Market Overview:

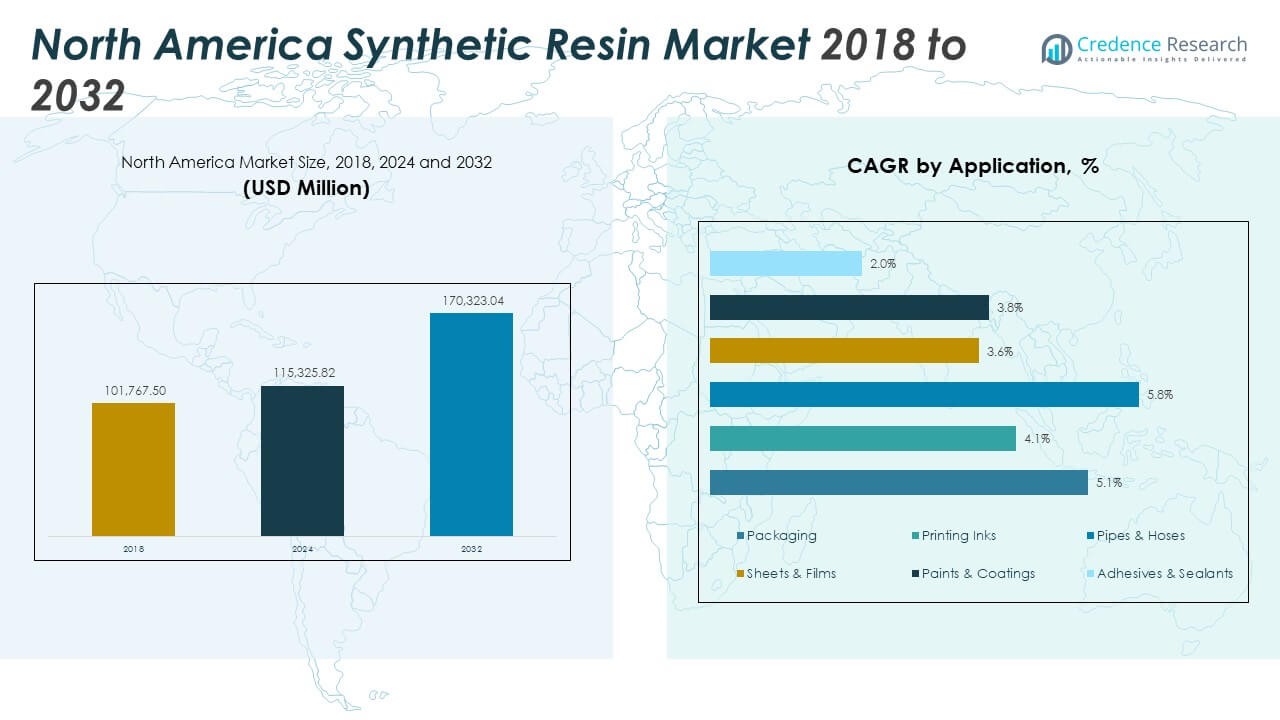

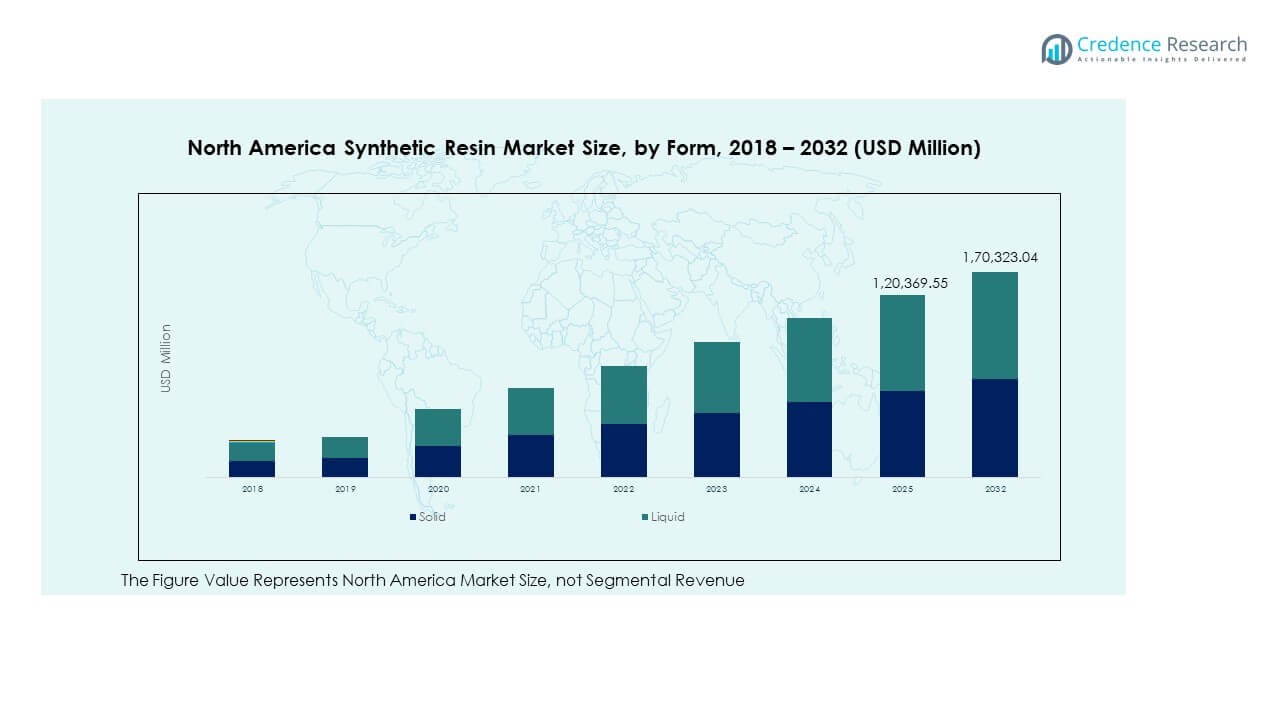

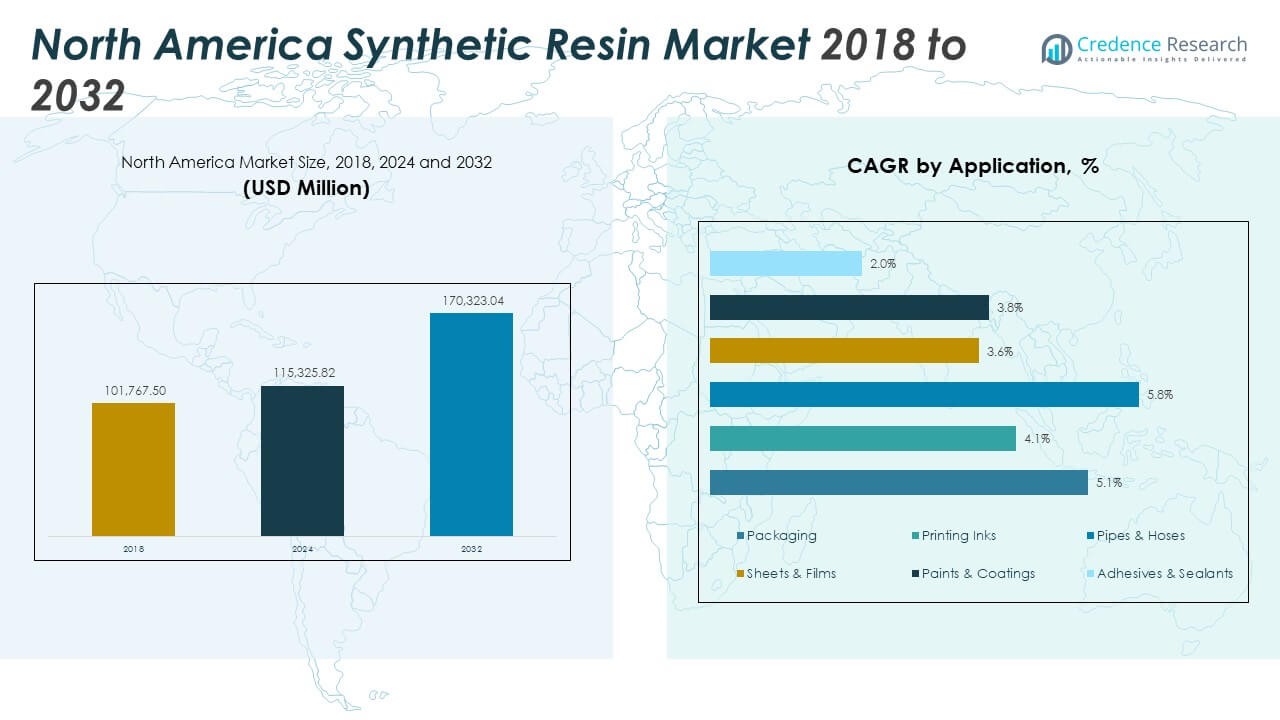

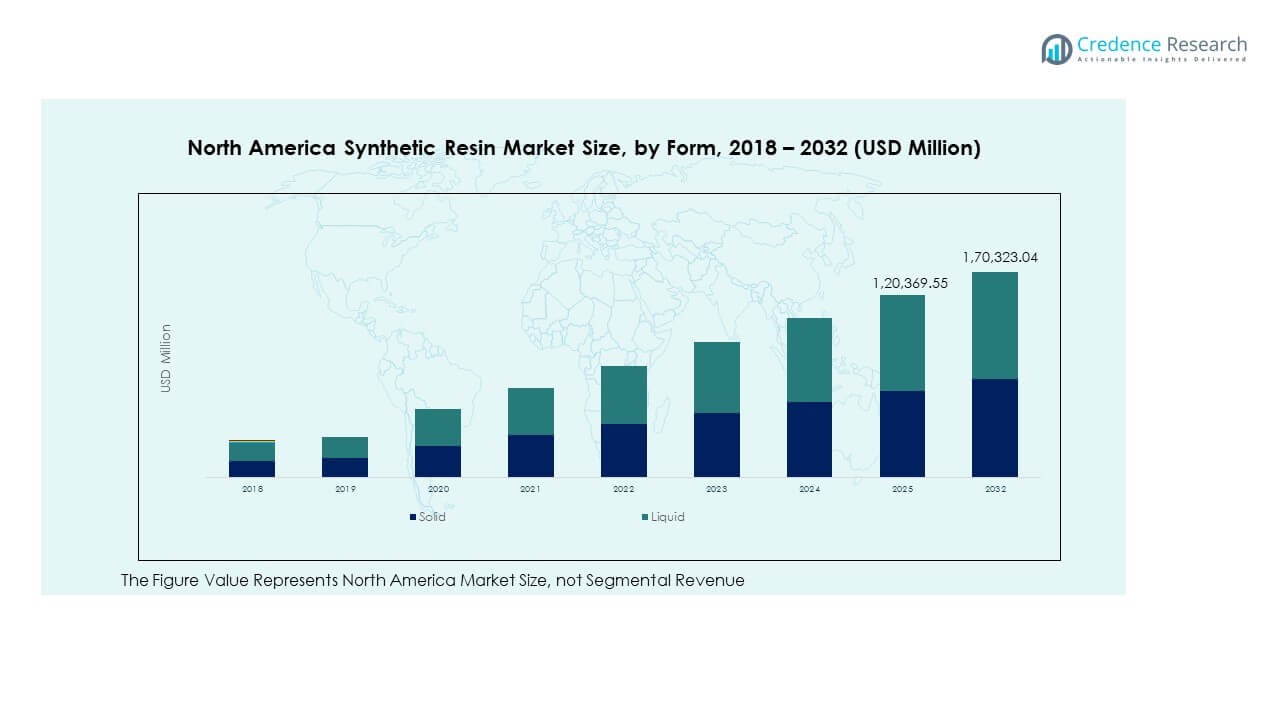

The North America Synthetic Resin Market size was valued at USD 101,767.50 million in 2018 to USD 115,325.82 million in 2024 and is anticipated to reach USD 170,323.04 million by 2032, at a CAGR of 4.92% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Synthetic Resin Market Size 2024 |

USD 115,325.82 Million |

| North America Synthetic Resin Market, CAGR |

4.92% |

| North America Synthetic Resin Market Size 2032 |

USD 170,323.04 Million |

The market is driven by expanding applications across packaging, construction, automotive, and electronics industries. Demand is growing for lightweight, durable, and high-performance materials. Rising adoption of thermoplastics and thermosetting resins in manufacturing is enhancing product versatility and performance. Shifting focus toward sustainable resin solutions is further shaping new product innovations. Infrastructure expansion and increased consumer goods production are also supporting market growth. It benefits from strong technological capabilities and advanced production facilities.

The U.S. dominates the market due to its advanced manufacturing base and established petrochemical infrastructure. Canada follows, supported by steady industrial modernization and sustainable material adoption. Mexico is emerging as a key growth hub, driven by rising industrial investment and expanding automotive and packaging sectors. Strategic supply chain integration across these countries strengthens overall regional competitiveness. Environmental regulations and innovation-driven production trends are expected to shape future market dynamics. It positions the region as a leading global hub for synthetic resin production and consumption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America Synthetic Resin Market was valued at USD 101,767.50 million in 2018 and USD 115,325.82 million in 2024 and is projected to reach USD 170,323.04 million by 2032, growing at a CAGR of 4.92%.

