Market Overview

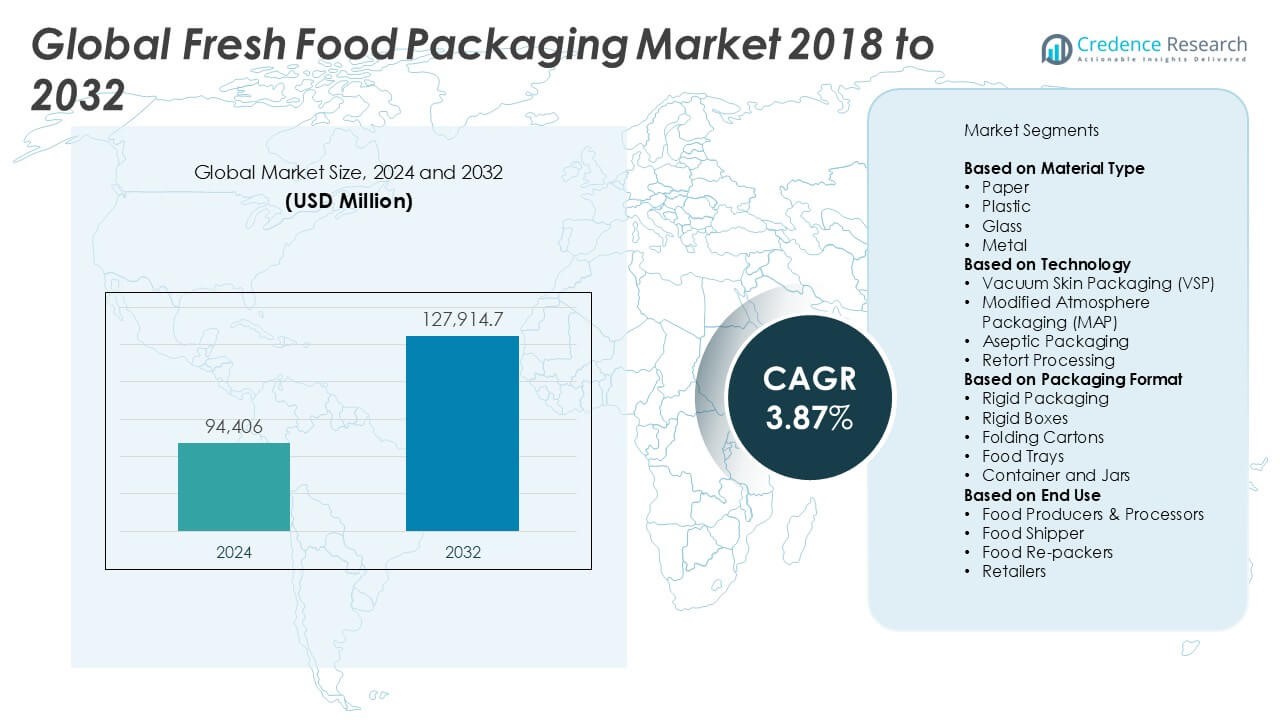

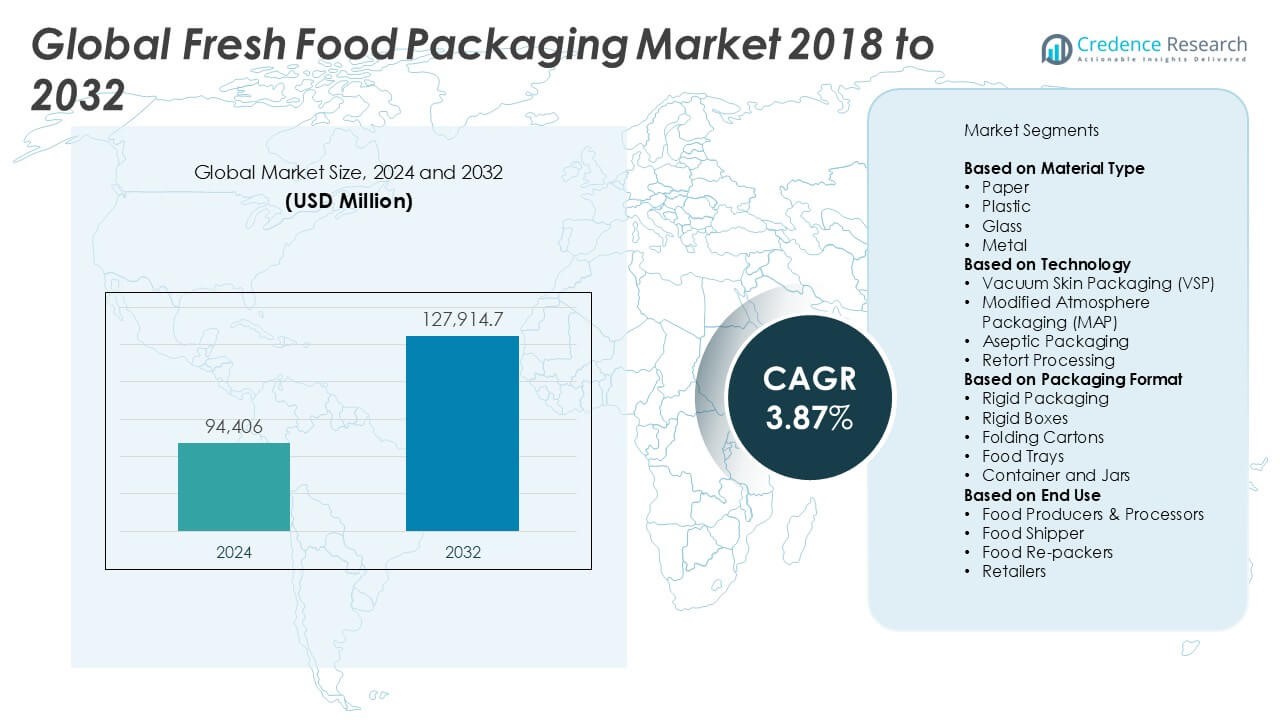

The Fresh Food Packaging market size was valued at USD 94,406 million in 2024 and is anticipated to reach USD 127,914.7 million by 2032, growing at a CAGR of 3.87% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fresh Food Packaging Market Size 2024 |

USD 94,406 Million |

| Fresh Food Packaging Market, CAGR |

3.87% |

| Fresh Food Packaging Market Size 2032 |

USD 127,914.7 Million |

The fresh food packaging market is led by key players such as Amcor, Sealed Air Corporation, Tetra Pak, Ball Corporation, Mondi, Crown Holdings, Inc., Smurfit Kappa, and ECO GEM BIO-TECH PVT LTD., all of which focus on sustainable packaging innovations and advanced preservation technologies. These companies drive market growth through continuous R&D, strategic partnerships, and expansion into emerging markets. Asia Pacific dominates the global market, holding the largest share at 32% in 2024, driven by rapid urbanization, rising demand for packaged fresh food, and growing retail infrastructure in countries like China and India.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Insights

- The Fresh Food Packaging market was valued at USD 94,406 million in 2024 and is projected to reach USD 127,914.7 million by 2032, growing at a CAGR of 3.87% during the forecast period.

- Market growth is primarily driven by rising demand for extended shelf life, increased consumption of ready-to-eat food, and the expansion of organized retail and e-commerce channels.

- Trends such as sustainable packaging, intelligent labeling, and convenience-oriented formats are shaping product innovations and consumer preferences across global markets.

- Competitive dynamics feature key players like Amcor, Sealed Air Corporation, Tetra Pak, Ball Corporation, and Smurfit Kappa, who focus on sustainable materials, strategic acquisitions, and smart packaging technologies.

