| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| 8K Technology Market Size 2024 |

USD 1,807.22 million |

| 8K Technology Market, CAGR |

27.22% |

| 8K Technology Market Size 2032 |

USD 13,996.61 million |

Market Overview:

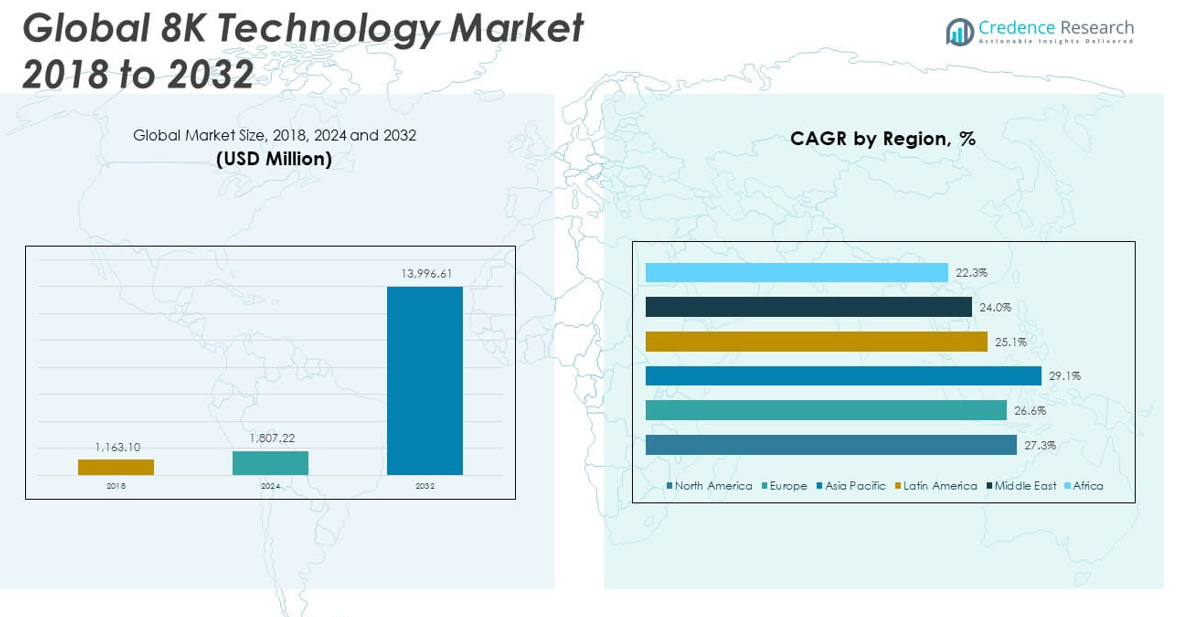

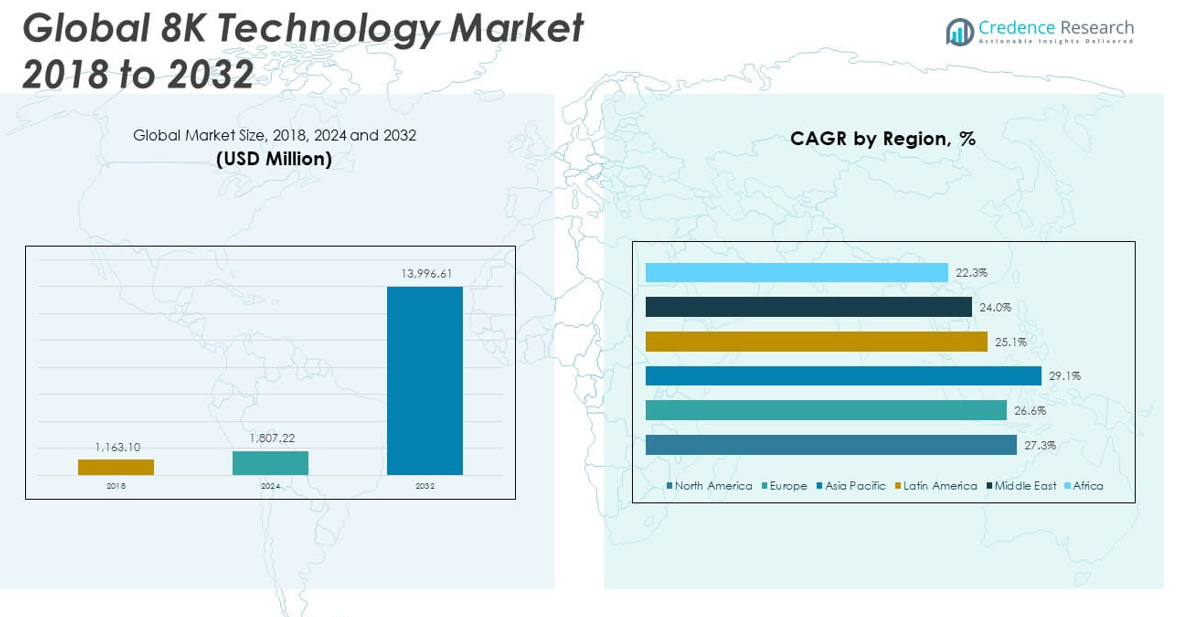

The Global 8K Technology Market size was valued at USD 1,163.10 million in 2018 to USD 1,807.22 million in 2024 and is anticipated to reach USD 13,996.61 million by 2032, at a CAGR of 27.22% during the forecast period.

Key drivers propelling the global 8K technology market include increasing consumer demand for superior visual experiences and the growing adoption of high-resolution display panels in televisions, laptops, and gaming monitors. The entertainment industry, particularly broadcasting and streaming platforms, is investing heavily in 8K-compatible infrastructure to meet content quality expectations. Additionally, professional sectors such as healthcare, surveillance, digital advertising, and filmmaking are integrating 8K technology to enhance image clarity and operational precision. Technological advancements in panel production, HDMI and video compression standards, and 5G connectivity are further accelerating market adoption by making 8K devices more affordable and functionally integrated with existing systems. These combined forces are not only fueling demand but also encouraging manufacturers and content creators to expand 8K ecosystems.

