Market Overview

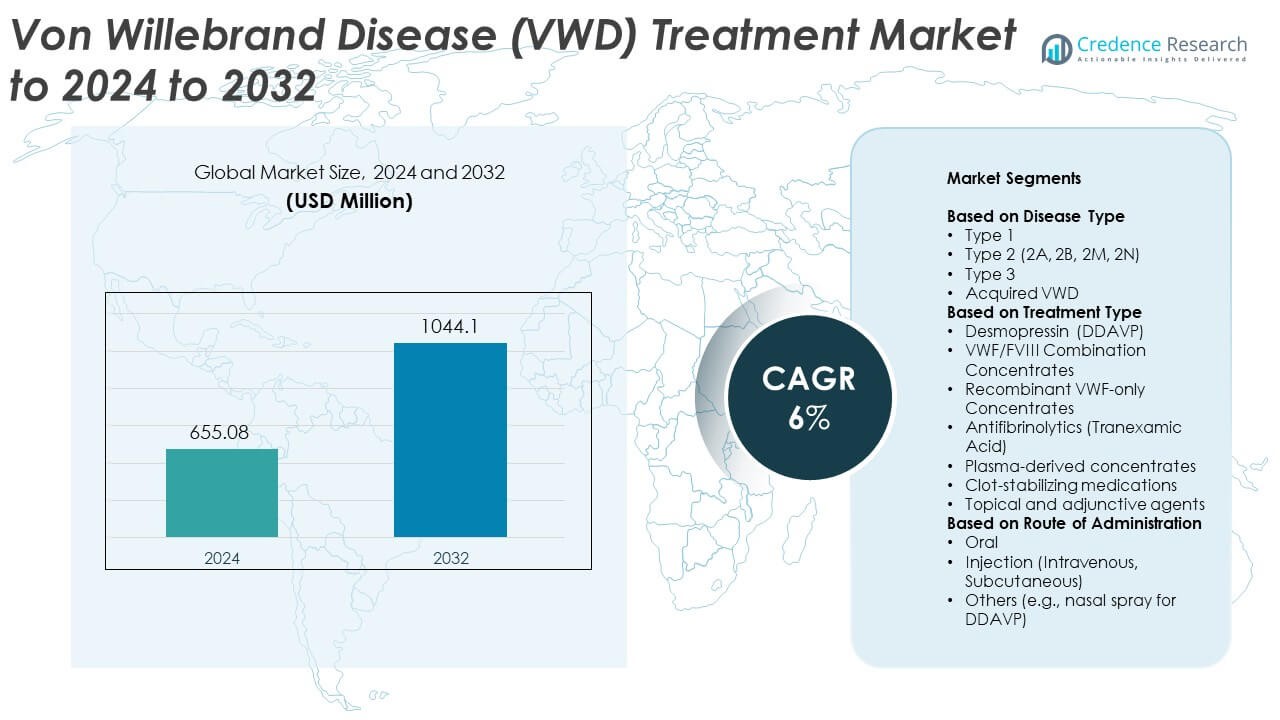

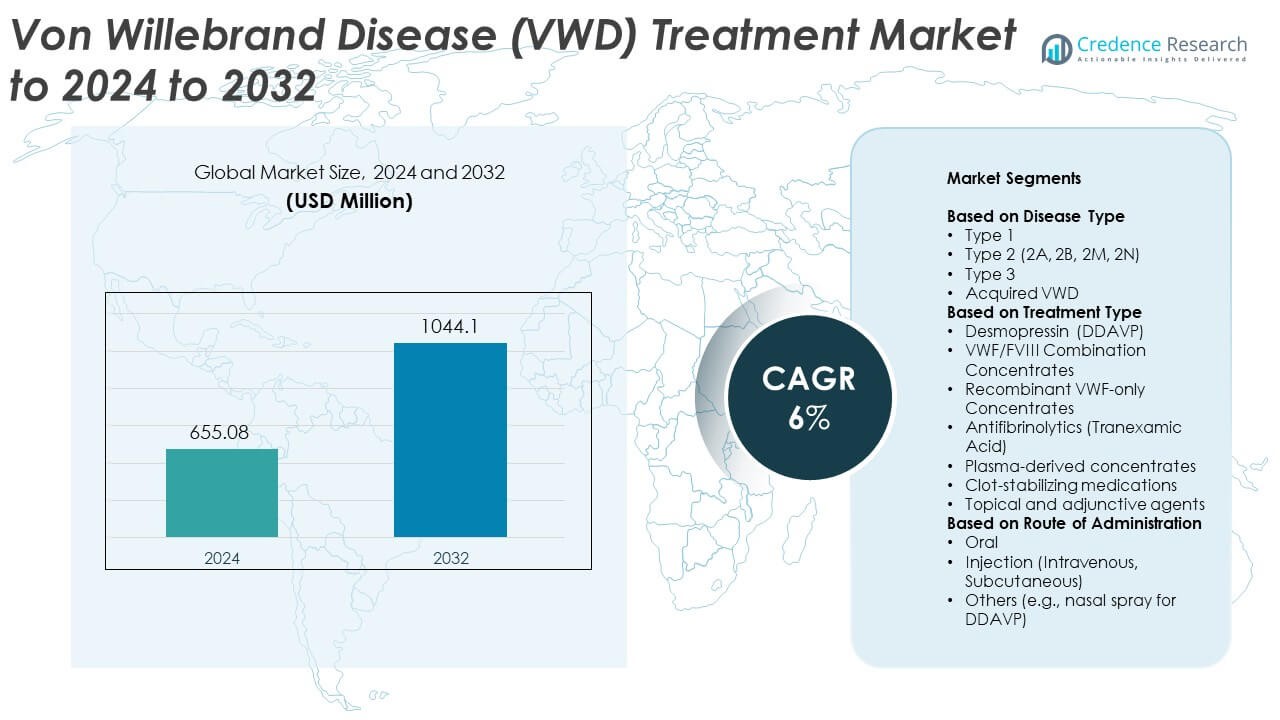

Von Willebrand Disease (VWD) Treatment Market size was valued USD 655.08 Million in 2024 and is anticipated to reach USD 1044.1 Million by 2032, at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Von Willebrand Disease (VWD) Treatment Market Size 2024 |

USD 655.08 Million |

| Von Willebrand Disease (VWD) Treatment Market, CAGR |

6% |

| Von Willebrand Disease (VWD) Treatment Market Size 2032 |

USD 1044.1 Million |

The Von Willebrand Disease (VWD) Treatment Market is shaped by leading companies including Grifols, S.A., Sun Pharmaceutical Industries Ltd., Bayer AG, Novo Nordisk A/S, Pfizer Inc., Ferring Pharmaceuticals, Takeda (Shire plc), Sanofi S.A., CSL Behring, Octapharma AG, and Baxter/Baxalta. These players compete through advanced recombinant therapies, improved plasma-derived products, and broader global distribution networks. North America emerged as the leading region in 2024 with about 41% share, supported by strong diagnostic systems and high adoption of VWF concentrates. Europe followed with roughly 32% share due to structured bleeding disorder care programs and expanding access to recombinant VWF therapies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Von Willebrand Disease (VWD) Treatment Market was valued at USD 655.08 Million in 2024 and is projected to reach USD 1044.1 Million by 2032, growing at a CAGR of 6%.

- Market growth is driven by rising diagnostic rates, increased use of recombinant therapies, and higher surgical volumes requiring bleeding management, with Type 1 remaining the largest disease segment at about 70%.

- Key trends include expanding home-based care, personalized dosing pathways, and strong R&D activity focused on longer-acting and safer VWF formulations that improve clinical outcomes.

- Competition centers on advanced biologics, plasma-derived products, and global distribution strength, supported by investments in manufacturing capacity and partnerships with hematology centers.

- North America led the market in 2024 with about 41% share, followed by Europe at nearly 32%, while Asia Pacific held around 18%, showing strong growth as diagnostic infrastructure improved across major countries.

