| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Shotcrete Accelerator Market Size 2024 |

USD 930.1 million |

| Shotcrete Accelerator Market, CAGR |

7.40% |

| Shotcrete Accelerator Market Size 2032 |

USD 1,342.0 million |

Market overview

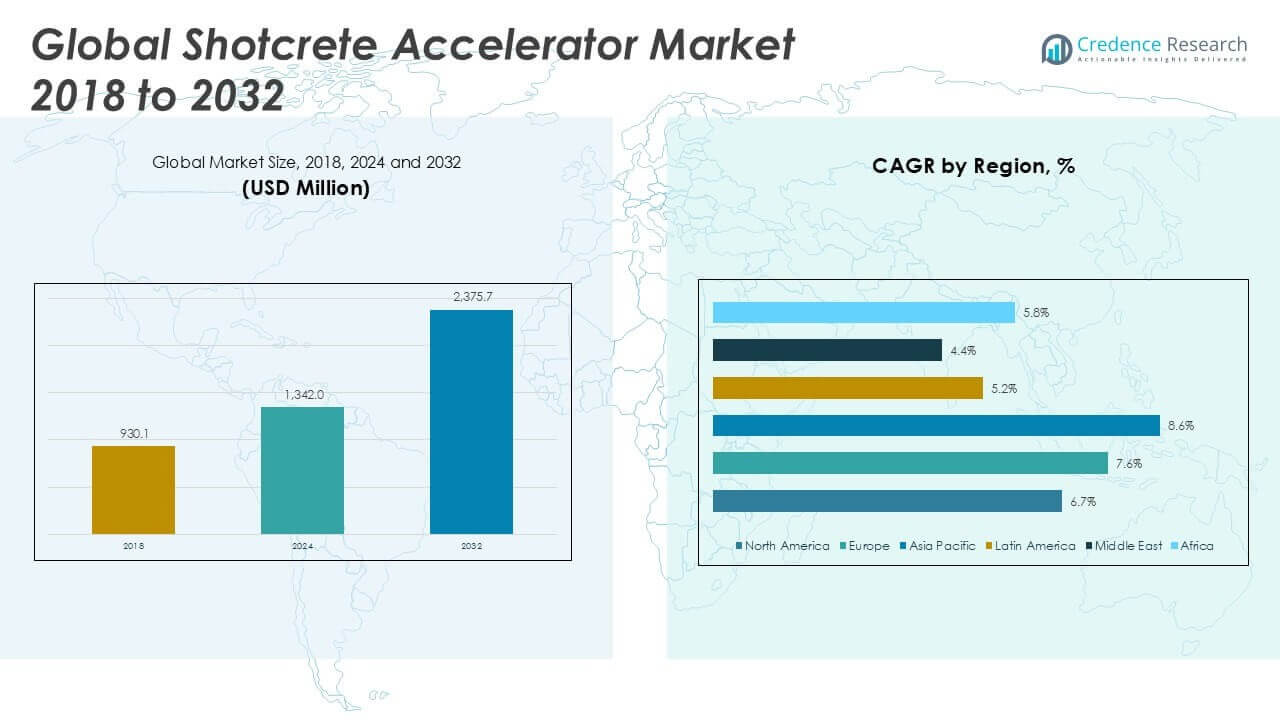

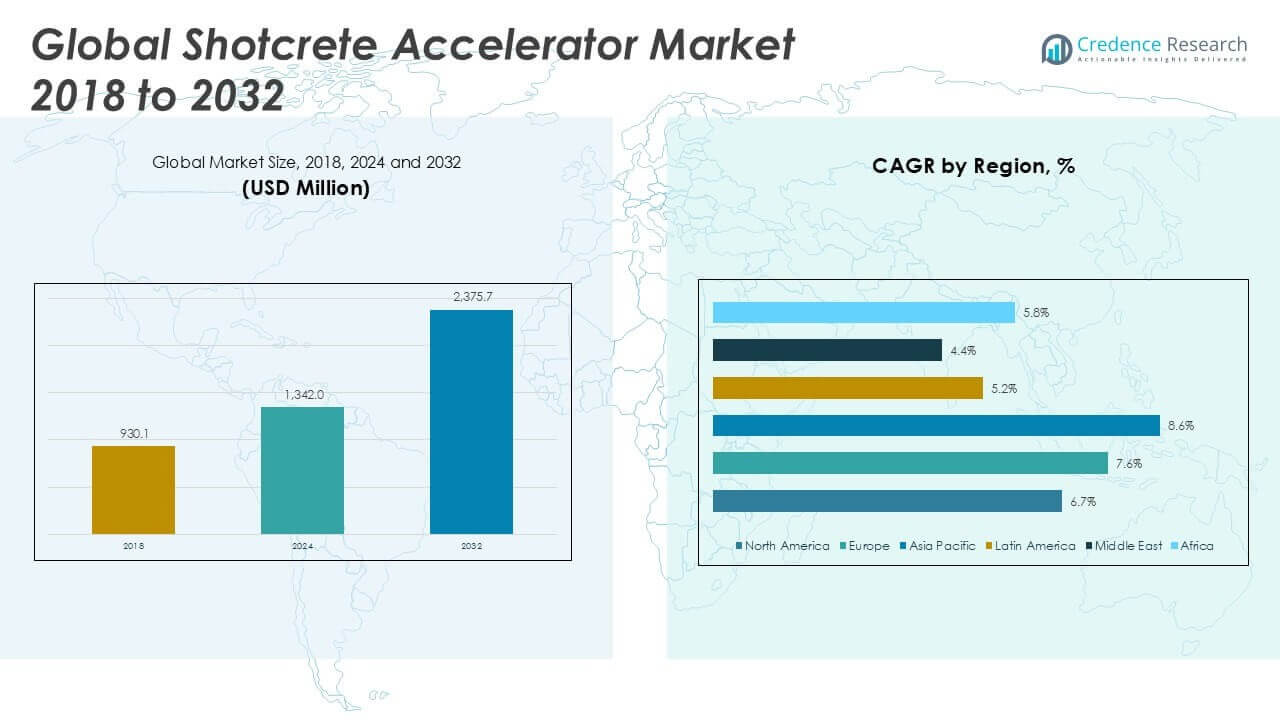

The Shotcrete Accelerator market size was valued at USD 930.1 million in 2018, reached USD 1,342.0 million in 2024, and is anticipated to reach USD 2,375.7 million by 2032, growing at a CAGR of 7.40% during the forecast period.

The Shotcrete Accelerator market is led by prominent players such as Sika AG, BASF SE, MAPEI S.p.A., GCP Applied Technologies, and Normet Group, which collectively command a significant share of the global market. These companies focus on technological innovation, product diversification, and expanding their global footprint to maintain competitive advantage. Asia Pacific emerges as the dominant region, holding approximately 46.4% of the global market share in 2024, driven by rapid infrastructure development, large-scale mining activities, and increasing investments in tunnelling projects. North America and Europe follow, with market shares of 24.5% and 22.9%, respectively, supported by advanced construction technologies and stringent safety regulations.

Market Insights

- The Shotcrete Accelerator market was valued at USD 930.1 million in 2018, reached USD 1,342.0 million in 2024, and is expected to reach USD 2,375.7 million by 2032, growing at a CAGR of 7.40% during the forecast period.

- Market growth is driven by increasing infrastructure development, particularly in tunnelling, mining, and underground construction projects requiring faster setting and improved structural stability.

- The market is witnessing a strong trend toward the adoption of alkali-free accelerators due to rising environmental and safety concerns, along with advancements in shotcrete application technologies like automated spraying systems.

- Leading players such as Sika AG, BASF SE, MAPEI S.p.A., and Normet Group dominate the competitive landscape, focusing on innovation, sustainability, and global expansion to secure their market positions.

- Asia Pacific holds the largest regional share at 46.4% in 2024, followed by North America (24.5%) and Europe (22.9%), with the wet mix process and alkali-free accelerator segments leading by type and process.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The alkali-free accelerator segment dominates the Shotcrete Accelerator market, accounting for the largest market share. This dominance is driven by its superior performance in reducing dust, improving early strength development, and enhancing the long-term durability of shotcrete structures. Alkali-free accelerators are widely preferred in projects with strict safety and environmental regulations, particularly in underground construction where minimal exposure to harmful substances is crucial. Additionally, their compatibility with modern cement types and lower rebound rates further strengthen their market position compared to alkaline aluminate and alkaline silicate accelerators.

- For instance, Sika’s Sigunit® P‑10 AF achieves early compressive strength values between 1–15 N/mm² within two hours and reduces rebound to 6–10% in wet-mix applications.

