Market Overview

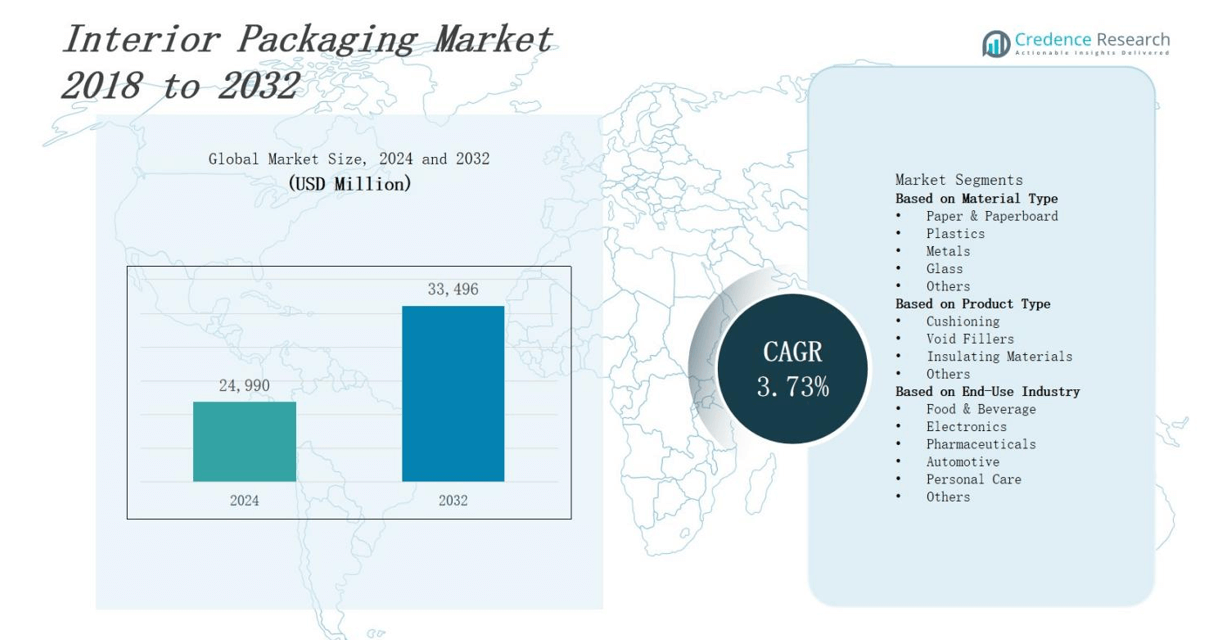

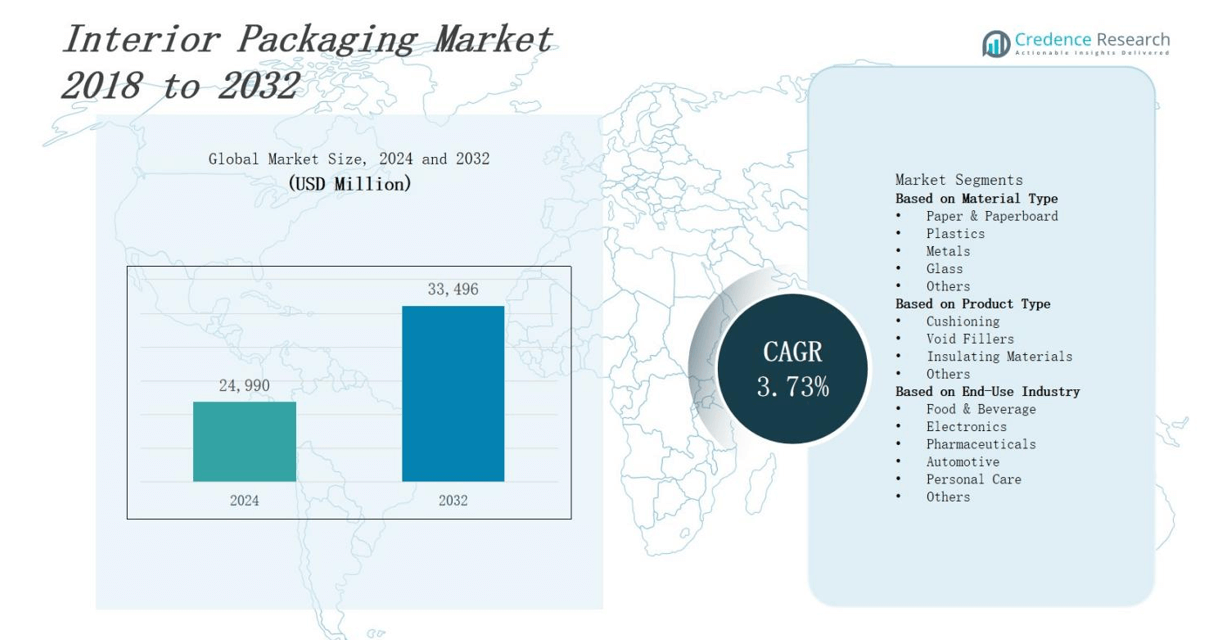

The interior packaging market is projected to expand from USD 24,990 million in 2024 to USD 33,496 million by 2032, representing a CAGR of 3.73%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Interior Packaging Market Size 2024 |

USD 24,990 million |

| Interior Packaging Market, CAGR |

3.73% |

| Interior Packaging Market Size 2032 |

USD 33,496 million |

Market drivers include rising e‑commerce shipments, stringent sustainability regulations, and demand for lightweight, cost‑effective solutions that reduce material use and shipping costs. Manufacturers invest in recyclable and bio‑based substrates to comply with environmental mandates and meet consumer preferences. Automation and digital printing accelerate production, enable customization, and improve operational efficiency. Trends highlight integration of smart packaging technologies—such as RFID and IoT sensors—for real‑time monitoring and enhanced supply chain visibility. Collaborative partnerships between interior packaging suppliers and brands drive innovation in protective, tailored designs. Growing emphasis on circular economy principles and advanced barrier films further shapes market evolution.

Geographical analysis shows Asia Pacific leads with 40% share, followed by Europe 25%, North America 20%, Latin America 8%, Middle East & Africa 7% in the interior packaging market. Key players tailor strategies regionally: Sealed Air and Berry Global expand foam solutions in North America; Smurfit Kappa and DS Smith drive sustainable paperboard adoption in Europe; Mondi and International Paper cater to high‑volume demands in Asia Pacific; WestRock and Amcor enter Latin America with inserts; Nefab and Huhtamaki serve niche segments in Middle East & Africa with modular systems.

Market Insights

- The interior packaging market will grow from USD 24,990 million in 2024 to USD 33,496 million by 2032 at a CAGR of 3.73%.

- Rising e‑commerce volumes drive demand for tailored inserts that minimize damage and reduce return rates.

- Stringent sustainability mandates push adoption of recyclable paperboard and bio‑based substrates to meet environmental targets.