Market Segmentation Analysis:

By Disease Type

Type 1 dominated the disease-type segment in 2024 with about 70% share due to its high prevalence among diagnosed VWD cases. Healthcare systems reported more screenings for mild bleeding symptoms, which increased early identification of Type 1 patients. Wider adoption of standardized diagnostic panels supported stable treatment demand. Type 2 and its subtypes showed steady growth because of rising awareness and improved phenotype-genotype testing. Type 3 remained the smallest group due to low incidence, while acquired VWD saw moderate expansion driven by aging populations and higher cases linked to cardiac disorders and autoimmune conditions.

- For instance, Takeda’s clinical trials for recombinant von Willebrand factor (rVWF) typically included patients with severe von Willebrand disease (VWD) who had baseline VWF:RCo levels of less than 20 IU/dL, not up to 40 IU/dL, to be eligible for the studies.

By Treatment Type

Desmopressin led the treatment-type segment in 2024 with nearly 48% share, supported by strong use in Type 1 VWD and its role as the first-line therapeutic option. Hospitals favored Desmopressin because it raises endogenous VWF levels quickly and supports outpatient care. VWF/FVIII combination concentrates gained traction for moderate to severe cases, while recombinant VWF-only concentrates expanded due to reduced infection risk. Antifibrinolytics grew steadily in dental and surgical procedures. Plasma-derived options and clot-stabilizing agents maintained niche roles, while topical adjunctive agents supported targeted bleeding control.

- For instance, the FDA-approved prescribing information for Humate-P in the “Clinical Studies” section clearly states that the median in vivo recovery (IVR) for VWF:RCo activity was 2.4 IU/dL per IU/kg in a US study.

By Route of Administration

Injection-based administration led this segment in 2024 with about 62% share, driven by strong use of intravenous VWF/FVIII concentrates and recombinant therapies for moderate and severe VWD types. Hospitals preferred injection routes because they deliver rapid correction of bleeding episodes and support precise dosing during surgeries. Oral therapies showed steady uptake due to strong use of antifibrinolytics in mild cases and outpatient scenarios. Nasal spray forms, especially for Desmopressin, held a supportive share as patients sought non-invasive options for episodic bleeding management and home-based treatment.

Key Growth Drivers

Rising Diagnosis and Screening Expansion

Wider screening programs for bleeding disorders and improved diagnostic tools have increased VWD detection rates, especially for mild Type 1 cases. Hospitals now use advanced assays that identify VWF activity with higher accuracy, which expands the pool of treated patients. Growing awareness among clinicians and patients also encourages early evaluation of unexplained bruising or prolonged bleeding. Higher diagnosis rates directly raise treatment demand, making this the key growth driver for the Von Willebrand Disease (VWD) Treatment Market.

- For instance, the official INNOVANCE VWF Ac Instruction For Use states the Limit of Detection (LoD) is 1.4 IU/dL (or 1.4%), while the Limit of Blank (LoB) is 1.1 IU/dL.

Shift Toward Recombinant and Safer Therapies

The market grows as healthcare providers shift from plasma-derived concentrates to recombinant VWF therapies that reduce infection risk and offer consistent potency. Many clinical guidelines now encourage safer biologic options for moderate and severe VWD, especially during surgical procedures. Regulatory approvals for newer recombinant formulations support broader adoption across developed regions. This shift toward safety-focused treatment options remains a major growth driver for the Von Willebrand Disease (VWD) Treatment Market.

- For instance, in the clinical trials for the perioperative management of bleeding, a dose of 40 to 60 IU per kg body weightof Vonvendi was administered before surgery to achieve target VWF:RCo levels.

Increase in Surgical Interventions Requiring Bleeding Control

Rising global surgical volumes enhance demand for VWD therapies because patients require targeted bleeding management before and during operations. Hospitals rely on VWF/FVIII concentrates, Desmopressin, and antifibrinolytics to prevent complications in both minor and major procedures. More orthopedic, cardiac, and dental surgeries among aging populations further elevate treatment needs. This rising surgical burden acts as a strong growth driver in the Von Willebrand Disease (VWD) Treatment Market.