By Process

The wet mix process holds the largest share in the Shotcrete Accelerator market owing to its operational efficiency, better material adhesion, and reduced dust generation. The wet mix process offers precise control over water content and ensures uniform mixing of accelerators, which enhances application quality and structural integrity. This process is particularly favored in large-scale tunnelling and mining projects where consistency and speed are critical. Its advantages over the dry mix process, including lower material rebound and improved safety for workers, continue to drive its widespread adoption across key applications.

- For example, Normet’s Spraymec 8100 VC wet‑mix sprayer delivers up to 30 m³/h of concrete output with precise accelerator dosing synchronized at 12 bar, boosting speed and worker safety.

By Application

Mining is the leading application segment in the Shotcrete Accelerator market, securing the highest market share due to the extensive use of shotcrete in underground mine reinforcement and tunnel linings. The growing global demand for minerals and metals fuels the need for stable and secure underground excavation environments, thereby increasing the consumption of shotcrete accelerators. Additionally, mining operations often take place in challenging geotechnical conditions that require rapid setting and high early strength, making accelerators essential. Other applications like tunnelling, construction repair works, and waterproofing walls follow, but mining remains the primary growth driver.

Market Overview

Increasing Infrastructure Development Projects

The growing number of infrastructure projects worldwide, including tunnels, highways, subways, and underground facilities, significantly drives the demand for shotcrete accelerators. These accelerators enable faster construction cycles by improving setting time and early strength development, which is essential for large-scale, time-sensitive projects. Rapid urbanization in emerging economies, coupled with investments in transportation and water management structures, further fuels the market growth. Governments and private entities are increasingly focusing on durable, cost-effective, and efficient construction methods, where shotcrete accelerators offer substantial advantages.

- For instance, GCP Applied Technologies’ TYTRO® SA 528 accelerator achieved attested strength gains in the Doha Metro project, reaching compressive strength of 10 MPa within 2 hours, which expedited lining installation and maintained project schedules.

Rising Demand in the Mining Industry

The mining industry represents a major growth driver for the shotcrete accelerator market, primarily due to the need for stable underground structures. As global demand for minerals and metals increases, the need for rapid excavation support systems grows, particularly in deep mining operations. Shotcrete accelerators enable faster application, quicker setting times, and enhanced ground support, which are essential for improving safety and operational efficiency in mines. This rising focus on safety and productivity in mining activities is a key factor propelling the market forward.

- For instance, Normet’s SmartSpray ProPlus system maintains nozzle-to-wall distance within ±5 cm and automates spray paths over 10 m lengths in a single run, optimizing safety and reducing rebound in deep mines.

Adoption of Alkali-Free Accelerators for Environmental Safety

The increasing preference for alkali-free shotcrete accelerators is significantly contributing to market growth. These accelerators minimize health hazards and environmental risks associated with alkaline substances. Regulatory bodies across various regions are implementing stringent safety standards for construction materials, which further boosts the demand for safer, alkali-free alternatives. Additionally, the superior performance of alkali-free accelerators in terms of durability, reduced rebound, and improved long-term structural stability makes them highly desirable in both mining and civil construction applications.

Key Trends & Opportunities

Technological Advancements in Shotcrete Equipment

Advancements in shotcrete application technologies, including robotic shotcrete systems and precision dosing equipment, present significant opportunities for market growth. Automated systems offer improved safety, accuracy, and reduced material waste, which attract major construction and mining companies seeking efficient and cost-effective solutions. These technological improvements also support the wider adoption of shotcrete accelerators by enabling more controlled and optimized application processes, further enhancing the quality and consistency of construction projects.

- For instance, Normet’s SmartScan 3D laser scanner measures tunnel faces up to 50 m away, scans across 180° horizontally and -60° to +140° vertically, and provides real-time thickness maps accurate within ±5 mm, enabling precise control and documentation of applied layers.

Expansion into Emerging Economies

Emerging economies, particularly in Asia-Pacific and Latin America, offer promising growth opportunities for the shotcrete accelerator market. Rapid industrialization, urbanization, and substantial government investments in infrastructure development create strong demand for efficient construction materials and techniques. Additionally, these regions face increasing demand for mining resources, which requires robust ground support systems. As multinational players expand their presence in these markets, the adoption of advanced shotcrete solutions, including accelerators, is expected to accelerate.

