Market Overview:

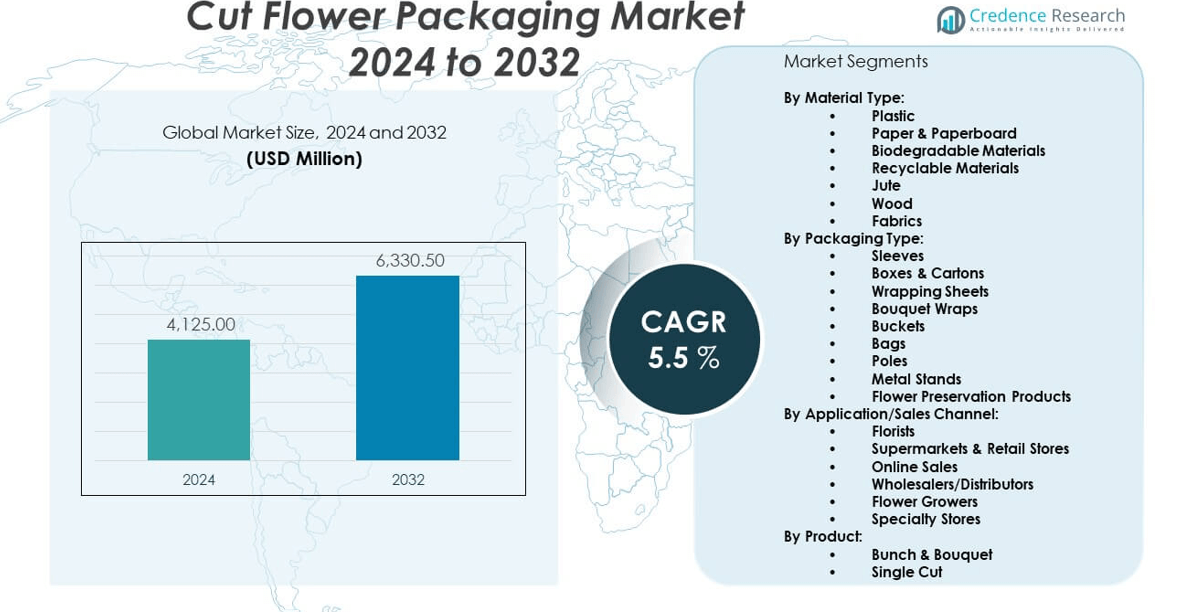

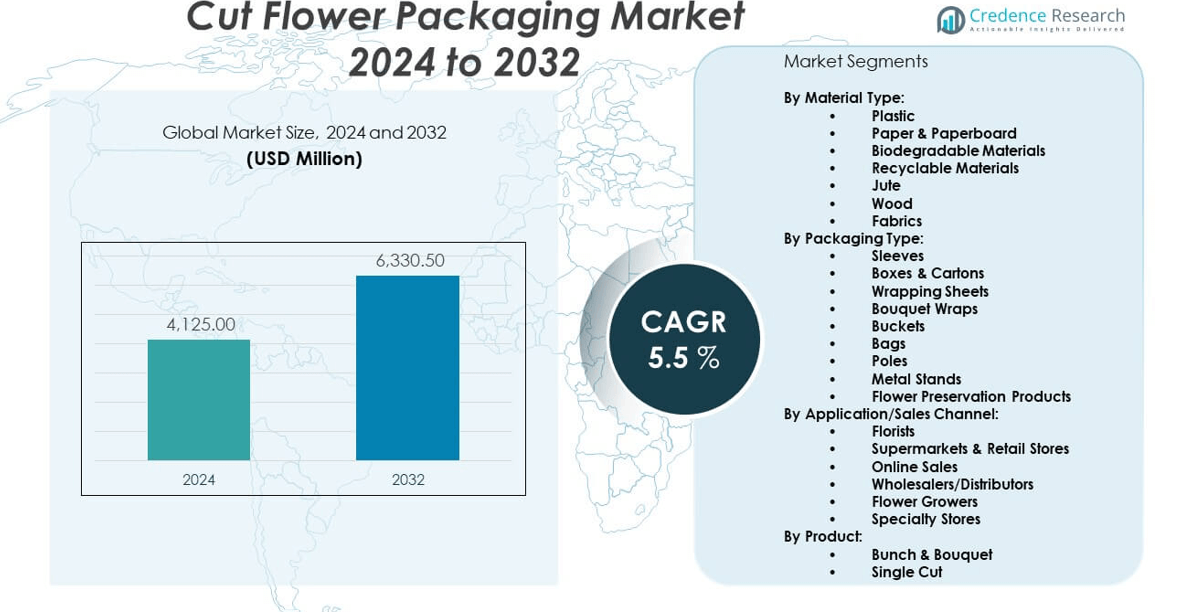

The cut flower packaging market is projected to grow from USD 4,125 million in 2024 to an estimated USD 6,330.5 million by 2032, with a compound annual growth rate (CAGR) of 5.5% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cut Flower Packaging Market Size 2024 |

