Market Overview

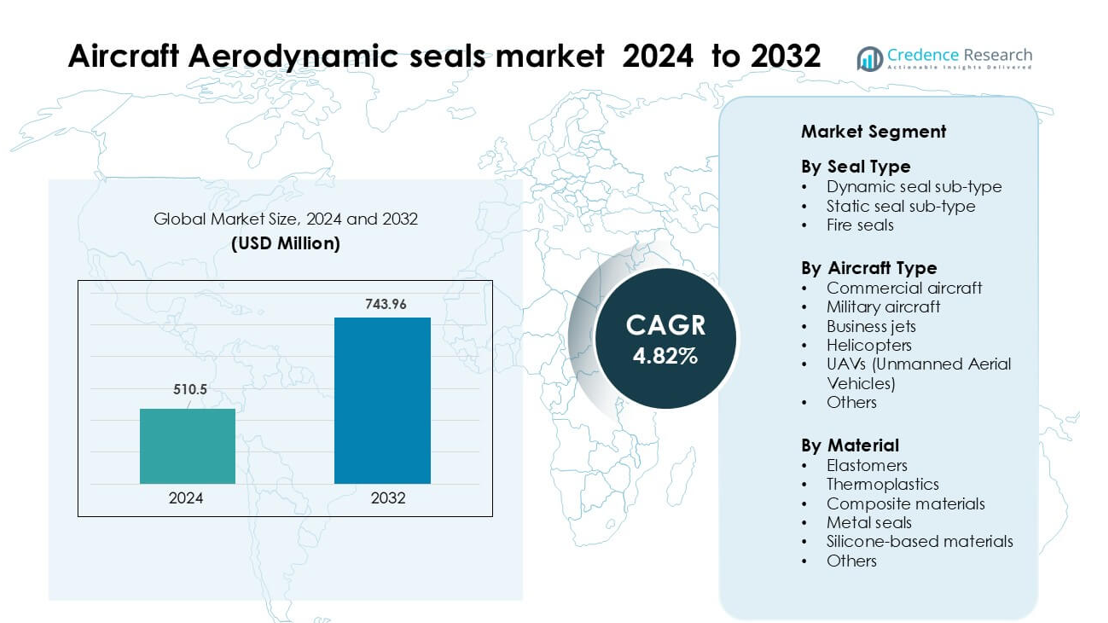

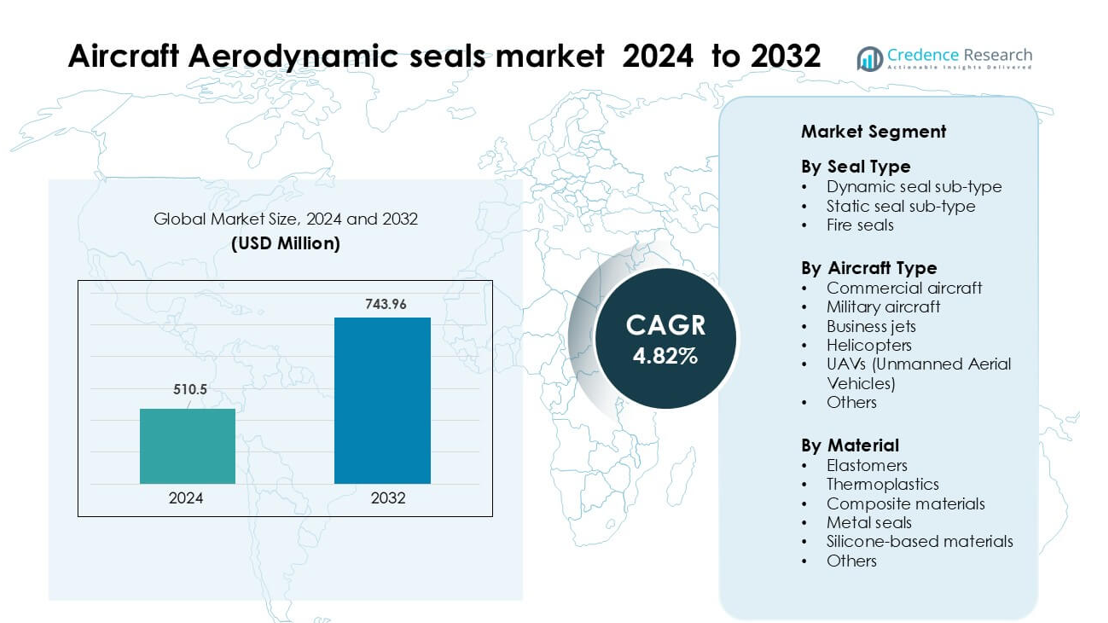

Aircraft Aerodynamic seals market was valued at USD 510.5 million in 2024 and is anticipated to reach USD 743.96 million by 2032, growing at a CAGR of 4.82 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aircraft Aerodynamic Seals Market Size 2024 |

USD 510.5 million |

| Aircraft Aerodynamic Seals Market, CAGR |

4.82% |

| Aircraft Aerodynamic Seals Market Size 2032 |

USD 743.96 million |

Top players in the aircraft aerodynamic seals market include Eaton Corporation plc, Freudenberg FST GmbH, Meggitt PLC, AB SKF, Parker Hannifin Corporation, Trelleborg AB, Precision Castparts Corp., Hutchinson SA, Transdigm Group, Inc., and Compagnie de Saint-Gobain S.A. These companies compete through material innovation, certification expertise, and long-term OEM supply partnerships. North America remained the leading region in 2024 with 37% share, driven by strong aircraft production, extensive MRO networks, and large-scale defense programs. The region’s mature aerospace ecosystem and high adoption of advanced sealing materials continue to reinforce its dominant position in both OEM and aftermarket demand.

Market Insights

- The aircraft aerodynamic seals market was valued at USD 5 million in 2024 and is projected to reach USD743.96 million by 2032, growing at a CAGR of 4.82 %.

- Market growth is driven by rising global aircraft production, expanding commercial fleets, and higher demand for advanced elastomer and composite-based seals used in engines, wings, and landing gear systems.

- Key trends include adoption of lightweight sealing materials, increased use of seals in UAVs, and rising investment in digital manufacturing for precision-engineered sealing components.

- Competition remains strong as Eaton Corporation plc, Freudenberg FST GmbH, Meggitt PLC, AB SKF, Parker Hannifin Corporation, Trelleborg AB, and others focus on certification capabilities and long-term OEM contracts while smaller suppliers face pressure from high compliance costs.