- Asia Pacific leads with a 32% market share, followed by North America at 28% and Europe at 26%; plastic remains the dominant material segment, while Modified Atmosphere Packaging (MAP) holds the largest share among technologies.

Market Segmentation Analysis:

By Material Type

In the fresh food packaging market, plastic remains the dominant material type, accounting for the largest market share in 2024 due to its flexibility, durability, and cost-effectiveness. Plastic packaging provides superior barrier properties against moisture and contaminants, making it ideal for preserving freshness and extending shelf life. The increasing adoption of recyclable and biodegradable plastics has further driven demand, aligning with sustainability goals. Although materials like paper and glass are gaining attention for their eco-friendly attributes, they are limited by lower durability and higher costs, restricting their adoption in certain high-volume packaging applications.

- For instance, Amcor has developed its AmPrima™ recycle-ready plastic packaging range, with over 1 billion units sold globally by 2023, offering high barrier properties while being fully compatible with existing polyethylene recycling streams.

By Technology

Modified Atmosphere Packaging (MAP) holds the largest market share among the technology segments, driven by its effectiveness in prolonging the shelf life of perishable products such as meat, dairy, and fresh produce. MAP modifies the internal atmosphere of the packaging to slow down microbial growth and oxidation, making it highly suitable for maintaining product freshness during extended transportation and retail display. Its wide application across various fresh food categories gives it a competitive edge over other technologies like Vacuum Skin Packaging (VSP) and Aseptic Packaging, which are more specialized and used in specific food processing and storage scenarios.

