Market Overview

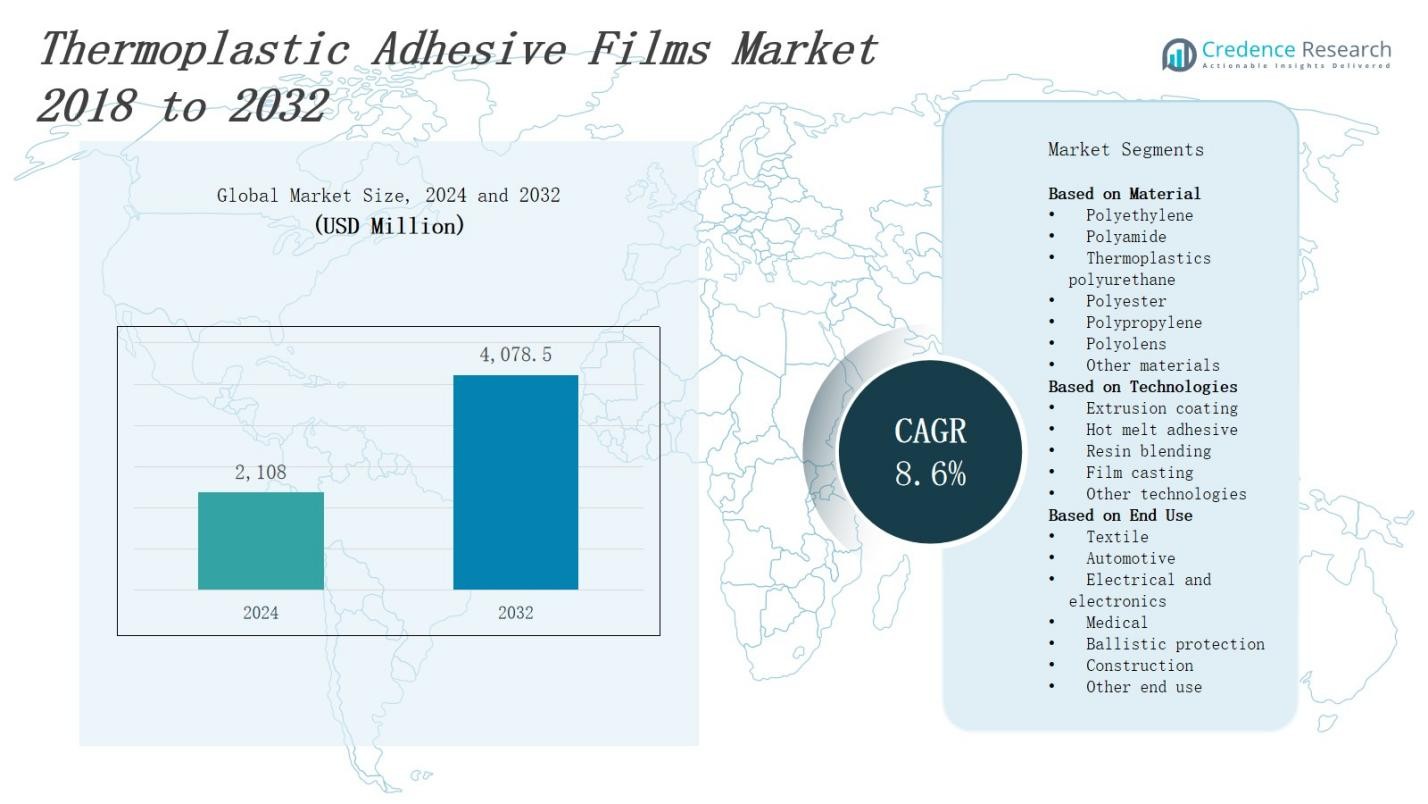

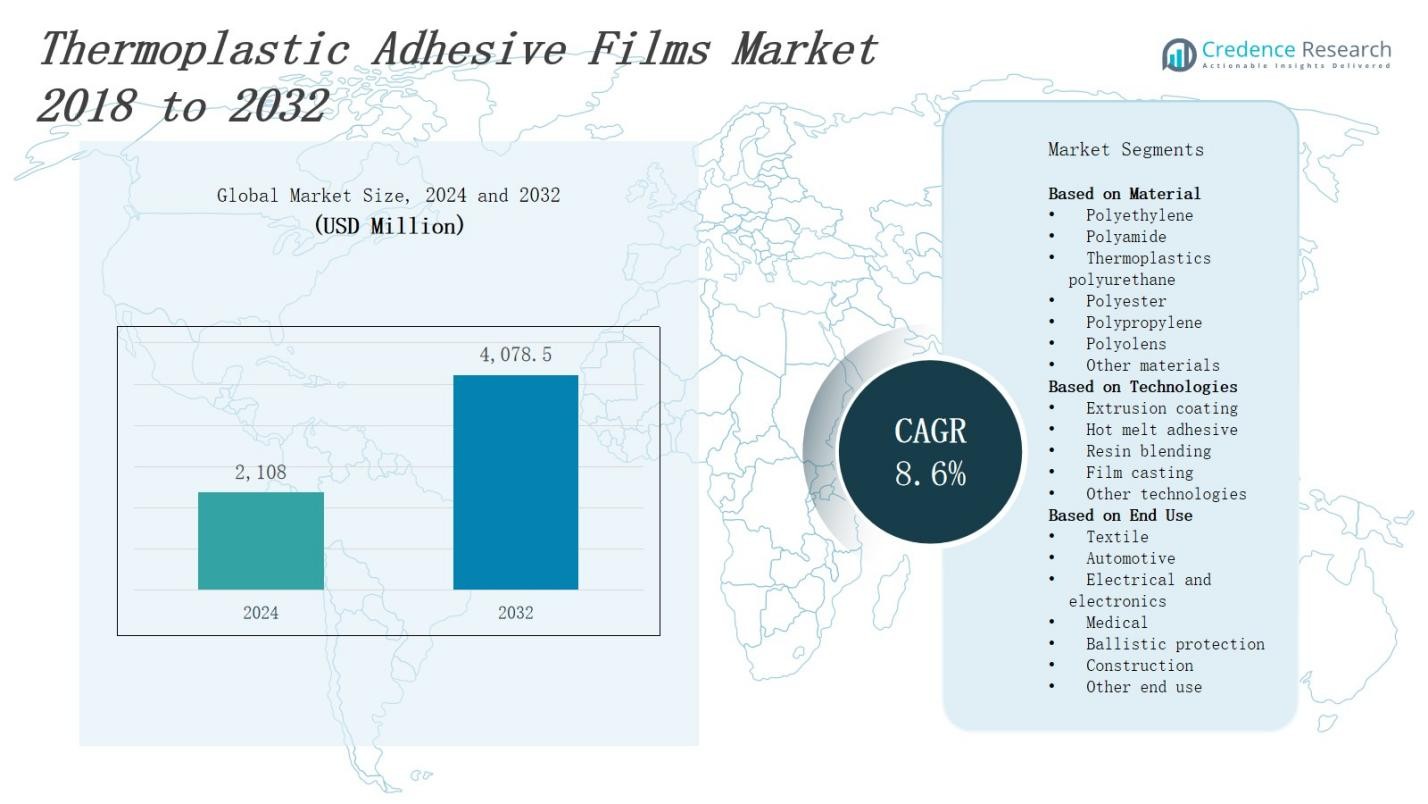

The Thermoplastic Adhesive Films market is projected to grow from USD 2,108 million in 2024 to USD 4,078.5 million by 2032, expanding at a CAGR of 8.6%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Thermoplastic Adhesive Films Market Size 2024 |

USD 2,108 Million |

| Thermoplastic Adhesive Films Market, CAGR |

8.6% |

| Thermoplastic Adhesive Films Market Size 2032 |

USD 4,078.5 Million |

The thermoplastic adhesive films market grows driven by rising demand for lightweight and durable bonding solutions across automotive, electronics, and packaging industries. Increasing adoption of thermoplastic adhesives enhances manufacturing efficiency and reduces assembly time. Innovations in high-performance and eco-friendly adhesive formulations support sustainability goals and regulatory compliance. The trend toward miniaturization in electronics and the expansion of electric vehicles stimulate market demand. Growing preference for automation in production processes further boosts adoption. Additionally, advancements in heat resistance and bonding strength expand application scope, positioning thermoplastic adhesive films as a critical material for modern manufacturing and sustainable product design.

The thermoplastic adhesive films market spans North America, Europe, Asia-Pacific, and the Rest of the World, with North America holding 32% market share, Asia-Pacific 30%, Europe 28%, and the Rest of the World 10%. Each region drives growth through diverse applications in automotive, electronics, packaging, and medical sectors. Leading companies such as Henkel AG, 3M Company, BASF SE, Dow Inc., and Arkema SA actively expand their regional footprints. These key players focus on innovation and strategic collaborations to capture opportunities across these dynamic markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The thermoplastic adhesive films market is projected to grow from USD 2,108 million in 2024 to USD 4,078.5 million by 2032, expanding at a CAGR of 8.6%.

- Rising demand for lightweight and durable bonding solutions in automotive, electronics, and packaging industries drives market growth.

- Increasing adoption of thermoplastic adhesives enhances manufacturing efficiency and reduces assembly time.

- Innovations in high-performance and eco-friendly formulations support sustainability goals and regulatory compliance.

- Trends such as miniaturization in electronics and electric vehicle expansion stimulate market demand.

- Automation adoption in production processes boosts market penetration by improving speed and precision.

- North America leads with 32% market share, followed by Asia-Pacific at 30%, Europe at 28%, and the Rest of the World at 10%.

Market Drivers

Growing Demand for Lightweight and Durable Bonding Solutions

The thermoplastic adhesive films market benefits from increasing demand for lightweight materials in automotive and aerospace industries. Manufacturers seek alternatives to mechanical fasteners to reduce vehicle weight and improve fuel efficiency. Thermoplastic adhesive films offer strong bonding with reduced material bulk, enhancing product durability. The shift toward electric vehicles intensifies the need for reliable, lightweight adhesives. It supports manufacturers in meeting stringent regulatory requirements on emissions and safety. This driver plays a crucial role in expanding the market across multiple sectors.

- For instance, ThreeBond’s high-performance adhesives, such as the TB3926 acrylic-based structural adhesive, enable automotive manufacturers to bond aluminum and carbon fiber-reinforced plastics in electric vehicles, reducing weight while maintaining crash safety and corrosion resistance.

Advancements in Eco-Friendly and High-Performance Formulations

The thermoplastic adhesive films market experiences growth due to innovations in sustainable and high-performance adhesives. Industry players develop formulations with lower volatile organic compound (VOC) emissions to comply with environmental regulations. Enhanced heat resistance and bonding strength widen the application range in electronics, packaging, and construction. It enables manufacturers to meet evolving customer expectations for durability and environmental responsibility. Research and development focus on bio-based materials further boost the market’s appeal and adoption globally.

- For instance, 3M has developed advanced acrylic-based thermoplastic adhesive films with enhanced durability and high heat resistance, widely used in automotive electronics and medical device bonding, combining strong adhesion with environmental compliance.

Expansion of Automation and Efficient Manufacturing Processes

Automation in production processes drives demand for thermoplastic adhesive films by improving assembly speed and reducing labor costs. The films allow faster curing times compared to traditional adhesives, supporting high-volume manufacturing. The thermoplastic adhesive films market benefits from increasing adoption in electronics and packaging sectors where precision and efficiency matter. It enables seamless integration into automated lines, minimizing errors and material waste. This factor enhances overall operational productivity, attracting manufacturers toward thermoplastic adhesive technologies.

Increasing Adoption in Electronics and Packaging Industries

The thermoplastic adhesive films market grows with rising use in consumer electronics and flexible packaging applications. Miniaturization of electronic devices requires adhesives that provide reliable bonding without adding bulk or weight. Thermoplastic films offer electrical insulation and thermal stability, meeting industry demands. In packaging, it supports sustainable, recyclable solutions with strong seals and extended shelf life. It helps manufacturers improve product performance and appeal, reinforcing market growth driven by evolving technological and consumer trends.