- North America led the market in 2024 with 37% share, while dynamic seals dominated by seal type with 46% share; elastomers remained the top material category with 58% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Seal Type

Dynamic seals led the aircraft aerodynamic seals market in 2024 with about 46% share. Aviation manufacturers preferred dynamic seals because they support constant movement in actuators, control surfaces, and landing gear systems. The segment grew as next-generation aircraft platforms adopted advanced hydraulic and electromechanical systems that require durable sealing. Rising MRO activity across commercial fleets also pushed demand for replacements. Fire seals held steady use in engines and nacelles, but dynamic seals remained dominant due to higher installation volumes and strong alignment with modern aircraft system designs.

- For instance, Trelleborg Sealing Solutions’ Turcon® VL Seal® used in fly-by-wire and electro-hydrostatic actuators is rated for a service life of over 100,000 flight hours in large aircraft.

By Aircraft Type

Commercial aircraft dominated the market in 2024 with roughly 52% share. The fleet expansion by major airlines and strong production rates for narrow-body models, such as the A320neo and 737 MAX families, increased seal consumption. Aerodynamic seals remained essential for cabin pressurization, wing structures, engines, and landing gear. Military aircraft showed steady demand from modernization programs, while UAVs gained interest from surveillance and logistics missions. Business jets and helicopters contributed smaller shares, but commercial aircraft stayed ahead due to large fleet sizes and constant replacement cycles.

- For instance, Airbus delivered 766 commercial aircraft in 2024, including many A320-family jets, reflecting its heavy single-aisle production.

