| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mobile Phone Accessories Market Size 2024 |

USD 79.7 billion |

| Mobile Phone Accessories Market CAGR |

6.63% |

| Mobile Phone Accessories Market Size 2032 |

USD 132.9 billion |

Market Overview

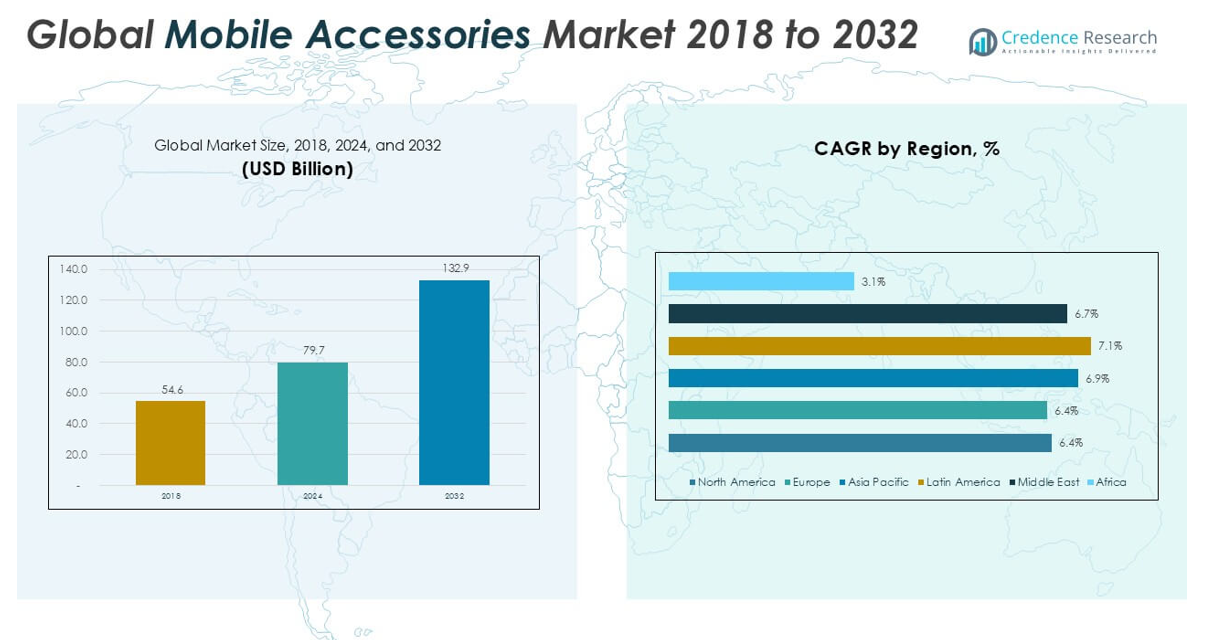

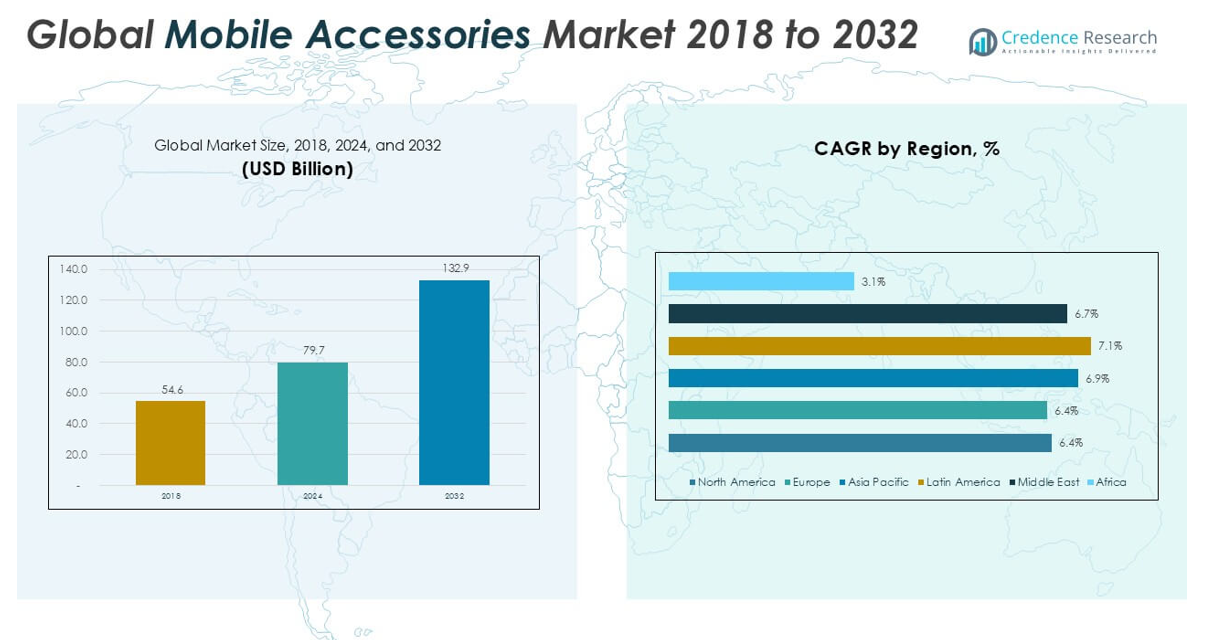

The Mobile Phone Accessories market size was valued at USD 54.6 billion in 2018 and USD 79.7 billion in 2024, and is anticipated to reach USD 132.9 billion by 2032, at a CAGR of 6.63% during the forecast period.

The Mobile Phone Accessories market is characterized by strong competition among top players such as Apple Inc., Samsung Electronics Co., Ltd., Belkin International, Inc., Anker Innovations Limited, Logitech International S.A., Aukey Technology Co., Ltd., RAVPower, Mophie, OtterBox, and Case-Mate. These companies maintain their leadership through robust product portfolios, continuous innovation, and expansive global distribution networks. Asia Pacific leads the market with a 35.6% share, driven by high smartphone adoption and large consumer bases in countries like China and India. North America and Europe follow, with market shares of 15.4% and 18.7% respectively, supported by premium product demand and advanced retail infrastructure.

Market Insights

- The Mobile Phone Accessories market reached USD 79.7 billion in 2024 and is projected to achieve USD 132.9 billion by 2032, registering a CAGR of 6.63% during the forecast period.

- Rising global smartphone adoption, increasing demand for protective and functional accessories, and frequent device upgrades continue to drive robust market growth across all regions.

