Market Overview:

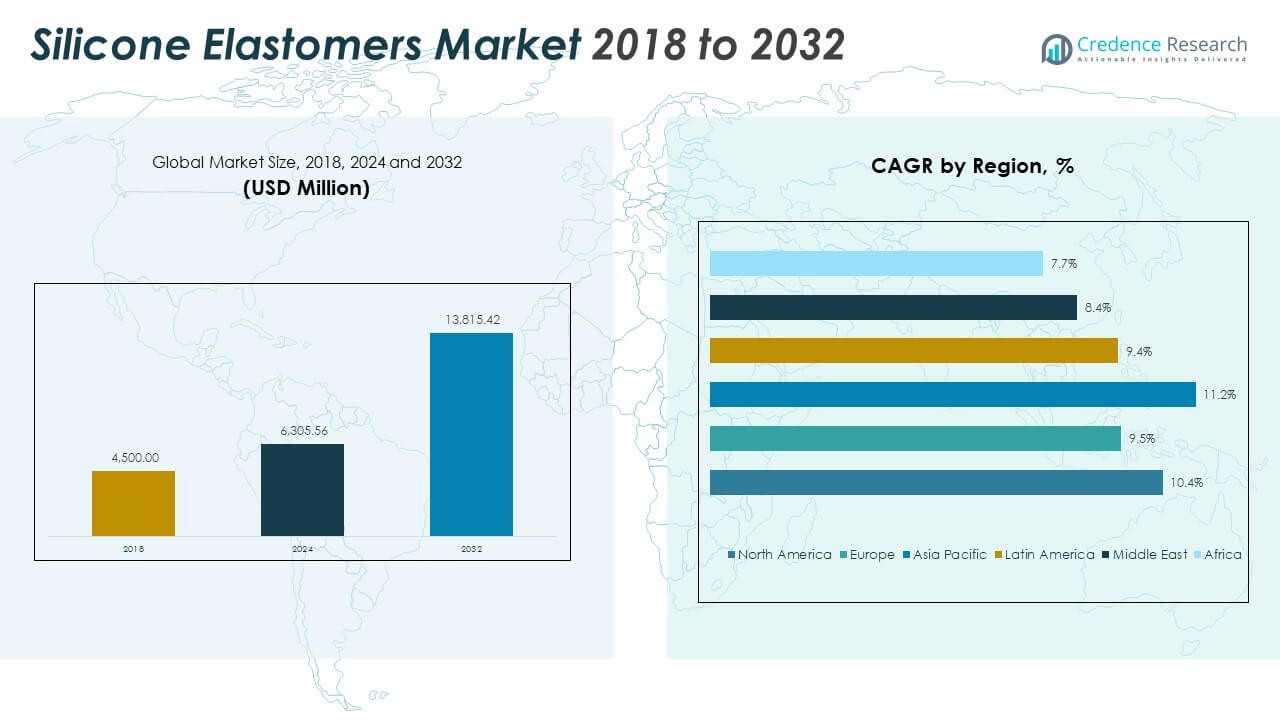

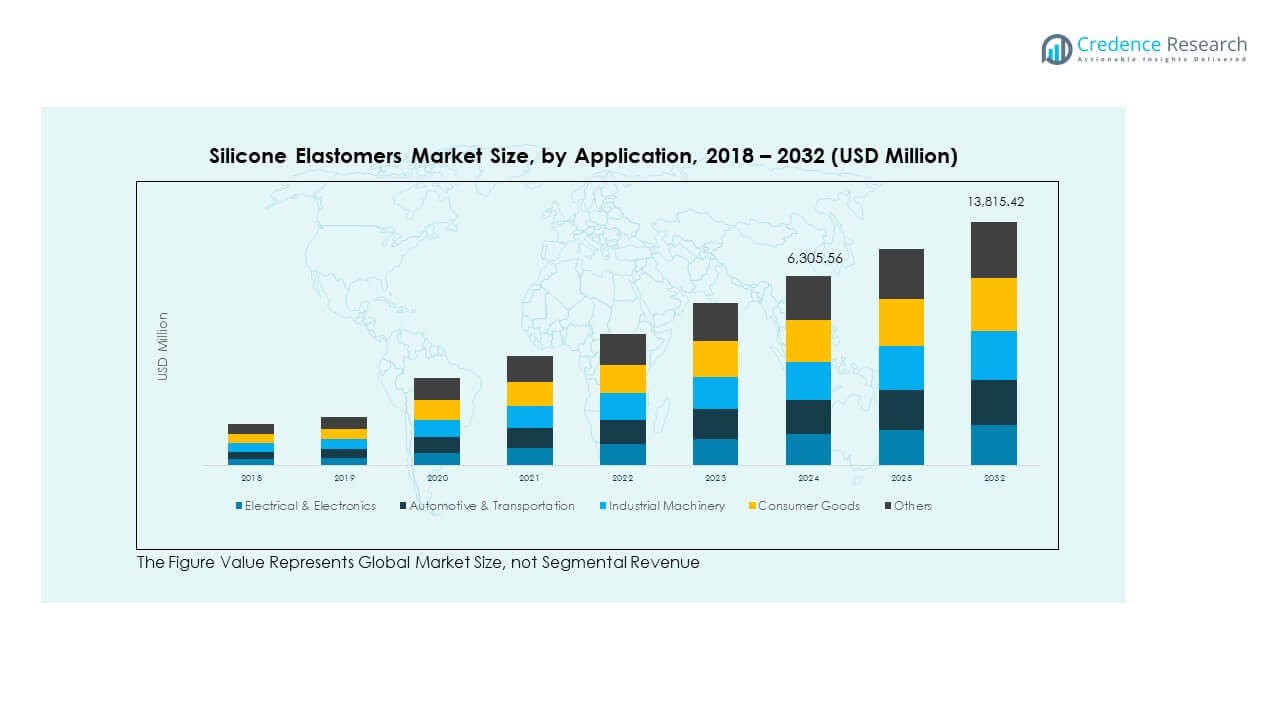

The Silicone Elastomers Market size was valued at USD 4,500.00 million in 2018, reached USD 6,305.56 million in 2024, and is anticipated to reach USD 13,815.42 million by 2032, at a CAGR of 10.43% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Silicone Elastomers Market Size 2024 |

USD 6,305.56 Million |

| Silicone Elastomers Market, CAGR |

10.43% |

| Silicone Elastomers Market Size 2032 |

USD 13,815.42 Million |

The market growth is driven by increasing demand from automotive, electronics, healthcare, and construction industries. It provides high flexibility, thermal stability, and chemical resistance, making it suitable for diverse applications. Rising urbanization and industrial automation amplify adoption. Healthcare and medical device sectors increasingly use it for biocompatible, durable products. Consumer goods and infrastructure projects also support growth. Manufacturers focus on innovative formulations to meet specialized needs. It enhances energy efficiency, operational reliability, and product longevity across industries, fueling global demand and technological adoption.

North America and Europe lead the market due to advanced automotive, electronics, and healthcare industries. Asia Pacific shows rapid growth driven by industrialization, urbanization, and infrastructure expansion. China, Japan, and South Korea dominate production and adoption in electronics and automotive sectors. Latin America, the Middle East, and Africa present emerging opportunities, supported by industrial growth, construction projects, and rising consumer demand. Regional players focus on localized production, partnerships, and technology adoption. The combination of mature and emerging markets ensures balanced global expansion and diversified growth prospects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Silicone Elastomers Market size was valued at USD 4,500.00 million in 2018, reached USD 6,305.56 million in 2024, and is anticipated to reach USD 13,815.42 million by 2032, at a CAGR of 10.43% during the forecast period.

- North America leads the market with a 21% share, driven by advanced automotive and electronics industries, followed by Europe at 19% due to mature healthcare and industrial sectors, and Asia Pacific at 18% supported by rapid industrialization and infrastructure development.

- Asia Pacific is the fastest-growing region, benefiting from urbanization, rising electronics and automotive manufacturing, and increasing infrastructure investments, capturing expanding market share.

- By application, Electrical & Electronics dominate with approximately 30% share, supported by insulation and flexible connector usage, while Automotive & Transportation hold 25%, driven by gaskets, seals, and vibration-resistant components.

- Industrial Machinery and Consumer Goods segments collectively account for around 28% of the market, reflecting demand for durable components, household appliances, and construction sealants across global regions.

