Market Overview:

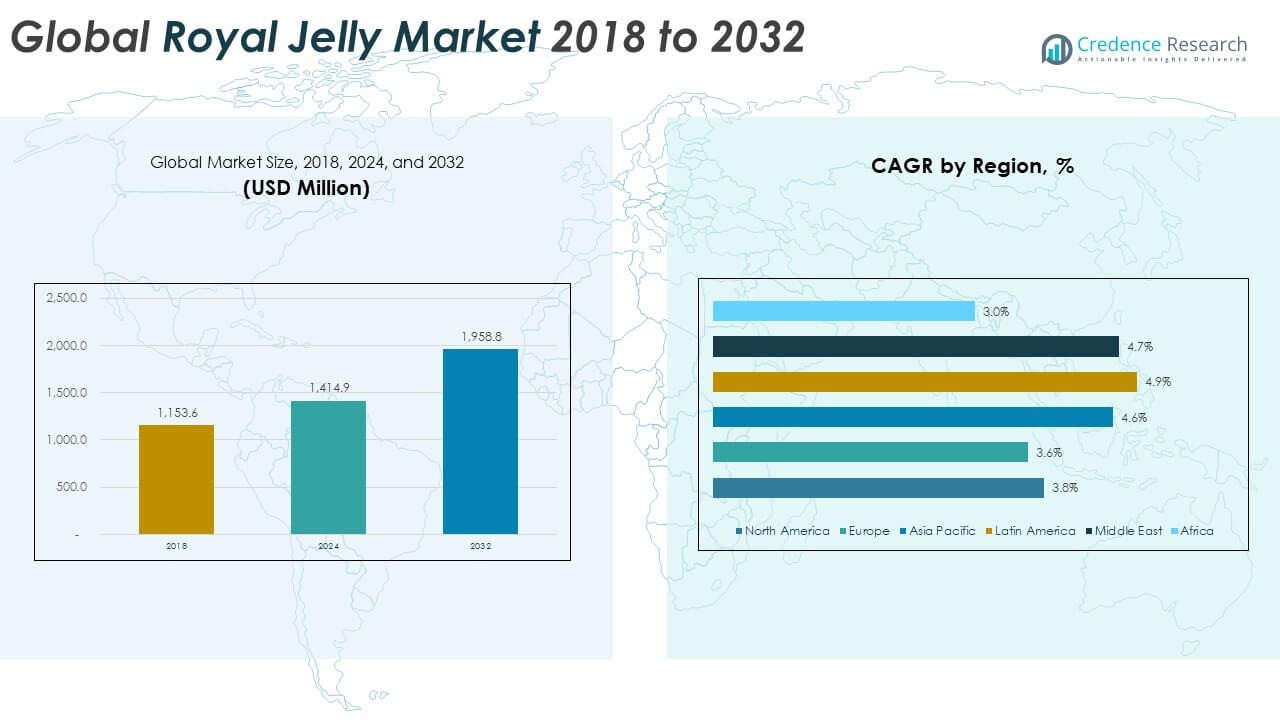

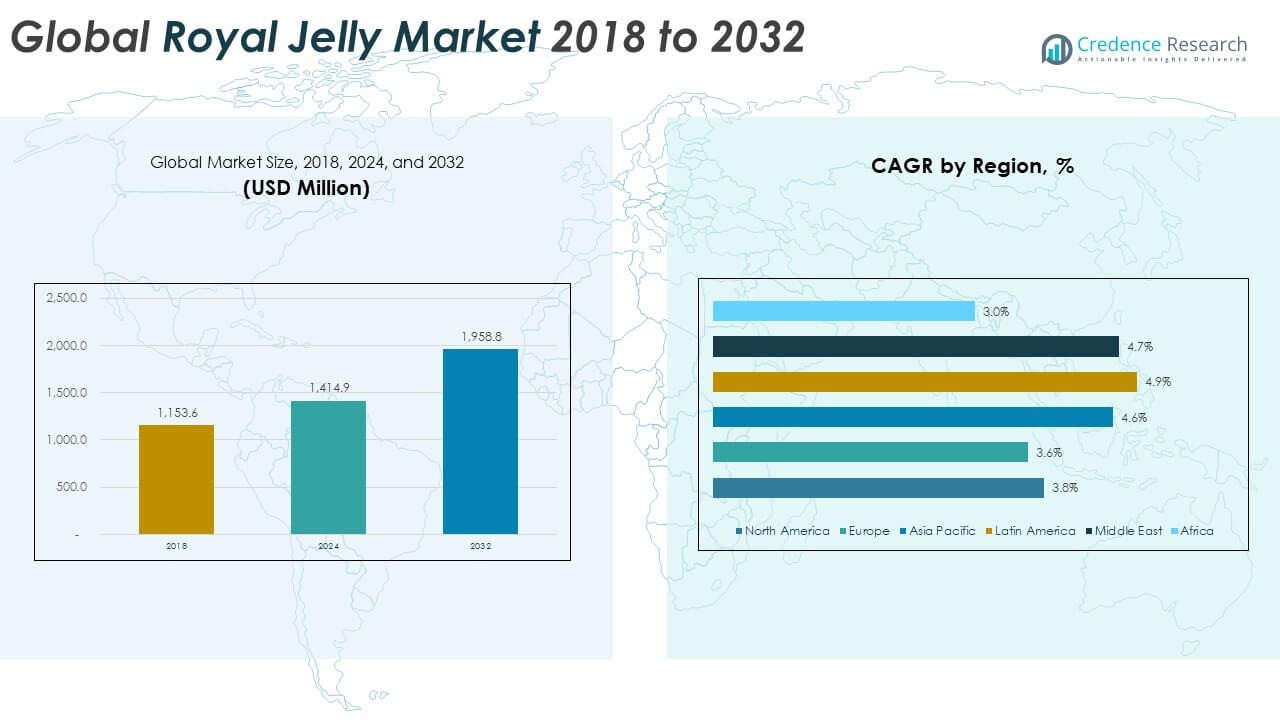

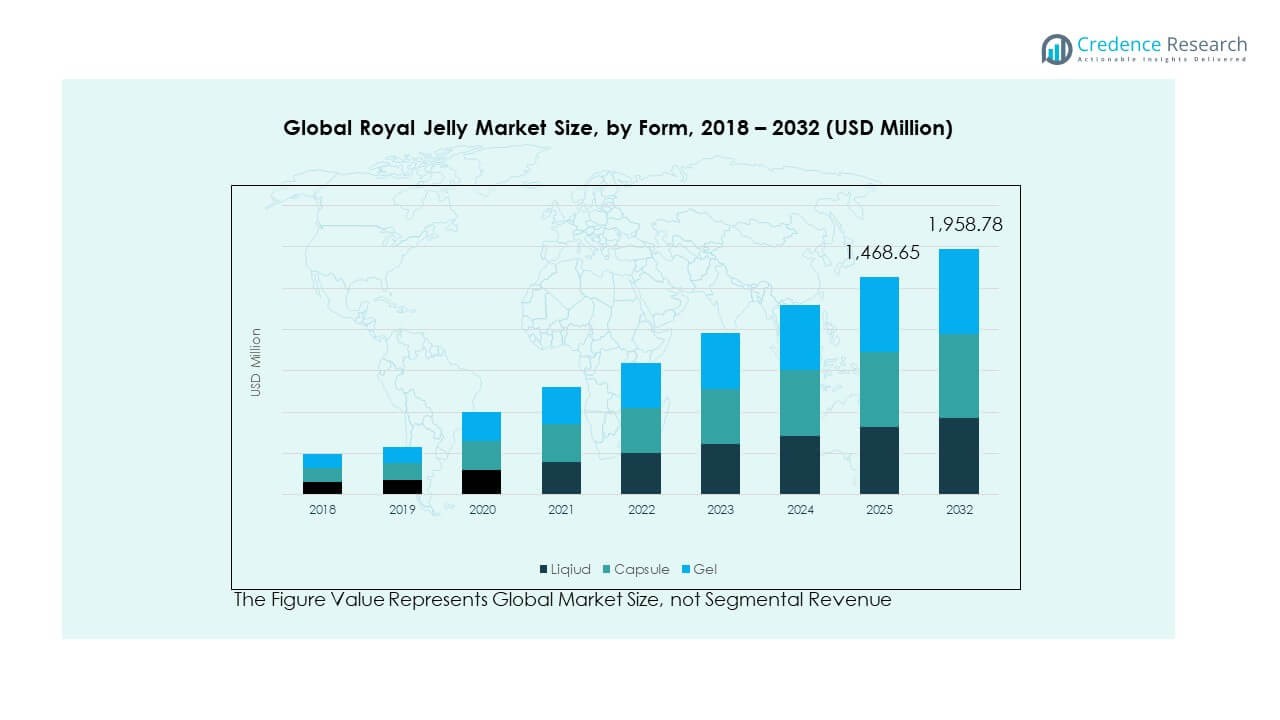

The Global Royal Jelly Market size was valued at USD 1,153.6 million in 2018 to USD 1,414.9 million in 2024 and is anticipated to reach USD 1,958.8 million by 2032, at a CAGR of 4.20% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Royal Jelly Market Size 2024 |

