Market overview

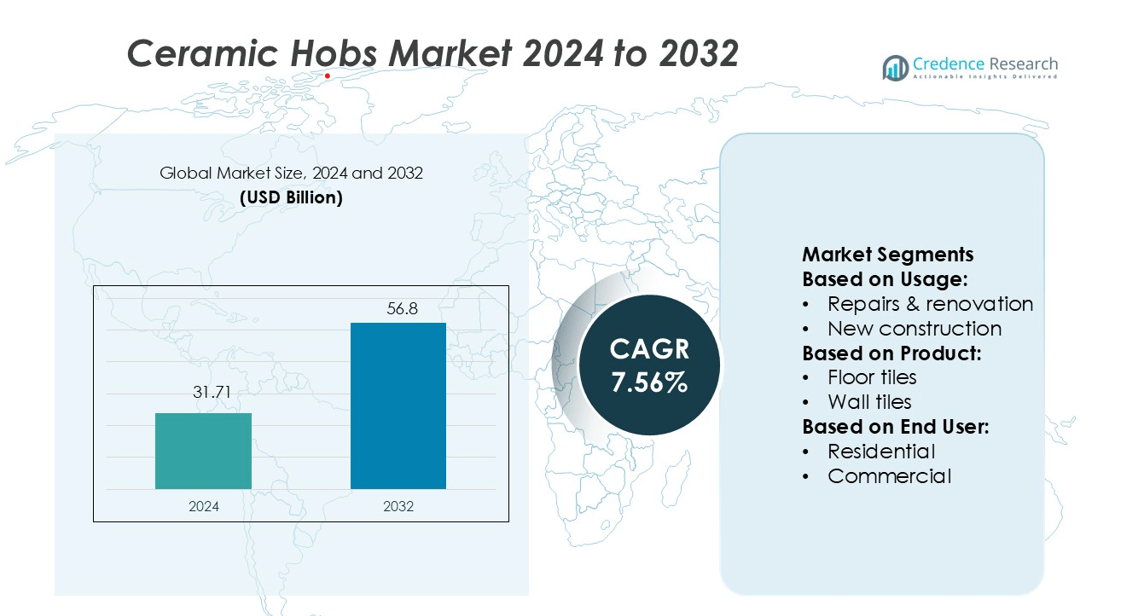

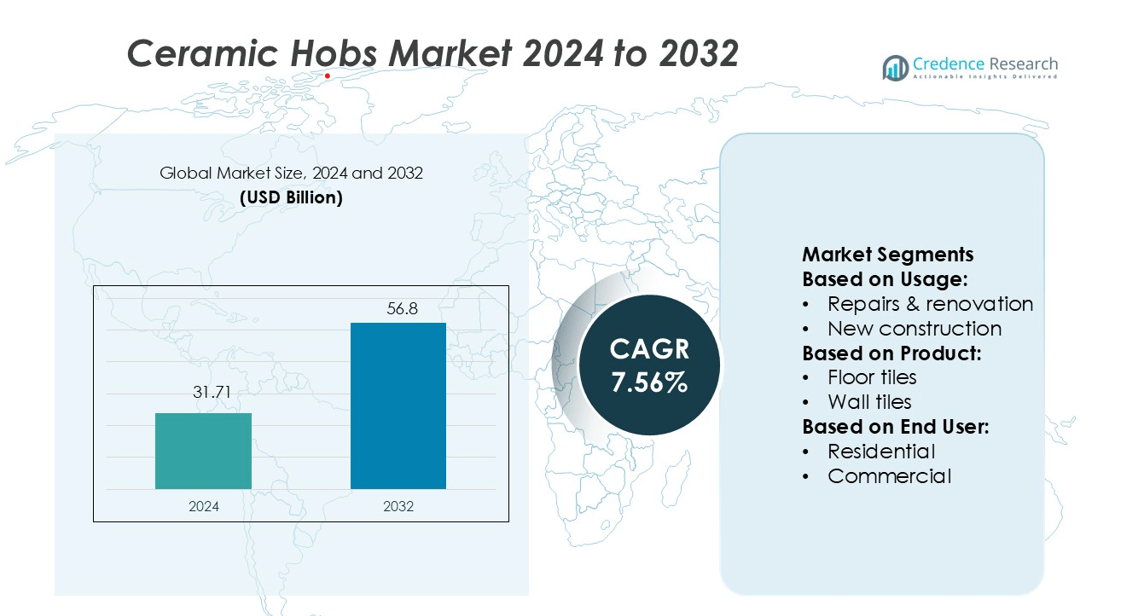

Ceramic Hobs Market size was valued USD 31.71 billion in 2024 and is anticipated to reach USD 56.8 billion by 2032, at a CAGR of 7.56% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ceramic Hobs Market Size 2024 |