- The U.S. leads with a 62% share, supported by advanced infrastructure, strong manufacturing, and high R&D investments. Canada follows with 23%, driven by construction and energy demand, while Mexico holds 15% through expanding industrialization.

- Mexico is the fastest-growing region with its 15% share, driven by rising automotive, packaging, and construction activities supported by foreign investments and cost advantages.

- Solid resin accounts for 58% of the market share, driven by its strength, durability, and widespread use in automotive, construction, and packaging applications.

- Liquid resin represents 42% of the market share, supported by its versatility in coatings, adhesives, and flexible product applications.

Market Drivers

Rising Demand Across Core End-Use Sectors Such as Automotive, Construction, and Packaging

The North America Synthetic Resin Market is growing due to increased usage in automotive, construction, and packaging. The automotive sector uses synthetic resins in interior panels, coatings, and lightweight structural parts. The construction sector depends on resins for insulation materials, piping, sealants, and protective coatings. The packaging industry leverages their moisture resistance, strength, and cost-effectiveness. Strong demand across these industries ensures stable production volumes. It allows manufacturers to invest in better processing technologies. Expanding urbanization and infrastructure projects further strengthen end-user demand. Market expansion is reinforced by the versatility and durability of resin products.

Increased Penetration of High-Performance and Specialty Resins in Industrial Applications

Industrial users are shifting toward high-performance resin solutions that deliver superior results. Specialty resins offer high tensile strength, thermal resistance, and corrosion protection. These properties make them suitable for aerospace, transportation, and high-specification electronics. It improves operational reliability in harsh environments and reduces maintenance costs. Industries adopt these materials to meet evolving quality and regulatory standards. Manufacturers invest in advanced formulation technologies to supply consistent performance. The focus on specialized materials supports long-term product innovation. This driver accelerates market development in high-value applications.

Sustainability Push Encouraging Bio-Based Resin Production and Circular Economy Models

Sustainability has become a strategic priority across industrial segments. Bio-based resins reduce dependency on fossil feedstocks and minimize emissions. It aligns with tightening environmental standards and consumer preference for eco-friendly materials. Producers are scaling up manufacturing capacities for recyclable and biodegradable resin types. Government incentives and corporate sustainability goals support this shift. Major packaging and consumer goods companies lead the adoption of green alternatives. The transition strengthens market resilience and aligns with long-term environmental commitments. The move toward sustainable materials reshapes product portfolios.

- For instance, Dow Inc. expanded its REVOLOOP™ recycled plastic resin portfolio in 2024, introducing new grades designed for non-food contact packaging applications, strengthening its sustainable materials offering for the North American packaging sector.

Infrastructure Expansion and Manufacturing Capacity Growth Across the Region

Growing infrastructure investment plays a significant role in market expansion. Residential and commercial construction projects increase demand for high-performance resin-based products. It improves construction efficiency and enhances building durability. Manufacturers expand production capacity to support rising volumes. Investments in new facilities create stronger domestic supply chains. The infrastructure boom also benefits transportation and energy segments that rely on structural resin components. Regional production growth improves cost competitiveness for producers. Capacity expansion supports faster response to changing industry demands.

- For instance, in February 2025, Westlake Corporation announced plans to start up a new specialty PVC plant in Texas by 2026, aimed at strengthening its North American PVC resin production capacity, as confirmed by company and industry reports.

Market Trends

Digital Transformation in Resin Manufacturing to Improve Efficiency and Quality

The North America Synthetic Resin Market is experiencing increased use of digital tools and automated systems. Advanced monitoring technologies optimize plant operations and minimize human error. It supports predictive maintenance and reduces downtime. Automation improves process consistency and enhances product quality. Companies deploy real-time data analytics to control cost and boost output. Integration of Industry 4.0 systems makes production more flexible and scalable. Digitalization also accelerates product development timelines. This trend helps producers maintain competitiveness in dynamic markets.

Increased Focus on Lightweight Materials to Support Evolving Design Standards

Lightweight resin solutions are gaining popularity across transportation and consumer goods sectors. The shift reflects the need for fuel efficiency, cost savings, and design flexibility. It allows manufacturers to replace heavier metal components without compromising strength. Lightweight materials support innovation in automotive and aerospace structures. The use of advanced thermoplastic resins expands design possibilities. End users favor these materials to meet performance and regulatory standards. Product development focuses on achieving strength-to-weight advantages. This trend reshapes the market landscape with high-value opportunities.

- For instance, SABIC has introduced its LNP™ ELCRIN™ polycarbonate copolymer resin portfolio, featuring recycled and bio-based content, to support lightweighting and sustainability initiatives in the automotive sector, including applications for electric vehicle components in North America.

Emergence of Smart Coating and Functional Resin Applications

Resins with smart functionalities are creating new growth avenues in multiple industries. Self-healing, anti-corrosive, and temperature-resistant formulations attract strong demand. It offers extended product life cycles and lower maintenance costs. Coating manufacturers use these resins to enhance durability and performance. Construction and electronics industries are early adopters of smart resin technologies. Product innovation focuses on blending mechanical strength with advanced surface properties. Functional resin applications open new market segments. This trend supports stronger product differentiation strategies.

Increased Market Penetration of Recyclable and Reprocessed Resin Solutions

The demand for recyclable resin products is increasing steadily across the region. Consumer preference and regulatory frameworks push companies to upgrade product portfolios. It aligns with circular economy goals and reduces landfill waste. Manufacturers invest in recycling technologies to recover high-quality resin materials. Packaging and automotive industries drive this shift through large-scale adoption. The focus on recycled content improves brand reputation and compliance. Strong supply chain collaborations enable steady raw material flow. This trend supports long-term sustainability targets.

- For instance, Eastman Chemical Company operates a U.S.-based molecular recycling facility with an annual processing capacity of approximately 110,000 metric tons of hard-to-recycle plastic waste, supporting the production of certified recycled PET resin for packaging applications.

Market Challenges Analysis

Tightening Environmental Regulations and Rising Sustainability Expectations

The North America Synthetic Resin Market faces increasing pressure from environmental agencies and regulators. Traditional resin production methods rely on fossil-based feedstocks that raise emissions. Tight standards on single-use plastics impact downstream packaging demand. It forces producers to rethink production models and invest in sustainable technologies. Compliance with evolving chemical safety norms increases operational costs. Stakeholders face public pressure to adopt cleaner alternatives. Companies must balance profitability with environmental responsibility. These factors create significant barriers for smaller producers.

Volatility in Feedstock Prices and Supply Chain Disruptions

Feedstock cost fluctuations create major challenges for resin producers. Geopolitical uncertainties and oil market volatility impact raw material prices. It affects manufacturing stability and profit margins. Global supply chain disruptions increase procurement risks. Companies face higher logistics and inventory management costs. Unpredictable pricing impacts contract negotiations with end users. Producers must build flexible sourcing strategies to minimize shocks. This challenge limits the ability to maintain stable pricing and delivery schedules.

Market Opportunities

Growing Potential of Bio-Based Resins and High-Value Sustainable Alternatives

The North America Synthetic Resin Market has strong opportunities in bio-based materials. Eco-friendly resins align with regulatory frameworks and customer expectations. It enables producers to access high-margin applications in packaging and consumer goods. The shift toward cleaner inputs supports long-term market positioning. R&D investments create advanced, scalable bio-resin solutions. Demand from food, healthcare, and transportation sectors provides strong growth momentum. Companies adopting sustainable portfolios can strengthen their competitive edge. Partnerships in green innovation enhance value chain integration.

Expansion into Niche and High-Performance End-Use Applications

Opportunities are expanding in high-tech sectors such as renewable energy, aerospace, and electronics. It allows producers to diversify revenue streams beyond traditional segments. Advanced resin formulations meet the performance needs of specialized applications. Customized solutions support strong, long-term partnerships with strategic buyers. High-value segments offer better pricing stability and contract security. Innovation drives differentiation and competitive advantage. Companies expanding in niche applications can establish leadership positions. This opportunity supports stable growth across the region.

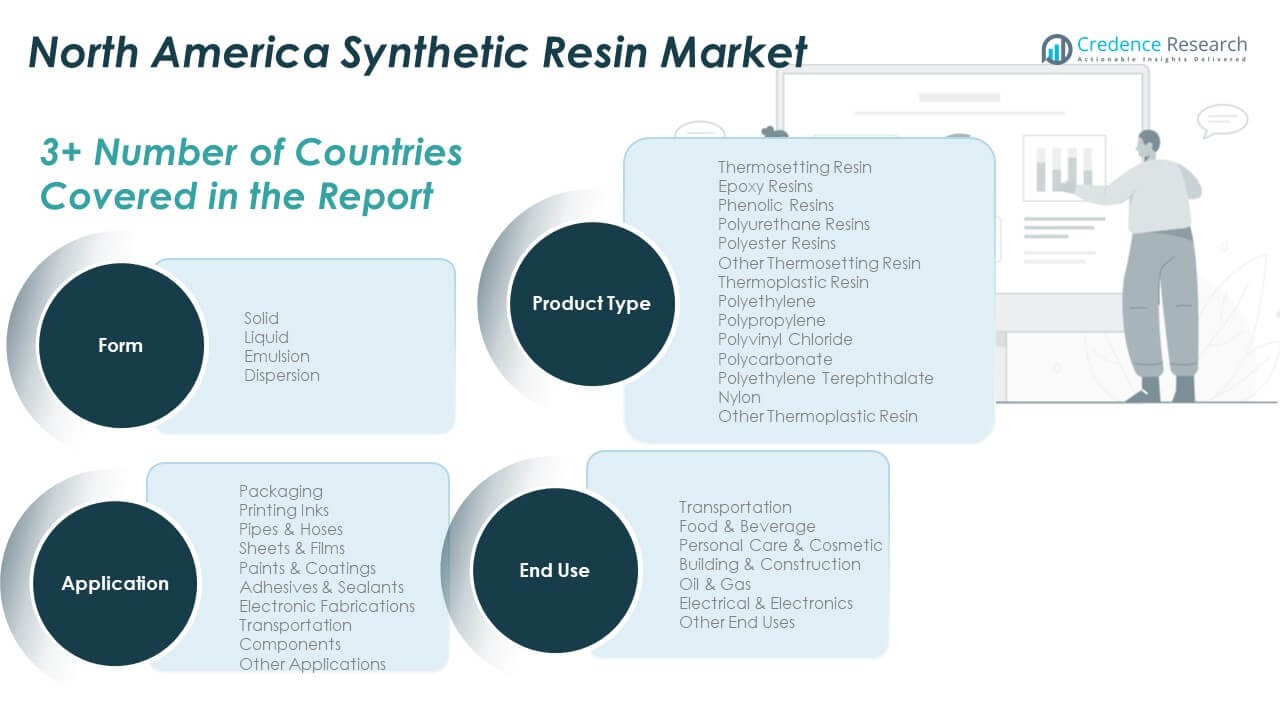

Market Segmentation Analysis

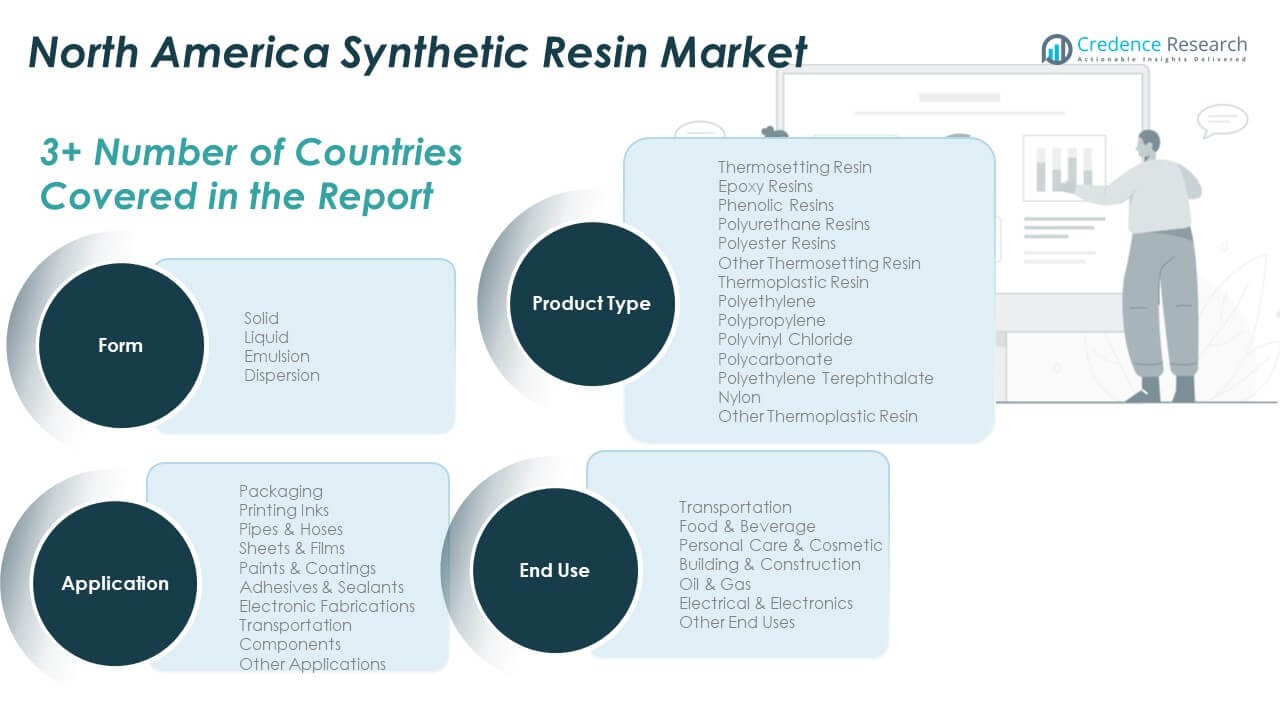

By Form

The North America Synthetic Resin Market is segmented into solid, liquid, emulsion, and dispersion forms. Solid resins dominate due to their strong mechanical properties and ease of storage, making them preferred in automotive, construction, and industrial uses. Liquid resins are widely used in coatings and adhesives for their excellent bonding strength and easy application. Emulsion resins gain traction in water-based systems driven by environmental compliance. Dispersion resins find niche applications in flexible and specialty products. It benefits from their adaptability across multiple production processes. The balance of performance and cost efficiency supports their strong market presence.

- For instance, BASF’s Joncryl® dispersion resin portfolio is widely used in flexible packaging applications across North America, offering improved film strength, printability, and process efficiency for converters and packaging manufacturers.

By Application

The application segment includes packaging, printing inks, pipes and hoses, sheets and films, paints and coatings, adhesives and sealants, electronic fabrications, transportation components, and other applications. Packaging holds the largest share due to its wide use in consumer goods and food industries. Paints and coatings show steady demand driven by construction and automotive sectors. Adhesives and sealants gain relevance in assembly and infrastructure projects. Electronic fabrications expand their usage in advanced circuit manufacturing. It reflects how diversified applications sustain market strength and resilience.

- For instance, Henkel’s LOCTITE® resin-based sealants are widely used in North America for infrastructure and construction applications, providing high durability and performance in demanding structural and joint sealing projects.

By End Use

The end-use segment covers transportation, food and beverage, personal care and cosmetic, building and construction, oil and gas, electrical and electronics, and other industries. Transportation leads the segment supported by lightweight material demand and structural applications. Building and construction follow with extensive use in insulation, sealants, and protective layers. Electrical and electronics gain market share from advanced polymer use in devices and components. Food and beverage packaging contributes steadily to volume. It benefits from wide acceptance across consumer and industrial sectors.

