Market Overview

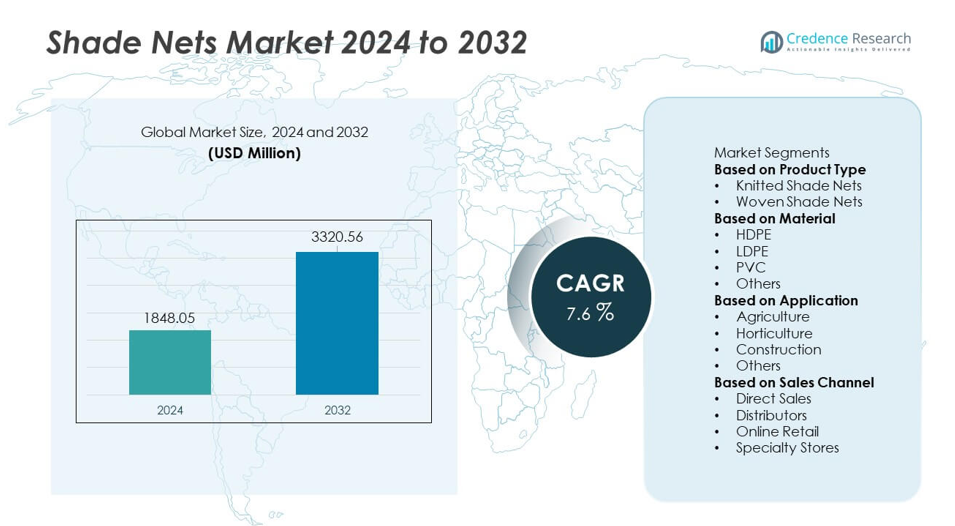

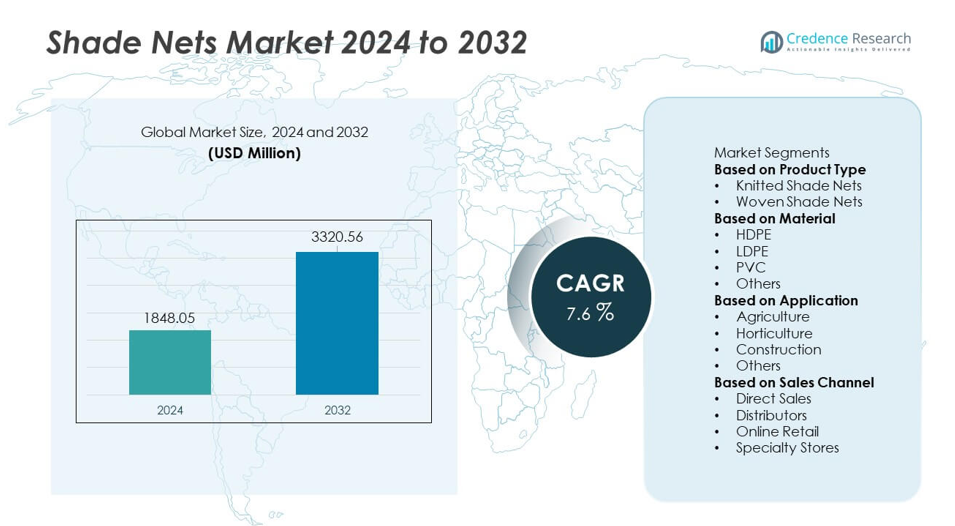

The Shade Nets market was valued at USD 1,848.05 million in 2024 and is projected to reach USD 3,320.56 million by 2032, expanding at a CAGR of 7.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Shade Nets market Size 2024 |

USD 1,848.05 million |

| Shade Nets market, CAGR |

7.6% |

| Shade Nets market Size 2032 |

USD 3,320.56 million |

The top players in the Shade Nets market include Garware Technical Fibres Ltd., Tenax Corporation, Beaulieu Technical Textiles, Shri Ambica Polymer Pvt. Ltd., Balaji Agro Plast, Polynet Products, Tuflex India, Ginegar Plastic Products Ltd., Arry’s Agro Products, and Supreme Plastic Industries. These companies strengthen their presence through advanced HDPE-based nets, UV-stabilized materials, and region-specific shading solutions. Asia Pacific leads the global market with a 34% share, driven by large-scale agricultural activity and rapid greenhouse expansion. Europe holds a 27% share, supported by strong horticulture and controlled-environment farming. North America accounts for a 23% share, fueled by commercial nurseries and construction safety applications.

