplaces further drive consumer engagement. Efficient distribution and wide product availability, coupled with growing urbanization, ensure that both mainstream and premium vegan mayonnaise products reach an expanding audience, supporting sustained growth.

Key Trends & Opportunities

Innovation in Ingredients and Flavors

Manufacturers are exploring novel plant-based ingredients such as aquafaba, peas, and coconut oil to enhance texture, flavor, and nutritional value. Flavor diversification—including herbs, spices, and ethnic profiles—offers opportunities to attract adventurous consumers and differentiate products. Such innovations allow vegan mayonnaise to mimic traditional taste and consistency more closely, boosting acceptance. Additionally, product customization for dietary needs, such as low-fat or fortified variants, opens new avenues for market expansion and premium pricing opportunities.

- For instance, Plamil also owns its registered “Plamil Vegan” trademark (UK 00003062646), ensuring no cross-contamination with non‑vegan ingredients and upholding rigorous vegan integrity.

Sustainability and Ethical Sourcing

Consumers increasingly favor products with sustainable and ethically sourced ingredients. Vegan mayonnaise aligns with environmental concerns by reducing animal-based production impacts. Companies adopting transparent supply chains, recyclable packaging, and carbon-conscious sourcing gain a competitive advantage. This trend encourages long-term brand loyalty among eco-conscious buyers and creates opportunities for marketing products as both healthy and environmentally responsible, driving growth across retail and industrial segments globally.

- For instance, Amy’s Kitchen operates as a certified B Lab B Corporation™ — in its 2024 recertification, it achieved a score of 107.5, placing it among the highest‑scoring large U.S. food companies.

Plant-Based Menu Expansion in Foodservice

Foodservice operators are increasingly incorporating vegan mayonnaise into menu offerings to meet rising plant-based demand. Quick-service restaurants, cafes, and catering services seek versatile condiments that appeal to vegan, vegetarian, and health-conscious consumers. Collaborative product launches with foodservice chains provide visibility and drive trial consumption. This trend presents opportunities for manufacturers to supply bulk and customized formulations while enhancing brand presence across institutional channels.

Key Challenges

Taste and Texture Limitations

Achieving the taste, creaminess, and mouthfeel of traditional mayonnaise remains a challenge. Some plant-based ingredients can produce off-flavors or inconsistent textures, limiting consumer acceptance. Manufacturers must invest in R&D to create formulations that closely mimic conventional mayonnaise, balancing nutritional benefits with sensory appeal. Overcoming this barrier is critical for scaling adoption in mainstream retail and foodservice channels.

High Production Costs and Pricing

Vegan mayonnaise production often involves higher costs due to specialized plant-based ingredients and processing techniques. These costs can result in premium pricing, making products less accessible to price-sensitive consumers. Maintaining profitability while offering competitive pricing presents a challenge, particularly in emerging markets. Efficient supply chain management, ingredient sourcing, and process optimization are essential to address cost barriers and ensure wider market penetration.

Regional Analysis

North America

North America holds the largest share of the vegan mayonnaise market, accounting for approximately 35%. The region benefits from high consumer awareness of plant-based diets, widespread vegan and flexitarian populations, and strong retail and e-commerce networks. The United States leads demand, driven by health-conscious consumers seeking cholesterol-free and allergen-friendly alternatives. Innovation in flavors, organic formulations, and sustainable packaging further supports growth. Foodservice adoption in quick-service restaurants and cafes also contributes to market expansion. Rising environmental and ethical concerns, coupled with strong distribution channels, ensure that North America remains a dominant market for vegan mayonnaise.

Europe

Europe captures roughly 30% of the vegan mayonnaise market, propelled by growing veganism, regulatory support for plant-based foods, and high disposable incomes. Countries such as Germany, the UK, and France show strong adoption due to health awareness and lifestyle shifts. Organic and gluten-free variants are particularly popular, aligning with consumer preferences for clean-label products. Retail expansion, coupled with innovative flavor offerings and sustainable sourcing, drives market growth. Additionally, the foodservice sector is increasingly incorporating vegan condiments into menus, providing opportunities for product trials and boosting market penetration across both urban and semi-urban regions.

