Market overview

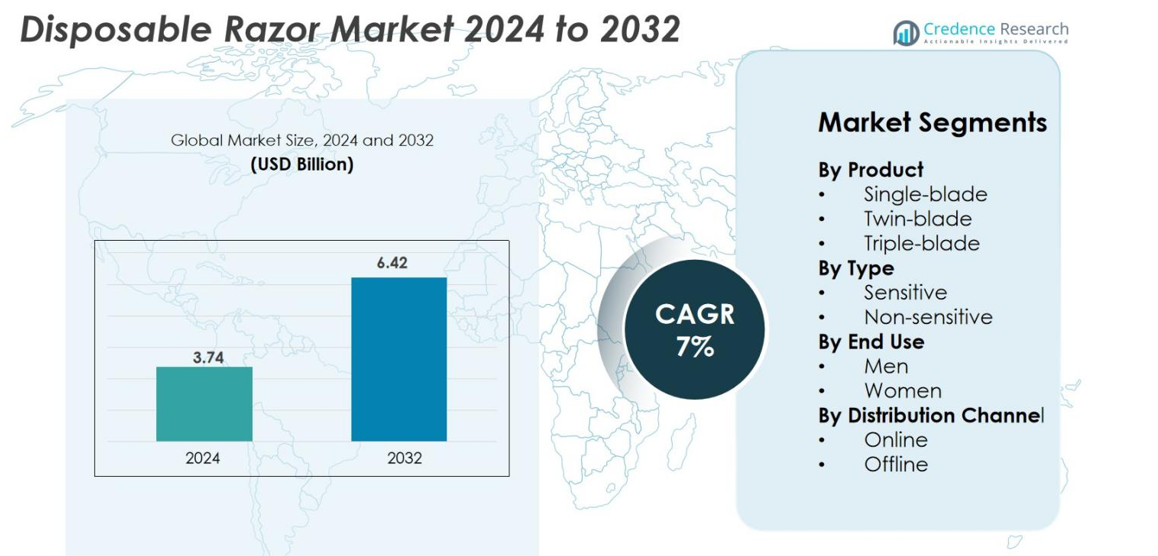

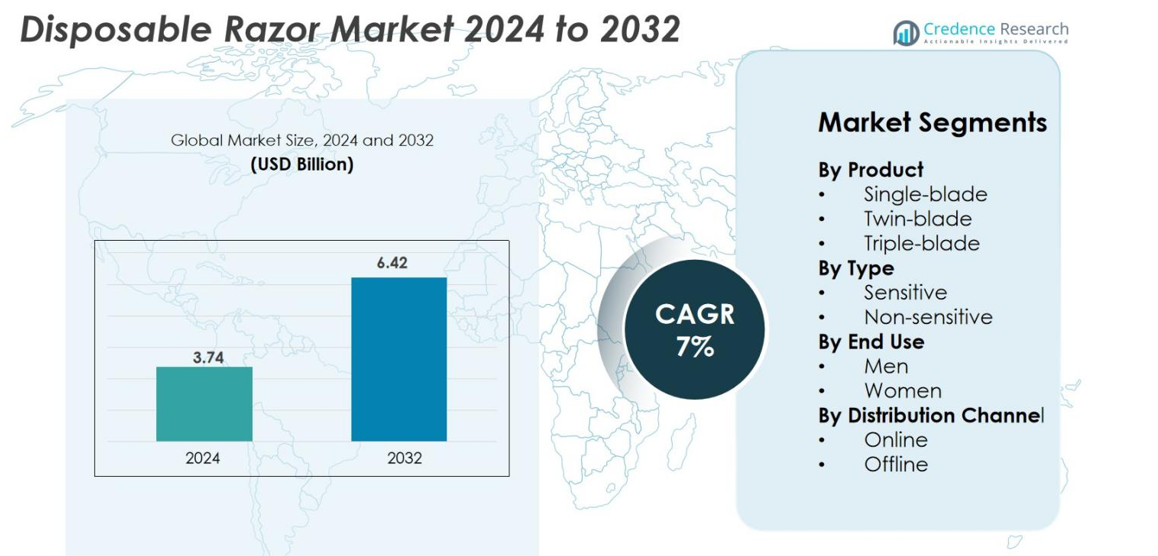

Disposable Razor market size was valued at USD 3.74 Billion in 2024 and is anticipated to reach USD 6.42 Billion by 2032, at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Disposable Razor Market Size 2024 |

USD 3.74 Billion |

| Disposable Razor Market, CAGR |

7% |

| Disposable Razor Market Size 2032 |

USD 6.42 Billion |

qThe disposable razor market is shaped by major players such as Procter & Gamble (Gillette), Edgewell Personal Care, BIC Group, DORCO, Kai Group, Super-Max Group, LORD International, Perio, Kaili Razor, and Laroch, all competing through product innovation, pricing, and broad distribution. These companies leverage advanced blade technologies, ergonomic designs, and expanding e-commerce channels to strengthen market presence. Asia-Pacific leads the global market with a commanding 34% share, driven by its large consumer base, rising grooming awareness, and strong penetration of both premium and value-based products. North America and Europe follow as mature markets with steady demand for high-performance disposables

Market Insights

- The disposable razor market reached USD 3.74 billion in 2024 and is projected to hit USD 6.42 billion by 2032, registering a 7% CAGR during the forecast period.

- Market growth is driven by rising grooming awareness, expanding retail and e-commerce penetration, and increasing demand for multi-blade razors, with triple-blade products holding about 45% of the segment share.

- Key trends include premiumization, sustainability-focused innovations, and growing adoption of gender-specific and sensitive-skin variants, supported by heightened consumer preference for convenience.

- The competitive landscape features major players such as Procter & Gamble, Edgewell Personal Care, BIC, DORCO, Kai Group, Super-Max, and LORD International, competing through technology upgrades, value packs, and eco-friendly designs.

- Regionally, Asia-Pacific leads with 34% of the market, followed by North America at 28% and Europe at 24%, while Latin America and MEA collectively contribute the remaining share, driven by affordability and expanding retail networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Product

The triple-blade segment dominates the disposable razor market, capturing around 45% of total share due to its balance of precision, comfort, and affordability. Consumers increasingly prefer triple-blade razors for smoother results and reduced irritation, supporting repeat purchases across both retail and online channels. Twin-blade razors hold a moderate share as a cost-effective option, while single-blade razors remain niche, primarily used for travel and institutional supply. Growth in the triple-blade category is driven by rising grooming awareness, product upgrades, and expanding availability in multipack formats.

- For instance, BIC’s Hybrid Flex 3 razor line combines three flexible blades with a pivoting head and is popular among male grooming consumers seeking value and performance.

By Type

The non-sensitive type leads the market with approximately 60% share, supported by widespread adoption among everyday users who prioritize cost efficiency and basic grooming performance. Non-sensitive razors are favored for their durability and broad compatibility with diverse skin types, making them a staple across mass-market retail shelves. The sensitive segment, while smaller, is expanding steadily as consumers with skin concerns seek gentler blade coatings and lubricating strips. Its growth is driven by increasing skincare awareness and manufacturers’ efforts to introduce premium sensitive-skin variants with enhanced comfort features.

- For instance, Schick’s Xtreme® 2 Sensitive disposable razor, which features a cost-effective design with a lubricating strip containing Vitamin E, providing basic grooming with reduced irritation.

By End Use

The men’s segment dominates the disposable razor industry, accounting for around 65% of total market share, driven by higher shaving frequency and long-standing reliance on disposable grooming tools. Men’s razors benefit from targeted marketing, wider product variety, and performance-focused blade technologies. Meanwhile, the women’s segment is witnessing faster growth as brands introduce ergonomic handles, moisturizing strips, and aesthetic designs tailored to feminine grooming routines. Rising personal-care spending and the expansion of women-centric grooming products are accelerating demand in this category.

Key Growth Drivers

Rising Grooming Awareness and Personal Hygiene Priorities

Increasing consumer focus on grooming, hygiene, and appearance is a major driver of the disposable razor market. Men and women across all age groups are adopting regular shaving routines, encouraged by lifestyle changes, workplace expectations, and social media influence. The market benefits heavily from the rising popularity of quick, convenient grooming solutions, especially among young adults and first-time shavers. Disposable razors offer an affordable entry point for grooming, making them attractive in emerging economies where income growth supports higher personal-care spending. Furthermore, growing urbanization and exposure to global grooming standards have accelerated product demand across supermarkets, pharmacies, and e-commerce platforms.

- For instance, Gillette’s Presto 3 disposable razor features a three-blade design with spring-mounted blades and a lubricating strip, delivering a smooth and comfortable shave favored by men seeking convenience and precision.

Product Innovation and Enhanced Blade Technologies

Technological advancements in blade design, coatings, and ergonomic engineering significantly contribute to market expansion. Manufacturers are introducing multi-blade configurations, lubricating strips with aloe or vitamin E, pivoting heads, and anti-slip handles to improve shaving comfort and reduce skin irritation. These innovations create strong differentiation in a market where convenience-oriented consumers actively seek smoother and safer shaving experiences. Premiumization trends have also supported higher-value product lines, contributing to revenue growth despite the low-cost nature of disposables. Packaging innovations—such as eco-friendlier materials and multipack value formats—enhance shelf appeal and affordability. Companies increasingly deploy advanced manufacturing technologies to reduce blade micro-irregularities, resulting in higher precision and less tugging.

