| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mexico Cosmetic Market Size 2024 |

USD 11,116.13 million |

| Mexico Cosmetic Market, CAGR |

4.79% |

| Mexico Cosmetic Market Size 2032 |

USD 16,600.48 million |

Market Overview:

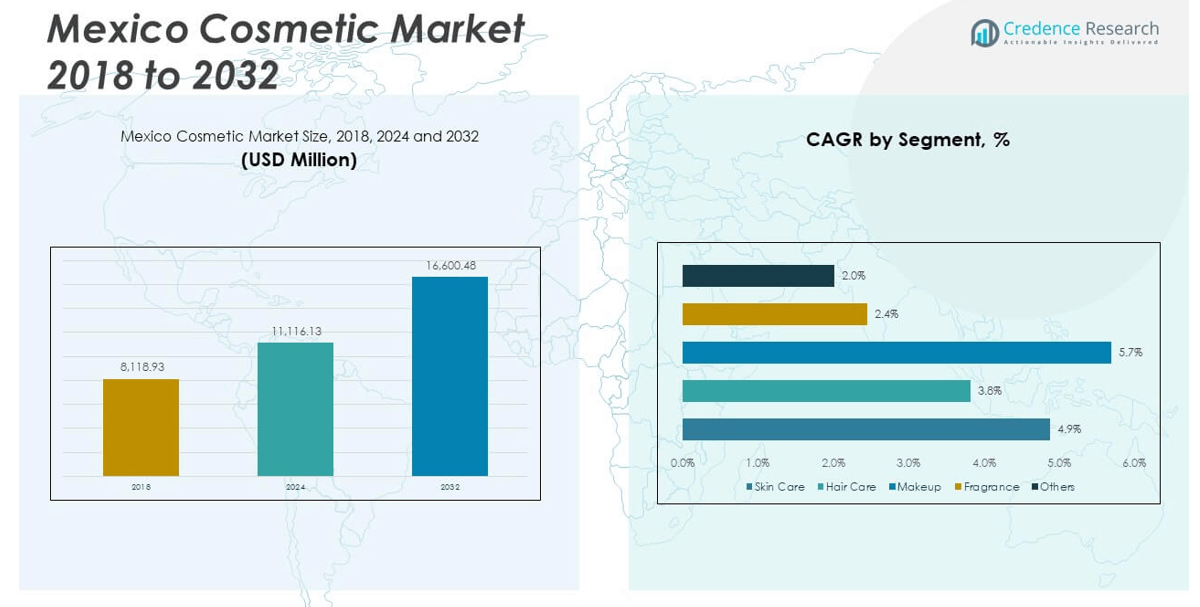

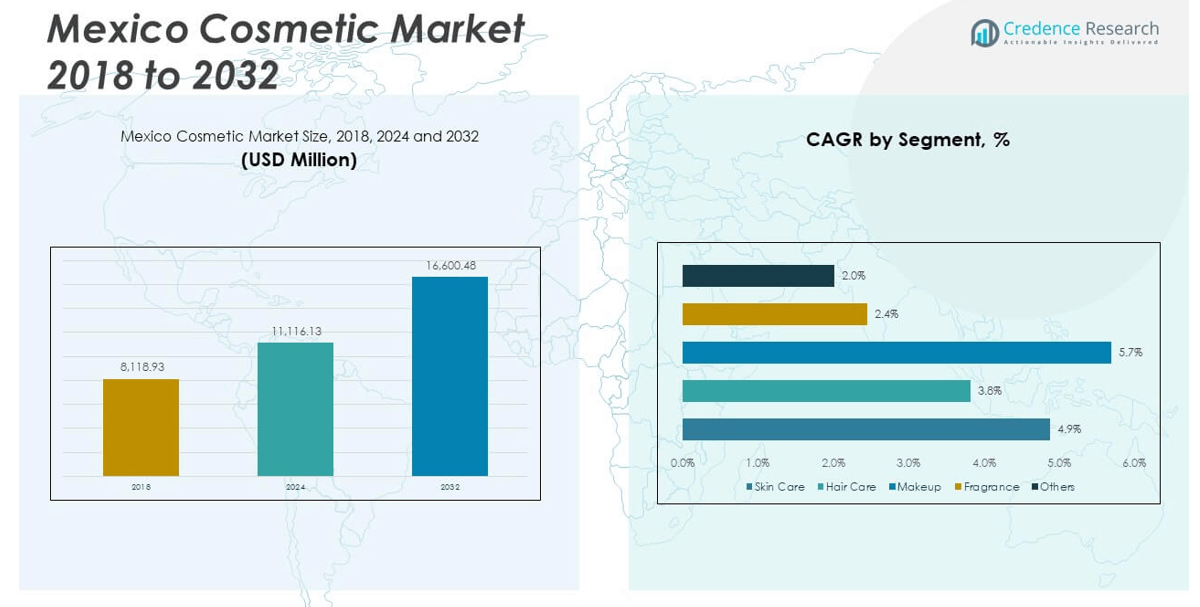

The Mexico Cosmetic Market size was valued at USD 8,118.93 million in 2018 to USD 11,116.13 million in 2024 and is anticipated to reach USD 16,600.48 million by 2032, at a CAGR of 4.79% during the forecast period.

Market growth is strongly supported by a combination of social, economic, and technological factors. Rising disposable incomes and an expanding middle class are allowing Mexican consumers to spend more on both basic and luxury cosmetic products. Youth demographics, particularly Gen Z and millennials, are increasingly influenced by social media trends and beauty influencers, which has led to higher adoption of color cosmetics, skincare routines, and grooming products. The growing popularity of clean, organic, and natural beauty alternatives is also reshaping the product landscape, with both domestic and international companies responding to consumer demand for sustainability and ethical sourcing. E-commerce penetration and omnichannel retailing have further boosted accessibility, while major brands are leveraging online platforms, digital campaigns, and influencer marketing to drive engagement and reach.

Geographically, Mexico City remains the dominant hub for cosmetic consumption, followed by Guadalajara and Monterrey. These urban centers benefit from high consumer spending, dense population clusters, and advanced retail infrastructure, making them ideal launchpads for product rollouts and promotional campaigns. The presence of large shopping malls, beauty retailers, and flagship stores enhances consumer access to international and domestic brands. Beyond these metropolitan zones, secondary cities and semi-urban regions are emerging as new growth frontiers due to rapid urbanization and infrastructure development. Retail expansion into these areas, especially through pharmacies, supermarkets, and digital channels, is helping to tap into previously underserved segments. In addition, industrial regions such as Nuevo León are strengthening the supply chain landscape with increasing investments in local manufacturing, packaging, and distribution.

Market Insights:

- The Mexico Cosmetic Market reached USD 11,116.13 million in 2024 and is projected to grow to USD 16,600.48 million by 2032, registering a CAGR of 4.79% due to rising consumer demand and product diversification.

- Increasing disposable income and a growing middle class are shifting consumer focus toward premium, high-quality cosmetics, creating new opportunities across skincare, haircare, and makeup segments.

- Digital platforms like Instagram and TikTok have amplified product discovery, with Gen Z and millennials driving growth through influencer-led trends and virtual beauty engagement.

- Demand for clean-label, organic, and sustainable beauty products is accelerating, with both global and domestic brands introducing eco-conscious lines featuring locally sourced ingredients.

- Omnichannel retail strategies are expanding market reach, as seamless integration of physical stores and online channels enhances accessibility across urban and semi-urban regions.

- Regulatory challenges from COFEPRIS and increased compliance costs hinder market agility, particularly for smaller or emerging brands navigating complex approval processes.

- Mexico City leads in cosmetic consumption, followed by Guadalajara and Monterrey, while secondary cities and regions like Nuevo León are gaining traction through infrastructure growth and local manufacturing investment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Disposable Income and Expanding Middle-Class Fuel Premium Product Demand

The steady rise in disposable income across urban and semi-urban regions has led to increased consumer spending on non-essential lifestyle products, including cosmetics. A growing middle class is fueling demand for both mass-market and premium beauty products, particularly among women aged 18 to 40. Consumers are no longer satisfied with basic personal care; they now seek specialized and higher-quality products tailored to individual needs. This shift is creating opportunities for global brands and domestic manufacturers to diversify offerings. The Mexico Cosmetic Market benefits directly from these socio-economic improvements, translating consumer aspiration into measurable growth. Retailers are also optimizing their pricing and promotion strategies to align with evolving spending patterns.

- For instance, L’Oréal reported a 16.2% year-on-year sales growth in Latin America for Q1 2024, with Mexico identified as the third-largest contributor to the company’s global growth during this period. This performance is attributed to localized product strategies and targeted innovation tailored to Mexican consumer preferences, as confirmed in L’Oréal’s official quarterly and annual reports.

Influence of Digital Media and Social Platforms Drives Beauty Awareness and Product Adoption

The increasing penetration of social media platforms such as Instagram, YouTube, and TikTok has transformed beauty consumption behaviors across Mexico. Consumers, especially millennials and Gen Z, are heavily influenced by beauty influencers, tutorials, and user-generated content showcasing product application and results. Brands are leveraging digital platforms to enhance visibility and foster engagement with targeted audiences. Influencer partnerships, live-streamed product launches, and interactive content now play central roles in marketing strategies. The Mexico Cosmetic Market is seeing accelerated demand for products promoted through these digital avenues. It creates a dynamic feedback loop where consumer awareness directly drives product trial and loyalty.

- For example, major brands such as Estée Lauder and L’Oréal have shifted up to 40% of their marketing budgets to digital channels, focusing on influencer partnerships and live-streamed product launches.

Shift Toward Natural, Clean, and Sustainable Beauty Products Gains Momentum

Growing environmental awareness and health consciousness have shifted consumer preferences toward natural and organic formulations. Shoppers are increasingly scrutinizing product labels, avoiding parabens, sulfates, and synthetic chemicals, and opting for cruelty-free and vegan alternatives. Domestic brands are responding by integrating local botanicals and heritage-based ingredients to develop clean-label offerings with cultural relevance. Global players are also expanding their sustainable portfolios to meet rising demand. The Mexico Cosmetic Market is aligning with global clean beauty trends while incorporating regional preferences. It positions itself competitively by embracing eco-conscious innovation and transparent sourcing.

Omnichannel Retail Expansion and E-commerce Penetration Enhance Accessibility and Convenience

The retail landscape in Mexico is undergoing significant transformation, driven by the rise of e-commerce and omnichannel retail models. Consumers now expect seamless integration between physical stores and online platforms, with flexible delivery and pickup options. Major players are investing in digital storefronts, loyalty programs, and mobile-friendly interfaces to enhance user experience. E-commerce platforms such as Amazon Mexico, Mercado Libre, and brand-owned websites have gained prominence in cosmetic distribution. The Mexico Cosmetic Market is capitalizing on this retail shift to reach broader demographics and geographies. It ensures consistent access to products across urban and semi-urban areas, driving higher frequency of purchases.

Market Trends:

Personalized Beauty Solutions Gain Traction Through AI and Skin Diagnostics

Personalization is redefining consumer expectations in the cosmetic industry. Brands are adopting artificial intelligence, machine learning, and skin diagnostic tools to offer tailored product recommendations. Consumers are responding positively to virtual consultations, skin analyzers, and smart devices that identify unique skincare needs. These innovations enable companies to build deeper customer relationships and reduce product returns. The Mexico Cosmetic Market is seeing increased demand for customized skincare, foundation shades, and treatment regimens aligned with individual skin types and concerns. It supports higher consumer satisfaction and strengthens brand differentiation in a competitive landscape.

- For example, Haut.AI has introduced SkinGPT, the first scientifically accurate generative AI skin simulation tool, allowing brands to visualize projected skincare outcomes directly on users’ faces. This platform supports omnichannel engagement and remote clinical studies, and is recognized for its privacy-first design and robust computer vision capabilities.