Asia-Pacific

Asia-Pacific holds around 20% of the vegan mayonnaise market and demonstrates strong growth potential due to rising urbanization, increasing disposable incomes, and expanding awareness of plant-based diets. Countries like Japan, China, and Australia are witnessing rising demand for vegan and allergen-free alternatives. Retail chains, modern supermarkets, and e-commerce platforms facilitate product accessibility, while foodservice adoption in cafes and fast-food outlets accelerates market penetration. Flavor innovation and ingredient diversification, such as avocado and aquafaba-based formulations, drive consumer interest. The region presents significant growth opportunities as health-conscious and environmentally aware consumers increasingly shift toward plant-based condiments.

Latin America

Latin America accounts for approximately 10% of the global vegan mayonnaise market, driven by growing urbanization, increased exposure to Western dietary trends, and rising vegan and flexitarian populations. Brazil and Mexico lead regional adoption due to higher health awareness and expanding retail networks. Retail availability, combined with innovative flavors and clean-label offerings, supports growth. Foodservice adoption is gradually increasing as restaurants and cafes seek plant-based alternatives to cater to health-conscious and environmentally aware consumers. Market expansion is also fueled by rising social media influence and promotional campaigns emphasizing health, sustainability, and ethical consumption.

Middle East & Africa

The Middle East & Africa represents nearly 5% of the vegan mayonnaise market, with demand concentrated in urban areas of the UAE, Saudi Arabia, and South Africa. Rising health awareness, increasing adoption of plant-based diets, and higher disposable incomes drive growth. Retail expansion, specialty stores, and e-commerce platforms are improving product accessibility. Consumers are increasingly seeking organic, gluten-free, and allergen-friendly alternatives. While market penetration is lower compared to developed regions, increasing interest in vegan lifestyles, sustainable sourcing, and modern retail infrastructure presents significant opportunities for long-term market development in the region.

Market Segmentations:

By Ingredient:

- Soy-Based Mayonnaise

- Aquafaba-Based Mayonnaise

By Nature:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The vegan mayonnaise market, including Eden Foods Inc., VBites Foods Limited, Tofutti Brands Inc., Danone S.A, Beyond Meat, Plamil Foods Ltd, Amy’s Kitchen, VITASOY International Holdings Limited, SunOpta, and Daiya Foods Inc. The vegan mayonnaise market is highly competitive, characterized by rapid product innovation, brand differentiation, and expanding distribution channels. Companies focus on developing diverse plant-based formulations, including soy, aquafaba, and avocado-based mayonnaise, alongside organic, gluten-free, low-fat, and flavored variants to meet evolving consumer preferences. Strategic initiatives such as partnerships with retailers and foodservice providers, expansion into emerging markets, and adoption of sustainable, clean-label packaging enhance market presence. Continuous improvement in taste, texture, and nutritional profile is critical for gaining a competitive edge, while effective marketing, promotional campaigns, and consumer engagement play a pivotal role in capturing and retaining market share in this rapidly growing segment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, Vegan Food Group (VFG), a leading European plant-based food producer, announced a ground-breaking partnership with Eat Just, Inc., the pioneering US food technology company.

- In March 2024, Daiya launched a new Dry Powdered Mac & Cheese in 3 flavors: Cheddar, White Cheddar, and Aged Cheddar. They also had prepared a box of gluten-free pasta and a sachet of powdered cheese mix. This new product extends Daiya’s existing line of vegan cheese and mac, shredded cheese, and pizzas.

- In March 2023, Kraft Heinz and NotCo launched NotMayo, a plant-based mayonnaise made with chickpea flour as an egg substitute. The product was launched in the Midwest, Northeast, and Southeast regions of the U.S. and was the second product from their joint venture.

Report Coverage

The research report offers an in-depth analysis based on Ingredient, Nature, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for plant-based mayonnaise is expected to grow steadily due to rising vegan and flexitarian populations.

- Consumers will increasingly prefer clean-label, organic, and allergen-free formulations.

- Innovation in ingredients, including aquafaba, avocado, and other plant-based sources, will expand product offerings.

- Flavored and fortified variants will gain traction among health-conscious and culinary-exploring consumers.

- Retail and e-commerce channels will continue to drive market penetration and accessibility.

- Foodservice adoption will grow as restaurants and quick-service chains incorporate vegan condiments.

- Sustainable and eco-friendly packaging will become a key factor in consumer purchasing decisions.

- Emerging markets in Asia-Pacific, Latin America, and the Middle East will present significant growth opportunities.

- Investment in R&D to improve taste, texture, and shelf life will intensify.

- Strategic collaborations, partnerships, and mergers will shape competitive dynamics in the market.