Market Drivers

Rising Demand From Automotive And Electronics Industries

The Silicone Elastomers Market experiences strong growth from automotive and electronics sectors. It offers high heat resistance, electrical insulation, and flexibility that meet critical industry needs. Automotive manufacturers adopt it for gaskets, seals, and engine components to improve performance. Electronics producers use it in circuit boards, displays, and protective coatings. Rising vehicle production in emerging economies supports material adoption. It enables lightweight designs that improve fuel efficiency. Industrial automation and smart device expansion also drive demand. Its chemical stability ensures durability under harsh conditions, boosting its preference. Manufacturers invest in advanced formulations to meet evolving application requirements.

- For example, in September 2025, Dow also introduced DOWSIL™ EG-4175 Silicone Gel, supporting higher-voltage EV batteries and featuring thermal conductivity and dielectric properties optimized for next-generation automotive electronics, as stated in Dow’s official press release.

Growing Applications In Healthcare And Medical Devices

Healthcare and medical device sectors increasingly utilize silicone elastomers. It provides biocompatibility and sterilization resistance essential for implants, catheters, and wearable medical devices. Hospitals and medical labs demand reliable, safe materials to enhance patient outcomes. It supports precision molding for complex medical components. Rising global healthcare expenditure further fuels its adoption. The material’s resistance to chemical degradation ensures consistent performance in medical instruments. Pharmaceutical packaging applications also rely on its inert properties. Regulatory approvals and certifications strengthen its credibility. Industry investments in medical-grade silicone formulations continue to expand usage.

- For instance, Momentive provides a broad range of liquid silicone rubber (LSR) healthcare elastomers, which comply with biocompatibility regulations and enable repeated sterilization and precision molding in medical devices.

Demand For Energy-Efficient And Sustainable Solutions In Construction

Construction and infrastructure projects drive silicone elastomer usage due to energy efficiency requirements. It delivers excellent thermal insulation and weather resistance for roofing, facades, and sealants. Architects and builders prefer it for long-lasting and sustainable building solutions. It helps reduce maintenance costs and energy consumption. Rising green building initiatives in Asia-Pacific and Europe strengthen adoption. It resists UV radiation and extreme temperature fluctuations, enhancing structural durability. High-performance sealants and adhesives support smart city developments. It integrates with modern construction techniques and prefabricated structures. Investment in eco-friendly formulations further enhances market traction.

Expansion Of Consumer Goods And Household Applications

The market benefits from increasing use in consumer goods and household appliances. It offers flexibility, temperature resistance, and aesthetic versatility for kitchenware, personal care products, and electronics. Rising disposable income and lifestyle modernization drive consumer adoption. It ensures safety and durability in products exposed to heat and moisture. Appliance manufacturers use it to improve operational efficiency and lifespan. Household innovations, including smart devices, integrate silicone elastomers for reliability. Packaging applications for cosmetics and food products also rely on its inert properties. Continuous product innovations expand its application range. It supports brand differentiation through functional and durable consumer goods.

Market Trends

Integration Of Advanced Formulations With High-Performance Capabilities

The Silicone Elastomers Market follows a trend toward high-performance, specialty formulations. It incorporates enhanced thermal, mechanical, and chemical resistance for demanding applications. Industry players focus on blending silicone with additives for improved durability. New grades enable lighter and more flexible components. It supports miniaturization trends in electronics and automotive parts. Manufacturers prioritize formulations that maintain performance under extreme conditions. Customized products meet specific requirements in medical, industrial, and consumer sectors. Sustainable materials are gaining preference. Research centers focus on next-generation elastomers with multifunctional properties.

- For instance, in October 2025, Wacker Chemie AG unveiled ceramifying silicone elastomers for electric vehicle battery modules that significantly enhance thermal protection, with lightweight sensors based on silicone successfully operating at temperatures exceeding 200°C in real-world electromobility applications, as documented in their official product showcase.

Rising Adoption Of Digital Manufacturing And Automation Techniques

Digital manufacturing and automation transform silicone elastomer production and application. It integrates with precision molding, 3D printing, and automated assembly lines. The trend ensures consistent quality, repeatability, and reduced waste. It accelerates product development cycles for automotive and electronics industries. Smart factories leverage data-driven monitoring to optimize silicone elastomer use. It supports rapid prototyping and mass production efficiently. Robotics applications increasingly utilize it for resilient components. Manufacturers benefit from cost savings and operational efficiency. Collaborative robotics drive demand for flexible and durable materials.

