Market Overview:

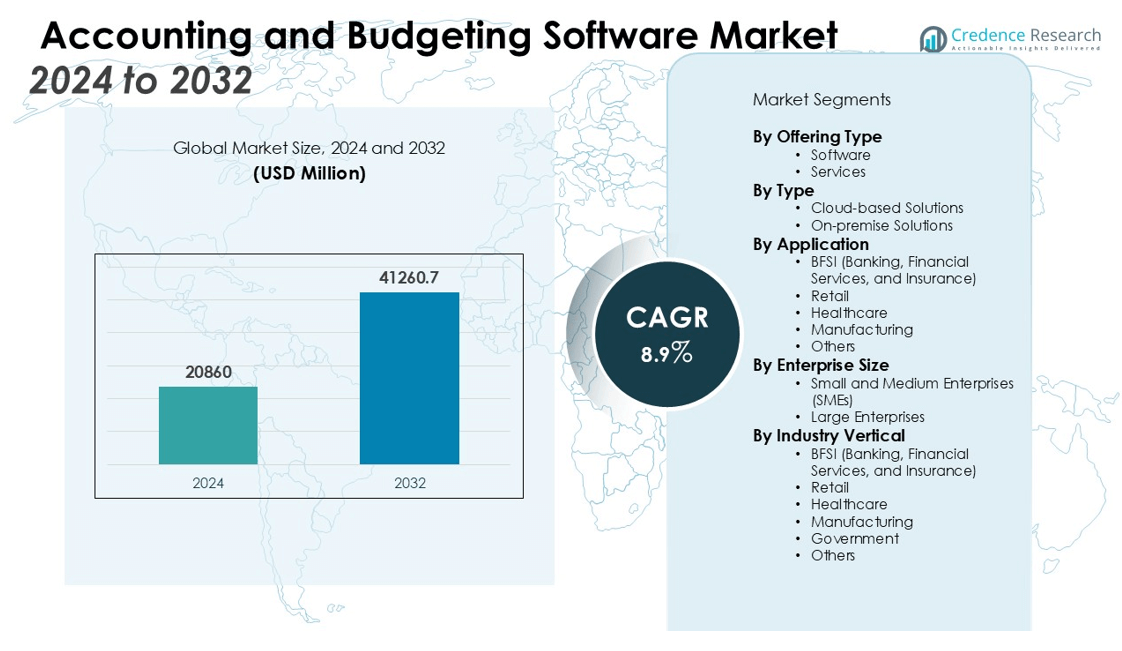

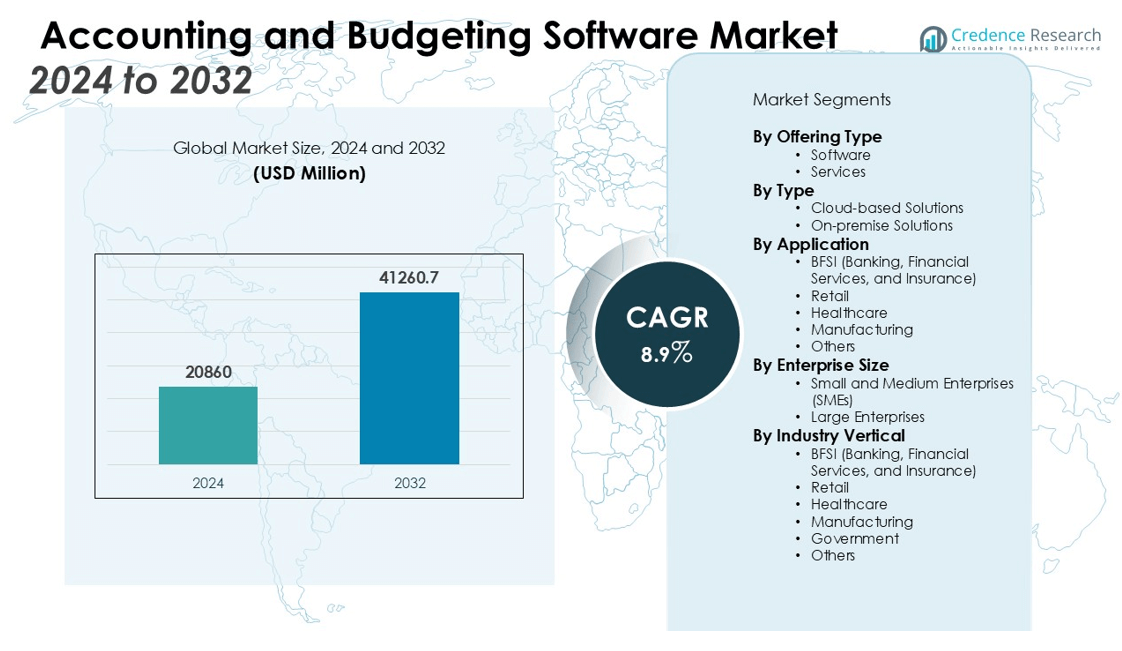

The Accounting and Budgeting Software Market size was valued at USD 20860 million in 2024 and is anticipated to reach USD 41260.7 million by 2032, at a CAGR of 8.9% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Accounting and Budgeting Software Market Size 2024 |

USD 20860 million |

| Accounting and Budgeting Software Market, CAGR |

8.9% |

| Accounting and Budgeting Software Market Size 2032 |

USD 41260.7 million |

Key drivers fueling this growth include the increasing adoption of cloud-based solutions, automation, and artificial intelligence (AI) integration. Cloud platforms offer scalability and cost-effectiveness, while AI enhances real-time analytics and decision-making capabilities. Additionally, the rise of remote work and stringent regulatory compliance requirements have heightened the demand for efficient financial management tools. The shift towards integrated financial solutions that streamline operations and ensure data accuracy is also driving growth in this market.

Regionally, North America leads the market, driven by a high concentration of small and medium-sized enterprises (SMEs) and large enterprises adopting advanced financial solutions. The United States, in particular, accounts for a significant share due to early technology adoption and substantial investments in digital transformation. The Asia-Pacific region is expected to witness the highest growth rate, fueled by rapid digitalization and increasing enterprise needs in emerging economies like India and China. The adoption of advanced financial tools in the region is further accelerated by government initiatives promoting digital financial services.

Market Insights:

- The Accounting and Budgeting Software market is valued at USD 20,860 million in 2024 and is expected to reach USD 41,260.7 million by 2032, growing at a CAGR of 8.9%.

- Cloud-based solutions drive growth by offering scalability, flexibility, and remote access to financial tools, especially for SMEs.

- Automation streamlines tasks like invoicing and payroll, reducing errors and enhancing efficiency, enabling finance teams to focus on strategic goals.

- AI integration improves real-time data analysis, forecasting, trend identification, and process automation to enhance decision-making and efficiency.

- Stricter regulatory requirements are prompting businesses to adopt advanced software that ensures compliance and accurate financial data tracking.

- North America leads the market with a high concentration of SMEs and enterprises prioritizing automation, cloud integration, and AI-driven solutions.

- Asia-Pacific is expected to grow the fastest due to rapid digitalization, increasing financial tech investments, and government-led digital transformation initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Cloud-Based Solutions Driving Market Growth

The adoption of cloud-based solutions significantly contributes to the growth of the Accounting and Budgeting Software market. Cloud platforms offer scalability, flexibility, and cost efficiency, allowing businesses to scale financial operations without significant infrastructure investments. Small and medium-sized enterprises (SMEs), in particular, benefit from cloud accounting solutions that reduce overhead costs and improve operational efficiency. The growing preference for remote work further accelerates cloud adoption, as it enables seamless access to financial tools from any location. As companies look for more adaptable financial management systems, cloud solutions continue to gain traction across various industries.

- For instance, ScienceSoft developed an Azure-based cloud accounting system for a leading European accounting provider, successfully migrating over 75,000 SMBs to the new platform, resulting in robust, always-available operations.

Automation Enhancing Financial Management

Automation is a key driver in the Accounting and Budgeting Software market, as businesses strive for operational efficiency and accuracy. Automated processes streamline repetitive financial tasks such as invoice processing, payroll management, and expense tracking. By reducing human intervention, automation lowers the risk of errors and accelerates decision-making. The shift toward automation supports companies in maintaining compliance with regulations while improving productivity. It enables finance teams to focus on strategic initiatives rather than time-consuming manual tasks, leading to greater resource optimization.

- For instance, Numeric’s automation software reduced the month-end close cycle for clients from about two weeks to as little as three days by integrating automated task management and ERP reconciliation, significantly easing audit processes.

Artificial Intelligence for Enhanced Analytics and Decision-Making

Artificial intelligence (AI) integration in accounting software is transforming how businesses handle data analysis and decision-making. AI-driven tools can analyze vast amounts of financial data in real-time, providing insights that guide better business strategies. This capability enhances forecasting accuracy and financial planning, allowing businesses to make more informed decisions. AI also helps identify trends, detect fraud, and automate complex processes, offering a competitive edge for companies that adopt it. Its impact on the Accounting and Budgeting Software market is significant, driving increased efficiency and reducing operational costs.

Compliance and Regulatory Pressures Fueling Demand

Stricter regulatory frameworks are pushing businesses to adopt advanced financial software solutions. Compliance with tax laws, financial reporting standards, and other industry-specific regulations requires accurate, real-time tracking of financial data. The Accounting and Budgeting Software market is driven by companies’ need to ensure their systems meet these evolving requirements. Financial management software simplifies the process of adhering to regulatory standards, helping businesses avoid penalties and manage risks effectively. This heightened focus on compliance is particularly notable in industries such as healthcare, banking, and retail.

Market Trends:

Rise in Cloud Adoption and Integration with Other Business Systems

One of the prominent trends in the Accounting and Budgeting Software market is the widespread shift toward cloud-based solutions. Businesses are increasingly opting for cloud accounting software due to its cost efficiency, scalability, and flexibility. Cloud solutions allow for real-time data access, enabling better collaboration among remote teams and enhanced decision-making capabilities. The seamless integration of accounting software with other business systems such as customer relationship management (CRM) and enterprise resource planning (ERP) tools is another key trend. This integration streamlines business operations and provides a comprehensive view of financial data across departments. The trend toward cloud adoption is particularly strong in small and medium-sized enterprises (SMEs), which gain access to advanced financial management tools without heavy upfront investments in infrastructure. These shifts are driving the growth of the Accounting and Budgeting Software market, as businesses look for solutions that enhance operational efficiency and improve financial visibility.

- For instance, QuickBooks Online has 5.3 million users worldwide, supporting businesses with real-time financial data access and integration with multiple third-party applications.

Growing Demand for AI and Automation Features in Financial Software

The increasing incorporation of artificial intelligence (AI) and automation into accounting software is transforming the financial management landscape. Businesses are adopting software that incorporates AI-driven features to enhance financial data analysis, improve forecasting accuracy, and streamline decision-making processes. Automation tools within accounting software can handle repetitive tasks such as invoicing, payroll, and tax compliance, reducing manual errors and boosting productivity. The demand for these AI-powered tools is growing as companies look for solutions that provide deeper insights into financial performance and business trends. These advancements in automation and AI are expected to accelerate the growth of the Accounting and Budgeting Software market, as businesses seek smarter solutions that not only reduce operational costs but also provide more strategic insights for decision-making.

- For instance, in July 2025, Intuit QuickBooks’ newly launched AI agents have enabled businesses to save up to 12 hours per month by automating workflows related to accounting, payments, and customer management, according to official product announcements.

Market Challenges Analysis:

Complexity of Integration with Existing Systems

One of the primary challenges facing the Accounting and Budgeting Software market is the complexity of integrating new software with existing financial and business systems. Many organizations use legacy systems that may not be easily compatible with modern accounting solutions, requiring significant time and resources for customization. This complexity can lead to disruptions in business operations, especially during the transition phase. Businesses must ensure that their new software integrates seamlessly with their customer relationship management (CRM), enterprise resource planning (ERP), and other critical systems to avoid operational inefficiencies. The cost of integration and potential technical issues remain significant hurdles for companies considering upgrading their financial software.

Data Security and Privacy Concerns

Data security and privacy are growing concerns for businesses adopting accounting and budgeting software. With the increasing amount of sensitive financial data being stored on cloud platforms, companies must address cybersecurity risks effectively. The Accounting and Budgeting Software market faces pressure to provide secure solutions that comply with stringent data protection regulations such as GDPR and CCPA. Organizations need to ensure that their financial software meets these standards to protect against data breaches and potential financial losses. As cybersecurity threats evolve, maintaining data security in cloud-based accounting systems becomes more challenging, requiring continuous updates and monitoring.

Market Opportunities:

Expanding Demand for Cloud Solutions in Small and Medium Enterprises

The growing adoption of cloud solutions presents a significant opportunity for the Accounting and Budgeting Software market. Small and medium-sized enterprises (SMEs) are increasingly turning to cloud-based financial software for its scalability, flexibility, and lower upfront costs. This trend is driven by the need for more accessible and affordable financial management tools that do not require significant infrastructure investments. Cloud solutions enable SMEs to manage their finances efficiently while benefiting from advanced features such as real-time data access, automation, and integration with other business systems. As cloud technology becomes more affordable and user-friendly, the market sees a growing demand from this segment, offering substantial growth potential.

AI and Automation Integration for Enhanced Financial Insights

There is a notable opportunity for the Accounting and Budgeting Software market to leverage artificial intelligence (AI) and automation to offer more advanced and insightful financial management solutions. AI-driven tools can provide businesses with predictive analytics, improving forecasting accuracy and financial planning. Automation helps reduce manual tasks such as invoicing, payroll processing, and tax compliance, allowing finance teams to focus on more strategic activities. The integration of AI and automation can streamline processes, enhance decision-making, and increase operational efficiency. This technological evolution opens up significant market opportunities as businesses seek software solutions that can deliver more precise insights and drive greater financial performance.

Market Segmentation Analysis:

By Offering:

The market is divided into software and services. Software holds the largest share due to its ability to automate and streamline accounting processes, enhancing efficiency and accuracy. The demand for cloud-based software is growing, as it provides scalability, flexibility, and remote accessibility. Services, including implementation, consulting, and support, also play a significant role in driving market expansion, helping businesses maximize the value of their software investments.

- For instance, in a 2021 Gartner Magic Quadrant report that evaluated 20 global service providers, Accenture was named a Leader for its capabilities in delivering SAP S/4HANA application services.

By Type:

The market is categorized into cloud-based and on-premise solutions. Cloud-based solutions dominate the market, accounting for the majority of the share, due to their cost-effectiveness, easy scalability, and flexibility. These solutions are particularly attractive to small and medium-sized enterprises (SMEs) looking for affordable financial management tools. On-premise solutions continue to serve large enterprises that prioritize data security and control over their internal infrastructure.

- For instance, an on-premise solution like SAP Business One provides businesses with extensive control by integrating 5 core functions—financials, sales, customer relationship management (CRM), inventory management, and operations—within the company s own secure infrastructure.

By Application:

The Accounting and Budgeting Software market is applied across various industries, including BFSI (banking, financial services, and insurance), retail, healthcare, and manufacturing. The BFSI sector holds the largest share due to strict regulatory requirements and the need for accurate financial reporting. Retail and manufacturing industries are increasingly adopting software to manage budgeting, financial planning, and forecasting processes. These solutions enable improved operational efficiency, better compliance, and enhanced decision-making across various sectors.Bottom of Form

Segmentations:

- By Offering:

- By Type:

- Cloud-based Solutions

- On-premise Solutions

- By Application:

- BFSI (Banking, Financial Services, and Insurance)

- Retail

- Healthcare

- Manufacturing

- Others

- By Enterprise Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By Industry Vertical:

- BFSI (Banking, Financial Services, and Insurance)

- Retail

- Healthcare

- Manufacturing

- Government

- Others

- By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Leading the Market

North America holds the largest market share in the Accounting and Budgeting Software market, accounting for 40% of global revenue. The region’s strong technological infrastructure and high adoption rate of advanced financial solutions are key drivers of this dominance. The United States plays a significant role due to its large number of small and medium-sized enterprises (SMEs) and large enterprises seeking efficient financial management tools. Companies in North America prioritize automation, cloud integration, and AI-driven insights, which are essential features of modern accounting software. Regulatory compliance, scalability, and digital transformation continue to drive market growth in this region, ensuring its continued leadership in the market.

Europe: Regulatory Demands and Efficiency Gains

Europe holds a substantial market share in the Accounting and Budgeting Software market, contributing 30% of global market revenue. This growth is largely driven by stringent regulatory frameworks and a focus on financial transparency and data protection. Businesses in Europe require accounting solutions that ensure compliance with regulations like the General Data Protection Regulation (GDPR) and international accounting standards. The region is increasingly adopting cloud-based financial systems to streamline operations, reduce costs, and improve efficiency. Countries like the UK, Germany, and France are leading the way in embracing advanced accounting technologies to enhance financial visibility and decision-making.

Asia-Pacific: Rapid Growth and Digital Transformation

The Asia-Pacific region commands a growing share of the Accounting and Budgeting Software market, representing 20% of global market revenue. The region is experiencing rapid digitalization and increasing investments in financial technology, particularly in countries like China, India, and Japan. The rise of SMEs and government initiatives to promote digital business transformation are driving the demand for cloud-based financial management solutions. As businesses seek automation and real-time financial analysis to enhance operational efficiency, demand for advanced accounting software continues to rise. This trend positions Asia-Pacific for significant market growth in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Xero Limited

- Oracle

- Scoro Software

- Prophix

- SAP SE

- Intuit Inc.

- FreshBooks

- Zoho Corporation Pvt. Ltd

- QuickBooks

- Microsoft

- MIP Fund Accounting

- Wave Financial Inc.

- Coupa Software

- Quicken

- Vena Solutions

- The Sage Group plc

- Planful

Competitive Analysis:

The Accounting and Budgeting Software market is highly competitive, with key players offering a range of solutions to cater to diverse business needs. Leading companies include Intuit Inc., Oracle Corporation, Microsoft Corporation, SAP SE, and Xero Limited. These companies dominate the market by offering comprehensive software solutions with features such as automation, real-time analytics, and integration with other business systems. They continue to innovate through cloud-based solutions and AI-driven tools, addressing the growing demand for scalable and flexible financial management. Smaller players and startups also contribute by focusing on niche markets or offering specialized solutions tailored to specific industries. The market is characterized by continuous product development, strategic partnerships, and mergers and acquisitions as companies aim to strengthen their competitive positions. As businesses increasingly adopt cloud-based financial software, competition intensifies, with companies striving to enhance user experience, security, and compliance capabilities.

Recent Developments:

- In June 2025, Xero announced the beta launch of a redesigned homepage and navigation experience, which was co-created with feedback from users to provide a more intuitive platform.

- In May 2025, Oracle expanded its partnership with IBM, making IBM’s watsonx platform available on Oracle Cloud Infrastructure.

- In January 2025, Prophix launched Prophix One™ FP&A Plus, a new application on its Financial Performance Platform, and on the same day introduced the Solutions Marketplace to offer pre-built templates and connectors.

Market Concentration & Characteristics:

The Accounting and Budgeting Software market exhibits moderate concentration, with a few large players commanding a significant share. Companies like Intuit, Oracle, and SAP dominate due to their comprehensive solutions, strong brand presence, and extensive customer bases. Smaller players also contribute by offering specialized or industry-specific solutions that target niche markets. The market is characterized by rapid technological advancements, with a focus on cloud-based solutions, AI integration, and automation to meet evolving business needs. Companies compete based on product features, scalability, ease of use, and customer support. High demand for regulatory compliance and data security drives innovation, especially in cloud solutions. Despite the dominance of major players, new entrants continue to emerge, bringing innovative approaches and targeting underserved market segments, further intensifying competition within the market.

Report Coverage:

The research report offers an in-depth analysis based on Offering, Type, Application, Enterprise Size, Industry Vertical and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Cloud-based accounting solutions will continue to dominate, offering scalability and cost-efficiency for businesses of all sizes.

- Artificial intelligence (AI) integration will enhance real-time analytics, automate tasks, and improve decision-making processes.

- Automation features will streamline repetitive financial tasks, reducing human error and increasing operational efficiency.

- Mobile accessibility will become increasingly important, allowing users to manage finances on-the-go through smartphones and tablets.

- Regulatory compliance requirements will drive demand for software solutions that ensure adherence to evolving financial regulations.

- Data security and privacy concerns will lead to enhanced security features, including encryption and multi-factor authentication.

- Integration with other business systems, such as customer relationship management (CRM) and enterprise resource planning (ERP), will be prioritized.

- Small and medium-sized enterprises (SMEs) will increasingly adopt accounting software to streamline operations and reduce costs.

- Advanced forecasting and budgeting tools will assist businesses in making informed financial decisions and planning for growth.

- The Asia-Pacific region is expected to experience significant growth due to rapid digitalization and increasing adoption of financial technology.