Market Overview:

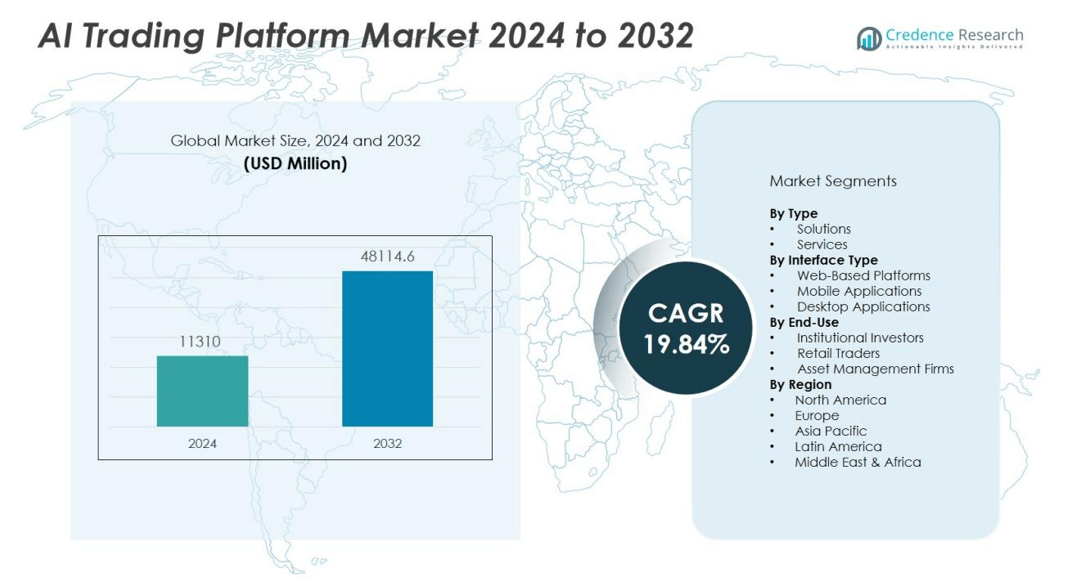

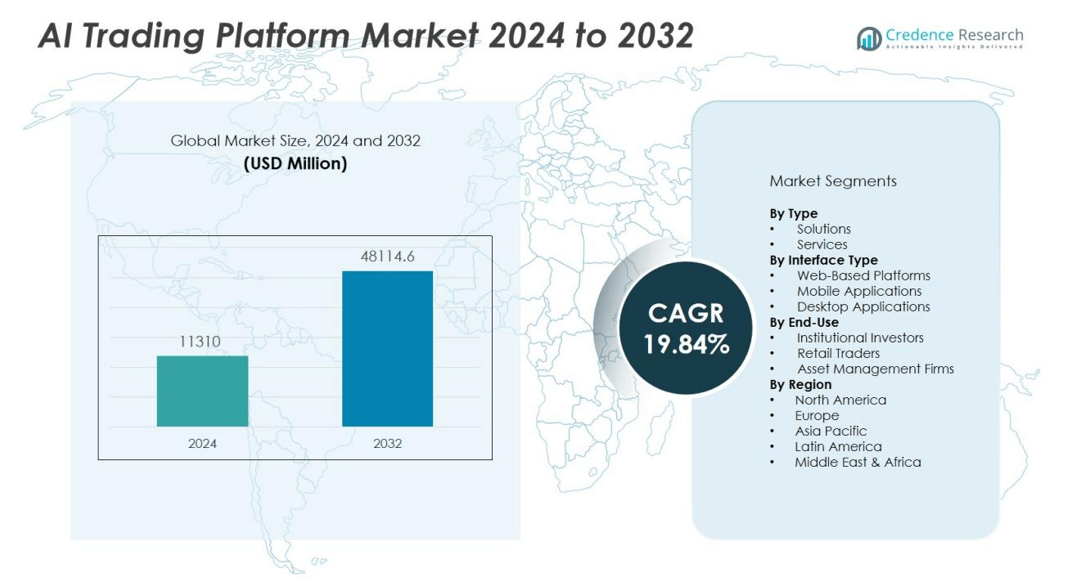

The Ai trading platform market size was valued at USD 11310 million in 2024 and is anticipated to reach USD 48114.6 million by 2032, at a CAGR of 19.84 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| AI Trading Platform Market Size 2024 |

USD 11310 million |

| AI Trading Platform Market, CAGR |

19.84% |

| AI Trading Platform Market Size 2032 |

USD 48114.6 million |

Market growth is primarily fueled by several key drivers. The escalating need for data-driven decision-making, the proliferation of high-frequency trading, and heightened pressure to deliver superior portfolio returns are compelling financial institutions to integrate AI technologies into their trading infrastructure. Enhanced regulatory scrutiny also incentivizes the adoption of platforms that ensure transparency, compliance, and risk mitigation. AI trading platforms deliver predictive analytics, sentiment analysis, and automated risk assessment, enabling users to identify patterns, forecast market trends, and respond swiftly to shifting market dynamics. The surge in digitalization, coupled with growing interest from tech-savvy retail investors, further accelerates market expansion.

From a regional perspective, North America leads the AI trading platform market, driven by the presence of major financial hubs, strong investment in fintech innovation, and early technology adoption by key players in the United States and Canada. Leading companies in the region include TD Ameritrade Holding Corporation, Interactive Brokers, and TRADE. Europe follows closely, supported by stringent regulatory frameworks, established financial markets, and increasing demand for algorithmic trading solutions in the UK, Germany, and Switzerland. Notable providers such as Rademade Technologies and Devexperts LLC strengthen the region’s market presence. The Asia Pacific region is poised for rapid growth, fueled by the digital transformation of financial services, expanding capital markets, and a rising number of retail traders in countries such as China, Japan, and India.

Market Insights:

- The AI trading platform market reached USD 11,310 million in 2024 and is set to hit USD 48,114.6 million by 2032.

- Data-driven decision-making and the rise of high-frequency trading fuel rapid adoption among financial institutions.

- Enhanced regulatory scrutiny incentivizes firms to deploy platforms focused on transparency, compliance, and automated risk management.

- AI trading platforms enable predictive analytics, sentiment analysis, and rapid response to evolving market conditions.

- North America leads the market with a 39% share, supported by strong fintech investment and established trading hubs like TD Ameritrade Holding Corporation and Interactive Brokers.

- Europe holds a 31% share, driven by stringent regulation and growing demand for algorithmic solutions from players such as Rademade Technologies and Devexperts LLC.

- Asia Pacific commands 21% share and delivers the fastest growth, underpinned by digital transformation, expanding retail trading, and capital market development in China, Japan, and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Accelerating Demand for Automation and Data-Driven Decision Making:

The integration of AI into trading platforms responds to the financial sector’s demand for automated, data-driven solutions. AI trading platform market participants seek to leverage vast datasets for real-time analysis and fast execution of trades. Automated trading reduces manual intervention, lowers the risk of human error, and supports more consistent portfolio performance. Institutional investors and asset managers prioritize speed and accuracy, driving rapid adoption of AI-based systems. It enables smarter trade execution, adapts to market fluctuations, and improves outcomes for both retail and professional traders. The preference for algorithm-driven trading continues to intensify with increased market volatility and complexity.

- For instance, a user-backed AI trading system processed 285 trades and secured 199 winning trades, delivering a success rate of approximately 70% in real market conditions.

Rise of High-Frequency and Algorithmic Trading Strategies

High-frequency and algorithmic trading strategies are key forces propelling the AI trading platform market. These strategies depend on rapid, data-intensive decision processes, which AI excels at delivering. It processes and reacts to market signals faster than traditional systems, giving users a competitive edge. Market participants benefit from the ability to implement multiple strategies across different asset classes with high precision. The shift toward quantitative and systematic trading models reflects the need for advanced analytics and real-time adaptability. AI platforms also facilitate back-testing and optimization, enhancing the effectiveness of trading operations.

