Market Overview

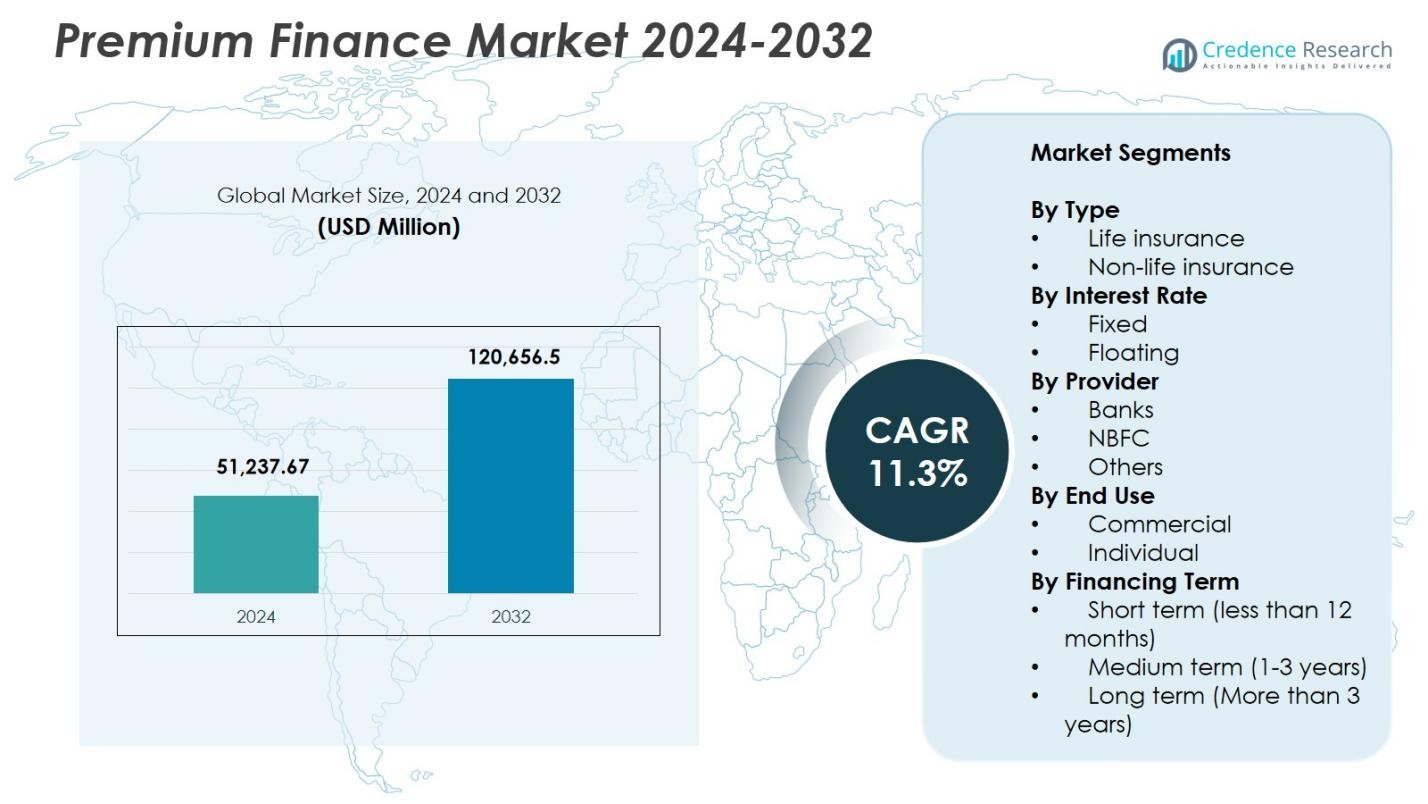

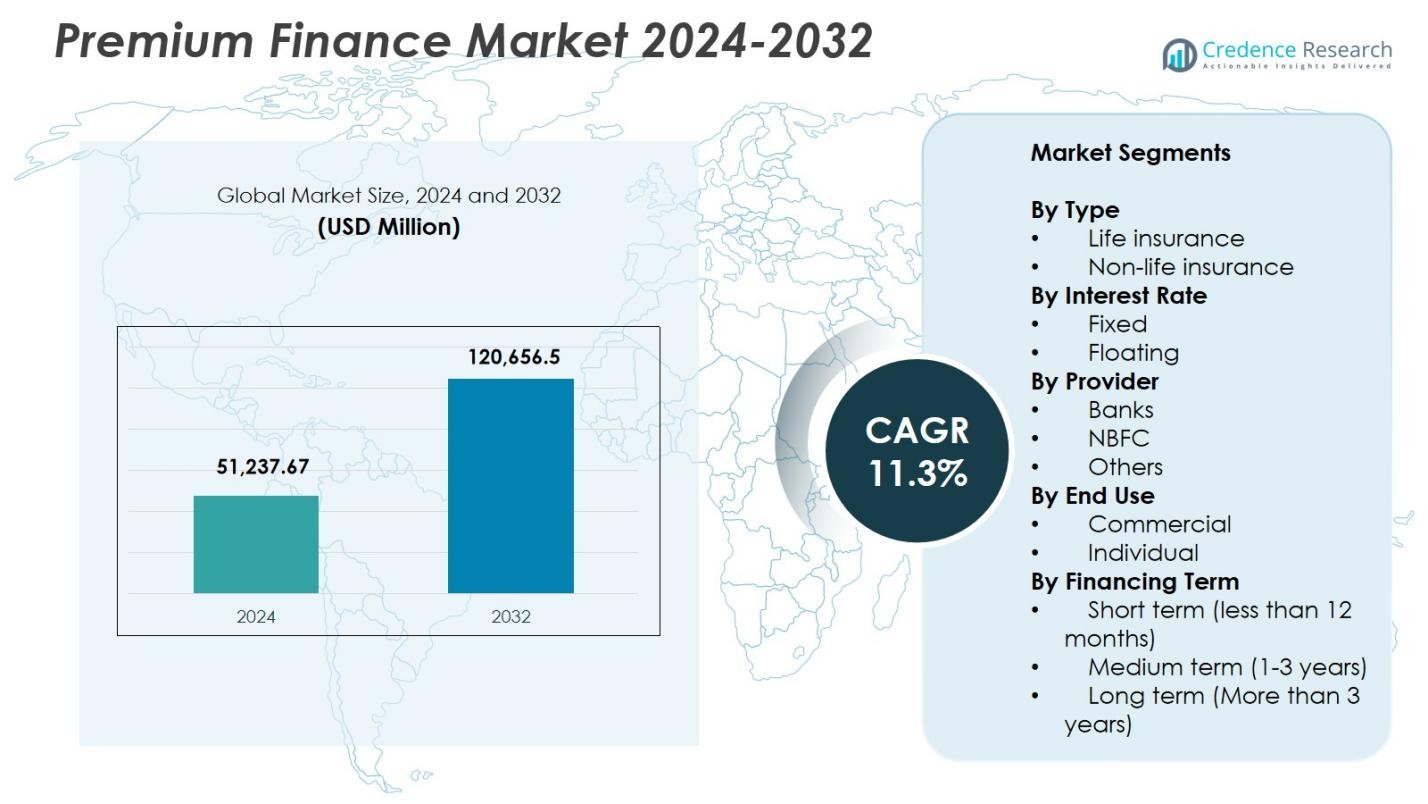

Premium Finance Market size was valued at USD 51,237.67 Million in 2024 and is anticipated to reach USD 120,656.5 Million by 2032, at a CAGR of 11.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Premium Finance Market Size 2024 |

USD 51,237.67 Million |

| Premium Finance Market, CAGR |

11.3% |

| Premium Finance Market Size 2032 |

USD 120,656.5 Million |

Premium Finance Market features leading participants such as AFCO Credit, Agile Premium Finance, ARI Financial Group, Byline Bank, First Insurance Funding (Wintrust), IPFS, JP Morgan, Lincoln National, Truist Insurance Holdings, and Valley National Bancorp, each strengthening market presence through advanced lending platforms and expanded insurer partnerships. North America led the market with a 41.6% share in 2024, driven by strong adoption of premium-financed life insurance and well-established financial institutions offering flexible policy funding. Europe held a 27.3% share, supported by rising commercial insurance costs and increasing integration of premium financing into corporate and wealth-planning strategies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Premium Finance Market reached USD 51,237.67 Million in 2024 and will grow USD 120,656.5 at a CAGR of 11.3% through 2032.

- Rising demand for high-value life insurance fuels growth, with the life insurance segment holding 62.4% share as affluent clients adopt liquidity-preserving financing structures.

- Digital lending platforms, automated underwriting, and embedded finance models reshape market trends, enabling faster approvals and expanding adoption across SMEs and high-net-worth individuals.

- Key players strengthen market position through expanded insurer partnerships and advanced lending solutions, while banks lead the provider segment with a 7% share, supported by strong capital capacity.

- North America leads regional demand with 6% share, followed by Europe at 27.3% and Asia-Pacific at 21.4%, driven by strong insurance penetration, wealth expansion, and increasing need for structured premium financing across commercial and personal markets.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type

Life insurance dominated the Premium Finance Market with a 62.4% share in 2024, driven by rising demand for high-value life policies, estate-planning strategies, and liquidity-focused financing solutions for affluent clients. The segment benefits from increasing adoption of interest-only financing structures that help preserve cash flow while maintaining long-term coverage. Non-life insurance held a 37.6% share, supported by commercial clients financing large property, casualty, and specialty insurance premiums. Expanding risk-management requirements across corporate sectors continues to reinforce demand for structured premium finance in both categories.

- For instance, Bajaj Finserv provides premium financing for life insurance to help affluent individuals preserve liquidity and secure family legacies. Clients fund premiums via loans, retaining capital for investments or business needs.

By Interest Rate

Fixed-rate financing led the market with a 68.1% share in 2024, as borrowers preferred predictable repayment structures amid fluctuating interest-rate environments. This segment grows as insurers, banks, and premium finance companies market long-term stability to high-net-worth individuals and corporate policyholders seeking consistent cost planning. Floating-rate financing captured a 31.9% share, driven by clients targeting lower short-term financing costs and benefiting from rate resets during easing monetary cycles. The shift toward diversified lending products continues to expand both fixed and floating offerings across premium finance providers.

- For instance, J.P. Morgan Private Bank offers life insurance premium financing with fixed or variable interest rates tailored to estate planning, allowing clients to collateralize policy cash value without liquidating assets.

By Provider

Banks accounted for the largest position in this segment with a 54.7% share in 2024, supported by their strong capital base, integrated insurance-lending platforms, and ability to offer competitive interest terms. NBFCs held a 33.5% share, driven by flexible underwriting, faster loan approvals, and increasing penetration among small to mid-sized commercial clients. Other providers, including specialized finance firms and brokerage-linked lenders, represented 11.8%, gaining traction as they offer tailored financing solutions for life and commercial insurance policies. Strengthening distribution networks continues to improve market accessibility across all provider categories.

Key Growth Drivers

Growing Demand for High-Value Life Insurance Policies

The Premium Finance Market expands rapidly as affluent individuals increasingly fund high-value life insurance policies through structured financing. Demand rises as policyholders leverage premium finance to preserve liquidity, optimize estate-planning structures, and enhance wealth-transfer efficiency. Financial institutions offer interest-only and collateral-flexible arrangements, enabling borrowers to maintain long-term coverage without large upfront payments. As tax-efficient wealth management becomes a priority, premium financing strengthens its relevance, driving strong adoption among high-net-worth clients and family offices seeking leverage-based insurance strategies.

- For instance, IPFS Corporation offers premium financing solutions that streamline cash flow for agents and high-net-worth insureds by covering large policy premiums via loans secured by policy value.

Rising Commercial Insurance Costs Driving Corporate Adoption

Businesses increasingly rely on premium finance to manage escalating commercial insurance costs across property, casualty, liability, and specialty lines. Corporations use financing to maintain coverage levels while preserving operational cash flow, reducing upfront capital strain, and aligning insurance expenses with revenue cycles. Growing risk exposures in sectors such as construction, logistics, and energy further accelerate adoption. As insurers tighten underwriting standards, corporate buyers turn to premium finance providers for flexible repayment structures, supporting steady market growth across small, mid-size, and large enterprises.

- For instance, First Insurance Funding, a Wintrust company, provides premium finance across all 50 U.S. states for trucking and transportation businesses’ commercial auto coverage, handling over $16 billion in annual loan volume to ease premium burdens.

Expansion of Bank and NBFC Financing Capabilities

Banks and NBFCs expand premium finance offerings supported by strong capital reserves, integrated digital underwriting systems, and diversified risk portfolios. Their ability to offer competitive interest rates, seamless policy-lender coordination, and enhanced borrower servicing attracts both individual and commercial clients. NBFCs gain momentum by providing fast approvals and customized financing options for high-risk or underserved segments. As financial institutions strengthen distribution partnerships with insurers and brokers, premium finance becomes more accessible, driving continuous market penetration and accelerating long-term adoption.

Key Trends & Opportunities

Digitalization and Automation Transforming Premium Finance

Digital lending platforms, automated underwriting, and API-enabled insurer integrations reshape market operations, enabling faster approvals, transparent documentation, and real-time premium payment management. Lenders leverage analytics to assess borrower profiles more accurately, improving risk scoring and reducing defaults. Embedded finance models allow brokers and insurers to offer financing options at the point of sale, increasing conversion rates. This digital shift creates significant opportunities for providers to scale operations, enhance customer experience, and expand into underserved small business and retail insurance segments.

- For instance, HDFC ERGO integrated over 300 API services through Apigee into its insurance superapps, facilitating seamless connections with partners like garages and retailers for embedded customer journeys and streamlined back-end operations.

Growing Use of Premium Finance in Estate and Wealth Planning

Premium financing gains prominence as wealth managers incorporate leveraged insurance into estate-planning and tax-optimization strategies. High-net-worth clients increasingly use financed policies to cover estate taxes, protect business succession plans, and enhance generational wealth transfer without liquidating assets. As private banks and advisory firms expand structured insurance solutions, cross-selling opportunities rise. This trend positions premium finance as an attractive tool within holistic wealth-planning portfolios, opening significant growth avenues across ultra-HNI, private banking, and family-office ecosystems.

- For instance, Synovus Life Finance structures customized premium financing loans collateralized by policy cash values for high-net-worth individuals, allowing borrowed funds to pay premiums while retaining client liquidity for investments and avoiding sales of illiquid assets like real estate.

Key Challenges

Interest Rate Volatility Impacting Borrowing Affordability

Fluctuating interest rates present a major challenge as rising borrowing costs reduce affordability and profitability for financed insurance strategies. Higher rates increase total repayment obligations, leading some borrowers to reconsider long-term commitments or restructure collateral arrangements. Lenders must frequently reassess risk exposure, especially in floating-rate portfolios. This volatility pressures both borrowers and finance providers, potentially slowing new transaction volumes during tightening monetary cycles and increasing the risk of policy lapses or refinancing difficulties in unstable rate environments.

Stringent Collateral and Underwriting Requirements

Premium finance transactions often require robust collateral, detailed credit assessments, and rigorous lender-insurer coordination, creating barriers for certain borrowers. High-value policies, particularly in life insurance, demand comprehensive financial documentation and strict loan-to-value controls, limiting access for clients with variable income profiles or limited assets. These stringent requirements increase processing complexity for lenders and may delay approvals. As regulatory scrutiny intensifies, maintaining compliance while managing credit risk becomes more challenging, restricting expansion in some emerging or high-risk customer segments.

Regional Analysis

North America

North America led the Premium Finance Market with a 41.6% share in 2024, supported by strong penetration of high-value life insurance policies, advanced wealth-planning practices, and a mature network of banks and premium finance companies. The United States drives regional dominance as high-net-worth clients and corporate buyers increasingly use financing to manage liquidity and rising insurance costs. Robust digital lending infrastructure, extensive broker partnerships, and favorable estate-planning frameworks further accelerate adoption. Canada contributes steady growth as insurers and financial institutions expand premium finance offerings for commercial and personal policyholders.

Europe

Europe held a 27.3% share in 2024, driven by growing use of premium financing in corporate insurance, professional indemnity, and specialty risk segments. The region experiences strong adoption in the United Kingdom, Germany, and France as businesses utilize financing tools to manage rising premiums and regulatory-driven coverage requirements. Wealth managers in Western Europe increasingly integrate financed life insurance into tax-efficient legacy-planning strategies. Digital lending expansion and cross-border insurer–lender collaborations support market growth. Southern and Eastern Europe witness emerging demand as SMEs adopt premium finance to preserve working capital and enhance cash-flow stability.

Asia-Pacific

Asia-Pacific accounted for 21.4% of the market in 2024, reflecting rapid expansion in commercial insurance, rising HNI populations, and growing adoption of leveraged insurance strategies across major economies. Strong market momentum in China, Japan, India, and Australia is fueled by rising insurance penetration, increasing regulatory compliance needs, and the availability of flexible financing products from banks and NBFCs. Corporate clients across manufacturing, infrastructure, and logistics rely on premium finance to manage increasing premiums. As wealth accumulation accelerates in emerging markets, premium-financed life insurance gains traction, driving long-term growth in the region.

Latin America

Latin America captured a 6.8% share in 2024, supported by expanding commercial insurance requirements, rising adoption of risk-management frameworks, and growing awareness of premium finance among small and mid-sized enterprises. Countries such as Brazil, Mexico, and Chile lead regional uptake as businesses seek financing solutions to manage rising liability, property, and specialty insurance costs. While high interest rates pose challenges, demand increases for flexible repayment structures and digital onboarding. Strengthening partnerships between insurers, brokers, and financial institutions enhances accessibility, driving broader regional participation in premium financing solutions.

Middle East & Africa

The Middle East & Africa region represented 2.9% of the market in 2024, driven by increasing demand for commercial and specialty insurance in construction, energy, and logistics industries. Wealth growth in GCC countries boosts adoption of premium-financed life insurance among high-net-worth individuals. Banks and regional finance companies expand offerings to support premium payment flexibility amid rising policy values. In Africa, gradual insurance-market development and SME growth create new opportunities, though limited financial access and credit constraints slow progress. Ongoing regulatory modernization and digital lending support incremental market expansion.

Market Segmentations:

By Type

- Life insurance

- Non-life insurance

By Interest Rate

By Provider

By End Use

By Financing Term

- Short term (less than 12 months)

- Medium term (1-3 years)

- Long term (More than 3 years)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Premium Finance Market features leading participants such as AFCO Credit, Agile Premium Finance, ARI Financial Group, Byline Bank, First Insurance Funding (Wintrust), IPFS, JP Morgan, Lincoln National, Truist Insurance Holdings, and Valley National Bancorp. Market dynamics are shaped by diversified product portfolios, interest-rate strategies, and expanding digital lending capabilities that enhance underwriting speed and customer onboarding. Banks maintain strong influence through integrated insurance–lending ecosystems and competitive capital access, while specialized finance companies strengthen their position through flexible loan structures and niche policy-financing expertise. Providers increasingly invest in automation, risk analytics, and broker-integrated platforms to improve decision-making and reduce processing overheads. Strategic partnerships with insurers and independent agencies continue to expand distribution reach and drive transaction volumes. As interest-rate environments evolve, players focus on pricing efficiency, collateral management, and long-term relationship models to retain market share and support scalable growth across life and commercial insurance financing segments.

Key Player Analysis

Recent Developments

- In April 2024 IPFS Corporation acquired Stonemark, Inc., adding over 4,000 agencies and their team to its premium finance operations.

- In June 2023 Agile Premium Finance entered into a strategic partnership with Pavo Insurance Solutions to deliver an enhanced premium finance marketplace for insurers and brokers.

- In December 2024 AFCO Direct partnered with ePayPolicy to integrate premium finance options into digital payment systems for insurance agencies and carriers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Interest Rate, Provider, End Use, Financing Term and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Premium finance adoption will rise as high-net-worth individuals increasingly integrate leveraged life insurance into estate and wealth-planning strategies.

- Digital lending platforms will streamline underwriting, accelerate approvals, and expand market access across individual and commercial segments.

- Corporate demand for premium finance will grow as businesses manage escalating property, liability, and specialty insurance costs.

- Banks and NBFCs will enhance product innovation, offering more flexible repayment options and risk-adjusted interest structures.

- Embedded finance models will expand as insurers and brokers integrate financing directly into policy sales workflows.

- Growth in commercial construction, logistics, and energy sectors will increase demand for financed insurance coverage.

- Expanding regulatory compliance requirements will push more companies toward premium-financed coverage to manage rising costs.

- Wealth accumulation in Asia-Pacific and the Middle East will accelerate adoption of financed life insurance solutions.

- Partnerships between insurers, brokers, and finance providers will strengthen distribution networks and customer acquisition.

- Advanced analytics and AI-driven risk assessment will improve borrower profiling and reduce default risks, enhancing market stability.

Market Segmentation Analysis:

Market Segmentation Analysis: