Market overview

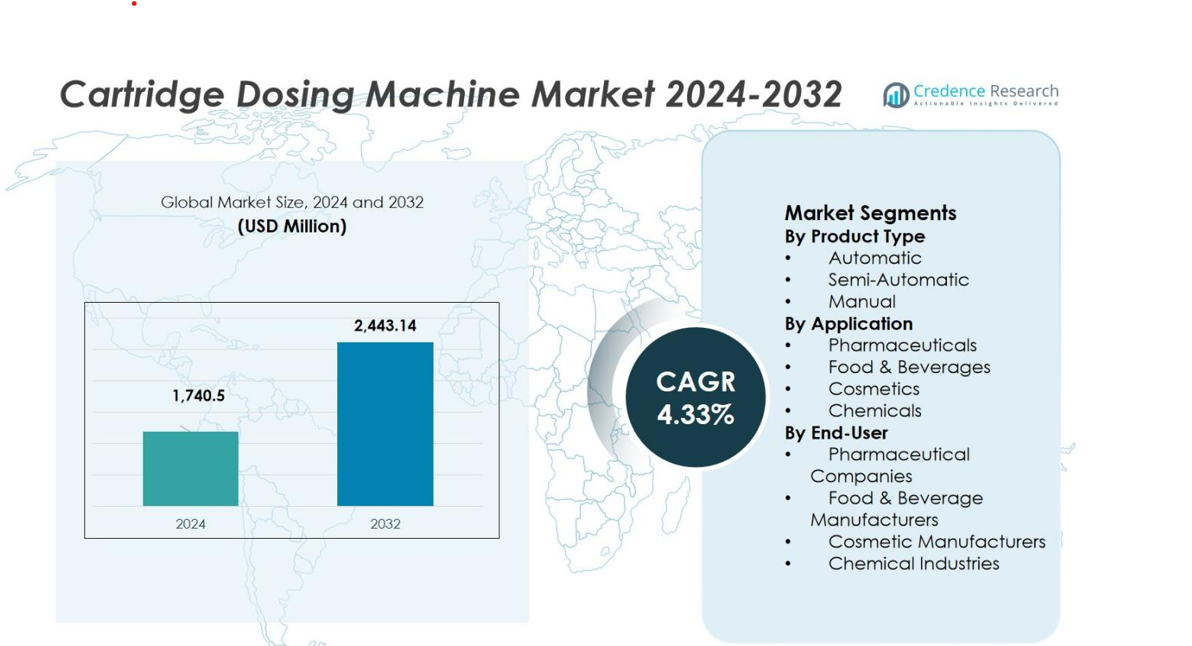

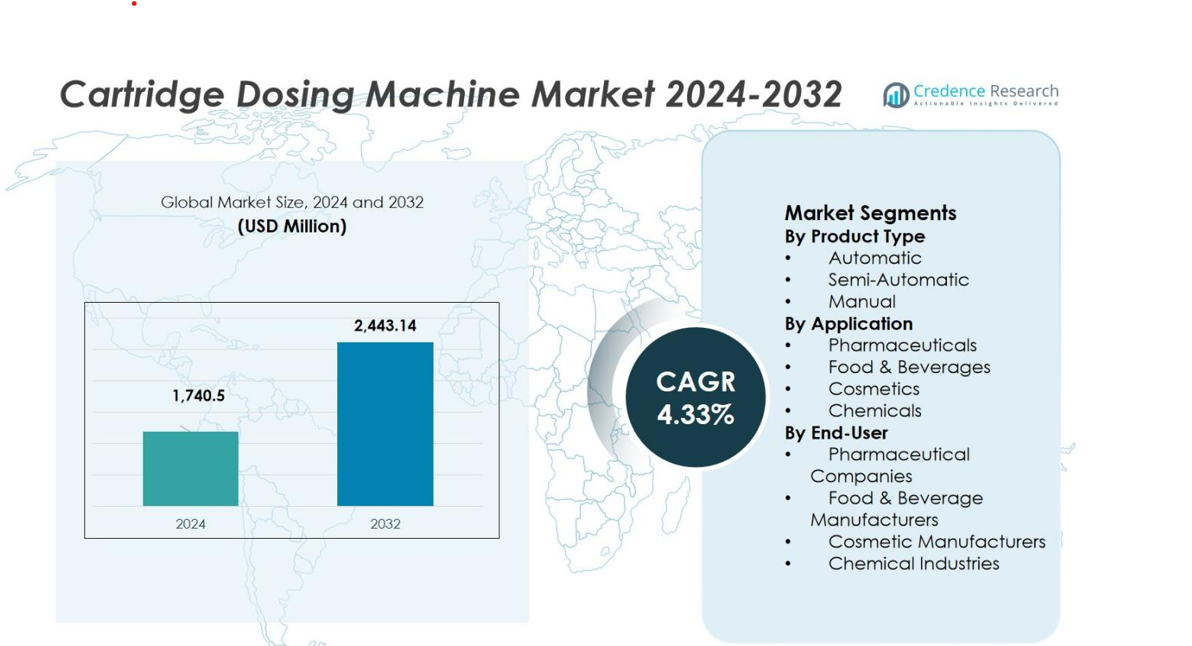

The Cartridge Dosing Machine market size was valued at USD 1,740.5 Million in 2024 and is anticipated to reach USD 2,443.14 Million by 2032, at a CAGR of 4.33% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cartridge Dosing Machine Market Size 2024 |

USD 1,740.5 Million |

| Cartridge Dosing Machine Market, CAGR |

4.33% |

| Cartridge Dosing Machine Market Size 2032 |

USD 2,443.14 Million |

The Cartridge Dosing Machine market is led by major companies such as Bausch, Nanninirenato, Axiss GmbH, DARA, Schwerdtel, Nordson, Hugematic, Loctite, HaiCheng Environment and Tridak, each actively innovating dosing technologies to expand their global footprints. Regionally, North America is the dominant market with a share of 33.5% in 2024. Europe follows closely, holding 28% of market share, while Asia Pacific commands 22%. The Rest of the World (Latin America, Middle East & Africa) accounts for 17%. These regions enable top players to deploy advanced cartridge dosing systems in pharmaceuticals, food & beverage, cosmetics and chemicals manufacturing.

Market Insights

- The Cartridge Dosing Machine market size was valued at USD 1,740.5 million in 2024 and is projected to reach USD 2,443.14 million by 2032 at a CAGR of 4.33%.

- The automatic product type segment held a market share of 58.7% in 2024.

- The pharmaceuticals application segment commanded a market share of 40.2% in 2024 driven by stringent regulatory demands for accuracy and hygiene.

- In 2024, North America accounted for a regional share of 33.5%, Europe held 28%, Asia‑Pacific captured 22%, and the Rest of the World comprised 17%.

- Growth is propelled by rising demand for automation and precision dosing, offset by restraints including high initial investment costs and complexity of integrating new machines into existing systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type:

The Cartridge Dosing Machine market is segmented into automatic, semi-automatic, and manual product types. The automatic dosing machines dominate this segment with a market share of 58.7% in 2024. These machines are highly favored for their precision, speed, and ability to handle large volumes efficiently, making them ideal for industries requiring consistent dosing, such as pharmaceuticals and food & beverages. The increasing demand for automation in production lines to enhance productivity and reduce human error is driving the growth of the automatic segment.

- For instance, Syntegon’s automatic cartridge filling and capping solutions achieve optimal processing conditions in pharmaceutical manufacturing, ensuring highly accurate and consistent dosing in sterile environments.

By Application:

The Cartridge Dosing Machine market is categorized into pharmaceuticals, food & beverages, cosmetics, and chemicals. The pharmaceuticals segment leads the market with a share of 40.2% in 2024. This dominance is driven by the growing need for accurate and hygienic dosing in the production of medications and vaccines, where precision and sterility are critical. The increasing investment in pharmaceutical manufacturing and stringent regulatory requirements for dosage consistency are key factors propelling the growth of this segment.

- For instance, the Accu-Doser by Accutek Packaging is an automatic high-precision dosing machine capable of filling small volumes from 0.1 mL to 200 mL in vials, syringes, and cartridges, ideal for sectors requiring exact dosing.

By End-User:

The end-user segment of the Cartridge Dosing Machine market includes pharmaceutical companies, food & beverage manufacturers, cosmetic manufacturers, and chemical industries. Pharmaceutical companies hold the largest share at 43.6% in 2024. The demand for precise dosing in drug production, coupled with the rapid expansion of the pharmaceutical sector globally, is driving the dominance of this sub-segment. The need for automation in drug manufacturing to meet the increasing production demand, as well as stringent quality control, contributes to the growth of the pharmaceutical segment.

Key Growth Drivers

Growing Demand for Automation in Manufacturing

The increasing adoption of automation in manufacturing processes is a major growth driver for the Cartridge Dosing Machine market. Industries such as pharmaceuticals, food & beverages, and chemicals are turning towards automated systems to improve efficiency, reduce human error, and enhance product consistency. The need for high-speed production with minimal downtime and waste is pushing companies to invest in automated dosing solutions. The ability of automatic dosing machines to handle large volumes while maintaining precision is making them indispensable across various industries.

- For instance, in the food and beverage sector, ABB’s integrated automation solutions streamline processes from brewing to bottling, boosting efficiency and reducing waste.

Rising Demand for Accurate Dosing in Pharmaceuticals

Accurate and reliable dosing is critical in pharmaceutical manufacturing, where even minor deviations can impact the efficacy and safety of products. The growing global demand for medications, especially with the increasing prevalence of chronic diseases, is driving the need for precise dosing machines. Pharmaceutical companies are investing in advanced cartridge dosing machines to ensure high-quality production and compliance with regulatory standards. This trend is further supported by the push for automation to increase throughput and reduce the risk of contamination in sensitive pharmaceutical environments.

- For instance, Dara Pharma offers aseptic equipment for dual-chamber cartridges that enables exact dosing of drugs used in self-administration, optimizing space and energy efficiency in production facilities.

Expansion of the Food & Beverage Industry

The rapid expansion of the global food & beverage industry is fueling demand for cartridge dosing machines. As consumer preferences shift towards healthier, more consistent, and safe food products, manufacturers are investing in advanced dosing solutions to ensure precision in ingredient measurements. This is particularly important for the production of products such as sauces, beverages, and prepared foods, where accurate dosing is crucial for flavor consistency and nutritional content. The increasing trend of customization in food products is also driving the need for more flexible dosing machines capable of handling a variety of ingredients.

Key Trends & Opportunities

Advancement in Machine Integration and IoT Technology

One of the key trends in the Cartridge Dosing Machine market is the integration of IoT (Internet of Things) technology with dosing machines. The ability to connect dosing machines to central control systems allows for real-time monitoring, data analytics, and predictive maintenance, enhancing machine efficiency and reducing downtime. This integration is especially beneficial in industries like pharmaceuticals and food & beverages, where operational continuity and quality control are paramount. As IoT technology becomes more accessible, there are significant opportunities for manufacturers to optimize production lines and improve operational flexibility.

- For instance, Pfizer employs digital twins-virtual replicas of physical processes powered by IoT data-to simulate and optimize pharmaceutical production, reducing human error and ensuring consistent quality.

Sustainability and Eco-friendly Manufacturing Solutions

Sustainability is becoming a key focus for industries worldwide, and the Cartridge Dosing Machine market is no exception. Manufacturers are increasingly investing in energy-efficient, low-waste dosing solutions to reduce their environmental impact. This trend is driven by both consumer demand for eco-friendly products and regulatory pressure for companies to adopt sustainable practices. Dosing machines that minimize material waste, reduce energy consumption, and are made from recyclable materials are expected to gain traction in the market. As sustainability becomes a priority, companies can seize opportunities by developing more environmentally responsible dosing technologies.

- For instance, medmix Switzerland AG has developed the MIXPAC™ greenLine™ two-component cartridge systems made with post-consumer recycled (PCR) and post-industrial recycled (PIR) materials, reducing CO2 emissions by up to 66% while maintaining high performance and compatibility with existing dispensers.

Key Challenges

High Initial Investment Costs

One of the key challenges in the Cartridge Dosing Machine market is the high initial investment cost associated with automated dosing systems. While these machines offer long-term operational benefits, such as increased efficiency and precision, the upfront cost can be a significant barrier for small and medium-sized enterprises (SMEs). Additionally, the cost of maintenance and the need for specialized training for staff can add to the financial burden. As a result, some companies may be hesitant to invest in advanced dosing technology, limiting market growth potential.

Technological Complexity and Integration Issues

Another challenge in the Cartridge Dosing Machine market is the technological complexity and potential integration issues when incorporating new dosing systems into existing production lines. Many manufacturers, especially in the food & beverage and pharmaceutical industries, already have established machinery and workflows. Integrating advanced dosing machines with older systems can be challenging and costly, requiring specialized expertise. Furthermore, the complexity of newer systems may require extensive training and adaptation, which can slow down adoption and impact the overall efficiency of production.

Regional Analysis

North America

In 2024, the Cartridge Dosing Machine Market in North America accounted for a market share of 33.5%, making it the largest regional contributor. The region’s dominance is underpinned by mature pharmaceutical, food & beverage, and chemical manufacturing sectors that demand high‑precision dosing systems. Strong regulatory frameworks emphasizing accuracy, automation and traceability also favor the deployment of advanced dosing equipment. As manufacturers increasingly upgrade to automated cartridge dosing machines to enhance throughput and reliability, the North American market remains a strategic hotspot for technology‑driven growth.

Europe

Europe holds a substantial portion of the global cartridge dosing machine market with an estimated share of 28% in 2024 (by inference from major region shares). The region benefits from its robust industrial base—particularly in Germany, France and the UK—with strong adoption of dosing machinery in pharmaceuticals, cosmetics and specialty chemicals. The push toward Industry 4.0 and the integration of automation across manufacturing plants provide a favourable environment for deploying cartridge dosing solutions. Sustainability legislation in the EU further accelerates demand for precision dosing machines that minimise waste and enhance operational efficiency.

Asia Pacific

The Asia Pacific region is emerging as a dynamic growth region in the cartridge dosing machine sector, with an estimated market share of 22% in 2024. Growth here is fuelled by rapid expansion of manufacturing in China, India and Southeast Asia, driven by rising pharmaceutical production, cosmetics manufacturing and food & beverage processing. Investment in automation and rising labour costs are pushing companies to adopt automated dosing systems. Moreover, government initiatives favouring “make in country” manufacturing and regulatory upgrades enhance adoption of precision dosing equipment, positioning the region for above‑average growth.

Rest of the World (Latin America, Middle East & Africa)

The combined Rest of the World segment—including Latin America, Middle East & Africa—accounts for the remaining 17% of global market share in 2024. While this region currently lags the developed markets in terms of penetration, it presents significant opportunity due to growing manufacturing capacity in Brazil, Mexico, UAE and South Africa. Key drivers include increasing investments in pharmaceuticals and food production, rising demand for higher‑end dosing equipment over time, and the potential for second‑wave automation as plants upgrade. Market players focusing on cost‑effective solutions and service networks in these regions stand to gain traction.

Market Segmentations:

By Product Type

- Automatic

- Semi-Automatic

- Manual

By Application

- Pharmaceuticals

- Food & Beverages

- Cosmetics

- Chemicals

By End-User

- Pharmaceutical Companies

- Food & Beverage Manufacturers

- Cosmetic Manufacturers

- Chemical Industries

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Cartridge Dosing Machine market features key players such as Bausch, Nanninirenato, Axiss GmbH, DARA, Schwerdtel, Nordson, Hugematic, Loctite, HaiCheng Environment and Tridak. Established global firms compete strongly on product innovation, service networks and geographic footprint. Many are investing heavily in R&D to launch dosing systems with enhanced precision, connectivity and material compatibility, enabling differentiation. Strategic collaborations, acquisitions and regional expansions have become common as players seek to bolster market position and tap emerging regions. Smaller regional suppliers carve out niche spaces by offering tailored solutions for local requirements or lower‑cost alternatives, thereby creating a moderately fragmented competitive structure. To stay ahead, companies prioritise customer‑centric after‑sales service, digital integration of machines and sustainability credentials to meet evolving industry demands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- HaiCheng Environment

- Loctite

- DARA

- Bausch

- Tridak

- Nordson

- Schwerdtel

- Axiss GmbH

- Nanninirenato

- Hugematic

Recent Developments

- In June 2024, the company BAUSCH Germany GmbH was acquired by DEC Group and will now operate as DEC Filling Germany GmbH, enhancing its aseptic fill–finish capabilities.

- In March 2024, the company Nordson EFD released its new EV Series 3‑axis automated fluid dispensing robot for high‑precision cartridge‑based dosing applications.

- In June 2025, Techcon (part of OK International / Dover Corporation) launched a new line of “Side‑by‑Side Dispensing Cartridges” for electronics, industrial, medical device and automotive industries.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The increasing adoption of automated production lines across pharmaceuticals, cosmetics, food & beverages, and chemicals will drive growth in the cartridge dosing machine market as manufacturers seek high‑speed, high‑precision dosing solutions.

- Expanded demand for personalised medicine and small‑batch manufacturing will require cartridge dosing machines that offer greater flexibility, modularity and rapid changeover capabilities.

- Enhanced focus on sustainability will push suppliers to develop dosing machines with reduced material waste, lower energy consumption and recyclable components, aligning with corporate and regulatory environmental goals.

- Integration of IoT, AI and edge‑analytics into dosing systems will enable real‑time monitoring, predictive maintenance and process optimisation, thereby increasing machine uptime and overall equipment effectiveness.

- Emerging regions such as Asia‑Pacific and Latin America will present significant growth opportunities as manufacturers upgrade from manual to automated dosing technologies to meet rising production and quality demands.

- Growth in high‑value specialty applications including adhesives, sealants, advanced materials and micro‑electronics will expand demand for precision cartridge dosing machines capable of handling diverse viscosities and chemistries.

- Strategic partnerships and M&A among machine builders, automation technology providers and consumable suppliers will accelerate innovation and expand global service and distribution footprints in the cartridge dosing sector.

- Rising regulatory pressure in highly‑regulated industries (e.g., pharmaceuticals, medical devices, food safety) will increase the adoption of dosing machines offering traceability, documentation and validated performance.

- Market players will need to offer scalable service models, remote diagnostics and digital support ecosystems to retain customers and capture recurring‑revenue opportunities beyond machine sales.

- The transition toward servitisation where manufacturers shift from selling equipment to offering “dosing‑as‑a‑service” or performance‑contract models will create new revenue streams and reshape vendor‑end‑user relationships in the cartridge dosing machine market.