USD 1,414.9 Million |

| Royal Jelly Market, CAGR |

4.20% |

| Royal Jelly Market Size 2032 |

USD 1,958.8 Million |

The Global Royal Jelly Market is driven by rising consumer awareness of natural and functional food products. Increasing adoption of royal jelly in dietary supplements and skincare formulations supports its demand. Growing research into its anti-inflammatory, antioxidant, and immunity-boosting properties strengthens product credibility. Expanding application across nutraceuticals, pharmaceuticals, and cosmetics further enhances market growth potential.

Asia-Pacific leads the Global Royal Jelly Market, driven by strong consumption in China, Japan, and South Korea. Europe and North America are witnessing steady growth due to rising health awareness and preference for natural supplements. Emerging markets in Latin America and the Middle East show growing adoption, supported by urbanization, lifestyle changes, and expanding distribution networks promoting bee-derived wellness products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Royal Jelly Market size was valued at USD 1,153.6 million in 2018, reached USD 1,414.9 million in 2024, and is projected to hit USD 1,958.8 million by 2032, expanding at a CAGR of 4.20%.

- Asia Pacific leads with 37% market share, driven by strong production in China, Japan, and South Korea, along with high consumer trust in natural and functional bee-based products.

- Europe follows with 24%, supported by its strict quality standards, sustainability focus, and high demand for organic supplements, while North America holds 19%, led by the U.S. nutraceutical and cosmetic sectors.

- Latin America is the fastest-growing region, holding about 12% share, fueled by increasing urbanization, rising disposable incomes, and expansion of local apiculture industries.

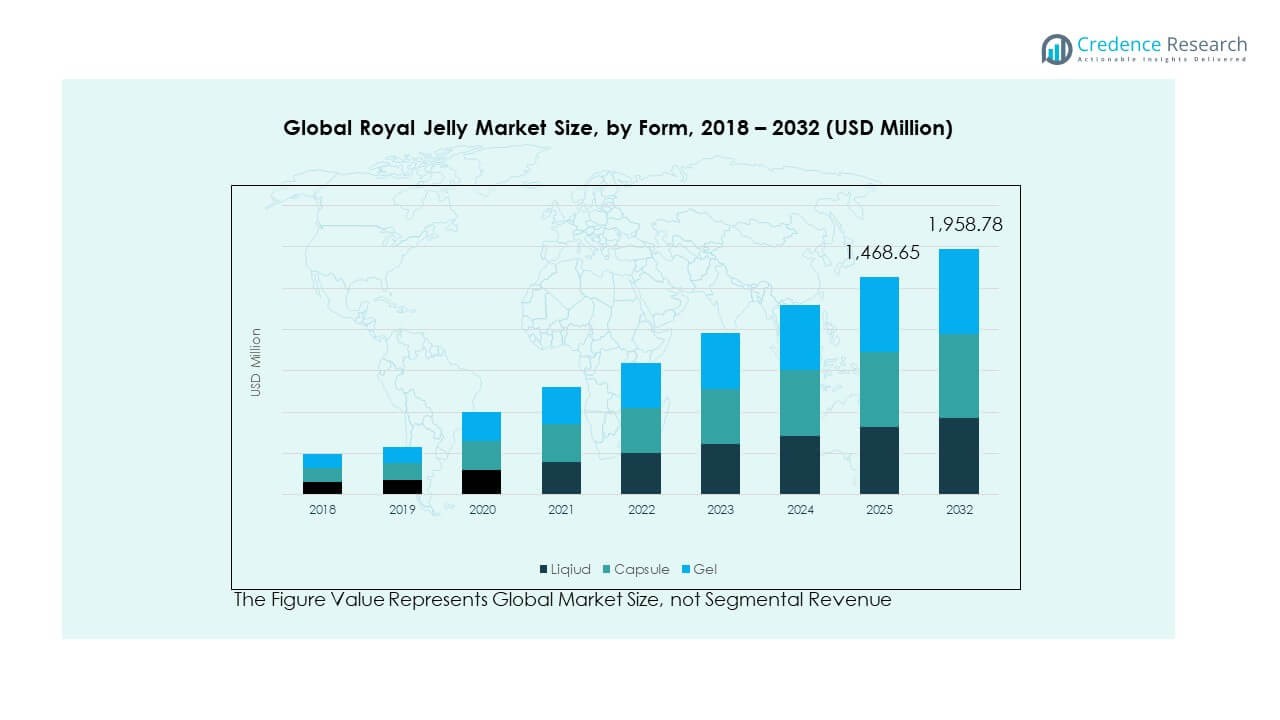

- Based on form, Liquid products account for roughly 45% of total market share, while Capsules hold 35%, with Gel steadily expanding across skincare and health applications.

Market Drivers:

Rising Health Awareness and Preference for Natural Nutraceuticals

Consumers are increasingly shifting toward natural and organic health supplements, strengthening the Global Royal Jelly Market. Royal jelly’s rich nutritional content, including proteins, amino acids, and vitamins, attracts attention from health-conscious individuals. It supports immunity enhancement and overall wellness, fueling global consumption. Pharmaceutical and nutraceutical firms are incorporating royal jelly into tablets, capsules, and energy drinks. Growing awareness of preventive healthcare promotes product demand. E-commerce and health retail platforms enhance accessibility and visibility. The clean-label trend supports wider consumer trust in bee-derived ingredients. It creates a favorable environment for market expansion.

Expanding Use in Cosmetic and Skincare Applications

The Global Royal Jelly Market benefits from strong growth in cosmetic applications due to its anti-aging and skin-repair properties. Beauty brands are integrating royal jelly in creams, serums, and face masks targeting hydration and rejuvenation. It boosts collagen synthesis and enhances skin elasticity, appealing to consumers seeking natural beauty solutions. Rising awareness of sustainable and ethical skincare supports the adoption of bee-based formulations. The growing male grooming segment also contributes to new opportunities. Marketing campaigns emphasizing purity and functionality attract premium consumers. Increased collaboration between apiculture producers and cosmetic formulators accelerates innovation. It positions royal jelly as a vital bioactive in personal care industries.

- For instance, Shiseido’s Bio-Performance Advanced Super Revitalizing Cream contains Super Bio-Hyaluronic Acid to deliver long-lasting moisture. In an independent consumer study of 202 participants, 93% reported that their skin had become “very smooth” after one month of regular use.

Rising Demand in Functional Food and Beverage Applications

The Global Royal Jelly Market is witnessing expanding integration into fortified foods and drinks. Manufacturers are introducing royal jelly-enriched honey, milk, and energy beverages to attract wellness-focused buyers. The rising focus on energy-boosting natural ingredients supports demand across fitness and active lifestyle segments. It promotes endurance, cognitive health, and fatigue reduction, appealing to working professionals and athletes. Food companies use advanced encapsulation technologies to preserve bioactivity. Growing retail and online availability expand consumer reach. Strategic product diversification enhances brand competitiveness. It establishes royal jelly as a mainstream functional ingredient in the evolving health food industry.

Government Initiatives and Supportive Apiculture Development

Governments and industry bodies are promoting apiculture as part of sustainable agricultural practices, stimulating the Global Royal Jelly Market. Financial incentives and training programs for beekeepers increase production capacity and quality. Enhanced regulatory frameworks ensure standardized product purity and traceability. It improves consumer trust and supports international trade. Technological advancements in bee management optimize yield and resource efficiency. Growing export opportunities in Asia-Pacific and Europe strengthen global supply chains. Research institutions are partnering with agricultural agencies to improve extraction and preservation processes. These coordinated efforts boost long-term market sustainability.

Market Trends:

Emergence of Premium and Organic Royal Jelly Products

The Global Royal Jelly Market is witnessing a shift toward premium and certified organic products. Consumers are prioritizing traceability and purity in natural supplements. Producers are offering organic-certified royal jelly with transparent sourcing practices. It helps brands differentiate and justify premium pricing strategies. The trend aligns with growing demand for ethical and environmentally safe products. Companies focus on cold-chain logistics to retain nutrient value. Packaging innovations highlight freshness and authenticity. This movement redefines consumer expectations toward higher-quality royal jelly products.

- For instance, a company like Beekeeper’s Naturals offers a royal jelly product like its B.LXR Brain Fuel, which is tested by independent laboratories for pesticides and contaminants.

Technological Advancements in Extraction and Preservation

Innovations in freeze-drying and microencapsulation technologies are transforming the Global Royal Jelly Market. These processes extend shelf life and preserve bioactive compounds effectively. Manufacturers adopt advanced cold-extraction methods to minimize oxidation and nutrient loss. It ensures consistent product potency for supplements and cosmetics. Automation in production enhances efficiency and quality control. Continuous R&D drives new formulations with improved absorption and taste. These developments help brands expand product portfolios across multiple categories. Technology-driven improvements enhance competitiveness in global markets.