Regionally, Asia-Pacific leads the global market and is expected to maintain its dominance throughout the forecast period. Countries like China, Japan, and South Korea are spearheading 8K adoption due to strong manufacturing capabilities, early consumer acceptance of premium electronics, and robust investments in digital infrastructure. Japan, in particular, has been at the forefront with broadcasters like NHK actively promoting 8K content. North America represents the second-largest market, with strong uptake driven by high consumer purchasing power, a well-established media industry, and early deployment of 8K-capable gaming and streaming platforms. Europe follows closely, with steady demand from markets such as Germany, the UK, and France, primarily in commercial and healthcare applications. Meanwhile, regions such as the Middle East & Africa and Latin America are emerging as potential growth zones, fueled by urbanization, expanding digital infrastructure, and growing interest in high-resolution technologies for both consumer and enterprise use.

Market Insights:

- The Global 8K Technology Market was valued at USD 1,807.22 million in 2024 and is projected to reach USD 13,996.61 million by 2032, growing at a CAGR of 27.22%.

- Consumer demand for ultra-high-definition displays in televisions, gaming monitors, and laptops is a primary driver of market expansion.

- Professional sectors such as healthcare, digital advertising, and film production are adopting 8K technology for its superior clarity and precision.

- Continuous advancements in OLED, QLED, and MicroLED panels, combined with 5G and HDMI 2.1, are enabling faster, more efficient 8K content delivery.

- Broadcasters and gaming companies are building complete 8K content ecosystems, fueling hardware upgrades and software development.

- Market challenges include high product costs and limited availability of native 8K content, which restrict mass adoption.

