Market Overview

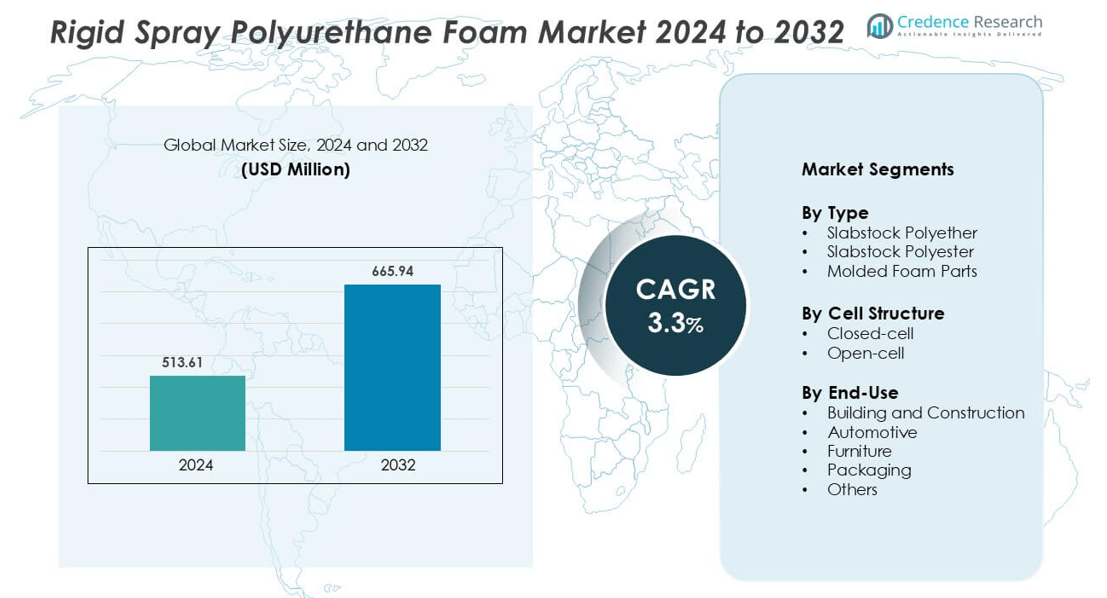

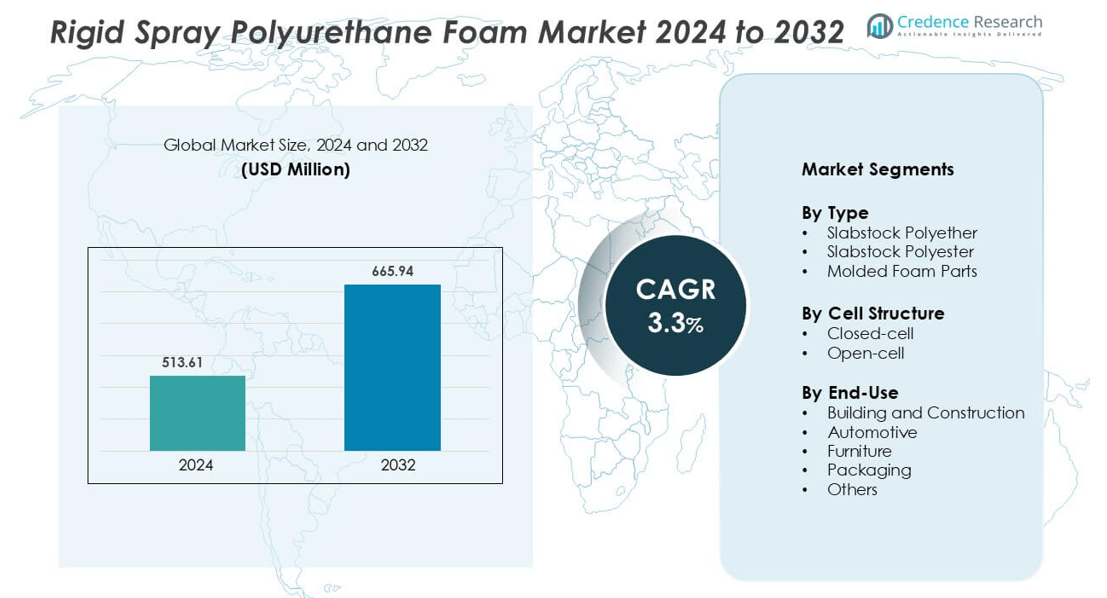

Rigid Spray Polyurethane Foam market was valued at USD 513.61 million in 2024 and is anticipated to reach USD 665.94 million by 2032, growing at a CAGR of 3.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rigid Spray Polyurethane Foam Market Size 2024 |