USD 31.71 billion |

| Ceramic Hobs Market, CAGR |

7.56% |

| Ceramic Hobs Market Size 2032 |

USD 56.8 billion |

The top players in the Ceramic Hobs Market include GRUPO PAMESA, Mohawk Industries, Inc., Porcelanosa Grupo, China Ceramics Co., Ltd., GRUPO LAMOSA, KAJARIA CERAMICS, Florida Tile, Inc., Ceramiche Atlas Concorde S.p.A., Crossville, Inc., and Gruppo Ceramiche Ricchetti S.p.A. These companies are focusing on technological innovation, energy efficiency, and modern design features to strengthen their market presence. Europe leads the global market with a 32% share, supported by strong consumer preference for premium kitchen solutions and strict energy efficiency standards. The region’s advanced infrastructure, rising adoption of smart homes, and established distribution networks give it a competitive edge.

Market Insights

- The Ceramic Hobs Market size was valued at USD 31.71 billion in 2024 and is projected to reach USD 56.8 billion by 2032, growing at a CAGR of 7.56%.

- Rising demand for energy-efficient and smart kitchen appliances is driving strong adoption in residential and commercial spaces.

- Europe leads the market with a 32% regional share, supported by advanced infrastructure, smart home penetration, and strict energy standards.

- Major players focus on innovation, safety features, and design enhancements to strengthen their global competitiveness.

- High initial costs and strong competition from induction and gas cooktops remain key restraints, while growing residential construction and smart home integration offer strong future growth opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Usage

The new construction segment holds the dominant market share in the Ceramic Hobs Market. This segment benefits from the increasing number of residential and commercial building projects worldwide. Rising urbanization and smart home adoption drive demand for modern, energy-efficient cooking appliances in new properties. Builders and developers integrate ceramic hobs as a standard fixture to enhance kitchen aesthetics and functionality. Government initiatives supporting affordable housing and green buildings further support segment growth. Repairs and renovation also show steady growth as consumers upgrade old kitchen systems to more efficient and stylish ceramic hobs.

- For instance, GRUPO PAMESA has invested in advanced kiln technology capable of firing vast quantities of ceramic tiles daily at temperatures exceeding 1,200 °C. These investments have enabled the large-scale production of durable and uniform tile surfaces for flooring and walls.

By Product

The floor tiles segment leads the Ceramic Hobs Market with the largest share. This dominance is driven by its wide use in modern kitchen designs, which often pair ceramic hobs with premium floor tiles for a sleek look. Floor tiles are durable, cost-effective, and easy to clean, aligning well with evolving kitchen layouts. Manufacturers are introducing advanced ceramic coatings that resist heat and stains, increasing product appeal. Wall tiles and other materials continue to grow as consumers seek integrated design solutions that combine functionality with modern aesthetics.

- For instance, Mohawk’s new ceramic tile manufacturing facility, a 1.4 million-square-foot plant in Dickson County, was designed to increase the company’s total global ceramic tile production capacity to over 2 billion square feet annually.

By End User

The residential segment accounts for the highest market share in the Ceramic Hobs Market. Rising disposable incomes, urban lifestyle shifts, and the growing preference for modular kitchens drive residential demand. Homeowners favor ceramic hobs for their elegant design, ease of cleaning, and precise temperature control. Real estate developments and smart home projects strengthen product adoption across urban and suburban areas. The commercial segment, including restaurants and hotels, also grows steadily due to demand for efficient, modern cooking solutions. Residential buyers, however, remain the key revenue drivers for this segment.

Key Growth Drivers

Rising Demand for Modern Kitchen Appliances

The growing preference for sleek and efficient kitchen solutions is driving ceramic hob adoption. Homeowners are increasingly upgrading to built-in cooking surfaces that enhance both performance and aesthetics. Ceramic hobs offer fast heating, easy cleaning, and seamless integration with modular kitchen designs. Urbanization and lifestyle shifts are boosting household appliance spending. Manufacturers are expanding product lines with touch controls and safety features to meet this rising demand. This shift positions ceramic hobs as a preferred alternative to traditional gas cooktops in modern households.

- For instance, Porcelanosa launched its “SmartKitchen invisible cooktop with dual inductive technology” which supports two independent induction zones hidden beneath a countertop surface measuring 1,200 × 600 mm.