Key Trends and Opportunities

Expansion of Personalized Treatment Pathways

Personalized therapy selection based on disease subtype, genetic profile, and patient response is becoming a key trend and opportunity. Clinicians increasingly rely on VWF-specific activity tests and DDAVP challenge assessments to tailor treatment plans. Precision dosing tools and digital monitoring platforms help optimize bleeding control while reducing treatment burden. This trend supports better outcomes and drives innovation in the Von Willebrand Disease (VWD) Treatment Market.

- For instance, the official Roche Diagnostics cobas t 711 product specifications and published studies document the maximum throughput for routine Prothrombin Time (PT) and Activated Partial Thromboplastin Time (APTT) tests as approximately 390 tests per hour(or 387-402 tests/h in some evaluations), enabling high-volume testing in clinical laboratories.

Growing Adoption of Home-Based and Self-Administered Care

Home infusion programs and nasal spray-based therapies create an opportunity for wider treatment access with greater convenience. Patients with mild to moderate VWD increasingly prefer home-based management for episodic bleeding, reducing hospital load and improving adherence. Manufacturers are developing user-friendly delivery systems and storage-stable formulations to support this trend. This shift toward decentralized care presents a major opportunity in the Von Willebrand Disease (VWD) Treatment Market.

- For instance, the FDA-approved oral tranexamic acid tablets available in the US (under brand names like Lysteda or generics) are supplied as 650 mg tablets

R&D Focus on Longer-Acting and Novel Agents

A strong research push toward longer-acting VWF products and innovative hemostatic agents is shaping future opportunities. Developers explore extended half-life molecules that require fewer doses during procedures or acute bleeding episodes. Emerging biologics also aim to enhance stability and reduce treatment intervals. This sustained innovation pipeline creates significant opportunity in the Von Willebrand Disease (VWD) Treatment Market.

Key Challenges

High Treatment Costs and Limited Access

Advanced therapies, especially recombinant VWF products, remain expensive and limit accessibility in low- and middle-income regions. Many patients depend on plasma-derived options due to affordability issues, which creates disparities in treatment quality. Reimbursement gaps and inconsistent insurance coverage also restrict uptake of newer formulations. This cost-related barrier stands as a major challenge for the Von Willebrand Disease (VWD) Treatment Market.

Diagnosis Complexity and Under-Recognition

Despite improved testing, many patients remain undiagnosed due to variable symptoms and inconsistent diagnostic practices. Mild bleeding signs often go unnoticed or misattributed, delaying treatment. Lack of standardized testing infrastructure in several regions contributes to persistent under-recognition. This diagnostic challenge continues to hinder early intervention in the Von Willebrand Disease (VWD) Treatment Market.

Regional Analysis

North America

North America held the largest share of the Von Willebrand Disease (VWD) Treatment Market in 2024 at about 41%, supported by strong access to advanced recombinant therapies and well-established diagnostic systems. The United States contributed most of the regional demand due to higher diagnosis rates, strong reimbursement frameworks, and wide availability of VWF/FVIII concentrates. Canada showed steady adoption as national bleeding disorder programs expanded screening coverage. Growing use of home-based care and strong presence of specialized hematology centers further strengthened the region’s leadership position.

Europe

Europe accounted for nearly 32% share of the market in 2024, driven by strong government-funded healthcare systems and high adoption of standardized VWD care protocols. Countries such as Germany, the United Kingdom, France, and Italy reported steady therapeutic demand due to advanced diagnostic capabilities and structured hemophilia and bleeding disorder networks. Recombinant VWF products gained rapid uptake as clinicians favored safer formulations. Rising surgical procedures in aging populations and improved access to antifibrinolytics supported sustained market momentum across Western and Northern Europe.

Asia Pacific

Asia Pacific captured about 18% share of the market in 2024, with growth driven by expanding healthcare infrastructure and rising awareness of inherited bleeding conditions. Countries including China, Japan, South Korea, and India increased diagnostic testing, which helped identify more untreated or misdiagnosed cases. Adoption of VWF concentrates and Desmopressin improved as tertiary hospitals expanded hematology services. Rising surgical demand and improving insurance coverage further strengthened the regional outlook, though access gaps between urban and rural areas continued to shape growth patterns.

