Market Overview

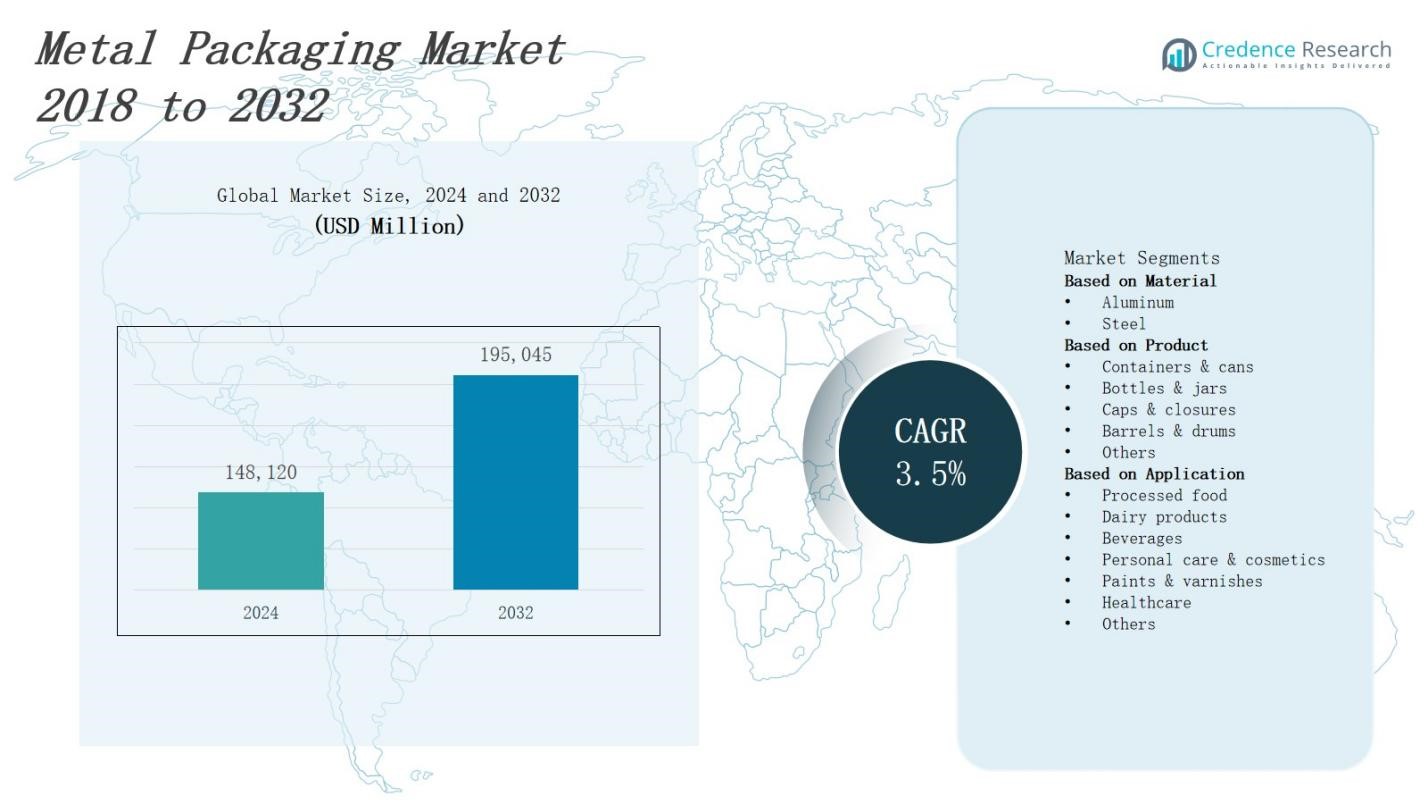

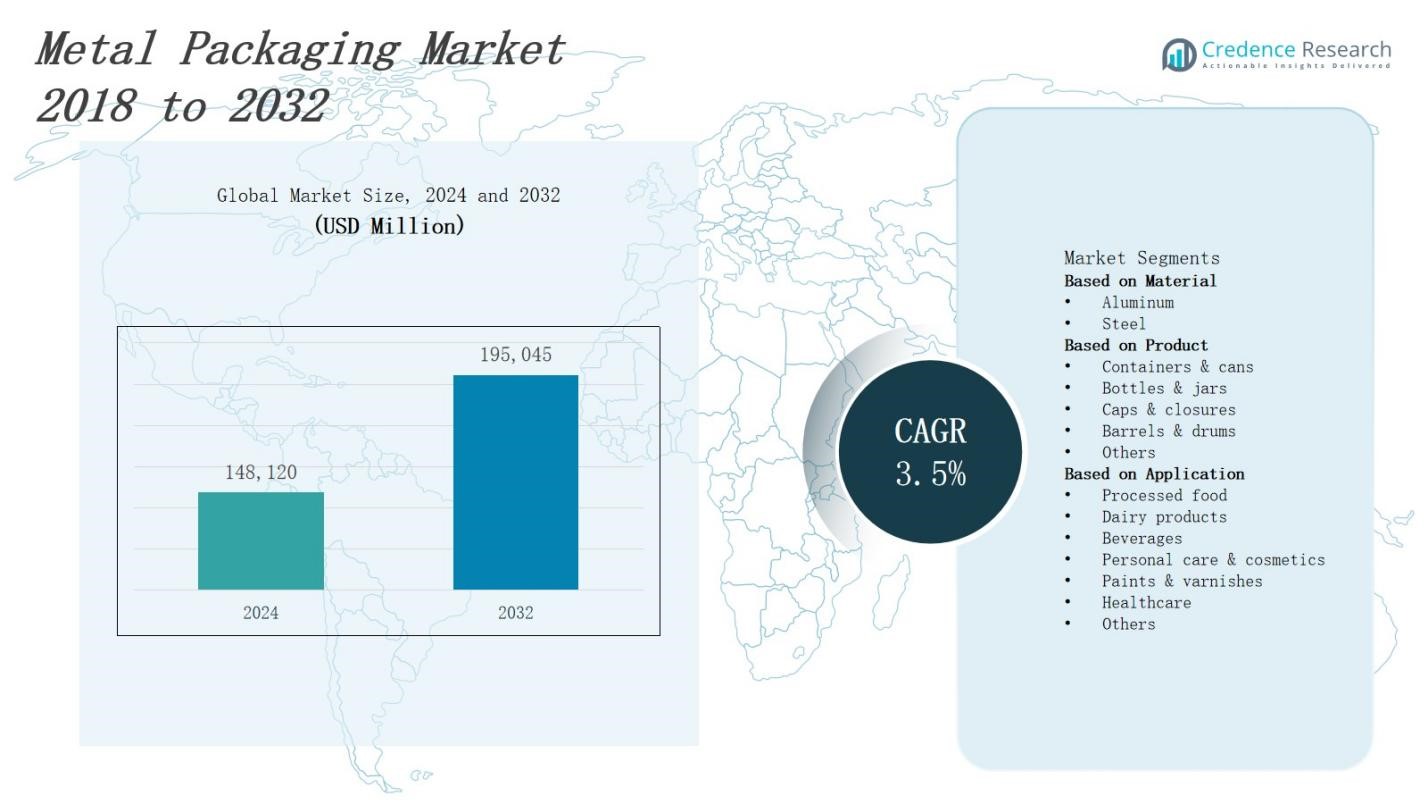

The global metal packaging market is projected to expand from USD 148,120 million in 2024 to USD 195,045 million by 2032, growing at a CAGR of 3.5%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Metal Packaging Market Size 2024 |

USD 148,120 Million |

| Metal Packaging Market , CAGR |

3.5% |

| Metal Packaging Market Size 2032 |

USD 195,045 Million |

Manufacturers invest in corrosion‑resistant alloys to support growing demand for sustainable packaging. Rising beverage consumption and food safety regulations drive adoption of metal cans and closures. Brands leverage digital printing and embossing to enhance shelf appeal. Growth in e‑commerce fuels demand for durable, lightweight metal containers designed for long‑distance shipping. Regulatory emphasis on recyclability and circular economy principles boosts use of infinitely recyclable aluminum and steel. Technological advances in thin‑gauge production and alloy formulations optimize material use and cost efficiency. Collaborations between metal producers and converters accelerate innovation in barrier coatings, supporting market expansion and responding to consumer preferences.

The metal packaging market spans key regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America and Europe lead with strong recycling infrastructure and stringent regulations, holding significant market shares. Asia Pacific experiences rapid growth driven by urbanization and rising consumer demand. Latin America and the Middle East & Africa present emerging opportunities despite infrastructure challenges. Leading players such as Amcor, Ball Corporation, Ardagh Group, Crown Holdings, and Silgan Holdings drive innovation and expansion across these regions, leveraging sustainability and technological advancements to capture market share globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global metal packaging market is projected to grow from USD 148,120 million in 2024 to USD 195,045 million by 2032, with a CAGR of 3.5%.

- Manufacturers focus on corrosion-resistant alloys to meet rising demand for sustainable packaging solutions.

- Increasing beverage consumption and stringent food safety regulations drive adoption of metal cans, closures, and high-barrier packaging.

- Digital printing, embossing, and lightweight container designs enhance shelf appeal and support e-commerce logistics.

- Regulatory pressure on recyclability promotes use of infinitely recyclable aluminum and steel, aligning with circular economy principles.

- Technological advances in thin-gauge production and alloy formulation improve material efficiency and cost control.

- Key regions include North America (28%), Europe (32%), Asia Pacific (27%), Latin America (8%), and Middle East & Africa (5%), where leading players like Amcor and Ball Corporation drive innovation and expansion.

Market Drivers

Rising Beverage and Food Demand

Growing consumer demand for ready-to-drink beverages drives container requirements. Food safety regulations enforce stricter packaging standards across canned goods. The metal packaging market responds by offering high-barrier cans that protect product quality. It delivers consistent performance under extreme temperature and pressure variations. Premiumization trends push brands toward customized finishes and unique shapes. Collaborative projects between beverage companies and metal converters accelerate product innovation and market penetration. Manufacturers expand production capacity in high-growth regions to meet rising volumes.

- For instance, Ardagh Group converted its UK Rugby plant from steel to aluminium cans in 2018 to meet demand for lightweight, high-quality packaging that better protects product integrity under varying conditions.

Regulatory Emphasis on Sustainability

Governments enforce recycling targets to reduce packaging waste. Legislation mandates recyclable content and material recovery rates. The metal packaging market aligns with circular economy principles by using infinitely recyclable aluminum and steel. It cuts carbon footprint through lightweight gauges and efficient processing. Environmental certifications and compliance audits drive supplier accountability. Industry alliances facilitate standardized collection and recycling infrastructure development. Suppliers invest in closed-loop systems to track material flows.

Advancements in Material and Manufacturing Technology

Innovations in alloy formulations enhance corrosion resistance and reduce weight. High-precision thin-gauge production techniques optimize raw material usage and cut costs. The metal packaging market benefits from barrier coatings that extend shelf life and preserve flavor. It supports integration of smart technologies like NFC and QR codes for traceability. Automated stamping and welding systems increase output consistency and reduce labor needs. R&D partnerships between metal producers and research institutes accelerate process improvements. Manufacturers deploy digital inspection tools to ensure defect-free output.

- For instance, Arnold Magnetic Technologies produces ultra-thin alloy strips, including thin titanium and silicon steels, which enhance the strength and reduce the weight of components in aerospace and motor applications, showcasing precise thin-gauge production capabilities.

E-commerce and Supply Chain Dynamics

Rapid growth in online retail demands durable and tamper-evident packaging solutions. Efficient stacking and nesting designs reduce shipping volume and transportation costs. The metal packaging market accommodates these needs with robust container formats. It withstands handling stresses and protects contents over long distances. Cross-border trade agreements and logistics advancements streamline delivery times. Stakeholders optimize inventory management by leveraging predictive analytics and just-in-time production. Packaging converters expand regional warehouses to enhance distribution flexibility.

Market Trends

Increased Adoption of Sustainable and Recyclable Materials

The metal packaging market emphasizes sustainability by adopting aluminum and steel, both of which offer infinite recyclability. Companies prioritize lightweight designs to reduce material consumption and transportation emissions. Brands promote eco-friendly credentials to meet consumer demand for responsible packaging. Industry players invest in closed-loop recycling systems to ensure resource efficiency. Suppliers collaborate with waste management firms to improve collection and sorting processes. Recycling initiatives gain traction across regions, influencing product development and market growth.

- For instance, Crown Holdings launched the Twentyby30 initiative, which sets ambitious recycling targets globally and promotes consumer education to boost metal recycling rates and the recycled content in their products.

Integration of Advanced Printing and Decoration Technologies

Digital printing gains prominence for metal packaging, enabling high-resolution graphics and rapid customization. It allows brands to deliver limited-edition designs and regional variations with shorter lead times. Embossing and laser engraving enhance tactile appeal and brand differentiation. The metal packaging market leverages these technologies to increase consumer engagement and shelf impact. Automation in printing processes improves precision and reduces production errors. Adoption of eco-friendly inks supports regulatory compliance and environmental goals. Continuous innovation in decoration techniques drives competitive advantage.

- For instance, BrewDog, a craft beer company, utilizes embossed aluminum cans with full-body high-resolution printing to tell its brand story and launch limited-edition designs that boost consumer engagement and brand loyalty.

Expansion of Smart and Interactive Packaging Solutions

Smart packaging technologies, including NFC tags and QR codes, enhance consumer interaction and product traceability. The metal packaging market integrates these features to provide authenticity verification and personalized marketing. Real-time data capture supports supply chain transparency and anti-counterfeit measures. Brands use interactive elements to gather consumer insights and build loyalty. Integration with mobile applications creates new engagement channels. Investments in smart packaging contribute to operational efficiency and enhanced user experience. This trend supports digital transformation across the packaging ecosystem.

Growing Demand from Emerging Markets and New Applications

Emerging economies demonstrate increasing consumption of packaged beverages and processed foods, expanding metal packaging demand. The metal packaging market diversifies into non-traditional sectors such as personal care and pharmaceuticals. Lightweight, durable metal containers meet strict safety and shelf-life requirements in these industries. Manufacturers expand production facilities closer to growth regions to reduce costs and improve responsiveness. Strategic partnerships accelerate market entry and local customization. These dynamics foster competitive positioning and long-term market expansion.

Market Challenges Analysis

Raw Material Price Volatility and Supply Chain Constraints

Fluctuations in prices of aluminum and steel create cost uncertainties for manufacturers. The metal packaging market faces challenges in securing stable raw material supplies amid geopolitical tensions and trade restrictions. Supply chain disruptions increase lead times and production costs, impacting profitability. It requires strategic sourcing and inventory management to mitigate risks. Rising energy expenses for metal processing add financial pressure. Manufacturers must balance cost control with quality and sustainability goals. Volatile markets demand agile procurement strategies and long-term supplier partnerships.

Environmental Regulations and Compliance Costs

Stringent environmental laws impose higher standards for emissions, waste management, and recyclability. The metal packaging market invests in cleaner technologies and process upgrades to meet regulatory requirements. It incurs additional capital expenditure for emission controls and certification processes. Compliance complexities vary across regions, creating challenges for global manufacturers. Failure to adhere risks penalties and reputational damage. Companies must maintain transparent reporting and collaborate with regulators. Navigating evolving legislation demands proactive planning and continuous improvement initiatives.

Market Opportunities

Expansion into Emerging Markets with Growing Consumer Demand

The metal packaging market can capitalize on rising disposable incomes and urbanization in emerging economies. Increasing demand for packaged beverages and processed foods drives container consumption in these regions. It can tailor product offerings to local preferences and regulatory standards. Establishing manufacturing facilities closer to key markets reduces logistics costs and improves responsiveness. Partnerships with regional distributors and brand owners enhance market penetration. Investment in market-specific innovations creates competitive differentiation. These strategies enable sustained growth in high-potential territories.

Innovation in Sustainable and Smart Packaging Solutions

Growing consumer focus on sustainability presents opportunities to develop eco-friendly metal packaging with reduced material usage. The metal packaging market can leverage advancements in lightweight alloys and recyclable coatings to meet environmental mandates. Integration of smart technologies such as NFC and QR codes offers enhanced consumer engagement and supply chain transparency. It can collaborate with technology providers to create interactive packaging experiences. Expansion of smart packaging supports premiumization and brand loyalty. These innovations open new revenue streams and strengthen market positioning.

Market Segmentation Analysis:

By Material

The metal packaging market primarily segments into aluminum and steel. Aluminum dominates due to its lightweight, corrosion resistance, and recyclability, making it ideal for beverage cans and food containers. Steel offers superior strength and durability, preferred in barrels, drums, and heavy-duty containers. It serves industries requiring robust protection and extended shelf life. Both materials drive innovation in sustainable packaging solutions. Manufacturers optimize alloy compositions to enhance performance while reducing environmental impact.

- For instance, Del Monte uses hermetically sealed metal cans to preserve fruits and vegetables naturally, aligning with the consumer demand for clean-label products without preservatives.

By Product

Containers and cans represent the largest product segment, widely used in food and beverage packaging for their protective properties. Bottles and jars gain traction in personal care and healthcare sectors for secure and hygienic storage. Caps and closures ensure product integrity and convenience across all packaged goods. Barrels and drums serve industrial applications, including paints and varnishes, requiring bulk containment. The metal packaging market expands product offerings to meet diverse industry requirements and consumer preferences.

- For instance, Open Top Sanitary (OTS) cans made from tinplate or aluminum are extensively used for processed foods like soups and vegetables due to their durability and airtight seals that ensure long shelf life.

By Application

Processed food and beverages constitute the major application segments, driven by growing demand for convenience and extended shelf life. Dairy products benefit from metal packaging’s barrier properties that preserve freshness. Personal care and cosmetics adopt metal containers for premium appeal and product protection. The healthcare sector relies on sterile, tamper-evident packaging solutions. Paints and varnishes utilize durable metal drums for safe transportation. The metal packaging market tailors its solutions to meet the specific needs of varied end-use industries.

Segments:

Based on Material

Based on Product

- Containers & cans

- Bottles & jars

- Caps & closures

- Barrels & drums

- Others

Based on Application

- Processed food

- Dairy products

- Beverages

- Personal care & cosmetics

- Paints & varnishes

- Healthcare

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

The North America metal packaging market holds a significant share of 28%. It benefits from a mature beverage industry and stringent food safety regulations that drive demand for durable packaging. The region’s strong recycling infrastructure supports sustainable metal packaging adoption. Leading manufacturers focus on innovation in lightweight alloys and digital decoration to meet consumer preferences. E-commerce growth increases demand for protective and tamper-evident packaging solutions. Investments in advanced manufacturing facilities enhance production efficiency. North America remains a key market for premium and specialty metal packaging products.

Europe

Europe commands a 32% share in the metal packaging market, driven by robust sustainability mandates and circular economy initiatives. It enforces strict regulations on recyclability, pushing manufacturers to adopt eco-friendly materials and designs. The region’s well-established food and beverage sectors fuel demand for high-quality metal containers. Innovation in smart packaging technologies enhances product traceability and consumer engagement. Collaborative efforts between industry and government improve recycling systems. Europe’s focus on reducing carbon footprints propels lightweight and energy-efficient production. It remains a global leader in metal packaging sustainability practices.

Asia Pacific

The Asia Pacific metal packaging market accounts for 27% of the global share. Rapid urbanization and rising disposable incomes increase consumption of packaged foods and beverages. It attracts investments in manufacturing capacities to cater to growing domestic and export demands. The region witnesses expanding applications in personal care and healthcare packaging. Market players adapt products to local regulations and cultural preferences. Infrastructure improvements in logistics and recycling support market growth. Asia Pacific offers significant opportunities for metal packaging expansion.

Latin America

Latin America holds 8% market share in metal packaging. It experiences steady growth fueled by increasing processed food consumption and beverage sales. It faces challenges in recycling infrastructure, but ongoing government initiatives aim to improve sustainability. The market benefits from expanding e-commerce and modern retail channels. Local manufacturers collaborate with global players to introduce innovative packaging solutions. Investments focus on enhancing production capabilities and supply chain efficiency. Latin America presents a developing market with growth potential.

Middle East and Africa

The Middle East and Africa contribute 5% to the metal packaging market. Demand increases due to rising food and beverage industries and growing urban populations. It encounters logistical and regulatory challenges that impact market expansion. Efforts to improve recycling and waste management gain momentum. The market explores new applications in healthcare and personal care sectors. Investments target regional manufacturing and distribution improvements. The region offers emerging opportunities with gradual market development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Silgan Holdings

- CCL Containers

- Greif

- Crown Holding

- Amcor

- Mauser Packaging Solutions

- Ball Corporation

- Sonoco Products

- Novelis

- Ardagh Group

- CAN-PACK

- CPMC Holdings

- DS Containers

Competitive Analysis

The metal packaging market features a competitive landscape dominated by established global players and innovative regional manufacturers. Leading companies such as Amcor, Ball Corporation, Ardagh Group, and Crown Holdings focus on expanding product portfolios and enhancing sustainability through advanced materials and recycling initiatives. It prioritizes investments in technology to improve production efficiency and decoration capabilities. Strategic partnerships and acquisitions enable market participants to enter new regions and diversify applications. The market demands continuous innovation in lightweight alloys and smart packaging solutions to meet evolving consumer preferences and regulatory requirements. Smaller players leverage customization and niche segments to maintain competitiveness. Overall, the metal packaging market remains dynamic, driven by technological advancements and growing sustainability commitments among key stakeholders.

Recent Developments

- On June 24, 2024, Sonoco Products Company announced it would acquire Eviosys, Europe’s leading food cans, ends and closures manufacturer, for approximately $3.9 billion.

- On April 15, 2025, Steelforce Packaging expanded its business by launching a dedicated Aluminium Division to meet growing demand for sustainable and recyclable aluminum packaging globally.

- In 2023, Coca-Cola partnered with Novelis to use 100% recycled aluminum in its cans by 2030, supporting its “World Without Waste” sustainability initiative.

- In July 2024, AkzoNobel introduced its Securshield 500 series coatings for metal packaging, designed to be free from bisphenols and PVC.

Market Concentration & Characteristics

The metal packaging market demonstrates a moderately concentrated structure dominated by several global key players such as Amcor, Ball Corporation, Ardagh Group, and Crown Holdings. These companies maintain strong competitive advantages through extensive manufacturing capacities, advanced technological capabilities, and robust distribution networks. It exhibits high barriers to entry due to capital-intensive production processes and stringent regulatory requirements. The market features continuous innovation in sustainable materials, lightweight alloys, and smart packaging solutions to meet evolving consumer and regulatory demands. Regional diversification and strategic partnerships enable companies to expand their geographical footprint and address localized market needs. The metal packaging market balances competition with collaboration through joint ventures and mergers, fostering innovation and efficiency. Demand stability in core segments like beverages and processed foods supports steady growth, while emerging applications in healthcare and personal care provide new opportunities. Overall, the market reflects a dynamic environment shaped by innovation, sustainability, and strategic consolidation.

Report Coverage

The research report offers an in-depth analysis based on Material, Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The metal packaging market will expand due to increasing demand for sustainable and recyclable materials.

- Manufacturers will invest more in lightweight alloys to reduce material usage and shipping costs.

- Digital printing and advanced decoration techniques will enhance brand differentiation and consumer appeal.

- Smart packaging technologies like NFC and QR codes will gain wider adoption for improved traceability and engagement.

- Growth in e-commerce will drive demand for durable, tamper-evident metal containers.

- Emerging markets will offer significant opportunities due to rising urbanization and disposable incomes.

- Regulatory pressure will push companies to adopt eco-friendly production processes and materials.

- Collaboration between metal producers and converters will accelerate innovation in barrier coatings and packaging performance.

- Automation and digital inspection tools will improve production efficiency and reduce defects.

- Expansion into new application areas such as healthcare and personal care will support market diversification.