Market Overview:

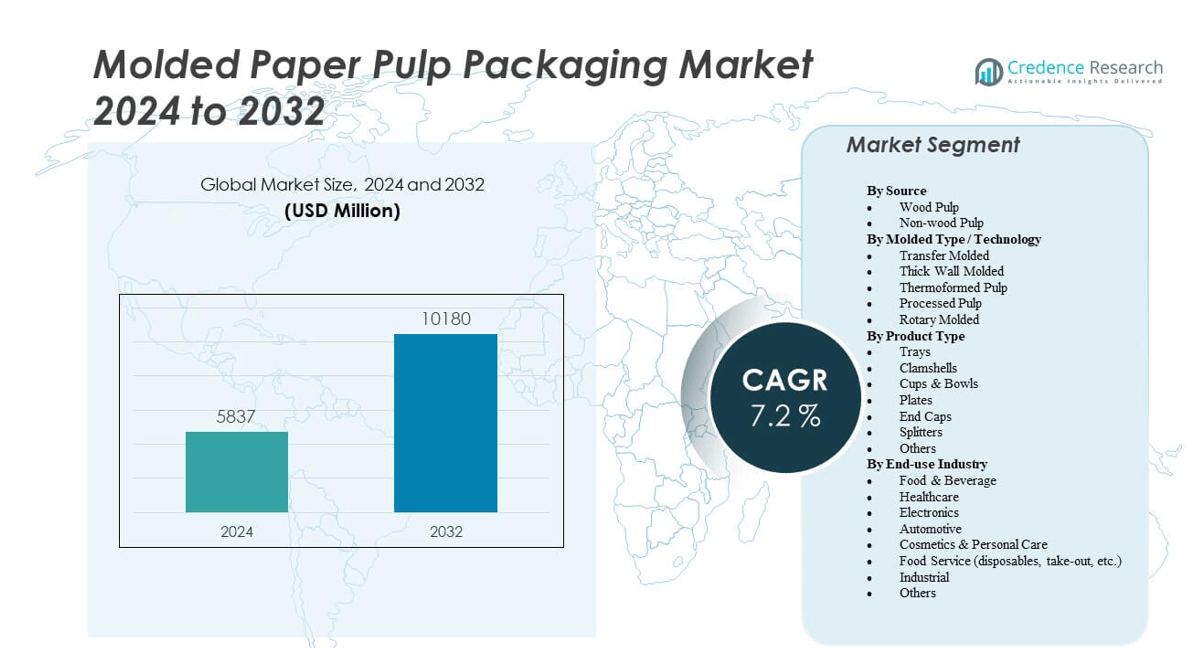

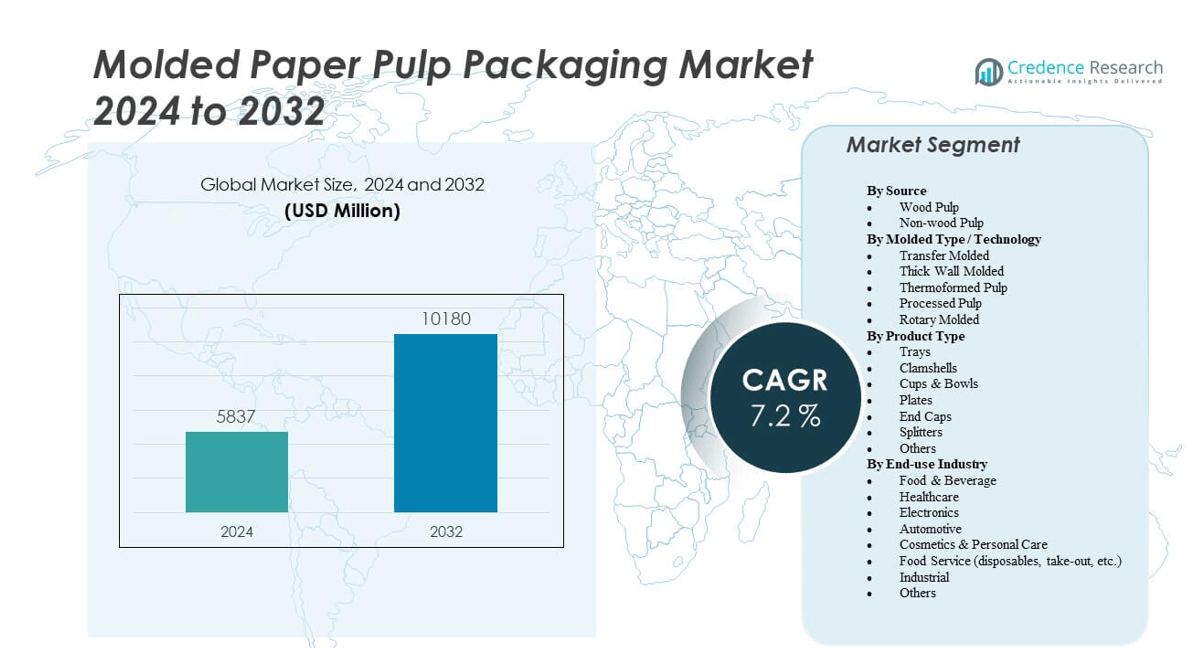

The Molded Paper Pulp Packaging Market is projected to grow from USD 5,837 million in 2024 to an estimated USD 10,180 million by 2032, with a compound annual growth rate (CAGR) of 7.2% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Molded Paper Pulp Packaging MarketSize 2024 |

USD 5,837 million |

| Molded Paper Pulp Packaging Market, CAGR |

7.2% |

| Molded Paper Pulp Packaging Market Size 2032 |

USD 10,180 million |

The market is gaining strong momentum due to increasing demand for sustainable and biodegradable packaging solutions across various industries, particularly in food and beverage, electronics, and healthcare. Heightened consumer awareness about environmental impact and strict regulations on single-use plastics are compelling manufacturers to adopt molded pulp alternatives. Companies are investing in innovative designs and automation technologies to improve efficiency, product aesthetics, and scalability, further supporting market expansion.

Regionally, North America and Europe lead the Molded Paper Pulp Packaging Market due to early adoption of sustainable practices and strong regulatory frameworks. The United States, Germany, and France remain prominent markets driven by established retail and food service industries. Meanwhile, Asia-Pacific is emerging rapidly, especially in China and India, fueled by expanding e-commerce, urbanization, and increasing awareness of eco-friendly alternatives. Latin America and the Middle East are witnessing gradual uptake as regulatory pressure and consumer preferences evolve.

Market Insights:

- The Molded Paper Pulp Packaging Market was valued at USD 5,837 million in 2024 and is expected to reach USD 10,180 million by 2032, growing at a CAGR of 7.2%.

- Rising demand for eco-friendly packaging across food, electronics, and healthcare sectors is driving widespread market adoption.

- Government regulations banning single-use plastics are accelerating the shift toward molded pulp solutions in developed and emerging economies.

- Technological advancements in mold design and biodegradable coatings are enhancing product performance and expanding application range.

- Limited barrier properties against moisture and grease restrict adoption in certain food and pharmaceutical packaging segments.

- North America holds the largest market share at 34%, driven by sustainability mandates and mature recycling infrastructure.

- Asia-Pacific is the fastest-growing region, supported by rising e-commerce, local manufacturing, and increasing consumer awareness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Sustainable Packaging Across End-Use Industries

Global efforts to replace plastic with eco-friendly materials have accelerated the adoption of molded paper pulp packaging across various industries. It is increasingly used in food service, electronics, healthcare, and consumer goods where biodegradable and recyclable options are in high demand. Governments are enforcing strict environmental policies that restrict single-use plastics, encouraging the shift toward compostable alternatives. The Molded Paper Pulp Packaging Market benefits from this regulatory pressure and corporate sustainability commitments. Brands are aligning with consumer values by adopting environmentally responsible packaging. Product innovations tailored for recyclability and compostability have improved industry appeal. Companies are leveraging molded pulp to enhance brand image and meet environmental goals. The rising preference for minimalistic, eco-friendly packaging continues to boost demand.

Government Regulations and Policies Favoring Eco-Friendly Materials

Many countries are implementing policies and mandates that limit plastic packaging and support alternatives made from renewable resources. These regulations have created favorable conditions for molded paper pulp products to replace foam, plastic, and other synthetic materials. The Molded Paper Pulp Packaging Market is witnessing strong growth in countries with active plastic ban legislation and incentives for sustainable packaging innovations. Policy frameworks in the European Union and North America drive R&D in fiber-based packaging. Compliance requirements force manufacturers to shift toward more environmentally compatible solutions. It benefits from subsidies and support schemes offered to green packaging ventures. Regulatory clarity has reduced industry risks and improved investor confidence. The global policy landscape continues to expand in support of sustainable packaging.

- For instance, California’s Plastic Pollution Reduction Act set a 25% reduction target for single-use plastics by 2032 alongside a 65% recycling rate, compelling mainstream manufacturers to switch to compostable alternatives.

Advancements in Manufacturing and Mold Design Technology

Rapid advancements in pulp molding machinery and automation are enhancing production efficiency, customization, and throughput. It allows manufacturers to meet the growing demand while maintaining consistency in quality. Computer-aided mold design has improved precision, enabling customized and complex packaging shapes tailored to product-specific needs. The Molded Paper Pulp Packaging Market is benefiting from innovations that reduce material waste and energy consumption. Production technologies now support high-speed outputs suited for large-scale commercial packaging operations. Improved drying techniques and multi-cavity molds reduce cycle times and costs. Machine learning and IoT integration support predictive maintenance and process control. The technological shift ensures scalability and cost-effectiveness, improving overall market competitiveness.

- For example, HP’s Molded Fiber Advanced Tooling Solution reduces tool weight by approximately 80%, enabling single-operator handling and faster maintenance. It also supports high-resolution customization, allowing detailed logos and recycling instructions to be molded directly into packaging at commercial scale.

Consumer Preference for Natural and Aesthetic Packaging

Growing consumer awareness around climate change and sustainability has elevated demand for eco-conscious products. Molded pulp packaging is perceived as clean, minimal, and naturally aesthetic, aligning with modern consumer preferences. It offers a tactile and visual appeal that enhances unboxing experiences in retail and e-commerce. The Molded Paper Pulp Packaging Market benefits from the trend of ethical consumption and product authenticity. Luxury and lifestyle brands are adopting molded pulp for its premium visual impression and minimal environmental impact. Rising demand for plastic-free packaging in personal care, wine, and specialty food further supports this shift. It also complements minimalist branding trends. As consumer buying behavior shifts toward sustainable values, demand for molded paper pulp packaging strengthens.

Market Trends:

Integration of Smart Features into Molded Pulp Packaging

Smart packaging features such as QR codes, NFC tags, and anti-counterfeit elements are being integrated into molded pulp formats. These features enhance traceability and consumer interaction without compromising sustainability. The Molded Paper Pulp Packaging Market is evolving with the need to combine environmental responsibility with digital utility. Brands use smart-enabled pulp trays to improve transparency and engage consumers post-purchase. Integration helps communicate product origin, shelf life, and disposal instructions. It aligns with traceability mandates in food and pharmaceutical sectors. Advanced printing techniques make it feasible to add digital markers directly onto molded surfaces. This trend supports circular economy models and consumer engagement goals. Demand for traceable, interactive packaging is growing across global markets.

- For example, Toppan embeds tamper‑evident NFC tags directly into molded fiber or paper packaging, preserving package design while enabling secure anti‑counterfeit and item‑level traceability. This structural integration supports seamless smartphone scanning and supply‑chain authentication without external labels.

Design Optimization and Customization for Brand Differentiation

Brands increasingly demand customized packaging that communicates identity, values, and product positioning. Molded pulp allows for high degrees of shape, texture, and design flexibility. The Molded Paper Pulp Packaging Market is experiencing rising interest from premium and boutique brands. Customized packaging supports visual shelf appeal and storytelling. Molded features like embossing and engraving help reinforce brand identity. Color infusion and biodegradable inks allow further personalization. It responds to the retail industry’s need for packaging that differentiates and delights. Manufacturers invest in tooling and mold innovations to offer unique geometries. The trend is particularly strong in cosmetics, electronics, and artisanal goods.

Expansion of Molded Pulp into Non-Traditional Applications

Beyond traditional egg trays and cup carriers, molded pulp is penetrating new application areas such as medical packaging, protective industrial trays, and furniture cushioning. The Molded Paper Pulp Packaging Market is expanding in scope due to advancements in structural integrity and moisture resistance. Modified pulp compositions enhance performance in humid or high-impact settings. Automotive and aerospace suppliers explore molded pulp for lightweight protective packaging. It addresses demands for recyclable transport solutions across supply chains. Demand is also rising in horticulture, where molded pulp is used for plant pots and seeding trays. Application diversity helps the market adapt to multiple industry needs. This trend indicates long-term market resilience.

- For example, PulPac, through its Blister Pack Collective initiative, has developed dry-molded fiber blister packaging aimed at replacing plastic in pharmaceutical and medical applications. These fiber-based packs significantly reduce plastic use and offer improved end-of-life sustainability through recyclability and compostability.

Growing Role of Retail and E-Commerce in Driving Demand

The surge in direct-to-consumer shipments and e-commerce transactions has amplified demand for protective, lightweight, and sustainable packaging formats. Molded pulp fits these requirements effectively. The Molded Paper Pulp Packaging Market benefits from retail brands seeking environmentally conscious unboxing experiences. E-commerce requires secure and shock-absorbent packaging to reduce product damage. Pulp trays, inserts, and corner protectors are increasingly replacing plastic foam or bubble wrap. Retailers are also switching to molded pulp for shelf-ready packaging. It supports brand transparency and regulatory compliance. Consumer feedback loops from online reviews often praise sustainable packaging choices. Retailers use packaging as a differentiator in competitive digital marketplaces.

Market Challenges Analysis:

Limitations in Barrier Properties and Moisture Resistance

One of the significant challenges in the Molded Paper Pulp Packaging Market is the limited barrier performance of pulp materials against moisture, grease, and oxygen. It hampers the application of molded pulp in industries requiring extended shelf life or strict hygiene, such as frozen foods and pharmaceuticals. Although innovations like plant-based coatings are being tested, they often add to costs or compromise recyclability. Achieving performance parity with plastic in demanding applications remains a hurdle. This limitation discourages adoption in high-moisture or high-fat content packaging. Temperature sensitivity also restricts use in thermal packaging formats. Market players are compelled to balance functionality and sustainability without sacrificing performance.

High Capital Investment and Production Complexity

Setting up pulp molding lines requires significant capital investment and specialized technical expertise. The Molded Paper Pulp Packaging Market faces barriers to entry for small and medium enterprises due to complex mold-making and drying processes. Production efficiency depends on precision tooling and energy-intensive operations. Operators need to invest in high-grade molds, water filtration systems, and drying ovens. Inconsistent quality from low-grade setups can damage brand reputation and limit scalability. Achieving consistent throughput and structural integrity across batch volumes adds operational challenges. These production constraints slow down widespread market penetration, especially in cost-sensitive emerging markets.

Market Opportunities:

Rising Demand from Emerging Economies and Localized Manufacturing

Rapid urbanization and evolving environmental regulations in emerging economies present strong opportunities for molded pulp packaging. Countries such as India, Brazil, and Indonesia are experiencing rising awareness about plastic waste and shifting consumer preferences. The Molded Paper Pulp Packaging Market can capitalize on localized manufacturing using agricultural waste and recycled paper as feedstock. It supports rural employment and decentralizes supply chains. Regional governments are encouraging sustainable business models, further easing market entry. Local players can use abundant biomass resources to produce cost-effective molded packaging. Increasing demand from local FMCG, food delivery, and retail sectors further opens regional growth avenues.

Innovations in Coating Technologies and Hybrid Packaging Models

Ongoing innovations in biodegradable coatings and composite formulations enable molded pulp to compete in moisture-sensitive applications. It supports wider usage in frozen foods, dairy, and high-end electronics. The Molded Paper Pulp Packaging Market is seeing collaboration between coating developers and packaging manufacturers to improve surface properties without compromising sustainability. Hybrid models, where molded pulp is combined with bio-laminates or water-resistant liners, are entering commercial use. These solutions offer a bridge between full plastic replacement and performance integrity. Opportunities exist in developing region-specific or product-specific barrier formulations. Players investing in advanced material science will gain a competitive edge.

Market Segmentation Analysis:

The Molded Paper Pulp Packaging Market is segmented

By source into wood pulp and non-wood pulp. Wood pulp currently holds a larger share due to its consistent fiber quality and wide availability. However, non-wood pulp—sourced from agricultural waste, grasses, and bagasse—is gaining traction as sustainability and circular economy practices take priority. It supports localized sourcing and reduces raw material dependency, especially in emerging economies focused on waste valorization.

- For example, Huhtamaki’s Future Smart Duo fiber lids are made from renewable plant-based materials, including wood fiber and bagasse, a byproduct of sugarcane processing. These lids are plastic-free, recyclable, and industrially compostable, offering a sustainable alternative for hot and cold beverages.

By molded type or technology, transfer molded and thermoformed pulp dominate due to their ability to produce smooth-surfaced, dimensionally accurate packaging. Thick wall and rotary molded types cater to industrial applications where durability is key. Processed pulp is increasingly used in customized protective packaging across electronics and medical devices, supporting complex product requirements.

- For example, Brødrene Hartmann A/S is a leading global producer of molded fiber egg packaging, with operations in the U.S. and a strong presence in the North American market. The company offers premium cartons with smooth surfaces suitable for high-quality retail printing.

By product type, trays, clamshells, and end caps are widely adopted due to their versatility and protective capabilities. Cups, bowls, and plates serve the food and beverage segment, while splitters and specialty formats support electronics and fragile items.

By end-use industry, food and beverage remains the largest segment due to strong demand for sustainable alternatives in fresh produce and takeaway services. Healthcare and electronics segments are growing rapidly, requiring sterile, protective, and eco-friendly packaging. Automotive, cosmetics, and industrial users are also increasing adoption for component packaging, gift boxes, and display products. The Molded Paper Pulp Packaging Market reflects a broad application base, with growing demand across sectors aiming to reduce plastic reliance and meet environmental mandates.

Segmentation:

By Source

- Wood Pulp

- Non-wood Pulp (includes agricultural waste, grasses, bagasse, etc.)

By Molded Type / Technology

- Transfer Molded

- Thick Wall Molded

- Thermoformed Pulp

- Processed Pulp

- Rotary Molded

By Product Type

- Trays

- Clamshells

- Cups & Bowls

- Plates

- End Caps

- Splitters

- Others

By End-use Industry

- Food & Beverage

- Healthcare

- Electronics

- Automotive

- Cosmetics & Personal Care

- Food Service (disposables, take-out, etc.)

- Industrial

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America holds the largest share of the Molded Paper Pulp Packaging Market, accounting for 34% of the global revenue in 2024. The region’s dominance is driven by strong regulatory enforcement against single-use plastics, a well-established recycling infrastructure, and rising demand for sustainable packaging across retail, food service, and electronics. The United States plays a central role, with packaging manufacturers investing heavily in automation and product innovation. High consumer awareness and corporate sustainability commitments further support growth in this market. Canada also contributes significantly due to eco-conscious policies and government incentives promoting biodegradable packaging. Market maturity in North America ensures consistent demand and steady innovation.

Europe represents the second-largest market, capturing 28% of the Molded Paper Pulp Packaging Market share in 2024. It benefits from strict environmental legislation under the EU Green Deal and widespread consumer adoption of plastic alternatives. Countries like Germany, France, and the Netherlands lead with advanced recycling programs and strong commercial adoption of pulp-based solutions. The region continues to invest in packaging R&D, especially in food-safe coatings and high-performance molded fiber. European manufacturers are also expanding their export capabilities, supplying pulp packaging to global clients seeking compliance with EU standards. Sustainable retail trends and corporate ESG commitments further boost regional demand.

Asia-Pacific holds a 22% share and emerges as the fastest-growing region in the Molded Paper Pulp Packaging Market. Rapid industrialization, urbanization, and the growth of e-commerce across countries like China, India, and Southeast Asian economies are driving demand. China dominates regional production, leveraging its raw material availability and cost-efficient manufacturing. India’s market is expanding through localized pulp molding businesses using agricultural waste as feedstock. Japan and South Korea are witnessing uptake in premium and eco-conscious consumer segments. Regional demand is further propelled by governmental bans on plastic and rising sustainability awareness among middle-class consumers. Asia-Pacific is poised to gain a larger market share over the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Huhtamaki Oyj

- Pactiv Evergreen Inc. (Pactiv LLC)

- UFP Technologies Inc.

- Brodrene Hartmann A/S

- EnviroPAK Corporation

- Best Plus Pulp Co.

- FiberCel Packaging LLC

- Henry Molded Products Inc.

- Keiding Inc.

- Pacific Pulp Molding LLC

Competitive Analysis:

The Molded Paper Pulp Packaging Market features a moderately fragmented landscape with a mix of global players and specialized regional manufacturers. Key companies such as Huhtamaki Oyj, Pactiv Evergreen Inc., UFP Technologies Inc., and Brodrene Hartmann A/S lead through innovation, automation, and diversified end-use offerings. These players invest in new product development and sustainable coatings to enhance product performance and expand applications. Regional firms like EnviroPAK Corporation, FiberCel Packaging LLC, and Keiding Inc. compete by leveraging localized production and cost efficiency. The market witnesses growing interest from companies integrating digital printing and custom mold capabilities. Strategic partnerships, capacity expansions, and acquisitions are common as players aim to strengthen their geographic reach and product portfolios. Competitive advantage hinges on design innovation, material sourcing, and technological integration across manufacturing processes.

Recent Developments:

- In July 2025, Huhtamaki Oyj launched new compostable ice cream cups that combine innovative recyclability and compostability, expanding their eco-friendly product range for the ice cream industry. These cups are made from responsibly sourced paperboard and feature a bio-based material coating, keeping plastic content below 10% and reinforcing the company’s commitment to sustainability.

- In April 2025, Pactiv Evergreen Inc. became part of Novolex after a $6.7 billion acquisition. This merger created a leading entity in food, beverage, and specialty packaging, allowing both brands to combine their portfolios and drive further product innovation and operational excellence. Following this transaction, Pactiv Evergreen’s stock was delisted from Nasdaq, and the company now works under Novolex’s leadership.

- In July 2024, EnviroPAK Corporation entered a new era with Patrick Martini becoming the full owner and relocating the company to a new manufacturing facility in Portland, Oregon. With this change, EnviroPAK aims to focus on advanced R&D and introduce innovative food processing and packaging solutions, fueling growth and operational flexibility for customers.

Market Concentration & Characteristics:

The Molded Paper Pulp Packaging Market exhibits moderate concentration with a combination of established multinational firms and emerging local producers. It operates within a cost-sensitive yet innovation-driven environment, with companies focusing on sustainability, product protection, and aesthetic appeal. The market favors vertically integrated players that control raw material sourcing and mold design. Customization, speed-to-market, and regulatory compliance are key competitive factors. It evolves rapidly with advancements in barrier coatings and forming technologies that expand application scope. The industry responds quickly to environmental policies and shifting consumer preferences, reinforcing its adaptability and long-term growth potential.

Report Coverage:

The research report offers an in-depth analysis based on Source, Molded Type / Technology, Product Type and End-use Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising consumer preference for eco-friendly alternatives will continue to drive adoption of molded pulp packaging across retail and consumer goods sectors.

- Expansion of e-commerce will fuel demand for sustainable protective packaging solutions in direct-to-consumer shipments.

- Technological advancements in mold design and production automation will enhance scalability and product consistency.

- Government bans on single-use plastics will strengthen regulatory support for fiber-based packaging formats.

- Increasing application in electronics, cosmetics, and healthcare sectors will diversify the market’s end-user base.

- Investments in biodegradable barrier coatings will improve suitability for moisture-sensitive products.

- Local manufacturing using agricultural waste and recycled fibers will gain traction in emerging economies.

- Smart packaging integrations like QR codes and NFC tags will boost brand engagement and traceability.

- Mergers and acquisitions will continue as key players aim to expand geographic reach and capabilities.

- The market will benefit from growing ESG mandates and sustainability reporting across global supply chains.