- For instance, Normet opened its fourth Asia-Pacific plant in 2021, increasing regional wet-mix sprayer output by 25 units annually, and equipped these units with SmartScan systems to support infrastructure and mining projects across Southeast Asia.

Key Challenges

Fluctuating Raw Material Prices

One of the primary challenges faced by the shotcrete accelerator market is the volatility in raw material prices, particularly for chemicals used in accelerator formulations. Price fluctuations can impact the overall production cost, making it difficult for manufacturers to maintain stable profit margins. This unpredictability may also lead to pricing pressures and supply chain disruptions, especially for small and medium-sized players with limited purchasing power and less flexible sourcing strategies.

Health and Safety Concerns

Despite advancements in product formulations, certain types of shotcrete accelerators, especially those with high alkali content, still pose health and safety risks to workers. Exposure to chemical dust and vapors during application can cause respiratory issues and skin irritation. Regulatory agencies continue to impose stricter safety guidelines, which can increase compliance costs and limit the use of some traditional accelerators. Manufacturers are under pressure to develop safer alternatives while ensuring high performance and cost competitiveness.

Technical Application Limitations

The shotcrete process, particularly when using accelerators, requires skilled labor and precise equipment calibration to achieve optimal results. Inadequate application techniques can lead to issues such as material rebound, uneven surface finishes, and compromised structural integrity. This technical complexity can restrict market growth, especially in regions with limited access to trained personnel and advanced application machinery. Overcoming these barriers requires targeted training programs and broader dissemination of best practices within the industry.

Regional Analysis

North America

In 2024, North America held a market share of approximately 24.5% in the Shotcrete Accelerator market, with a market size of USD 328.8 million, growing from USD 256.7 million in 2018. The market is projected to reach USD 517.9 million by 2032, expanding at a CAGR of 6.7% during the forecast period. The region’s growth is driven by increasing underground construction activities, particularly in transportation infrastructure and tunnelling projects. The strong presence of advanced construction technologies and a well-established mining sector further contributes to the steady demand for shotcrete accelerators across North America.

Europe

Europe accounted for around 22.9% of the market share in 2024, with its market size increasing from USD 224.2 million in 2018 to USD 306.0 million in 2024. It is anticipated to reach USD 491.8 million by 2032, growing at a CAGR of 7.6%. The region’s growth is supported by stringent safety and environmental regulations that encourage the adoption of alkali-free accelerators. Additionally, ongoing infrastructure renovation and the expansion of underground transport networks in countries like Germany, France, and Switzerland are fueling the demand. Europe’s mature construction industry continues to create consistent growth opportunities.

Asia Pacific

Asia Pacific dominates the Shotcrete Accelerator market, holding the largest market share of approximately 46.4% in 2024. The market expanded from USD 327.4 million in 2018 to USD 518.0 million in 2024 and is projected to reach USD 1,042.9 million by 2032, registering the highest CAGR of 8.6%. Rapid urbanization, large-scale tunnelling, and extensive mining activities across China, India, and Southeast Asia are driving regional growth. Massive investments in infrastructure development and increasing safety standards in underground construction further solidify Asia Pacific’s leading position in the global market.

Latin America

Latin America held a modest market share of approximately 4.6% in 2024, with the market size growing from USD 39.1 million in 2018 to USD 61.7 million in 2024, and is expected to reach USD 121.2 million by 2032, at a CAGR of 5.2%. Growth in the region is supported by the expansion of mining activities in countries such as Chile, Peru, and Brazil, where shotcrete accelerators are crucial for underground support systems. Additionally, infrastructure projects aimed at improving transportation and water management are gradually increasing the adoption of shotcrete technology in this region.

Middle East

The Middle East accounted for 5.9% of the market share in 2024, with the market size rising from USD 55.8 million in 2018 to USD 79.2 million in 2024, and projected to reach USD 147.3 million by 2032, growing at a CAGR of 4.4%. The region’s demand is driven by major tunnelling and infrastructure development projects in countries such as the UAE, Saudi Arabia, and Qatar. The ongoing expansion of metro systems, road tunnels, and water storage facilities contributes to the market’s steady growth, although its pace remains moderate compared to other high-growth regions.