USD 4,125 million |

| Cut Flower Packaging Market, CAGR |

5.5% |

| Cut Flower Packaging Market Size 2032 |

USD 6,330.5 million |

Growth in the cut flower packaging market is driven by increasing global demand for fresh flowers across events, gifting, retail, and hospitality sectors. Consumers expect flowers to retain freshness, fragrance, and visual appeal during transport and display. Packaging manufacturers respond by offering materials with enhanced moisture retention, breathability, and durability. The shift toward biodegradable and recyclable packaging formats also supports market expansion. Brands seek custom designs and printing to improve product visibility and customer engagement, while e-commerce channels require stronger, temperature-resistant options to preserve flower quality.

Regionally, North America and Europe dominate the market due to established floral supply chains, high gifting culture, and strong retail presence. The Netherlands remains a global floral hub, while the U.S. and Germany show consistent demand. Emerging markets such as China, India, and Brazil display rapid growth driven by rising disposable income, urbanization, and the expansion of organized retail and online flower delivery platforms. These markets invest in efficient packaging to meet quality standards and sustainability expectations.

Market Insights:

- The cut flower packaging market is projected to grow from USD 4,125 million in 2024 to USD 6,330.5 million by 2032, at a CAGR of 5.5%.

- Rising demand for fresh flowers in retail, events, and e-commerce drives the need for protective and visually appealing packaging.

- Packaging solutions focus on extending shelf life, retaining moisture, and enhancing the aesthetic value of floral arrangements.

- Sustainable materials such as biodegradable films and recycled paper gain traction due to environmental concerns.

- High packaging costs and limited durability under varying climatic conditions challenge market growth.

- North America and Europe lead the market due to mature floral industries and high consumer spending on decorative flowers.

- Asia-Pacific and Latin America show rapid growth supported by rising income levels and expansion of online flower delivery services.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Floral Consumption in Events and Retail Fuels Packaging Demand:

The cut flower packaging market gains momentum through increased flower consumption in weddings, corporate events, and holiday gifting. Florists and retailers prioritize packaging solutions that enhance freshness, reduce bruising, and maintain visual appeal. Consumers associate premium packaging with quality, prompting brands to invest in presentation and protection. It meets rising demand from luxury hotels, spas, and wellness centers that frequently purchase floral decor. Floriculture exports to high-income countries also expand packaging requirements to meet international transit standards. Customization in wrapping, sleeve materials, and branding strengthens buyer engagement. Seasonal peaks such as Valentine’s Day and Mother’s Day amplify volumes, requiring scalable packaging operations. The market aligns with these expanding uses by delivering performance and aesthetic flexibility.

- For example, Research from Epsilon indicates that 80% of consumers are more likely to make a purchase when brands offer personalized experiences.

Rapid Growth in Online Flower Delivery Services Stimulates Packaging Innovation:

The shift to online floral purchases creates demand for packaging that ensures freshness and structural integrity during transport. The cut flower packaging market benefits from the rise of e-commerce platforms offering home delivery of bouquets. It supports protective packaging materials that resist moisture loss, temperature fluctuations, and rough handling. Retailers require tamper-evident and branded packaging to enhance unboxing experience and customer trust. Same-day delivery and quick-ship models challenge suppliers to provide easy-to-assemble, lightweight formats. Packaging innovations aim to reduce transit damage while preserving arrangement shape and stem alignment. The sector capitalizes on urban demand for personalized and convenient floral gifts. It enables service providers to offer high-quality, fresh flowers regardless of distance.

- For instance, Uflex Ltd. introduced its patented Flexfresh™ packaging, which extends flower shelf life up to 15 days without water, enabling e-commerce florists to reduce return rates by 25% and expand delivery radius by 40%.

Demand for Freshness and Extended Shelf Life Enhances Packaging Performance:

Preservation of cut flower freshness remains a top driver for packaging development. The cut flower packaging market evolves to meet strict quality expectations from both retail and consumer segments. It prioritizes materials that maintain humidity, control ethylene exposure, and minimize bacterial growth. Packaging design influences respiration rate and petal dehydration, directly impacting shelf life. Vacuum pouches, hydration wraps, and micro-perforated films play a growing role. Retailers prefer packaging that reduces wilting and ensures longer display cycles. It helps supermarkets and florists minimize waste and enhance profit margins. The need for extended freshness drives R&D in breathable, flexible, and barrier-efficient solutions.