By Product Type

The product type segment includes thermosetting and thermoplastic resins. Thermoplastic resins, including polyethylene, polypropylene, and PVC, dominate due to their versatility, recyclability, and low cost. Thermosetting resins, including epoxy, phenolic, polyurethane, and polyester, support applications requiring high strength and chemical resistance. It meets performance standards in automotive, construction, and industrial settings. Polyethylene and polypropylene show strong adoption in packaging and transportation. Epoxy and polyurethane play a key role in structural bonding and coatings. This segmentation highlights a strong balance between high-volume and high-performance products.

Segmentation

By Form

- Solid

- Liquid

- Emulsion

- Dispersion

By Application

- Packaging

- Printing Inks

- Pipes & Hoses

- Sheets & Films

- Paints & Coatings

- Adhesives & Sealants

- Electronic Fabrications

- Transportation Components

- Other Applications

By End Use

- Transportation

- Food & Beverage

- Personal Care & Cosmetic

- Building & Construction

- Oil & Gas

- Electrical & Electronics

- Other End Uses

By Product Type

· Thermosetting Resin

- Epoxy Resins

- Phenolic Resins

- Polyurethane Resins

- Polyester Resins

- Other Thermosetting Resin

· Thermoplastic Resin

- Polyethylene

- Polypropylene

- Polyvinyl Chloride (PVC)

- Polycarbonate

- Polyethylene Terephthalate (PET)

- Nylon

- Other Thermoplastic Resin

Regional Analysis

The U.S. holds a 62% share of the North America Synthetic Resin Market. Strong demand from packaging, construction, automotive, and electronics industries drives steady growth. The country benefits from advanced petrochemical infrastructure, strong manufacturing capabilities, and high investment in R&D. Government regulations encourage the adoption of sustainable resin solutions. Rising demand for high-performance materials in electric vehicles, green construction, and consumer packaging supports market leadership. It continues to be the primary production and consumption hub, attracting large-scale investments in capacity expansion and process innovation.