- Asia-Pacific leads the market, driven by strong manufacturing in China, Japan, and South Korea, followed by North America and Europe with robust media and tech infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Ultra-High-Definition Displays in Consumer Electronics

The Global 8K Technology Market is experiencing strong momentum due to the increasing demand for ultra-high-definition screens in televisions, monitors, and home entertainment systems. Consumers are prioritizing superior image quality and immersive viewing, particularly in large-format displays. High-resolution panels provide sharper visuals, enhanced depth, and vibrant colors that appeal to enthusiasts and premium users. Consumer preferences are shifting toward 8K televisions as prices drop and more models enter the mainstream market. Home entertainment, fueled by larger screens and expanding content platforms, continues to serve as a foundational growth engine. It benefits from the rising adoption of high-end gaming consoles and 8K-enabled streaming services that require advanced visual support.

- For instance, Samsung’s 2024 Neo QLED 8K lineup, including the QN900D and QN800D, delivers native 8K resolution (7,680 x 4,320 pixels), 100–120Hz refresh rates, and advanced features such as the NQ8 AI Gen3 processorfor real-time AI upscaling and motion enhancement

Adoption of 8K Technology Across Industrial and Professional Applications

The Global 8K Technology Market is gaining traction in medical imaging, digital signage, and surveillance, where precise visuals are critical. Healthcare providers are deploying 8K systems in surgical rooms and diagnostic tools to achieve higher accuracy and better outcomes. In retail and advertising, 8K digital signage enhances visual appeal, offering lifelike clarity for product displays and promotions. Film production and broadcasting industries are incorporating 8K resolution to future-proof content and meet rising viewer expectations. Museums, architectural visualization, and simulation-based training sectors are also adopting 8K to deliver realistic experiences. It creates strong demand across niche industries that rely on resolution, scale, and clarity.

- For example, in professional imaging, Canon’s EOS R5 C camera supports 8K HDR recordingin Hybrid Log-Gamma (HLG) and Perceptual Quantization (PQ) formats, offering Cinema RAW Light capture and 10-bit 4:2:2 XF-AVC codecs for robust post-production workflows

Advancement in Supporting Infrastructure and Display Technologies

The Global 8K Technology Market benefits from continuous improvements in display panel technology and transmission standards. Developments in OLED, QLED, and MicroLED panels enhance pixel density and energy efficiency. These technologies allow manufacturers to build thinner, more powerful displays without compromising performance. Connectivity standards such as HDMI 2.1 and efficient video codecs support high data throughput, enabling smoother 8K content delivery. The availability of 5G and fiber-optic networks improves transmission reliability for high-resolution video in real-time applications. It allows content creators, broadcasters, and consumers to interact with 8K media more seamlessly across platforms.

Growth of Content Creation, Broadcasting, and Gaming Ecosystems

The Global 8K Technology Market is supported by expanding ecosystems of 8K-compatible cameras, editing software, and broadcasting systems. Major broadcasters are preparing for widespread 8K transmission to enhance sports, live events, and cinematic experiences. Content producers are investing in equipment that captures and processes in native 8K, targeting both current and future platforms. The gaming industry is driving hardware demand, pushing GPU and display manufacturers to deliver higher resolution capabilities. Virtual and augmented reality applications are also beginning to align with 8K standards for improved realism. It positions 8K as a transformative upgrade across visual content ecosystems.

Market Trends:

Emergence of AI-Based Upscaling in Enhancing Lower-Resolution Content

The Global 8K Technology Market is witnessing growing integration of artificial intelligence for content upscaling. Manufacturers are embedding AI-driven processors in 8K televisions and displays to enhance lower-resolution media to near-8K quality. This trend helps bridge the gap between available content and display capabilities, expanding usability across streaming, gaming, and broadcasting platforms. AI upscaling also improves motion clarity and detail sharpness in real-time, enhancing visual consistency. Brands are using this feature to justify higher display costs while improving user satisfaction. It addresses one of the primary limitations of native 8K content scarcity by optimizing legacy formats.

