Market Overview:

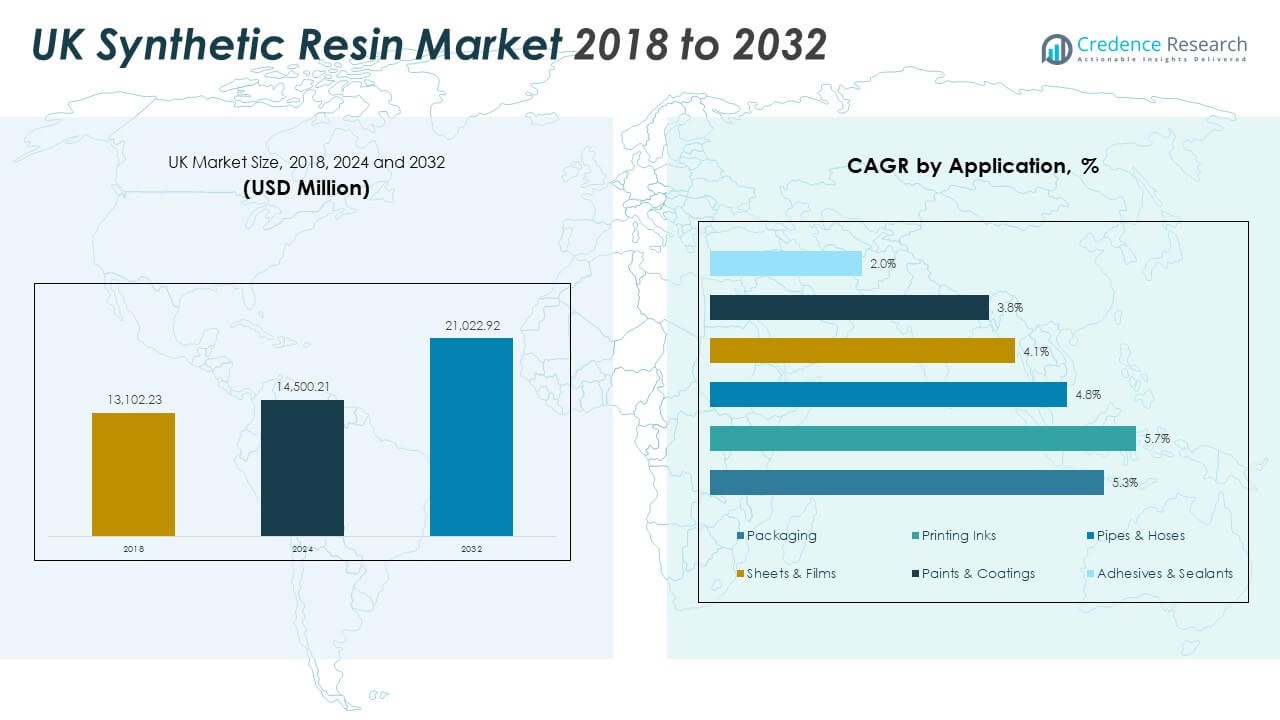

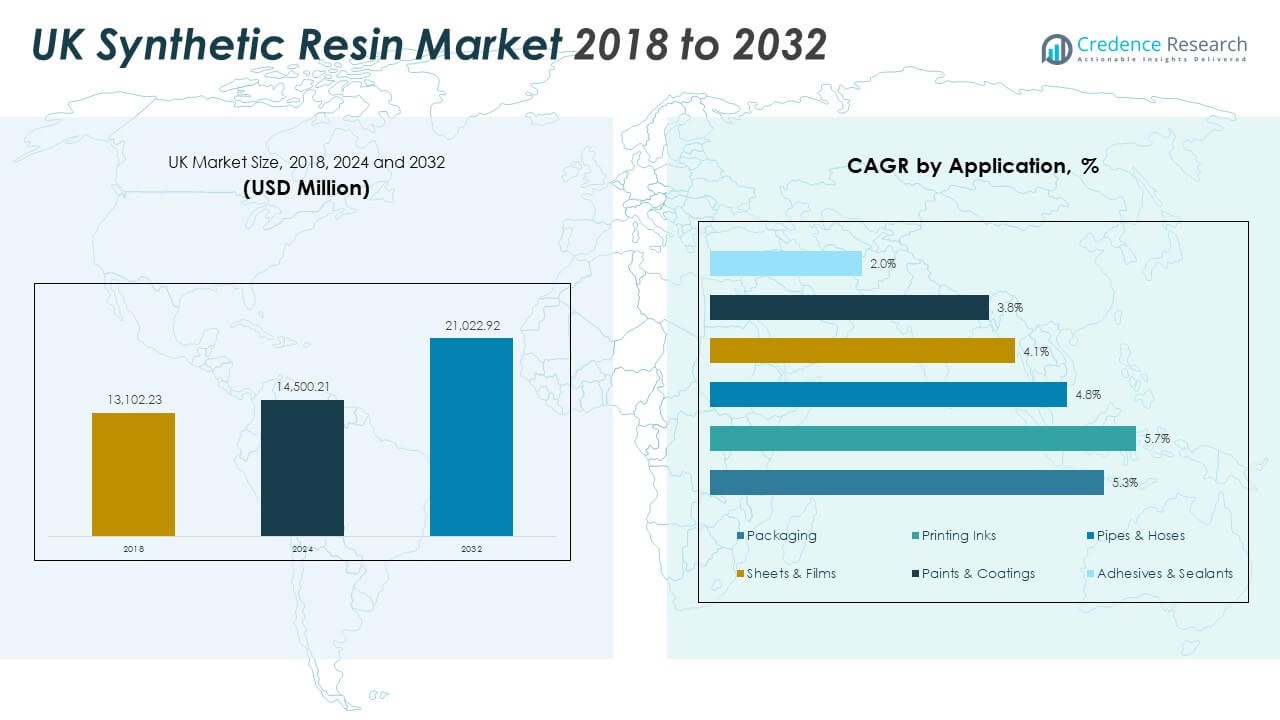

The UK Synthetic Resin Market size was valued at USD 13,102.23 million in 2018 to USD 14,500.21 million in 2024 and is anticipated to reach USD 21,022.92 million by 2032, at a CAGR of 4.75% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Synthetic Resin Market Size 2024 |

USD 14,500.21 Million |

| UK Synthetic Resin Market, CAGR |

4.75% |

| UK Synthetic Resin Market Size 2032 |

USD 21,022.92 Million |

Strong demand from packaging, automotive, and construction industries drives consistent growth across the market. Manufacturers are investing in advanced resin formulations that offer higher durability, improved performance, and environmental benefits. Rising regulatory pressure to adopt sustainable materials accelerates the transition toward bio-based and recyclable resin products, strengthening market competitiveness and innovation.

England dominates the market, supported by a strong industrial base, developed infrastructure, and advanced R&D capabilities. Scotland is emerging as a high-potential growth region, driven by green manufacturing initiatives and expanding industrial clusters. Wales and Northern Ireland also show increasing activity due to SME-driven production and strategic location advantages. This regional distribution highlights the combined role of innovation hubs, infrastructure strength, and industrial capacity in shaping market expansion across the UK.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UK Synthetic Resin Market was valued at USD 13,102.23 million in 2018, reached USD 14,500.21 million in 2024, and is projected to hit USD 21,022.92 million by 2032, growing at a CAGR of 4.75%.

- England leads the market with a 64% share, supported by strong manufacturing, infrastructure, and export capacity. Scotland follows with 19% due to green innovation, and Wales and Northern Ireland collectively hold 17%, driven by SME-based growth.

- Scotland represents the fastest-growing region, benefiting from renewable energy initiatives, innovation hubs, and infrastructure projects that boost industrial resin demand.

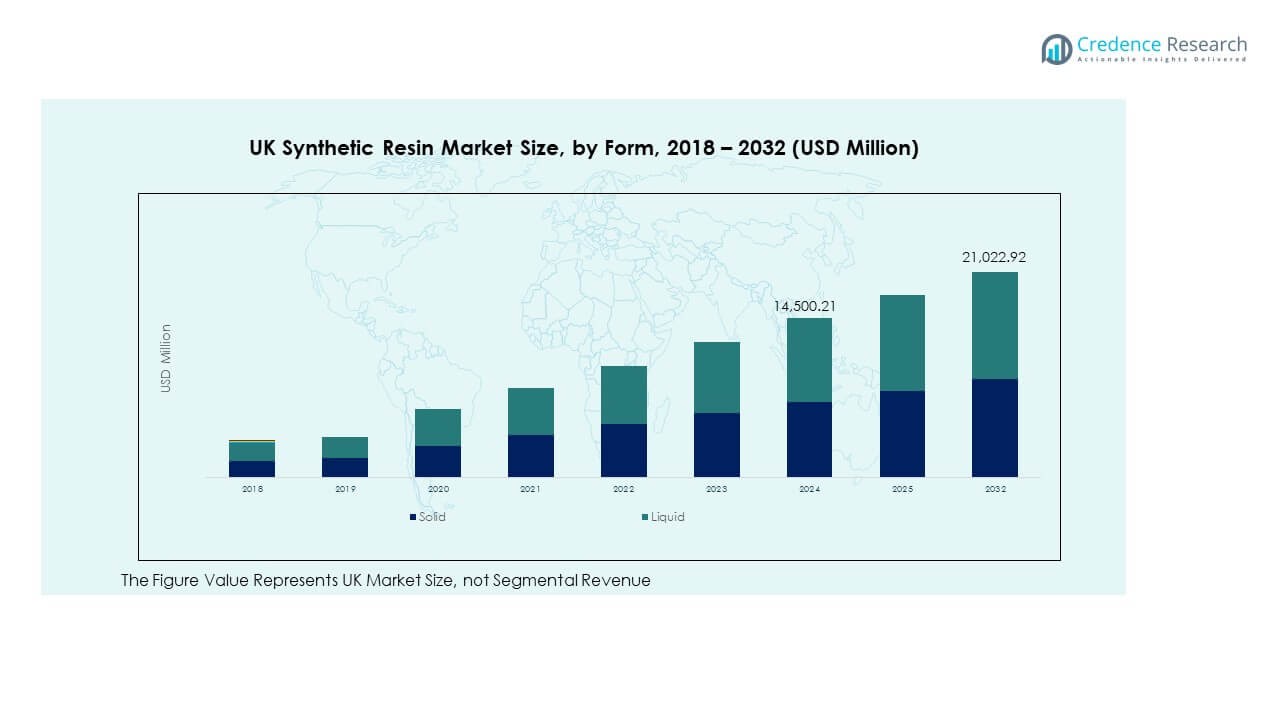

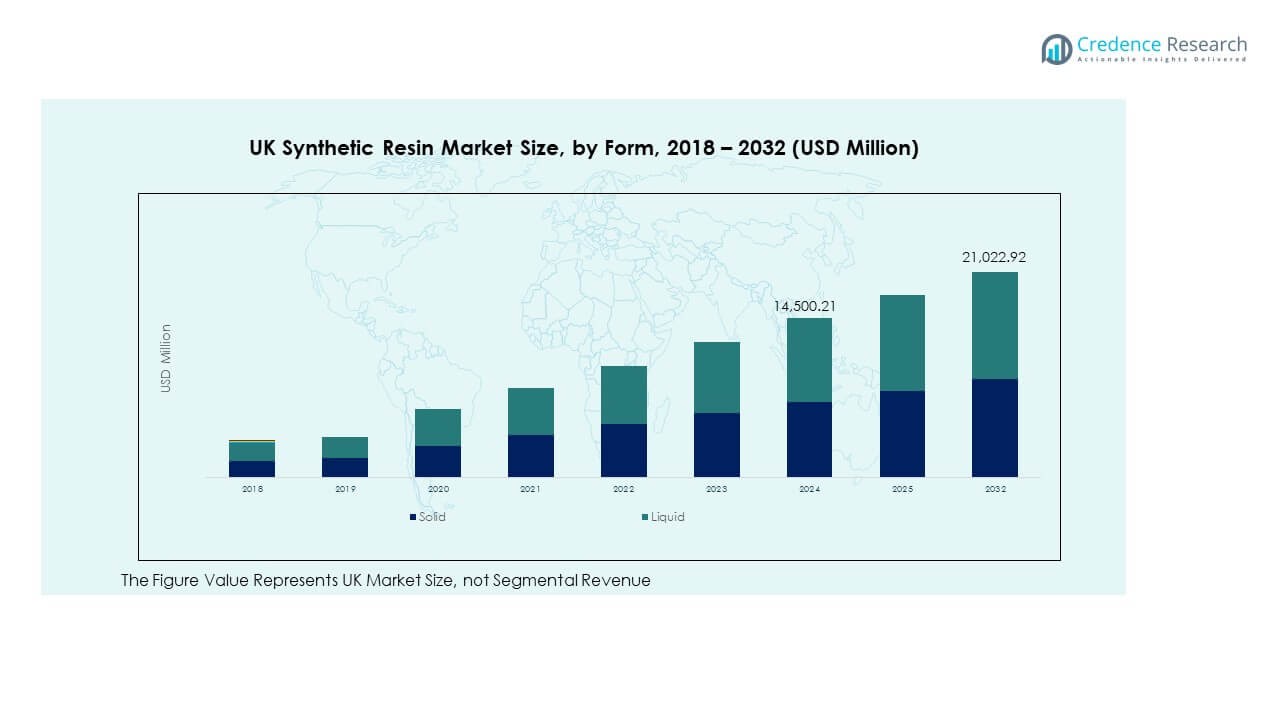

- Solid resins account for approximately 58% of the market, driven by their high strength and versatile use across packaging, construction, and automotive sectors.

- Liquid resins represent roughly 42% of the market, supported by growing demand in coatings, adhesives, and electronic applications where flexibility and performance are key.

Market Drivers

Rising Demand for Lightweight and Durable Materials Across Key End-Use Sectors

The growing preference for lightweight and durable materials drives the UK Synthetic Resin Market. Industries such as packaging, automotive, and construction use synthetic resins to enhance product performance and reduce operational costs. It supports the creation of high-strength components while maintaining flexibility and corrosion resistance. Automotive manufacturers favor these materials to improve fuel efficiency and reduce emissions. The construction sector benefits from strong adhesion, durability, and weather resistance. Packaging applications rely on synthetic resins for sealing, product protection, and sustainability compliance. This broad adoption strengthens market growth and innovation.

Stringent Environmental Regulations Promoting Sustainable Resin Development

Evolving environmental policies encourage companies to adopt more sustainable resin solutions. Regulatory frameworks limit harmful emissions and single-use plastics, pushing industries toward eco-friendly alternatives. It drives investments in bio-based resins and recyclable polymers. Manufacturers integrate cleaner production methods to comply with circular economy goals. These changes create opportunities for sustainable product lines and green certifications. Government-backed initiatives further strengthen domestic innovation capacity. The shift toward environmentally responsible materials boosts market competitiveness. It also aligns long-term industry strategies with sustainability goals.

Expanding Industrial Base and Infrastructure Modernization in the Country

A strong industrial base supports the rapid expansion of the synthetic resin sector in the UK. Manufacturing hubs in England and Wales fuel demand for high-performance resin products. Modernization projects in transportation, housing, and energy infrastructure create steady opportunities. It enables increased adoption of synthetic resin in coatings, sealants, and construction materials. Technological advancements improve product consistency and quality. Industrial growth attracts investments from global suppliers and domestic producers. These developments enhance market capacity and efficiency. This expansion strengthens the sector’s contribution to the economy.

