Market Overview

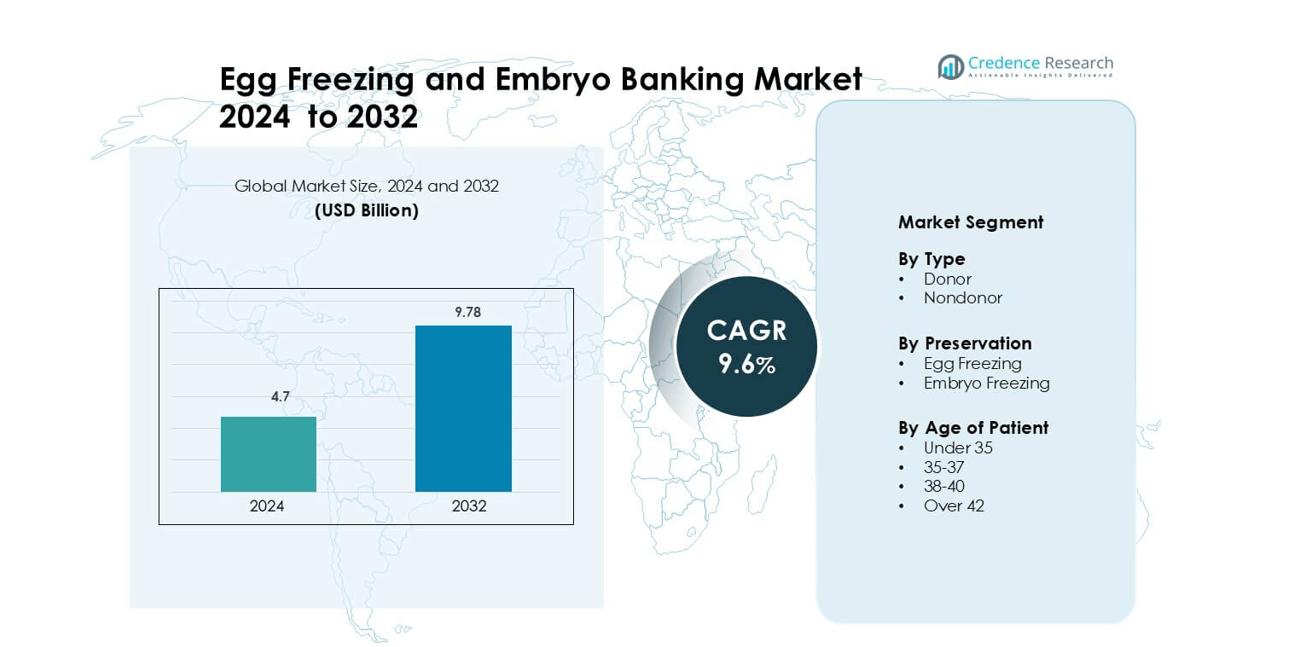

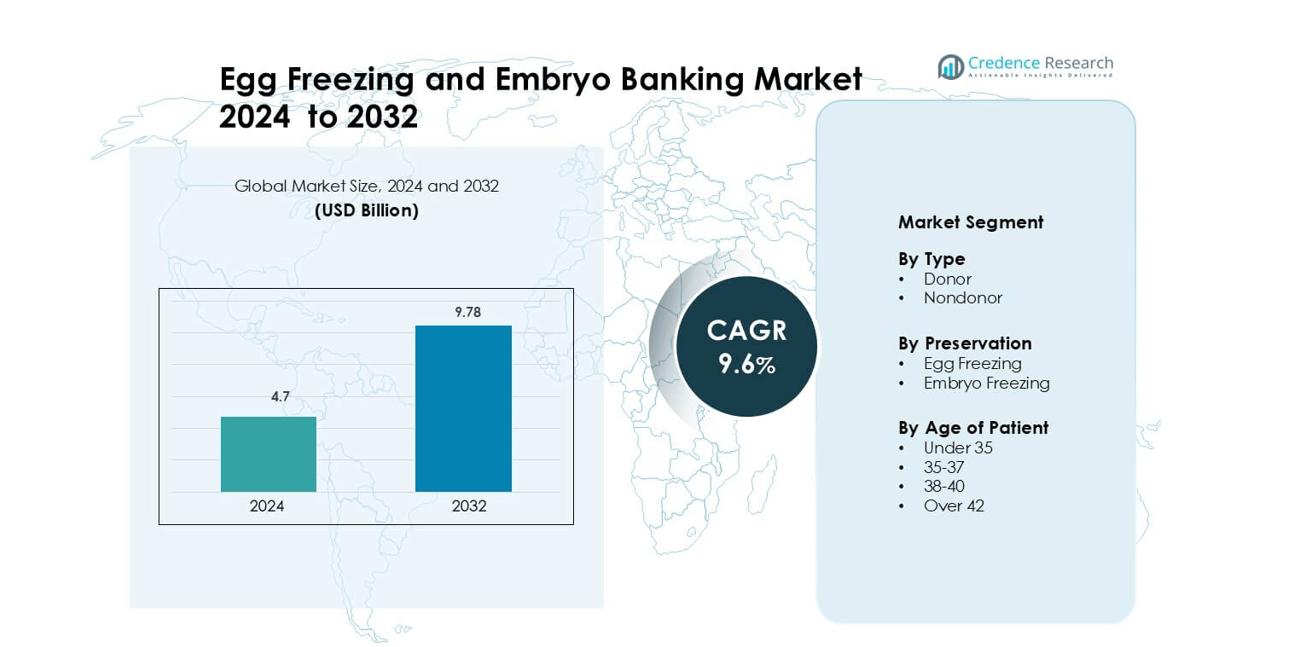

Egg Freezing and Embryo Banking Market was valued at USD 4.7 billion in 2024 and is anticipated to reach USD 9.78 billion by 2032, growing at a CAGR of 9.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Egg Freezing and Embryo Banking Market Size 2024 |

USD 4.7 billion |

| Egg Freezing and Embryo Banking Market, CAGR |

9.6% |

| Egg Freezing and Embryo Banking Market Size 2032 |

USD 9.78 billion |

Leading players in the Egg Freezing and Embryo Banking market include Boston IVF, CCRM Fertility, IVIRMA, Monash IVF Group, Genea Pty, Extend Fertility, Cryos International, Ovation Fertility, Carrot, and New Hope IVF & Fertility Clinic. These providers invest in advanced vitrification, automated cryostorage, genetic screening, and AI-based embryo grading to improve success rates and attract international patients. North America remains the dominant region with a 35% market share, supported by high IVF procedure volume, strong fertility awareness, and employer-funded preservation benefits. Expanding clinic networks and advanced laboratory infrastructure continue to strengthen the competitive position of key players across global markets.

Market Insights

- The Egg Freezing and Embryo Banking market reached a multi-billion USD 4.7 valuation in 2024 and is projected to grow at a steady CAGR of 9.6% through 2032.

- A key driver is delayed parenthood, as more women and couples choose long-term reproductive planning and fertility preservation at younger ages, boosting egg and embryo storage cycles.

- A major trend is the growing adoption of vitrification, AI-based embryo selection, and automated cryostorage, which improve post-thaw survival and success rates across leading IVF centers.

- The competitive landscape includes Boston IVF, CCRM Fertility, IVIRMA, Monash IVF Group, Extend Fertility, Genea Pty, Cryos International, Ovation Fertility, Carrot, and New Hope IVF & Fertility Clinic, all expanding storage capacity and digital fertility services.

- North America leads with a 35% regional share, followed by Europe at 30% and Asia-Pacific at 25%, while the nondonor segment holds the largest share based on self-preservation demand and high IVF procedure volume

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The nondonor category held the largest share in the Egg Freezing and Embryo Banking market due to higher demand among women opting to preserve their own eggs for personal family planning. Rising career prioritization, delayed pregnancies, and increased awareness about fertility preservation support segment growth. Clinics promote ovarian stimulation and vitrification techniques for self-use, which has improved success rates and reduced procedural risks. Insurance coverage in some regions also encourages women to select nondonor programs. Donor programs show steady use, mainly for patients with low ovarian reserve or genetic risks, but their volume remains smaller than self-preservation cycles.

- For instance, a retrospective study covering 3,328 elective oocyte vitrification cycles in 2,280 patients reported a return‐to‐use rate of 14 %.

By Preservation

Embryo freezing dominated the market with a higher share, supported by strong clinical success rates and broader acceptance among IVF patients. Embryos offer a higher chance of future pregnancy compared to frozen eggs, making this method preferred in fertility treatment plans. Couples undergoing IVF store multiple embryos for future cycles, reducing repeat hormonal stimulation procedures. Advancements in vitrification keep embryos viable for long durations, which improved adoption across fertility clinics. Egg freezing shows increasing traction among single women and individuals preserving fertility before medical treatments, but embryo storage remains the market leader.

- For instance, the CCRM Fertility network in the U.S. has reported using its proprietary vitrification protocol to help manage thousands of cryopreserved embryos with survival rates above 95% for the high-quality blastocysts typically processed through their labs.

By Age of Patient

Women under 35 accounted for the largest share due to higher egg quality and stronger clinical outcomes during IVF cycles. Younger patients benefit from better ovarian response and reduced genetic abnormalities, leading to improved success rates after thawing and transfer. Fertility centers encourage preservation at earlier reproductive ages, which drives demand in this segment. The 35–37 and 38–40 age groups also participate actively, often driven by delayed parenting trends. However, storage cycles among patients over 42 remain limited due to declining ovarian reserve and reduced implantation success, making early preservation a key growth driver.

Key Growth Drivers

Rising Demand for Delayed Parenthood

A major growth driver is the rising trend of delayed parenthood among women and couples. Many individuals now focus on higher education, career growth, and financial security before starting a family. This shift increases the demand for fertility preservation services. Clinics see more first-time patients seeking long-term reproductive planning. Social awareness campaigns and medical counseling encourage younger women to freeze eggs for future use. Many companies also provide fertility preservation benefits to employees, which boosts adoption. The option gives women control over their reproductive timeline. Higher success rates of frozen embryo transfers also reinforce patient trust. As more women choose to delay childbirth, demand will continue to rise.

- For instance, Apple and Meta provide fertility preservation support that reimburses up to USD 20,000 for egg freezing and storage, confirmed in company benefit disclosures.

Technological Advancements in Vitrification and Storage

Rapid improvements in vitrification and cryopreservation systems drive strong market growth. Modern vitrification reduces ice-crystal formation and improves post-thaw survival rates. Clinics now achieve better embryo and egg viability after storage. This builds confidence among patients and physicians. Automated cryo-storage, digital monitoring, and temperature-controlled tanks offer safer long-term preservation. These systems reduce human error and improve traceability. Many facilities also use AI-based embryo selection tools to increase transfer success. Hospitals and fertility centers invest in lab upgrades to attract more patients. As success rates improve, more couples and single women adopt egg and embryo banking services. Technology reduces procedural risks and serves as a major growth catalyst.

- For instance, one randomized trial reported a survival rate of 84.3% (183 out of 217 embryos) with vitrification versus 52.5% (105 out of 200) with slow-freezing.

Increasing Fertility Issues and Medical Needs

Rising infertility rates support strong demand for egg and embryo banking. Lifestyle changes, stress, pollution, and late pregnancies increase fertility complications. Women facing early ovarian failure and low ovarian reserve seek preservation at younger ages. Cancer patients undergoing chemotherapy also choose egg or embryo freezing to protect future fertility. Doctors routinely recommend preservation before medical treatments that may damage reproductive organs. This expands patient volume in hospitals and specialty clinics. Awareness programs run by healthcare providers improve patient understanding. As fertility challenges grow worldwide, preservation becomes a trusted medical solution. The service gives patients hope for biological parenthood, which strengthens long-term demand.

Key Trends and Opportunities

Growing Adoption Among Single Parents and LGBTQ+ Community

A key trend is rising adoption among single women, single men using surrogacy, and LGBTQ+ families. Social acceptance is expanding, and clinics offer tailored fertility packages. Many individuals plan parenthood without a spouse, so egg or embryo banking provides flexibility. Same-sex couples use donor eggs, donor sperm, and gestational carriers supported by preserved embryos. Several countries now allow inclusive fertility policies, helping clinics reach new patient groups. As family structures evolve, demand for long-term storage and IVF cycles continues to rise. This expands the customer base and supports market revenue.

- For instance, at the London Women’s Clinic, one in four IVF patients between 2020-2023 were single women or same-sex couples; their internal data show a birth rate of 50% for single women and 73% for same-sex couples over that period.

Expansion of Cross-Border Fertility Tourism

Fertility tourism grows as patients travel to countries with lower treatment costs or more flexible regulations. Some countries restrict donor access or storage duration, so patients travel for services. Clinics in popular destinations market competitive costs, advanced lab technology, and quick appointment availability. Many offer bundled IVF packages with embryo freezing and extended storage. Medical tourism agencies connect foreign patients with accredited fertility centers. This trend increases international revenue for clinics and banks. As cross-border reproductive healthcare becomes easier, the market gains new opportunities for global expansion.

- For instance, at Nova IVF Center in Bangalore, India, nearly 49% of its international patients in early 2023 came from other parts of Asia and 25% from the African continent.

Key Challenges

High Cost of Fertility Preservation Procedures

A major challenge is the high cost of egg retrieval, IVF cycles, and long-term storage. Many patients pay for medication, lab work, and yearly preservation fees. In some regions, insurance does not cover these services. This limits access for middle-income patients. Many delay treatment due to financial barriers, which reduces clinical success rates at older ages. Cost also varies by country, which impacts patient choices. Although payment plans exist, affordability remains a concern. Expensive technology investments also raise clinic costs. Price sensitivity slows adoption and creates dependence on premium patients.

Ethical and Legal Regulations Across Countries

Ethical and legal rules create barriers for the global market. Some countries limit storage time, donor usage, or embryo disposal. Others ban commercial surrogacy or restrict embryo ownership rights. These policies force patients to seek treatment abroad. Complex regulations also increase legal paperwork for clinics. Rules around donor anonymity and genetic screening differ widely. In some regions, religious concerns slow adoption of embryo freezing. These variations challenge clinic expansion and global standardization. Without uniform laws, patients and providers navigate uncertain legal pathways, which limits long-term market growth.

Regional Analysis

North America

North America held a 35% share in the Egg Freezing and Embryo Banking market, the highest worldwide, driven by advanced fertility centers, high IVF volumes, and strong awareness about reproductive planning. The U.S. remains the core contributor due to late maternal age, career-centric lifestyles, and broad availability of egg freezing benefits provided by employers. Leading clinics adopt AI-based embryo grading and automated cryostorage to improve success. Canada also shows rising adoption supported by growing acceptance of single-parent and LGBTQ+ family planning. Strong regulatory standards, large patient numbers, and modern laboratory infrastructure keep North America the dominant regional contributor.

Europe

Europe accounted for a 30% share of the global market, supported by large IVF cycle numbers, advanced reproductive regulations, and extensive vitrification use. The U.K., Spain, Denmark, and Germany lead storage services due to strong clinical networks and high treatment success rates. Cross-border fertility tourism, especially in Spain, increases regional revenue by offering competitive pricing and diverse donor availability. Government-supported reproductive programs and broader insurance coverage improve patient access. Many countries allow long-term preservation, encouraging younger women to store eggs for delayed pregnancy. Advanced cryo-labs and standardized treatment procedures strengthen Europe’s market performance.

Asia-Pacific

Asia-Pacific captured a 25% share and recorded the fastest growth due to a large reproductive-age population, rising infertility rates, and strong adoption of IVF facilities. Women in China, India, Japan, and South Korea increasingly freeze eggs due to late marriages and career priorities. Cost-effective treatments attract medical tourists from other regions. Private hospitals expand fertility networks across major cities, and governments invest in IVF infrastructure. Social acceptance of delayed motherhood and single-parent families continues to improve. Growing affordability and modern cryopreservation technology position Asia-Pacific as a rapidly expanding contributor to the global market.

Latin America

Latin America held a 6% share, supported by growing access to fertility preservation in Brazil, Mexico, Argentina, and Chile. Clinics upgrade cryo-labs and offer bundled IVF services that include egg or embryo storage. Lower treatment costs attract patients from North America and Europe seeking affordable fertility care. Awareness campaigns in major cities encourage younger women to preserve fertility before age-related decline. Specialized hospitals in Brazil lead in embryo storage and success rates. While the market remains smaller than developed regions, steady adoption and wider private healthcare participation continue to support regional expansion.

Middle East & Africa

The Middle East & Africa captured a 4% share due to limited availability of advanced fertility services in several countries. Growth concentrates in the UAE, Saudi Arabia, and South Africa, where private hospitals provide modern vitrification, donor programs, and long-term storage. Expatriates and medical tourists contribute significant volume in Gulf nations. Cultural barriers, regulatory complexity, and high treatment costs restrict broader adoption across developing areas. However, rising infertility rates, expanding IVF infrastructure, and increasing acceptance of reproductive treatments support slow but consistent demand. Investments in specialty fertility hospitals are expected to improve future market share.

Market Segmentations:

By Type

By Preservation

- Egg Freezing

- Embryo Freezing

By Age of Patient

- Under 35

- 35-37

- 38-40

- Over 42

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Egg Freezing and Embryo Banking market is moderately consolidated, with global fertility networks, specialized IVF centers, donor banks, and digital fertility management platforms competing for patients. Leading players, including Boston IVF, IVIRMA, CCRM Fertility, Genea Pty, Monash IVF Group, Extend Fertility, Cryos International, New Hope IVF & Fertility Clinic, Ovation Fertility, and Carrot, invest in advanced vitrification systems, automated cryostorage, and AI-based embryo selection to improve clinical outcomes. Companies expand through partnerships, cross-border clinics, and mergers to increase cycle volume and storage capacity. Many providers offer bundled IVF packages, genetic testing, and multi-year storage plans to attract patients seeking long-term reproductive solutions. Digital fertility benefits and teleconsultations also support customer reach, especially for international patients. As success rates continue to rise, competition focuses on lab technology upgrades, personalized treatment, donor availability, and cost-effective preservation programs. Expansion into growing markets in Asia-Pacific and Latin America continues to strengthen global market presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2025, Extend Fertility launched an egg-freezing guarantee with Gaia in NYC, offering refunds or a second cycle tied to future IVF outcomes.

- In July 2025, Cryos International opened the Cryos IVF Clinic in Nicosia, expanding from donor banking into full fertility treatment and preservation.

Report Coverage

The research report offers an in-depth analysis based on Type, Preservation, Age of Patient and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as more women delay parenthood for career, health, and lifestyle reasons.

- Clinics will adopt fully automated cryostorage systems for safer long-term preservation.

- AI-based embryo and oocyte selection will improve success rates and reduce failed cycles.

- Fertility benefits from employers will expand, making preservation more affordable for younger patients.

- Cross-border fertility tourism will grow as patients seek lower treatment costs or flexible regulations.

- More single parents and LGBTQ+ families will use egg and embryo banking to plan future families.

- Genetic screening and preimplantation testing will become standard offerings in preservation packages.

- Regulatory frameworks will slowly evolve to support longer storage periods and donor access.

- Medical preservation will increase for cancer patients and individuals with genetic or reproductive disorders.

- Asia-Pacific and Latin America will record faster adoption due to expanding IVF infrastructure and rising awareness.