Expansion of 8K in Consumer Photography and Mobile Imaging Devices

The Global 8K Technology Market is expanding into high-end photography and mobile imaging devices. Smartphone manufacturers are integrating 8K video recording capabilities into flagship models to offer professional-grade performance. This development reflects increasing user demand for premium content creation tools in compact formats. Camera brands are also launching mirrorless and DSLR systems with 8K support for commercial, wildlife, and cinematic use. Consumer interest in high-resolution imaging for personal and professional applications is driving this shift. It signals a wider adoption of 8K beyond stationary displays into handheld devices and personal media equipment.

- For instance, Flagship smartphones in 2025, such as the Vivo X200 Pro, Xiaomi 15 Ultra, and OnePlus 13, now offer 8K video recording at up to 30 fps, integrating advanced features like ZEISS optics, 10-bit color depth, and 4-axis optical image stabilization.

Proliferation of 8K in Virtual Production and Extended Reality Environments

The Global 8K Technology Market is gaining traction in virtual production studios and extended reality (XR) environments. Production companies are using LED walls and 8K-capable cameras to create realistic backgrounds during filming, replacing green screens. This approach improves on-set visualization and reduces post-production timelines, leading to faster content delivery. In XR applications, including virtual training and immersive entertainment, 8K provides a broader field of view and sharper image detail. Technology providers are aligning software and hardware ecosystems to support seamless 8K rendering in immersive spaces. It opens new dimensions for content creators seeking high-fidelity virtual storytelling.

Increasing Role of Strategic Alliances Among Industry Stakeholders

The Global 8K Technology Market is evolving through strategic partnerships among display manufacturers, chipset developers, content producers, and telecom providers. Companies are entering cross-industry collaborations to accelerate 8K readiness across ecosystems, from content generation to delivery infrastructure. Broadcasters are working with camera manufacturers and cloud platforms to ensure end-to-end support for 8K workflows. Hardware makers are partnering with semiconductor firms to improve processing power and thermal efficiency in 8K devices. Telecom providers are building capacity to support data-intensive media delivery through fiber-optic and 5G networks. It highlights a coordinated industry effort to remove fragmentation and speed up 8K adoption.

- For example, HiSilicon’s Hi3796C V300 8K chipset, used in next-generation set-top boxes and TVs, supports 8Kp120 decoding, AVS3 codec (offering 36% better compression than H.265), and includes a neural processing unit (NPU) with up to 4 TOPS (trillion operations per second) for AI-driven enhancements and intelligent interactions

Market Challenges Analysis:

High Cost of 8K Hardware and Limited Consumer Accessibility

The Global 8K Technology Market faces significant challenges due to the high cost of 8K-compatible hardware. Televisions, monitors, cameras, and editing systems with 8K capability remain premium-priced, making them less accessible to mainstream consumers. Production and material costs for high-resolution display panels, advanced GPUs, and data handling components contribute to elevated retail prices. Many consumers opt for 4K devices that offer acceptable quality at a lower price, limiting the mass-market penetration of 8K. The market struggles to scale unless manufacturers introduce more affordable models without compromising performance. It creates a pricing barrier that slows adoption in both residential and commercial settings.

Insufficient Native 8K Content and Network Infrastructure Limitations

Another challenge impacting the Global 8K Technology Market is the scarcity of native 8K content and the infrastructure required to support it. Content producers hesitate to invest heavily in 8K filming due to high production costs, longer editing workflows, and minimal distribution platforms. Streaming 8K content demands high-bandwidth internet connections, which remain unavailable or inconsistent in many regions. Broadcasters and content platforms are still in the early stages of integrating 8K pipelines, leaving users with limited viewing options. Without robust content ecosystems and supporting networks, consumers lack incentives to upgrade to 8K devices. It limits market growth and places pressure on stakeholders to expand infrastructure and content availability.