- For instance, Y.S. Organic Bee Farms, a company founded in 1985, is known for its long-standing reputation as a leader in certified organic beekeeping. Their products, such as raw honey and royal jelly, are certified organic, unpasteurized, and unfiltered, and the company emphasizes its focus on producing high-quality, natural bee products. Y.S. Eco Bee Farms, a name associated with the company, has also long promoted its products, including royal jelly, for their “maximum level of 10-HDA,” and uses raw honey for preservation.

E-Commerce Growth and Digital Marketing Expansion

The Global Royal Jelly Market is experiencing strong momentum from online retail platforms. E-commerce offers consumers convenient access to diverse product options. Digital marketing campaigns and influencer promotions drive awareness of product benefits. It enables manufacturers to target niche health and beauty audiences. Subscription-based delivery models promote customer retention. User-generated content and product reviews strengthen brand credibility. Cross-border e-commerce supports exports to health-conscious regions. This trend increases market visibility and consumer engagement globally.

Rising Popularity of Combination Formulations with Other Superfoods

Manufacturers are blending royal jelly with honey, propolis, and ginseng, diversifying the Global Royal Jelly Market. These formulations enhance nutritional value and taste. It attracts consumers seeking multifunctional wellness products. Combination supplements improve energy, vitality, and immune support. Brands promote synergistic benefits through targeted campaigns. Research-backed product positioning appeals to educated buyers. The expanding variety in hybrid products increases consumption frequency. This trend reinforces royal jelly’s role in holistic wellness nutrition.

Market Challenges Analysis:

Fluctuating Production and Supply Chain Limitations

The Global Royal Jelly Market faces volatility due to climate-sensitive beekeeping practices. Production depends heavily on seasonal variations, affecting consistency and volume. Diseases and habitat loss among bee colonies disrupt raw material supply. It leads to price fluctuations and limited availability for manufacturers. Small-scale beekeepers often lack access to modern preservation facilities, reducing product quality. Export logistics for temperature-sensitive products add operational challenges. Regulatory differences between countries complicate global trade. The sector must address sustainability and supply stability through better infrastructure and technology adoption.

Quality Standardization and Regulatory Constraints

Variability in royal jelly composition poses challenges for standardization within the Global Royal Jelly Market. Differences in protein content, freshness, and storage conditions impact quality perception. Regulatory bodies impose strict labeling and testing requirements that increase compliance costs. It creates barriers for smaller producers entering premium markets. Counterfeit and adulterated products damage consumer trust. Limited global harmonization of safety standards restricts cross-border trade. Continuous efforts toward uniform testing and certification can support better market transparency and consumer confidence.

Market Opportunities:

Expanding Application Scope Across Health and Wellness Sectors

The Global Royal Jelly Market is gaining traction across healthcare, nutrition, and cosmetic industries. Its wide-ranging biological benefits attract pharmaceutical and nutraceutical manufacturers. It is being explored for managing cholesterol, inflammation, and oxidative stress. Rising awareness of holistic wellness boosts consumer interest in multifunctional products. Cross-sector collaborations are expanding product innovation potential. Retailers are offering new dosage forms such as soft gels and oral liquids. This diversification strengthens brand portfolios and enhances accessibility across demographics. The trend supports sustained growth across the global health ecosystem.

Growing Demand in Emerging Economies and Online Retail Expansion

The Global Royal Jelly Market is witnessing rising demand from emerging markets in Asia-Pacific, Latin America, and the Middle East. Increasing disposable incomes and urban lifestyles foster health-focused consumption. It benefits from digital platforms offering direct-to-consumer access. Global brands are leveraging e-commerce channels to reach new audiences. Local players are partnering with online distributors to improve visibility. Rapid urbanization and social media engagement enhance awareness of natural supplements. This shift expands market penetration and accelerates future growth potential worldwide.