Market Insights

- The Shade Nets market reached USD 1,848.05 million in 2024 and is projected to hit USD 3,320.56 million by 2032, expanding at a CAGR of 7.6% during the forecast period.

- Market growth is driven by rapid adoption of protected farming, strong demand for microclimate control, and rising greenhouse installations; knitted shade nets lead the product segment with a 62% share, while HDPE dominates the material segment with a 68% share.

- Key trends include rising use of UV-stabilized polymers, recyclable materials, and lightweight net designs that support durability and better shading performance across diverse climates.

- Competition intensifies as major players invest in advanced extrusion, high-density knitting technologies, and region-specific shading densities, helping them strengthen distribution networks and maintain price competitiveness.

- Asia Pacific leads with a 34% share, followed by Europe with 27% and North America with 23%, supported by expanding agriculture, horticulture, and construction demand across these key markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Knitted shade nets lead the segment with a 62% market share, supported by strong usage in agriculture and horticulture. These nets offer higher durability, better UV stability, and improved flexibility, which encourages wider adoption across protected farming systems. Woven shade nets hold the remaining share but grow slowly due to lower wear resistance and heavier construction. Rising demand for temperature-controlled farming and increased investment in greenhouse expansion continues to strengthen the dominance of knitted shade nets in global markets.

- For instance, Garware Technical Fibres introduced a high-tenacity monofilament knitted net using yarns with 6.2 g/denier tensile strength, which improved tear resistance by 27% over standard agricultural nets.

By Material

HDPE dominates the material segment with a 68% market share, driven by its tensile strength, long service life, and superior weather resistance. HDPE nets support uniform shading and withstand prolonged exposure to sunlight, making them ideal for commercial farms and nurseries. LDPE and PVC serve niche requirements where lighter or more rigid structures are preferred, while the “Others” category includes blended materials for specialized shading needs. Expanding greenhouse adoption and rising demand for cost-effective, UV-stabilized shading solutions continue to support HDPE’s leadership.

- For instance, Tenax Corporation manufactures HDPE shade fabrics, which are available in a variety of weights and shade coverage percentages depending on the specific product line.

By Application

Agriculture holds the largest application share at 59%, supported by widespread use of shade nets for crop protection, heat reduction, and improved plant growth. Farmers rely on shading systems to manage microclimate conditions for vegetables, fruits, and nursery crops, enhancing productivity under rising temperature stress. Horticulture maintains steady demand due to extensive use in floriculture and ornamental plant propagation. Construction and “Others” applications grow at a moderate pace, driven by safety needs and livestock shading. Increasing focus on climate-smart cultivation reinforces the dominance of agricultural applications.

Key Growth Drivers

Rising Demand for Protected Cultivation

Growing adoption of protected farming systems drives strong demand for shade nets, as growers seek reliable solutions to control heat, light, and moisture levels. Shade nets help reduce crop stress, enhance yield consistency, and support year-round production, making them essential for climate-smart agriculture. Farmers use these nets widely for vegetables, fruits, nurseries, and floriculture, especially in regions facing high temperature fluctuations. Government initiatives promoting greenhouse farming and protected horticulture further accelerate adoption. The shift toward efficient microclimate management continues to position shade nets as a vital tool in modern agricultural practices.

- For instance, Ginegar Plastic Products developed advanced Aluminet and other multi-layered agro nets that use high-quality, UV-stabilized materials to enable uniform shading and optimal light diffusion, leading to improved micro-climatic conditions for crop development.

Expansion of Greenhouse and Nursery Infrastructure

The rapid development of greenhouse farms and commercial nurseries supports strong market growth, as shade nets remain a core structural component. Large growers invest in shading solutions to manage solar intensity and improve plant quality across high-value crops. Rising urbanization boosts demand for nurseries and landscaping plants, increasing shade net installations in both rural and urban settings. The construction of advanced polyhouses also requires durable shading materials with long service life. As greenhouse acreage expands across Asia, Europe, and the Middle East, the need for high-grade shade nets continues to rise.