Market Opportunities:

Expansion of 8K Applications in Healthcare, Security, and Industrial Visualization

The Global 8K Technology Market holds strong opportunities in professional sectors such as medical imaging, security surveillance, and industrial visualization. Hospitals and diagnostic centers seek higher-resolution systems for surgical precision and accurate analysis. Security agencies benefit from 8K cameras that provide detailed footage for facial recognition and threat detection. Manufacturing and design teams use 8K displays for simulation, modeling, and real-time process monitoring. These sectors prioritize image clarity and data accuracy, making them ideal early adopters. It allows 8K technology to move beyond consumer entertainment into mission-critical environments.

Growth Potential in Emerging Markets and Smart City Deployments

The Global 8K Technology Market can grow through adoption in emerging economies undergoing digital transformation. Governments and urban planners integrate 8K signage, monitoring systems, and immersive kiosks into smart city infrastructure. Expanding 5G networks and rising digital literacy support the deployment of 8K systems in transportation hubs, public venues, and commercial spaces. Local content creators and broadcasters in these regions show rising interest in future-ready platforms. It presents long-term value for manufacturers and service providers targeting next-generation public and commercial systems.

Market Segmentation Analysis:

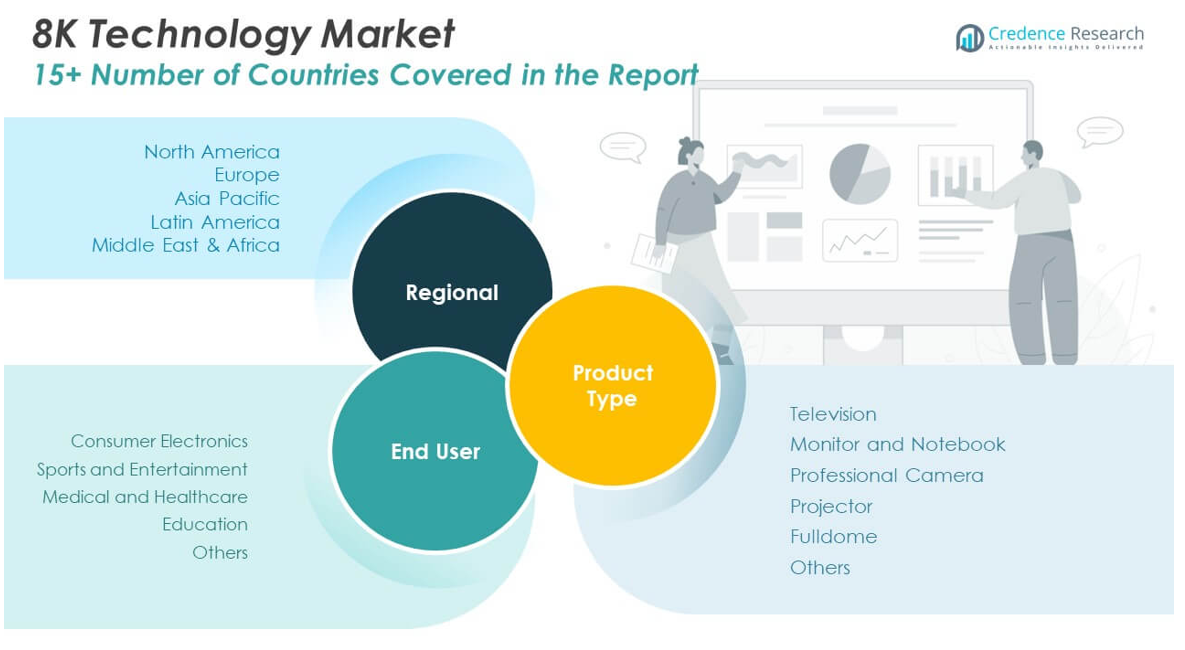

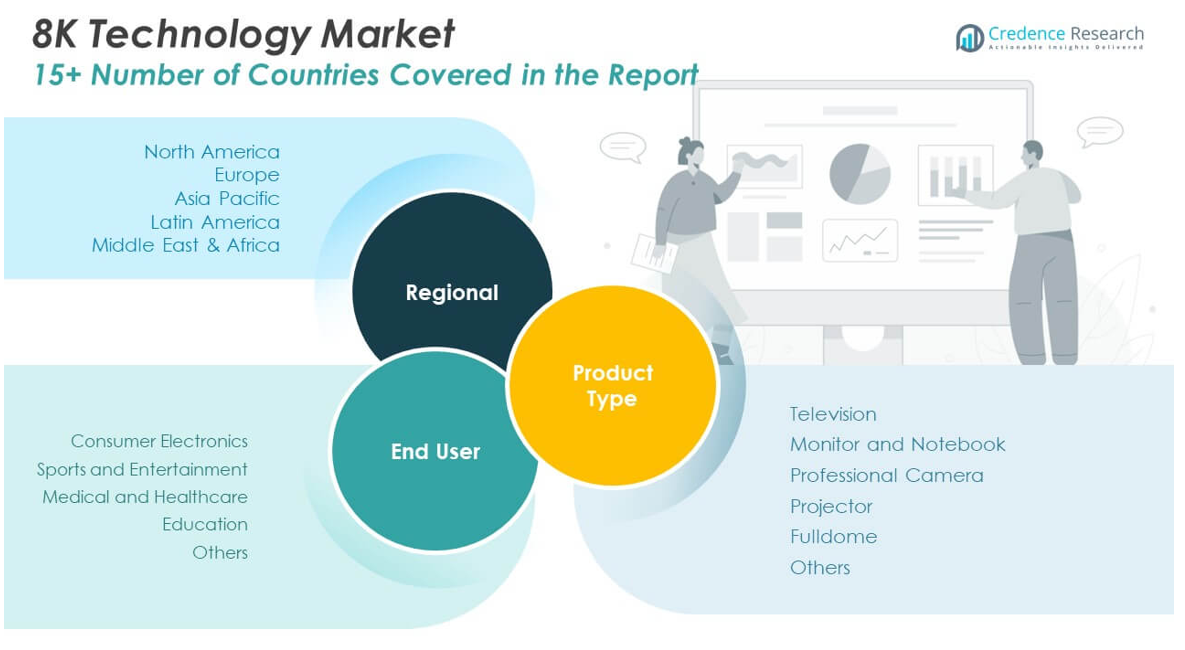

The Global 8K Technology Market is segmented by product type and end user, each contributing distinctly to market growth.