Men’s Grooming and Skincare Segment Expands Beyond Traditional Offerings

Male consumers in Mexico are increasingly embracing grooming and personal care products beyond basic hygiene items. Demand is growing for men-specific skincare, hair styling, anti-aging creams, and beard care solutions. Social shifts and changing attitudes toward masculinity are driving acceptance of routine-based grooming among younger male demographics. Brands are launching dedicated product lines and targeting male consumers through influencers and sports sponsorships. The Mexico Cosmetic Market is expanding its focus to include male-centric innovations in packaging, scent, and formulation. It reflects a broader cultural acceptance of self-care and aesthetic enhancement among men.

Hybrid and Multi-Functional Products Meet Demand for Efficiency and Value

Consumers are seeking products that deliver multiple benefits in a single application to save time and reduce clutter. Hybrid cosmetics that combine skincare with makeup, such as tinted moisturizers with SPF or serums with anti-aging properties, are gaining popularity. These products appeal to busy professionals, minimalists, and value-conscious buyers. Innovation in formulation technology allows brands to create lightweight, high-performance blends that cater to multifunctional needs. The Mexico Cosmetic Market is experiencing rising demand for all-in-one solutions, particularly in urban markets. It aligns well with evolving lifestyles and increasing product expectations.

Rise of Indie and Local Brands Offers Authentic, Affordable Alternatives

Independent beauty brands and local manufacturers are carving out space in a market once dominated by multinationals. These companies focus on authenticity, cultural relevance, and niche positioning, often resonating more deeply with local consumers. Their agility allows them to introduce trend-responsive products faster and with more customized branding. Consumers are also supporting small businesses that reflect Mexican identity and use native ingredients. The Mexico Cosmetic Market is benefiting from this shift, with greater diversity in product availability and price points. It encourages healthy competition and fosters innovation across all tiers of the market.

- For example, Aora, a plastic-free makeup startup, opened a creative retail hub in Mexico City and secured distribution in El Palacio de Hierro and select museums, positioning itself at the intersection of sustainability and cultural relevance.

Market Challenges Analysis:

Regulatory Complexity and Product Compliance Limit Market Agility

Navigating regulatory frameworks in Mexico poses a challenge for both domestic and international cosmetic brands. The Federal Commission for the Protection against Sanitary Risk (COFEPRIS) imposes strict guidelines on product safety, labeling, and permissible ingredients. Adhering to these standards can delay product launches, increase compliance costs, and limit flexibility in formulation. Smaller brands, especially local startups and indie players, often struggle with the administrative burden and resource demands of regulatory adherence. The Mexico Cosmetic Market must operate within these constraints, which can hinder innovation and slow the introduction of global trends. It requires businesses to invest in legal counsel, documentation systems, and ongoing regulatory monitoring to remain competitive.

Economic Volatility and Informal Competition Undermine Profitability

Macroeconomic fluctuations, inflationary pressures, and shifts in consumer spending behavior can impact purchasing patterns in the cosmetic sector. While demand for beauty products remains resilient, affordability concerns lead consumers to favor lower-priced alternatives, including counterfeit or unregulated items sold in informal markets. This parallel economy erodes trust in branded products and compromises safety standards. The Mexico Cosmetic Market must contend with this widespread informal trade, which diminishes margins and distorts pricing structures. It puts pressure on established brands to justify their premium through quality assurance, education, and value-driven marketing. Strengthening distribution control and improving consumer awareness remain essential strategies to mitigate these risks.

Market Opportunities:

Expansion into Tier 2 Cities and Semi-Urban Regions Unlocks Untapped Demand

Rapid urbanization and infrastructure development are creating new growth avenues beyond Mexico’s primary metropolitan centers. Tier 2 cities and semi-urban regions now present viable markets with rising incomes and increased access to retail channels. Consumers in these areas are becoming more beauty-conscious, supported by mobile connectivity and social media exposure. Brands that invest in regional distribution, localized marketing, and culturally relevant products can gain early mover advantage. The Mexico Cosmetic Market is well-positioned to capitalize on this geographic expansion. It can build deeper customer loyalty by aligning offerings with regional preferences and price sensitivity.

Wellness Integration and Derma-Cosmetics Create Premium Product Niches

Consumer interest in holistic wellness is fueling demand for skincare and beauty products with therapeutic and functional benefits. Derma-cosmetics, nutraceutical beauty supplements, and products promoting skin health are gaining traction among health-aware buyers. This segment offers higher margins and allows brands to differentiate through clinical claims and dermatological endorsements. Companies that align with wellness trends and partner with health professionals can establish strong brand equity. The Mexico Cosmetic Market has significant room to grow in this category. It can attract a loyal base of consumers seeking advanced, science-backed beauty solutions.

Market Segmentation Analysis:

The Mexico Cosmetic Market is segmented by product type, gender, and distribution channel, reflecting diverse consumer preferences and retail dynamics.

By product type, skincare leads in market share due to growing awareness of skin health, demand for anti-aging solutions, and the rise of natural and derma-based formulations. Hair care follows, driven by concerns around hair damage, styling needs, and product innovation in oils and treatments. Makeup products, especially foundations and lip colors, maintain strong traction among urban consumers, while fragrances gain popularity through premium positioning and gifting trends. The “others” category includes niche products such as men’s grooming and wellness-integrated cosmetics.

- For example, Laneige, a Korean skincare brand, launched in Mexico in partnership with Sephora in September 2023, bringing advanced hydration and anti-aging solutions to Mexican consumers.

By gender, women account for the majority of cosmetic purchases, supported by higher product usage frequency and wider category engagement. However, the men’s segment is expanding, with growing demand for skincare, beard care, and grooming essentials.

By distribution channel, specialty stores hold a major share due to product variety and in-store consultation. Hypermarkets and supermarkets maintain strong regional presence, while online channels are growing rapidly, favored for convenience, exclusive deals, and influencer-driven product discovery. The Mexico Cosmetic Market continues to evolve through these distinct and interdependent segments.

- For instance, Amazon and Mercado Libre saw record sales during Mexico’s Hot Sale 2025, with 90% of buyers using digital channels and 60% shopping exclusively online.

Segmentation:

By Product Type:

- Skin Care

- Hair Care

- Makeup

- Fragrance

- Others

By Gender:

By Distribution Channel:

- Specialty Stores

- Hypermarket/Supermarket

- Online Channels

- Others

Regional Analysis:

Mexico City dominates the Mexico Cosmetic Market, accounting for approximately 38% of the national market share. Its dense population, high income levels, and advanced retail infrastructure support widespread product availability and consumer access to both premium and mass-market brands. Leading beauty chains, department stores, and specialty boutiques maintain a strong presence in the capital, reinforcing its position as the industry’s central hub. International brands often launch new products in Mexico City first, leveraging high visibility and established influencer networks. Consumer trends in the city strongly influence nationwide purchasing behavior. It also serves as a strategic base for logistics and distribution to other regions. The city’s consistent demand and spending patterns make it a cornerstone for sustained revenue generation.

Guadalajara holds a market share of nearly 22%, making it the second most important region for cosmetic sales in the country. It benefits from a large urban population, vibrant youth demographics, and expanding retail spaces. The city supports growing demand for skincare, haircare, and grooming products, with increased interest in clean beauty and affordable luxury. Local and regional brands often test product launches in Guadalajara due to its trend-sensitive consumer base. The rise of e-commerce and improved infrastructure have increased the reach of cosmetic brands in the area. Guadalajara’s evolving beauty preferences continue to drive innovation and brand engagement across formats.

Monterrey captures approximately 18% of the Mexico Cosmetic Market, supported by its strong economic base and rising consumer affluence. The city’s professional population seeks advanced, science-backed cosmetic products, including derma-cosmetics and wellness-integrated skincare. Monterrey’s proximity to the United States influences cross-border shopping habits and consumer exposure to international trends. Retail development remains strong, with premium shopping centers hosting flagship stores of top global brands. Local distributors and retailers actively expand digital and physical touchpoints to increase customer engagement. It remains a strategic location for supply chain operations and cross-regional brand management.

Other emerging urban regions—including Puebla, Tijuana, and León—collectively represent around 22% of the remaining market share. These areas are witnessing accelerated urbanization, greater internet penetration, and rising beauty awareness. While product variety may be limited compared to major metros, growing demand is prompting retailers to expand their presence and offer broader assortments. These regions offer untapped potential for brands aiming to scale beyond saturated urban markets. The Mexico Cosmetic Market is gradually adapting to regional diversity in demand, pricing, and product preference across its geographic footprint.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Natura

- AHAL

- Viva Organics

- Xamania

- Teia Cosméticos

- Royal Lashes

- Beserva

Competitive Analysis:

The Mexico Cosmetic Market features a competitive mix of multinational corporations, regional brands, and emerging local players. Leading companies such as L’Oréal, Procter & Gamble, Unilever, and Estée Lauder maintain strong market presence through extensive product portfolios, aggressive marketing, and wide distribution networks. Local brands are gaining ground by offering culturally relevant products, competitive pricing, and natural ingredient-based formulations. E-commerce platforms and social media channels are enabling smaller brands to scale rapidly and reach niche consumer segments. The market is highly dynamic, with players focusing on product innovation, clean beauty, and personalized skincare solutions to capture evolving consumer preferences. The Mexico Cosmetic Market encourages differentiation through brand positioning, ingredient transparency, and digital engagement. It rewards agility, innovation, and strong customer loyalty, making it an active battleground for market share.

Recent Developments:

- In May 2025, UK luxury beauty brand Charlotte Tilbury officially launched its complete line of makeup, skincare, and fragrance products in Mexico through Sephora Mexico, with further rollouts in two El Palacio de Hierro department stores and a travel retail concession at Mexico City International Airport.

- In May 2, 2025, Unilever declared a USD 1.5 billion investment plan in Mexico through 2028, dedicating approximately USD 407 million toward a new beauty and personal care manufacturing facility in Nuevo León. The facility will generate around 1,200 jobs and bolster Unilever’s production capacity, aligning with “Plan Mexico” and reinforcing its supply chain and export footprint.

- In Nov 2024, L’Oreal launched a new eco-friendly skincare line in Mexico, emphasizing sustainable ingredients and packaging. This initiative reflects the company’s commitment to environmental responsibility while catering to the growing demand for green beauty products in the region.

Market Concentration & Characteristics:

The Mexico Cosmetic Market exhibits moderate to high market concentration, with a few multinational corporations controlling a significant share. L’Oréal, Unilever, Procter & Gamble, and Estée Lauder dominate key segments through broad product portfolios, brand equity, and expansive distribution networks. Despite this dominance, local and indie brands are steadily capturing attention by targeting underserved niches and offering culturally resonant formulations. The market is characterized by high consumer engagement, fast-changing trends, and growing demand for natural and multifunctional products. It remains price-sensitive but shows increasing willingness to invest in premium and personalized solutions. The Mexico Cosmetic Market supports both mass and luxury segments, with strong performance across skincare, haircare, color cosmetics, and grooming categories. It continues to evolve with digital integration, retail innovation, and shifting lifestyle preferences.

Report Coverage:

The research report offers an in-depth analysis based on product type, gender, and distribution channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Premiumization is expected to accelerate as consumers seek higher-quality and personalized beauty solutions.

- Clean beauty and sustainable packaging will drive brand differentiation and consumer loyalty.

- Digital-first strategies, including virtual try-ons and influencer collaborations, will reshape marketing approaches.

- E-commerce growth will expand access in tier 2 and semi-urban regions, enhancing nationwide reach.

- Demand for derma-cosmetics and wellness-integrated skincare will rise among health-conscious consumers.

- Male grooming will continue to expand, encouraging brands to diversify product lines and messaging.

- Local brands will gain traction by leveraging regional ingredients and culturally relevant branding.

- Product innovation in hybrid cosmetics will appeal to time-conscious and value-driven consumers.

- Strategic investments in supply chain localization will improve speed-to-market and cost efficiency.

- Regulatory alignment and consumer education will support formal market expansion and product trust.