- Key trends include the shift toward wireless and smart accessories, rapid innovation in fast-charging and eco-friendly products, and growing consumer preference for customization and premium quality.

- The market is highly competitive, led by major players such as Apple Inc., Samsung Electronics Co., Ltd., Belkin International, Anker Innovations Limited, Logitech, and others, with Asia Pacific holding a dominant 35.6% regional share and mobile cases being the leading product segment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type:

Mobile cases represent the largest share within the product type segment, primarily driven by the consistent demand for device protection and personalization. Rugged and designer cases dominate this space, appealing to a wide spectrum of consumers who value both durability and style. Chargers account for a substantial share of the Mobile Phone Accessories market, with fast-charging and wireless chargers emerging as the leading sub-segments. Consumer preference for efficient and quick power solutions drives this segment, especially as device usage intensifies. Mobile earphones & chargers form a robust segment, where true wireless earbuds command the highest market share. The battery segment captures a notable portion of the market, with replacement batteries and extended-life options leading the way. Consumers are replacing batteries more frequently due to increased mobile usage for gaming, streaming, and business. Power banks have become an indispensable accessory, especially among travelers and professionals requiring uninterrupted connectivity.

- For instance, Xiaomi’s Mi Power Bank 3 Ultra Compact provides a capacity of 10,000 mAh and supports up to three devices simultaneously with its dual USB-A and single USB-C ports.