Brand Visibility and Product Differentiation Encourage Custom Packaging Solutions:

Visual appeal drives sales in a saturated floral market, pushing brands to invest in packaging that reflects their identity. The cut flower packaging market responds with custom printing, transparent sleeves, and premium decorative wraps. It enables product differentiation in physical stores and digital catalogs. Retailers use packaging to communicate sustainability, care instructions, and promotional messages. Premium packaging formats elevate perceived value and align with gifting expectations. The integration of barcodes, QR codes, and digital labels also adds functionality. Designers collaborate with florists to create seasonally themed and occasion-specific sleeves. Branding through packaging helps companies capture repeat buyers and build loyalty.

Market Trends:

Sustainability Push Drives Demand for Compostable and Recycled Materials:

Manufacturers respond to environmental regulations and consumer preferences by developing eco-friendly packaging formats. The cut flower packaging market embraces biodegradable films, recycled paper sleeves, and compostable plastic alternatives. It supports circular economy goals without compromising performance. Brands label packaging with environmental claims to attract eco-conscious customers. Sustainable designs reduce landfill waste and improve the brand’s ethical positioning. Retailers seek suppliers that align with zero-waste policies. The trend influences material sourcing, design, and disposal strategies across the floral supply chain. Packaging becomes a critical factor in sustainability-focused purchasing decisions.

- For instance, Faerch’s CPET trays for chilled floral products now contain 40% post-consumer recycled PET, reducing carbon emissions by 57% compared to virgin PET and meeting EU sustainability certification standards.

Minimalist Aesthetic Preferences Influence Structural and Visual Design:

Consumers prefer clean, simple, and elegant packaging that highlights the natural beauty of flowers. The cut flower packaging market aligns with this trend by offering transparent sleeves, neutral color palettes, and uncoated materials. It promotes packaging that frames rather than conceals the bouquet. Designers eliminate unnecessary embellishments and opt for sleek lines. Minimalist packaging improves perceived freshness and aligns with modern retail displays. The trend appeals to millennial and Gen Z buyers who value authenticity and understated luxury. It simplifies logistics and reduces packaging waste while maintaining market appeal. Retailers adopt this style to match broader visual merchandising strategies.

- For instance, Logistics data confirms lower volumetric footprint in shipping, streamlining both supply chain efficiency and retail shelf presentation without sacrificing protective qualities.

Technological Integration Enhances Smart Packaging Capabilities:

The integration of smart features is gaining interest among packaging manufacturers. The cut flower packaging market incorporates QR codes, NFC tags, and freshness indicators to engage customers and ensure quality tracking. It enables buyers to scan codes for care tips, product origins, or delivery verification. Real-time temperature monitoring helps detect spoilage risks in transit. Smart labeling supports supply chain transparency and reduces product loss. Companies explore interactive packaging to build brand engagement. It allows customization and personalized messaging for events and gifting. This trend opens new value-added opportunities in digital-enabled floral marketing.

Rising Popularity of Subscription-Based Flower Services Increases Bulk Packaging Needs:

Subscription services offering weekly or monthly floral deliveries influence packaging volumes and consistency. The cut flower packaging market adjusts to recurring orders requiring cost-efficient, durable, and easy-to-process formats. It emphasizes stackable designs, reduced weight, and reusability. Packaging must perform across diverse climate zones and delivery timelines. The rise of flower clubs and curated boxes expands packaging frequency and material use. Suppliers cater to subscription businesses with scalable and pre-branded options. Uniformity in packaging design enhances brand identity and recognition. It transforms the supply chain from single-purchase models to repeat-order logistics.

Market Challenges Analysis:

Packaging Durability Under Variable Conditions Presents Performance Limitations:

Maintaining cut flower quality throughout the supply chain remains a significant challenge. The cut flower packaging market must address exposure to fluctuating temperatures, humidity, and pressure during handling and transit. Packaging failure can lead to petal damage, moisture loss, and reduced shelf appeal. Lightweight or thin materials often lack the structural integrity to protect delicate stems during bulk shipping. Logistics inconsistencies add pressure to ensure durability across short and long-haul deliveries. The challenge grows in developing regions with weak cold-chain systems. Manufacturers must balance protection with flexibility, cost, and sustainability. This complexity demands constant innovation and testing.

High Cost of Sustainable Materials and Limited Infrastructure Affect Adoption:

The transition to eco-friendly packaging faces resistance due to pricing and infrastructure gaps. The cut flower packaging market experiences cost pressure from biodegradable films, compostable plastics, and recycled paper that are often more expensive than conventional options. Small florists and suppliers may avoid sustainable materials due to affordability issues. Lack of composting facilities or recycling systems in many regions reduces the practical impact of green packaging. Market participants must educate buyers and invest in awareness to justify premium prices. The challenge includes aligning end-of-life disposal with consumer behavior and waste processing systems.

Market Opportunities:

Expansion of Emerging Markets Creates New Demand for Value-Based Packaging:

Rising urbanization and disposable income in countries like India, Brazil, and Indonesia increase flower consumption. The cut flower packaging market can tap into this growth by offering low-cost, scalable solutions tailored to budget-sensitive buyers. It supports regional packaging units that reduce lead times and logistics cost. Local demand drives investments in simplified formats that retain freshness while meeting price points. Opportunities lie in mass retail, festivals, and mid-tier floriculture.

Innovative Designs for Gifting and E-Commerce Personalization Expand Market Reach:

Consumer preference for personalized, visually rich packaging opens new design possibilities. The cut flower packaging market benefits from the rise of gifting-focused floral purchases. It enables value-added formats like window sleeves, message inserts, and decorative closures. Brands offering unique packaging experiences can differentiate and grow in competitive urban markets. Packaging innovation enhances both functionality and emotional impact.

Market Segmentation Analysis:

By Material Type: Balancing Functionality and Sustainability

The cut flower packaging market includes a variety of materials designed for protection, presentation, and environmental impact. Plastic continues to lead in usage due to its durability and moisture resistance. Paper & paperboard gain popularity among brands focusing on recyclability and cost-effective retail display. Biodegradable and recyclable materials see strong demand growth, supported by regulations and sustainability goals. Jute and fabrics appeal to premium and eco-conscious segments, especially in artisanal and local markets. Wood packaging is used for upscale presentation and structural support in bulk transport. Material selection reflects both functional needs and brand identity.

- For instance, Amcor reduced the weight of its hot-fill beverage bottles by 35–50% using advanced simulation design, a technology now being adapted for lightweight floral packaging with similar material savings.

By Packaging Type: Functional Diversity Across Retail and Logistics

Packaging types in the cut flower packaging market vary by use case and distribution format. Sleeves and bouquet wraps are preferred for point-of-sale and gift-ready arrangements. Boxes & cartons are vital for wholesale and international shipping. Wrapping sheets offer flexibility for custom arrangements, while bags provide portable retail options. Buckets, poles, metal stands, and preservation products cater to bulk storage and florist use. These formats meet the demands of freshness, convenience, and handling efficiency.

By Application/Sales Channel: Serving Diverse Points of Sale

The market serves florists, supermarkets, and online retailers with targeted packaging solutions. Florists require flexible, attractive wraps and storage tools, while supermarkets depend on durable, pre-formed packaging for high-turnover sales. Online platforms prioritize protective, lightweight, and branded formats for home delivery. Wholesalers and distributors focus on bulk handling, while flower growers need practical packaging for harvest-to-shelf logistics. Specialty stores often use customized and decorative packaging for added value.

By Product and Packaging Style: Aligning with Consumer Preferences

Product types such as bunch & bouquet and single cut dictate packaging form and structure. Bunches typically require sleeves or wraps, while single cuts often use tubes or rigid holders. Packaging styles range from plain and economical for daily retail to printed, luxury, and premium options for gifting occasions. This segmentation supports tiered pricing, branding, and seasonal positioning across different sales channels. The cut flower packaging market adapts design and material selection to match buyer intent and floral category.

Segmentation:

By Material Type:

- Plastic

- Paper & Paperboard

- Biodegradable Materials

- Recyclable Materials

- Jute

- Wood

- Fabrics

By Packaging Type:

- Sleeves

- Boxes & Cartons

- Wrapping Sheets

- Bouquet Wraps

- Buckets

- Bags

- Poles

- Metal Stands

- Flower Preservation Products

By Application/Sales Channel:

- Florists

- Supermarkets & Retail Stores

- Online Sales

- Wholesalers/Distributors

- Flower Growers

- Specialty Stores

By Product:

- Bunch & Bouquet

- Single Cut

By Packaging Style:

- Plain/Simple

- Printed/Designed

- Luxury/Premium

- Economical

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Leads Due to High Floral Consumption and E-Commerce Expansion

North America accounts for approximately 35% of the global cut flower packaging market. The United States drives the region’s leadership through strong demand in retail chains, supermarkets, and online flower delivery platforms. It supports a mature floral supply chain that prioritizes freshness and presentation. Packaging formats emphasize sustainability, product protection, and branding for gifting occasions. Canada contributes through seasonal floral trends and high per-capita floral spending. The region adopts eco-friendly materials and value-added packaging features such as labeling and messaging inserts. The cut flower packaging market in North America benefits from high consumer expectations and strong retail infrastructure.

Europe Maintains Strong Presence Backed by Production and Export Capacity

Europe holds around 30% of the global cut flower packaging market. The Netherlands serves as a key hub for flower cultivation, trade, and distribution across the continent. It influences packaging standards and technological innovations, especially for long-distance logistics. Countries like Germany, France, and the UK exhibit consistent retail and e-commerce-driven demand. The European market favors sustainable packaging options aligned with environmental policies and customer values. Seasonal and cultural events generate regular peaks in demand for decorative and functional packaging. It supports broad adoption of recyclable, compostable, and printed wrapping formats tailored to each segment.

Asia Pacific Emerges Rapidly with Growing Urban Demand and Retail Modernization

Asia Pacific represents approximately 25% of the global cut flower packaging market. China, Japan, and India lead with expanding consumption of decorative flowers in urban households, weddings, and festivals. Evolving lifestyles and rising disposable incomes increase demand for pre-packaged flowers in supermarkets and online channels. Regional packaging companies respond with cost-effective and aesthetically appealing formats. The shift toward organized retail and gifting culture accelerates the need for durable and fresh-preserving materials. It positions Asia Pacific as a high-growth market with strong localization potential. The region continues to attract investment in logistics and material innovation to support rising floral trade.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Smurfit Kappa Group

- DS Smith Plc

- Uflex Ltd.

- Koenpack BV

- Decowraps

- Broekhof Verpakkingen BV

- A-ROO Co. LLC

- Sirane Limited

- Flamingo Holland Inc.

Competitive Analysis:

The cut flower packaging market is highly competitive, driven by innovation in materials, design, and sustainability. Leading companies such as Smurfit Kappa, DS Smith, Uflex Ltd., Koenpack BV, and Decowraps compete through advanced packaging formats that preserve freshness and visual appeal. It prioritizes quick turnaround, customization, and cost-efficiency across retail and e-commerce supply chains. Companies focus on lightweight, eco-friendly solutions and invest in regional production facilities to shorten lead times. Strong branding, distribution networks, and responsiveness to seasonal trends provide competitive advantages. Strategic partnerships with florists, retailers, and exporters strengthen customer relationships and market presence.

Recent Developments:

- In July 2025, Uflex Ltd. highlighted its dedication to sustainable packaging for flowers at Aahar 2025, showcasing its latest flexible packaging materials engineered for extended freshness and improved compostability of cut flower products.

- In 2025, DS Smith Plc actively participated in Packaging Innovations 2025 in Birmingham, focusing on advanced and sustainable packaging solutions for the floral sector, signaling a continued push toward design-led, eco-friendly options.

Market Concentration & Characteristics:

The cut flower packaging market displays moderate concentration with a mix of multinational players and specialized regional suppliers. It favors companies offering sustainable materials, flexible order fulfillment, and innovative printing. Seasonal demand peaks and fast-moving supply chains require high responsiveness and efficient logistics. It supports a diverse customer base across florists, supermarkets, and online retailers. Design agility, material performance, and eco-certifications are key market differentiators.

Report Coverage:

The research report offers an in-depth analysis based on Material Type and Packaging Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Sustainable materials such as biodegradable films and recycled papers will gain wider acceptance across retail and export channels.

- Online flower delivery will continue to expand, prompting demand for lightweight and impact-resistant packaging formats.

- Custom-printed and aesthetically designed wraps will become standard for premium and gifting flower segments.

- Asia Pacific will witness accelerated growth driven by urbanization, rising disposable income, and retail modernization.

- Smart packaging features like freshness indicators and QR codes will emerge as tools to enhance customer engagement.

- Technological advancements will improve moisture control, breathability, and flower shelf-life in transit.

- Subscription-based floral services will drive bulk packaging innovations and repeat-order logistics models.

- Supermarkets and hypermarkets will adopt value-added packaging to differentiate seasonal floral assortments.

- Demand for reusable buckets and eco-friendly accessories will increase among wholesalers and florists.

- Brands will invest in regional packaging hubs to reduce delivery time and enhance customization flexibility.