Market Overview:

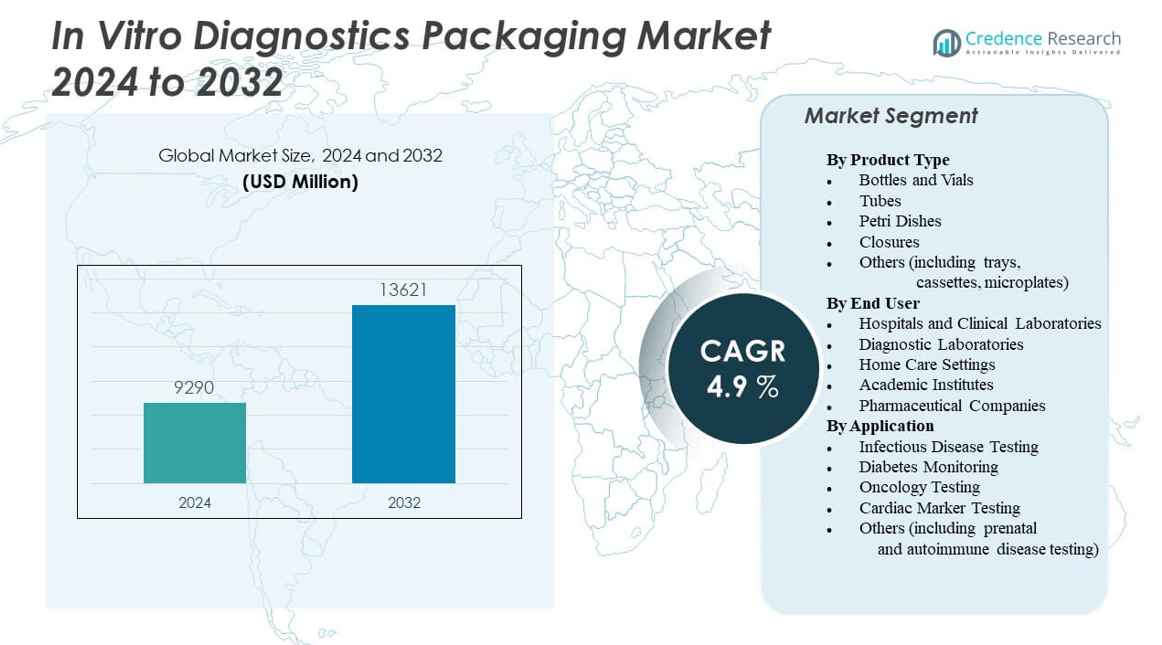

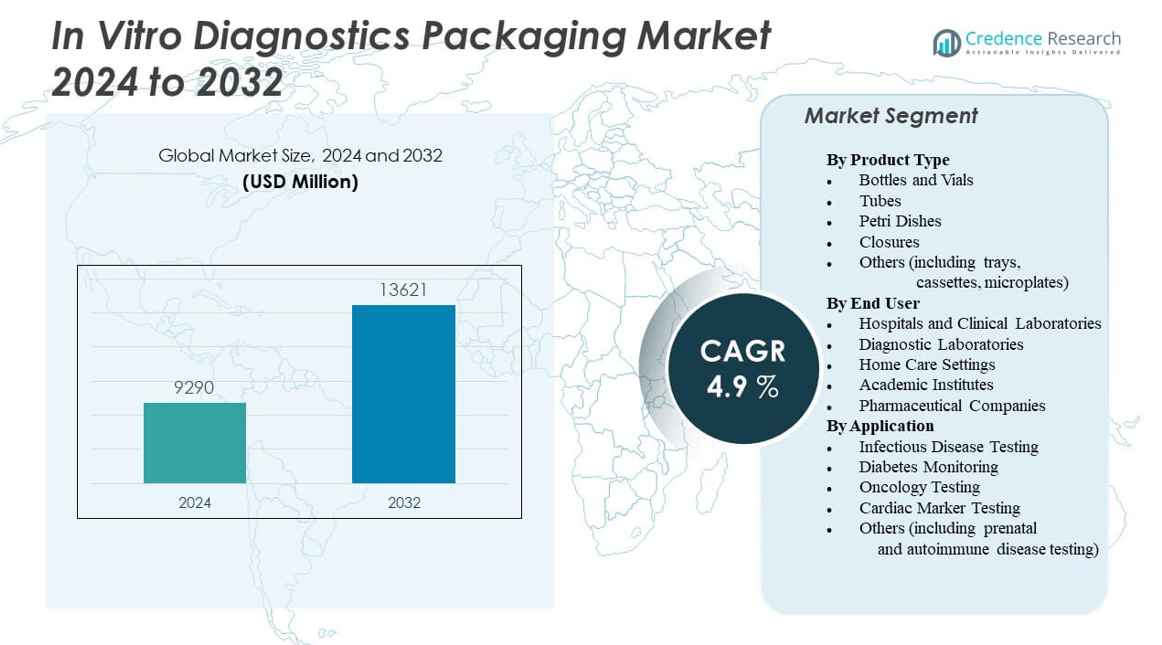

The In Vitro Diagnostics Packaging Market is projected to grow from USD 9,290 million in 2024 to an estimated USD 13,621 million by 2032, with a compound annual growth rate (CAGR) of 4.9% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| In Vitro Diagnostics Packaging Market Size 2024 |

USD 9,290 million |

| In Vitro Diagnostics Packaging Market, CAGR |

4.9% |

| In Vitro Diagnostics Packaging Market Size 2032 |

USD 13,621 million |

The market is being driven by the growing demand for accurate, safe, and contamination-free diagnostic test packaging amid rising chronic disease prevalence and increasing diagnostic testing volumes. Innovations in molecular diagnostics, point-of-care testing, and companion diagnostics have led to heightened demand for specialized packaging solutions that ensure integrity and extended shelf life. Manufacturers are investing in tamper-evident, sterile, and user-friendly formats to meet regulatory and clinical requirements.

North America leads the In Vitro Diagnostics Packaging Market, supported by its advanced healthcare infrastructure, strong diagnostic testing rates, and presence of key industry players. Europe follows closely, driven by regulatory emphasis on product safety and rising adoption of precision diagnostics. The Asia-Pacific region is emerging as a high-growth market due to expanding healthcare access, rising awareness about early disease detection, and government investments in diagnostic laboratories, particularly in China and India. Latin America and the Middle East are also witnessing gradual growth with improvements in medical diagnostics and increasing focus on laboratory quality standards.

Market Insights:

- The In Vitro Diagnostics Packaging Market is valued at USD 9,290 million in 2024 and is expected to reach USD 13,621 million by 2032, growing at a CAGR of 4.9%.

- Rising demand for sterile and tamper-evident packaging is accelerating growth in molecular and point-of-care diagnostics.

- Increasing diagnostic volumes across hospitals and labs are pushing the need for scalable, automated packaging solutions.

- Complex global regulatory frameworks and high material costs are restraining smaller firms from expanding packaging operations.

- North America leads the market with 35% share, supported by a mature diagnostics sector and advanced packaging capabilities.

- Europe holds 28% share, driven by stringent compliance standards and strong sustainability initiatives in packaging.

- Asia Pacific is the fastest-growing region with 22% share, backed by healthcare expansion and localized packaging demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Reliable Packaging in Molecular and Point-of-Care Diagnostics

The growth of molecular diagnostics and point-of-care testing is significantly increasing the need for robust and contamination-free packaging. These tests require highly precise handling, often involving temperature-sensitive reagents and biologics. The demand for high-barrier materials is growing to prevent moisture and oxygen ingress. Manufacturers are shifting toward single-use packaging formats to improve convenience and minimize cross-contamination. Packaging designs must ensure sterility while supporting ease of transport and storage. Regulatory scrutiny over packaging compliance continues to intensify across major markets. Companies are integrating tamper-evident and leak-proof closures to improve reliability. The In Vitro Diagnostics Packaging Market is evolving rapidly to support the complexity and safety needs of modern diagnostic workflows.

- For instance, Gerresheimer AG offers cyclic olefin polymer (COP) primary packaging for molecular diagnostic applications. COP materials, as documented by suppliers such as TOPAS Advanced Polymers, are capable of achieving oxygen transmission rates (OTR) as low as 0.01 cc/m²/day at 23°C and 0% RH, making them suitable for preserving the integrity of sensitive reagents. Gerresheimer utilizes these high-barrier COP materials to help minimize reagent degradation in diagnostic workflows.

Stricter Global Regulatory Frameworks Pushing Packaging Innovation

Evolving regulations by authorities such as the FDA and EMA are compelling packaging providers to develop more compliant, traceable, and reliable formats. The need for serialization, anti-counterfeit solutions, and validated packaging processes is reshaping material selection and design strategy. Regulatory requirements now include stability testing, environmental impact assessments, and full documentation trails. It must support proper labeling, shelf-life integrity, and sterility assurance to meet growing regulatory expectations. Packaging suppliers are adopting ISO 13485 and other certifications to stay competitive. Contract packaging firms are investing in high-performance cleanroom infrastructure to meet global standards. The emphasis on validated processes drives demand for advanced sealing and forming technologies. The In Vitro Diagnostics Packaging Market benefits from regulatory clarity that promotes innovation and quality control.

Increasing Global Diagnostic Testing Volumes Driving Demand for Scalable Packaging Solutions

Rising volumes of diagnostic tests across hospitals, labs, and home healthcare settings are placing pressure on packaging operations. Companies need packaging that supports mass production without compromising quality or safety. Automation in packaging lines is growing to meet high throughput requirements efficiently. Large diagnostic manufacturers are adopting flexible packaging formats to reduce costs and storage space. The need for secondary and tertiary packaging that meets transport regulations is also growing. Cold chain integration remains a focus for temperature-sensitive assays. The In Vitro Diagnostics Packaging Market is responding by enabling scalability while ensuring regulatory compliance and product protection. It is witnessing increased investment in materials with lower lead times and optimized logistics compatibility.

Greater Focus on Product Integrity and Shelf-Life Extension Across the Supply Chain

Product degradation risks from light, oxygen, or microbial contamination continue to challenge diagnostic kit stability. Packaging developers are introducing high-barrier films and laminates to preserve chemical efficacy. Vacuum-sealing and desiccant-integrated solutions are gaining traction in kit packaging. Focus is shifting toward passive packaging systems that extend shelf life without adding logistics complexity. Shelf-life validation studies influence material and design selection during product development. The packaging must support extended storage across various climates and geographies. Pharmaceutical-grade container systems are becoming the preferred choice for critical reagents. The In Vitro Diagnostics Packaging Market is increasingly defined by its ability to protect sensitive components through the product’s lifecycle.

- For instance, Amcor’s UltraGuard™ high-barrier films, utilized in diagnostic kit packaging, have demonstrated the ability to extend shelf life of lyophilized reagents by up to 24 months under accelerated stability testing at 40°C and 75% RH, as validated in published case studies with multinational diagnostic manufacturers.

Market Trends:

Shift Toward Sustainable and Recyclable Materials in Diagnostic Packaging

Growing emphasis on sustainability is driving the transition to eco-friendly materials across healthcare packaging. Regulatory bodies and healthcare providers are aligning procurement policies with sustainability goals. Companies are investing in recyclable plastics, paper-based structures, and bio-based films for diagnostic kits. The packaging must maintain barrier properties while meeting environmental performance standards. Suppliers are exploring mono-material packaging formats to improve recycling efficiency. End-users in laboratories and hospitals are increasingly demanding lower-waste packaging formats. The In Vitro Diagnostics Packaging Market is adjusting to new sustainability benchmarks set by industry leaders and government bodies. It now supports eco-conscious product portfolios without compromising sterility or performance.

Integration of Smart Labeling and Track-and-Trace Technologies for Diagnostics

Smart packaging features such as RFID, QR codes, and NFC-enabled tags are gaining traction across diagnostic test packaging. These technologies enhance product authentication, expiration monitoring, and supply chain visibility. In vitro diagnostics companies use smart labels to streamline inventory management and track usage trends. Temperature loggers and time-temperature indicators are also being embedded for cold chain-sensitive assays. The adoption of serialized labeling improves regulatory compliance and combats counterfeiting. Manufacturers are working with tech vendors to integrate digital features into primary and secondary packaging layers. The In Vitro Diagnostics Packaging Market is adapting to this trend by offering digital-ready packaging solutions across high-value product lines. It supports improved operational transparency and patient safety.

Customization and Modular Packaging Designs for Lab and Home Testing Kits

Rising diversification in diagnostic formats is leading to greater customization in packaging configurations. Lab-based test kits, home diagnostics, and clinical trial packages demand unique packaging workflows. Modular trays, resealable pouches, and pre-filled containers are being tailored to specific assay requirements. Companies are leveraging modular systems to reduce time-to-market for new diagnostic launches. It allows packaging to accommodate multiple test types within a standardized logistics framework. Medical device packaging partners offer configurable tooling to streamline prototyping and scale-up. The In Vitro Diagnostics Packaging Market is responding to demand for flexible, application-specific designs that enhance user convenience and brand identity. It supports packaging agility in an innovation-driven market.

- For instance, Cepheid’s GeneXpert Xpress cartridges were delivered in custom-molded, stackable pouches for their SARS-CoV-2 tests, allowing for rapid distribution during the COVID-19 pandemic. Cepheid reported the shipment of over 200 million of these custom cartridges worldwide by the end of 2023, according to Danaher’s

Growing Use of Cold Chain-Ready and Passive Thermal Packaging Solutions

Temperature-sensitive diagnostic kits such as molecular reagents and immunoassays require specialized cold chain packaging. Manufacturers are increasingly adopting passive thermal packaging systems to reduce dependency on active refrigeration. Expanded polystyrene (EPS) alternatives, phase change materials (PCMs), and vacuum-insulated panels are now embedded into secondary packaging. These materials help maintain internal temperatures during long-distance shipping. Kits must remain stable during distribution across diverse climates and geographies. Cold chain infrastructure advancements in developing regions further support broader test access. The In Vitro Diagnostics Packaging Market is expanding its portfolio of validated cold chain solutions that meet stringent transport and storage protocols. It ensures diagnostic integrity throughout the logistics cycle.

- For instance, Greiner Bio-One, in partnership with va-Q-tec, reported using vacuum-insulated thermal packaging to deliver over 400,000 molecular diagnostics kits to African healthcare facilities in 2022–2023, with all shipments maintained within validated temperature ranges, according to company case studies.

Market Challenges Analysis:

Complex Regulatory Landscape and Varying Global Compliance Requirements

The In Vitro Diagnostics Packaging Market faces a major challenge in managing compliance across diverse regulatory jurisdictions. Each country or region imposes different packaging and labeling rules, including language, documentation, and traceability mandates. Companies must conduct repeated validations and often maintain region-specific packaging inventories, leading to higher costs and operational inefficiencies. Delays in regulatory approvals can hinder market access and disrupt packaging timelines. It requires packaging systems that are adaptable yet standardized enough to streamline global supply chains. Smaller diagnostic manufacturers struggle to meet stringent packaging standards without significant investments. The need for constant updates to labeling, serialization, and transport protocols strains packaging development cycles. Navigating these complexities is essential for companies to maintain compliance and competitiveness.

High Material Costs and Limited Access to Sustainable Alternatives

Rising raw material prices, especially for high-barrier plastics and sterile-grade polymers, are impacting cost efficiency. The shift toward sustainable packaging is further constrained by the limited availability of recyclable medical-grade materials. Companies face challenges in sourcing eco-compliant films that match the required performance benchmarks for diagnostics. New materials often require re-validation, which adds time and cost to the product launch cycle. It becomes difficult to balance product safety, environmental goals, and pricing strategy. Supply chain disruptions have also increased lead times for critical packaging components. Diagnostic firms with limited capital reserves are particularly vulnerable to these fluctuations. Managing material supply and cost volatility remains a pressing challenge in the In Vitro Diagnostics Packaging Market.

Market Opportunities:

Expansion of Diagnostic Services in Emerging Markets Boosts Local Packaging Demand

Rapid healthcare infrastructure development in emerging economies presents growth potential for local and regional packaging providers. Governments are investing in disease surveillance, early diagnosis, and healthcare access initiatives. This expansion requires cost-effective, compliant packaging formats tailored to local logistics and storage conditions. Domestic diagnostic companies seek partners for scalable, affordable packaging options that can be deployed quickly. Growth in retail and home-based diagnostic kits is creating demand for intuitive and easy-to-use packaging formats. It opens up licensing and OEM opportunities for global firms to establish regional manufacturing hubs. The In Vitro Diagnostics Packaging Market has significant room to grow in Southeast Asia, Africa, and Latin America by aligning with expanding diagnostic access programs.

Technological Innovation in Sterile Barrier Systems and Automated Packaging Equipment

Advances in sterile barrier systems offer diagnostic firms better control over contamination risks without relying heavily on complex handling. New thermoforming, sealing, and blister-pack technologies support tamper-evident, gas-tight packaging for sensitive reagents. Automation in packaging lines enhances consistency, throughput, and compliance tracking. It allows companies to scale without sacrificing quality or increasing labor overhead. Integration of robotics and vision systems reduces packaging defects and enhances inspection accuracy. Suppliers that offer turnkey packaging solutions with in-line sterilization and digital traceability gain a competitive edge. The In Vitro Diagnostics Packaging Market is positioned to benefit from these innovations as companies seek packaging that supports faster deployment and longer shelf stability.

Market Segmentation Analysis:

The In Vitro Diagnostics Packaging Market is segmented by product type, end user, and application, each contributing uniquely to market dynamics.

By product type, bottles and vials hold the largest share due to their wide use in storing reagents and samples. Tubes and petri dishes follow, driven by their role in specimen collection and microbial testing. Closures are critical for maintaining sterility and preventing contamination. The others category, which includes trays, cassettes, and microplates, supports specialized diagnostic platforms and niche applications.

- For instance, SCHOTT AG’s TopPac® polymer vials are widely adopted for in vitro diagnostic applications, with over 1 billion units delivered globally as of 2023, featuring breakage resistance and endotoxin levels consistently below 06 EU/mL, ensuring high safety for reagent storage.

By end user, hospitals and clinical laboratories lead demand due to the high volume of routine and emergency diagnostics. Diagnostic laboratories represent a strong segment, requiring packaging that supports batch testing and storage. Home care settings are growing with the expansion of self-testing kits and portable diagnostics. Academic institutes and pharmaceutical companies contribute steadily, supporting research and clinical validation with secure and standardized packaging.

- For instance, Siemens Healthineersserves over 10,000 hospital and clinical lab customers worldwide with its Atellica and ADVIA platforms, delivering standardized reagent bottles and vials with barcoded identifiers for secure sample management.

By application, infectious disease testing accounts for the largest share due to global screening efforts and pandemic preparedness. Diabetes monitoring sees consistent growth, driven by chronic disease management programs. Oncology and cardiac marker testing are expanding rapidly, supported by advancements in personalized diagnostics. The others segment includes prenatal and autoimmune disease testing, reflecting the diversification of diagnostic offerings and the need for flexible packaging solutions. The In Vitro Diagnostics Packaging Market supports these applications with formats designed for precision, safety, and compliance across diverse settings.

Segmentation:

By Product Type

- Bottles and Vials

- Tubes

- Petri Dishes

- Closures

- Others (including trays, cassettes, microplates)

By End User

- Hospitals and Clinical Laboratories

- Diagnostic Laboratories

- Home Care Settings

- Academic Institutes

- Pharmaceutical Companies

By Application

- Infectious Disease Testing

- Diabetes Monitoring

- Oncology Testing

- Cardiac Marker Testing

- Others (including prenatal and autoimmune disease testing)

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America dominates the In Vitro Diagnostics Packaging Market with a market share of 35%. The region benefits from a mature healthcare infrastructure, a high volume of diagnostic procedures, and early adoption of innovative packaging technologies. Strong regulatory oversight from the FDA drives consistent demand for compliant and high-quality packaging solutions. Major diagnostic firms headquartered in the U.S. continue to invest in automation and sustainability across their packaging operations. Canada supports market growth through increased healthcare spending and public health screening programs. It remains a key region for advanced, tamper-evident, and temperature-controlled packaging formats.

Europe holds the second-largest market share at 28%, supported by a robust pharmaceutical and diagnostic ecosystem. The region emphasizes stringent regulatory frameworks, particularly through the European Medicines Agency (EMA) and the In Vitro Diagnostic Regulation (IVDR). Germany, France, and the UK lead in test kit consumption and manufacturing, promoting demand for sterile and traceable packaging. The push for sustainable materials and circular economy practices encourages the adoption of recyclable and mono-material packaging solutions. It reflects strong alignment between diagnostic providers and environmental policy goals. Europe remains central to innovation in high-barrier and eco-compliant packaging formats.

The Asia Pacific region accounts for 22% of the market share and is the fastest-growing region due to expanding diagnostic infrastructure and rising demand for early disease detection. Countries such as China, India, and South Korea are investing heavily in laboratory capacity and healthcare access. Domestic manufacturers are scaling up production of diagnostic kits, creating demand for cost-effective yet compliant packaging. It benefits from local material sourcing, improving supply chain efficiency. Regulatory frameworks are tightening, driving standardization and improved packaging quality. The region presents long-term opportunities for packaging providers offering scalable, low-waste, and logistics-friendly solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amcor plc

- AptarGroup Incorporated

- Thermo Fisher Scientific Incorporated

- Greiner Holding AG

- DWK Life Sciences

- COMAR, LLC

- WS Packaging Group

- SCHOTT Poonawalla (SCHOTT AG)

- SGD Pharma

- Stevanato Group

- Bio-Rad Laboratories

- Abbott Laboratories

- Siemens Healthineers

- Becton Dickinson (BD)

Competitive Analysis:

The In Vitro Diagnostics Packaging Market features strong competition among global and regional players focused on innovation, regulatory compliance, and sustainability. Leading companies such as Amcor plc, Gerresheimer AG, West Pharmaceutical Services, and DS Smith plc invest heavily in developing sterile, tamper-evident, and high-barrier packaging solutions tailored for diagnostic applications. It rewards firms with capabilities in custom design, automation, and eco-compliant materials. Strategic partnerships with diagnostic kit manufacturers help streamline packaging integration into production workflows. Players emphasize ISO-certified manufacturing, cold chain compatibility, and rapid prototyping to meet market demands. Emerging companies target cost-effective solutions for growing markets in Asia Pacific and Latin America. Continuous investment in R&D, cleanroom infrastructure, and digital traceability tools enhances competitive positioning. The market favors suppliers who can deliver scalable, compliant, and sustainable packaging formats under tight timelines.

Recent Developments:

- In July 2025, AptarGroup Incorporated strengthened its clinical trial services by acquiring the manufacturing capabilities of Mod3 Pharma. This move expands Aptar Pharma’s portfolio, offering seamless and accelerated paths to market for clinical products, and deepens its expertise in phase 1 and 2 clinical manufacturing.

- In May 2025, Thermo Fisher Scientific entered a strategic partnership with Mirai Bio to accelerate the development of genetic medicines. Thermo Fisher’s global pharmaceutical services—including cGMP services and commercial manufacturing—will be paired with Mirai’s machine intelligence-enabled platform for nucleic acid therapeutics, supporting rapid development and industrialization of targeted therapies. This partnership will initially utilize Thermo Fisher’s state-of-the-art facility for RNA and Advanced Formulations.

- In April 2025, Amcor plc successfully completed its all-stock combination with Berry Global, positioning Amcor as a global leader in consumer and healthcare packaging solutions. The integration brings substantial synergies and enhances Amcor’s product offering, particularly in the field of sustainable packaging, as the company moves into fiscal 2026 with $650million in identified synergies and a stronger innovation footprint.

- In May 2023, DWK Life Sciences completed the acquisition of Assem-Pak | Aluseal, a U.S. manufacturer of premium rubber stoppers and aluminum seals. This acquisition broadens DWK’s customizable packaging solutions, enhances its bundled services, and strengthens its manufacturing footprint for primary packaging in the diagnostic and life sciences sectors.

Market Concentration & Characteristics:

The In Vitro Diagnostics Packaging Market is moderately concentrated, with a mix of multinational corporations and specialized regional players competing across material innovation, regulatory compliance, and scalability. It is characterized by high entry barriers due to strict quality standards, sterilization requirements, and cleanroom manufacturing capabilities. Companies differentiate through proprietary technologies, sustainable material offerings, and integrated packaging solutions tailored to diagnostic applications. The market demands high reliability, precision, and traceability in packaging, favoring firms with strong R&D capabilities and ISO certifications. Long-term contracts and supplier partnerships with diagnostic kit manufacturers shape competitive dynamics.

Report Coverage:

The research report offers an in-depth analysis based on product type, end user, and application It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for advanced sterile barrier systems will rise to support the growing use of molecular diagnostics and point-of-care testing across healthcare settings.

- Adoption of sustainable and recyclable packaging materials will accelerate, driven by environmental regulations and consumer preference for eco-friendly solutions.

- Cold chain packaging solutions will expand to address the storage and transportation needs of temperature-sensitive reagents and diagnostic kits.

- Smart packaging technologies, including serialization and RFID tags, will gain traction for enhanced traceability, inventory control, and anti-counterfeit protection.

- Regional manufacturing hubs will grow to support localized production, reduce lead times, and improve supply chain resilience in key markets.

- Custom packaging formats will increase to accommodate varying diagnostic platforms, user requirements, and distribution models, including home testing.

- Automation in packaging operations will scale to improve throughput, consistency, and compliance with stringent quality and hygiene standards.

- Regulatory harmonization across international markets will streamline packaging design, reduce compliance complexity, and support faster product approvals.

- Emerging economies will drive significant demand for diagnostic packaging due to rising healthcare investments and broader test accessibility.

- Collaboration between diagnostics companies and packaging suppliers will strengthen to co-develop integrated, scalable, and regulatory-compliant solutions.