By Distribution Channel

Within the construction distribution channel, Bricks and Blocks stand as the dominant sub-segment. Demand for Mobile Phone Accessories in this segment is largely driven by field workers and contractors seeking rugged, durable accessories for use on construction sites. Bricks and Blocks represent the leading sub-segment in construction, where heavy-duty Mobile Phone Accessories are essential for protecting devices in challenging environments. The dominant sub-segment addresses the need for durable products that withstand vibration, dust, and extreme conditions, ensuring uninterrupted device usage for workers and supervisors on the move. The Portland Cement and Concrete sub-segment features accessories engineered for extreme durability and protection. Mobile cases and power banks are particularly prominent, with their market share driven by the harsh, dusty conditions prevalent in this environment. The segment benefits from continuous innovation aimed at increasing the lifespan and reliability of mobile devices in the field. Agriculture as a distribution channel sees demand for weatherproof and rugged Mobile Phone Accessories, with power banks and waterproof cases as dominant products.

- For instance, Caterpillar’s Cat S62 Pro smartphone is designed for tough environments, meeting MIL-STD-810H standards for drop resistance up to 1.8 meters onto steel.

Market Overview

Rising Smartphone Penetration

Growing global smartphone adoption drives robust demand for Mobile Phone Accessories. As emerging economies witness higher smartphone ownership, the need for protective cases, chargers, earphones, and power banks continues to rise. Consumers are increasingly seeking products that enhance device functionality, comfort, and longevity, which directly fuels market expansion. The proliferation of affordable smartphones in both urban and rural markets ensures sustained growth for the accessory ecosystem across diverse user demographics.

- For instance, Samsung shipped 272 million smartphones worldwide in 2022, supporting increased demand for corresponding accessories.

Technological Advancements and Product Innovation

Advances in mobile technology and accessory design propel the market forward. Manufacturers are focusing on features such as fast charging, wireless connectivity, and enhanced durability. Innovations like true wireless earphones, quick-charging power banks, and eco-friendly materials capture evolving consumer preferences. These innovations drive frequent upgrades and repeat purchases, establishing a cycle of continual demand and expanding the market for premium, value-added accessories.

- or instance, Belkin’s BOOST↑CHARGE PRO 3-in-1 Wireless Charger with MagSafe delivers up to 15 watts of wireless power for iPhone 12 and later, enabling simultaneous charging for iPhone, Apple Watch, and AirPods.

Growth of E-commerce Channels

The rapid expansion of e-commerce has revolutionized the distribution of Mobile Phone Accessories. Online retail platforms offer consumers a wide variety of products, competitive pricing, and the convenience of home delivery. E-commerce enables brands to reach broader markets without significant investments in physical infrastructure. With the rise of digital payment systems and increased internet penetration, online channels have become a critical growth driver, especially among younger, tech-savvy consumers.

Key Trends & Opportunities

Shift Toward Wireless and Smart Accessories

Consumer preference is shifting toward wireless and smart accessories, such as Bluetooth earphones, wireless chargers, and smart wearables. The convenience of untethered devices and integration with IoT ecosystems appeal to tech-focused users. This trend creates opportunities for manufacturers to introduce innovative products that address seamless connectivity, portability, and multi-device compatibility, expanding their footprint among early adopters and lifestyle-driven buyers.

- For instance, Apple’s AirPods Max are equipped with custom-built 40-mm dynamic drivers and nine microphones, offering high-fidelity audio and adaptive noise cancellation, while seamlessly connecting across Apple devices using the H1 chip.

Sustainability and Eco-friendly Materials

Sustainability is emerging as a significant trend in the Mobile Phone Accessories market. Consumers and regulatory bodies are demanding products made from recycled or biodegradable materials. Brands that prioritize sustainable sourcing and eco-conscious packaging gain a competitive edge. This shift presents opportunities for manufacturers to differentiate their offerings, capture environmentally aware consumers, and contribute to global sustainability goals.

For instance, Logitech has incorporated post-consumer recycled plastic in 65% of the materials used for its K780 Multi-Device Wireless Keyboard, advancing its sustainability commitment.

Key Challenges

Intense Market Competition and Price Pressure

The Mobile Phone Accessories market faces intense competition, particularly from low-cost manufacturers and unbranded products. This environment puts pressure on established brands to differentiate through quality, innovation, and marketing. Price wars can erode profit margins, making it challenging for premium brands to maintain market share while balancing affordability and profitability.

Counterfeit and Low-quality Products

The prevalence of counterfeit and substandard products poses a significant challenge to the market. Fake accessories often fail to meet safety and performance standards, undermining consumer trust and damaging brand reputations. Regulatory oversight and consumer education are required to combat this issue and ensure the market’s healthy, sustainable growth.

Rapid Technological Change

Frequent advances in mobile device technology can render certain accessories obsolete. Manufacturers must invest continuously in research and development to stay ahead of changing compatibility requirements and evolving consumer preferences. Failure to adapt quickly risks inventory obsolescence and loss of relevance in a highly dynamic market.

Regional Analysis

North America

North America accounted for USD 10.25 billion in 2018, rising to USD 14.81 billion in 2024, and is projected to reach USD 24.36 billion by 2032, with a CAGR of 6.4%. The region commands an estimated 15.4% market share in 2024, supported by strong smartphone adoption, frequent device upgrades, and high consumer spending on premium accessories. Technological advancements and widespread e-commerce channels further drive market growth. Early adoption of wireless charging and smart wearables reinforces North America’s role as a key revenue contributor in the global Mobile Phone Accessories market.

Europe

Europe reached a value of USD 12.49 billion in 2018, which grew to USD 17.96 billion in 2024 and is forecast to reach USD 29.36 billion by 2032, reflecting a CAGR of 6.4%. Holding a 18.7% share in 2024, Europe’s market is propelled by growing demand for stylish, functional accessories and the trend toward sustainability. Regulatory emphasis on product quality and safety boosts consumer trust. Robust retail networks and rapid uptake of new technologies ensure Europe remains a critical market for mobile accessory manufacturers.

Asia Pacific

Asia Pacific leads the global Mobile Phone Accessories market, valued at USD 22.68 billion in 2018, USD 33.60 billion in 2024, and expected to hit USD 57.13 billion by 2032, at a CAGR of 6.9%. Representing 35.6% of the market in 2024, the region benefits from surging smartphone penetration, population growth, and affordable device options. China and India are primary demand centers, fueled by price sensitivity and tech-savvy consumers. Expanding online retail and continuous innovation reinforce Asia Pacific’s dominant position.

Latin America

Latin America recorded USD 3.39 billion in 2018, increasing to USD 5.08 billion in 2024, and is projected to reach USD 8.78 billion by 2032, registering the highest CAGR at 7.1%. The region holds a 5.4% share in 2024, driven by expanding smartphone access and a youthful population. Market growth is supported by increasing internet connectivity, rising disposable incomes, and strong demand for affordable accessories. Local manufacturing and growing online distribution further fuel Latin America’s Mobile Phone Accessories sector.

Middle East

The Middle East market reached USD 4.67 billion in 2018, expanded to USD 6.85 billion in 2024, and is estimated to achieve USD 11.48 billion by 2032, with a CAGR of 6.7%. Capturing a 7.2% share in 2024, the market benefits from rising urbanization, increased smartphone usage, and a growing preference for high-quality accessories. Regional investments in digital infrastructure and a vibrant retail environment support further expansion, while consumer interest in premium products strengthens the market outlook.