- For instance, Schick incorporates lubricating strips infused with Vitamin E and aloe in its Xtreme series, which helps soothe and reduce skin irritation during shaving.

Expanding Distribution Channels and E-Commerce Penetration

Broader availability of disposable razors across modern retail formats, convenience stores, and online platforms is accelerating global market growth. Large retailers, pharmacies, and hypermarkets prominently feature disposable razors due to their high turnover rates and appeal to impulse buyers. E-commerce growth has significantly boosted accessibility, particularly for consumers seeking price comparison, bulk purchases, or brand variety. Subscription and direct-to-consumer models are also emerging, offering convenience and personalized grooming bundles. In developing regions, expanding retail infrastructures and partnerships with local distributors enable brands to reach rural and semi-urban consumers more effectively. The combination of omnichannel sales strategies and rising digital adoption ensures that disposable razors remain highly accessible, reinforcing steady growth across mature and emerging markets.

Key Trends & Opportunities

Growing Demand for Sustainable and Eco-Friendly Products

Sustainability is becoming a defining trend, creating strong opportunities for brands to differentiate through environmentally responsible solutions. Consumers increasingly prefer razors featuring recycled plastics, biodegradable handles, and reduced packaging waste. Regulatory pressure in several regions further encourages manufacturers to adopt greener production processes and environmentally safe materials. Brands that integrate sustainability into their value proposition are gaining favor among environmentally conscious buyers. Opportunities also arise from circular economy initiatives, such as razor recycling programs and refillable disposable variants. As sustainability concerns rise globally, companies that innovate with lower-impact materials and transparent environmental commitments are well positioned to capture emerging demand and build long-term customer loyalty.

- For instance, Schick’s Xtreme3 Eco Glide uses handles made with 100% recycled plastic and packaging made with 100% recycled paper, a verified product line available across major retailers.

Premiumization and Personalization in Grooming Products

A shift toward premium, high-performance disposable razors presents a significant opportunity for manufacturers seeking higher margins. Consumers are increasingly willing to pay more for advanced blade coatings, enhanced lubrication systems, and ergonomic improvements. Personalization trends—including gender-specific designs, skin-type-oriented razors, and customizable grooming kits—are reshaping competitive dynamics. The rise of self-care and grooming rituals has expanded demand beyond basic functionality, creating space for niche subcategories such as sensitive-skin razors and aesthetic designs for women. As grooming becomes a lifestyle category rather than a necessity, brands that prioritize personalization, performance, and aesthetic appeal stand to capture substantial market growth.

- For instance, BIC’s Soleil Escape disposables integrate multi-blade heads, improved pivoting, and scented handles designed for a spa-like grooming experience, appealing to consumers seeking both performance and aesthetic appeal.

Key Challenges

Rising Competition from Electric Shavers and Cartridge Systems

The disposable razor market faces growing pressure from electric shavers and reusable cartridge systems that offer long-term cost benefits and reduced environmental impact. Electric grooming solutions continue to gain traction among consumers seeking convenience, precision, and reduced irritation, particularly in urban markets. Cartridge systems also maintain a strong presence due to their sustainability advantages and premium shaving performance. These alternatives often appeal to consumers shifting away from single-use plastics or seeking more durable, high-value grooming tools. As these competing categories expand, disposable razor brands must innovate aggressively and differentiate their offerings to maintain relevance and market share.

Environmental Concerns and Regulatory Pressures

The disposable razor market faces increasing scrutiny due to its reliance on plastics and limited recyclability. Governments and environmental organizations are pressuring companies to reduce waste and adopt sustainable manufacturing processes. Single-use plastics regulations in several regions pose a direct threat to the category’s traditional business model. Consumers are also becoming more aware of environmental impacts, prompting some to shift toward reusable grooming alternatives. Meeting these expectations requires significant investment in eco-friendly materials, recycling programs, and sustainable packaging—challenges that can raise production costs and strain profit margins. Failure to adapt may hinder long-term market competitiveness.

Regional Analysis

North America

North America holds around 28% of the global disposable razor market, supported by strong grooming awareness, high product availability, and the presence of major brands with extensive retail networks. Consumers increasingly prefer multi-blade and sensitive-skin variants, driving demand for premium disposables. The region also benefits from steady e-commerce growth, where value packs and subscription-based offerings gain traction. Rising travel frequency and convenience-oriented grooming habits further sustain market adoption. However, increasing interest in electric shavers and sustainable alternatives prompts manufacturers to innovate with eco-friendly designs to maintain competitiveness across the U.S. and Canada.