Market Segmentation Analysis:

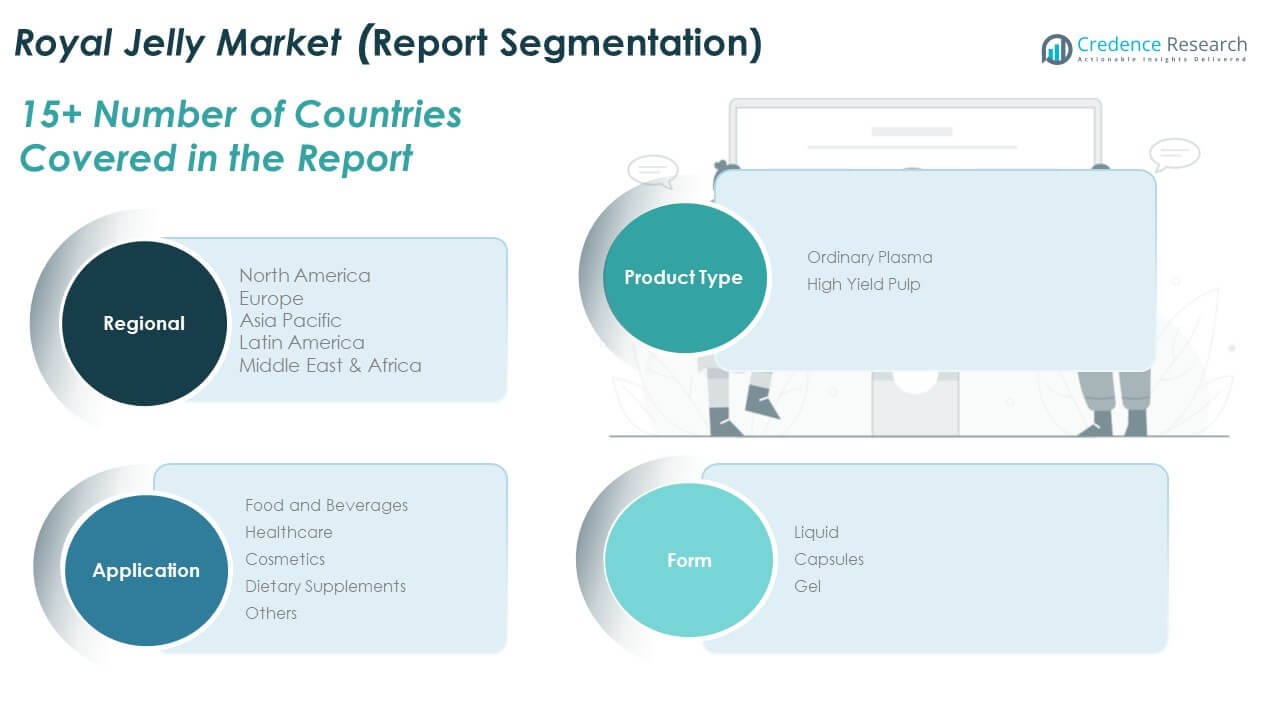

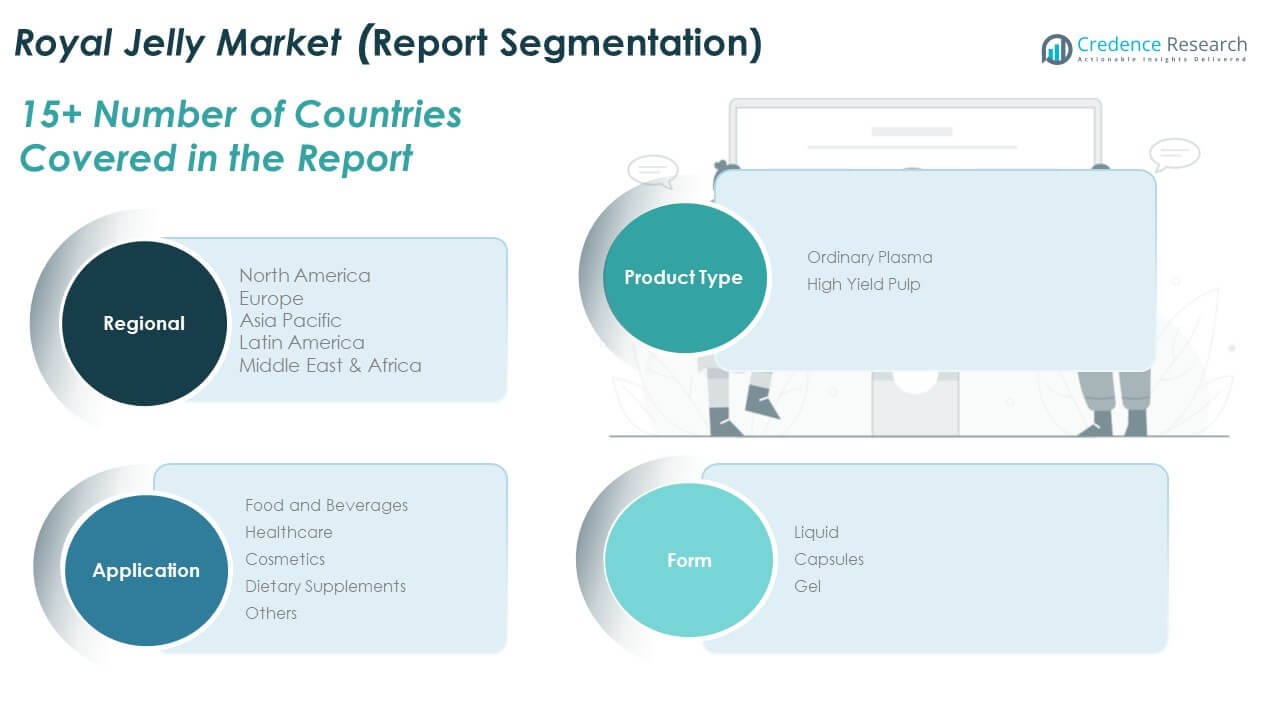

By Product Segment

The Global Royal Jelly Market is segmented into Ordinary Plasma and High Yield Pulp. Ordinary plasma dominates due to its widespread use in traditional health supplements and food products. It offers balanced nutrient content and easy formulation compatibility. High yield pulp is gaining traction for its concentrated composition and enhanced bioactive properties. It is preferred in premium nutraceuticals and cosmetic formulations that emphasize potency and purity. Growing production innovations and quality extraction techniques are driving higher adoption across both segments.

- For instance, based on publicly available product information, Now Foods offers a range of royal jelly supplements, with some products emphasizing a high percentage of the active compound 10-HDA, while others focus on different concentrations and delivery methods.

By Application Segment

The Global Royal Jelly Market finds major applications in Food and Beverages, Healthcare, Cosmetics, Dietary Supplements, and Others. The dietary supplements segment holds a strong position, supported by increasing health awareness and preventive nutrition trends. Healthcare applications are growing through pharmaceutical integration and immunity-focused product lines. Cosmetics leverage royal jelly’s anti-aging and skin-repair benefits to create high-value beauty solutions. Food and beverage producers are infusing it into functional products targeting energy and vitality enhancement.

- For instance, Suntory Wellness sells supplements containing royal jelly in Japan, such as the Royal Jelly + Sesamin E tablet product, not a beverage. The product is a tablet supplement with a recommended daily dosage of 4 tablets, containing 1,800 mg of royal jelly (raw equivalent).

By End User Segment

The Global Royal Jelly Market is divided into Liquid, Capsules, and Gel segments. Liquid forms lead due to their easy absorption and use in food and drink formulations. Capsules are gaining preference among consumers seeking convenient and precise dosage options. Gel-based products are expanding across skincare and health applications due to their versatility and smooth formulation. Each format caters to specific consumer needs, reinforcing product diversity and supporting sustained market growth.