Market Trends

Rising Integration of Advanced Technologies in Adhesive Formulations

The thermoplastic adhesive films market shows a clear trend toward incorporating advanced technologies such as nanotechnology and biopolymers. These innovations improve adhesive strength, thermal stability, and environmental compatibility. It enables manufacturers to offer customized solutions tailored for specific industry needs like electronics and automotive. The integration of smart materials also facilitates enhanced performance in extreme conditions. This trend reflects a growing focus on product differentiation and innovation to capture diverse market segments.

- For instance, L&L Products launched T-Link, a thermoplastic resin adhesive technology available in multiple formats (film, yarn, powder, etc.), combining recyclability and manufacturability while reducing production cycle times in industrial applications.

Shift Toward Sustainable and Bio-Based Adhesive Solutions

Sustainability gains prominence within the thermoplastic adhesive films market as companies develop bio-based and recyclable adhesive products. Industry players invest in reducing reliance on petrochemical-based raw materials to meet stringent environmental regulations and consumer demand for green alternatives. It promotes circular economy principles by enabling adhesives that support product recyclability. This movement accelerates collaborations between chemical manufacturers and end-users to develop eco-friendly solutions without compromising performance.

- For instance, Henkel AG & Co. KGaA has invested in bio-based formulations derived from renewable resources, enabling adhesives with reduced carbon footprints and low VOC emissions suitable for sustainable building and packaging applications.

Increasing Adoption of Thermoplastic Films in Emerging Applications

The thermoplastic adhesive films market expands into emerging applications including wearable electronics, medical devices, and flexible packaging. The demand for lightweight, flexible, and durable bonding materials rises in these sectors due to evolving product designs. It supports miniaturization and enhanced functionality, particularly in healthcare and consumer electronics. Growing urbanization and technological advancement in emerging economies further boost adoption. This trend diversifies the market and opens new revenue streams for manufacturers.

Focus on Enhancing Process Efficiency and Automation Compatibility

The thermoplastic adhesive films market witnesses growing emphasis on formulations that enable faster curing and simplified application processes. Manufacturers prioritize adhesives compatible with automated production lines to reduce cycle times and increase throughput. It improves consistency in product quality and reduces material wastage during assembly. This focus aligns with industry demands for lean manufacturing and cost-effective solutions. The trend promotes wider adoption of thermoplastic adhesive films in high-volume manufacturing environments.

Market Challenges Analysis

Stringent Regulatory Compliance and Environmental Concerns

The thermoplastic adhesive films market faces challenges due to increasingly strict regulatory requirements related to chemical safety and environmental impact. Manufacturers must ensure compliance with regulations governing volatile organic compounds (VOCs) and hazardous substances, which can increase production costs. It limits the choice of raw materials and necessitates reformulation efforts to meet sustainability standards. The need for extensive testing and certification delays product launches and affects time-to-market. This regulatory complexity creates barriers for new entrants and pressures existing players to maintain compliance while balancing cost efficiency.

High Initial Investment and Technical Limitations

The thermoplastic adhesive films market encounters hurdles related to the high cost of advanced raw materials and specialized equipment required for production. It requires significant capital investment to develop and scale innovative formulations that meet performance expectations. Technical limitations such as sensitivity to processing conditions and bonding challenges with certain substrates restrict broader application. Manufacturers must invest in skilled labor and continuous R&D to overcome these issues. These factors slow adoption rates and create competitive pressures, particularly in price-sensitive markets and emerging economies.

Market Opportunities

Expansion into Emerging End-Use Industries and Regions

The thermoplastic adhesive films market holds significant opportunities in emerging sectors such as healthcare, wearable electronics, and renewable energy. These industries demand lightweight, flexible, and durable bonding solutions to support innovative product designs. It can capitalize on growing urbanization and industrialization in regions like Asia-Pacific and Latin America, where rising consumer spending and infrastructure development fuel market expansion. Targeting these high-growth areas enables manufacturers to diversify revenue streams and strengthen their global footprint.

Development of Sustainable and Customized Adhesive Solutions

The thermoplastic adhesive films market can leverage the increasing demand for eco-friendly and application-specific products. Developing bio-based, recyclable adhesives aligns with global sustainability goals and appeals to environmentally conscious customers. It also offers opportunities to create tailored formulations that address unique performance requirements across automotive, electronics, and packaging sectors. Collaborating with end-users to innovate bespoke solutions enhances customer loyalty and competitive advantage, driving long-term growth in a rapidly evolving market.

Market Segmentation Analysis:

By Material

The thermoplastic adhesive films market segments by materials including polyethylene, polyamide, thermoplastic polyurethane, polyester, polypropylene, polyolefins, and other specialized materials. Each polymer offers distinct properties such as flexibility, chemical resistance, and bonding strength, catering to varied industry requirements. It enables manufacturers to tailor adhesive films for specific applications, enhancing performance and durability. Polyethylene and polypropylene lead due to their cost-effectiveness and versatility, while polyamide and thermoplastic polyurethane serve high-performance needs in automotive and electronics sectors.

- For instance, Bostik’s hot melt polyamide adhesives are widely used in automotive filters like air, oil, and fuel filters due to their high mechanical resistance, heat resistance, and chemical durability, improving the lifespan and efficiency of these components.

By Technologies

The thermoplastic adhesive films market incorporates technologies like extrusion coating, hot melt adhesive, resin blending, film casting, and other advanced methods. These technologies influence product quality, adhesion characteristics, and production efficiency. It allows manufacturers to optimize films for thermal stability, curing speed, and bonding strength. Extrusion coating and hot melt adhesives dominate due to scalability and compatibility with automated processes. Resin blending and film casting support customized formulations for niche applications requiring precise material properties.

- For instance, Polifilm manufactures thermoplastic hot melt adhesive films ideal for bonding diverse substrates like metal, rubber, and textiles, improving sealing and surface finishing applications.

By End Use

The thermoplastic adhesive films market targets end uses such as textile, automotive, electrical and electronics, medical, ballistic protection, construction, and others. Each segment demands unique adhesive features, including flexibility, strength, and environmental resistance. It supports automotive and electronics industries with lightweight, durable bonding solutions critical for performance and safety. Medical and ballistic protection sectors require films with biocompatibility and impact resistance. Growth in construction and textiles further diversifies the market, driving adoption across multiple industries.

Segments:

Based on Material

- Polyethylene

- Polyamide

- Thermoplastics polyurethane

- Polyester

- Polypropylene

- Polyolens

- Other materials

Based on Technologies

- Extrusion coating

- Hot melt adhesive

- Resin blending

- Film casting

- Other technologies

Based on End Use

- Textile

- Automotive

- Electrical and electronics

- Medical

- Ballistic protection

- Construction

- Other end use

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America leads the thermoplastic adhesive films market with a market share of 32%. The region benefits from a well-established automotive and electronics industry demanding high-performance adhesive solutions. It supports growth through significant investments in R&D and adoption of advanced manufacturing technologies. Strict regulatory standards drive the development of eco-friendly and safer adhesive films. The presence of key market players and growing demand for lightweight materials in aerospace and packaging also contribute. It offers lucrative opportunities for innovation and expansion in various end-use sectors.

Europe

Europe holds 28% of the thermoplastic adhesive films market share, driven by strong environmental regulations and sustainability initiatives. The region focuses on reducing carbon footprint through bio-based and recyclable adhesive products. It has a mature automotive sector embracing lightweight bonding solutions to improve fuel efficiency and reduce emissions. The electronics and medical industries also contribute to demand due to high product quality standards. It benefits from collaborations between manufacturers and research institutions to develop cutting-edge adhesive technologies. Growth in renewable energy applications further supports market expansion.

Asia-Pacific

Asia-Pacific captures 30% of the thermoplastic adhesive films market, fueled by rapid industrialization, urbanization, and expanding manufacturing bases in China, India, Japan, and Southeast Asia. Rising disposable incomes and increasing demand for consumer electronics, automotive, and packaging products drive growth. It witnesses heightened adoption of automation and advanced adhesive technologies to meet production efficiency goals. The region also attracts investments from global adhesive manufacturers seeking to capitalize on large-scale production and emerging application areas. It is poised for continued growth due to evolving industrial infrastructure and expanding end-use industries.

Rest of the World

The Rest of the World accounts for 10% of the thermoplastic adhesive films market share, including Latin America, the Middle East, and Africa. Market growth in these regions benefits from increasing infrastructure development and expanding automotive and packaging sectors. It faces challenges related to regulatory frameworks and limited technological adoption but shows promising potential. Emerging markets in these regions present opportunities for new product introduction and regional partnerships. It supports regional manufacturers in meeting rising demand for sustainable and efficient adhesive solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mitsui Chemicals Inc.

- Henkel AG and Co. KGaA

- Arkema SA

- Avery Dennison Corporation

- BASF SE

- Dow Inc.

- Sika AG

- Huntsman Corporation

- 3M Company

- Covestro AG

- Lanxess AG

- I. du Pont de Nemours and Company

Competitive Analysis

The thermoplastic adhesive films market features intense competition among leading global and regional players. Key companies focus on innovation, product differentiation, and strategic partnerships to strengthen market presence. It drives continuous investment in research and development to enhance adhesive performance and sustainability. Market participants leverage advanced technologies to meet evolving customer demands across automotive, electronics, and packaging sectors. Competitive pricing and expanding manufacturing capacities also influence market dynamics. It compels companies to optimize supply chains and improve operational efficiency. The market remains fragmented, with opportunities for mergers and acquisitions to consolidate positions and capture new growth avenues. Increasing demand for eco-friendly products and rising emphasis on automation further push companies to innovate rapidly and scale production capabilities to maintain a competitive edge globally.

Recent Developments

- In April 2025, Henkel launched AI-generated virtual adhesives, enabling faster, smarter electric vehicle battery development by reducing physical prototypes and enhancing material behavior prediction early in the design process.

- In June 2025, Trinseo introduced LIGOS™ A9615, a general-purpose acrylic adhesive formulated for film labels and tailored to the Southeast Asian market.

- In May 2024, Henkel and Panverta CPP developed a film for improved barrier performance, enhancing the durability and sustainability of packaging materials through advanced adhesive technologies.

- In May 2024, Lubrizol Corporation launched Pearlbond ECO 590 HMS TPU, a bio-based thermoplastic polyurethane adhesive film designed for hot melt adhesives and extrusion applications.

Market Concentration & Characteristics

The thermoplastic adhesive films market exhibits moderate concentration with a mix of established global players and regional manufacturers competing actively. It features a fragmented landscape where innovation and product differentiation serve as key competitive factors. Leading companies invest heavily in research and development to introduce advanced formulations that meet evolving industry standards for performance and sustainability. It faces pressures from cost-sensitive markets and stringent regulatory requirements, which influence material selection and manufacturing processes. The market benefits from strategic partnerships, mergers, and acquisitions that enable capacity expansion and geographic reach. It also sees continuous efforts to optimize supply chains and enhance operational efficiency. The diverse end-use applications across automotive, electronics, packaging, and medical sectors demand customized solutions, driving competition based on technology, quality, and compliance. This competitive environment fosters rapid innovation and positions the thermoplastic adhesive films market for sustained growth globally.

Report Coverage

The research report offers an in-depth analysis based on Material, Technologies, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The thermoplastic adhesive films market will expand due to increasing demand for lightweight bonding solutions.

- Manufacturers will focus on developing eco-friendly and sustainable adhesive formulations.

- Advancements in adhesive technology will improve heat resistance and bonding strength.

- The adoption of automation in manufacturing processes will increase market penetration.

- Growth in electric vehicles and electronics will drive demand for specialized adhesive films.

- Emerging economies will offer new opportunities for market expansion.

- Companies will invest in research to create bio-based and recyclable adhesives.

- Strategic collaborations and partnerships will strengthen market positions.

- Regulatory compliance will continue to shape product innovation and development.

- Customized adhesive solutions will gain popularity across diverse end-use industries.