Europe

Europe accounts for approximately 24% of the market, driven by high grooming standards, strong brand loyalty, and widespread availability across supermarkets, pharmacies, and online platforms. The region shows growing demand for sensitive-skin disposable razors due to heightened skin health awareness. Western Europe leads consumption, while Eastern Europe presents growth opportunities with expanding retail infrastructures. Sustainability trends strongly influence purchasing patterns, encouraging brands to adopt recyclable materials and reduced-plastic packaging. Despite strong competition from cartridge systems, Europe remains a stable market supported by consistent grooming habits and ongoing product premiumization.

Asia-Pacific

Asia-Pacific dominates the global market with around 34% share, fueled by its large population, rising disposable incomes, and rapidly expanding grooming culture. Countries such as China, India, and Southeast Asian nations show strong adoption driven by affordability and increasing urbanization. Local and international brands intensify competition by offering cost-effective multi-blade razors and value packs tailored to regional shaving habits. E-commerce penetration continues to accelerate sales, particularly among younger consumers. The region also sees growing interest in female grooming products, contributing to broader market growth. APAC remains the fastest-growing region due to sustained demographic and economic expansion.

Latin America

Latin America represents about 8% of the global market, with demand concentrated in Brazil, Mexico, and Argentina. Consumers favor disposable razors for their affordability and accessibility, making them a staple within personal-care routines. Growth is supported by expanding modern retail channels, local manufacturing, and increasing male grooming engagement. Economic fluctuations and price sensitivity influence purchasing behavior, prompting companies to focus on competitively priced multi-pack offerings. While competition from cartridge razors is rising, the convenience and low upfront cost of disposables maintain steady market penetration across both urban and semi-urban areas.

Middle East & Africa (MEA)

The Middle East & Africa region holds around 6% of the disposable razor market, driven by growing grooming awareness and increasing availability of international brands. Adoption is rising across urban centers, supported by expanding retail networks and affordable product offerings catering to price-sensitive consumers. In the Middle East, strong personal-care spending and demand for premium grooming products contribute to moderate market growth. Africa’s growth is fueled by a young population and improving distribution channels. Despite challenges such as limited spending power in some areas, the practicality and low cost of disposable razors ensure continued market expansion.

Market Segmentations

By Product

- Single-blade

- Twin-blade

- Triple-blade

By Type

By End Use

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the disposable razor market is characterized by the strong presence of global and regional players that compete on product performance, pricing, distribution reach, and brand visibility. Leading companies such as Procter & Gamble (Gillette), Edgewell Personal Care, BIC Group, DORCO, and Kai Group dominate the market with extensive product portfolios, advanced blade technologies, and broad retail penetration. Emerging players like Super-Max Group, LORD International, Perio, Kaili Razor, and Laroch further intensify competition through cost-effective multi-blade offerings and localized strategies. Innovation remains a key competitive lever, with companies developing ergonomic designs, lubricating strips, and eco-friendly materials to differentiate in a highly commoditized market. E-commerce expansion has broadened access to both premium and value-tier products, allowing smaller brands to compete more effectively. As sustainability concerns and premiumization trends rise, market players increasingly focus on material innovation and brand positioning to strengthen long-term competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DORCO

- BIC Group

- Perio

- Kai Group

- Procter and Gamble

- Kaili Razor

- Super-Max Group

- LORD International

- Laroch

- Edgewell Personal Care

Recent Developments

- In May 2025, Harry’s launched its most advanced razor system yet, the Harry’s Plus Razor, featuring a pivoting cartridge and five precision-engineered German blades.

- In April 2022, Edgewell Personal Care advanced sustainability in the shaving category by introducing the Schick Xtreme Men’s and Schick Intuition Women’s Bamboo Hybrid Razors. These new products are crafted with recycled, recyclable, or renewable materials, both in the razors and their packaging. Designed to offer an eco-friendlier alternative to traditional razors, these innovations align with Edgewell’s commitment to reducing environmental impact while meeting consumer demand for sustainable grooming options.

Report Coverage

The research report offers an in-depth analysis based on Product, Type, End-Use, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as grooming awareness continues to rise across both developed and emerging economies.

- Multi-blade and sensitive-skin razors will gain greater adoption as consumers seek enhanced comfort and performance.

- Sustainability will strongly influence future product development, driving demand for eco-friendly materials and reduced-plastic designs.

- E-commerce and subscription-based grooming models will expand, offering consumers greater convenience and product variety.

- Premium disposable razors will see increased preference as users shift toward higher-quality, ergonomically designed options.

- Emerging markets in Asia, Africa, and Latin America will contribute significantly to future volume growth due to rising disposable incomes.

- Manufacturers will focus more on gender-specific innovations to strengthen presence in the women’s grooming segment.

- Technological advancements in blade coatings and lubricating strips will further improve shave quality and user satisfaction.

- Competition will intensify as new regional brands enter the market with cost-effective alternatives.

- Regulatory pressure related to single-use plastics will accelerate the shift toward recyclable and sustainable disposable razor solutions.