- For instance, Synthomer entered a £2 million R&D partnership with the University of York in February 2025, developing bio-based monomers with lower carbon footprints for coatings and construction, targeting operational scales of hundreds to thousands of tonnes per year while progressing toward net zero targets.

Growing Consumer Preference for Recyclable and High-Quality Packaging

Changing consumer behavior supports demand for eco-friendly and reliable packaging materials. Brands use synthetic resins to create packaging with better shelf life and reduced environmental impact. It enables the development of reusable, lightweight, and tamper-resistant packaging solutions. Retail and e-commerce growth boosts packaging volumes, further accelerating resin use. Consumer demand influences manufacturers to adopt advanced formulations. Industry players invest in R&D to meet regulatory and consumer expectations. Sustainable packaging also improves product branding and shelf appeal. This trend aligns business strategies with evolving market demands.

- For instance, in February 2024, DS Smith confirmed it had replaced over 274 million pieces of plastic packaging in the UK with fibre-based alternatives, exceeding its initial sustainability target. This milestone marked a major advance in packaging recyclability and supported compliance efforts among UK retailers.

Market Trends

Technological Advancements Enhancing Resin Processing Efficiency and Quality

The rising focus on innovation drives new processing technologies in the resin industry. Advanced extrusion and molding systems increase precision and reduce material waste. It enables better product customization and improves performance in various applications. Digital monitoring systems ensure quality control and regulatory compliance. Automated production reduces lead times and energy use. Resin producers leverage smart manufacturing technologies to stay competitive. Innovation creates opportunities for specialized resin products in high-value industries. This trend strengthens the sector’s position in global supply chains.

Widening Use of Bio-Based Resins and Green Chemistry Solutions

The shift toward eco-friendly materials defines a strong market trend. Companies develop bio-based resins using renewable feedstocks to reduce carbon footprints. It allows producers to meet regulatory targets and appeal to environmentally conscious consumers. Green chemistry innovations support lower emissions and enhanced recyclability. Large manufacturers integrate renewable inputs into their production lines. This approach drives competitive differentiation and brand value. Bio-resins gain traction in packaging, automotive, and consumer goods. The movement toward sustainable production reshapes market dynamics and product portfolios.

- For instance, DuPont’s Sorona® range achieved a verified 37% reduction in greenhouse gas emissions and incorporates 37% plant-based renewables in its feedstock, as demonstrated at the 2025 World Bio Markets Conference and confirmed through DuPont’s sustainability reports and peer-reviewed metrics.

Increased Collaboration Between Industries and Research Institutions

Partnerships between resin producers, research bodies, and technology firms are increasing. These collaborations accelerate product development and regulatory compliance. It improves access to advanced testing facilities and innovative technologies. Universities support applied research in new polymer chemistry and recycling processes. Joint projects lead to scalable solutions for energy efficiency and environmental impact reduction. Companies benefit from shared expertise and cost optimization. Collaborative ecosystems strengthen national competitiveness in the resin sector. This trend boosts innovation speed and market adaptation.

- For instance, Covestro and its academic partners, including ETH Zurich, launched the Circular Foam project in August 2025, piloting a “smart pyrolysis” chemical recycling method for polyurethane foam waste. The initiative enabled up to 900 kg/day recycled foam throughput and purity above 95%, verified through operational trials and Covestro project announcements.

Emergence of Circular Economy Models and Closed-Loop Systems

Circular economy strategies redefine production and consumption patterns. Industry players adopt closed-loop recycling systems to reduce resource dependency. It supports the reuse and repurposing of materials across applications. Regulations drive businesses to redesign products for longer lifecycles. Companies invest in collection and processing facilities to strengthen supply chains. Consumer pressure encourages brands to adopt transparent sourcing. These models create new revenue streams and cost efficiencies. This transformation shapes a more resilient and sustainable market environment.

Market Challenges Analysis

Regulatory Pressure and High Cost of Transitioning to Sustainable Alternatives

Strict environmental regulations create operational challenges for producers. Meeting evolving standards requires heavy investment in cleaner technologies and sustainable formulations. It increases compliance costs, especially for small and medium enterprises. Bio-based resin production involves higher raw material and processing costs. Companies face difficulties in balancing price competitiveness with environmental obligations. Limited availability of certified raw materials adds further complexity. Slow approval cycles for new products delay market entry. These factors restrict rapid adaptation, affecting overall market performance.

Volatility in Raw Material Prices and Global Supply Chain Disruptions

Price fluctuations in petrochemical feedstocks impact production stability. Synthetic resin producers face rising procurement costs and unstable supply channels. It affects profit margins and limits strategic flexibility. Global supply chain disruptions add uncertainty to delivery timelines. Geopolitical factors and energy price shifts amplify cost pressures. Manufacturers struggle to maintain consistent pricing models. Transport and logistics disruptions reduce operational efficiency. These challenges create strong pressure on producers to diversify sourcing and strengthen local supply networks.

Market Opportunities

Rising Investments in Bio-Based Resin Development and Green Manufacturing

Strong government support and private investments create new growth avenues. Companies invest in bio-based resin production to meet future sustainability targets. It opens opportunities for high-value applications in packaging, construction, and mobility sectors. R&D efforts lead to performance enhancements and reduced production costs. Green manufacturing aligns with national decarbonization goals. These developments strengthen product portfolios and expand export potential. Early adoption gives companies a competitive edge. The transition supports long-term market resilience and leadership.

Expansion of Circular Economy Initiatives and Recycling Infrastructure

Growing focus on circular economy strategies creates scalable opportunities for industry players. Companies invest in closed-loop recycling and advanced recovery technologies. It supports material reuse and improves cost efficiency across production cycles. Strong infrastructure development enables waste reduction and product traceability. Collaboration with municipalities and private firms accelerates these initiatives. Regulatory support enhances investment confidence and market stability. These advancements expand application potential and build supply security. The shift strengthens the market’s strategic position for future growth.