By product types, television holds the largest share due to rising consumer demand for immersive home entertainment and declining panel costs. Monitor and notebook segments are expanding as professionals and gamers seek higher resolution for detailed tasks and competitive experiences. Professional cameras are gaining traction in filmmaking, broadcasting, and digital production environments where visual precision is critical. Projectors and fulldome systems are used in educational and planetarium settings, while the others category includes specialized equipment for industrial and creative applications.

- For instance, Samsung’s Neo QLED 8K TVs, are available in sizes up to 98 inches and feature advanced AI upscaling, Q Symphony 3.0, and integrated voice assistants (Amazon Alexa and Bixby), delivering a highly immersive home entertainment experience.

By end user, the consumer electronics segment dominates, driven by the popularity of 8K TVs, personal computing, and gaming devices. The sports and entertainment sector follows, supported by high-resolution broadcasting and stadium displays. Medical and healthcare applications are increasing, particularly in diagnostic imaging and surgical visualization. Education institutions are adopting 8K displays for simulation and interactive learning. The others segment includes enterprise and public sector use, reflecting a growing range of professional applications. The market continues to evolve across all segments, driven by technological advancements and expanding use cases.

- For instance, Sharp’s 120-inch 8K monitor is used in classrooms and planetariums to deliver high-fidelity, immersive educational content.