Africa

Africa’s market grew from USD 1.09 billion in 2018 to USD 1.36 billion in 2024 and is forecast at USD 1.74 billion by 2032, with a CAGR of 3.1%. The region holds a modest 1.4% market share in 2024, limited by lower smartphone penetration and economic challenges. However, ongoing efforts to improve digital access and the popularity of low-cost accessories are gradually increasing demand. Urban centers show faster growth, supported by expanding retail networks and the adoption of entry-level smartphones across key African markets

Market Segmentations:

By Product Type

- Mobile Cases

- Chargers

- Mobile Earphones & Chargers

- Battery

- Power Banks

- Others

By Distribution Channel

- Construction

- Bricks and Blocks

- Road Construction

- Portland Cement and Concrete

- Agriculture

- Mining

- Others

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Mobile Phone Accessories market features a mix of global technology leaders, specialized accessory manufacturers, and innovative new entrants. Major players such as Apple Inc., Samsung Electronics Co., Ltd., Belkin International, Inc., and Anker Innovations Limited dominate through strong brand recognition, extensive product portfolios, and continuous innovation in design and functionality. Companies like Logitech International S.A., Aukey Technology Co., Ltd., RAVPower, Mophie, OtterBox, and Case-Mate further intensify market competition by targeting niche segments and delivering specialized solutions such as rugged cases, advanced power banks, and wireless charging devices. These key players leverage wide distribution channels, strategic collaborations, and frequent product launches to maintain their competitive edge. The market also sees increasing competition from regional brands and low-cost manufacturers, which challenge established players on pricing and local relevance. Continuous investment in research, sustainable materials, and technology integration remains vital for sustaining market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Apple Inc.

- Samsung Electronics Co., Ltd.

- Belkin International, Inc.

- Anker Innovations Limited

- Logitech International S.A.

- Aukey Technology Co., Ltd.

- RAVPower

- Mophie

- OtterBox

- Case-Mate

Recent Developments

- In March 2024, Apple has launched a new mobile phone case, watch band and iPhone camera mount accessories which will be available in pastel colors.

- In September 2024, Belkin, a leading consumer electronics brand for over 40 years, announced 11 new travel-ready products across its mobile charging category, as well as solutions to enable more flexible options to work while on the go.

- In July 2024, Samsung’s accessory brand, Samsung Friends, is preparing to launch a number of new cases and add-ons for its latest mobile devices, including the Galaxy Buds 3 series, Galaxy Watches, and Galaxy Z Fold 6 and Z Flip 6 foldable phones.

- In September 2023, Samsung electronics co have launched a new Samsung eco friends accessories lineup which have made accessories from recycling materials.

- In April 2022, Samsung Electronics Co., Ltd. announced a partnership with plant-based designer Sean Wotherspoon to launch an eco-friendly smartphone case and watch accessories. The device accessories are all sourced sustainably using 100% recycled materials, also all the cases and watch bands are biodegradable.

Market Concentration & Characteristics

The Mobile Phone Accessories Market displays moderate to high market concentration, with a few global leaders holding significant market share and a broad base of regional and local players operating in competitive niches. It is characterized by constant innovation, fast-paced product life cycles, and high consumer sensitivity to trends, design, and technology integration. Leading companies such as Apple Inc., Samsung Electronics Co., Ltd., Belkin International, and Anker Innovations Limited shape product standards and set pricing benchmarks, while emerging brands compete on affordability and specialized features. The market benefits from strong brand loyalty and extensive distribution networks, particularly in Asia Pacific, North America, and Europe. It exhibits a clear segmentation by product type, with mobile cases and chargers commanding the largest shares, and a growing emphasis on wireless, eco-friendly, and smart accessory categories. Intense competition, rapid technological changes, and consumer demand for both quality and affordability define its key characteristics, keeping the market dynamic and highly responsive.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Distribution Channel, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Anticipated acceleration in wireless charging and true wireless audio accessory adoption

- Continued expansion of sustainable and recycled-material products

- Growth of smart accessories integrating IoT features and health monitoring

- Rising customization demand for personalized cases and skins

- Increased focus on fast-charging capabilities and high-capacity power banks

- Expansion of accessory ecosystems tied to foldable and 5G devices

- E-commerce dominance powering direct-to-consumer accessory sales

- Emerging regional penetration in Asia Pacific and Latin America markets

- Ongoing consolidation and partnerships among major brands to innovate

- Strengthening of quality and safety standards to counter counterfeit products