Latin America

Latin America held roughly 6% share of the market in 2024, supported by gradual improvements in specialized care for bleeding disorders. Brazil and Mexico led regional demand due to better diagnostic capabilities and wider availability of antifibrinolytics and Desmopressin. Access to recombinant products remained limited because of cost barriers, but plasma-derived therapies continued to support most treatment volumes. Growing investment in public healthcare programs and rising training initiatives for clinicians helped improve treatment outcomes and expand patient identification across the region.

Middle East and Africa

Middle East and Africa accounted for nearly 3% share in 2024, reflecting limited access to specialized VWD diagnostics and advanced therapies across several countries. Gulf Cooperation Council nations, particularly Saudi Arabia and the United Arab Emirates, showed higher adoption due to strong hospital infrastructure and better availability of VWF concentrates. Many African nations continued to rely heavily on basic antifibrinolytics and limited Desmopressin supplies. Gradual improvements in diagnostic laboratories, rising awareness campaigns, and partnerships with global bleeding disorder organizations are expected to support long-term regional growth.

Market Segmentations:

By Disease Type

- Type 1

- Type 2 (2A, 2B, 2M, 2N)

- Type 3

- Acquired VWD

By Treatment Type

- Desmopressin (DDAVP)

- VWF/FVIII Combination Concentrates

- Recombinant VWF-only Concentrates

- Antifibrinolytics (Tranexamic Acid)

- Plasma-derived concentrates

- Clot-stabilizing medications

- Topical and adjunctive agents

By Route of Administration

- Oral

- Injection (Intravenous, Subcutaneous)

- Others (e.g., nasal spray for DDAVP)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Von Willebrand Disease (VWD) Treatment Market is shaped by major companies such as Grifols, S.A., Sun Pharmaceutical Industries Ltd., Bayer AG, Novo Nordisk A/S, Pfizer Inc., Ferring Pharmaceuticals, Takeda (Shire plc), Sanofi S.A., CSL Behring, Octapharma AG, and Baxter/Baxalta. The market features strong activity in recombinant and plasma-derived VWF therapies, where firms compete through product purity, safety profiles, and manufacturing scalability. Many players invest in expanding their biologics pipelines to offer longer-acting and more targeted treatments. Regulatory approvals across the United States, Europe, and Asia support broader adoption of advanced VWF products. Companies also strengthen their positions by upgrading plasma collection networks, enhancing distribution channels, and collaborating with hematology centers to improve patient access. Rising demand for surgical bleeding management further intensifies competition, as firms aim to deliver faster-acting and more reliable therapy options for acute and perioperative care.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Grifols, S.A.

- Sun Pharmaceutical Industries Ltd.

- Bayer AG

- Novo Nordisk A/S

- Pfizer Inc.

- Ferring Pharmaceuticals

- Takeda (Shire plc)

- Sanofi S.A.

- CSL Behring

- Octapharma AG

- Baxter/Baxalta

Recent Developments

- In 2025, Takeda received U.S. FDA approval for expanded use of Vonvendi, a recombinant von Willebrand factor therapy, adding an indication for routine prophylaxis to reduce the frequency of bleeding episodes in adults with type 1 and type 2 von Willebrand disease.

- In 2024, Grifols Announced positive phase 4 clinical trial results for Fanhdi®, a human anti-hemophilic factor used for long-term treatment in VWD patients.

- In 2024, Octapharma Relaunched the VWDtest.com website, an educational platform to increase awareness of VWD symptoms and empower patients.

Report Coverage

The research report offers an in-depth analysis based on Disease Type, Treatment Type, Route of Administration and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as diagnosis rates rise across mild and moderate VWD cases.

- Recombinant VWF therapies will gain stronger adoption due to safety advantages.

- Demand will increase as surgical volumes grow among aging populations.

- Home-based treatment programs will improve therapy adherence and access.

- Personalized dosing strategies will improve patient outcomes and treatment precision.

- Longer-acting VWF products will reduce dosing frequency during acute episodes.

- Digital monitoring tools will support continuous management of bleeding risks.

- Emerging biologics will enhance therapeutic options beyond current standards.

- Developing regions will show faster uptake as diagnostic infrastructure improves.

- Partnerships between hospitals and bleeding disorder networks will strengthen care delivery.