Segmentation:

By Product Type:

- Television

- Monitor and Notebook

- Professional Camera

- Projector

- Fulldome

- Others

By End User:

- Consumer Electronics

- Sports and Entertainment

- Medical and Healthcare

- Education

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

The North America 8K Technology Market size was valued at USD 357.47 million in 2018 to USD 547.24 million in 2024 and is anticipated to reach USD 4,255.11 million by 2032, at a CAGR of 27.3% during the forecast period. North America commands a substantial share of the Global 8K Technology Market, driven by early adoption across consumer electronics, gaming, broadcasting, and healthcare. The region benefits from high disposable incomes, strong content creation industries, and a mature digital infrastructure that supports 8K streaming and data processing. Leading technology firms in the U.S. and Canada continue to invest in display innovation and 8K-compatible devices. Broadcasters and production houses in Hollywood and major sports networks are actively experimenting with 8K formats to enhance viewing experiences. It accounts for approximately 24.5% of the global market in 2024 and remains a key hub for technological innovation and content delivery in ultra-high-definition formats.

The Europe 8K Technology Market size was valued at USD 481.79 million in 2018 to USD 730.12 million in 2024 and is anticipated to reach USD 5,430.72 million by 2032, at a CAGR of 26.6% during the forecast period. Europe holds the largest share in the Global 8K Technology Market, representing nearly 32% of global revenue in 2024. Germany, the UK, and France are key contributors, supported by advancements in smart manufacturing, medical imaging, and cinema technology. European consumers are embracing premium television and display systems, aided by growing awareness of image fidelity and immersive media experiences. Regulatory frameworks and green electronics initiatives are also influencing energy-efficient 8K display development. It demonstrates consistent demand from both consumer and professional sectors, reinforcing Europe’s position as a high-value regional market.

The Asia Pacific 8K Technology Market size was valued at USD 230.95 million in 2018 to USD 388.00 million in 2024 and is anticipated to reach USD 3,391.87 million by 2032, at a CAGR of 29.1% during the forecast period. Asia Pacific is the fastest-growing region in the Global 8K Technology Market, holding a 17.1% share in 2024 with expectations of rapid expansion. Japan, South Korea, and China lead in both manufacturing and consumption of 8K televisions, cameras, and signage solutions. The presence of global electronics giants and rising disposable incomes across emerging economies contribute to steady adoption. Japan’s early 8K broadcasting efforts, such as those by NHK, and China’s aggressive rollout of high-resolution content platforms drive momentum. It benefits from supportive government initiatives, competitive pricing strategies, and growing consumer interest in next-generation technology.

The Latin America 8K Technology Market size was valued at USD 51.45 million in 2018 to USD 78.88 million in 2024 and is anticipated to reach USD 535.89 million by 2032, at a CAGR of 25.1% during the forecast period. Latin America holds a modest 3.5% share of the Global 8K Technology Market in 2024 but offers emerging opportunities. Brazil and Mexico lead regional adoption, especially in digital advertising, entertainment, and public event coverage. Improving internet infrastructure and increasing investments in 5G and broadband services support future deployment. Demand remains primarily urban, with limited rural penetration due to cost and bandwidth constraints. It remains a developing market, where growth depends on affordability and broader content availability.

The Middle East 8K Technology Market size was valued at USD 28.18 million in 2018 to USD 39.44 million in 2024 and is anticipated to reach USD 249.47 million by 2032, at a CAGR of 24.0% during the forecast period. The Middle East accounts for 1.8% of the Global 8K Technology Market in 2024, with potential expansion linked to smart city initiatives and digital transformation strategies. The UAE and Saudi Arabia are deploying advanced display systems in airports, malls, and surveillance networks. Government-led innovation projects and national digitization agendas provide favorable conditions for high-tech rollouts. The commercial sector shows growing interest in premium signage and immersive displays. It is gradually shifting from pilot-stage use to more widespread deployment in public and private sectors.