Expanding Residential and Commercial Construction

New residential and commercial projects are fueling ceramic hob installations. Modern housing projects often include premium kitchen fittings as a standard feature. Restaurants, hotels, and cafes are also adopting ceramic hobs to optimize cooking speed and energy efficiency. Government incentives supporting energy-efficient buildings are further driving demand. Real estate developers are partnering with appliance brands to provide pre-installed kitchen solutions. This integration ensures a steady growth pipeline for ceramic hob manufacturers across key urban markets.

- For instance, China Ceramics has developed ultra-thin tiles with a thickness of between 4.8 mm and 6.6 mm, which enable lighter weight wall and floor systems. These tiles are designed for a variety of applications, including kitchen and bathroom floors, as well as wall coverings.

Advancements in Heating Technology

Technological innovation is transforming ceramic hob performance and safety standards. Features such as rapid heating zones, automatic shut-off, and smart temperature control enhance cooking efficiency. Integration with smart home systems allows users to manage appliances remotely. Manufacturers are focusing on durability, energy optimization, and user-friendly interfaces to gain a competitive edge. These advancements are improving user experience while supporting eco-friendly cooking practices. As consumers seek smarter kitchens, the demand for advanced ceramic hobs continues to strengthen.

Key Trends & Opportunities

Integration with Smart Home Ecosystems

Smart home adoption is creating new opportunities for ceramic hob makers. Voice control and mobile app connectivity enable users to manage cooking remotely. This trend aligns with the growing demand for convenience and energy efficiency. Manufacturers are incorporating IoT capabilities to provide personalized cooking experiences and predictive maintenance alerts. The rise of connected kitchens offers strong potential for product differentiation and premium pricing strategies.

- For instance, Kajaria Ceramics equipped its manufacturing facilities with robotic tile glazing lines, enabling the production of large-format tiles of up to 1,200 × 2,400 mm in its Morbi plants.

Growing Preference for Energy-Efficient Appliances

Sustainability is shaping purchasing decisions in the appliance sector. Consumers are increasingly choosing ceramic hobs for their energy efficiency and reduced carbon footprint. Regulatory bodies are introducing energy performance standards, pushing manufacturers to innovate further. This shift supports the development of eco-friendly technologies and boosts market competitiveness. Companies focusing on energy-saving solutions stand to gain strong market positioning.

- For instance, Florida Tile states that its Lawrenceburg facility fires porcelain tiles at 1200 °C (2200 °F) for about 45 minutes in the kiln, producing dense tiles with high strength and lower water absorption.

Expansion in Emerging Economies

Rapid urban growth in Asia-Pacific and Latin America is creating lucrative opportunities. Rising disposable incomes and expanding middle-class populations are boosting appliance purchases. Builders are incorporating modern kitchen designs, increasing ceramic hob penetration. Local manufacturing initiatives and lower product costs are supporting wider availability. These factors are opening new growth avenues for both global and regional players.

Key Challenges

High Initial Costs and Installation Barriers

Ceramic hobs often involve higher upfront costs compared to gas cooktops. Installation requires proper electrical infrastructure, which may not be available in older buildings. This factor limits adoption in price-sensitive markets. Consumers may also perceive high repair costs as a drawback. These challenges can slow down market penetration, particularly in developing regions with lower purchasing power.

Competition from Induction and Gas Cooktops

Intense competition from alternative cooktop technologies is restraining market growth. Induction hobs offer faster heating and greater energy efficiency, while gas cooktops remain popular for their affordability and familiarity. Consumers often weigh cost, functionality, and ease of use before making purchasing decisions. This competitive pressure forces ceramic hob manufacturers to differentiate through innovation and pricing strategies.

Regional Analysis

North America

North America holds a 28% market share in the ceramic hobs market, driven by strong demand for modern kitchen appliances. High disposable incomes and a well-established residential infrastructure support steady adoption. Consumers prefer ceramic hobs for their sleek design, energy efficiency, and easy maintenance. The U.S. dominates regional sales, with growing integration of smart home technologies boosting product penetration. Real estate developers are incorporating ceramic hobs in premium and mid-range housing projects. Additionally, government incentives promoting energy-efficient appliances further enhance market growth across the U.S. and Canada, reinforcing the region’s leadership position.

Europe

Europe commands a 32% market share, making it the leading regional market for ceramic hobs. High adoption rates stem from a strong culture of energy efficiency and sustainable home appliances. Countries such as Germany, the UK, and France are key contributors, supported by modern housing designs and stringent energy regulations. Consumers favor built-in kitchen appliances for their aesthetics and performance. Manufacturers in the region focus on innovative designs with smart touch controls and safety features. Growing demand in the hospitality sector also boosts installations, strengthening Europe’s position as a key revenue-generating market.