Market Segmentation Analysis

By Form

The market is segmented into solid, liquid, emulsion, and dispersion forms. Solid resins dominate due to their high thermal resistance and easy handling in manufacturing processes. Liquid resins find increasing use in coatings and adhesives for their superior flow properties. Emulsions support eco-friendly formulations in paints and packaging, reducing solvent emissions. Dispersion resins gain traction for their application in high-performance coatings and electronic components. This diversified usage strengthens product adaptability across industries and ensures stable demand in multiple downstream applications.

- For instance, phenolic (PF) molding compounds provide thermal stability exceeding 300 °C and compressive strength above 65,000 psi, as documented in manufacturer technical datasheets. These properties make PF compounds suitable for demanding automotive engine applications where heat and mechanical resistance are critical.

By Application

Packaging leads the application segment due to its wide use in food, beverage, and consumer goods. Printing inks benefit from rising labeling and branding demand. Pipes and hoses gain traction in infrastructure and utilities. Sheets and films support lightweight and flexible product designs. Paints and coatings use resins to enhance durability and aesthetics. Adhesives and sealants ensure reliable bonding across industries. Electronic fabrications and transportation components further expand application scope. Other uses include industrial and specialty products with performance requirements.

By End Use

Transportation remains a strong segment due to the need for lightweight and durable materials. Food and beverage applications reflect the expanding packaging industry. Personal care and cosmetics rely on synthetic resins for product protection and presentation. Building and construction drive demand for insulation, coatings, and structural materials. Oil and gas use high-performance resins in harsh environments. Electrical and electronics industries integrate these materials for insulation and performance enhancement. Other end uses span multiple industrial applications.

- For instance, Dow and BASF have developed APEO-free, ultra-low VOC acrylic binders for coatings and packaging applications. These formulations are designed to meet strict environmental standards and maintain low-emission performance. Verified product data shows VOC levels under 50 g/L in select binder series, supporting sustainable material adoption in regulated markets.

By Product Type

Thermosetting resins, including epoxy, phenolic, polyurethane, and polyester, are favored for strength, durability, and resistance properties. Thermoplastics such as polyethylene, polypropylene, PVC, polycarbonate, PET, and nylon lead in mass applications due to versatility and recyclability. It enables flexible use across industries including packaging, automotive, construction, and electronics. The combination of thermosetting and thermoplastic resins ensures broad functionality, supporting both structural and flexible product requirements. This balanced product mix strengthens the UK Synthetic Resin Market growth outlook.

Segmentation

By Form

- Solid

- Liquid

- Emulsion

- Dispersion

By Application

- Packaging

- Printing Inks

- Pipes & Hoses

- Sheets & Films

- Paints & Coatings

- Adhesives & Sealants

- Electronic Fabrications

- Transportation Components

- Other Applications

By End Use

- Transportation

- Food & Beverage

- Personal Care & Cosmetic

- Building & Construction

- Oil & Gas

- Electrical & Electronics

- Other End Uses

By Product Type

· Thermosetting Resin

- Epoxy Resins

- Phenolic Resins

- Polyurethane Resins

- Polyester Resins

- Other Thermosetting Resin

· Thermoplastic Resin

- Polyethylene

- Polypropylene

- Polyvinyl Chloride (PVC)

- Polycarbonate

- Polyethylene Terephthalate (PET)

- Nylon

- Other Thermoplastic Resin

Regional Analysis

England – Leading Industrial and Manufacturing Hub (64%)

England holds the largest share of 64% in the UK Synthetic Resin Market due to its strong industrial base and advanced manufacturing capabilities. Major production facilities and packaging clusters across the Midlands and South East drive consistent demand for thermoplastic and thermosetting resins. It benefits from well-developed infrastructure, a skilled workforce, and strong R&D networks that support high-volume production. Automotive, packaging, and construction sectors represent key consumption segments in this subregion. England’s regulatory framework encourages investment in sustainable manufacturing technologies, promoting the shift toward bio-based and recyclable resin solutions. Export activities through major ports strengthen its role in international trade flows. This dominance establishes England as the central hub of resin production and consumption within the country.