Growth Of Eco-Friendly And Biodegradable Silicone-Based Products

Sustainability trends influence silicone elastomer development and usage. It enables energy-efficient appliances, eco-friendly construction, and low-impact consumer goods. Companies invest in formulations with reduced environmental footprints. It supports recyclable and long-life products that reduce waste. Eco-conscious consumers prefer products using it for durability and safety. Regulatory frameworks encourage adoption of environmentally responsible materials. It finds applications in green packaging, medical, and automotive sectors. Industry players highlight sustainability as a differentiating factor. Awareness campaigns promote the advantages of silicone elastomers in eco-friendly solutions.

Increasing Cross-Sector Collaborations And Strategic Partnerships

The market shows a trend of cross-industry collaborations to enhance product offerings. It enables the development of specialized silicone elastomers for niche applications. Partnerships with automotive, healthcare, and electronics companies accelerate innovation. It fosters co-development of materials with improved thermal and mechanical properties. Research institutions support technological breakthroughs and certifications. Collaborative ventures expand geographic reach and production capabilities. It encourages standardization of high-performance grades across sectors. Strategic alliances drive product diversification and market penetration. Focused innovation strengthens competitive advantage in the global market.

- For example, Shin-Etsu Chemical, in collaboration with Stratasys, launched P3™ Silicone 25A in July 2025 for industrial 3D printing. It offers high durability and biocompatibility for medical and industrial applications, verified through official product documentation.

Market Challenges Analysis

High Production Costs And Raw Material Price Volatility Limiting Adoption

The Silicone Elastomers Market faces challenges from high production costs and raw material price fluctuations. It relies on specialized siloxane chemicals that experience price volatility. Rising energy and processing costs affect product affordability. Small manufacturers face difficulty competing with large, vertically integrated companies. It requires advanced equipment and skilled labor for consistent quality production. Maintaining profitability while ensuring performance standards remains challenging. Supply chain disruptions may affect availability and lead times. It limits adoption in cost-sensitive end-use industries. Manufacturers must optimize production processes to mitigate cost pressures.

Regulatory Compliance And Environmental Constraints On Material Usage

Strict regulatory requirements pose challenges for silicone elastomer manufacturers. It must meet environmental, safety, and health standards in various applications. Compliance with medical, food, and automotive regulations increases development costs. It requires thorough testing for biocompatibility, chemical resistance, and durability. Environmental concerns drive demand for sustainable production methods. Limited recycling options for some formulations restrict adoption. It faces scrutiny in regions with stringent ecological policies. Ensuring compliance without affecting performance is a continuous challenge. Industry investments in research and compliance programs remain essential.

Market Opportunities

Expansion Into Emerging Economies With Growing Industrial Sectors

The Silicone Elastomers Market finds opportunities in emerging economies with expanding automotive, electronics, and construction industries. It enables local manufacturers to access high-performance materials. Rising urbanization and infrastructure development further support adoption. It allows international companies to establish production facilities closer to demand centers. Government initiatives encourage industrial growth and innovation. It can penetrate medical and consumer goods segments. Strategic partnerships with regional players enhance market reach. Investment in local R&D centers helps tailor products for regional requirements.

Innovation In High-Performance And Specialty Silicone Elastomers

Opportunities exist in developing advanced and specialty silicone elastomers for niche applications. It supports aerospace, electronics, medical devices, and renewable energy sectors. Customized formulations enhance mechanical, thermal, and chemical performance. It enables lightweight, durable, and multifunctional components. Collaborations with research institutions accelerate material innovation. It provides differentiation for manufacturers competing in high-value markets. Industry focus on sustainable and eco-friendly solutions increases market potential. Marketing specialized products strengthens brand positioning and expands client base.