Asia-Pacific

Asia-Pacific accounts for a 25% market share and represents the fastest-growing region. Rapid urbanization, rising disposable incomes, and changing lifestyle preferences are fueling ceramic hob adoption. China, Japan, and India lead the regional market with expanding residential and commercial construction. The rise of smart homes and modular kitchen concepts is also boosting penetration. Manufacturers are localizing production to reduce costs and meet price-sensitive demand. Increasing awareness of energy-efficient cooking solutions and government programs promoting modern infrastructure support strong growth prospects in this region, making it a key future growth engine.

Latin America

Latin America holds a 9% market share in the ceramic hobs market, supported by growing residential construction and modernization trends. Brazil and Mexico are the largest contributors, with rising middle-class populations driving appliance purchases. Kitchen remodeling activities and the growing appeal of built-in cooking solutions are increasing product adoption. However, price sensitivity remains a key consideration, prompting manufacturers to focus on affordable models. Expansion of retail distribution channels and e-commerce is improving product availability, further supporting steady market expansion across urban centers in Latin America.

Middle East & Africa

The Middle East & Africa (MEA) region captures a 6% market share and shows steady growth potential. Rising urbanization, hospitality sector expansion, and increasing tourism infrastructure investments are boosting ceramic hob installations. Countries such as the UAE, Saudi Arabia, and South Africa are witnessing a growing preference for modern kitchen solutions. Government housing projects and premium real estate developments are key contributors. Although market penetration is still lower than other regions, increasing disposable incomes and modernization efforts are expected to strengthen MEA’s position in the global ceramic hobs market over the forecast period.

Market Segmentations:

By Usage:

- Repairs & renovation

- New construction

By Product:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Ceramic Hobs Market is shaped by GRUPO PAMESA, Mohawk Industries, Inc., Porcelanosa Grupo, China Ceramics Co., Ltd., GRUPO LAMOSA, KAJARIA CERAMICS, Florida Tile, Inc., Ceramiche Atlas Concorde S.p.A., Crossville, Inc., and Gruppo Ceramiche Ricchetti S.p.A. The Ceramic Hobs Market is defined by rapid innovation, strategic partnerships, and growing investments in advanced technologies. Manufacturers are focusing on integrating smart control features, rapid heating zones, and energy-efficient systems to enhance product appeal. Many companies are expanding their global footprint through collaborations with real estate developers and kitchen solution providers. Product differentiation strategies center on sleek designs, enhanced safety features, and seamless integration with smart home ecosystems. Sustainability initiatives, including eco-friendly manufacturing and energy-saving technologies, are also gaining traction. This competitive environment drives continuous product upgrades and market expansion across key regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GRUPO PAMESA

- Mohawk Industries, Inc.

- Porcelanosa Grupo

- China Ceramics Co., Ltd.

- GRUPO LAMOSA

- KAJARIA CERAMICS

- Florida Tile, Inc.

- Ceramiche Atlas Concorde S.p.A.

- Crossville, Inc.

- Gruppo Ceramiche Ricchetti S.p.A.

Recent Developments

- In September 2024, AEG, one of the prominent kitchen appliances technology and innovation brands by AB Electrolux (publ), launched a series of innovations driven by factors including care, taste, and well-being in IFA (Internationale Funkausstellung Berlin) 2024.

- In April 2024, Meghna Ceramic Industries increased its production capacity with an investment worth USD 45 million to capture a larger market share of the tiles market. Since July 2023, the company’s factory near Dhaka has been producing 51,000 square meters of “Fresh Ceramics” tiles daily.

- In April 2024, Laguna Clay Company was recognized in multiple global ceramics industry reports as a leading supplier of clay bodies and glaze materials, driven by consistent demand from art schools and studio potters across North America.

- In April 2023, Elica Spa, an Italian designer and manufacturer of kitchen appliances, entered into a strategic partnership with Italian company ILVE to expand into the home cooking market by introducing hobs and induction oven

Report Coverage

The research report offers an in-depth analysis based on Usage, Product, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for energy-efficient cooking appliances will continue to rise globally.

- Smart home integration will drive product innovation and premium adoption.

- Manufacturers will expand product lines with advanced safety and touch control features.

- Residential construction growth will boost ceramic hob installations in urban areas.

- Hospitality and commercial kitchens will increasingly adopt modern cooking technologies.

- Eco-friendly manufacturing and sustainable product designs will gain greater focus.

- Regional players will invest in local production to reduce costs and improve availability.

- E-commerce and retail partnerships will strengthen global distribution networks.

- Competition will intensify with continuous innovation and technological upgrades.

- Government regulations promoting energy efficiency will further support market expansion.