| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

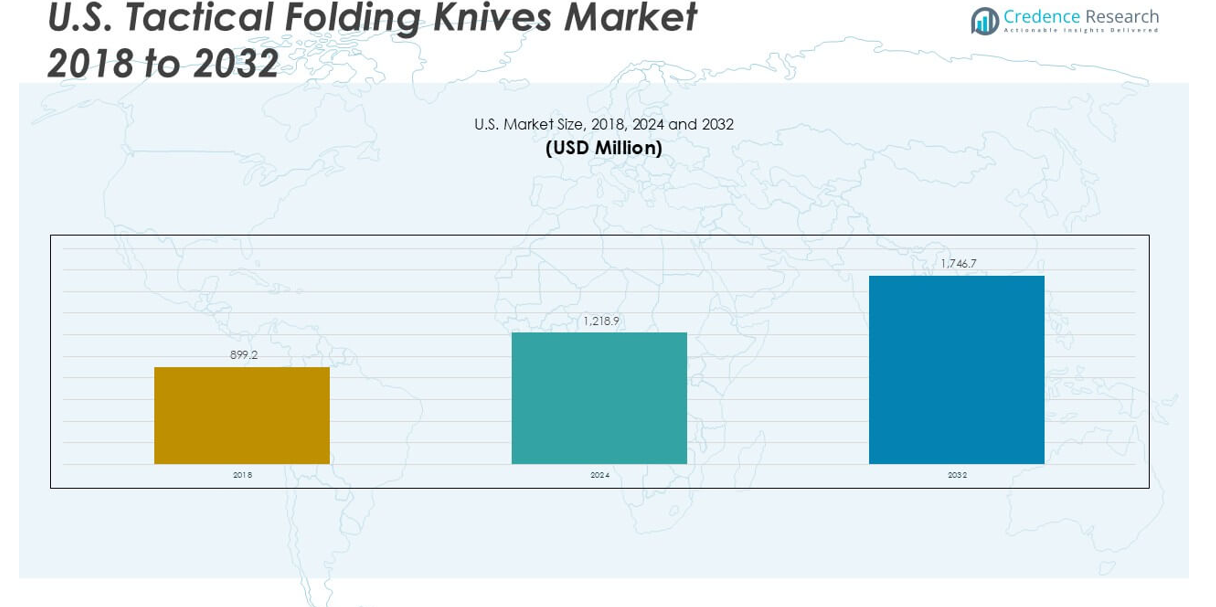

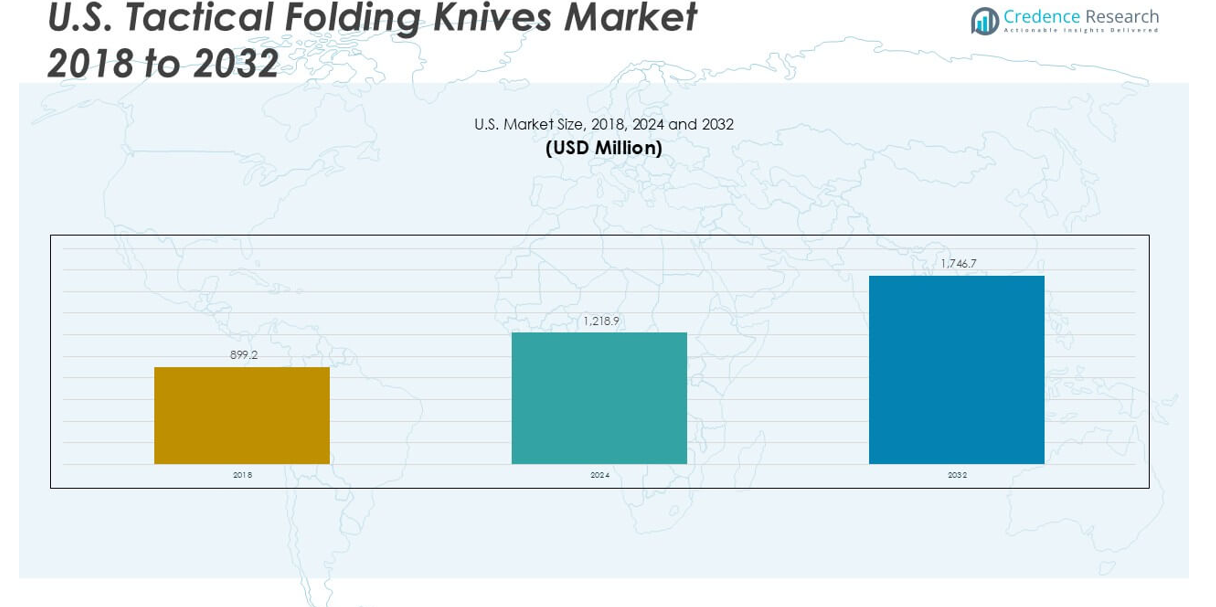

| U.S. Tactical Folding Knives Market Size 2024 |

USD 1,218.9 million |

| U.S. Tactical Folding Knives Market, CAGR |

4.60% |

| U.S. Tactical Folding Knives Market Size 2032 |

USD 1,746.7 million |

Market Overview

The U.S. Tactical Folding Knives market size was valued at USD 899.2 million in 2018, reached USD 1,218.9 million in 2024, and is anticipated to reach USD 1,746.7 million by 2032, at a CAGR of 4.60% during the forecast period.

The U.S. Tactical Folding Knives market is led by key players such as Benchmade Knife Company, Spyderco, Inc., Gerber Gear, Buck Knives, Inc., Zero Tolerance (ZT Knives – Kai USA), Kershaw Knives, and SOG Specialty Knives. These companies maintain strong market positions through product innovation, high-quality materials, and well-established brand loyalty among military, law enforcement, and outdoor users. The Western region dominates the market with a 35% share in 2024, driven by a strong outdoor culture and high defense activity. The Southern region follows closely, holding approximately 28% of the market share, supported by favorable regulations and a large consumer base.

Market Insights

- The U.S. Tactical Folding Knives market was valued at USD 1,218.9 million in 2024 and is expected to reach USD 1,746.7 million by 2032, growing at a CAGR of 4.60% during the forecast period.

- Growing demand from the military, defense, and outdoor recreational sectors is driving market growth, supported by rising consumer interest in durable, high-performance tactical knives.

- Increasing preference for premium materials, customizable designs, and e-commerce platforms is shaping key market trends, with online channels capturing a significant share.

- The market faces restraints due to varying state-level knife regulations, strict carry laws, and rising competition from low-cost and counterfeit products impacting brand credibility.

- Regionally, the West holds the largest market share at 35% in 2024, followed by the South at 28%, with the military and defense segment leading the application share across all regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