Scotland – Emerging Growth Region with Strong Innovation Potential (19%)

Scotland accounts for 19% of the market share, supported by expanding industrial activity and targeted green investments. The government promotes advanced materials research and circular economy practices, driving resin use across manufacturing and construction. It leverages innovation hubs and university partnerships to improve product quality and sustainability. Industrial clusters in Central Scotland contribute to rising demand for high-performance resin products. Renewable energy initiatives further boost the need for resin-based coatings, sealants, and insulation materials. Transport and infrastructure development projects increase adoption in civil engineering applications. This growth momentum positions Scotland as a strong emerging market with long-term strategic value.

Wales and Northern Ireland – Expanding Industrial Applications (17%)

Wales and Northern Ireland collectively hold 17% of the market share, supported by expanding SME-based manufacturing and logistics networks. These subregions benefit from lower production costs and strategic proximity to export routes. It supports flexible resin use in packaging, personal care, and consumer goods manufacturing. Investment in infrastructure and industrial modernization encourages the adoption of advanced resin-based solutions. Local manufacturers focus on specialized applications and niche product segments, contributing to regional diversification. Government-led incentives and trade partnerships enhance competitiveness and attract new investments. These developments strengthen their contribution to the overall market structure and regional economic growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- SABIC

- Covestro AG

- Mitsubishi Chemical Group Corporation

- LG Chem

- Sumitomo Chemical Co., Ltd.

- Arkema S.A.

- DSM-Firmenich

Competitive Analysis

The UK Synthetic Resin Market is characterized by strong competition among global and domestic producers. Key players focus on capacity expansion, product innovation, and sustainable material development to strengthen their market position. It drives investments in advanced processing technologies and bio-based resin formulations to meet regulatory and consumer demands. Leading companies emphasize cost efficiency and high-quality performance standards to secure long-term contracts with major end users. Strategic partnerships with packaging, automotive, and construction industries support product integration and enhance market penetration. Players also prioritize R&D programs to improve product durability, recyclability, and chemical resistance. Mergers and acquisitions increase operational scale and enable access to wider distribution networks. Global brands compete on pricing, technology, and sustainability leadership, while domestic firms build strength through localized production and specialized product portfolios. Competitive dynamics continue to evolve with rising pressure to meet environmental goals and optimize manufacturing efficiency. This competition shapes market direction and accelerates technological transformation across the value chain.

Recent Developments

- In October 2025, BASF SE introduced several innovative formulations during the SEPAWA Congress, including new sensory-focused polymers and a water-soluble UVA filter named Uvinul® TS Hydro, designed to support light and effective sun care products.

- In October 2025, Mitsui Chemicals, Inc. and Polyplastics Co., Ltd., a wholly owned subsidiary of Daicel Corporation, announced a new strategic partnership in Europe targeting marketing operations for engineering resins. This collaboration is part of Daicel Group’s reorganization plan, unveiled on October 16, 2025, and it aims to increase operational synergies across the synthetic resin market in Europe while optimizing group-wide resources.

- In October 2025, SMX (Security Matters Ltd) introduced a new molecular traceability solution for synthetic resins in Europe, aimed at supporting verified products and sustainable supply chains. This launch ushers in advanced traceability across resin manufacturing, enabling stakeholders to ensure environmental compliance and product authenticity throughout the value chain.

- In October 2025, SABIC unveiled a series of advanced material solutions at K 2025, with a particular emphasis on innovative synthetic resin products that help customers design and manufacture increasingly sustainable everyday products in the European market.

Report Coverage

The research report offers an in-depth analysis based on Form, Application, End Use and Product Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Bio-based resin adoption will accelerate due to stricter environmental regulations and rising sustainability goals.

- Packaging applications will remain a dominant segment, supported by rapid retail and e-commerce expansion.

- Technological advancements in processing systems will improve operational efficiency and product customization.

- R&D investments will grow, focusing on recyclable and high-performance resin formulations.

- Automotive and construction industries will continue to drive strong demand for durable and lightweight materials.

- Regulatory frameworks will shape production strategies, promoting low-emission and circular manufacturing models.

- Regional players will increase investments in specialized product lines to enhance market positioning.

- Strategic partnerships and mergers will strengthen supply chains and global competitiveness.

- Infrastructure modernization will boost resin use across multiple industrial and commercial applications.

- The market will shift toward smart manufacturing practices and advanced material integration, improving overall resilience.