Segmentation:

- By Product Segment:

- Ordinary Plasma

- High Yield Pulp

- By Application Segment:

- Food and Beverages

- Healthcare

- Cosmetics

- Dietary Supplements

- Others

- By End User Segment:

- By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Royal Jelly Market size was valued at USD 230.73 million in 2018 to USD 276.91 million in 2024 and is anticipated to reach USD 372.17 million by 2032, at a CAGR of 3.8% during the forecast period. North America accounts for around 19% of the global market share. The region benefits from strong consumer demand for natural and functional health products. The United States leads due to its developed nutraceutical and cosmetic industries. Royal jelly is used widely in dietary supplements promoting energy, immunity, and cognitive wellness. Canada shows increasing growth supported by expanding health-conscious populations and online retail penetration. Product innovation and strategic distribution partnerships enhance availability. It continues to gain popularity as part of holistic wellness trends across urban consumers.

Europe

The Europe Global Royal Jelly Market size was valued at USD 285.87 million in 2018 to USD 339.81 million in 2024 and is anticipated to reach USD 450.52 million by 2032, at a CAGR of 3.6% during the forecast period. Europe holds nearly 24% of the global market share. Countries such as Germany, France, and the UK are major contributors due to robust demand for organic supplements and skincare products. Strict regulatory frameworks emphasize product quality and purity. It supports the growth of certified and traceable royal jelly products. European consumers prefer sustainable and ethically sourced ingredients. Growing integration into anti-aging cosmetics and wellness beverages further drives adoption. Rising focus on eco-friendly packaging and local sourcing strengthens the regional market presence.