Market Segmentation Analysis:

By Type Segment

The Silicone Elastomers Market is segmented by type into Liquid Silicone Rubber (LSR), High Consistency Rubber (HCR), Fluorosilicone Elastomers, and others. LSR dominates due to its superior flow properties, precision molding capability, and fast curing, making it ideal for medical devices, electronics, and automotive components. HCR offers high mechanical strength and durability, which suits applications requiring robust performance under extreme conditions. Fluorosilicone elastomers provide excellent chemical and temperature resistance, supporting niche applications in aerospace and industrial machinery. The “Others” category includes specialty silicone formulations tailored for specific industrial or consumer needs, which gradually gain traction due to innovation and customization.

- For example, Elkem Silicones won the 2025 Ringier Technology Innovation Award for its BLUESIL™ LSR 3935 silicone elastomer series, developed for high-voltage connectors in new-energy vehicles and offering a hardness range from ShA 20 to ShA 60, along with superior sealing and thermal stability.

By Application Segment

Application-wise, the market spans Electrical & Electronics, Automotive & Transportation, Industrial Machinery, Consumer Goods, Construction, and other sectors. Electrical & Electronics utilize silicone elastomers for insulation, protective coatings, and flexible connectors. Automotive and Transportation adopt it for gaskets, seals, and vibration-resistant components to enhance safety and performance. Industrial Machinery relies on durable silicone parts to sustain high temperatures and mechanical stress. Consumer Goods and Construction sectors use it for household appliances, sealants, and energy-efficient solutions. It supports product longevity, operational efficiency, and compliance with regulatory standards across diverse end-use applications.

- For example, Silicone 70 O-rings are genuine replacement parts for Caterpillar heavy equipment, designed for high-heat and industrial applications. These components are verified in Caterpillar’s official OEM and aftermarket parts catalogs for 2024–2025, confirming their durability and engineering standards.

Segmentation:

By Type

- Liquid Silicone Rubber (LSR)

- High Consistency Rubber (HCR)

- Fluorosilicone Elastomers

- Others

By Application

- Electrical & Electronics

- Automotive & Transportation

- Industrial Machinery

- Consumer Goods

- Construction

- Others

By Regional

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Silicone Elastomers Market size was valued at USD 1,017.00 million in 2018, reached USD 1,397.27 million in 2024, and is anticipated to reach USD 3,054.61 million by 2032, at a CAGR of 10.19% during the forecast period. It dominates the global market with an estimated share of 21% in 2024. The U.S. leads with advanced automotive, electronics, and medical device sectors driving demand. Canada supports growth through industrial and construction applications. North American manufacturers focus on high-performance silicone grades to meet stringent regulatory standards. Rising adoption of smart electronics and energy-efficient solutions fuels expansion. It benefits from a strong R&D ecosystem and technological innovation. Regional collaborations and partnerships enhance production capabilities and market penetration. Robust supply chains ensure consistent availability for industrial and consumer applications.

Europe

The Europe Silicone Elastomers Market size was valued at USD 958.50 million in 2018, reached USD 1,278.59 million in 2024, and is anticipated to reach USD 2,607.70 million by 2032, at a CAGR of 9.23% during the forecast period. Europe accounts for approximately 19% of the global market share in 2024. Germany, France, and the UK lead due to automotive, electronics, and healthcare industries. Manufacturers focus on sustainable and high-performance materials for energy-efficient construction and industrial applications. It benefits from strict environmental regulations that encourage adoption of durable and recyclable silicone elastomers. Increasing investments in research support innovative product development. Expansion in Eastern European markets provides additional growth opportunities. Industrial automation and precision manufacturing enhance demand for specialized silicone grades. Market players invest in local production and regional distribution networks to strengthen presence.

Asia Pacific

The Asia Pacific Silicone Elastomers Market exhibits rapid growth due to industrialization and urbanization. It covers major countries including China, Japan, South Korea, and India. China leads with a robust electronics, automotive, and medical device manufacturing base. Rising infrastructure and construction projects in India and Southeast Asia support increased adoption. It benefits from cost-effective manufacturing and skilled labor availability. Consumer electronics, smart devices, and renewable energy applications drive demand. Local companies collaborate with global players to expand production and distribution. Rapid urban population growth further increases market penetration. Technological innovation and government support encourage use of high-performance silicone elastomers.