- For instance, Sealed Air’s Cryovac® MAP systems have been adopted by over 20,000 food processors globally, enabling an average shelf life extension of 7 to 10 days for fresh meat products.

By Packaging Format

Rigid packaging leads the market in terms of packaging format, with food trays and rigid containers being the most widely used sub-segments. Rigid packaging offers structural stability and protection, making it ideal for transporting and displaying fresh products without compromising their quality. Food trays, in particular, dominate due to their convenience in portion control and direct-to-consumer presentation, especially in retail-ready packaging formats. The increasing demand for ready-to-eat and pre-cut food items has further fueled the adoption of rigid packaging solutions, supported by innovations in recyclable and lightweight materials that cater to sustainability-conscious consumers.

Key Growth Drivers

Rising Demand for Extended Shelf Life

The increasing consumer preference for fresh, ready-to-eat, and minimally processed foods has significantly driven demand for packaging solutions that extend shelf life. Technologies such as Modified Atmosphere Packaging (MAP) and Vacuum Skin Packaging (VSP) play a crucial role in preserving product freshness and preventing spoilage. Retailers and food service providers increasingly rely on these packaging innovations to reduce waste and ensure longer product availability. As supply chains become more complex, the need for durable, shelf-stable packaging solutions continues to propel market growth globally.

- For instance, Mondi’s PerFORMing paper-based tray, developed for fresh food applications, helps reduce spoilage while maintaining performance, and has been adopted by over 30 food producers across Europe since its launch, replacing approximately 80 tons of plastic annually.

Shift Toward Sustainable and Eco-Friendly Packaging

Growing environmental awareness among consumers and stringent government regulations on single-use plastics have accelerated the shift toward sustainable fresh food packaging. Manufacturers are adopting recyclable, biodegradable, and compostable materials, such as plant-based plastics and paper-based alternatives. This transition not only helps reduce environmental impact but also enhances brand value and consumer trust. Companies investing in sustainable packaging innovations are gaining a competitive edge, especially in developed markets where eco-conscious purchasing behavior is significantly influencing food packaging decisions.

- For instance, Tetra Pak has launched more than 100 million packages made with plant-based polymers derived from sugarcane, reducing carbon emissions by up to 17% per package compared to conventional plastic-based cartons.

Growth in Organized Retail and Online Grocery Sales

The expansion of organized retail chains and the rapid rise of online grocery platforms have positively impacted the fresh food packaging market. Retailers require visually appealing and protective packaging that ensures product safety during transportation and shelf display. E-commerce platforms, in particular, demand sturdy, leak-proof, and temperature-resistant packaging to maintain product integrity during last-mile delivery. This growing retail ecosystem, supported by rising urbanization and changing consumption patterns, is a key factor driving the demand for innovative and functional packaging solutions.

Key Trends & Opportunities

Technological Advancements in Packaging Solutions

The adoption of intelligent and active packaging technologies is emerging as a notable trend in the fresh food packaging market. Smart labels, temperature indicators, and antimicrobial coatings are being integrated to enhance product safety, traceability, and shelf life. These technologies offer value-added benefits to both retailers and consumers by ensuring freshness and reducing food waste. As digital transformation influences supply chains, tech-enhanced packaging provides a major opportunity for manufacturers to differentiate their offerings and cater to the evolving needs of modern retail environments.

- For instance, Avery Dennison has distributed over 700 million RFID-enabled food packaging labels, enhancing cold chain monitoring and inventory management for major retailers across North America and Europe.

Increasing Preference for Convenience Packaging

Consumers are increasingly seeking packaging solutions that offer ease of handling, portion control, and resealability. This trend is driving the development of lightweight, portable, and user-friendly formats such as resealable trays, easy-peel films, and single-serve containers. The shift toward on-the-go consumption and smaller household sizes further fuels this demand. Packaging companies have the opportunity to capitalize on this trend by designing innovative, functional packaging that aligns with consumers’ fast-paced lifestyles without compromising product quality or sustainability.

- For instance, Sealed Air has reported a 40% year-over-year increase in demand for its EasyOpen and resealable Cryovac® FlexPrep™ pouches, used by meal kit brands and quick-service restaurants in over 15 countries.

Key Challenges

Environmental Concerns Related to Plastic Waste

Despite their utility, plastic-based packaging materials remain under scrutiny due to their contribution to environmental pollution. Improper disposal and low recycling rates of plastic packaging have led to increasing regulatory pressure and consumer backlash. Companies face the challenge of balancing performance requirements such as barrier properties and durability with environmental sustainability. Transitioning to alternative materials requires significant investment in research, supply chain adaptation, and consumer education—posing a substantial barrier for many small and mid-sized enterprises.

High Costs of Sustainable Packaging Materials

While sustainable packaging is in high demand, the cost of biodegradable and compostable materials remains considerably higher than conventional plastic alternatives. These cost disparities limit large-scale adoption, particularly in price-sensitive markets. Manufacturers are challenged to achieve cost efficiency without compromising on quality or sustainability goals. The development of affordable, scalable green materials and technologies is essential to overcoming this hurdle and ensuring wider adoption of environmentally friendly packaging solutions across the industry.

Regulatory Compliance and Standardization Issues

The fresh food packaging industry is subject to a complex web of regulations concerning food safety, labeling, and environmental standards across different regions. Navigating these varying compliance requirements can be time-consuming and costly for manufacturers, especially those operating in multiple markets. Inconsistent standards and frequent policy updates increase operational complexity and delay product launches. Ensuring consistent regulatory compliance while maintaining production efficiency poses an ongoing challenge for companies striving to expand their global footprint.

Regional Analysis

North America

North America held a substantial share of the fresh food packaging market in 2024, accounting for approximately 28% of the global revenue. The region’s dominance is attributed to high consumption of packaged fresh foods, advanced cold chain infrastructure, and strong demand for sustainable packaging. The U.S. leads the market due to its mature retail sector and consumer preference for convenient and eco-friendly packaging formats. Stringent regulations by agencies such as the FDA further drive innovation in food-safe and recyclable materials. Growing online grocery sales continue to create new opportunities for efficient and durable packaging solutions across the region.

Europe

Europe captured around 26% of the global fresh food packaging market in 2024, supported by its strong focus on sustainability and circular economy policies. Countries like Germany, France, and the U.K. are leading in the adoption of recyclable and biodegradable packaging materials. Regulatory frameworks such as the EU Packaging and Packaging Waste Directive are driving manufacturers to innovate and replace traditional plastic formats. The region also benefits from well-developed retail and logistics networks. Demand for organic and locally sourced fresh food further fuels the use of transparent, compostable, and informative packaging to build consumer trust and promote eco-conscious purchasing.

Asia Pacific

Asia Pacific emerged as the largest regional market, accounting for over 32% of the global fresh food packaging share in 2024. Rapid urbanization, rising disposable incomes, and increased consumption of fresh and ready-to-eat foods in countries like China, India, and Japan are driving market expansion. The growth of organized retail and e-commerce further supports demand for efficient, lightweight, and durable packaging formats. However, concerns about environmental pollution are leading to a gradual shift toward sustainable alternatives. Government initiatives promoting food safety and packaging innovations are expected to further strengthen the market outlook across this high-potential region.

Latin America

Latin America accounted for nearly 8% of the global fresh food packaging market in 2024, with Brazil and Mexico leading regional demand. Growth is driven by rising consumer awareness of food safety, increasing penetration of modern retail formats, and demand for extended shelf life solutions. The region is experiencing a growing preference for packaged fresh fruits, vegetables, and meat products due to urbanization and changing dietary habits. However, economic volatility and underdeveloped recycling infrastructure pose challenges. Nevertheless, increasing investments in food processing and packaging technologies are expected to gradually improve regional performance over the forecast period.

Middle East & Africa

The Middle East & Africa region contributed around 6% to the global fresh food packaging market in 2024. Market growth is supported by a growing population, increasing food imports, and expanding retail infrastructure in countries such as the UAE, Saudi Arabia, and South Africa. The rising demand for convenience food and improvements in cold chain logistics are driving adoption of high-barrier packaging formats. However, limited recycling facilities and regulatory inconsistencies pose challenges. Government initiatives to reduce food waste and promote food security are encouraging investments in efficient packaging solutions that support product preservation and hygiene across diverse climate conditions.

Market Segmentations:

By Material Type

- Paper

- Plastic

- Glass

- Metal

By Technology

- Vacuum Skin Packaging (VSP)

- Modified Atmosphere Packaging (MAP)

- Aseptic Packaging

- Retort Processing

By Packaging Format

- Rigid Packaging

- Rigid Boxes

- Folding Cartons

- Food Trays

- Container and Jars

By End Use

- Food Producers & Processors

- Food Shipper

- Food Re-packers

- Retailers

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The competitive landscape of the fresh food packaging market is characterized by the presence of both global and regional players focusing on innovation, sustainability, and cost-effectiveness. Key companies such as Amcor, Sealed Air Corporation, Tetra Pak, Ball Corporation, and Mondi dominate the market by leveraging advanced packaging technologies and expanding their sustainable product portfolios. These players continuously invest in R&D to develop eco-friendly materials and smart packaging solutions that extend shelf life and enhance product safety. Strategic partnerships, mergers, and acquisitions are common tactics employed to strengthen market presence and diversify offerings. Emerging companies like ECO GEM BIO-TECH PVT LTD. and SUNN BIOTECH SUSTAINABLE SOLUTIONS are gaining traction with biodegradable and compostable packaging alternatives, addressing the rising demand for green solutions. Regional players compete by offering localized, cost-efficient products tailored to specific market needs. Overall, the market remains highly competitive, driven by innovation, regulatory compliance, and shifting consumer preferences toward sustainable and functional packaging.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Muhurat Mithaas

- Ball Corporation

- Smurfit Kappa

- SUNN BIOTECH SUSTAINABLE SOLUTIONS

- Crown Holdings, Inc.

- Kruger Packaging

- Prafal Agro LLP

- Amcor

- ECO GEM BIO-TECH PVT LTD.

- Sealed Air Corporation

- Tetra Pak

- Mondi

Recent Developments

- In May 2025, KIND Snacks, a company known for its tasty and nutritious snacks launched its first curbside recyclable paper wrapper pilot in the United States. While the brand continues to move closer to its goal of having all packaging designed for recyclability by 2030, this industry-leading innovation represents a significant step in creating a wrapper that is ready for recycling in the bars category. Made from pulpable paper, KIND’s pilot will be utilizing a curbside recyclable, How2Recycle pre-qualified paper type, which will help consumers make a kinder choice for the environment and on the shelf. The KIND paper wrapper will be exclusively available at a few Whole Foods Market stores in Connecticut, New Jersey, and New York.

- In February 2025, Kaliroy Fresh LLC, company based in Texas revealed the launched the newly patented peel-back shaker snacking tomato clamshell at Southeast Produce Council’s Southern Exposure event held in Orlando, Florida, U.S.

- In March 2025, Placon, a pioneer in eco-friendly, creative thermoformed food packaging, announced the debut of its new Fresh ‘n Clear Dip Cup range for dips, spreads, and hummus. In response to growing consumer demand for more environmentally friendly food packaging choices for the expanding market for hummus, spread, and dip, the dip cup line was created.

- In October 2024, Bolthouse Fresh Foods, announced the launch of three flavorful, fresh carrot products in vibrant new Bolthouse Fresh packaging.

- In November 2023, Fresh Del Monte Inc., announced its collaboration with Arena Packaging to develop Reusable Plastic Containers (RPCs) for bananas.

- In July 2023, iD Fresh, announced the launch of iD Squeeze & Fry Vada Batter 2.0. It is developed with an unique product packaging.

Market Concentration & Characteristics

The Fresh Food Packaging Market exhibits a moderately fragmented structure with a mix of global leaders and regional players competing on innovation, material sustainability, and cost efficiency. It features strong competition in developed regions, where regulatory frameworks and consumer awareness drive the adoption of eco-friendly and high-performance packaging. The market shows high demand predictability, supported by consistent consumption of fresh produce, meat, and dairy across retail and foodservice sectors. It responds quickly to shifts in consumer preferences, such as convenience and transparency in labeling. Entry barriers remain moderate due to material cost volatility and compliance requirements, particularly in food safety and environmental standards. Companies that offer recyclable, compostable, or intelligent packaging solutions maintain a competitive advantage. It favors suppliers with strong distribution networks and advanced R&D capabilities. Demand concentration is highest in Asia Pacific, North America, and Europe, where urbanization and retail expansion support continuous volume growth. It reflects evolving trends in health-conscious eating and sustainability.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Technology, Packaging Format, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily, supported by rising demand for packaged fresh produce and ready-to-eat meals.

- Sustainable packaging materials such as biodegradable plastics and recyclable paper will gain wider adoption.

- Companies will invest more in active and intelligent packaging technologies to enhance shelf life and traceability.

- Online grocery and e-commerce platforms will drive demand for durable and tamper-proof packaging solutions.

- Asia Pacific will maintain its lead due to rapid urbanization, growing middle class, and expanding retail infrastructure.

- Regulatory pressure on single-use plastics will push manufacturers to adopt eco-friendly alternatives.

- Consumer preference for convenient and portion-controlled packaging will influence design innovations.

- Packaging automation and digital printing will improve efficiency and customization in production.

- Food safety concerns will encourage stricter compliance with packaging material standards and hygiene protocols.

- Strategic collaborations and mergers among key players will reshape the competitive landscape and drive innovation.