Regulatory Focus on Transparency and Risk Management

Evolving regulatory requirements in the financial sector drive adoption of the AI trading platform market. Regulators emphasize transparency, compliance, and comprehensive risk management to safeguard investor interests. It enables detailed record-keeping, audit trails, and automated reporting that meet stringent global standards. AI-driven platforms identify and address compliance risks, ensuring proactive management of regulatory changes. Financial institutions favor these solutions for their ability to continuously monitor trading activity and mitigate operational risks. Enhanced transparency builds trust and fosters broader acceptance of automated trading technologies.

Expansion of Digital Infrastructure and Rising Retail Participation

Widespread digital transformation within financial markets fuels the expansion of the AI trading platform market. Modern infrastructure allows seamless integration of AI capabilities with existing systems and third-party applications. It supports mobile and cloud-based trading, enabling broader access for retail investors. The growing availability of user-friendly platforms encourages participation from a new generation of tech-savvy traders. Increased competition among solution providers drives innovation in feature sets, customization, and user experience. Global capital markets continue to evolve, making AI-powered platforms essential for those seeking a strategic advantage.

- For instance, CME Group reported a record revenue of $1.64 billion in Q1 2025, driven in part by strong retail trading activity enabled by next-generation digital trading platforms, highlighting the positive impact of AI-driven infrastructure and increased retail participation on financial market growth.

Market Trends:

Integration of Advanced Machine Learning and Predictive Analytics

Leading players in the AI trading platform market invest heavily in advanced machine learning models and predictive analytics to enhance trading accuracy and efficiency. It incorporates neural networks, deep learning, and natural language processing to analyze vast datasets and detect subtle market patterns. These technologies empower users to anticipate price movements, uncover arbitrage opportunities, and optimize trading strategies. The market witnesses rapid adoption of sentiment analysis tools that extract actionable intelligence from news, social media, and financial reports. Real-time predictive models help traders manage volatility and make faster, more informed decisions. Continued advancements in artificial intelligence strengthen the competitive edge of market participants and drive platform innovation.

- For instance, Trumid’s Fair Value Model Price (FVMP) now provides real-time predictive pricing for about 22,000 U.S. dollar-denominated corporate bonds, updating every 30 seconds to support pre-trade analysis and automation on its trading platform.

Growth of Personalization, Customization, and Democratization of Trading

The AI trading platform market reflects a clear trend toward greater personalization and customization, meeting the unique needs of individual traders and institutional clients. It enables users to configure risk thresholds, algorithm parameters, and portfolio strategies tailored to their investment goals. Low-code and no-code interfaces have simplified algorithmic trading, making sophisticated tools accessible to a wider range of users, including retail investors. The market sees a shift toward mobile-first, cloud-enabled platforms, supporting 24/7 trading and remote portfolio management. Personalization features and seamless integration with analytics platforms improve user engagement and retention. Increased accessibility drives the democratization of AI-powered trading, reshaping market dynamics and participation.

- For instance, the Market Simplified mobile trading platform, running on AWS cloud infrastructure, has processed over 11 million messages and more than $1 billion in trade value across brokerage partners, empowering users with real-time analytics and execution on mobile devices.

Market Challenges Analysis:

Complex Regulatory Environment and Compliance Burden

The AI trading platform market faces ongoing challenges due to a complex and evolving regulatory environment. Financial authorities around the world implement new rules to address algorithmic trading risks, market manipulation, and data privacy. It requires significant investment in compliance infrastructure to meet these standards. Maintaining up-to-date audit trails, real-time monitoring, and detailed reporting increases operational costs for both vendors and users. Navigating regulatory differences across regions creates hurdles for global expansion. Rapid regulatory changes also add uncertainty, forcing market participants to adapt quickly and reassess risk strategies.

Cybersecurity Threats and Technology Integration Issues

Rising cybersecurity threats and technology integration issues create further obstacles for the AI trading platform market. The increasing use of cloud-based platforms and third-party APIs exposes systems to data breaches, hacking, and unauthorized access. It demands robust security protocols, frequent system updates, and continuous risk assessments. Integrating AI-driven trading platforms with legacy systems often leads to compatibility problems and operational disruptions. High implementation costs and technical complexity can delay adoption, especially for smaller firms. These challenges highlight the need for advanced cybersecurity solutions and seamless integration frameworks to ensure reliable and secure trading environments.

Market Opportunities:

Expansion into Emerging Markets and New Asset Classes

The AI trading platform market presents strong opportunities for growth in emerging markets and new asset classes. It enables financial institutions and fintech firms to enter high-growth regions in Asia Pacific, Latin America, and the Middle East, where digital transformation is accelerating. Expanding into cryptocurrency, digital assets, and ESG-focused securities provides new revenue streams and competitive differentiation. Localized AI solutions tailored to unique regulatory environments and market structures enhance user adoption. The ability to process multiple asset classes on a single platform attracts both institutional and retail investors. Strategic partnerships with regional players can amplify market reach and brand recognition.

Adoption of Advanced AI Technologies and Personalized Solutions

Rapid advancements in AI technologies create substantial opportunities for differentiation and value creation in the AI trading platform market. It allows vendors to offer highly personalized trading experiences, intelligent risk management, and real-time portfolio optimization. Integrating natural language processing, voice-activated commands, and predictive analytics helps users make better decisions and manage volatility. White-label and modular solutions appeal to brokers and wealth managers seeking customized offerings. Enhanced data visualization and scenario analysis further strengthen user engagement. These innovations support long-term client retention and market share expansion.

Market Segmentation Analysis:

By Type

The AI trading platform market segments by type into solutions and services. Solutions represent the larger share, driven by growing demand for advanced algorithmic trading software that automates execution and enhances portfolio returns. It includes platforms offering predictive analytics, sentiment analysis, and strategy back-testing, meeting the needs of both institutional and retail traders. Services, including consulting, implementation, and support, play a critical role in platform adoption, especially for organizations seeking tailored deployments and seamless integration with existing infrastructure.

- For instance, Inoxoft delivers AI trading software development services, integrating real-time data analysis tools and custom API connections for brokerages, with solutions adopted by over 20 clients in the past year for quantitative trading automation.

By Interface Type

User interface remains a key differentiator within the AI trading platform market. Web-based platforms lead the segment, favored for accessibility, ease of updates, and multi-device compatibility. Mobile interfaces see rapid growth, attracting tech-savvy retail investors who demand real-time access and intuitive design. Desktop applications maintain relevance among professional traders who prioritize advanced charting, custom analytics, and integration with high-frequency trading tools.

- For instance, SmartCharts, a web-based AI trading platform, has enabled over 5,000 verified users to access its proprietary one-click trading and analytics via any browser, offering 27 premium features for seamless use.

By End-Use

The AI trading platform market serves diverse end-users, including institutional investors, retail traders, and asset management firms. Institutional investors dominate adoption due to their need for high-speed execution, large-scale data analysis, and regulatory compliance features. Retail traders represent a fast-growing segment, supported by user-friendly platforms and educational resources. Asset managers leverage AI capabilities to optimize portfolio strategies and deliver superior client outcomes, driving steady demand for comprehensive, customizable trading solutions.

Segmentations:

By Type:

By Interface Type:

- Web-Based Platforms

- Mobile Applications

- Desktop Applications

By End-Use:

- Institutional Investors

- Retail Traders

- Asset Management Firms

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America:

North America holds a 39% share of the AI trading platform market, maintaining its position as the leading region by revenue and technology adoption. The United States anchors this dominance, supported by a mature financial sector, robust investment in fintech, and a strong ecosystem of technology providers. Financial institutions in the region actively integrate AI-driven solutions to automate trading and enhance decision-making accuracy. It benefits from an advanced digital infrastructure and the presence of major stock exchanges, which facilitate large-scale implementation of AI trading platforms. Regulatory clarity and ongoing investments in cybersecurity also strengthen market growth. High adoption rates among hedge funds, asset managers, and retail investors drive continued expansion across North America.

Europe:

Europe commands a 31% share of the AI trading platform market, ranking second globally due to its established financial centers and comprehensive regulatory frameworks. The United Kingdom, Germany, and Switzerland serve as key hubs for algorithmic and AI-powered trading activities. It experiences steady growth as banks and asset management firms invest in AI technologies to enhance compliance, operational efficiency, and client service. The region’s regulatory bodies encourage transparency and innovation, supporting the uptake of advanced trading platforms. Efforts to modernize capital markets and embrace digital transformation further bolster demand. The influx of retail traders and fintech startups also increases platform adoption throughout Europe.

Asia Pacific:

Asia Pacific accounts for 21% share of the AI trading platform market and exhibits the fastest growth trajectory. China, Japan, and India drive regional momentum, backed by rapid digitalization of financial services and increasing trading volumes. It attracts significant investment from global and regional fintech players eager to tap into growing retail participation and expanding capital markets. Rising internet penetration and mobile-first trading solutions accelerate market development. Localized products tailored to diverse regulatory requirements help vendors gain a competitive advantage. Government initiatives to foster financial innovation and cross-border investment position Asia Pacific as a dynamic hub for future market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Td Ameritrade Holding Corporation

- Rademade Technologies

- Devexperts LLC

- Interactive Brokers

- TRADE

- Pragmatic Coder

- Empirica

- EffectiveSoft Ltd.

- Profile Software

- Chetu Inc.

Competitive Analysis:

The AI trading platform market features strong competition among established players and innovative technology firms. Key companies include TD Ameritrade Holding Corporation, Rademade Technologies, Devexperts LLC, Interactive Brokers, and TRADE. It benefits from rapid technological advancements, with vendors investing in AI-driven analytics, predictive modeling, and real-time data integration to differentiate their offerings. Companies focus on user experience, security, and scalability to meet the evolving needs of institutional and retail clients. Strategic partnerships, acquisitions, and continuous research and development strengthen market positions and accelerate innovation. New entrants face high barriers due to the complexity of regulatory compliance and integration requirements.

Recent Developments:

- In July, 2025, announced the launch of IBKR InvestMentor, a new mobile microlearning app developed by its wholly owned subsidiary. This platform aims to provide bite-sized investing education to users.

- In August 2024, Interactive Brokers enabled its clients to access listed derivatives on Bursa Malaysia. With this launch, clients could trade products like Crude Palm Oil Futures on the platform.

- In December 2024,Oracle Life Sciences Empirica released new updates to its signal detection and management solution, expanding multisource signaling capabilities in drug safety, including additional data mining from global safety databases and enhanced compliance workflows.

Market Concentration & Characteristics:

The AI trading platform market demonstrates moderate concentration, with a mix of established technology giants and specialized fintech firms competing for market share. It features rapid innovation cycles, with vendors introducing new algorithms, real-time analytics, and customizable features to attract institutional and retail clients. Leading companies maintain strong global footprints and invest heavily in research and development to enhance platform capabilities. The market is characterized by high barriers to entry due to regulatory compliance, technology integration, and cybersecurity demands. Strategic partnerships and acquisitions accelerate access to emerging technologies and new geographic markets. It reflects growing demand for scalable, secure, and user-friendly solutions that deliver a competitive edge in dynamic financial environments.

Report Coverage:

The research report offers an in-depth analysis based on Type, Interface Type, End-Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Investors will embrace hybrid AI models that combine machine learning with rule-based systems for enhanced precision and risk management.

- Platform providers will integrate generative AI to produce real-time trading insights and personalized recommendations for users.

- Voice and conversational interfaces will gain traction, enabling traders to interact with platforms through natural language commands.

- Cloud‑native architectures will dominate, enabling scalable compute power, improved latency, and seamless cross‑device access.

- Modular, API‑first solutions will enable users to assemble customized trading stacks and integrate third‑party analytics tools.

- Risk‑control frameworks powered by AI will deliver continuous monitoring, anomaly detection, and automated compliance alerts.

- Use of alternative data sources—such as satellite imagery, sentiment scores, and IoT metrics—will support more accurate market forecasting.

- Blockchain and decentralized finance integrations will extend AI platforms into tokenized assets, enabling smarter execution in digital markets.

- Partnerships among fintech innovators, broker‑dealers, and institutional investors will accelerate platform enhancements and market reach.

- Growing global demand from retail traders and wealth managers will drive user‑friendly features, educational tools, and cost‑effective platform tiers.