Market Overview

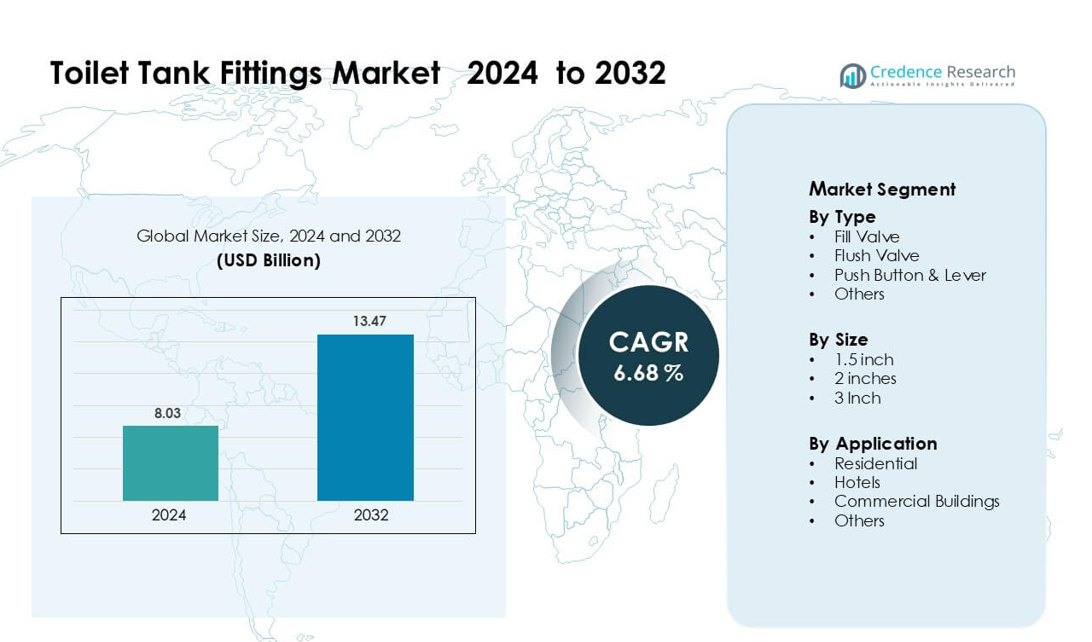

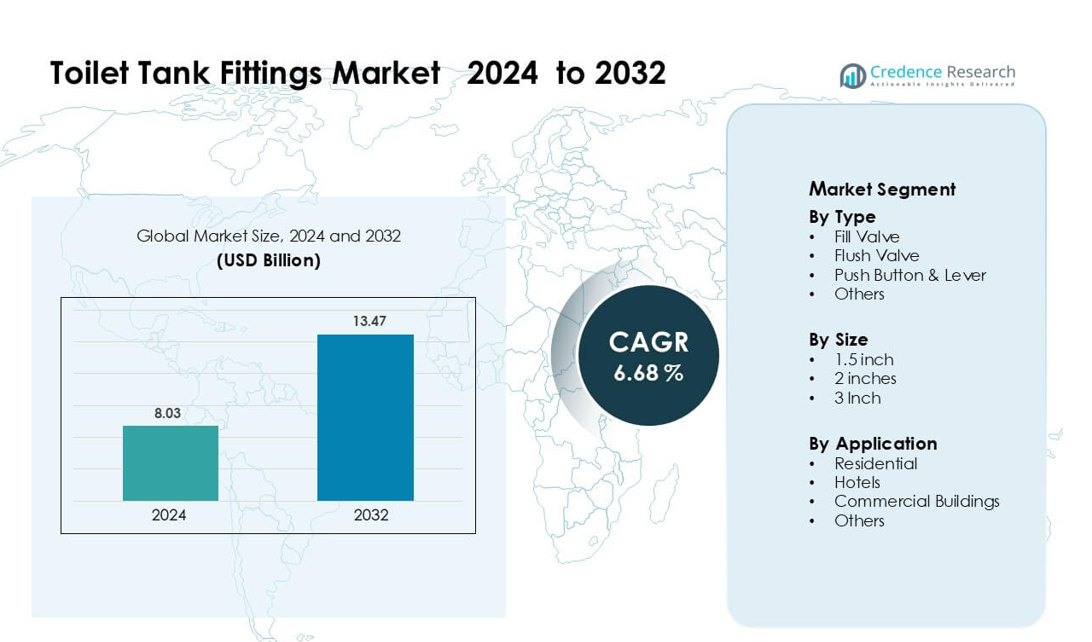

Toilet Tank Fittings Market was valued at USD 8.03 billion in 2024 and is anticipated to reach USD 13.47 billion by 2032, growing at a CAGR of 6.68 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Toilet Tank Fittings Market Size 2024 |

USD 8.03 billion |

| Toilet Tank Fittings Market, CAGR |

6.68% |

| Toilet Tank Fittings Market Size 2032 |

USD 13.47 billion |

The Toilet Tank Fittings Market is shaped by major players such as Yuyao Meige Sanitary, WDI, RandT Plumbing, SIAMP, Meitu, Zhoushan Haichen, Bestter, Geberit, Fluidmaster, and BQM, each strengthening their position through durable designs, water-saving technologies, and broad distribution networks. These companies compete by offering universal-fit valves, dual-flush systems, and corrosion-resistant materials that support both residential and commercial demand. Asia-Pacific emerged as the leading region in 2024 with about 34% share, driven by rapid urban growth, strong construction activity, and rising adoption of efficient plumbing solutions across developing markets.

Market Insights

- The Toilet Tank Fittings Market reached USD 03 million in 2024 and is projected to grow at a CAGR of 6.68% through 2032, supported by steady residential replacements and expanding commercial upgrades.

- Rising demand for water-efficient plumbing systems and frequent maintenance cycles in hotels and offices drive strong adoption of fill valves and flush valves, with fill valves holding the largest share at about 38% in 2024.

- Dual-flush technology, DIY installation trends, and wider e-commerce availability shape market growth, as consumers prefer quiet-fill, leak-resistant, and universal-fit designs.

- Leading players such as Yuyao Meige Sanitary, WDI, RandT Plumbing, SIAMP, Meitu, Zhoushan Haichen, Bestter, Geberit, Fluidmaster, and BQM compete through durability, innovation, and strong distribution networks, while price sensitivity remains a key restraint.

- Asia-Pacific led the market with around 34% share, followed by North America at 32%, driven by rapid urbanization, strong construction activity, and growing adoption of efficient flushing systems

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type

Fill valves led the Toilet Tank Fittings Market in 2024 with about 38% share. Buyers preferred fill valves due to steady demand in repair projects and their key role in water-level control. The sub-segment grew as consumers shifted toward low-noise, leak-resistant, and quick-fill mechanisms. Flush valves also gained traction with rising adoption of dual-flush systems, while push-button and lever units expanded through aesthetic upgrades. Growth across all types increased as manufacturers focused on durability, easy installation, and water-saving performance.

- For instance, Fluidmaster one of the leading players sells more than 67 million toilet-repair products annually, and its fill valves alone are used in more toilets globally than any other brand.

By Size

The 2-inch category dominated the Toilet Tank Fittings Market in 2024 with nearly 45% share. This segment remained the standard option for most residential and light-commercial toilets, supporting higher replacement frequency. Demand increased as plumbing suppliers promoted universal-fit 2-inch valves that suit a wide range of tank models. The 3-inch size gained momentum due to higher-flow designs in modern toilets, while 1.5-inch fittings stayed relevant in older installations. Market expansion was driven by wider adoption of water-efficient toilets and retrofit upgrades.

- For instance, Fluidmaster sells a 400H PerforMAX fill valve that is explicitly compatible with 2‑inch flush‑valve toilets. Fluidmaster 400H PerforMAX Fill Valve Fluidmaster markets more than 100 million toilet repair products per year, underlining how standard 2‑inch components form a large part of its global business.

By Application

Residential use held the largest share in 2024 with about 52%, supported by high replacement cycles and strong retail sales. Homeowners favored fittings with noise control, improved sealing, and water-saving functions. Hotels increased demand through frequent maintenance cycles and upgrades aimed at lowering water use. Commercial buildings adopted advanced flush valves for better durability and compliance with plumbing standards. Growth across all applications was strengthened by rising renovation activity and wider acceptance of high-efficiency flushing systems.

Key Growth Drivers

Rising Renovation and Replacement Demand

Growing renovation activity in residential and commercial buildings drives strong demand for toilet tank fittings. Many households replace aging fill valves, flush valves, and push-button mechanisms to improve water efficiency and reduce leakage issues. Commercial facilities, including malls, offices, and hotels, conduct frequent maintenance cycles that raise replacement rates and sustain steady product demand. Consumers also opt for modern, quiet-fill, and corrosion-resistant components that extend toilet life and improve performance. This shift toward faster installation, leak prevention, and long-term durability keeps the replacement market robust. Increased urban housing upgrades, plumbing maintenance programs, and availability of universal-fit valves further support market expansion.

- For instance, in 2024, Geberit recorded over 150,000 downloads of its BIM (Building Information Modeling) data packages showing strong engagement from facility managers, architects, and plumbers planning large-scale refurbishments.

Growing Focus on Water Conservation

Global efforts to reduce water consumption significantly boost adoption of advanced toilet tank fittings. Many regions enforce strict water-efficiency standards that encourage the use of dual-flush valves, adjustable fill valves, and high-efficiency flushing systems. Manufacturers respond by developing fittings that reduce per-flush water use without compromising flushing performance. Cities with water scarcity issues promote retrofitting programs that accelerate installation of low-flow systems in homes and commercial buildings. Consumer awareness of rising utility costs also increases the preference for water-saving components. These factors collectively make conservation-focused fittings a primary growth catalyst, supporting long-term adoption across new construction and replacement markets.

- For instance, Geberit Type 212 flush valve can be adjusted: its large flush volume ranges from 4 litres to 7.5 litres, and the small flush ranges from 2 litres to 4 litres, enabling significant water savings.

Expansion of Smart and Durable Plumbing Technologies

Advancements in plumbing technology create strong growth opportunities for toilet tank fittings. New designs include sensor-based flush systems, anti-corrosion materials, quiet-fill technology, and pressure-assisted fittings that enhance flushing efficiency. Premium fittings offer better reliability, reduced noise, and longer service life, attracting buyers in both residential and commercial sectors. Smart systems allow controlled flushing and leak detection, aligning with rising interest in connected home solutions. Manufacturers also improve compatibility with modern toilet designs, supporting fast installation and maintenance. These innovations help differentiate brands and increase demand for upgraded fittings, especially in markets prioritizing hygiene, convenience, and long-term performance.

Key Trend & Opportunity

Adoption of Dual-Flush and High-Efficiency Systems

The shift toward dual-flush and high-efficiency toilets creates major opportunities for tank fittings. Dual-flush systems need specialized flush valves, buttons, and seals, increasing demand for redesigned components. Many countries promote high-efficiency flushing to meet sustainability targets, pushing builders and homeowners to upgrade existing systems. Manufacturers benefit by introducing universal-fit dual-flush kits that enable retrofits without full toilet replacement. This trend aligns with water-scarcity concerns, rising environmental awareness, and regulatory requirements. As the market transitions from traditional single-flush systems, companies offering durable, leak-proof, and easy-install fittings gain a clear competitive edge.

- For instance, Geberit’s Type 212 flush valve, used in its Sigma and Omega concealed cisterns, allows full‑flush volumes of 4, 4.5, 6, or 7.5 litres, and a partial flush of 2 to 4 litres, with five throttle settings to optimize water use.

Growth of E-Commerce and DIY Installation

Online retail expansion creates strong growth avenues for toilet tank fittings. Homeowners increasingly purchase universal repair kits, fill valves, and flush valves through e-commerce platforms due to wider product choice and fast delivery. DIY maintenance is gaining popularity as modern fittings include simple installation features, video guides, and tool-free adjustment mechanisms. Manufacturers leverage this shift by offering bundled repair sets and compatibility-focused designs that appeal to non-professional users. The trend also supports premium fittings such as noise-control and water-saving products, which gain higher visibility online. As DIY adoption rises, suppliers strengthen digital branding and user-support channels to drive sales.

- For instance, Geberit s Duofix installation element uses the EFF3 (Easy Fast Fixing) system, which enables a mostly tool‑free installation and is said to cut installation time by 40% compared to conventional systems.

Growing Demand from Hospitality and Commercial Upgrades

Hotels, airports, and large commercial buildings present significant opportunities as they adopt durable and water-efficient fittings to reduce operating costs. High-traffic restrooms require robust flush valves, heavy-duty fill valves, and high-performance seals that withstand frequent use. Many facilities implement maintenance schedules to prevent leakage and meet hygiene standards, supporting repeat demand. Hospitality projects also prioritize guest comfort by adopting quiet-fill systems and modern push-button mechanisms. As tourism grows and commercial properties expand, demand for reliable, long-life toilet fittings increases. This trend encourages manufacturers to design premium components tailored for intensive daily use.

Key Challenge

Price Sensitivity and High Market Competition

The Toilet Tank Fittings Market faces intense price competition, especially in the mass-market segment. Many buyers choose low-cost valves and levers, reducing margins for manufacturers offering premium or advanced features. Local producers in emerging markets supply low-priced alternatives that challenge global brands. Retailers also push for competitive pricing, making differentiation difficult. As replacement cycles vary across regions, suppliers struggle to maintain consistent revenue. Price-sensitive consumers often prioritize cost over durability or efficiency, slowing adoption of advanced fittings. This pressure forces companies to balance innovation with affordability, creating a major strategic challenge.

Quality Variations and Maintenance Issues

Inconsistent product quality poses a significant challenge for market growth. Low-quality fittings may leak, degrade quickly, or fail under high water pressure, resulting in frequent replacements and customer dissatisfaction. Commercial facilities face higher risks as poor-quality valves increase maintenance costs and downtime. Variations in material standards across markets complicate product compatibility and long-term reliability. Poor installation practices further contribute to failure rates, making end users cautious about upgrading. These issues place pressure on manufacturers to improve material quality, certification, and performance testing, while educating installers to ensure reliable operation and longer product life.

Regional Analysis

North America

North America held about 32% share in 2024, driven by high renovation activity and steady replacement demand across residential and commercial buildings. Consumers preferred water-saving fill valves and upgraded flush mechanisms that meet strict plumbing standards. Hotels, offices, and public facilities increased adoption of durable fittings to reduce maintenance and enhance efficiency. Strong retail penetration and availability of universal-fit repair kits supported wider market reach. Growing interest in low-noise and leak-resistant designs further strengthened product demand across the U.S. and Canada.

Europe

Europe accounted for nearly 28% share in 2024, supported by strong sustainability regulations and wide acceptance of dual-flush systems. Countries such as Germany, the U.K., and France adopted high-efficiency fittings to reduce water consumption in homes and commercial buildings. Renovation programs in aging residential infrastructure increased replacement cycles, while hotels and institutional buildings favored durable components with long service life. Manufacturers gained traction through advanced sealing technologies and corrosion-resistant materials. The region’s focus on eco-design and certified plumbing products helped boost long-term growth.

Asia-Pacific

Asia-Pacific led the Toilet Tank Fittings Market with about 34% share in 2024, supported by rapid urban development and strong residential construction growth. Expanding middle-class populations in China, India, and Southeast Asia increased demand for affordable, easy-install fittings. Commercial infrastructure upgrades, including malls, hotels, and airports, boosted adoption of high-durability flush valves. Rising awareness of water efficiency encouraged wider use of dual-flush and low-flow systems. Local manufacturers strengthened market presence with cost-competitive products, while premium brands gained momentum in urban areas.

Latin America

Latin America captured roughly 4% share in 2024, driven by steady demand for replacement fittings in residential spaces. Brazil and Mexico remained key markets due to rising housing upgrades and gradual adoption of water-efficient plumbing systems. Consumers sought reliable and budget-friendly fill valves and flush mechanisms suitable for older toilet models. Commercial facilities, including hotels and offices, increased maintenance-driven replacements, supporting moderate growth. Limited infrastructure investment slowed broader adoption, but growing retail availability of universal repair kits improved market accessibility.

Middle East & Africa

The Middle East & Africa accounted for about 2% share in 2024, supported mainly by construction activity in the UAE, Saudi Arabia, and South Africa. Commercial buildings and hospitality projects adopted durable, high-performance flush valves to handle heavy usage. Water-scarcity concerns accelerated interest in efficient fittings across select markets. Residential adoption grew gradually as households replaced older components to reduce leakage and improve performance. Despite limited penetration of premium products, the region showed steady potential through expanding urban development and plumbing modernization efforts.

Market Segmentations:

By Type

- Fill Valve

- Flush Valve

- Push Button & Lever

- Others

By Size

By Application

- Residential

- Hotels

- Commercial Buildings

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Toilet Tank Fittings Market features leading companies such as Yuyao Meige Sanitary, WDI, RandT Plumbing, SIAMP, Meitu, Zhoushan Haichen, Bestter, Geberit, Fluidmaster, and BQM, each strengthening market presence through product innovation and wide distribution. Major players focus on durable materials, leak-resistant designs, and universal-fit mechanisms to meet rising replacement demand. Brands expand portfolios with dual-flush systems, quiet-fill valves, and corrosion-resistant components that appeal to both residential and commercial users. Strong OEM partnerships help secure volume sales, while e-commerce visibility boosts direct consumer reach. Many manufacturers invest in automated production and quality testing to improve reliability and reduce failure rates. Competition intensifies as local suppliers offer cost-efficient alternatives, pushing established companies to emphasize performance, long service life, and compliance with water-efficiency standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Yuyao Meige Sanitary

- WDI

- RandT Plumbing

- SIAMP

- Meitu

- Zhoushan Haichen

- Bestter

- Geberit

- Fluidmaster

- BQM

Recent Developments

- In July 2025, an industry feature highlights Geberit flush tanks with TurboFlush low-noise flushing. The coverage strengthens Geberit positioning in premium concealed cistern and fitting solutions.

- In January 2025, Fluidmaster sponsored Waterwise’s Leaky Loo Challenge campaign in the UK. The partnership promoted toilet repair and tank fitting upgrades to cut leakage.

Report Coverage

The research report offers an in-depth analysis based on Type, Size, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as homeowners replace aging valves with efficient designs.

- Dual-flush and low-flow systems will see wider global adoption.

- Smart and sensor-based fittings will gain traction in premium residential projects.

- Hotels and commercial buildings will increase upgrades to reduce water use.

- Manufacturers will focus on durable, corrosion-resistant materials to improve product life.

- E-commerce channels will expand reach for repair kits and universal-fit components.

- DIY installation demand will rise due to easier adjustment and tool-free mechanisms.

- Product innovation will center on noise reduction and leak-proof performance.

- Local suppliers will intensify competition with cost-effective alternatives.

- Asia-Pacific will remain the key growth region driven by construction and urban expansion.