Canada accounts for 23% of the regional market, supported by increasing infrastructure investments and modernization of industrial facilities. Construction, transportation, and energy sectors drive consumption across major provinces. The push toward green building solutions and sustainable manufacturing strengthens demand for advanced resins. Producers are enhancing their domestic manufacturing footprint to meet both local and export needs. A stable regulatory environment and favorable trade relations support market expansion. It benefits from access to abundant raw materials and a strong logistics network connecting North American markets.

Mexico represents 15% of the North America Synthetic Resin Market, with rapid growth supported by its expanding manufacturing base. Automotive, packaging, and consumer goods industries are key demand centers. Foreign investments in industrial development increase local resin production capacity. Trade agreements and lower production costs strengthen its role in regional supply chains. Industrialization and urbanization are boosting construction activities, further driving demand. It is emerging as a cost-effective manufacturing hub, attracting both domestic and international players seeking strategic positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- SABIC

- Covestro AG

- Mitsubishi Chemical Group Corporation

- LG Chem

- Sumitomo Chemical Co., Ltd.

- Arkema S.A.

- DSM-Firmenich

- Dow Inc.

- DuPont de Nemours, Inc.

- Westlake Chemical Corporation

Competitive Analysis

The North America Synthetic Resin Market is characterized by intense competition among global and regional companies. Leading players focus on advanced product development, sustainable resin solutions, and capacity expansion. Key strategies include investing in R&D, forming strategic partnerships, and optimizing supply chain networks. Companies are increasing focus on recyclable and bio-based resins to align with regulatory and consumer trends. Technological innovation enhances production efficiency and cost competitiveness. Brand reputation and established distribution networks provide a competitive edge to major producers. It benefits from continuous product differentiation, strong market coverage, and targeted application expansion across multiple industries.

Recent Developments

- In October 2025, BASF SE and International Flavors & Fragrances Inc. (IFF) announced a strategic partnership aimed at accelerating the development of IFF’s Designed Enzymatic Biomaterials™ platform for next-generation enzyme and polymer innovation in North America. This collaboration is set to bring new high-performance, sustainable solutions into synthetic resin applications for cleaning and personal care, reflecting a joint push toward sustainability and advanced functionality.

- In September 2025, Arkema S.A. highlighted its commitment to the synthetic resin sector through multiple partnership-driven sustainability initiatives. The company earned ISCC PLUS certification for its polyester powder coating resins in North Kansas City, MO, enabling certified low-carbon products for the North American market.

- In August 2024, LG Chem inaugurated its new Customer Solution (CS) Center in Ravenna, Ohio. The facility, spanning 8,300 square meters, is equipped for mass-production extrusion and injection, enabling tailored technical solutions for product development and process improvement in resin applications—particularly ABS—across North America. The move aligns LG Chem’s operations with local demand and logistics advantages, boosting service capabilities in the synthetic resin market.

- In January 2025, Covestro AG announced a major site expansion in Hebron, Ohio, investing a low triple-digit million Euro amount to increase its local production capacity for specialized polycarbonate materials. This move strengthens Covestro’s market position for high-quality materials serving automotive, electronics, and healthcare sectors in North America, while enhancing supply reliability for regional customers.

Report Coverage

The research report offers an in-depth analysis based on Form, Application, End Use and Product Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing investment in bio-based and recyclable resin technologies will strengthen sustainable product development.

- Expansion of infrastructure and transportation sectors will drive high-volume resin consumption across key applications.

- Advanced thermoplastic resins will dominate due to their flexibility, cost efficiency, and wide industrial adoption.

- Automation and digitalization in manufacturing will improve production efficiency and enhance market competitiveness.

- Shifts in regulatory standards will encourage companies to upgrade formulations to meet environmental compliance.

- The packaging sector will remain a core revenue driver supported by demand for lightweight and durable materials.

- Strategic capacity expansions by leading producers will enhance regional supply chain strength.

- Growth in electric vehicles and renewable energy projects will create demand for specialized resin applications.

- Cross-industry collaborations will accelerate product innovation and diversification in end-use segments.

- The U.S. will continue to maintain its dominant position due to its strong industrial and technological base.