Asia Pacific

The Asia Pacific Global Royal Jelly Market size was valued at USD 403.78 million in 2018 to USD 507.34 million in 2024 and is anticipated to reach USD 724.75 million by 2032, at a CAGR of 4.6% during the forecast period. Asia Pacific dominates with about 37% of the global market share. China, Japan, and South Korea lead production and consumption due to established apiculture industries. It benefits from widespread traditional medicine usage and strong consumer trust in bee-derived products. Expanding applications in food, cosmetics, and pharmaceuticals drive consistent demand. Technological advancements in extraction and preservation enhance product quality. India and Southeast Asia are emerging growth markets with rising disposable incomes. Regional manufacturers focus on exports and value-added innovations to strengthen their position globally.

Latin America

The Latin America Global Royal Jelly Market size was valued at USD 123.09 million in 2018 to USD 157.40 million in 2024 and is anticipated to reach USD 229.77 million by 2032, at a CAGR of 4.9% during the forecast period. Latin America represents roughly 12% of the global market share. Brazil and Argentina lead consumption supported by growing awareness of nutritional and cosmetic benefits. It is gaining visibility across wellness and organic supplement channels. Local producers are investing in beekeeping modernization to improve quality standards. Rising demand from urban populations seeking natural health solutions supports growth. Export potential is expanding, with regional players focusing on European and Asian partnerships. The trend toward clean-label and sustainable products aligns with evolving consumer preferences in Latin markets.

Middle East

The Middle East Global Royal Jelly Market size was valued at USD 58.84 million in 2018 to USD 74.28 million in 2024 and is anticipated to reach USD 106.75 million by 2032, at a CAGR of 4.7% during the forecast period. The region accounts for approximately 5% of the global market share. Gulf Cooperation Council countries, including Saudi Arabia and the UAE, are leading markets with rising demand for health supplements. Growing disposable incomes and strong retail expansion drive product visibility. It is gaining traction among consumers seeking natural alternatives for immunity and vitality enhancement. Import dependency encourages regional partnerships and private labeling initiatives. The rise of e-commerce and specialty health stores supports market accessibility. Ongoing investments in bee farming and local production improve regional supply stability.

Africa

The Africa Global Royal Jelly Market size was valued at USD 51.34 million in 2018 to USD 59.14 million in 2024 and is anticipated to reach USD 74.83 million by 2032, at a CAGR of 3.0% during the forecast period. Africa contributes nearly 3% of the global market share. The market is growing gradually with expanding awareness of natural health products. South Africa leads in demand supported by the nutraceutical and skincare industries. It benefits from government support for apiculture development and small-scale beekeeping. Challenges such as limited infrastructure and distribution networks restrict wider adoption. Emerging online retail platforms are creating new consumer touchpoints. Rising urbanization and improving income levels foster steady growth across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- S. Organic Bee Farms

- NOW Foods

- NaturaNectar

- Golden Hive

- Durham’s Bee Farm

- Swanson Health Products

- Bee Alive

- API Health

- Highland Beekeeping

- Puritan’s Pride

Competitive Analysis:

The Global Royal Jelly Market is characterized by moderate competition with the presence of regional and international players. Companies focus on organic certification, product diversification, and technological innovation to maintain market presence. It witnesses growing strategic alliances among producers and distributors to expand supply networks. Established firms invest in R&D to enhance product purity, shelf life, and nutrient retention. Branding initiatives emphasizing sustainability and quality assurance strengthen consumer trust. Local apiculture enterprises are emerging as strong niche competitors through direct sales and e-commerce. The increasing preference for traceable and ethically sourced products supports continuous product innovation.

Recent Developments:

- In October 2023, the Indian government announced a program to train tribal women in advanced techniques for extracting royal jelly from worker bees.

Report Coverage:

The research report offers an in-depth analysis based on Product Segment and Application Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for clean-label and organic royal jelly products will rise globally.

- Innovations in extraction and preservation technology will enhance product quality.

- Nutraceutical and cosmetic applications will remain key growth contributors.

- Expansion of e-commerce platforms will boost market accessibility worldwide.

- Emerging economies will see strong growth through increased health awareness.

- Sustainable apiculture practices will become critical for supply stability.

- Product diversification across liquid, capsule, and gel formats will strengthen sales.

- Regulatory harmonization across major regions will support global trade.

- Partnerships between farmers and supplement brands will improve sourcing transparency.

- Ongoing R&D investments will drive next-generation bioactive formulations.