| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Animal Bedding Market Size 2024 |

USD 53.79 million |

| UK Animal Bedding Market, CAGR |

4.37% |

| UK Animal Bedding Market Size 2032 |

USD 77.66 million |

Market Overview:

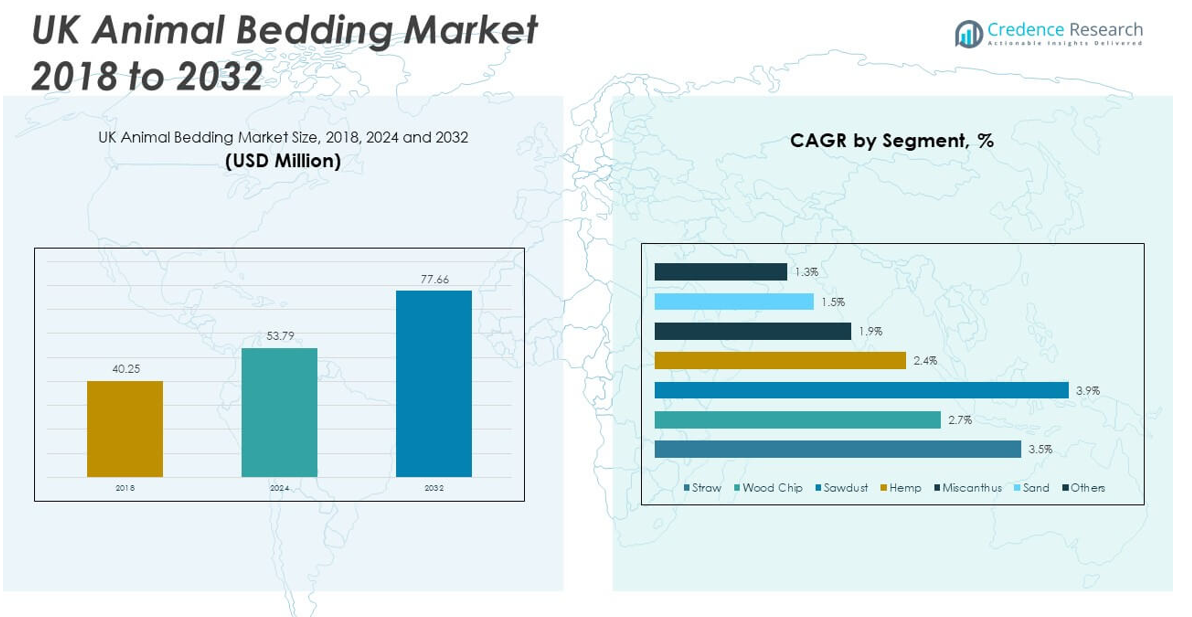

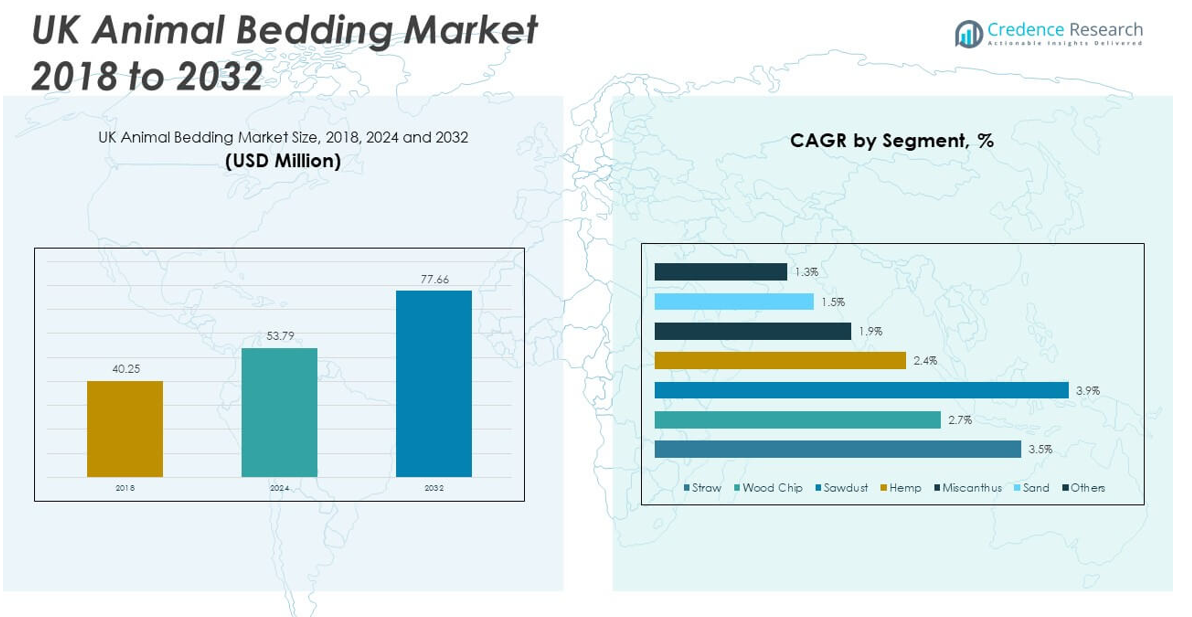

The UK Animal Bedding Market size was valued at USD 40.25 million in 2018 to USD 53.79 million in 2024 and is anticipated to reach USD 77.66 million by 2032, at a CAGR of 4.37% during the forecast period.

One of the key drivers propelling market growth is the significant rise in pet ownership across the UK, especially after the COVID-19 pandemic. As more households include small animals like rabbits, guinea pigs, hamsters, and reptiles, the demand for safe, absorbent, and low-dust bedding has surged. Consumers are increasingly inclined towards premium and sustainable options that ensure comfort and odor control. In parallel, the livestock sector continues to emphasize biosecurity and animal welfare, especially in dairy, poultry, and pig farming. Bedding is critical in reducing infections, maintaining temperature control, and supporting productivity. Farmers are adopting absorbent and low-moisture retention materials such as wood pellets and chopped straw to comply with regulatory standards. Additionally, the growing focus on environmental sustainability is shaping the market, with manufacturers introducing biodegradable, compostable, and recycled-material bedding products.

Regionally, England dominates the UK animal bedding market due to its high concentration of pet-owning households and extensive livestock operations. Urban centers such as London, Birmingham, and Manchester show strong retail and e-commerce demand for small animal bedding products, while rural regions in Yorkshire, the West Midlands, and the South West exhibit consistent demand from cattle, sheep, and equine farms. Scotland, Wales, and Northern Ireland also contribute significantly to the market, particularly in livestock-intensive areas such as the Scottish Highlands and Welsh uplands. These regions often require seasonally intensive bedding use during indoor housing periods, such as lambing or winter calving. Moreover, interest in natural and local materials is growing in these areas, driven by environmental awareness and support for regional suppliers. The distribution landscape is well-developed, with national chains like Pets at Home, regional farm supply cooperatives, and online platforms catering to a diverse set of customers.

Market Insights:

- The UK Animal Bedding Market was valued at USD 53.79 million in 2024 and is projected to reach USD 77.66 million by 2032, expanding at a CAGR of 4.37%.

- Surge in pet ownership post-COVID-19 continues to drive strong demand for absorbent, low-dust, and comfortable bedding for small mammals and exotic pets.

- Livestock farms are increasingly adopting high-performance bedding materials like wood pellets and chopped straw to meet hygiene and welfare regulations.

- Sustainability is a major market trend, with growing consumer preference for biodegradable, compostable, and recycled bedding made from hemp, paper, and straw.

- Product innovation is enhancing market competitiveness, with bedding tailored by species and function, improving hygiene, labor efficiency, and animal comfort.

- Rising costs of raw materials and ongoing supply chain disruptions challenge producers to balance quality and pricing, especially in agricultural segments.

- Regionally, England leads the market with 65% share, followed by Scotland (15%), Wales (12%), and Northern Ireland (8%), each shaped by local livestock density and pet ownership trends.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Surge in Pet Ownership and Emphasis on Animal Comfort Accelerates Bedding Demand

rising number of pet-owning households in the UK significantly drives demand for high-quality animal bedding. Small mammals such as rabbits, guinea pigs, hamsters, and reptiles require specific bedding types that support hygiene, comfort, and health. Consumers increasingly prefer absorbent, dust-free, and odor-controlling products to ensure optimal living conditions for their pets. Retailers are expanding their product ranges to meet expectations of convenience, quality, and sustainability. The UK Animal Bedding Market benefits from growing awareness about pet welfare and an emotional connection between owners and their animals. It continues to expand as consumers view pets as family members and invest in premium care products.

- For example, Small Pet Select UKoffers premium soft paper bedding made from 100% virgin fiber, specifically engineered to be 99% dust-free and free from additives, dyes, or irritants, directly addressing respiratory health concerns in small mammals. Their product absorbs moisture efficiently, reducing odor without artificial scent blockers.

Livestock Industry Adopts High-Performance Bedding to Support Hygiene and Welfare Compliance

The UK’s livestock sector relies on consistent bedding use to maintain animal health and comply with stringent welfare regulations. Dairy, poultry, and swine farms use bedding to manage waste, reduce disease risk, and improve comfort for animals in enclosed environments. Bedding products such as wood shavings, chopped straw, and paper pellets offer absorbency and moisture control, which help limit bacterial growth. Farmers adopt advanced bedding materials to align with regulatory requirements under farm assurance schemes and government guidelines. The UK Animal Bedding Market gains traction in rural regions where intensive farming demands large-scale, cost-effective bedding solutions. It responds to these needs with performance-oriented materials designed to enhance operational efficiency and herd wellbeing.

Sustainability Goals Push Demand for Eco-Friendly Bedding Alternatives

Environmental responsibility shapes purchasing behavior across both pet and livestock sectors. Consumers and commercial users seek biodegradable, compostable, and recycled bedding products that align with low-carbon practices. Manufacturers respond by introducing natural fiber-based bedding made from hemp, recycled paper, or straw, minimizing the ecological footprint. It reflects a shift toward ethical sourcing, waste reduction, and product transparency in the UK Animal Bedding Market. Retailers and distributors promote sustainable lines as part of their broader environmental strategies. The market gains momentum from this shift toward green product innovation and consumer preference for low-impact materials.

- For instance, Bearaby’s Pupper Podpet bed, launched in December 2022, is made from 100% natural organic rubber (melofoam) and features an OEKO-TEX-certified cotton cover, ensuring the product is biodegradable, cruelty-free, and free from harmful chemicals. The design provides deep touch pressure for stress reduction and includes a removable, machine-washable cover with a waterproof inner foam for easy cleaning.

Innovation in Product Performance and Customization Enhances Market Appeal

Product development plays a crucial role in supporting growth by meeting diverse customer requirements. Manufacturers invest in advanced formulations that improve absorbency, reduce dust, and extend usage intervals between replacements. Bedding products tailored for specific animal types—whether equine, poultry, or small pets—offer targeted features and superior performance. It allows users to select products that match their species-specific needs, housing conditions, and hygiene standards. The UK Animal Bedding Market evolves with innovations that add value, reduce labor, and elevate animal care standards. The presence of customizable and multifunctional solutions strengthens long-term adoption across domestic and agricultural applications.

Market Trends:

Expansion of E-Commerce Channels Is Redefining Consumer Access and Convenience

The rapid growth of online retail platforms has significantly influenced how consumers purchase animal bedding across the UK. Pet owners and livestock managers now explore a broader range of brands, materials, and pack sizes from online stores. E-commerce enables direct-to-door delivery, subscription services, and price comparisons that enhance purchasing efficiency. It supports niche suppliers and start-ups in reaching a national audience without relying on physical distribution. The UK Animal Bedding Market has adapted to this shift by strengthening its presence across digital marketplaces and enhancing mobile ordering capabilities. It continues to benefit from evolving digital behavior and rising consumer expectations for convenience and variety.

Growth in Specialty Bedding Categories Is Creating New Revenue Streams

Manufacturers are introducing specialized bedding lines designed to cater to specific needs of animals with allergies, respiratory conditions, or orthopedic requirements. These products often feature hypoallergenic, antibacterial, or therapeutic properties that provide comfort and support health. Specialty categories also include color-coded bedding for lab animals and enriched textures for behavioral enrichment. It encourages consumers to explore functional products beyond standard materials, increasing brand differentiation. The UK Animal Bedding Market sees rising interest in this segment among both pet owners and research facilities seeking superior performance. It supports premiumization by offering targeted solutions that justify higher price points.

Private Label Expansion by Retail Chains Is Intensifying Competition

Leading UK retailers are launching their own private-label animal bedding products to capture value-conscious segments and reinforce brand loyalty. These offerings often match the quality of branded alternatives while offering competitive pricing and in-store promotions. Supermarkets, pet care chains, and farm supply outlets are allocating shelf space to store brands that feature recyclable packaging and consumer-trusted claims. It places pressure on national and niche manufacturers to innovate and differentiate through features, packaging, or eco-certifications. The UK Animal Bedding Market reflects this trend with a growing number of private labels competing across all price tiers. It adds complexity to purchasing decisions and reshapes brand positioning strategies.

- For example, fine Bedding Company, a major private label supplier, operates a state-of-the-art eco-factory in Estonia powered entirely by renewable energy and certified as a B Corporation, reflecting a verified commitment to sustainability.

Rising Integration of Smart Packaging and QR Codes Enhances Transparency

Technology is increasingly being integrated into product packaging to offer traceability, usage instructions, and real-time information access. Brands are embedding QR codes on bedding packs that direct consumers to educational content, sourcing details, and recycling instructions. This approach supports transparency, engages tech-savvy customers, and aligns with modern marketing strategies. It enables brands to build trust while reinforcing claims around sustainability or product safety. The UK Animal Bedding Market is witnessing gradual adoption of such features in both premium and mid-range segments. It signals a shift toward smarter consumer interaction and digitally supported brand communication.

- For example, Metsä Board, a key supplier, began incorporating QR codes on all paperboard deliveries in November 2024, allowing customers to access detailed recycling guidance via a dedicated app.

Market Challenges Analysis:

Rising Raw Material Costs and Supply Chain Instability Disrupt Market Dynamics

Volatility in raw material costs poses a significant challenge for manufacturers and suppliers in the UK animal bedding sector. Fluctuations in prices of wood shavings, straw, paper pulp, and hemp affect production expenses and compress profit margins. Supply chain disruptions—driven by weather-related crop failures, global trade instability, or regional shortages—make consistent sourcing difficult. It increases reliance on imports or alternative materials, which may not meet the same performance or sustainability standards. The UK Animal Bedding Market faces pressure to maintain price competitiveness while preserving product quality, especially in cost-sensitive livestock segments. Manufacturers must navigate these challenges through procurement strategies, material innovation, or closer supplier collaboration.

Waste Management and Disposal Regulations Add Operational Complexity

Stringent environmental regulations surrounding waste disposal and compostability of used bedding create compliance burdens for farms and consumers. Bedding materials, especially those mixed with animal waste, require proper handling and disposal to prevent pollution or biohazards. It increases the demand for clear labelling, waste management solutions, and on-site composting guidance. Some regions enforce specific rules on waste bedding from livestock, complicating logistics and increasing costs. The UK Animal Bedding Market must align with evolving environmental standards without compromising performance or affordability. Producers need to ensure product compatibility with current waste infrastructure while educating end-users on responsible disposal practices.

Market Opportunities:

Product Diversification for Species-Specific and Medical Use Offers New Growth Avenues

There is growing demand for animal bedding tailored to specific species and medical needs. Products designed for animals with respiratory sensitivities, orthopedic conditions, or post-operative recovery create room for premium and functional bedding solutions. Brands can capitalize by offering targeted variants for horses, reptiles, birds, and laboratory animals. The UK Animal Bedding Market can expand its consumer base by serving underserved niches with specialized features. It enables better alignment with veterinary advice, welfare standards, and owner expectations. Custom formulations enhance perceived value and support brand differentiation in a crowded marketplace.

Export Potential for Eco-Friendly Bedding Strengthens Long-Term Outlook

Global markets show rising interest in sustainable animal care products, creating export opportunities for UK-based bedding manufacturers. Products made from locally sourced, biodegradable, or recycled materials appeal to buyers in Europe and beyond. It positions UK suppliers as reliable partners in the growing green economy. The UK Animal Bedding Market can leverage its regulatory alignment, product quality, and innovation to build a stronger export presence. Government support for green manufacturing and international trade can further enable this expansion. Strategic partnerships and certifications will help UK firms scale responsibly into new markets.

Market Segmentation Analysis:

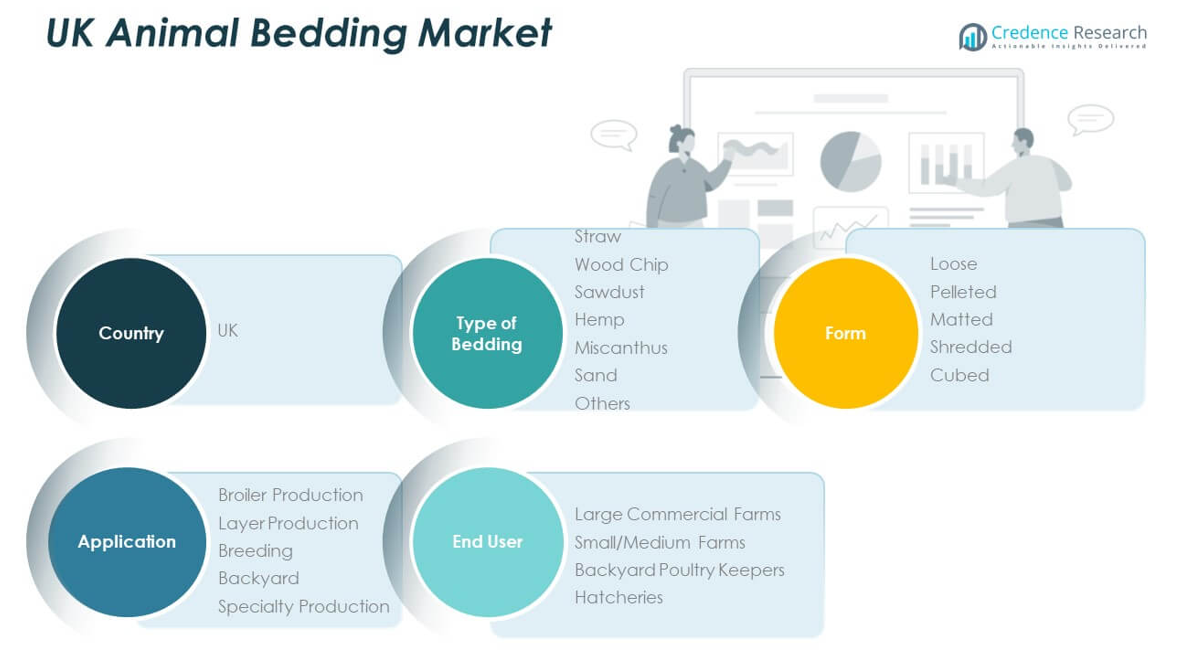

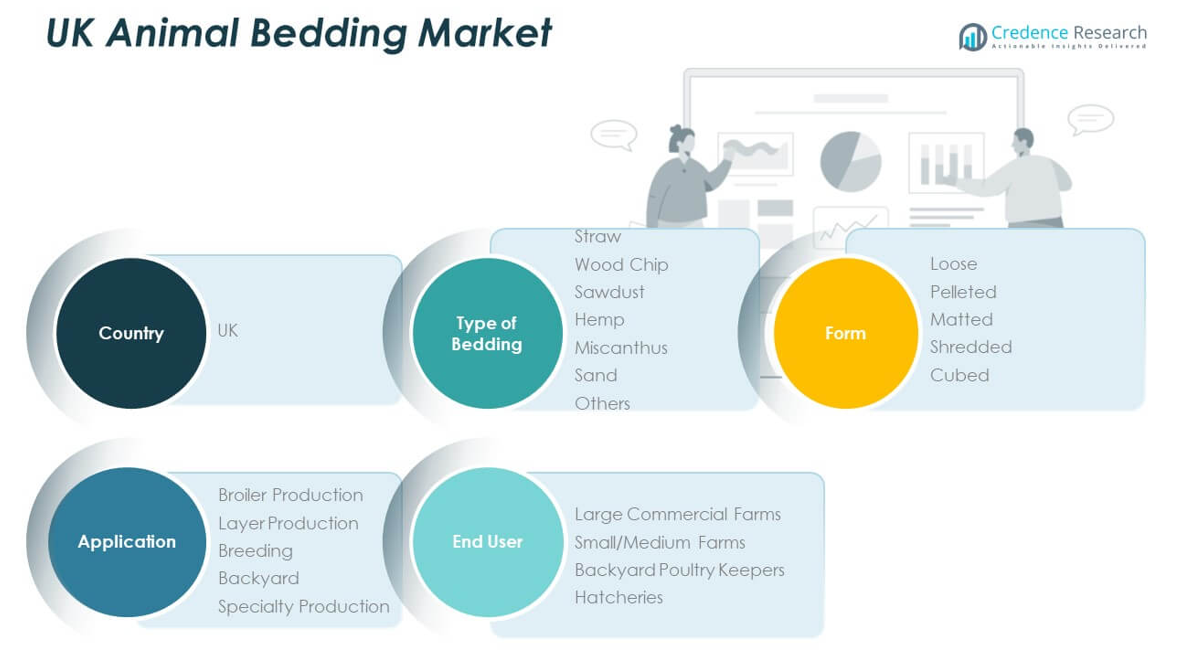

The UK Animal Bedding Market is segmented by type of bedding, form, application, and end user, reflecting its diverse usage across pet care and livestock management.

By type of bedding, straw, wood chip, and sawdust dominate the market due to their availability, absorbency, and cost-effectiveness. Hemp and miscanthus are gaining interest as sustainable alternatives, while sand and other materials cater to niche or specialized requirements.

- For example, Miscanthus bedding, produced by Terravesta, is now supplied to over 350 UK poultry and equine farms, with documented ammonia reduction rates of up to 40% compared to straw, as detailed in their 2024 technical datasheet.

By form, loose bedding remains the most widely used across both pet and farm applications, supported by its ease of handling and cost efficiency. Pelleted and shredded forms are popular in urban pet settings and equine care for their low dust and convenience. Matted and cubed forms serve smaller but growing segments such as specialty animal care and laboratory use.

- For example, Sorbeo’s wood pellet horse bedding, made from 100% Scottish spruce pine, now represents 20% of the UK horse bedding marketdue to its high absorbency, virtually dust-free nature, and ease of use; each 18kg bag expands to three times its volume and is favored for its consistent quality and environmental credentials.

By application, broiler and layer production drive demand in poultry operations, while breeding and specialty production support usage in high-care environments. Backyard use remains steady, driven by hobbyists and smallholders.

By end user, large commercial farms represent the dominant share, followed by small and medium farms. Backyard poultry keepers and hatcheries contribute steadily, supported by targeted product offerings and retail accessibility. The UK Animal Bedding Market continues to diversify across these segments to meet changing user demands.

Segmentation:

By Type of Bedding

- Straw

- Wood Chip

- Sawdust

- Hemp

- Miscanthus

- Sand

- Others

By Form

- Loose

- Pelleted

- Matted

- Shredded

- Cubed

By Application

- Broiler Production

- Layer Production

- Breeding

- Backyard

- Specialty Production

By End User

- Large Commercial Farms

- Small/Medium Farms

- Backyard Poultry Keepers

- Hatcheries

Regional Analysis:

England holds the largest share of the UK Animal Bedding Market, accounting for 65% of the total market value. It leads in both pet and livestock bedding demand due to a high concentration of pet-owning households and intensive farming operations. Regions such as Yorkshire, the West Midlands, and the South West contribute significantly through large-scale cattle, sheep, and equine farms. Urban centers like London, Manchester, and Birmingham drive pet bedding sales through retail and e-commerce channels. The presence of national chains and specialty suppliers strengthens product availability and consumer reach. It benefits from infrastructure, dense population, and established distribution networks, reinforcing its market leadership.

Scotland represents 15% of the UK Animal Bedding Market, with strong demand from sheep farming and dairy operations, particularly in the Highlands and Southern Uplands. Seasonal bedding use during lambing and indoor winter housing supports volume demand. Local preferences for natural and bulk materials influence product selection, with straw and wood shavings being widely used. Equestrian activities and hobby farming also contribute to steady sales in rural communities. It shows rising interest in sustainable alternatives sourced from local materials. Regional distributors play a key role in reaching remote farms and pet owners.

Wales contributes 12% to the overall market, driven by upland livestock farming and growing small-animal ownership in semi-urban areas. Farmers prioritize absorbent and cost-effective bedding for cattle and sheep kept indoors during colder months. The equine sector, especially in South Wales, supports demand for low-dust and therapeutic bedding products. It faces logistical challenges in remote areas, but ongoing expansion of rural supply chains improves access to specialized products. Consumer behavior increasingly aligns with national trends favoring sustainability and animal welfare.

Northern Ireland holds an 8% market share, supported by cattle farming, poultry production, and a stable equestrian segment. Bedding usage is closely linked to livestock housing practices and farm scale. Pet bedding sales remain modest but show growth in urban centers such as Belfast and Derry. It benefits from strong ties to both UK and Irish suppliers, creating a competitive distribution environment. Demand for compostable and low-waste options continues to rise, especially among environmentally conscious users in both commercial and domestic sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Arden Wood Shavings

- Animal Comfort Ltd

- Bodens Group

- Bomford Turner Ltd

- Capper Animal Feeds

- Easichick

- EnviroSystems

- Janbor Ltd

- H. Winterton & Son

- Wynnstay Group Plc

Competitive Analysis:

The UK Animal Bedding Market features a mix of established manufacturers, private label brands, and regional suppliers competing across pet and livestock segments. Key players focus on product performance, eco-friendliness, and pricing to gain competitive advantage. Leading companies offer wood shavings, paper-based bedding, straw pellets, and niche variants tailored to species-specific needs. Private label expansion by retail chains intensifies competition in the budget and mid-range categories. Local suppliers maintain strong positions in rural markets through bulk supply and regional distribution networks. It sees innovation in sustainable materials and packaging, which supports brand differentiation. Digital engagement and e-commerce integration help firms strengthen customer retention and expand reach across diverse consumer groups.

Market Concentration & Characteristics:

The UK Animal Bedding Market is moderately fragmented, with a combination of national brands, private labels, and local suppliers catering to distinct consumer needs. It supports diverse product offerings across pet, equine, and livestock applications, with no single player dominating the entire market. The presence of private label products from large retail chains has increased competition in price-sensitive segments. Regional suppliers hold strong positions in agricultural zones by offering bulk and customizable solutions. The market emphasizes product functionality, hygiene, sustainability, and species compatibility. It shows seasonal demand fluctuations, particularly in livestock farming during colder months. Branding, packaging, and regulatory compliance remain key characteristics influencing purchasing decisions.

Report Coverage:

The research report offers an in-depth analysis based on type of bedding, form, application, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for premium pet bedding will rise with increasing pet humanization and health-conscious consumer behavior.

- Livestock farms will adopt more hygienic and absorbent bedding to meet welfare and biosecurity standards.

- Growth of e-commerce platforms will enhance product accessibility and broaden customer reach nationwide.

- Manufacturers will invest in eco-friendly materials such as recycled paper, hemp, and biodegradable fibers.

- Expansion of private label bedding by major retailers will intensify price competition across categories.

- Innovation in odor control, dust reduction, and antimicrobial properties will drive product differentiation.

- Smart packaging with traceability and user engagement features will improve brand transparency.

- Seasonal demand shifts, especially in livestock housing, will continue to shape supply strategies.

- Export potential for sustainable UK-made bedding products will increase across European markets.

- Strategic partnerships with veterinary professionals and farm cooperatives will strengthen product positioning.