The Africa 8K Technology Market size was valued at USD 13.26 million in 2018 to USD 23.53 million in 2024 and is anticipated to reach USD 133.56 million by 2032, at a CAGR of 22.3% during the forecast period. Africa holds the smallest regional share at 1.1% of the Global 8K Technology Market in 2024 but reflects early growth signals. South Africa and Nigeria are leading adopters, focusing on smart infrastructure, entertainment, and education solutions. Infrastructure gaps, high import costs, and limited access to high-speed internet remain key barriers. Urban centers and private enterprises are investing in digital displays and security systems with high-resolution capabilities. It offers long-term potential, particularly in sectors aligned with public safety, education, and digital transformation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Samsung Electronics

- LG Electronics

- Sony Corporation

- Sharp Corporation

- Canon Inc.

- Red Digital Cinema

- Panasonic Corporation

- Dell Technologies

- Hisense Co., Ltd.

- TCL Corporation

Competitive Analysis:

The Global 8K Technology Market is highly competitive, with leading companies investing in innovation, product development, and strategic alliances. Key players include Samsung Electronics, LG Electronics, Sony Corporation, Sharp Corporation, BOE Technology Group, and Hisense. These companies focus on enhancing display quality, reducing panel costs, and expanding product portfolios to maintain market leadership. It features continuous competition in hardware, content development, and chipset integration. New entrants and regional manufacturers are entering niche segments such as 8K signage, medical displays, and professional imaging tools. Strategic collaborations between display makers, semiconductor firms, and content providers are accelerating ecosystem growth. Companies compete on pricing, resolution performance, and compatibility with AI-based features and streaming platforms. Competitive positioning relies heavily on technological differentiation, brand recognition, and distribution strength across developed and emerging markets.

Recent Developments:

- In March 2025, Samsung Electronics America unveiled the 2025 Neo QLED 8K TV series, including the flagship models QN900D and QN800D. The new line incorporates Samsung’s Vision AI, which offers refined image and audio processing, gesture control via Galaxy Watch, and enhanced real-time subtitle translation. This launch marks Samsung’s most expansive Neo QLED lineup to date, reinforcing its leadership in the premium 8K space.

- In June 2025, BOE showcased its first-ever 31.5-inch 8K monitor with 120 Hz refresh rate at Display Week. The CR3000 panel features an 8000:1 contrast ratio and 99% DCI-P3 color coverage, setting a new industry standard for high-performance displays. BOE plans to begin mass production by late 2025, signaling strong momentum in professional-grade 8K panels.

Market Concentration & Characteristics:

The Global 8K Technology Market exhibits moderate to high market concentration, dominated by a few large multinational corporations with strong R&D capabilities and global distribution networks. It is characterized by rapid technological advancements, high capital requirements, and a strong focus on innovation. The market favors vertically integrated players that can control panel manufacturing, software integration, and hardware optimization. Barriers to entry remain high due to the complexity of 8K production standards, content requirements, and infrastructure demands. It also shows early-stage fragmentation in niche applications such as medical imaging and digital signage, where specialized providers are emerging. Consumer expectations for quality, compatibility, and seamless content delivery shape product design and pricing strategies.

Report Coverage:

The research report offers an in-depth analysis based on product type and end user It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for 8K televisions will grow steadily as prices decline and screen sizes increase.

- AI-powered upscaling will become a standard feature, enhancing compatibility with non-8K content.

- 8K cameras and editing tools will see wider adoption in filmmaking, sports broadcasting, and documentaries.

- Gaming consoles and GPUs will evolve to support native 8K resolution and smoother frame rates.

- Healthcare and surgical visualization will adopt 8K systems for improved diagnostic accuracy.

- Cloud platforms will expand support for 8K streaming and content storage solutions.

- Commercial sectors will deploy 8K displays in public signage, control rooms, and event venues.

- Telecom infrastructure upgrades, including 5G, will enable real-time 8K content delivery.

- Emerging economies will adopt 8K technology through smart city initiatives and digital inclusion programs.

- Strategic alliances among manufacturers, broadcasters, and chipset providers will shape long-term innovation.