Africa

Africa represented around 4.3% of the market share in 2024, with the market growing from USD 27.0 million in 2018 to USD 48.3 million in 2024, and expected to reach USD 54.6 million by 2032, registering a CAGR of 5.8%. The market in Africa is primarily driven by mining sector growth, especially in countries rich in mineral resources like South Africa and the Democratic Republic of Congo. Infrastructure development, although progressing at a slower pace, is gradually increasing the adoption of shotcrete accelerators, particularly in urban construction and road development projects across the continent.

Market Segmentations:

By Type

- Alkali-Free Accelerator

- Alkaline Aluminate Accelerator

- Alkaline Silicate Accelerator

By Process

- Wet Mix Process

- Dry Mix Process

By Application

- Mining

- Tunnelling

- Construction Repair Works

- Waterproofing Walls

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Shotcrete Accelerator market is characterized by the presence of several well-established global and regional players competing on product innovation, pricing, and strategic partnerships. Major companies such as Sika AG, BASF SE, MAPEI S.p.A., GCP Applied Technologies, and Normet Group hold significant market shares, leveraging their extensive product portfolios, technological advancements, and strong global distribution networks. These key players are actively investing in research and development to introduce eco-friendly and alkali-free accelerators that comply with stringent environmental regulations. Additionally, companies like The Euclid Chemical Company, CHRYSO Group, Denka Company Limited, Fosroc International Ltd., and CICO Group are focusing on expanding their geographic presence through mergers, acquisitions, and collaborations to strengthen their competitive positioning. Intense competition is driving continuous innovation and quality improvements across the industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sika AG

- BASF SE

- MAPEI S.p.A.

- GCP Applied Technologies

- Normet Group

- The Euclid Chemical Company

- CHRYSO Group

- Denka Company Limited

- Fosroc International Ltd.

- CICO Group

- MC-Bauchemie

- ITW Construction Systems

- Mineral Technologies Inc.

- Basalite Concrete Products LLC

Recent Developments

- In November 2024, IISc introduced the Pravriddhi product accelerator program. Pravriddhi offers a platform for collaboration among enterprises, academic institutions, research labs, and investors, aiming to foster innovation and drive new product development for a self-reliant India.

- In September 2024, Deloitte unveiled outcome-driven, industry-specific Workday accelerators tailored for sectors including banking, healthcare, higher education, and technology and media.

- In December 2023, Sika AG established a new technology hub and production lines for its Sigunit® liquid shotcrete accelerator in Kirchberg, Switzerland. This investment expands manufacturing capacity, improves supply efficiency for major infrastructure projects (such as the Gotthard tunnel), and reduces CO₂ emissions by shortening transportation routes. The new technology focuses on high performance, rapid strength development, and sustainability in tunneling applications.

Market Concentration & Characteristics

The Shotcrete Accelerator Market demonstrates moderate to high market concentration, with a few dominant players holding significant market shares. Companies such as Sika AG, BASF SE, MAPEI S.p.A., GCP Applied Technologies, and Normet Group lead the competitive space through strong global networks, extensive product portfolios, and continuous research and development efforts. It features a combination of global giants and regional players, creating a competitive environment where innovation and product differentiation remain critical. The market shows a clear preference for alkali-free accelerators due to stricter environmental and worker safety regulations. It responds to growing demand from infrastructure, mining, and tunnelling sectors where faster setting times and high early strength are essential. The competitive landscape emphasizes the importance of regulatory compliance, cost efficiency, and sustainable product development. Companies seek to strengthen their positions by expanding distribution networks and enhancing product performance. It is driven by technological improvements and rising investments in large-scale construction projects worldwide.

Report Coverage

The research report offers an in-depth analysis based on Type, Process, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Market growth will intensify in urban and underground infrastructure investment zones.

- Demand for alkali‑free accelerators will expand due to stricter environmental standards.

- Innovations in robotic shotcrete application will improve accuracy and efficiency.

- Integration of smart dosing systems will reduce material waste and optimize performance.

- Collaborative R&D partnerships will drive development of eco‑friendly accelerator formulas.

- Expansion in emerging regions will accelerate through new manufacturing facilities and distribution networks.

- Training programs will proliferate to address technical challenges in application processes.

- Collaborations with mining and tunnelling contractors will improve product adoption rates.

- Industry consolidation will continue as larger firms acquire niche and regional competitors.

- Enhanced traceability and quality control measures will become standard in supply chains.