- Automation and digital printing enable rapid customization, shorten setup times, and improve operational efficiency.

- Integration of RFID tags and IoT sensors delivers real‑time monitoring and enhances supply chain visibility.

- Volatile fiber and resin prices create budget uncertainty, prompting firms to secure multiple suppliers and maintain inventory buffers.

- Asia Pacific leads with 40% share, followed by Europe 25%, North America 20%, Latin America 8%, and Middle East & Africa 7%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising E‑Commerce Demand Drives Growth

E‑commerce shipments surge worldwide, fueling need for protective interior packaging solutions. The interior packaging market responds with tailored inserts that reduce product damage and return rates. Manufacturers optimize material choices to lower weight while preserving strength. It enables brands to enhance unboxing experiences and customer satisfaction. Companies adopt modular designs to support diverse product dimensions and shapes. Collaboration between logistics providers and packaging engineers accelerates deployment of efficient solutions globally.

- For instance, Smurfit Kappa offers modular cardboard inserts tailored to various product shapes and sizes, enhancing both safety during transit and the customer unboxing experience.

Stringent Sustainability Regulations Promote Eco‑friendly Materials

Governments impose strict waste reduction policies, prompting use of recyclable substrates in the interior packaging market. Brands commit to bio‑based and compostable materials to meet compliance deadlines. It drives innovation in paperboard and molded pulp alternatives. Suppliers refine sourcing strategies to secure certified sustainable inputs. Companies invest in lifecycle analysis to verify environmental claims. Partnerships with recycling firms ensure circularity and material recovery. Consumers reward eco‑conscious choices with increased brand loyalty.

- For instance, PepsiCo has expanded 100% rPET (recycled polyethylene terephthalate) bottles across more than 60 markets, including the first 100% rPET carbonated beverage bottle launch in India, enhancing recyclability and reducing plastic waste.

Automation and Digital Printing Enhance Efficiency

Automation accelerates production and reduces manual errors in the interior packaging market. Digital printing permits rapid customization and lower setup times. It empowers brands to offer variable designs for different products. Manufacturers deploy robotics to increase throughput and maintain precision. Suppliers integrate online ordering platforms to streamline order management. Continuous monitoring software optimizes equipment performance and minimizes downtime. Investment in smart factories improves scalability and operational resilience cost‑effectively and significantly.

Collaborative Partnerships Accelerate Innovation

Industry leaders partner with brands to co‑develop tailored cushioning and support inserts. The interior packaging market benefits from joint research funded projects. It fosters shared expertise, reducing time to market. Suppliers and technology firms co‑create barrier film solutions with enhanced protection. Companies leverage pilot programs to validate designs before full‑scale deployment. Cross‑sector alliances drive adoption of sustainable and smart packaging. These collaborations generate competitive advantages and drive sector growth rapidly.

Market Trends

Emphasis on Sustainable and Lightweight Materials

The interior packaging market uses recyclable paperboard and bioplastics. Brands target material efficiency and test performance under stress conditions. It drives suppliers to optimize fiber sourcing and pulp molding processes. Companies conduct lifecycle assessments and secure third‑party certifications. Consumers expect clear sustainability credentials on package labels. Suppliers apply transit durability tests to validate insert strength.

- For instance, Nippon Paper Industries Co., Ltd. developed the SPOPS Paper Container, a durable and moisture-resistant paper-based packaging that replaces plastic containers while being fully recyclable and sourced from responsibly managed forests.

Integration of Digital Printing and Monitoring Technologies

Automation and digital printing deliver rapid customization and shorter setups. It enables brands to offer bespoke cushioning for diverse products. RFID tags and IoT sensors integrate into inserts for real‑time tracking. Data from smart inserts informs supply chain decisions and reduces damage. Manufacturers invest in software to manage design libraries and workflows. Collaboration with tech firms accelerates connected packaging adoption.

- For instance, Zebra Technologies integrates RFID tags with IoT sensors in their smart labels, enabling real-time tracking and condition monitoring across supply chains, enhancing decision making and reducing product damage.

Rise of Circular Economy and Recycling Partnerships

Companies in the interior packaging market establish recycling take‑back programs. It ensures material recovery and reduces landfill waste. Suppliers partner with waste managers to process post‑consumer and industrial scrap. Brands incentivize returns through deposit schemes and loyalty rewards. Design teams develop modular inserts that simplify separation and sorting. Standardization promotes compatibility across packaging systems and recycling streams.

Focus on Customization and Brand Differentiation Strategies

Demand for unboxing experiences elevates customization in the interior packaging market. It encourages variable data printing and embossed branding on protective inserts. Designers collaborate with marketing teams to align packaging aesthetics with brand identity. Rapid prototyping tools accelerate iteration on foam and molded pulp shapes. Flexible manufacturing lines adapt to low‑volume, high‑mix production runs. Strategic alliances with design agencies expand creative and functional capabilities.

Market Challenges Analysis

Escalating Raw Material Costs and Supply Disruptions

Manufacturers in the interior packaging market face pressure from unpredictable fiber and resin prices. It creates budget uncertainty and complicates long‑term planning. Suppliers must secure contracts with multiple vendors to hedge against single‑source failures. Companies invest in inventory buffers and real‑time analytics to anticipate shortages. Logistics bottlenecks amplify delays and raise freight expenses. Brands must balance protective performance with cost constraints to maintain margins. Strategic sourcing agreements offer partial relief but require stringent quality audits.

Striking the Balance Between Sustainability Goals and Cost Efficiency

Meeting stringent environmental mandates drives adoption of recycled and bio‑based substrates. It often increases unit costs compared to conventional materials. Brands confront higher processing fees and retrofit expenses for specialized equipment. Cross‑functional teams must validate eco‑credentials without sacrificing protective integrity. Consumers demand transparency yet resist significant price premiums. Collaboration with recyclers supports circularity but adds coordination complexity. Companies refine designs to minimize material use while preserving performance standards.

Market Opportunities

Leveraging E‑Commerce Growth and Personalized Unboxing Experiences

E‑commerce expansion fuels demand for secure and tailored interior protection solutions. It prompts design teams to develop inserts that fit diverse product dimensions. [interior packaging market ] responds by offering modular cushioning systems that brands can customize. Collaboration with consumer‑goods companies enhances branded unboxing experiences. Suppliers deploy rapid prototyping workflows to shorten time to market. Partnerships with technology firms enable RFID and smart sensors for real‑time monitoring. Service offerings such as design consultation and performance testing generate additional revenue.

Capitalizing on Sustainability Initiatives and Material Innovation

Strict environmental mandates and corporate sustainability targets unlock new product development opportunities. It encourages use of recycled pulp and bio‑based films in protective inserts. Governments offer incentives for green packaging and circular‑economy programs. [interior packaging market ] benefits from partnerships that fund materials research and pilot projects. Collaboration with universities accelerates testing of novel compostable substrates. Premium eco‑friendly solutions command higher price points and strengthen customer loyalty. Sales expansion into food and pharmaceutical sectors amplifies growth potential.

Market Segmentation Analysis:

By Material Type

The interior packaging market segments into Paper & Paperboard, Plastics, Metals, Glass, and Others. Paper & Paperboard dominates volume due to low cost and recyclability. Plastics hold share with flexible, lightweight inserts. Metals serve premium applications that require rigidity and product presentation. Glass supports fragile goods in niche markets. Others encompass composites and textile-based solutions for specialized cushioning. Suppliers optimize material choice to balance protection, cost, and environmental compliance.

- For instance, Tetra Pak® sold 180 billion paperboard-based milk and juice packages globally in 2017, with about 70% of the material made of paper, demonstrating widespread use in liquid packaging.

By Product Type

The interior packaging market divides into Cushioning, Void Fillers, Insulating Materials, and Others. Cushioning leads demand by reducing transit damage for electronics and cosmetics. Void Fillers secure irregular-shaped items and minimize movement. Insulating Materials protect temperature‑sensitive products in pharmaceutical and food shipments. Others include anti‑static wraps and moisture‑barrier liners for niche requirements. It drives suppliers to align design performance with handling and storage needs.

- For instance, FLOETER, a German manufacturer, specializes in air cushions and air pillow machines that fill voids in packages to stabilize irregular-shaped items and minimize movement.

By End‑Use Industry

The interior packaging market serves Food & Beverage, Electronics, Pharmaceuticals, Automotive, Personal Care, and Others. Food & Beverage accounts for bulk volume with molded pulp trays and paperboard dividers. Electronics demand precision‑fit foam inserts to safeguard delicate components. Pharmaceuticals rely on insulated liners and tamper‑evident inserts for cold‑chain integrity. Automotive parts use heavy‑duty cushioning and pallet dividers. Personal Care favors premium inserts with customizable branding. Others cover industrial and retail segments with tailored protective solutions.

Segments:

Based on Material Type

- Paper & Paperboard

- Plastics

- Metals

- Glass

- Others

Based on Product Type

- Cushioning

- Void Fillers

- Insulating Materials

- Others

Based on End-Use Industry

- Food & Beverage

- Electronics

- Pharmaceuticals

- Automotive

- Personal Care

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

Strong logistics and advanced manufacturing drive demand for tailored inserts interior packaging market leaders invest in automation to enhance protection and lower unit costs. Industry standards enforce high performance for electronics and medical devices. It benefits from robust e‑commerce infrastructure and consumer preference for premium unboxing. Suppliers collaborate with OEMs to develop lightweight cushioning. North America accounts for 20% market share; Europe 25%; Asia Pacific 40%; Latin America 8%; Middle East & Africa 7%.

Europe

Strict environmental mandates push suppliers to adopt recycled substrates and bio‑based films. interior packaging market participants refine designs to meet circular‑economy goals and regulatory requirements. It leverages strong recycling networks and certification programs. Brands differentiate through branded inserts and smart labels. Manufacturers pilot compostable inserts for food and cosmetics sectors. North America 20% market share; Europe 25%; Asia Pacific 40%; Latin America 8%; Middle East & Africa 7%.

Asia Pacific

Rapid e‑commerce growth and manufacturing capacity expansion fuel demand for protective inserts. interior packaging market companies scale modular cushioning systems to meet diverse end‑use needs. It integrates digital printing for variable branding across high‑volume runs. Regional players optimize cost structures through local sourcing and lean production. Firms partner with logistics providers to enhance supply chain visibility. North America 20% market share; Europe 25%; Asia Pacific 40%; Latin America 8%; Middle East & Africa 7%.

Latin America

Emerging retail and food‑service sectors drive need for sturdy, recyclable inserts. interior packaging market suppliers expand regional footprints to reduce lead times and import duties. It adapts paperboard cushioning to local packaging standards and cost expectations. Companies invest in capacity to serve growing pharmaceutical and cosmetics segments. Collaboration with waste‑management firms supports recycling initiatives. North America 20% market share; Europe 25%; Asia Pacific 40%; Latin America 8%; Middle East & Africa 7%.

Middle East & Africa

Infrastructure improvement and rising imports of electronics and pharmaceuticals boost protective insert demand. interior packaging market players introduce durable foam and molded pulp solutions for harsh transport conditions. It focuses on lightweight designs to offset high freight costs. Free‑trade zones accelerate joint ventures with global suppliers. Brands test smart inserts with RFID to improve product traceability. North America 20% market share; Europe 25%; Asia Pacific 40%; Latin America 8%; Middle East & Africa 7%.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mondi Group

- Nefab Group

- Stora Enso Oyj

- WestRock Company

- Amcor Plc

- Smurfit Kappa Group

- Berry Global Inc.

- Sealed Air Corporation

- Huhtamaki Oyj

- International Paper Company

- Sonoco Products Company

- DS Smith Plc

Competitive Analysis

Leading firms in the interior packaging market compete on sustainability innovation, digital capabilities, custom design services, and global reach. Sealed Air leverages advanced foam and protective solutions, improves drop‑performance. Smurfit Kappa and DS Smith focus on recyclable paperboard and circular economy programs that secure certifications to differentiate offerings. Mondi and International Paper harness extensive manufacturing networks to support high‑volume orders and regional responsiveness. WestRock and Amcor emphasize specialized barrier films and bio‑based substrates to address regulatory mandates. Sonoco and Berry Global invest in automation and digital printing platforms to deliver rapid prototyping and on‑demand customization. Stora Enso and Huhtamaki develop molded pulp and fiber‑based inserts to meet eco‑conscious demand. Nefab Group targets niche industrial segments with modular cushioning systems and end‑to‑end supply chain services. Competition intensifies through joint ventures and strategic alliances with technology providers. It drives continual performance improvements and cost optimization across the value chain.

Recent Developments

- On May 21, 2025, ProAmpac partnered with ScottsMiracle‑Gro to launch PRO‑EVO® Recyclable SOS Bags for O.M. Scott & Sons lawn care products, enabling curbside recyclability without sacrificing protection

- On June 5, 2025, Mondi teamed with Saga Nutrition to introduce the re/cycle FlexiBag, a mono‑material, high‑barrier recyclable insert for dry pet food, supporting a circular economy

- In 2025, International Paper acquired DS Smith, creating a leading sustainable packaging provider across North America and EMEA regions.

- On May 5, 2025, Sealed Air launched its Systems Advantage™ trayless laminate solutions featuring advanced EVOH barrier films at IFFA 2025 in Frankfurt.

Market Concentration & Characteristics

The interior packaging market exhibits moderate concentration, with the top five players—Sealed Air, Smurfit Kappa, DS Smith, Mondi, and International Paper—controlling roughly 45% of global revenues. It features high capital requirements for specialized machinery and stringent quality standards that limit new entrants. Large firms leverage extensive manufacturing networks to achieve economies of scale and negotiate favorable raw‑material contracts. Mid‑tier suppliers differentiate through niche solutions, including molded pulp and custom foam inserts. Brands demand rapid prototyping and digital printing capabilities, prompting service diversification. Sustainability drives investment in recycled and bio‑based substrates, and regulatory compliance influences strategic partnerships. Regional fragmentation persists, with domestic players dominating local markets in Asia Pacific and Latin America. Profitability depends on efficient logistics, tight cost control, and continuous innovation in protective performance. Competitive dynamics hinge on technology adoption, vertical integration, and end‑use collaboration to meet evolving e‑commerce and circular‑economy requirements.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Product Type, End-User Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- E‑commerce expansion drives demand for tailored protective inserts across diverse product categories and shipping requirements.

- Brands adopt recycled and bio‑based materials to satisfy stringent sustainability mandates and meet consumer expectations.

- Digital printing platforms enable rapid customization of interior packaging designs for various shapes and branding.

- RFID tags and IoT sensors within protective inserts enable improved real‑time shipment monitoring and transparency.

- Circular‑economy initiatives establish take‑back programs and recycling partnerships to recover materials and minimize environmental impact.

- Automation and robotics streamline operations, reduce errors, and accelerate interior packaging throughput across manufacturing lines.

- Modular cushioning systems provide scalable solutions that adapt to diverse product dimensions and shipping requirements.

- Cross‑sector collaborations drive development of advanced barrier films and enhance protective performance for temperature‑sensitive shipments.

- Regional manufacturers expand production capacities and invest in local sourcing to serve emerging markets effectively.

- Regulatory shifts prompt innovation in eco‑friendly substrates to align interior packaging solutions with compliance requirements.