Latin America

Latin America shows moderate growth in the Silicone Elastomers Market. Brazil and Argentina lead demand due to automotive and industrial sectors. It supports local manufacturing with materials for construction, consumer goods, and electrical applications. Regional investments in infrastructure drive demand for durable and efficient silicone elastomers. It faces challenges from supply chain fluctuations and import dependencies. Companies focus on strategic partnerships and localized production to improve availability. Rising awareness of energy efficiency in industrial applications encourages adoption. Growth opportunities exist in expanding electronics and medical device manufacturing.

Middle East

The Middle East market benefits from rapid industrialization and oil & gas infrastructure projects. It drives adoption of silicone elastomers for industrial machinery, construction, and transportation applications. GCC countries lead with investments in infrastructure and renewable energy. Israel and Turkey contribute through high-tech electronics and specialized manufacturing. It supports local industries with chemical, aerospace, and medical device applications. Manufacturers invest in regional distribution and partnerships to enhance market reach. Rising construction projects demand durable and high-performance sealants and adhesives. Regulatory compliance and environmental standards encourage advanced silicone usage.

Africa

Africa represents an emerging market for silicone elastomers. South Africa and Egypt lead demand in automotive, industrial, and construction applications. It supports local manufacturing with materials for electrical insulation, sealants, and consumer goods. Growth is driven by infrastructure development and urbanization. Limited local production encourages import of high-performance silicone grades. Companies focus on strategic partnerships to expand reach and availability. It benefits from rising industrial and energy projects in key regions. Adoption of advanced silicone solutions increases with the expansion of construction and electronics sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Dow Inc. (USA)

- Wacker Chemie AG (Germany)

- Momentive Performance Materials Inc. (USA)

- Shin-Etsu Chemical Co., Ltd. (Japan)

- China National Bluestar (Group) Co., Ltd. (China)

- Reiss Manufacturing Inc. (USA)

- Mesgo S.p.A. (Italy)

- KCC Corporation (South Korea)

- Evonik Industries AG (Germany)

- Elkem ASA (Norway)

- Zhejiang Xinan Chemical Industrial Group Co., Ltd.

- Stockwell Elastomerics

- Specialty Silicone Products, Inc.

Competitive Analysis:

The Silicone Elastomers Market is competitive, with several global and regional players actively expanding their portfolios. Leading companies focus on innovation, product quality, and expanding their production capacities to meet rising demand. Key players include Dow Inc., Wacker Chemie AG, Momentive Performance Materials, Shin-Etsu Chemical Co., and Elkem ASA. These companies invest in R&D to create advanced silicone elastomers for industries like automotive, healthcare, and construction. Smaller players and emerging firms enhance competition through niche offerings and customized solutions. Strategic alliances, mergers, and acquisitions continue to shape market dynamics. The market’s growth is driven by increasing demand across various end-use industries, including automotive, electronics, healthcare, and construction. The rising adoption of silicone elastomers in medical devices and healthcare applications further contributes to market expansion. Companies are also focusing on sustainability and eco-friendly manufacturing processes to meet regulatory standards and consumer preferences.

Recent Developments:

- In October 2025, Elkem announced its support for a pioneering local silicone supply chain in Saudi Arabia through strategic product integration. This move underscores the company’s commitment to regional market expansion and the development of advanced silicone elastomer solutions tailored for Middle East industrial and construction applications.

- In May 2025, Dow made headlines by launching its inaugural low carbon silicone elastomer blends under the new Decarbia™ reduced carbon platform, targeting the personal care sector. This innovative product line is specifically designed to help manufacturers reduce their carbon footprints while delivering high-performance characteristics necessary for next-generation cosmetic and hygienic applications.

Report Coverage:

The research report offers an in-depth analysis based on Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing adoption in automotive and electronics industries will drive market expansion.

- Rising demand for medical-grade silicone elastomers will enhance healthcare applications.

- Innovation in high-performance and specialty silicone grades will support diversified applications.

- Expansion in Asia Pacific and emerging markets will strengthen global penetration.

- Eco-friendly and sustainable silicone elastomers will attract environmentally conscious industries.

- Strategic collaborations and partnerships among key players will enhance technology and distribution.

- Growth in construction and infrastructure projects will boost demand for durable sealants.

- Advancements in industrial automation and smart devices will increase material usage.

- Customization and specialty formulations will create opportunities in niche sectors.

- Regulatory compliance and quality certifications will reinforce adoption in critical applications.