Market Overview

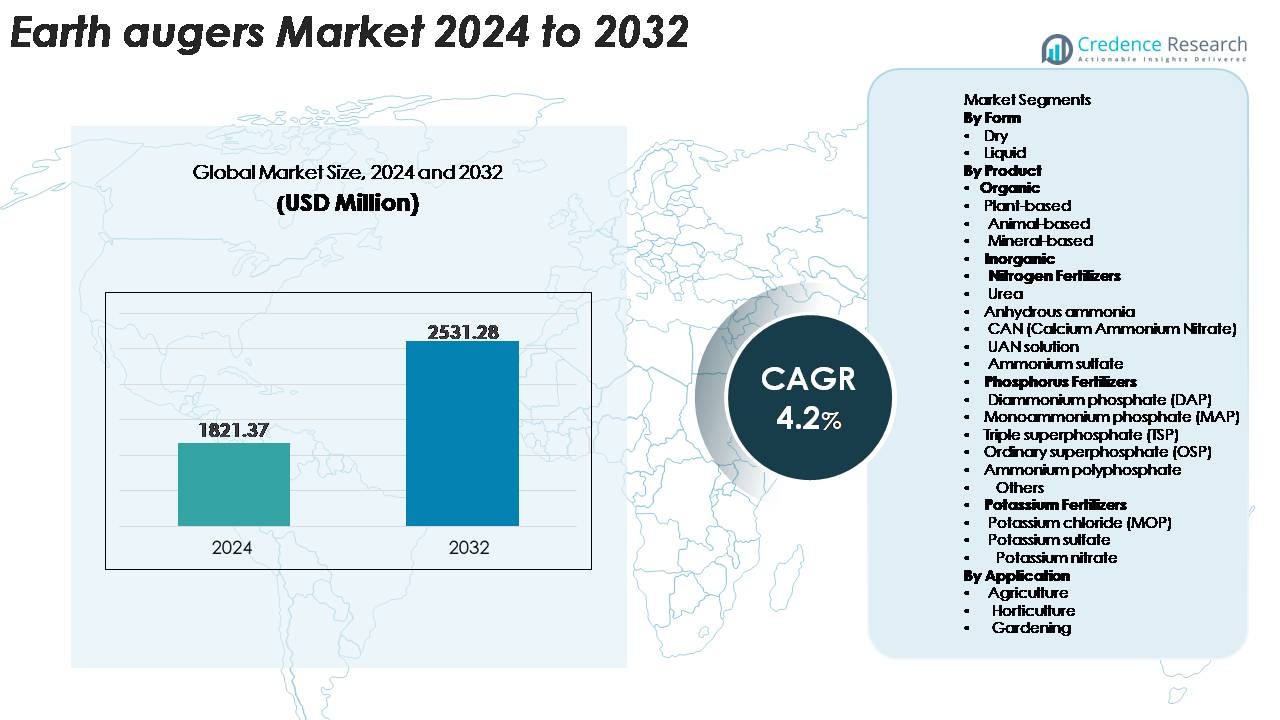

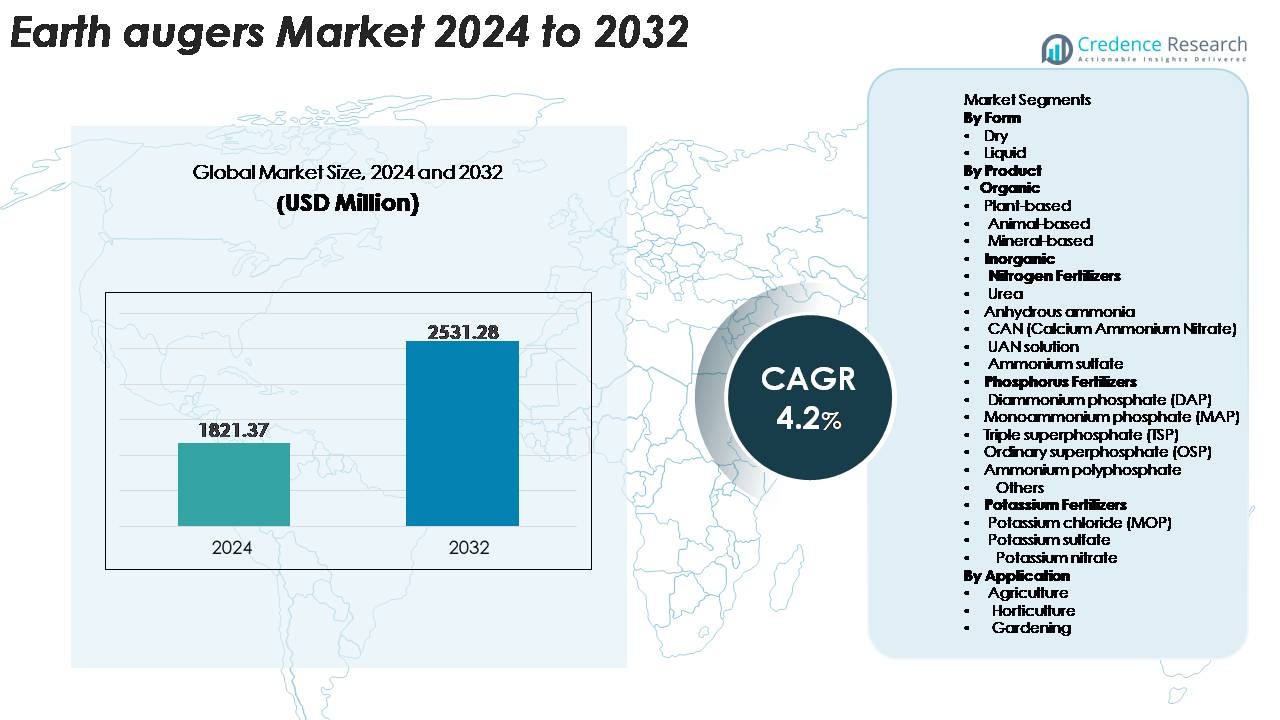

The global Earth Augers Market was valued at USD 1,821.37 million in 2024 and is projected to reach USD 2,531.28 million by 2032, registering a CAGR of 4.2% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Earth Augers Market Size 2024 |

USD 1,821.37 Billion |

| Earth Augers Market, CAGR |

4.2% |

| Earth Augers Market Size 2032 |

USD 2,531.28 Billion |

The Earth Augers market is shaped by a diverse group of manufacturers that compete through product durability, high-torque performance, and compatibility with agricultural and construction workflows. Key players such as IFFCO, Israel Chemicals, Nutrien, Haifa Group, K+S Group, Bunge Limited, OCP Group, Coromandel International Limited, EuroChem Group, and CF Industries Holdings strengthen market presence through broad distribution networks and equipment solutions supporting soil preparation, plantation, and land-development activities. North America remains the leading region with 32–34% market share, driven by high mechanization rates and strong adoption across agriculture, landscaping, and construction, followed by Asia-Pacific, which continues to expand rapidly through rising plantation and infrastructure projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Earth Augers market was valued at USD 1,821.37 million in 2024 and is projected to reach USD 2,531.28 million by 2032, registering a CAGR of 4.2%, supported by rising adoption across agriculture, landscaping, and construction applications.

- Market growth is driven by expanding mechanization, increasing plantation and fencing activities, and strong uptake of powered augers that reduce labor intensity and provide consistent drilling performance across varied soil conditions.

- Trends include rapid penetration of battery-powered augers, rising demand for multi-attachment systems, and growing alignment with sustainable land-development workflows, particularly in forestry and restoration projects.

- Competitive activity intensifies as leading companies enhance torque output, safety features, and durability while expanding distribution networks to capture demand across professional and residential user segments.

- Regionally, North America leads with 32–34%, followed by Asia-Pacific with 28–30%, while Europe holds 25–27%. By form, dry augers dominate, and by application, agriculture remains the largest segment due to extensive mechanized planting and pit-digging operations.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Form

Dry formulations represent the dominant segment in the earth auger ecosystem because they support superior handling stability, longer storage life, and better compatibility with mechanized soil-boring workflows. Users in agriculture, horticulture, and landscaping prefer dry forms for tasks requiring precise soil penetration and consistent granule delivery around boreholes, particularly during fencing, plantation, and pit preparation. Liquid formulations continue to gain traction where faster dispersion and ease of application are priorities, but adoption remains secondary due to higher logistics demands and the need for more controlled handling in field environments.