USD 513.61 million |

| Rigid Spray Polyurethane Foam Market, CAGR |

3.3% |

| Rigid Spray Polyurethane Foam Market Size 2032 |

USD 665.94 million |

The rigid spray polyurethane foam market features strong competition among key players such as Covestro AG, BASF SE, Dow Inc., Huntsman International LLC, SEKISUI CHEMICAL CO., LTD., Rogers Corporation, General Plastics Manufacturing Company, Performix by Plasti Dip International, Amino, and Krupashree Peb Private Limited. These companies focus on advanced formulations, sustainable raw materials, and enhanced application efficiency to strengthen their market presence. North America leads the global market with a 34% share, supported by strict building energy codes, large-scale infrastructure projects, and early adoption of eco-friendly insulation materials. Continuous innovation and expansion in construction and industrial insulation drive the region’s dominance.

Market Insights

- The Rigid Spray Polyurethane Foam Market was valued at USD 513.61 million in 2024 and is projected to reach USD 665.94 million by 2032, growing at a CAGR of 3.3% during the forecast period.

- Rising demand for energy-efficient insulation materials in residential and commercial construction drives market expansion, supported by stricter energy regulations and green building initiatives.

- Increasing adoption of closed-cell foams for roofing, wall insulation, and cold storage highlights a growing trend toward high-performance, moisture-resistant materials.

- Key players such as BASF SE, Covestro AG, and Huntsman International LLC compete through innovations in low-GWP formulations, bio-based polyols, and advanced spraying systems to enhance market positioning.

- North America holds a 34% regional share, driven by strong construction activity, while the building and construction segment leads with 42% share, supported by sustainable infrastructure projects and modern insulation standards.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The slabstock polyether segment dominates the rigid spray polyurethane foam market, holding the largest market share due to its superior mechanical strength and moisture resistance. Its widespread use in insulation panels, roofing, and wall systems enhances thermal efficiency in commercial and residential structures. Slabstock polyester follows, favored for applications requiring higher dimensional stability and chemical resistance, while molded foam parts cater to custom insulation and structural components. Growing demand for energy-efficient materials in infrastructure and industrial insulation continues to drive the adoption of polyether-based rigid foam solutions globally.

- For instance, BASF SE’s WALLTITE® US closed‑cell spray foam demonstrates a compressive strength of 26 psi (≈ 179 kPa) and a water absorption by volume of 60%, thereby evidencing strong moisture resistance.

By Cell Structure

Closed-cell foam holds the dominant share in the market, driven by its high compressive strength and low water vapor permeability. Its dense structure offers excellent insulation and moisture barrier properties, making it ideal for roofing, wall cavities, and refrigeration units. Open-cell foam, while lighter and more flexible, finds use in soundproofing and low-cost residential insulation. The expanding construction of energy-efficient buildings and stringent insulation standards support the demand for closed-cell foam in both residential and commercial projects.

- For instance, Carlisle Companies’s SealTite PRO Closed‑Cell product reports a compressive strength of 47 psi and a water‑vapour permeance of 0.23 perm at 3.5″ thickness. Its dense structure offers excellent insulation and moisture barrier properties, making it ideal for roofing, wall cavities, and refrigeration units.

By End-Use

The building and construction sector leads the rigid spray polyurethane foam market, accounting for the largest share due to rising insulation requirements in energy-efficient buildings. Rigid foams are extensively used in walls, roofs, and flooring for thermal regulation and moisture control. The automotive sector also shows steady growth, utilizing lightweight foams for noise reduction and temperature insulation. Furniture and packaging industries use rigid foams for cushioning and structural reinforcement. The surge in green building certifications and infrastructure modernization fuels consistent demand from the construction segment.

Key Growth Drivers

Rising Demand for Energy-Efficient Insulation Materials

The growing emphasis on energy conservation across commercial and residential sectors is a key driver for rigid spray polyurethane foam (SPF). Its superior thermal resistance and air-sealing capabilities help reduce heating and cooling losses, improving overall building efficiency. Governments worldwide are enforcing stricter building codes that promote high-performance insulation materials. This has increased the adoption of SPF in roofing, wall insulation, and cold storage applications. The material’s low thermal conductivity, combined with its ability to minimize energy consumption, makes it a preferred solution for green and sustainable construction initiatives.

- For instance, Sika’s Sikatherm Foam‑745 SPF closed‑cell system reports a core density of 38 – 45 kg/m³ and a compressive strength of ~250 kPa when tested per ASTM D1621.

Expanding Construction and Infrastructure Development

Rapid urbanization and infrastructure expansion are significantly boosting demand for rigid spray polyurethane foam. The product’s versatility in providing structural reinforcement, moisture control, and long-term durability has led to its use in both new construction and retrofitting projects. Emerging economies are witnessing increased adoption due to large-scale housing and commercial development. In addition, its lightweight composition allows easy application in high-rise buildings and prefabricated structures. This trend aligns with the global shift toward modern building materials that support durability and energy efficiency.

- For instance, BASF SE’s WALLTITE® v.5 medium‑density system exhibits a core density of 32.5 kg/m³ and a compressive strength of 203 kPa when tested per ASTM D1621.

Growing Adoption in Cold Chain and Industrial Applications

The rising need for temperature-controlled logistics in food, pharmaceuticals, and chemicals is driving SPF demand in the cold chain industry. Rigid SPF provides exceptional insulation for storage tanks, refrigerated transport, and industrial piping. Its closed-cell structure prevents thermal bridging, ensuring consistent temperature control. Industrial facilities also favor SPF for corrosion resistance and energy savings in manufacturing environments. The growth of e-commerce and global vaccine distribution has further accelerated cold storage expansion, positioning SPF as a critical material in industrial and temperature-sensitive applications.

- For instance, the 10‑016 System by NCFI Polyurethanes offers a core density of 2.8 lb/ft³ (~45 kg/m³) and a compressive strength of 58 psi (~400 kPa) for spray‑applied rigid foam roofing or cold‑storage insulation systems.

Key Trends and Opportunities

Integration of Eco-Friendly and Low-GWP Formulations

Sustainability trends are reshaping the rigid spray polyurethane foam market as manufacturers shift toward low-global-warming-potential (GWP) blowing agents. Formulations using hydrofluoroolefins (HFOs) and water-blown technologies are gaining traction to comply with environmental regulations. This transition supports corporate sustainability goals and appeals to green building certification programs such as LEED and BREEAM. Companies are also investing in bio-based polyols derived from soy and castor oil to reduce dependence on petrochemical sources. These innovations create opportunities for environmentally compliant and energy-efficient foam systems in global markets.

- For instance, HFO-1233zd(E) has an ultra-low Global Warming Potential (GWP) of 1 (comparable to CO2), making it an environmentally friendly alternative to high-GWP agents.

Advancements in Smart Application Technologies

Automation and precision spraying systems are transforming SPF application in construction and manufacturing. Advanced spray guns and real-time monitoring tools ensure uniform foam density and minimize waste. Digital integration allows contractors to track curing performance and environmental conditions for quality control. The rise of robotic spray systems in large-scale infrastructure projects further improves consistency and safety. These technological advancements enhance productivity and position SPF as a preferred material for large-scale, efficient insulation applications.

Key Challenges

Environmental and Regulatory Compliance Issues

The rigid spray polyurethane foam market faces challenges from evolving environmental regulations on isocyanates and hydrofluorocarbons (HFCs). Many traditional blowing agents contribute to ozone depletion and high global warming potential. Manufacturers are under pressure to reformulate products that meet environmental safety standards without compromising performance. Compliance with REACH, EPA, and Montreal Protocol amendments increases production costs and time-to-market. Balancing regulatory requirements with innovation remains a major obstacle for industry players seeking long-term competitiveness.

Fluctuating Raw Material Costs and Supply Constraints

Volatility in the prices of key raw materials such as methylene diphenyl diisocyanate (MDI) and polyols poses a significant challenge to SPF producers. Supply chain disruptions, particularly for petrochemical derivatives, directly impact manufacturing stability and profit margins. Additionally, dependence on a few global suppliers increases vulnerability to market fluctuations. These cost variations often translate into higher end-product prices, affecting competitiveness in price-sensitive markets. Ensuring raw material security through backward integration and diversified sourcing strategies is essential for maintaining consistent production.

Regional Analysis

North America

North America dominates the rigid spray polyurethane foam market with a market share of 34%, driven by high adoption in residential and commercial insulation applications. The United States leads regional demand due to strong enforcement of energy-efficiency standards such as IECC and ASHRAE. Growing retrofitting projects and green building initiatives further support market expansion. Manufacturers are investing in low-GWP foam formulations to meet EPA regulations and sustainability targets. The increasing use of SPF in industrial cold storage and roofing insulation continues to reinforce North America’s leadership in the global market.

Europe

Europe accounts for 28% of the global market, supported by stringent environmental regulations and strong construction activity. The region’s focus on carbon neutrality and energy-efficient buildings under the EU Green Deal drives demand for advanced insulation materials. Countries such as Germany, France, and the UK are leading adopters of rigid SPF in commercial and residential projects. Investments in renovation and retrofitting under government energy directives are fueling steady growth. The preference for low-emission and recyclable foam systems aligns with Europe’s circular economy goals, strengthening its position in sustainable insulation solutions.

Asia Pacific

Asia Pacific holds a 25% market share and is the fastest-growing region for rigid spray polyurethane foam. Expanding urban infrastructure in China, India, and Southeast Asia is fueling demand for cost-effective and durable insulation materials. The rapid growth of the construction and automotive sectors enhances foam consumption across multiple applications. Government initiatives promoting energy-efficient housing and industrial expansion are supporting market penetration. Increasing foreign investments and smart city projects further contribute to regional growth, positioning Asia Pacific as a key manufacturing and consumption hub for rigid SPF products.

Latin America

promoting affordable housing and infrastructure upgrades are encouraging the use of energy-efficient materials. The region also benefits from growing adoption in refrigeration, packaging, and automotive applications. Manufacturers are expanding production capacities to meet regional demand while introducing cost-effective, eco-friendly foam variants. The market continues to evolve with increasing awareness of building insulation standards and gradual adoption of sustainable construction technologies across key economies.

Middle East & Africa

The Middle East & Africa region accounts for 6% of the global market, primarily driven by large-scale construction and industrial projects. The growing focus on energy conservation in hot climates is increasing the demand for high-performance insulation materials. Countries such as Saudi Arabia, the UAE, and South Africa are adopting rigid SPF for roofing and wall insulation in commercial and residential projects. Expanding infrastructure in renewable energy and industrial sectors also contributes to market growth. Ongoing urban development initiatives and the rise of smart city projects further strengthen the regional market outlook.

Market Segmentations:

By Type

- Slabstock Polyether

- Slabstock Polyester

- Molded Foam Parts

By Cell Structure

By End-Use

- Building and Construction

- Automotive

- Furniture

- Packaging

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the rigid spray polyurethane foam market is characterized by the presence of leading global and regional manufacturers focusing on innovation, sustainability, and performance enhancement. Key players such as Covestro AG, BASF SE, Dow Inc., Huntsman International LLC, and SEKISUI CHEMICAL CO., LTD. are investing heavily in developing low-GWP formulations and bio-based polyols to meet tightening environmental regulations. Companies are expanding production capacities and strategic partnerships to strengthen their global supply chains and serve growing demand in the construction and industrial sectors. U.S.-based firms like Rogers Corporation and General Plastics Manufacturing Company emphasize high-performance insulation materials for aerospace and automotive applications, while emerging players such as Krupashree Peb Private Limited and Amino are gaining traction in regional markets. Product differentiation through improved thermal stability, faster curing times, and advanced spraying technologies continues to define competition, positioning sustainability and innovation as core growth strategies across the industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Covestro AG (Germany)

- Rogers Corporation (U.S.)

- Krupashree Peb Private Limited (India)

- Huntsman International LLC (U.S.)

- Amino (Brazil)

- Dow (U.S.)

- BASF (Germany)

- General Plastics Manufacturing Company (U.S.)

- Performix by Plasti Dip International (U.S.)

- SEKISUI CHEMICAL CO., LTD. (Japan)

Recent Developments

- In May 2025, Huntsman International LLC launched an intumescent polyurethane coating system, which is developed for automotive applications, which are useful in passive fire protection of metal and composite substrates used in electric vehicles.

- In April 2024, Huntsman International LLC launched a new product named SHOKLESS, a durable polyurethane foam, designed to protect electric vehicle batteries. The new product offers a flexible choice for safeguarding the structural integrity of EV batteries in case of impact or a thermal event.

- In October 2022, BASF launched new sustainable products in their rigid polyurethane (PU) foam segment, namely, Elastopor, Elastopir, and spray foam Elastospray, which contain recycled PET. These products are ideal for the production of facade and roof elements of buildings used for industrial purposes

Report Coverage

The research report offers an in-depth analysis based on Type, Cell structure, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing adoption of energy-efficient materials will continue to drive market expansion globally.

- Increased demand for sustainable and low-emission foam formulations will shape product innovation.

- Advancements in spray equipment and digital monitoring will enhance application precision and performance.

- Rising infrastructure investments in developing economies will boost large-scale insulation projects.

- Expansion of cold chain logistics and industrial refrigeration will increase the use of rigid foams.

- Integration of bio-based polyols will reduce dependence on petrochemical feedstocks.

- Stringent environmental regulations will accelerate the shift toward low-GWP blowing agents.

- Growing renovation and retrofitting projects will sustain demand in mature markets.

- Collaboration between chemical manufacturers and construction firms will strengthen product development.

- Increasing urbanization and smart city initiatives will further support long-term market growth.