By Material

Elastomers held the top position in 2024 with nearly 58% share. Aerospace companies widely used elastomeric seals because they offer strong flexibility, temperature resistance, and compatibility with hydraulic fluids. Growth in lightweight aircraft structures encouraged the use of advanced elastomer blends that maintain performance under pressure and vibration. Thermoplastics and composite materials grew in niche applications where weight reduction matters, while metal seals supported high-temperature zones near engines. Silicone-based materials expanded in cabin and environmental control systems, but elastomers remained dominant due to proven reliability and broad application coverage.

Key Growth Drivers

Rising Global Aircraft Production and Fleet Expansion

Demand for aircraft aerodynamic seals continues to rise as commercial and military aircraft production accelerates worldwide. Major OEMs increase output of narrow-body, wide-body, and regional aircraft to meet airline backlogs, which now span several years. Each aircraft requires hundreds of seals for wings, fuselage structures, engines, and landing gear, strengthening the need for durable aerodynamic sealing solutions. Fleet renewal initiatives by airlines further support this demand, as operators replace older models with fuel-efficient aircraft that rely on advanced sealing materials. Growth in global passenger traffic and expansion in low-cost carrier fleets amplify production cycles, directly boosting consumption of aerodynamic seals across manufacturing and maintenance channels.

- For instance, Airbus recorded a backlog of 8,658 aircraft at the end of 2024, underscoring the enormous production pressure on OEMs to deliver more jets.

Advancement in High-Performance Seal Materials

Material innovation plays a key role in market growth as aerospace manufacturers adopt advanced elastomers, thermoplastics, and composite-based seals for critical flight operations. These upgraded materials deliver better heat resistance, fatigue strength, and chemical compatibility, addressing the performance requirements of next-generation engines and lightweight airframes. Aircraft designers increasingly use aerodynamic seals to maintain structural efficiency, reduce drag, and improve fuel performance, further increasing their adoption. High-temperature-resistant seals gain priority in engine nacelles and high-pressure zones, while flexible elastomer blends support cabin pressurization systems. R&D investment in fluorocarbon, silicone, and hybrid materials continues to rise, enabling seals that last longer and reduce MRO costs for operators.

- For instance, Parker Hannifin developed a next-generation fluorosilicone compound LM100-70, which exhibits only 10% compression set after 336 hours at 302°F (about 150 °C), compared to ~53% for their traditional fluorosilicone.

Growing MRO Activity and Aftermarket Demand

Aftermarket demand acts as a strong driver because aircraft aerodynamic seals require routine inspection and periodic replacement due to wear in flight operations. Expanding commercial fleets, especially in Asia-Pacific and the Middle East, increase MRO workloads and boost procurement of seals for landing gear, actuators, control surfaces, and engines. Airlines rely on aerodynamic seals to maintain pressure integrity, reduce leakage, and ensure flight safety, reinforcing continuous replacement cycles. Rising air traffic accelerates utilization rates, making seal maintenance more frequent. The growth of MRO service networks, independent repair facilities, and OEM-authorized repair centers increases accessibility of high-quality seals and strengthens the aftermarket ecosystem.

Key Trends & Opportunities

Shift Toward Lightweight and Fuel-Efficient Sealing Solutions

A key trend shaping the market is the shift toward lightweight aerodynamic sealing materials that support fuel-efficient aircraft designs. As airlines push for lower operating costs and reduced emissions, OEMs integrate seals made from lightweight composites, fluorosilicone blends, and thermoplastic materials. These seals help reduce overall aircraft weight while maintaining strength and thermal stability. Demand for drag-reduction sealing technologies also grows, including seals that optimize airflow around control surfaces and fuselage joints. Manufacturers explore additive manufacturing and precision molding to deliver complex lightweight geometries, creating opportunities for new-generation sealing products tailored to electric, hybrid, and hydrogen-powered aircraft platforms.

- For instance, Trelleborg Sealing Solutions uses a true out-of-autoclave (OOA) process to manufacture continuous-fiber thermoplastic composite parts for rotor drive shafts, achieving weight reductions while maintaining high strength.

Rising Demand for Seals in UAVs and Advanced Military Platforms

UAV adoption increases sharply across surveillance, logistics, agriculture, and defense missions, creating new opportunities for aerodynamic seal suppliers. UAVs require high-precision lightweight seals for wings, propulsion systems, and environmental protection, supporting long endurance and stable flight control. Defense modernization programs further expand demand for seals that withstand extreme temperatures, vibration, and chemical exposure in fighter jets, rotorcraft, and unmanned combat systems. The integration of stealth technologies and advanced actuation systems requires high-tolerance sealing solutions. Suppliers who focus on high-performance materials and custom-engineered seals for UAVs and next-generation fighters benefit from long-term growth in aerospace defense investments.

- For instance, Trelleborg Sealing Solutions produces inflatable fabric-reinforced seals (used in military aircraft canopies) that are designed using finite-element analysis to withstand precise actuation under pressure loads; such technology could be adapted for light, flexible UAV airframes.

Digital Manufacturing and Predictive Maintenance Adoption

Digital technologies create strong opportunities as aerospace companies adopt predictive maintenance tools and smart manufacturing processes. Digital twins, sensor-embedded seals, and automated inspection systems help detect seal degradation earlier, reducing failure risks and MRO costs. Manufacturers integrate advanced molding, 3-D printing, and CNC sealing technologies to increase production precision and reduce lead times. Predictive analytics used by airlines enables optimized replacement cycles, improving operational reliability. These digital capabilities position the seal industry for higher productivity, enhanced material traceability, and improved lifecycle performance creating a competitive edge for suppliers investing in digital transformation.

Key Challenges

Stringent Certification Requirements and Long Qualification Cycles

The aircraft aerodynamic seals market faces challenges due to strict safety regulations and long approval timelines for new materials and designs. Every seal installed in aircraft structures must undergo extensive durability, fire resistance, chemical exposure, and vibration testing. These qualification processes are expensive and time-consuming, often taking several years before a new seal enters production. Small suppliers face higher financial pressure due to compliance costs, limiting innovation speed. OEMs also demand consistent documentation and traceability, increasing the operational burden on manufacturers. This lengthy certification environment slows market entry for new materials and affects product development cycles.

Volatile Raw Material Prices and Supply Chain Constraints

The market also struggles with fluctuations in raw material prices, especially related to elastomers, fluoropolymers, and specialty composites used in aerodynamic seals. Supply chain disruptions, geopolitical tensions, and limited availability of aerospace-grade materials increase procurement costs for manufacturers. Delays in the supply of rubber compounds, silicone, and engineered polymers impact production schedules for OEMs and MRO providers. Aerospace companies face additional pressure to maintain inventory buffers, raising operational costs. These supply uncertainties affect pricing stability, reduce profitability, and challenge smaller manufacturers that depend on consistent material flow to meet delivery commitments.

Regional Analysis

North America

North America held the largest share of the aircraft aerodynamic seals market in 2024 with about 37%. Strong demand came from high production rates of commercial aircraft, robust MRO activity, and continuous upgrades to military fleets. The United States remained the key contributor due to extensive aerospace manufacturing, large defense budgets, and steady procurement of next-generation aircraft. Growth in regional and business aviation also supported seal consumption across OEM and aftermarket channels. Rising adoption of advanced elastomers and fire-resistant seals further strengthened the region’s leadership. Canada added moderate demand through ongoing fleet maintenance programs.

Europe

Europe accounted for roughly 29% share of the aircraft aerodynamic seals market in 2024. The region benefited from strong aircraft production led by Airbus facilities in Germany, France, and the U.K. European OEMs continued to adopt lightweight sealing materials to meet fuel-efficiency and emission-reduction goals, boosting demand for advanced elastomeric and composite seals. Defense modernization projects in France and the U.K. supported consumption of high-temperature and vibration-resistant seals. The aftermarket remained stable due to a large operational fleet and strong MRO presence across Western Europe. Regional suppliers also expanded R&D in next-generation sealing technologies.

Asia Pacific

Asia Pacific held nearly 24% share of the aircraft aerodynamic seals market in 2024, driven by rapid fleet expansion and rising aircraft deliveries across China, India, and Southeast Asia. Growing air passenger volumes increased pressure on airlines to maintain larger fleets, supporting demand for both OEM and aftermarket seals. China’s rising presence in commercial aircraft manufacturing and military aviation programs boosted local procurement of advanced seal materials. India contributed growth through expanding MRO capabilities and defense aircraft upgrades. Increasing adoption of UAVs for commercial and security applications also improved regional sealing requirements.