· For instance, STIHL’s BT 131 one-man earth auger features a 36.3 cc engine delivering 1.4 kW of power, along with a high-torque gearbox designed for tough soil drilling. The model supports STIHL drill bits up to 200 mm and includes a QuickStop® drill-brake system that halts rotation when the auger jams. This setup helps operators maintain control and stability during demanding ground-boring tasks.

By Product

Organic products especially plant-based inputs lead this segment due to their strong alignment with sustainable land-management practices, reduced soil-impact concerns, and compatibility with auger-driven planting operations. Their increasing use in regenerative agriculture, orchard expansion, and afforestation boosts demand during large-scale boring and pit-digging activities. Inorganic products maintain steady adoption, with nitrogen fertilizers such as urea widely applied for post-auger soil enrichment in high-intensity farming. Phosphorus and potassium variants remain essential for targeted nutrient placement, but organic solutions continue to dominate because they support long-term soil health and comply with eco-certification standards.

- For instance, Novozymes’ BioAg portfolio includes microbial inoculants based on Bacillus species that are manufactured with high-stability spore formulations, typically standardized at 1×10⁹ CFU/g for reliable field performance. These dry microbial products are designed for seed treatment and soil application across broad-acre and horticultural crops. Their stable spore structure supports handling and placement in various field preparation methods.

By Application

Agriculture stands as the dominant application segment for earth augers, driven by expanding mechanization across crop establishment, fencing, irrigation post installation, and orchard development. Farmers increasingly depend on powered augers to accelerate pit creation and reduce labor intensity during high-volume planting cycles. Horticulture follows closely as commercial nurseries adopt augers for shrub, sapling, and transplant operations requiring uniform hole dimensions. Gardening and other small-scale uses grow steadily with rising urban landscaping and DIY activities, though their market contribution remains smaller compared to broad-acre agricultural deployment.

Key Growth Drivers:

Rising Mechanization in Agriculture and Land Development

Mechanization continues to accelerate across global agriculture, landscaping, and forestry operations, driving strong demand for earth augers to improve efficiency in soil boring, pit digging, fencing, and plantation activities. Farmers and land developers increasingly adopt powered augers to reduce manual labor, enhance precision, and support large-scale planting programs in orchards, vineyards, and agroforestry systems. Government initiatives promoting mechanized farming and rural infrastructure development further strengthen equipment adoption. Earth augers help achieve uniform hole dimensions, faster planting cycles, and improved soil disturbance control, enabling higher productivity across diversified terrains. Infrastructure projects such as solar farm installations, utility pole placement, and perimeter fencing also utilize augers extensively due to their ability to operate efficiently across compact, rocky, and mixed-soil conditions. As sustainability-oriented cultivation and land restoration programs expand, earth augers serve as essential tools for scalable planting operations, reinforcing their role in modern mechanized land-use systems.

· For instance, ECHO’s EA-410 earth auger uses a 42.7 cc professional-grade engine paired with a gear reduction ratio of 30.2:1, allowing strong torque output for drilling in compact or rocky soil during planting and fencing tasks.

Expansion of Construction, Landscaping, and Outdoor Infrastructure Projects

The growing volume of residential, commercial, and industrial construction significantly increases the need for earth augers in foundation support, utility installation, drainage preparation, and landscaping design. Contractors increasingly rely on augers to accelerate post-hole creation for fences, decks, signposts, lighting poles, and structural anchors, ensuring consistent depths and diameters across repetitive bore tasks. Urban landscaping projects including park development, green belts, recreational spaces, and streetscape upgrades further stimulate demand for precise and fast soil excavation tools. Public and private investments in outdoor recreational infrastructure, eco-tourism facilities, and renewable energy installations such as off-grid towers and wind measurement stations also expand auger use. Compact, portable, and multi-attachment auger systems allow operators to shift between soil types with minimal downtime, optimizing work rates in constrained environments. As construction workflows prioritize productivity and standardized execution, powered and hydraulic augers gain wider acceptance across contractor fleets and rental service providers.

- For instance, Bobcat’s 50PH planetary hydraulic auger drive delivers a published torque output of 5,291 ft-lbs at a maximum operating pressure of 3,500 psi, enabling stable boring in dense and rocky ground. The heavy-duty gearbox design supports demanding utility, fencing, and construction applications where consistent high-torque drilling is required.

Advancements in Engine Efficiency, Battery Technology, and Safety Features

Technological improvements in powertrains, ergonomics, and operator safety strongly support market expansion. Manufacturers increasingly introduce fuel-efficient engines, high-torque gear systems, and vibration-reduction mechanisms that enhance drilling precision and user comfort during prolonged field operations. Battery-powered augers represent one of the fastest-growing categories, driven by low noise, zero emissions, and reduced maintenance requirements. Improved lithium-ion battery density supports longer run times, faster recharge cycles, and robust torque output, making cordless models viable alternatives to traditional gas units. Enhanced safety features such as overload protection, quick-stop clutches, insulated handles, and anti-kickback designs encourage adoption among both professional and DIY users. Integration of multi-bit systems, variable-speed drives, and durable alloy components increases versatility across soil textures. As sustainability, noise regulations, and operational efficiency gain importance, equipment upgrades and electrification significantly accelerate the uptake of modern earth auger solutions.

Key Trends and Opportunities:

Growing Demand for Multi-Functional, Attachment-Compatible Auger Systems

A major market opportunity emerges from the rising demand for auger units that integrate with tractors, skid steers, mini-excavators, and compact utility loaders. These attachment-compatible systems allow operators to shift between drilling, trenching, tilling, and post-installation tasks using a single power unit, optimizing fleet utilization and reducing ownership costs. Landscaping companies, smallholder farmers, and rental businesses increasingly prioritize modular auger configurations with interchangeable bits, variable-length extensions, and reinforced flighting designed for diverse soil compositions. Advances in quick-attach mechanisms and hydraulic systems further enhance operational versatility, enabling rapid transitions between tasks without compromising drilling speed or stability. As contractors seek equipment that delivers both efficiency and adaptability, manufacturers offering versatile, attachment-ready augers with heavy-duty build quality and multi-purpose tooling gain a competitive edge across commercial and agricultural segments.

· For example, Kubota’s KX040-4 mini-excavator offers a maximum digging depth of 3.42 m, providing strong compatibility with attachment-driven tasks. The Land Pride SA35 auger system supports bit diameters from 152 mm to 914 mm, allowing operators to handle a wide range of post-hole and ground-boring applications.

Increasing Adoption of Battery-Powered and Low-Emission Augers

Electrification presents a significant opportunity as end users shift toward quieter, cleaner, and easier-to-maintain drilling equipment. Battery-powered earth augers attract strong interest from landscaping crews, urban contractors, and homeowners who require emission-free operation in noise-restricted zones such as residential areas, parks, and institutional campuses. Improvements in lithium-ion battery technology covering torque stability, run time, and rapid charging are making electric augers viable replacements for small engine-driven units. Lightweight structural materials and brushless motor systems further boost performance, portability, and longevity. Environmental regulations targeting emissions, fuel consumption, and operator safety accelerate adoption across regions prioritizing sustainable construction and green urban development. Manufacturers responding with durable, high-capacity cordless systems positioned for professional workloads stand to capture substantial growth in emerging eco-friendly equipment categories.

· For instance, Milwaukee Tool’s M18 FUEL™ QUIK-LOK™ Earth Auger uses a brushless POWERSTATE™ motor and operates on the M18™ REDLITHIUM™ battery system, including the 12.0 Ah High Output pack for longer runtime. The cordless auger provides emission-free drilling for landscaping and residential worksites and supports quick attachment changes through the QUIK-LOK™ interface.

Rising Opportunities in Afforestation, Land Restoration, and Environmental Projects

Global initiatives supporting large-scale reforestation, watershed development, and ecological restoration are creating new opportunities for earth augers. Governments, NGOs, and climate-focused organizations increasingly adopt mechanized auger systems to expedite sapling pit creation, soil aeration, and ground preparation for mass planting drives. Augers significantly reduce manual labor intensity and help maintain uniform planting depth critical for seedling survival in degraded soils. Their application extends to biodiversity parks, coastal restoration, and riverbank stabilization projects that require rapid and consistent soil drilling across wide areas. As climate resilience programs expand internationally, equipment suppliers offering rugged, high-output augers optimized for rocky and compacted soil conditions gain strategic advantages in tender-based and government-supported green projects.

Key Challenges:

Operational Limitations Across Rocky, Root-Dense, and High-Moisture Soils

Earth augers face consistent performance challenges in rocky terrains, dense-root zones, and waterlogged soil profiles, where bit obstruction, excessive vibration, and torque overload can reduce drilling efficiency. Operators often encounter difficulty achieving uniform boreholes due to frequent interruptions and hardware strain, leading to slower productivity and higher wear on cutting edges, gear mechanisms, and powerheads. These conditions increase the risk of kickback incidents and mechanical breakdowns, prompting users to switch to heavier or more specialized excavation tools. While reinforced bits and high-torque hydraulic augers offer partial solutions, cost considerations and limited versatility constrain broader adoption. Manufacturers must continue innovating hardened materials, adaptive torque controls, and terrain-responsive bit designs to overcome performance constraints in challenging soil environments.

High Upfront Costs and Maintenance Requirements for Professional-Grade Augers

Despite strong market demand, cost barriers remain significant, especially for small-scale operators, individual farmers, and micro-contractors. Professional-grade augers particularly hydraulic and heavy-duty engine-driven models require substantial upfront investment, which limits ownership in price-sensitive regions. Additionally, ongoing expenses related to engine servicing, lubrication, bit replacement, gearbox maintenance, and battery system upkeep increase the total cost of operation. Rental services help offset affordability challenges but may restrict access during peak planting or construction seasons. Users also face downtime risks when replacement components are unavailable or expensive. To sustain wider adoption, manufacturers must focus on durable designs, simplified maintenance systems, and modular component strategies that reduce long-term operational costs.

Regional Analysis

North America

North America holds the leading position in the Earth Augers market, accounting for around 32–34% of global revenue due to high mechanization levels in agriculture, landscaping, and construction. The U.S. drives most demand with widespread adoption of powered augers for fencing, decking, plantation, and utility installation. Strong rental equipment penetration and continuous housing redevelopment further support market expansion. Contractors and agricultural enterprises increasingly prefer fuel-efficient and battery-powered models, while expanding afforestation and conservation programs reinforce steady equipment uptake. Technological innovation and well-established distribution networks strengthen North America’s dominance across both commercial and residential user segments.

Europe

Europe represents approximately 25–27% of global market share, supported by advanced landscaping services, precision agriculture adoption, and stringent safety standards that encourage the use of modern auger systems. Countries such as Germany, France, and the U.K. demonstrate consistent demand for high-torque, ergonomically advanced augers used in fencing, horticulture, and infrastructure groundwork. Strong emphasis on environmental sustainability drives interest in battery-powered and low-emission augers across urban and semi-urban projects. Government-backed reforestation and land-restoration initiatives also contribute to equipment uptake. The region benefits from mature manufacturing capabilities and growing demand from both commercial contractors and DIY landscaping users.

Asia-Pacific

Asia-Pacific commands about 28–30% of the global market and remains the fastest-growing region, driven by expanding agricultural mechanization, large-scale plantation programs, and rapid infrastructure development. China and India lead adoption due to high rural labor shortages, increasing land-development activities, and government support for mechanized farming tools. Earth augers are widely used in orchard expansion, fencing, irrigation post installation, and afforestation projects. Growing acceptance of portable and low-cost models caters to smallholder farmers, while construction growth in Southeast Asia strengthens commercial demand. APAC’s large population, rising equipment affordability, and expanding rental networks collectively accelerate market penetration.

Latin America

Latin America accounts for around 7–8% of the global Earth Augers market, supported by the growth of commercial agriculture, forestry operations, and rural infrastructure improvement. Brazil, Mexico, and Argentina lead adoption due to extensive plantation activities, livestock fencing requirements, and increasing horticultural exports. Augers are also used in reforestation and land rehabilitation projects across the Amazon basin and Andean regions. The region shows strong interest in cost-effective, engine-powered augers suitable for varied soil conditions. While market maturity is lower compared to North America and Europe, expanding mechanization and construction upgrades continue to support steady regional demand.

Middle East & Africa (MEA)

MEA holds approximately 6–7% of global market share, driven by rising construction activity, landscaping expansion in urban centers, and increasing agricultural mechanization in parts of Africa. Gulf countries invest in modern landscaping, green belt development, and infrastructure projects that rely on augers for fencing, lighting poles, and irrigation installations. In Africa, adoption is rising due to afforestation programs, renewable energy installations, and efforts to improve crop cultivation efficiency. However, cost constraints and limited access to high-performance equipment slow widespread penetration. Growing interest from rental companies and government-backed land development programs supports future market growth.

Market Segmentations:

By Form

By Product

Organic

- Plant-based

- Animal-based

- Mineral-based

Inorganic

- Nitrogen Fertilizers

- Urea

- Anhydrous ammonia

- CAN (Calcium Ammonium Nitrate)

- UAN solution

- Ammonium sulfate

Phosphorus Fertilizers

- Diammonium phosphate (DAP)

- Monoammonium phosphate (MAP)

- Triple superphosphate (TSP)

- Ordinary superphosphate (OSP)

- Ammonium polyphosphate

- Others

Potassium Fertilizers

- Potassium chloride (MOP)

- Potassium sulfate

- Potassium nitrate

By Application

- Agriculture

- Horticulture

- Gardening

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Earth Augers market is characterized by a mix of global manufacturers, regional equipment providers, and specialized power tool brands competing on performance, durability, and operational efficiency. Leading companies focus on expanding their portfolios with high-torque, low-vibration, and ergonomically enhanced models tailored for agriculture, construction, and landscaping applications. Battery-powered augers are gaining prominence, prompting manufacturers to invest in advanced lithium-ion systems, brushless motors, and lightweight materials to attract both professional and residential users. Players also emphasize multi-attachment compatibility to strengthen their presence in rental fleets and contractor operations. Strategic partnerships with distributors, expansion of service networks, and continuous product upgrades help companies maintain competitiveness across price-sensitive and high-performance segments. Furthermore, growing demand from developing markets encourages manufacturers to introduce cost-effective, rugged augers optimized for diverse soil conditions. Overall, innovation-centered competition and expanding application diversity shape the evolving global market landscape.

Key Player Analysis

- IFFCO

- Israel Chemicals

- Nutrien

- Haifa Group

- K+S Group

- Bunge Limited

- OCP Group

- Coromandel International Limited

- EuroChem Group

- CF Industries Holdings

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Form, Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for earth augers will continue to rise as agriculture and landscaping sectors accelerate mechanization to improve efficiency and reduce labor dependency.

- Battery-powered and low-emission augers will gain strong traction as users prioritize quieter, cleaner, and lower-maintenance drilling solutions.

- Integration of advanced torque-control systems and ergonomic enhancements will improve operator safety and precision in varied soil conditions.

- Rental companies will expand auger offerings as contractors and small-scale users increasingly favor flexible, cost-efficient access over ownership.

- Multi-functional auger attachments compatible with tractors, skid steers, and compact loaders will drive adoption across commercial projects.

- Afforestation, land restoration, and environmental projects will create new opportunities for rapid drilling and mass planting applications.

- Manufacturers will focus on durable materials and reinforced bits to address performance issues in rocky and root-dense terrains.

- Smart augers with sensor-based depth control and digital monitoring capabilities will emerge gradually.

- Developing markets will experience higher adoption due to expanding construction, irrigation, and rural development activities.

- Competitive dynamics will intensify as companies introduce more versatile, lightweight, and high-torque models to serve diverse end-user segments.

Market Segmentation Analysis:

Market Segmentation Analysis: