Market Overview

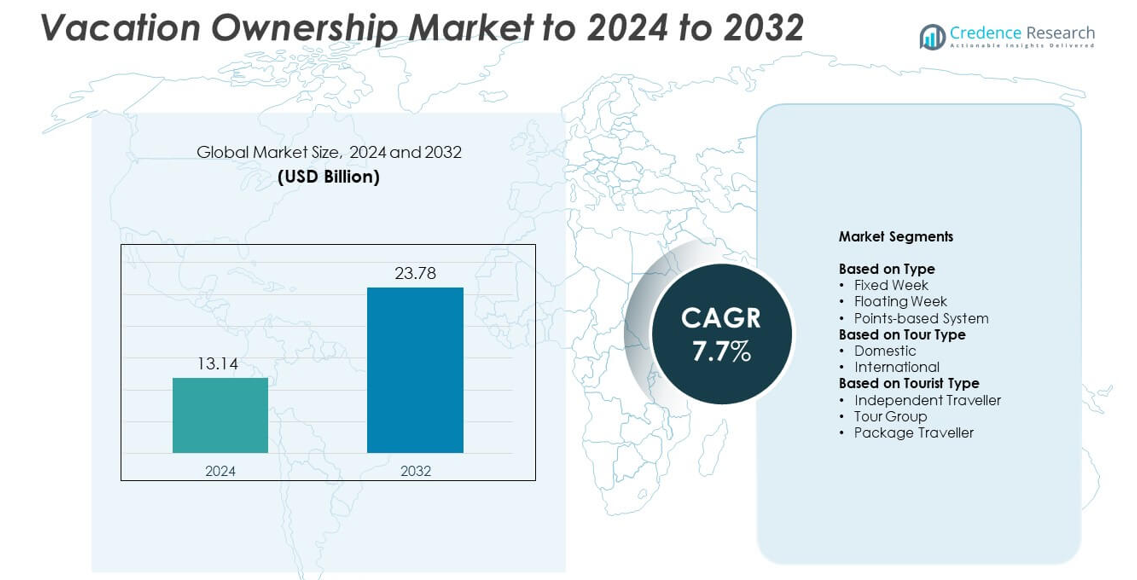

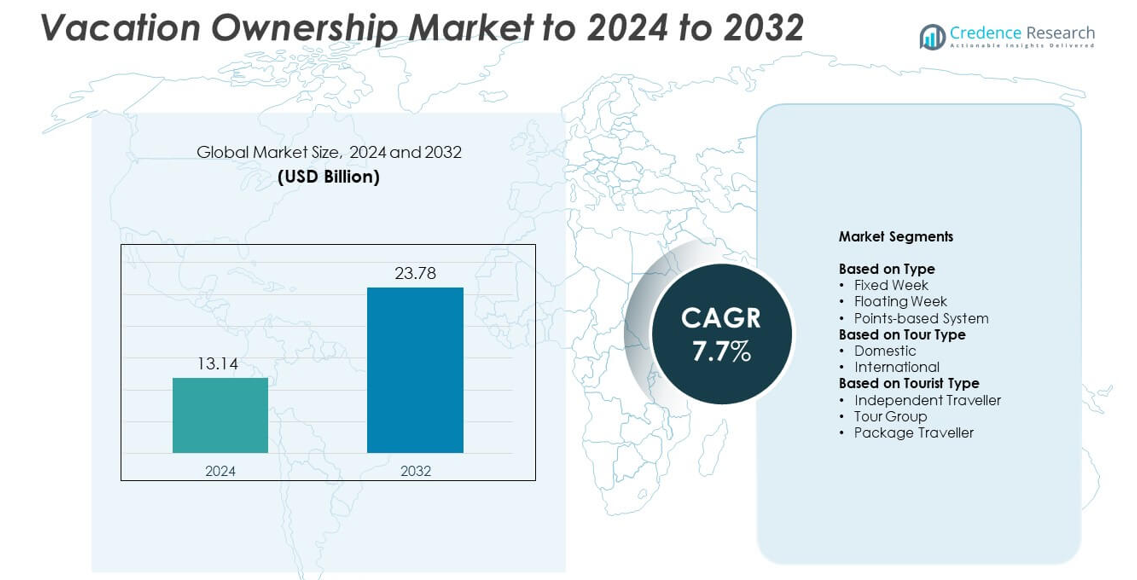

Vacation ownership market size was valued at USD 13.14 billion in 2024 and is anticipated to reach USD 23.78 billion by 2032, growing at a CAGR of 7.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vacation Ownership Market Size 2024 |

USD 13.14 billion |

| Vacation Ownership Market, CAGR |

7.7% |

| Vacation Ownership Market Size 2032 |

USD 23.78 billion |

The vacation ownership market features major players such as Marriott Vacations Worldwide, Hilton Grand Vacations, Disney Vacation Club, Bluegreen Vacations, Westgate Resorts, Hyatt Residence Club, Welk Resorts, Vidanta Resorts, and Holiday Inn Club Vacations (IHG), each expanding resort networks and flexible membership programs to strengthen customer retention. Their focus on premium amenities, curated experiences, and digital engagement supports steady global adoption. North America remained the leading region in 2024 with about 41% share, driven by strong domestic tourism, mature resort infrastructure, and high participation in structured vacation programs. Europe and Asia Pacific followed with rising interest in flexible and experience-driven ownership models.

Market Insights

- The vacation ownership market reached USD 13.14 billion in 2024 and is projected to hit USD 23.78 billion by 2032, growing at a 7.7% CAGR.

- Growth is driven by rising demand for planned family travel, strong adoption of fixed-week formats with a 42% share, and expanding branded hospitality networks offering predictable, high-value vacation options.

- Key trends include a shift toward flexible points-based systems, wellness-focused travel, and digital adoption through virtual tours and app-based member platforms that improve booking and engagement.

- Competition intensifies as major hospitality brands invest in premium resort upgrades, loyalty programs, and multi-destination exchange networks, strengthening long-term customer retention across domestic and international markets.

- North America led with a 41% share, followed by Europe at 28% and Asia Pacific at 23%, while Latin America and the Middle East & Africa held 5% and 3% respectively, supported by steady interest from independent travellers with a 48% segment share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Fixed week led the type segment in 2024 with about 42% share. Buyers preferred fixed week plans because they guarantee the same vacation period each year, which supports stable planning for families and repeat travellers. This format also offers clear cost expectations and stronger long-term value, making it attractive for middle-income households. Floating week products grew due to flexible date choices, while points-based systems expanded as younger travellers sought customizable stay lengths and multi-destination access across branded resort networks.

- For instance, RCI (Resorts Condominium International), a global leader in vacation exchange, gives members access to approximately 4,100 to 4,300affiliated resorts in around 100 to 110 countries worldwide, demonstrating their extensive global network for vacation ownership exchange.

By Tour Type

Domestic travel dominated the tour type segment in 2024 with nearly 63% share. Strong demand came from shorter booking cycles, lower travel expenses, and increased interest in in-country leisure destinations. Domestic packages also benefited from improved road and air connectivity and rising investment in resort infrastructure. International travel continued to recover as visa processing improved and outbound tourism increased among higher-income groups, but domestic ownership remained the preferred option due to convenience and predictable yearly costs.

- For instance, Mahindra Holidays & Resorts reported inventory of 4,940 keys across 102 resorts at the end of FY2023.

By Tourist Type

Independent traveller held the top position in the tourist type segment in 2024 with around 48% share. This group preferred vacation ownership because it allows flexible trip planning and offers access to multiple resort styles without strict group itineraries. Independent buyers also value privacy, self-guided experiences, and the ability to choose travel dates aligned with personal schedules. Tour groups and package travellers showed steady activity, but shifting preferences toward customized stays and experiential holidays strengthened the appeal of ownership among individual travellers.

Key Growth Drivers

Rising Demand for Family-Oriented Leisure Travel

Family travellers increased their spending on planned vacations, which strengthened interest in long-term ownership models. Buyers focused on predictable yearly stays, comfortable resort amenities, and multi-room units that support group travel. This shift encouraged households to secure guaranteed accommodation during peak seasons, reducing dependence on fluctuating hotel prices. Growing interest in repeat travel to familiar destinations further supported the appeal of structured ownership plans.

- For instance, the Disney Vacation Club (DVC) program has an estimated over 250,000 member families who hail from all 50 U.S. states and approximately 100 countries worldwide.

Expansion of Branded Hospitality Networks

Global hospitality brands expanded resort inventories, which boosted consumer confidence in ownership products. Stronger brand assurance, better maintenance standards, and access to loyalty programs attracted new buyers across mid- and premium-income groups. Resort developers also added integrated amenities such as spas, entertainment zones, and curated experience packages. These improvements strengthened long-term value perception and increased enrolment across major tourism regions.

- For instance, Hilton Grand Vacations’ acquisition of Bluegreen Vacations is expected to lift its membership base from 525,000 to more than 740,000 owners and expand its resort portfolio to nearly 200 properties.

Shift Toward Flexible Ownership Models

Flexible products such as points-based systems gained strong traction due to evolving traveller expectations. Modern buyers preferred the freedom to choose destinations, season types, and stay lengths without long-term commitment to a single week. Hospitality brands enhanced exchange networks, allowing members to access resorts across global portfolios. This adaptability supported higher adoption among younger travellers who prioritize customization and experience-based travel.

Key Trends and Opportunities

Growth of Experiential and Wellness Tourism

Travellers shifted toward wellness, adventure, and cultural experiences, increasing demand for resorts that offer curated on-site and destination activities. Developers introduced spa retreats, fitness programs, local cuisine journeys, and guided outdoor exploration to match evolving preferences. Ownership products integrated these features to boost engagement and repeat usage. This trend opened new opportunities for premium positioning and higher-value membership packages.

- For instance, Six Senses now offers dedicated sound-therapy wellness programs across 27 properties worldwide.

Digital Adoption in Sales and Member Engagement

Sales platforms moved toward virtual tours, AI-based recommendations, and digital contract management. These tools improved transparency and reduced the time needed for decision-making. Members benefited from mobile apps that manage bookings, track point usage, and access exclusive offers. This digital shift enhanced customer experience and created new cross-selling opportunities for resorts and tourism partners.

- For instance, Hyatt Vacation Club launched as a rebranded platform spanning 22 branded resorts, supporting digitally managed vacation ownership experiences.

Expansion into Emerging Tourism Destinations

Developers increased focus on emerging coastal, hill, and heritage locations with rising domestic tourism. These destinations offered lower development costs and strong long-term demand potential. Governments supported tourism infrastructure, improving accessibility and reducing operational barriers for new resorts. The expansion broadened ownership choices and strengthened the market’s future growth pipeline.

Key Challenges

High Upfront Investment and Maintenance Obligations

Many buyers hesitate due to significant upfront purchase requirements and recurring annual fees. These costs create long-term financial commitments that may not match income stability for some households. Market growth slows when economic uncertainty rises, prompting travellers to delay or reconsider ownership. Developers continue to refine financing options, but affordability remains a structural challenge.

Seasonal Demand Fluctuations and Inventory Pressure

Seasonal peaks restrict flexible booking options, leading to overcrowded resort calendars and member dissatisfaction during high-demand periods. Off-season underutilization reduces revenue efficiency and strains resort management. Maintaining fair access to popular weeks becomes difficult as membership volumes rise. Developers must balance inventory, expand available destinations, and optimize dynamic allocation systems to reduce pressure.

Regional Analysis

North America

North America held the leading position in 2024 with about 41% share. The region benefited from strong resort networks, high discretionary income, and rising demand for structured family vacations. Major hospitality brands expanded properties across coastal and mountain destinations, supporting steady ownership enrolment. Short-haul domestic travel also grew, helping buyers see long-term value in fixed and flexible ownership formats. Expanding loyalty programs and upgraded amenities kept retention high, while digital sales tools added transparency. Consistent tourism spending and mature exchange networks reinforced North America’s dominance.

Europe

Europe accounted for nearly 28% share in 2024, supported by strong tourism activity across Spain, Italy, France, and the UK. Buyers valued access to heritage locations, beach destinations, and wellness-focused resorts. Improved cross-country connectivity encouraged multi-destination ownership, strengthening the appeal of points-based plans. Economic stability in key markets helped maintain steady demand, while the rise of experiential travel encouraged developers to expand resort offerings. Growing interest from younger travellers and stronger adoption of digital booking tools contributed to healthy regional growth.

Asia Pacific

Asia Pacific captured around 23% share in 2024 and showed the fastest expansion. Rising middle-class income, growth in domestic tourism, and increasing resort development across Thailand, Indonesia, India, and Australia supported ownership uptake. Travellers sought predictable yearly stays and value-driven packages, making flexible plans attractive. Expanding hospitality chains widened access to new destinations, while governments invested heavily in roads, airports, and coastal tourism hubs. Younger travellers showed strong interest in flexible and points-based systems, helping Asia Pacific accelerate further.

Latin America

Latin America held about 5% share in 2024, supported by tourism growth in Mexico, Brazil, and the Caribbean belt. Buyers were drawn to beach resorts and all-inclusive packages that offered stable pricing and repeat travel benefits. Developers focused on improving resort quality and strengthening exchange partnerships to attract international interest. Currency fluctuations and economic uncertainty slowed adoption in some markets, but rising inbound tourism kept long-term prospects strong. Expanding air connectivity and investment in leisure infrastructure supported gradual growth.

Middle East and Africa

The Middle East and Africa accounted for roughly 3% share in 2024, with growth led by the UAE, Saudi Arabia, and South Africa. Travelers sought premium desert, beach, and safari experiences, prompting developers to add high-end resort offerings. Strong government-led tourism programs expanded market visibility and increased interest in structured ownership models. Limited supply and higher development costs slowed broad adoption, yet rising income levels and luxury travel demand created steady opportunities. Strengthening hospitality investments continued to support future expansion.

Market Segmentations:

By Type

- Fixed Week

- Floating Week

- Points-based System

By Tour Type

By Tourist Type

- Independent Traveller

- Tour Group

- Package Traveller

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The vacation ownership market is shaped by major players such as Vidanta Resorts, Welk Resorts, Hilton Grand Vacations, Bluegreen Vacations, Westgate Resorts, Hyatt Residence Club, Marriott Vacations Worldwide, Disney Vacation Club, and Holiday Inn Club Vacations (IHG). These companies focus on expanding resort inventories, enhancing member experience, and strengthening loyalty ecosystems across top leisure destinations. Developers invest in premium amenities, digital booking platforms, and flexible ownership structures to attract both new and repeat buyers. Strong emphasis on experiential travel, curated activities, and multi-destination access continues to widen the appeal of ownership programs. Competitive strategies now prioritize personalization, value differentiation, and long-term service quality to increase retention. Rising interest in environmentally responsible resort development and wellness-focused stay options further shapes portfolio planning. Partnerships with travel platforms, hospitality groups, and exchange networks improve global accessibility, while ongoing innovation in financing and membership models supports broader consumer adoption

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Vidanta Resorts

- Welk Resorts

- Hilton Grand Vacations

- Bluegreen Vacations

- Westgate Resorts

- Hyatt Residence Club

- Marriott Vacations Worldwide

- Disney Vacation Club

- Holiday Inn Club Vacations (IHG)

Recent Developments

- In 2024, Bluegreen Vacations was acquired by Hilton Grand Vacations, with the acquisition completed. This acquisition expanded Hilton Grand Vacations’ offerings, customer reach, and sales locations, effectively broadening its vacation ownership and experiences portfolio.

- In 2024, Vidanta East Cape opened as a new paradise resort, enhancing their coastal luxury offerings.

- In 2023, Holiday Inn Club Vacations (partner of IHG) acquired four beachfront resorts in Mexico (Cancun, Playa del Carmen, Riviera Maya) from Royal Resorts, marking their first properties outside the U.S

Report Coverage

The research report offers an in-depth analysis based on Type, Tour Type, Tourist Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as more families choose planned annual vacations.

- Flexible ownership models will attract younger travellers seeking customizable stays.

- Branded hospitality chains will grow resort portfolios to strengthen member confidence.

- Digital sales tools and virtual tours will improve buyer conversion rates.

- Wellness-focused and experiential resorts will gain higher adoption across segments.

- Domestic tourism growth will keep ownership demand strong in major regions.

- Exchange networks will widen, offering members access to more global destinations.

- Premium and luxury ownership tiers will grow as high-income travel spending rises.

- Emerging tourism destinations will see increased development activity and resort expansion.

- Improved financing options will help broaden ownership adoption among mid-income groups.