Latin America

Latin America captured around 6% share of the aircraft aerodynamic seals market in 2024. The region experienced steady growth due to gradual fleet expansion among major carriers and rising MRO activities in Brazil and Mexico. Embraer’s presence supported localized production demand for seals used in regional and business aircraft. Economic recovery across several countries helped airline operators resume aircraft procurement and maintenance cycles. Seal demand also increased within helicopter and defense platforms used for surveillance and transport missions. However, slower adoption of advanced materials and limited manufacturing infrastructure kept the region’s overall market share modest.

Middle East & Africa

Middle East & Africa accounted for about 4% share of the aircraft aerodynamic seals market in 2024. The Middle East led regional demand due to strong investments in commercial fleets by Gulf airlines and expanding MRO hubs in the UAE and Saudi Arabia. High utilization of wide-body aircraft increased replacement rates for aerodynamic seals in engines, landing gear, and fuselage systems. Africa contributed incremental growth through rising use of turboprops and helicopters for transport, mining, and humanitarian operations. Limited aerospace manufacturing capability kept overall volumes low, but aftermarket demand remained consistent across key aviation hubs.

Market Segmentations:

By Seal Type

- Dynamic seal sub-type

- Static seal sub-type

- Fire seals

By Aircraft Type

- Commercial aircraft

- Military aircraft

- Business jets

- Helicopters

- UAVs (Unmanned Aerial Vehicles)

- Others

By Material

- Elastomers

- Thermoplastics

- Composite materials

- Metal seals

- Silicone-based materials

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the aircraft aerodynamic seals market features leading companies such as Eaton Corporation plc, Freudenberg FST GmbH, Meggitt PLC, AB SKF, Parker Hannifin Corporation, Trelleborg AB, Precision Castparts Corp., Hutchinson SA, Transdigm Group, Inc., and Compagnie de Saint-Gobain S.A. These manufacturers focus on advanced material development, precision engineering, and compliance with stringent aerospace standards to strengthen their positions. Many players expand capabilities through acquisitions, partnerships, and long-term supply agreements with major OEMs. Investment in lightweight elastomers, high-temperature composites, and fire-resistant sealing technologies remains central to product differentiation. Companies also enhance global MRO support networks, offering faster delivery and extended product life cycles. Digital manufacturing, automated molding, and advanced testing technologies improve production efficiency and help meet rising aircraft build rates. As competition intensifies, suppliers emphasize reliability, certification expertise, and custom-engineered sealing solutions to secure long-term contracts in both OEM and aftermarket channels.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2025, AB SKF signed an agreement to divest its precision elastomeric device aerospace operation in Elgin, USA. The decision supported the group’s strategy to optimize its aerospace sealing assets and redirect resources toward advanced aerodynamic sealing solutions.

- In April 2025, AB SKF completed the divestment of its ring and seal operation in Hanover, USA. The move helped the company streamline its sealing portfolio and sharpen its focus on higher-value aerospace sealing technologies used in aerodynamic applications

Report Coverage

The research report offers an in-depth analysis based on SealType, Aircraft Type, Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as global aircraft production increases across commercial and defense sectors.

- Demand for lightweight and high-temperature sealing materials will rise with next-generation aircraft designs.

- OEMs will adopt more advanced elastomers and composites to improve durability and reduce maintenance cycles.

- UAV expansion in defense, cargo, and surveillance missions will create new sealing opportunities.

- MRO demand will climb as airlines operate larger fleets with higher utilization rates.

- Digital manufacturing and automation will improve seal precision and shorten production lead times.

- Suppliers will invest more in fire-resistant and chemically stable sealing materials for engine applications.

- Regulatory pressure for safer and more fuel-efficient aircraft will elevate the need for high-performance seals.

- Long-term supply partnerships between OEMs and major sealing manufacturers will strengthen.

- Asia Pacific will emerge as a faster-growing region due to rising aircraft deliveries and expanding MRO infrastructure.