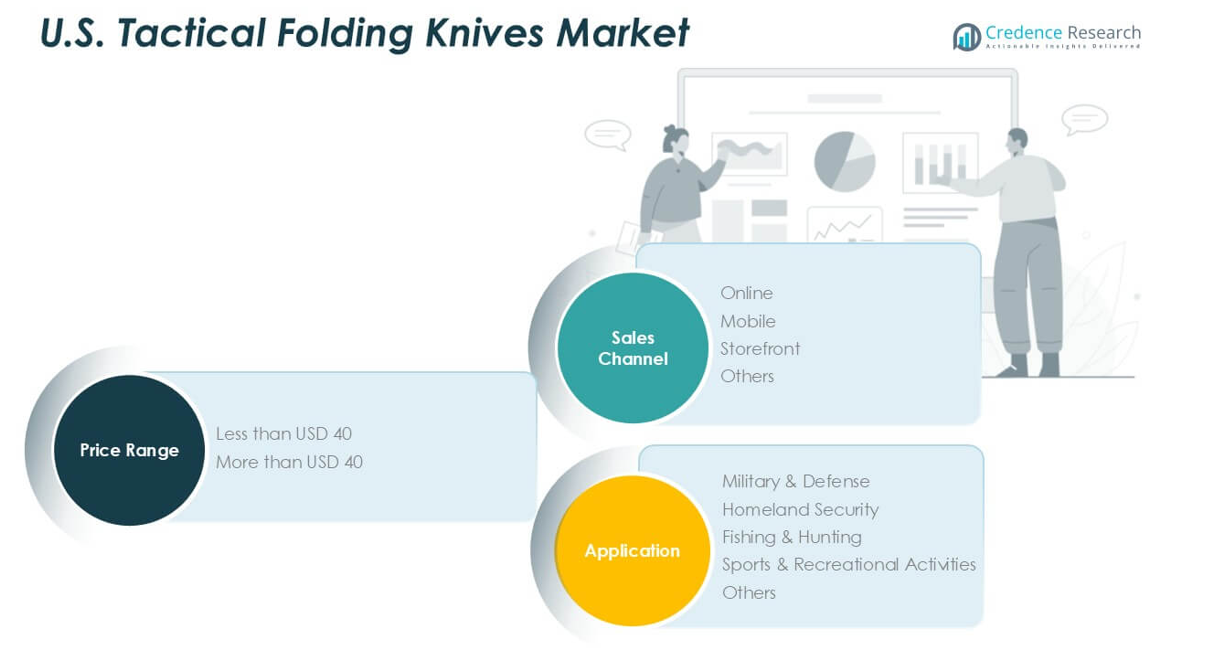

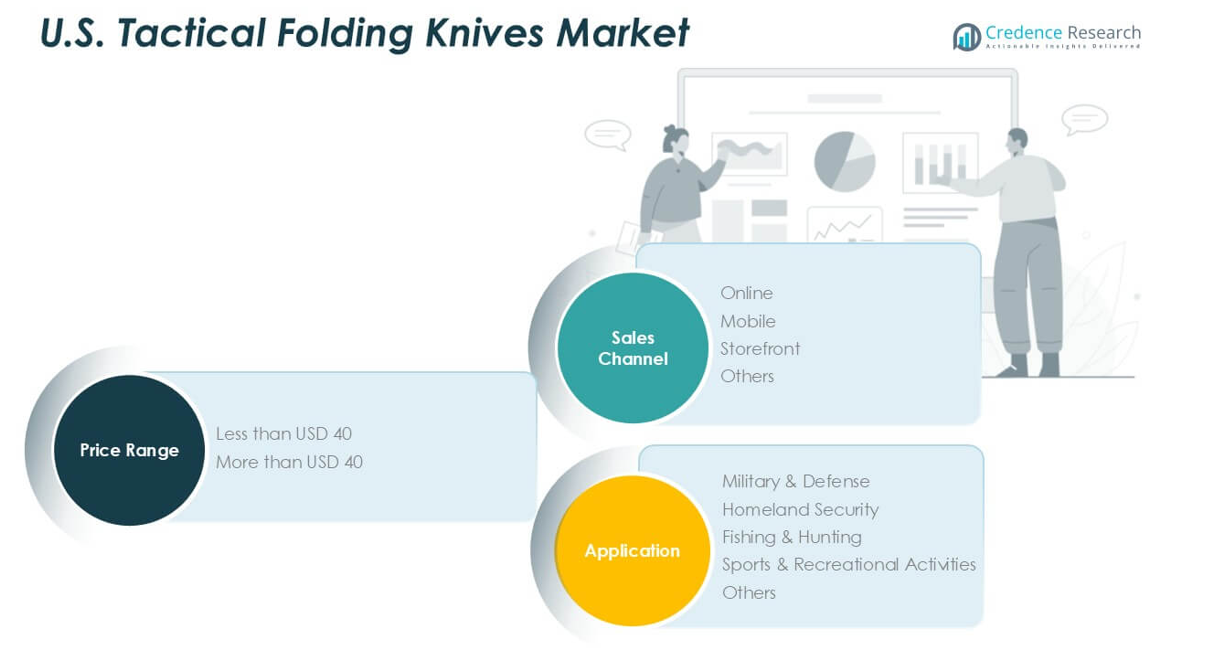

By Price Range:

In the U.S. Tactical Folding Knives market, the price range segment is divided into knives priced less than USD 40 and those priced above USD 40. The segment priced more than USD 40 dominated the market in 2024, accounting for a significant revenue share due to increasing consumer preference for high-quality, durable, and feature-rich tactical knives. These products offer superior blade materials and enhanced locking mechanisms, which appeal to military professionals, law enforcement, and outdoor enthusiasts. The demand in this segment is primarily driven by rising interest in premium performance knives for professional and recreational applications.

- For instance, Benchmade Knife Company offers tactical knives like the Benchmade 940 Osborne with a blade length of 86 mm and a thickness of 2.9 mm, utilizing CPM-S30V stainless steel for superior durability and edge retention.

By Application:

Military and defense emerged as the dominant sub-segment in 2024, holding a substantial market share. This dominance is supported by consistent government procurement and tactical requirements among armed forces and homeland security personnel. Tactical folding knives are essential for field operations, survival scenarios, and self-defense purposes in military settings. In the sales channel segment, the online platform leads the market with a considerable share. Online channels offer a wide product variety, competitive pricing, and easy accessibility, driving consumer preference. Growing reliance on e-commerce for specialty products, coupled with the convenience of doorstep delivery, has further strengthened online sales in this market.

- For instance, Gerber Gear supplies the U.S. military with tactical knives like the Propel Auto, featuring a 90 mm blade and an automatic opening mechanism, which meets specific operational standards for rapid deployment.

Market verview

Rising Demand from Military and Defense Sector

The U.S. tactical folding knives market is experiencing significant growth due to consistent demand from the military and defense sector. Tactical folding knives are essential tools for combat, survival, and field operations, making them a standard issue in many armed forces and law enforcement agencies. The versatility, portability, and multi-functional nature of these knives drive procurement initiatives. Ongoing modernization programs and increasing defense budgets further support market expansion as agencies prioritize reliable, high-performance equipment for operational efficiency and personnel safety.

- For instance, Emerson Knives, Inc. provides tactical models such as the CQC-7B, which has been in active use within the U.S. Navy SEAL teams and features a 76 mm blade with a wave-shaped opening mechanism for ultra-fast deployment

Increasing Populariy of Outdoor Recreational Activities

The growing interest in outdoor recreational activities, such as camping, hunting, and hiking, is fueling the demand for tactical folding knives in the U.S. market. Outdoor enthusiasts favor these knives for their compact design, easy handling, and multipurpose use in survival and field situations. Rising consumer awareness of self-reliance and preparedness has made tactical folding knives a preferred choice for outdoor gear. This shift in lifestyle preferences is creating strong growth opportunities for manufacturers offering lightweight, durable, and ergonomically designed products.

- For instance, Spyderco’s Paramilitary 2 offers a 3.44″ (87 mm) CPM‑S45VN blade and 3.75 oz (106 g) weight, making it a top choice among hikers and survivalists.

Expanding E-commerce and Direct-to-Consumer Channels

The rapid growth of e-commerce platforms and direct-to-consumer sales channels is significantly contributing to the market’s expansion. Online retail offers consumers a wide selection, detailed product specifications, and user reviews that influence purchasing decisions. Tactical folding knife manufacturers are leveraging online platforms to expand reach, offer customization, and engage directly with end-users. This sales strategy enhances customer loyalty, increases accessibility across the country, and allows smaller brands to effectively compete with established players, thereby stimulating market growth.

Key Trends & Opportunities

Technological Advancements in Blade and Handle Materials

The tactical folding knives market is witnessing a notable shift towards advanced materials that enhance product performance. Manufacturers are increasingly utilizing high-carbon stainless steel, titanium, and G-10 composites to improve blade sharpness, corrosion resistance, and handle durability. These innovations cater to the growing consumer demand for lightweight, robust, and long-lasting knives suitable for both professional and recreational use. Continuous research in material science presents an opportunity for companies to differentiate their offerings and capture niche customer segments.

- For instance, Zero Tolerance (ZT Knives) uses CPM-20CV steel in its ZT 0562CF model, with a 92 mm blade length, offering exceptional edge retention and corrosion resistance while incorporating a carbon fiber handle for lightweight performance.

Rising Demand for Customization and Personalization

Consumers are showing increased interest in customizable tactical folding knives that reflect personal preferences in design, blade style, and handle texture. This trend is particularly strong among hobbyists, collectors, and outdoor enthusiasts seeking unique and tailored products. Manufacturers are capitalizing on this opportunity by offering personalized engravings, interchangeable parts, and limited-edition releases. Customization not only enhances consumer satisfaction but also allows companies to command premium pricing, creating a profitable growth avenue within the market.

- For instance, Hogue, Inc. offers custom knife options with precision-machined aluminum handles and blade variations such as the Hogue X5, featuring a 102 mm blade, and allows customers to select from multiple finish and engraving options.

Key Challenges

Regulatory Restrictions and Compliance Requirements

The U.S. tactical folding knives market faces challenges due to varying state-level laws and restrictions regarding the ownership, carry, and sale of certain knife types. Strict compliance with local regulations is mandatory, particularly concerning blade length and assisted opening mechanisms. These legal complexities limit market accessibility in certain regions and can restrict distribution channels. Manufacturers and retailers must navigate a fragmented regulatory landscape, which can increase operational costs and slow market penetration.

Intense Market Competition and Price Sensitivity

The market is highly competitive with the presence of numerous domestic and international players offering a wide range of tactical folding knives. Price sensitivity among consumers, particularly in the entry-level and mid-range segments, intensifies pricing pressure on manufacturers. This competition challenges brands to balance product quality with affordability while maintaining profit margins. Smaller players may find it difficult to sustain operations without strong brand recognition or innovative product features to differentiate themselves.

Product Safety and Counterfeit Concerns

Product safety remains a critical concern in the tactical folding knives market, especially for low-cost imports and counterfeit products that may not meet industry standards. Substandard materials and poor locking mechanisms can pose significant safety risks to users. Additionally, counterfeit knives can damage brand reputation and erode consumer trust. Manufacturers need to invest in quality control, authentication technologies, and consumer education to mitigate these risks and maintain product integrity in the marketplace.

Regional Analysis

West

The Western region holds the largest share in the U.S. Tactical Folding Knives market, accounting for approximately 35% of the total market in 2024. This dominance is driven by the region’s strong military presence, widespread outdoor recreational culture, and high consumer spending on premium tactical gear. States like California and Arizona have a significant base of outdoor enthusiasts, law enforcement agencies, and defense personnel who contribute to the sustained demand. The popularity of hunting, hiking, and camping in this region further supports market growth, making the West a key contributor to overall market expansion.

South

The Southern region captures around 28% of the U.S. Tactical Folding Knives market share in 2024, supported by the region’s large military installations, hunting traditions, and a strong interest in survival gear. States like Texas and Florida are major markets due to their sizable consumer base and active defense procurement. The region also benefits from more lenient knife regulations compared to others, which encourages higher retail sales. Additionally, the Southern consumer preference for outdoor sports and tactical equipment continues to drive steady growth, positioning the South as a vital regional market for tactical folding knives.

Midwest

The Midwest holds approximately 20% of the U.S. Tactical Folding Knives market share in 2024, driven by the region’s well-established hunting culture and a growing interest in outdoor and sporting activities. States like Michigan, Wisconsin, and Ohio contribute significantly to the demand, particularly in rural and semi-urban areas where tactical knives are widely used for recreational and utility purposes. While the region exhibits moderate growth compared to the West and South, the increasing popularity of e-commerce platforms is boosting product accessibility, helping manufacturers expand their reach and tap into smaller yet consistent consumer markets.

Northeast

The Northeastern region represents about 17% of the U.S. Tactical Folding Knives market share in 2024. Growth in this region is somewhat constrained by stricter knife regulations, especially in densely populated urban centers like New York and Massachusetts, where carry restrictions limit product adoption. However, the region still maintains demand from law enforcement agencies and outdoor enthusiasts in less restrictive states. The Northeast shows potential for niche premium segments, particularly through specialty retailers and online platforms targeting collectors and professional users. Despite regulatory challenges, steady demand from security-focused consumers ensures a stable market presence.

Market Segmentations:

By Price Range

- Less than USD 40

- More than USD 40

By Application

- Military & Defense

- Homeland Security

- Fishing & Hunting

- Sports & Recreational Activities

- Others

By Sales Channel

- Online

- Mobile

- Storefront

- Others

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The U.S. Tactical Folding Knives market is highly competitive, with several established players dominating the landscape through product innovation, strong brand reputation, and extensive distribution networks. Key companies such as Benchmade Knife Company, Spyderco, Inc., Gerber Gear, and Buck Knives, Inc. focus on high-performance products that cater to both military professionals and outdoor enthusiasts. Competitive strategies include frequent product launches, customization options, and the use of advanced blade and handle materials to differentiate offerings. Companies like Zero Tolerance (ZT Knives – Kai USA) and Kershaw Knives are leveraging premium designs and precision manufacturing to capture niche, high-value segments. The market also sees strong competition from brands like SOG Specialty Knives, CRKT, and Cold Steel, which offer a diverse product range targeting various price points. Additionally, the increasing importance of online sales channels has intensified competition, as manufacturers aim to strengthen their digital presence and engage directly with consumers to build brand loyalty.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Benchmade Knife Company

- Spyderco, Inc.

- Gerber Gear

- Buck Knives, Inc.

- Zero Tolerance (ZT Knives – Kai USA)

- Kershaw Knives

- SOG Specialty Knives

- CRKT (Columbia River Knife & Tool)

- Cold Steel, Inc.

- ESEE Knives

- Emerson Knives, Inc.

- Hogue, Inc.

- TOPS Knives

- Ontario Knife Company

Recent Developments

- In June 2025, MAC Knife, Inc. launched the Matsato Knife, a premium control Japanese chef knife. Through advanced ergonomic knife design and traditional Japanese forging techniques, the Matsato Knife sets new standards in culinary precision.

- In July 2024, Yoshikin Global Corporation launched the new color “GLOBAL CAMP Black series” from “GLOBAL CAMP”. The newly added GLOBAL CAMP Black series has two types: Utility Knife and Serrated Knife. GLOBAL CAMP Black series knives use a processing technique called “oxidation coloring” to change the thickness of the stainless steel’s passive film, giving it the black color.

- In February 2024, Victorinox launched the Carving Knife Damast. This knife is made of Damasteel, produced in layers for incredible toughness, and is part of the Victorinox household knives range. With its lively Thor pattern, the Damasteel used for this knife cleverly combines corrosion resistance and superior strength.

Market Concentration & Characteristics

The U.S. Tactical Folding Knives market is shaped by intense competition, product innovation, and a growing focus on direct consumer engagement. Leading players like Benchmade Knife Company, Spyderco, Inc., Gerber Gear, and Buck Knives, Inc. dominate the market with extensive product portfolios, strong brand recognition, and consistent investment in research and development. These companies leverage advanced manufacturing techniques and high-quality materials such as stainless steel, carbon fiber, and titanium to deliver durable, precision-engineered products. Their long-standing partnerships with defense agencies and law enforcement units further strengthen their market presence. Customization and limited-edition releases have become key differentiators, allowing these companies to appeal to niche markets and command higher price points. These companies are particularly successful in reaching recreational users and the growing survivalist community. Their emphasis on ergonomic designs and multi-purpose functionality resonates well with consumers seeking reliable everyday carry (EDC) knives.

Report Coverage

The research report offers an in-depth analysis based on Price Range, Application, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The U.S. Tactical Folding Knives market is expected to grow steadily driven by rising demand from military, law enforcement, and outdoor enthusiasts.

- Increasing consumer preference for premium, durable, and customizable tactical knives will support market expansion.

- The growth of e-commerce platforms will continue to improve product accessibility and strengthen direct-to-consumer sales.

- Manufacturers will focus on developing lightweight, corrosion-resistant, and multi-functional knives using advanced materials.

- Customization and limited-edition product offerings will attract hobbyists, collectors, and survivalists seeking unique designs.

- The Western and Southern regions will maintain their dominance due to strong outdoor and defense-driven consumer bases.

- Companies will invest in online branding, customer engagement, and influencer partnerships to increase market share.

- Regulatory challenges at state levels will continue to impact product design, distribution strategies, and market entry.

- The market will face rising competition from counterfeit products, pushing manufacturers to enhance quality assurance and authentication practices.

- Partnerships with tactical sports, hunting communities, and defense training programs will emerge as key growth opportunities for manufacturers.