- For instance, Beaulieu Technical Textiles (BTT) produces UV-stabilized woven agrotextiles (ground covers) known for durability and strength, which are used in applications like greenhouses and nurseries.

Increasing Focus on Climate Resilience in Agriculture

Climate variability pushes farmers to adopt solutions that protect crops from heat waves, UV exposure, and erratic weather. Shade nets offer a practical and affordable method to reduce temperature stress and maintain stable growing conditions in open-field and semi-protected environments. Rising concerns over water scarcity also increase demand for shading systems that reduce evaporation and preserve soil moisture. Governments and agriculture agencies promote climate-resilient farming, supporting wider use of shade nets across vulnerable regions. This shift positions shade nets as a strategic asset in adapting agriculture to changing environmental conditions.

Key Trends & Opportunities

Growth of Eco-Friendly and Recyclable Shade Net Materials

Manufacturers focus on developing recyclable and eco-friendly shade nets as sustainability becomes a key industry priority. Advances in UV-stabilized polymers and biodegradable additives support greener product lines without compromising durability. Buyers increasingly prefer environmentally responsible materials for greenhouses, nurseries, and commercial farms. This shift opens opportunities for products made from recycled HDPE and low-impact polymers. As environmental regulations tighten globally, companies investing in sustainable materials gain a strong competitive advantage, creating a clear growth path for eco-conscious shade net solutions.

- For instance, Tenax Corporation manufactures over 19,000 tons of plastic netting annually using various raw materials including polypropylene and polyethylene. The company uses a range of extrusion processes and its own patented stretching technology to produce various netting products.

Rising Adoption of Lightweight and High-Durability Net Designs

The market sees a trend toward lightweight, high-strength nets that improve handling, installation, and long-term performance. New polymer engineering techniques enhance tear resistance, UV protection, and air circulation, meeting the needs of large farms and greenhouse operators. These innovations help reduce maintenance costs and extend asset life, creating opportunities for premium product lines. Strong demand from horticulture and high-value crop growers accelerates adoption of advanced fabric structures. Manufacturers benefit by offering specialized shading options tailored to different climate zones and crop requirements.

- For instance, Tuflex India engineered anti-hail nets using HDPE monofilament with a yarn thickness in the range of 0.18-0.22 mm, which have a typical bursting strength of 8-10 Kg/cm².

Key Challenges

Fluctuating Raw Material Prices

The price volatility of polymers such as HDPE and LDPE creates significant challenges for manufacturers and distributors. Since shade nets rely heavily on petrochemical-based materials, fluctuations in crude oil prices directly impact production costs. Sudden increases in polymer prices can reduce profit margins and limit the ability of producers to maintain stable pricing for end users. Smaller manufacturers face greater pressure due to limited procurement capacity, making cost planning more difficult. This challenge often restricts investment in product innovation and slows supply chain stability.

Low Awareness and Limited Technical Knowledge Among Small Farmers

Many small and marginal farmers lack awareness of the long-term benefits of shade nets, which restricts adoption in developing regions. Limited knowledge of correct shading density, installation methods, and crop-specific applications reduces effectiveness and discourages further investment. High upfront costs also remain a barrier for growers with low capital availability. Training programs and extension services remain insufficient in many rural areas, slowing the transition to modern protected cultivation. Without stronger awareness efforts, adoption gaps may persist across fragmented agricultural markets.

Regional Analysis

North America

North America holds a 23% market share, driven by strong adoption of protected cultivation and advanced greenhouse systems. Farmers in the United States and Canada invest in shade nets to improve crop resilience, manage sunlight intensity, and reduce heat stress during peak seasons. Commercial horticulture, nursery operations, and landscaping further contribute to demand across the region. The construction industry also uses shade nets for safety and debris control, supporting steady growth outside agriculture. Strong awareness of climate-smart farming practices and the expansion of controlled-environment agriculture sustain the region’s position in the global market.

Europe

Europe accounts for a 27% market share, supported by widespread greenhouse farming and high adoption of shading solutions in horticulture and floriculture. Countries such as Spain, Italy, and the Netherlands lead demand due to large-scale vegetable and ornamental plant production. Farmers prefer high-grade nets with enhanced UV stability to optimize light diffusion and maintain controlled growing conditions. Rising focus on sustainable agriculture and government-backed greenhouse programs further accelerate usage. Construction applications, particularly in scaffolding and worker safety, add complementary demand. Continuous investment in protected cultivation strengthens Europe’s presence in the global market.

Asia Pacific

Asia Pacific dominates the global market with a 34% market share, driven by extensive agricultural activity and rapid expansion of protected farming in China, India, and Southeast Asia. The region’s climate variations, including high temperatures and intense solar radiation, increase dependence on shading systems for crop protection. Strong growth in greenhouse vegetable production and rising adoption of nursery and plantation infrastructure support high consumption. Government initiatives promoting climate-resilient agriculture further encourage shade net usage. Lower manufacturing costs and strong polymer production capabilities also support large-scale supply, making Asia Pacific the leading regional market.

Latin America

Latin America holds an 11% market share, supported by rising adoption of shade nets in horticulture, floriculture, and high-value crop production. Countries such as Mexico, Brazil, and Chile use shading systems to manage heat stress, improve moisture retention, and protect crops under expanding commercial farming operations. Shade nets are also used in aquaculture and livestock shading, extending their utility beyond traditional agriculture. Growing investments in protected cultivation and greenhouse farming enhance market penetration. Although adoption varies across the region, rising focus on export-oriented farming strengthens the demand for durable and UV-resistant shading materials.

Middle East & Africa

The Middle East & Africa region accounts for a 5% market share, driven by high temperature conditions and increasing reliance on shading solutions for crop survival. Shade nets support water conservation by reducing evaporation, making them essential for agriculture in arid climates. Countries such as the UAE, Saudi Arabia, and South Africa adopt these systems for greenhouse farming, nurseries, and livestock shading. Construction and industrial applications add secondary demand. Government initiatives promoting food security and resource-efficient farming further encourage deployment. Despite lower adoption rates compared to other regions, the region shows strong long-term growth potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Product Type

- Knitted Shade Nets

- Woven Shade Nets

By Material

By Application

- Agriculture

- Horticulture

- Construction

- Others

By Sales Channel

- Direct Sales

- Distributors

- Online Retail

- Specialty Stores

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape includes major players such as Garware Technical Fibres Ltd., Tenax Corporation, Beaulieu Technical Textiles, Shri Ambica Polymer Pvt. Ltd., Balaji Agro Plast, Polynet Products, Tuflex India, Ginegar Plastic Products Ltd., Arry’s Agro Products, and Supreme Plastic Industries. Leading companies focus on high-durability HDPE shade nets, UV-stabilized materials, and customized shading solutions for agriculture, horticulture, and construction. Manufacturers invest in advanced knitting and extrusion technologies to enhance product strength, airflow control, and long-term weather resistance. Strategic expansions across Asia Pacific and the Middle East strengthen supply chains and reduce lead times for large-scale buyers. Many players prioritize sustainability by developing recyclable materials and low-impact polymers to align with rising eco-friendly demand. Partnerships with greenhouse developers, agri-input distributors, and nursery operators help companies expand market penetration. Continuous product innovation and region-specific shading densities support competitive differentiation across global markets.

Key Player Analysis

Recent Developments

- In June 2024, Beaulieu Technical Textiles (BTT) unveiled its latest Recover and Recover Pro range of woven ground covers, part of its existing R&D partnerships with agronomy experts, at the GreenTech Amsterdam event.

- In June 2024, Garware Technical Fibres Ltd. reported a visit by AQUA to its facilities in India — part of its ongoing outreach and strengthening of global technical-textile collaborations.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, Application, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for shade nets will grow as farmers adopt more climate-resilient cultivation methods.

- Greenhouse and nursery expansions will increase the need for durable and UV-stable shading systems.

- Manufacturers will focus on recyclable and eco-friendly materials to meet sustainability goals.

- Lightweight and high-strength net designs will gain preference for easier installation and maintenance.

- Adoption will rise in livestock, aquaculture, and landscaping due to broader shading applications.

- Construction sector demand will strengthen as safety and debris-control standards improve.

- Advances in polymer engineering will boost product lifespan and shading efficiency.

- Regional production capacity in Asia Pacific will expand, supporting global supply stability.

- Partnerships between shading-solution providers and agri-tech companies will accelerate product innovation.

- Government programs promoting protected cultivation will support long-term market growth across emerging economies.